$DKS | Dick's is -4.7% this morning.

🔹 EPS: $4.38 vs. $4.30 est. ✅

🔹 Revenue: $3.65B vs. $3.61B est. ✅

Key takeaways:

🔸 Comp sales: +5% YoY

🔸 Inventory: +7% YoY

🔸 FY revenue outlook: $13.85B ($13.8B prior)

🔸 FY EPS outlook: $14.20 ($14.10 prior)

28.08.2025 14:32 — 👍 0 🔁 0 💬 0 📌 0

$DG | Dollar General is -2.2% this morning.

🔹 EPS: $1.86 vs. $1.58 est. ✅

🔹 Revenue: $10.73B vs. $10.68B est. ✅

Key takeaways:

🔸 Consumables revenue: +5% YoY

🔸 Same store sales: +2.8% YoY

🔸 Inventory: -6% YoY

🔸 FY EPS outlook: ~$6.05 ($5.50 prior)

🔸 FY revenue outlook: ~+4.6% YoY (+4.2% prior)

28.08.2025 14:11 — 👍 0 🔁 0 💬 0 📌 0

$CRWD | CrowdStrike is -7.5% after-hours.

🔹 EPS: $0.93 vs. $0.83 est. ✅

🔹 Revenue: $1.17B vs. $1.15B est. ✅

Key takeaways:

🔸 Subscription revenue: +20% YoY

🔸 ARR: +20% YoY

🔸 Record cash: $4.97B

🔸 Acquired Onum Technology

🔸 FY EPS outlook: ~$3.66 ($3.50 prior)

🔸 Q3 revenue outlook: ~$1.21B

27.08.2025 20:59 — 👍 0 🔁 0 💬 0 📌 0

$NVDA | Nvidia is -3.0% after-hours.

🔹 EPS: $1.05 vs. $1.01 est. ✅

🔹 Revenue: $46.74B vs. $46.05B est. ✅

Key takeaways:

🔸 Data center revenue: +56% YoY

🔸 Gaming revenue: +49% YoY

🔸 Gross margin: 72.4%

🔸 Announced $60B in buybacks

🔸 Q3 revenue outlook: $54.0B

🔸 Q3 gross margin outlook: 73.3%

27.08.2025 20:42 — 👍 0 🔁 0 💬 0 📌 0

$DE | Deere & Co is -5.8% this morning.

🔹 EPS: $4.75 vs. $4.58 est. ✅

🔹 Revenue: $12.02B vs. $10.35B est. ✅

Key takeaways:

🔸 Production rev: -16% YoY

🔸 Small ag rev: -1% YoY

🔸 Financial rev: -5% YoY

🔸 FY net income outlook: $4.75B-$5.25B

🔸 FY revenue outlook: -10% to -15% YoY across all segments

14.08.2025 12:18 — 👍 0 🔁 0 💬 0 📌 0

$CSCO | Cisco is -2.7% after-hours.

🔹 EPS: $0.99 vs. $0.98 est. ✅

🔹 Revenue: $14.67B vs. $14.62B est. ✅

Key takeaways:

🔸 Networking revenue: +12% YoY

🔸 Security revenue: +9% YoY

🔸 RPO: $43.5B (+6% YoY)

🔸 FY revenue outlook: $59.0B-$60.0B

🔸 FY EPS outlook: $2.79-$2.91

13.08.2025 20:20 — 👍 0 🔁 0 💬 0 📌 0

$ABNB | Airbnb is +0.4% after-hours.

🔹 EPS: $1.03 vs. $0.94 est. ✅

🔹 Revenue: $3.10B vs. $3.03B est. ✅

Key takeaways:

🔸 Nights/experiences booked: +7% YoY

🔸 Gross booking value: +11% YoY

🔸 Adj EBITDA: +17% YoY

🔸 FY EBITDA margin outlook: 34.5%

🔸 Q3 revenue outlook: $4.06B (+9% YoY)

06.08.2025 20:21 — 👍 1 🔁 0 💬 0 📌 0

$DIS | Disney is -2.0% this morning.

🔹 EPS: $1.61 vs. $1.45 est. ✅

🔹 Revenue: $23.65B vs. $23.69B est. 🔴

Key takeaways:

🔸 Entertainment revenue: +1% YoY

🔸 Experiences revenue: +8% YoY

🔸 Disney+ subs: 128M (+21% YoY)

🔸 FY EPS outlook: $5.85 ($5.75 prior)

🔸 Q4 Disney+ subs outlook: +10M QoQ

06.08.2025 13:30 — 👍 0 🔁 0 💬 0 📌 0

$MCD | McDonald's is +3.4% this morning.

🔹 EPS: $3.19 vs. $3.14 est. ✅

🔹 Revenue: $6.84B vs. $6.70B est. ✅

Key takeaways:

🔸 Company revenue: Flat YoY

🔸 Franchise revenue: +7% YoY

🔸 Global comp sales: +3.8% YoY

🔸 US sales: +2.5% YoY

🔸 Systemwide sales: +8% YoY

06.08.2025 13:10 — 👍 1 🔁 0 💬 0 📌 0

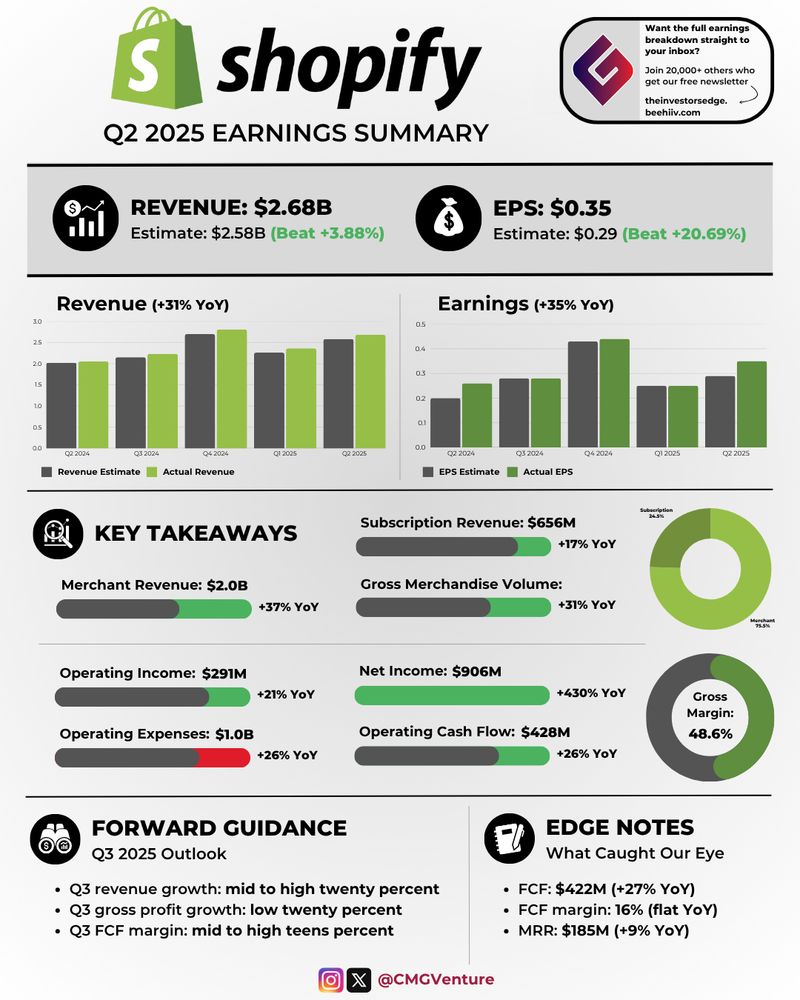

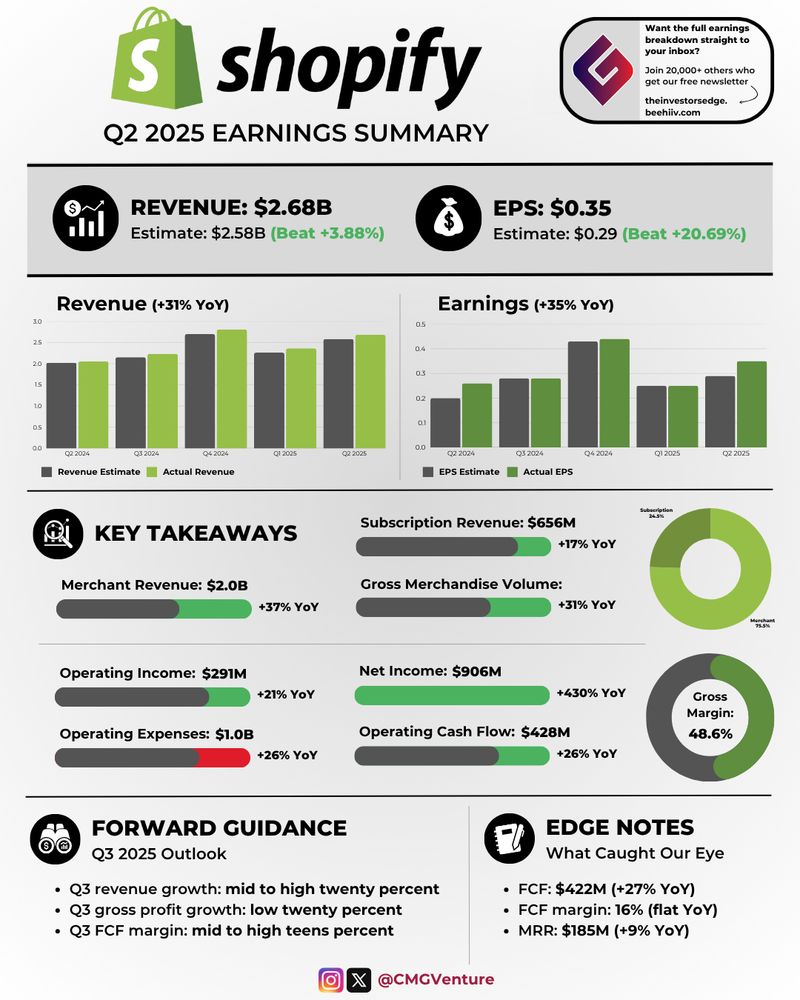

$SHOP | Shopify is +14.7% this morning.

🔹 EPS: $0.35 vs. $0.29 est. ✅

🔹 Revenue: $2.68B vs. $2.58B est. ✅

Key takeaways:

🔸 Merchant revenue: +37% YoY

🔸 Gross merch volume: +31% YoY

🔸 Free cash flow margin: 16%

🔸 Q3 profit outlook: +21% to +23% YoY

🔸 Q3 revenue outlook: +25% to +27% YoY

06.08.2025 12:59 — 👍 0 🔁 0 💬 0 📌 0

$UBER | Uber is -0.4% this morning.

🔹 EPS: $0.63 vs. $0.63 est. 🟠

🔹 Revenue: $12.65B vs. $12.47B est. ✅

Key takeaways:

🔸 Mobility revenue: +19% YoY

🔸 Gross bookings: +17% YoY

🔸 MAUs: 180M (+15% YoY)

🔸 Q3 bookings outlook: ~$49.0B (+19% YoY)

🔸 Q3 adj EBITDA outlook: ~$2.14B (+33% YoY)

06.08.2025 12:44 — 👍 0 🔁 0 💬 0 📌 0

$AMD | AMD is -3.4% after-hours.

🔹 EPS: $0.48 vs. $0.48 est. 🟠

🔹 Revenue: $7.69B vs. $7.41B est. ✅

Key takeaways:

🔸 Data center revenue: +14% YoY

🔸 Client revenue: +67% YoY

🔸 Gaming revenue: +73% YoY

🔸 Q3 margin outlook: 54.0%

🔸 Q3 revenue outlook: $8.4B-$9.0B

05.08.2025 20:28 — 👍 0 🔁 0 💬 0 📌 0

$PLTR | Palantir is +3.8% after-hours.

🔹 EPS: $0.16 vs. $0.14 est. ✅

🔹 Revenue: $1.00B vs. $937.7M est. ✅

Key takeaways:

🔸 US gov't revenue: +53% YoY

🔸 US commercial revenue: +93% YoY

🔸 Record contract wins: $2.3B TCV (+140% YoY)

🔸 FY rev outlook: $4.146B ($3.9B prior)

🔸 Q3 rev outlook: $1.085B

04.08.2025 20:26 — 👍 0 🔁 0 💬 0 📌 0

$CVX | Chevron beat earnings and revenue estimates in Q2. The stock is +1.0% this morning.

🔹 EPS: $1.77 vs. $1.73 est. ✅

🔹 Revenue: $44.82B vs. $43.87B est. ✅

Key takeaways:

🔸 Upstream earnings: -39% YoY

🔸 Downstream earnings: +23% YoY

🔸 Production: +3% YoY

🔸 FY capex outlook: $15.0B

01.08.2025 13:57 — 👍 0 🔁 0 💬 0 📌 0

$XOM | Exxon Mobil beat earnings and revenue estimates in Q2. The stock is -0.8% this morning.

🔹 EPS: $1.64 vs. $1.57 est. ✅

🔹 Revenue: $81.51B vs. $80.70B est. ✅

Key takeaways:

🔸 Upstream earnings: -20% YoY

🔸 Energy earnings: -22% YoY

🔸 Production: +14% YoY

🔸 FY capex outlook: $27.0B-$29.0B

01.08.2025 13:43 — 👍 0 🔁 0 💬 0 📌 0

NFP revisions to previous months are wild:

June: was 147k --> now 14k

May: was 144k --> now 19k

Total number of cuts = -258k

01.08.2025 12:53 — 👍 0 🔁 0 💬 0 📌 0

Nonfarm payrolls were weaker than expected, but May/June data saw massive revisions

🔹 Nonfarm payrolls: 73K vs. 104K est. (14K prior*)

🔸 Average Hourly Earnings MoM: 0.3% vs. 0.3% est. (0.2% prior)

🔸 Average Hourly Earnings YoY: 3.9% vs. 3.8% est. (3.9% prior)

01.08.2025 12:53 — 👍 0 🔁 0 💬 1 📌 0

$AAPL | Apple is +2.6% after-hours.

🔹 EPS: $1.57 vs. $1.43 est. ✅

🔹 Revenue: $94.04B vs. $89.35B est. ✅

Key takeaways:

🔸 iPhone revenue: +14% YoY

🔸 Services revenue: +13% YoY

🔸 Accessories revenue: +13% YoY

🔸 Mac revenue: +15% YoY

🔸 iPad revenue: -8% YoY

🔸 China revenue: +4% YoY

31.07.2025 20:49 — 👍 0 🔁 0 💬 0 📌 0

$AMZN | Amazon is -4.7% after-hours.

🔹 EPS: $1.68 vs. $1.33 est. ✅

🔹 Revenue: $167.70B vs. $162.19B est. ✅

Key takeaways:

🔸 N. America rev: +11% YoY

🔸 International rev: +16% YoY

🔸 AWS rev: +18% YoY

🔸 Q3 revenue outlook: $174.0B-$179.5B (+12% YoY)

🔸 Q3 op. income outlook: $15.5B-$20.5B (+3% YoY)

31.07.2025 20:18 — 👍 1 🔁 0 💬 0 📌 0

$ABBV | AbbVie is +2.5% this morning.

🔹 EPS: $2.97 vs. $2.88 est. ✅

🔹 Revenue: $15.42B vs. $15.03B est. ✅

Key takeaways:

🔸 Humira revenue: -58% YoY

🔸 Skyrizi revenue: +62% YoY

🔸 Rinvoq revenue: +42% YoY

🔸 FY EPS outlook: $11.88-$12.08 (~$11.77 prior)

31.07.2025 14:50 — 👍 0 🔁 0 💬 0 📌 0

$MA | Mastercard is +3.1% this morning.

🔹 EPS: $4.15 vs. $4.03 est. ✅

🔹 Revenue: $8.13B vs. $7.93B est. ✅

Key takeaways:

🔸 Payment network revenue: +13% YoY

🔸 Services revenue: +23% YoY

🔸 Gross dollar volume: +9% YoY

🔸 Cross border volume: +15% YoY

🔸 Q3/FY revenue outlook: +15% to +17% YoY

31.07.2025 14:09 — 👍 0 🔁 0 💬 0 📌 0

Jobless claims were lower than expected last week

🔹 Initial Jobless Claims: 218K vs. 224K est. (217K prior*)

🔸 Continuing Claims: 1.946M vs. 1.953M est. (1.946M prior*)

31.07.2025 13:24 — 👍 1 🔁 0 💬 0 📌 0

PCE month-over-month was in-line with estimates, as last month's data was revised higher

🔹 PCE MoM: 0.3% vs. 0.3% est. (0.2% prior)

🔸 Core PCE MoM: 0.3% vs. 0.3% est. (0.2% prior)

31.07.2025 13:04 — 👍 0 🔁 0 💬 0 📌 0

PCE was hotter than expected in June while May data was revised higher

🔹 PCE YoY: 2.6% vs. 2.5% est. (2.4% prior*)

🔸 Core PCE YoY: 2.8% vs. 2.7% est. (2.8% prior*)

31.07.2025 13:00 — 👍 0 🔁 0 💬 0 📌 0

$LRCX | Lam Research is +2.1% after-hours.

🔹 EPS: $1.33 vs. $1.21 est. ✅

🔹 Revenue: $5.17B vs. $5.00B est. ✅

Key takeaways:

🔸 Systems revenue: +58% YoY

🔸 China revenue: +20% YoY

🔸 Deferred revenue: $2.7B

🔸 Q1 revenue outlook: $4.9B-$5.5B

🔸 Q1 EPS outlook: $1.10-$1.30

30.07.2025 21:16 — 👍 0 🔁 0 💬 0 📌 0

$QCOM | Qualcomm is -4.5% after-hours.

🔹 EPS: $2.77 vs. $2.71 est. ✅

🔹 Revenue: $10.37B vs. $10.34B est. ✅

Key takeaways:

🔸 QCT revenue: +11% YoY

🔸 QTL revenue: +4% YoY

🔸 Handsets revenue: +7% YoY

🔸 Q4 EPS outlook: $2.75-$2.95

🔸 Q4 revenue outlook: $10.3B-$11.1B

30.07.2025 20:49 — 👍 0 🔁 0 💬 0 📌 0

$META | Meta is +9.6% after-hours.

🔹 EPS: $7.14 vs. $5.88 est. ✅

🔹 Revenue: $47.52B vs. $44.81B est. ✅

Key takeaways:

🔸 Advertising revenue: +21% YoY

🔸 Capex: +108% YoY

🔸 Daily active users: 3.48B

🔸 Q3 revenue outlook: ~$49.0B

🔸 FY capex outlook: ~$69.0B ($68.0B prior)

30.07.2025 20:34 — 👍 0 🔁 0 💬 0 📌 0

$MSFT | Microsoft beat earnings and revenue estimates in Q4. The stock is +6.5% after-hours.

🔹 EPS: $3.65 vs. $3.37 est. ✅

🔹 Revenue: $76.44B vs. $73.86B est. ✅

Key takeaways:

🔸 Intelligent Cloud revenue: +26% YoY

🔸 Azure/Cloud services: +39% YoY

🔸 Productivity revenue: +16% YoY

30.07.2025 20:21 — 👍 0 🔁 0 💬 0 📌 0

$SBUX | Starbucks missed earnings estimates in Q3. The stock is +5.0% after-hours.

🔹 EPS: $0.50 vs. $0.65 est. 🔴

🔹 Revenue: $9.46B vs. $9.29B est. ✅

Key takeaways:

🔸 N. America revenue: +2% YoY

🔸 US comp sales: -2% YoY

🔸 Int'l comp sales: Flat YoY

🔸 Global transactions: -2% YoY

29.07.2025 20:39 — 👍 0 🔁 0 💬 0 📌 0

$V | Visa is -2.2% after-hours.

🔹 EPS: $2.98 vs. $2.85 est. ✅

🔹 Revenue: $10.17B vs. $9.85B est. ✅

Key takeaways:

🔸 Service revenue: +9% YoY

🔸 Data process revenue: +15% YoY

🔸 Payment volume: +8% YoY

🔸 Q4 EPS outlook: +8% to +12% YoY

🔸 FY revenue outlook: +10% to +12% YoY

29.07.2025 20:26 — 👍 1 🔁 0 💬 0 📌 0