For PhD students - ChatGPT is super helpful if you want to deeply understand a paper in your field- e.g. I'm working through Humphries et al. (2024), which is fairly technical, and it can generate questions to check my understanding, and then answer them very clearly. papers.ssrn.com/sol3/papers....

21.05.2025 18:43 — 👍 1 🔁 0 💬 0 📌 0

Wait you're telling me that's Trump's CEA did the math, and it ended up being complete nonsense?

This is shocking to me.

Surely there's no precedent for an error this egregious.

03.04.2025 03:00 — 👍 1 🔁 0 💬 0 📌 0

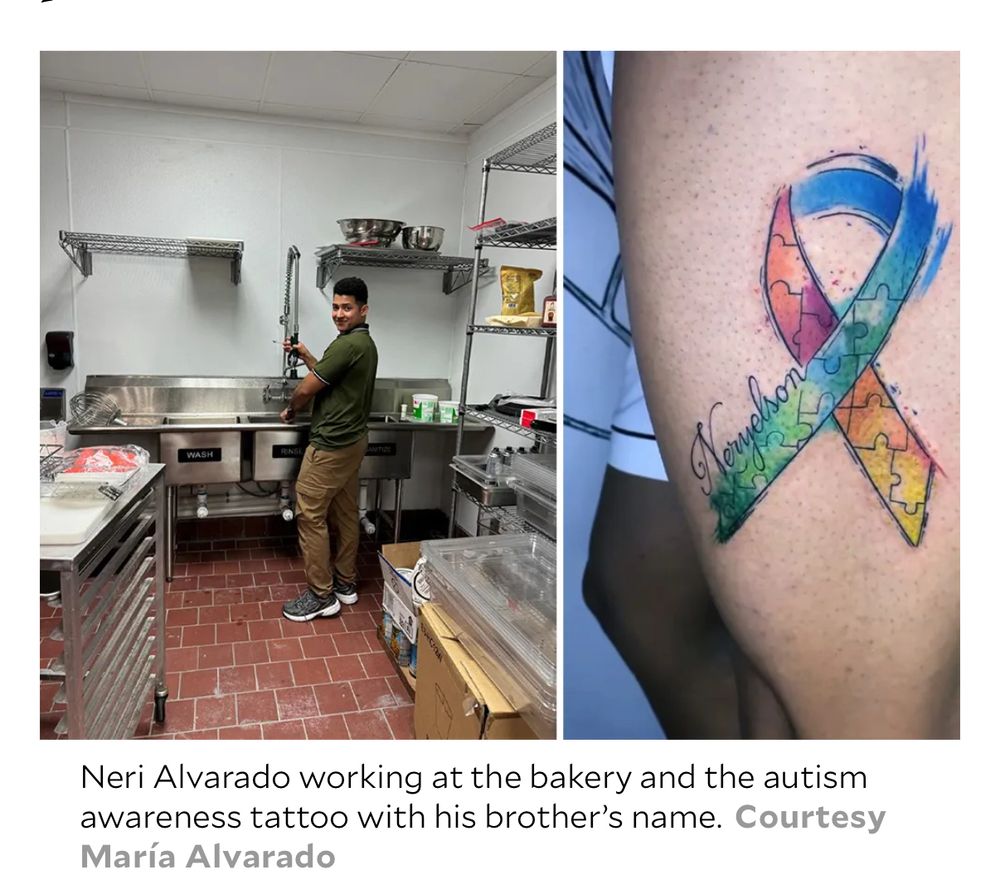

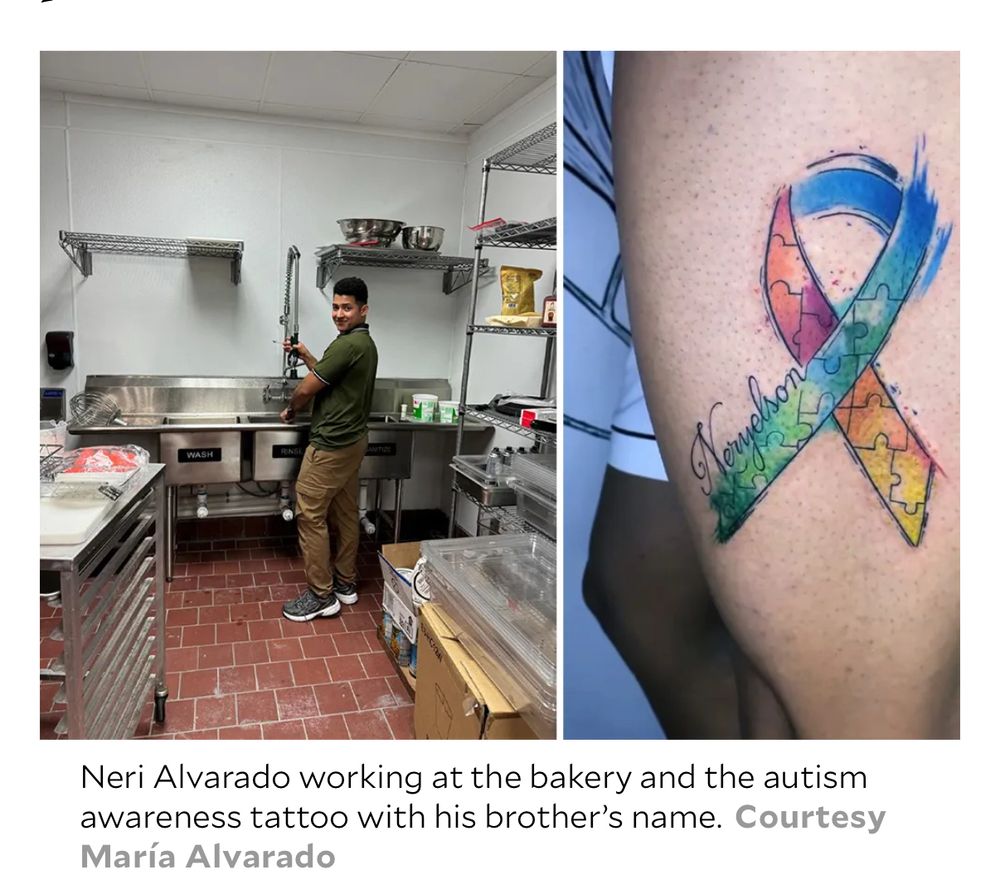

This guy is in one of the worst prisons in the world with no way out and may spend the rest of his life there because, it appears, he has an autism awareness tattoo in honor of his little brother.

www.motherjones.com/politics/202...

26.03.2025 23:46 — 👍 56604 🔁 21412 💬 2001 📌 1370

It would be nice if @bsky.app would add a “share to IG stories” option on posts in the same way you can share Twitter posts directly to IG (with nice formatting).

Seems like a good way to pull more users into the app and decrease traffic to X.

25.03.2025 14:09 — 👍 1 🔁 0 💬 0 📌 0

![February 24, 2025

Comments from survey respondents

These comments are from respondents’ completed surveys and have been edited for publication.

Chemical manufacturing

The dynamic tariff situation is one for us to follow and seek to understand. The approach to improve export tariffs for U.S. companies seeking to deliver goods in foreign countries is good, and we believe the current tactic of reciprocal tariffs could drive improvement for U.S. export competitiveness.

Tariff threats and uncertainty are extremely disruptive.

Computer and electronic product manufacturing

Keep lowering interest rates, please.

The overall effects of administrative change have stalled consumer and customer spending.

We are uncertain as to the full impact of tariffs related to our business. We procure parts from overseas. We have lost business opportunities for production of goods that goes to other countries as a result of tariffs. We may see new opportunities for products built elsewhere for companies who wish to shift manufacturing to the U.S. to avoid tariffs. There is much uncertainty at the moment as to how this will shake out.

With some of the new Buy America changes and tariffs incoming, we are looking at closing the business.

We are seeing broad signals of demand cyclically recovering. Personal electronics, communications equipment and enterprise business are now several quarters into a cyclical recovery. We are seeing industrial and automotive inventories cleaned out, and our revenues are returning to consumption.

Fabricated metal product manufacturing

We are starting to see old requests for quotations starting to receive purchase orders. We are still having issues filling positions.

We are still in a low-volume period but are holding steady as we’ve flexed down capacity and costs accordingly.

Food manufacturing

President Trump’s freeze on government contracts has had a dramatic impact on us. USAID [United States Agency for International Development] is our major customer. That as…](https://cdn.bsky.app/img/feed_thumbnail/plain/did:plc:pnx2fjuannbdpy3337ggthpp/bafkreidab44c624nghp4nt57pydbnfn6nk6tl62nuhybbmq2ni7inx5kdm@jpeg)

February 24, 2025

Comments from survey respondents

These comments are from respondents’ completed surveys and have been edited for publication.

Chemical manufacturing

The dynamic tariff situation is one for us to follow and seek to understand. The approach to improve export tariffs for U.S. companies seeking to deliver goods in foreign countries is good, and we believe the current tactic of reciprocal tariffs could drive improvement for U.S. export competitiveness.

Tariff threats and uncertainty are extremely disruptive.

Computer and electronic product manufacturing

Keep lowering interest rates, please.

The overall effects of administrative change have stalled consumer and customer spending.

We are uncertain as to the full impact of tariffs related to our business. We procure parts from overseas. We have lost business opportunities for production of goods that goes to other countries as a result of tariffs. We may see new opportunities for products built elsewhere for companies who wish to shift manufacturing to the U.S. to avoid tariffs. There is much uncertainty at the moment as to how this will shake out.

With some of the new Buy America changes and tariffs incoming, we are looking at closing the business.

We are seeing broad signals of demand cyclically recovering. Personal electronics, communications equipment and enterprise business are now several quarters into a cyclical recovery. We are seeing industrial and automotive inventories cleaned out, and our revenues are returning to consumption.

Fabricated metal product manufacturing

We are starting to see old requests for quotations starting to receive purchase orders. We are still having issues filling positions.

We are still in a low-volume period but are holding steady as we’ve flexed down capacity and costs accordingly.

Food manufacturing

President Trump’s freeze on government contracts has had a dramatic impact on us. USAID [United States Agency for International Development] is our major customer. That as…

![Miscellaneous manufacturing

Sales volumes have been trending downward in the last 28 months. We have cut hours to 36 per week, and it is not enough to get profitable. Next week, we are cutting further to 32 hours and laying off three people. The uncertainty in tariff threats and general chaos of another Trump presidency is weighing heavy on our business. All customers are decreasing or pushing out orders—taking a wait-and-see posture. Automotive OEM [original equipment manufacturer] and aftermarket represents 72 percent of our sales. The outlook from automotive OEM is that production should begin to pick up in second quarter 2025, but no firm increases have been promised. The outlook is bleak.

Nonmetallic mineral product manufacturing

It is very hard to plan. Interest rates? Tariffs? Wow.

Paper manufacturing

Currently it is very slow, and we started reduced production hours in the plant. Orders are also very slow. A price increase in the industry has been delayed 30 days due to softness.

Plastics and rubber products manufacturing

Customers, vendors and ourselves are all trying to get ahead of anticipated global trade challenges. It is stressing capacities, especially with production personnel.

Primary metal manufacturing

The proposed 25 percent tariffs on steel imports will directly and favorably improve the bottom line as a domestic steel manufacturer. However, uncertainty is sky high.

It is A Tale of Two Cities. February was down compared with January, but our outlook remains positive due to the 25 percent Section 232 tariff on aluminum. This tariff is expected to slow the influx of foreign aluminum from Mexico and other countries. Currently, a significant amount of aluminum is being dumped into the U.S. market, with many countries subsidizing their exports to gain a competitive edge. The bottom line: If the tariffs remain in place, they will benefit our industry. However, if they are reversed, many companies in our sector will struggle to survive.

Production impr…](https://cdn.bsky.app/img/feed_thumbnail/plain/did:plc:pnx2fjuannbdpy3337ggthpp/bafkreid6x4vexv53kgzplwxdiyyucbaylrf2ldupesbvoevzlei2gichgq@jpeg)

Miscellaneous manufacturing

Sales volumes have been trending downward in the last 28 months. We have cut hours to 36 per week, and it is not enough to get profitable. Next week, we are cutting further to 32 hours and laying off three people. The uncertainty in tariff threats and general chaos of another Trump presidency is weighing heavy on our business. All customers are decreasing or pushing out orders—taking a wait-and-see posture. Automotive OEM [original equipment manufacturer] and aftermarket represents 72 percent of our sales. The outlook from automotive OEM is that production should begin to pick up in second quarter 2025, but no firm increases have been promised. The outlook is bleak.

Nonmetallic mineral product manufacturing

It is very hard to plan. Interest rates? Tariffs? Wow.

Paper manufacturing

Currently it is very slow, and we started reduced production hours in the plant. Orders are also very slow. A price increase in the industry has been delayed 30 days due to softness.

Plastics and rubber products manufacturing

Customers, vendors and ourselves are all trying to get ahead of anticipated global trade challenges. It is stressing capacities, especially with production personnel.

Primary metal manufacturing

The proposed 25 percent tariffs on steel imports will directly and favorably improve the bottom line as a domestic steel manufacturer. However, uncertainty is sky high.

It is A Tale of Two Cities. February was down compared with January, but our outlook remains positive due to the 25 percent Section 232 tariff on aluminum. This tariff is expected to slow the influx of foreign aluminum from Mexico and other countries. Currently, a significant amount of aluminum is being dumped into the U.S. market, with many countries subsidizing their exports to gain a competitive edge. The bottom line: If the tariffs remain in place, they will benefit our industry. However, if they are reversed, many companies in our sector will struggle to survive.

Production impr…

The Dallas Fed's Manufacturing Activity Index records comments every month from its respondents (factories in southern NM, TX, and northern LA). These typically run pretty far to the right of the WSJ Editorial page. Anyhow, here's what they're saying this month:

www.dallasfed.org/research/sur...

24.02.2025 16:14 — 👍 734 🔁 234 💬 29 📌 64

🥳 The 16th #TWEC Transatlantic Workshop on the Economics of Crime is coming to Berlin in 2025!

🎓 @chtraxler.bsky.social and I are excited to host the workshop on 26-27 September, with keynotes by Paolo Pinotti and Marie Rosenkrantz Lindegaard.

⏱️ Deadline to submit your papers: 02 May 2025!

More👇

19.02.2025 21:50 — 👍 24 🔁 22 💬 1 📌 3

Nice little data viz tip

18.02.2025 20:51 — 👍 2 🔁 0 💬 0 📌 0

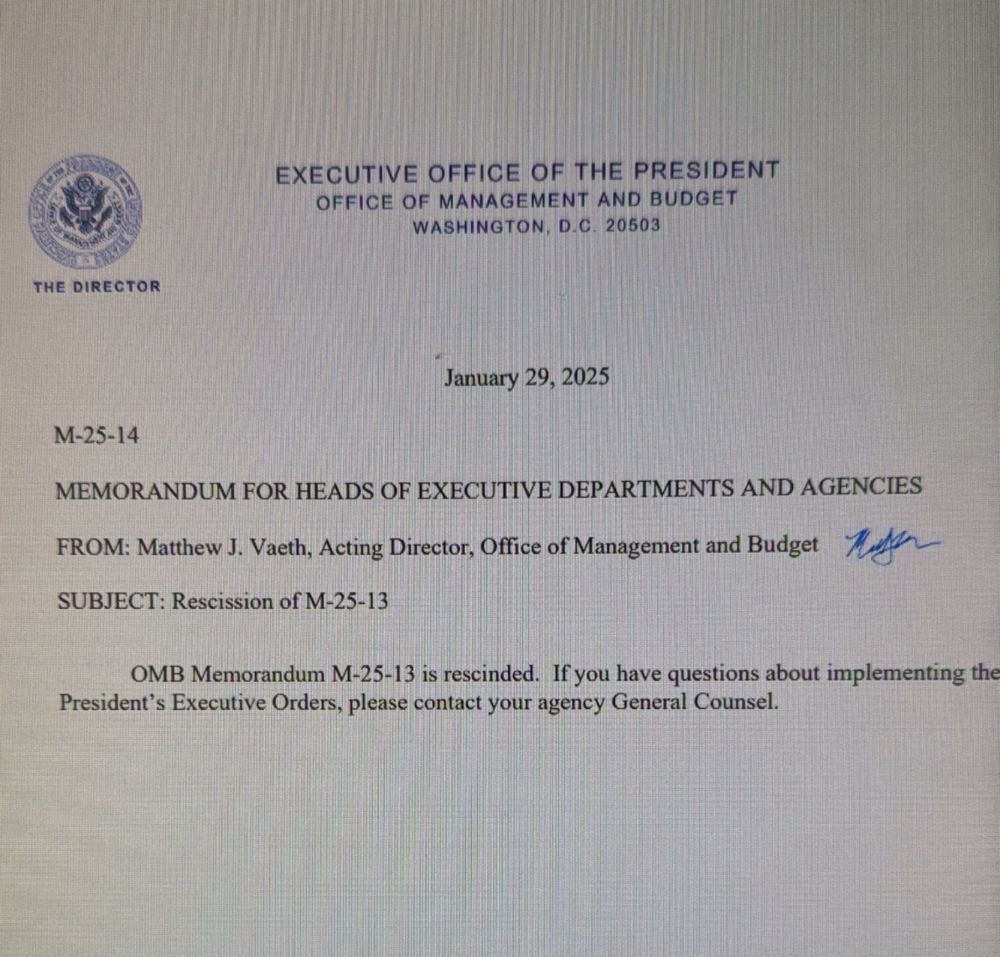

January 29, 2025

M-25-14

MEMORANDUM FOR HEADS OF EXECUTIVE DEPARTMENTS AND AGENCIES

FROM: Matthew J. Vaeth, Acting Director, Office of Management and Budget Me

SUBJECT: Rescission of M-25-13

OMB Memorandum M-25-13 is rescinded. If you have questions about implementing the

President's Executive Orders, please contact your agency General Counsel.

🚨 BREAKING: OMB has just issued a memo *rescinding* the previous memo freezing all federal financial assistance programs.

Full text, per government source:

29.01.2025 17:48 — 👍 11967 🔁 3826 💬 692 📌 1920

a graph of housing production by state, showing California, Colorado, and Washington at similar levels and far ahead of California throughout the 2010s

re: today's discourse, I have been battle-hardened by enough housing discourse to know that you have to couch criticism of California restrictions not just by contrasting it against Texas but also by contrasting it against Washington, Colorado, etc

18.01.2025 19:13 — 👍 175 🔁 21 💬 6 📌 2

Congestion pricing coverage is peak economics

Every person is like, "I didn't used to bear any of the external costs of my behavior. But now that I do, I am adjusting along an infinite variety of least-cost adaptive margins that no central planner could have foreseen or designed"

14.01.2025 23:06 — 👍 329 🔁 77 💬 6 📌 4

The vibes in my MN group chats are approaching record lows

14.01.2025 03:14 — 👍 1 🔁 0 💬 0 📌 0

Climate change may be a key driver of these fires in LA, but at some point you have to question the role "Dry January" is playing as well.

I may have to call it quits early. (For the sake of my community)

11.01.2025 21:46 — 👍 0 🔁 0 💬 0 📌 0

Watch Duty - Wildfire Maps & Alerts

Watch Duty, a 501(c)(3) nonprofit, alerts you of nearby wildfires and firefighting efforts in real-time.

Pretty amazing that nonprofit Watch Duty -- which says it has 150 volunteers working around the clock to track wildfires -- has become the most trusted source of information on LA fires. Operated by retired/volunteer firefighters, dispatchers, and reporters. Real people.

www.watchduty.org

09.01.2025 18:18 — 👍 1821 🔁 713 💬 29 📌 63

Ok, following on that last thread, here are my suggestions about how to be a good mentor (though this is still a work in progress!)

(And others should feel free to add to my list!)

A🧵

07.01.2025 22:44 — 👍 55 🔁 29 💬 5 📌 5

Dissertation Research Grants

The Russell Sage Foundation (RSF) has established a dissertation research grants (DRG) program to support innovative and high-quality dissertation research projects that address questions relevant to

ABD with an employment- or labor-related (broadly defined), policy-relevant dissertation?

@upjohninstitute.bsky.social partners with RSF to fund Dissertation Grants up to $15k.

Priority for topics focusing on BIPOC communities.

#FundSocSci #econ_ra

www.russellsage.org/research/fun...

07.01.2025 16:14 — 👍 7 🔁 7 💬 0 📌 1

Starting the new year off in Long Beach with some 10/10 walking weather ☀️

01.01.2025 23:03 — 👍 4 🔁 0 💬 0 📌 0

The discretion given to Attorney Generals (and District Attorneys) to decide who is allowed to break the law without consequence is… interesting.

31.12.2024 17:14 — 👍 1 🔁 0 💬 0 📌 0

This is a super interesting paper cognitive endurance.

30.12.2024 00:51 — 👍 95 🔁 17 💬 8 📌 2

We made a little “how to” card w/instructions that we set out by the cocktail station.

28.12.2024 19:46 — 👍 1 🔁 0 💬 0 📌 0

Earlier this year I did pre-batched French 75 mix - lemon juice, gin, and simple syrup. If your guests are down to pour ~3 oz of that into a shaker with ice, shake/strain in a coupe, and top with champagne (and a pre-cut lemon peel garnish), it’s vibey and delicious.

28.12.2024 19:46 — 👍 2 🔁 0 💬 1 📌 0

Bixby wishes you all a very Merry and sophisticated Christmas

25.12.2024 15:45 — 👍 0 🔁 0 💬 0 📌 0

Just finished season 2 of Shrinking and it has solidified itself as my favorite show of all time.

Highly highly recommend.

24.12.2024 05:53 — 👍 1 🔁 0 💬 0 📌 0

🚨 New paper alert! 🚨 Co-authored with Jose Azar: Chapter 10 - Monopsony Power in the Labor Market, in the Handbook of Labor Economics. doi.org/10.1016/bs.h... Honored to contribute to this series that inspired me as a young researcher! 🙌 #EconSky 🧵

11.12.2024 22:18 — 👍 94 🔁 24 💬 4 📌 1

Is there a good legal argument for why we have Presidential pardons at all?

They seem to directly go against the rule of law, no?

02.12.2024 01:17 — 👍 0 🔁 0 💬 0 📌 0

Need this in my life STAT

23.11.2024 22:48 — 👍 0 🔁 0 💬 0 📌 0

Every train is a wine train if you’re brave enough.

(This one is better though)

23.11.2024 22:00 — 👍 2 🔁 0 💬 0 📌 0

Christian, husband, dad. Vice President of the United States.

jdvance.com

economist & legal scholar studying criminal justice issues.

professor of law

professor of economics (by courtesy)

UVA

https://sites.google.com/view/megan-stevenson/home

Assistant professor at Yale. Labor economist. johnerichumphries.com

today we directly purchased Argentine pesos

Blogging at https://someunpleasant.substack.com/

Professor, Wharton School, and Senior Fellow, Lauder Inst (both at UPenn). Allianz Chief Economic Advisor. Chair, UnderArmour Board of Directors. Board member, NBER. CFR. Former co-CIO/CEO PIMCO and President, Queens' College, Cambridge University.

Lawyer for people at Kline & Specter. Teach @Duqklinelaw, “Faith and Democracy.” Former representative, Marine, prosecutor. Town hall participant.

The American Association of University Professors champions academic freedom, advances shared governance, and organizes faculty to ensure higher education's contribution to the common good.

aaup.org

Dad, husband, President, citizen. barackobama.com

White House + econ policy @washingtonpost.com. Bad golfer. jacob.bogage@washpost.com. Signal: jacobbogage.87.

Professor @sciencespo @ScPoEcon #econometrics #education

https://sites.google.com/site/clementdechaisemartin/

Journalist covering soccer in all its arenas (Substack: Five Asides) || Fmr. senior writer, The Athletic || MLS Weekly - Tuesdays on the Total Soccer Show || Putting the "bi" in byline 🏳️🌈

Minnesota Vikings beat writer @TheAthletic. Hosting Vikes pod, @AlecLewisShow. Mizzou alum from ‘Bama. alewis@theathletic.com. Let the kids write.

Assistant Professor in Sociology at the University of Minnesota studying housing, climate, racism, and population health.

Fellow at @cplusc.bsky.social

https://ncgraetz.com/

I'm a political scientist in @mccourtschool.bsky.social. I study trust in institutions and media effects on the public.

Web page: https://www.jonathanmladd.com/

Google Scholar: https://scholar.google.com/citations?user=J6tt69QAAAAJ&hl

Apologies for typos.

The Opportunity & Inclusive Growth Institute at the Minneapolis Fed supports research to expand economic opportunity and inclusive growth for all. Reposts ≠ endorsement.

Chief Policy Counsel, Council on Criminal Justice. Advancing public safety, individual liberty, and equal justice for all.

Freelance editor specializing in economics and justice policy (https://www.blueflowerediting) 🏊🏾♀️ 🚴🏾♀️

Husband, dad, veteran, writer, and proud Midwesterner. 19th US Secretary of Transportation and former Mayor of South Bend.

Making sense of it all. Become a member today. 👇

https://voxdotcom.visitlink.me/z3EPda

![February 24, 2025

Comments from survey respondents

These comments are from respondents’ completed surveys and have been edited for publication.

Chemical manufacturing

The dynamic tariff situation is one for us to follow and seek to understand. The approach to improve export tariffs for U.S. companies seeking to deliver goods in foreign countries is good, and we believe the current tactic of reciprocal tariffs could drive improvement for U.S. export competitiveness.

Tariff threats and uncertainty are extremely disruptive.

Computer and electronic product manufacturing

Keep lowering interest rates, please.

The overall effects of administrative change have stalled consumer and customer spending.

We are uncertain as to the full impact of tariffs related to our business. We procure parts from overseas. We have lost business opportunities for production of goods that goes to other countries as a result of tariffs. We may see new opportunities for products built elsewhere for companies who wish to shift manufacturing to the U.S. to avoid tariffs. There is much uncertainty at the moment as to how this will shake out.

With some of the new Buy America changes and tariffs incoming, we are looking at closing the business.

We are seeing broad signals of demand cyclically recovering. Personal electronics, communications equipment and enterprise business are now several quarters into a cyclical recovery. We are seeing industrial and automotive inventories cleaned out, and our revenues are returning to consumption.

Fabricated metal product manufacturing

We are starting to see old requests for quotations starting to receive purchase orders. We are still having issues filling positions.

We are still in a low-volume period but are holding steady as we’ve flexed down capacity and costs accordingly.

Food manufacturing

President Trump’s freeze on government contracts has had a dramatic impact on us. USAID [United States Agency for International Development] is our major customer. That as…](https://cdn.bsky.app/img/feed_thumbnail/plain/did:plc:pnx2fjuannbdpy3337ggthpp/bafkreidab44c624nghp4nt57pydbnfn6nk6tl62nuhybbmq2ni7inx5kdm@jpeg)

![Miscellaneous manufacturing

Sales volumes have been trending downward in the last 28 months. We have cut hours to 36 per week, and it is not enough to get profitable. Next week, we are cutting further to 32 hours and laying off three people. The uncertainty in tariff threats and general chaos of another Trump presidency is weighing heavy on our business. All customers are decreasing or pushing out orders—taking a wait-and-see posture. Automotive OEM [original equipment manufacturer] and aftermarket represents 72 percent of our sales. The outlook from automotive OEM is that production should begin to pick up in second quarter 2025, but no firm increases have been promised. The outlook is bleak.

Nonmetallic mineral product manufacturing

It is very hard to plan. Interest rates? Tariffs? Wow.

Paper manufacturing

Currently it is very slow, and we started reduced production hours in the plant. Orders are also very slow. A price increase in the industry has been delayed 30 days due to softness.

Plastics and rubber products manufacturing

Customers, vendors and ourselves are all trying to get ahead of anticipated global trade challenges. It is stressing capacities, especially with production personnel.

Primary metal manufacturing

The proposed 25 percent tariffs on steel imports will directly and favorably improve the bottom line as a domestic steel manufacturer. However, uncertainty is sky high.

It is A Tale of Two Cities. February was down compared with January, but our outlook remains positive due to the 25 percent Section 232 tariff on aluminum. This tariff is expected to slow the influx of foreign aluminum from Mexico and other countries. Currently, a significant amount of aluminum is being dumped into the U.S. market, with many countries subsidizing their exports to gain a competitive edge. The bottom line: If the tariffs remain in place, they will benefit our industry. However, if they are reversed, many companies in our sector will struggle to survive.

Production impr…](https://cdn.bsky.app/img/feed_thumbnail/plain/did:plc:pnx2fjuannbdpy3337ggthpp/bafkreid6x4vexv53kgzplwxdiyyucbaylrf2ldupesbvoevzlei2gichgq@jpeg)