#EconSky 📉📈

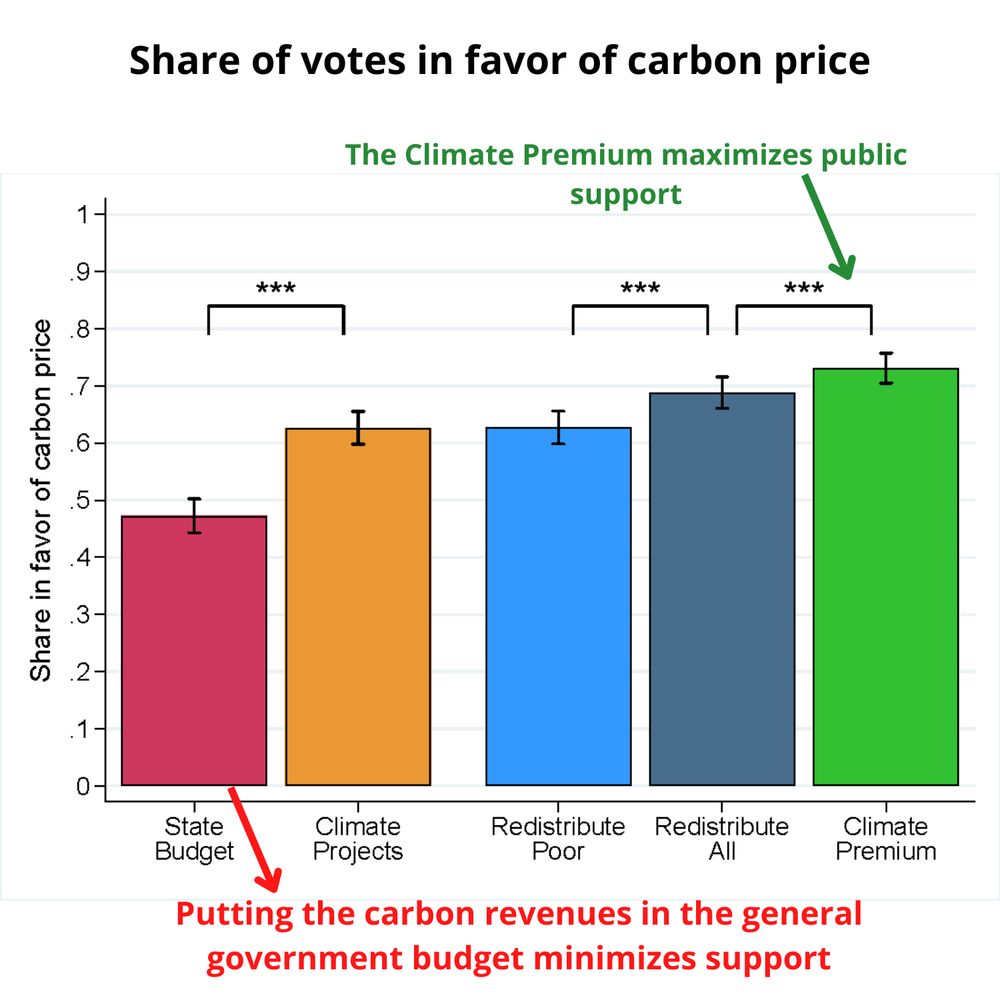

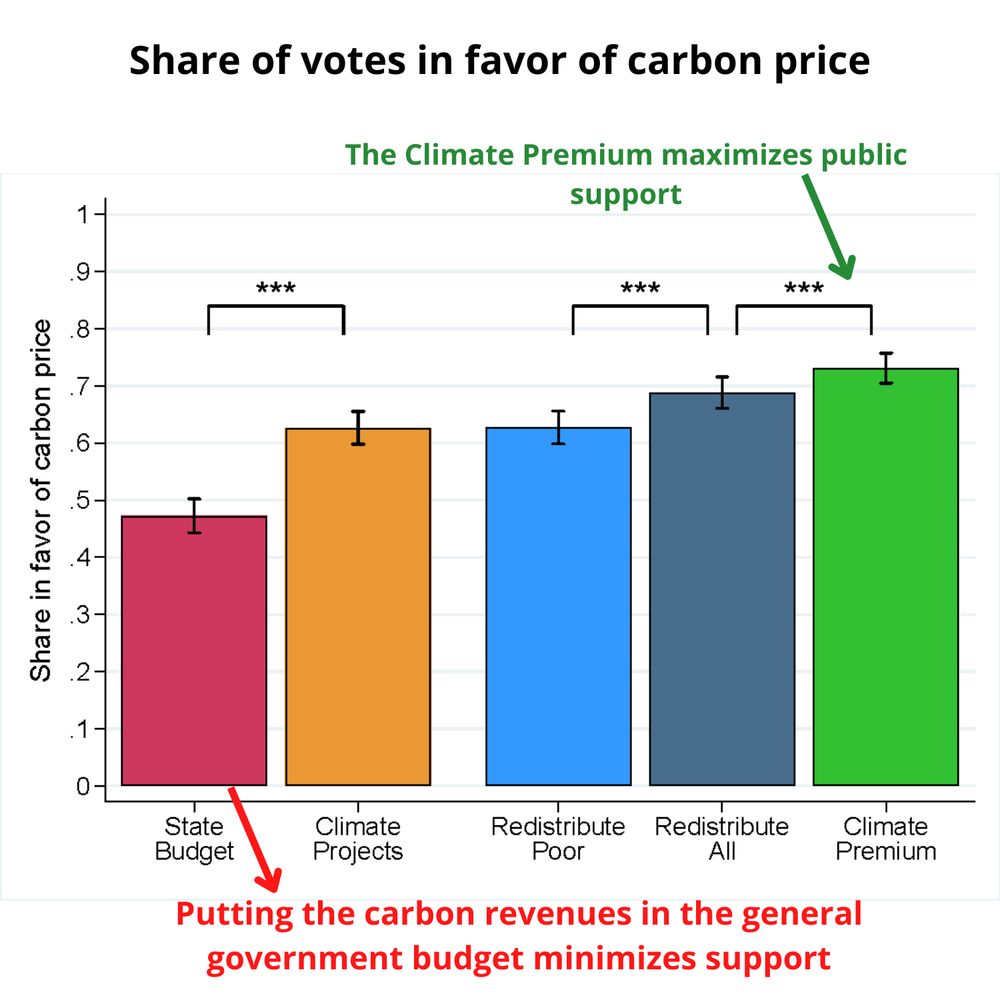

A new simple way to boost support for carbon pricing!

New article in @natureportfolio.bsky.social

- Public support is maximized by a Climate Premium: a fixed, uniform, upfront compensation

- Experts are too pessimistic about public support

- A novel incentivized design.

🧵 + link👇

21.11.2024 13:41 — 👍 59 🔁 18 💬 5 📌 5

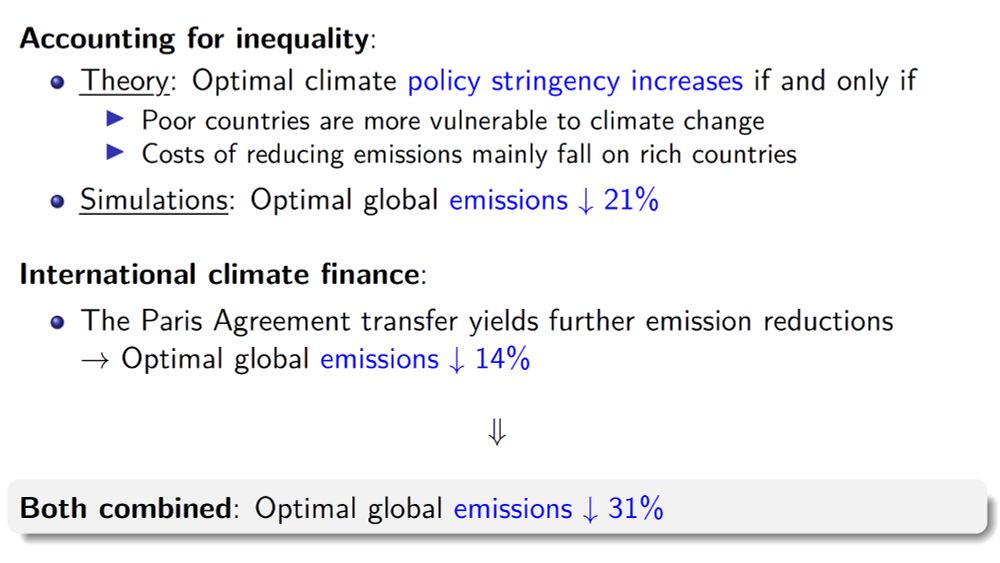

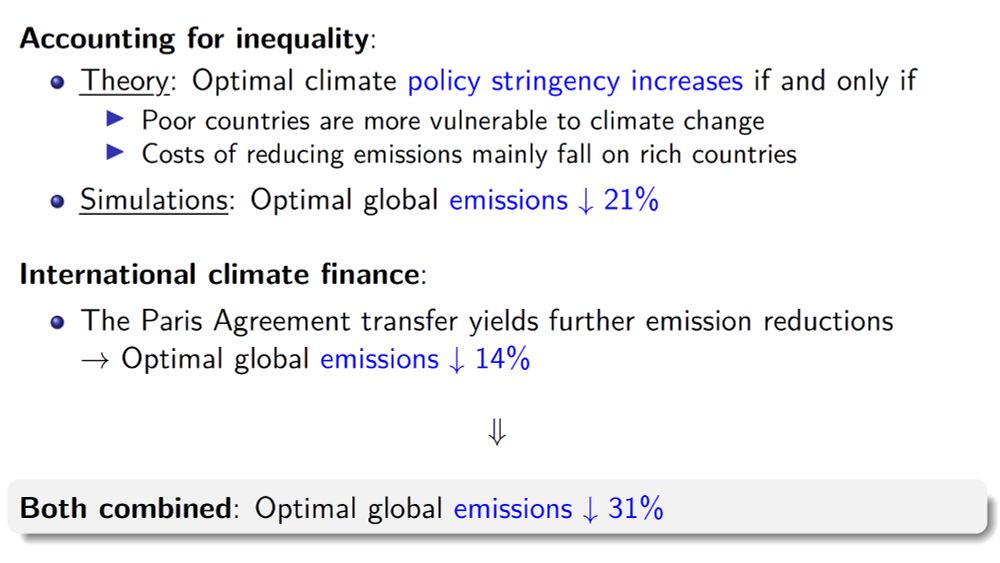

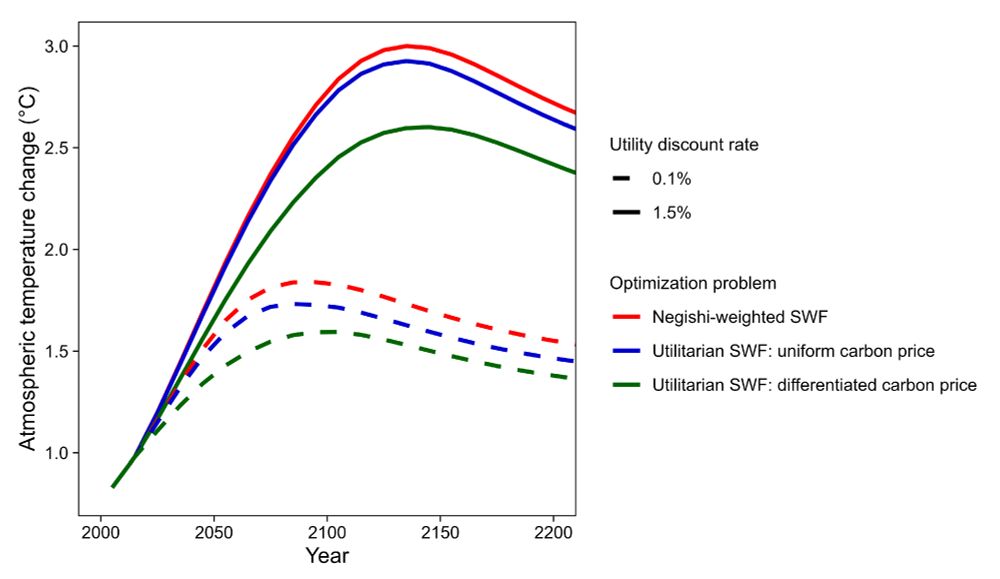

1️⃣+2️⃣ Together, accounting for inequality and international climate finance reduces optimal global emissions by 31% compared to a policy that excludes these factors.

03.12.2024 01:51 — 👍 1 🔁 0 💬 1 📌 0

👉I find that financial support for mitigation in developing countries substantially increases the stringency of optimal climate policy by lowering the welfare cost of abatement.

👉Notably, the optimal uniform carbon price in 2025 almost doubles.

03.12.2024 01:51 — 👍 0 🔁 0 💬 1 📌 0

2️⃣ How does international climate finance affect utilitarian carbon prices?

I’m focusing on the “Paris Agreement transfer” of $100 billion/yr (from developed to developing countries), and the main type of climate finance, which are payments for emission reductions.

03.12.2024 01:51 — 👍 0 🔁 0 💬 1 📌 0

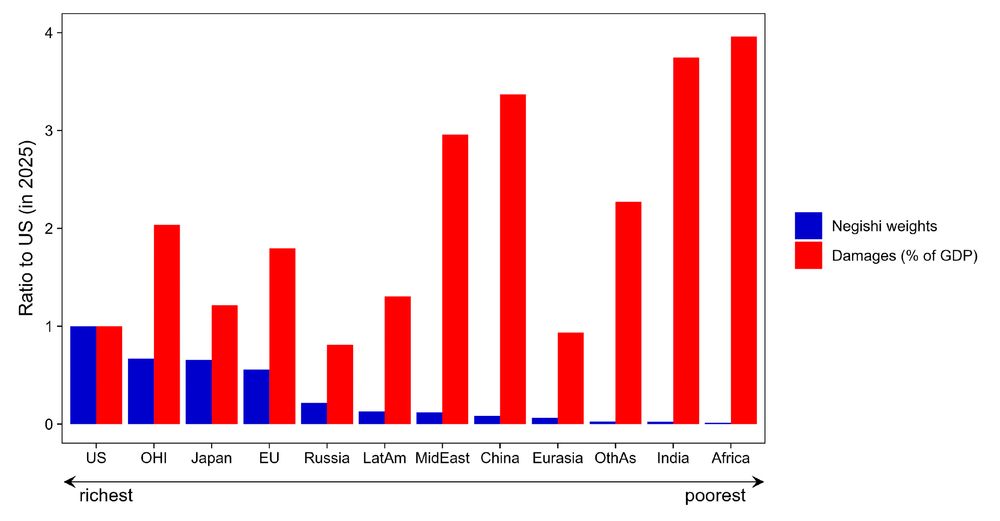

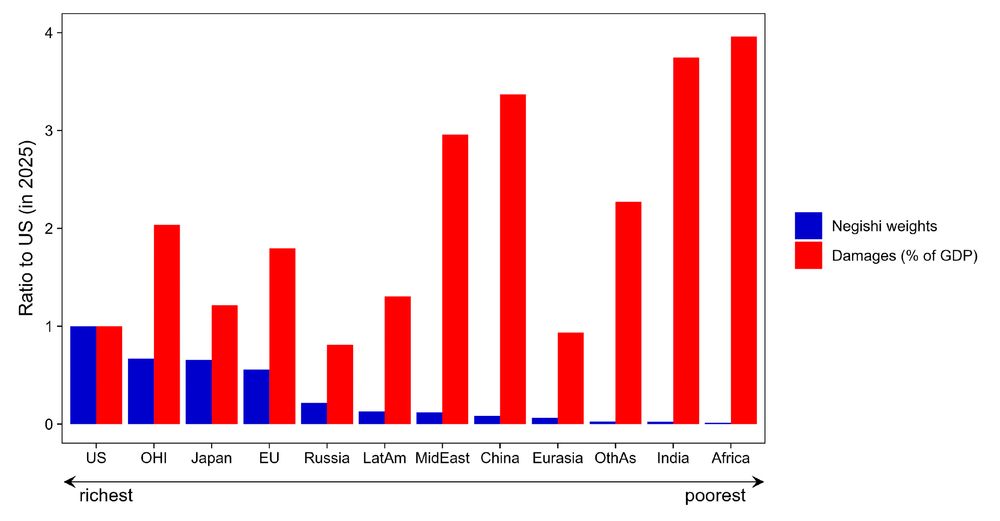

Leveraging the theoretical results provides additional intuition: The poorest region of the model, Africa, also has the highest preferred uniform carbon price—more than twice the preferred price of the US and the Negishi-weighted carbon price.

03.12.2024 01:51 — 👍 0 🔁 0 💬 1 📌 0

Main reason: disproportionately high climate damages in poorer countries.

Key intuition: By assigning lower weight to the welfare of poorer regions, Negishi weights effectively also downweight the regions most impacted by climate change (especially Africa).

03.12.2024 01:51 — 👍 0 🔁 0 💬 1 📌 0

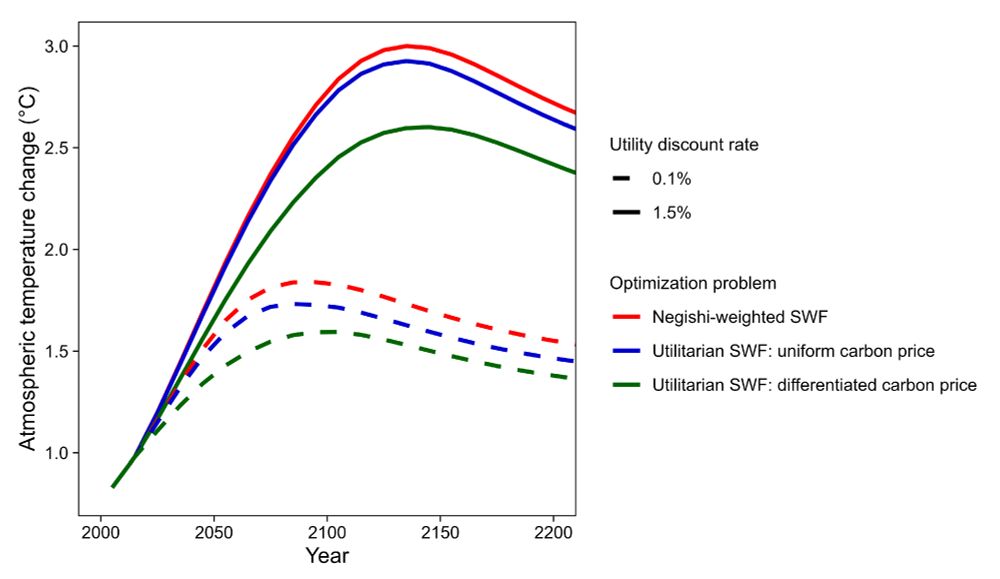

In simulations with the integrated assessment model RICE, I find that accounting for global inequality increases the optimal stringency of global climate policy, both if carbon prices are allowed to be regionally differentiated and if they are constrained to be globally uniform.

03.12.2024 01:51 — 👍 0 🔁 0 💬 1 📌 0

Regionally differentiated utilitarian carbon prices are welfare-cost-effective, while Negishi-weighted carbon prices are cost-effective (in monetary terms).

03.12.2024 01:51 — 👍 0 🔁 0 💬 1 📌 0

Furthermore, I introduce the concept of “welfare-cost-effectiveness”, which refers to emission reductions at the lowest possible welfare (utility) cost, and argue that this concept provides a useful perspective in settings with restricted transfers.

03.12.2024 01:51 — 👍 0 🔁 0 💬 1 📌 0

I link this result to nations’ preferred uniform carbon prices, a notion from Weitzman (2014) and Kotchen (2018):

The utilitarian uniform carbon price exceeds the Negishi-weighted carbon price iff poorer nations prefer higher uniform carbon prices than wealthier nations.

03.12.2024 01:51 — 👍 1 🔁 0 💬 1 📌 0

I identify the conditions under which accounting for global inequality leads to more stringent global climate policy.

This is the case if poorer nations have comparatively high marginal climate damages, steep marginal abatement cost functions, and fast-growing populations.

03.12.2024 01:51 — 👍 1 🔁 0 💬 1 📌 0

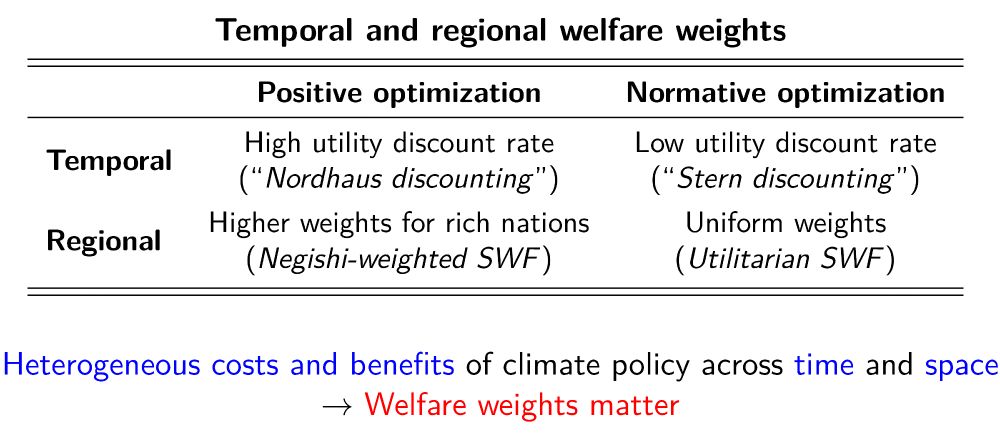

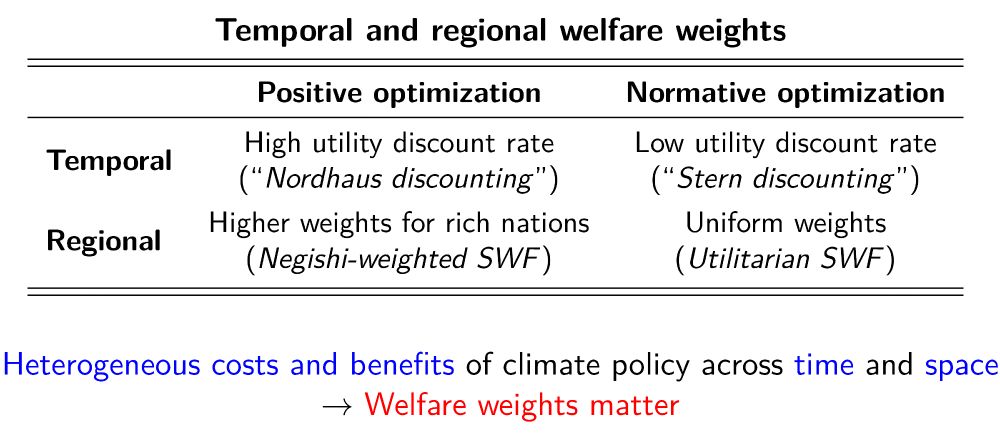

I focus on the two most commonly used welfare weights:

• Negishi weights: higher for rich nations, offsetting differences in marginal utilities of consumption across rich and poor countries, thereby disregarding global inequality

• Utilitarian weights: same for all countries

03.12.2024 01:51 — 👍 0 🔁 0 💬 1 📌 0

Using theory and calibrated simulations, I first examine how regional welfare weights affect optimal carbon prices (in the absence of international transfers).

03.12.2024 01:51 — 👍 0 🔁 0 💬 1 📌 0

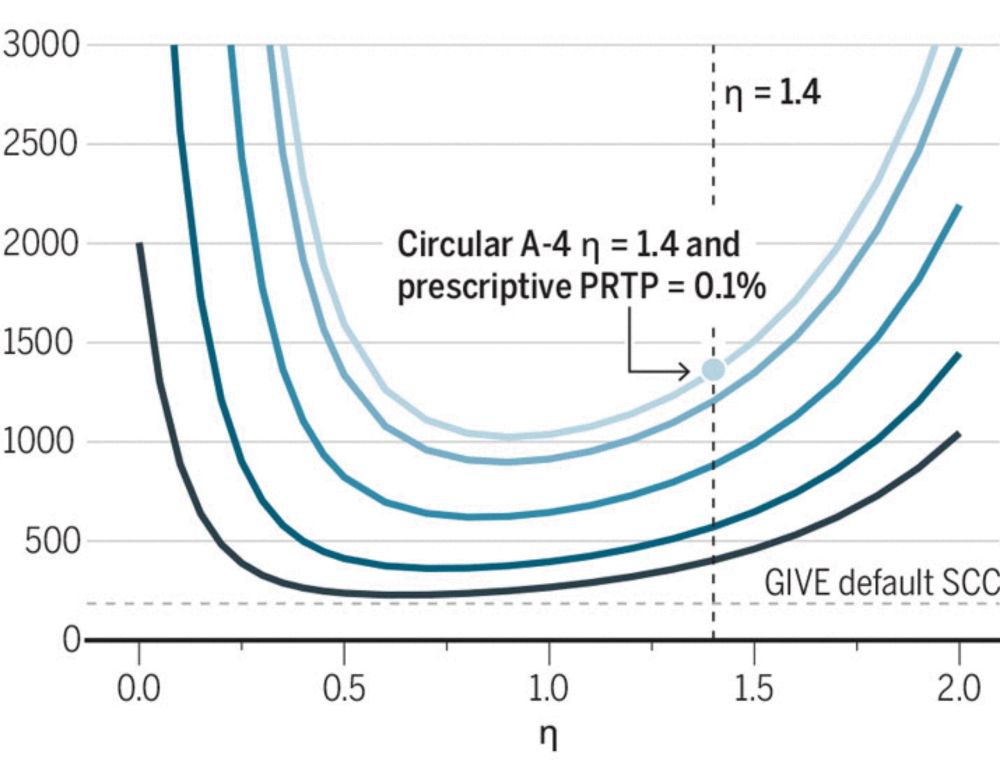

1️⃣ Climate change is global & long-term➡️ Optimal carbon prices depend on how we aggregate costs & benefits across countries and over time.

🕓Carbon prices are famously sensitive to discount rates.

🌐I focus on how costs & benefits are aggregated across countries.

03.12.2024 01:51 — 👍 0 🔁 0 💬 1 📌 0

Global inequality and international climate finance play central roles in international climate policy.

Yet, they are not reflected in standard estimates of optimal carbon prices.

I ask how these two aspects affect optimal carbon prices.

Let's start with global inequality 👇

03.12.2024 01:51 — 👍 0 🔁 0 💬 1 📌 0

Leading international journal dedicated to the systematic exploration of IPE from a plurality of perspectives.

Advancing transformative climate solutions. Analysis, insights, and research from the Climate, Economics, Finance and Equity team at the World Resources Institute.

CESifo is a global, independent research network with members from across the world. Our mission is to advance international scientific knowledge exchange in economics and economic policy.

www.cesifo.org

Econ prof at Harvard. (Mechanism design, market design, behavioral theory.) www.shengwu.li

ESRAH (formerly CEN) is researching the dynamics of Earth and society @uni-hamburg.de. It is home to the Cluster of Excellence #CLICCS. Our outreach team keeps you posted. uhh.de/esrah-imprint

Assistant Professor in Economics & Data Science at @univbordeaux.bsky.social | Distinguished Affiliate Member of @cesifo.org | PhD at @uni-hamburg.de

#climatepolicy #pollution #health #inequalities #sustainability #development

More here: bit.ly/3FB1tdI

Official account of the European Association of Environmental and Resource Economists - EAERE

https://www.eaere.org/

#EAERE

PhD candidate, The Fletcher School, Tufts University | Fellow, Climate Policy Lab | Green Economic Development, Industrial Policy, and Innovation

Climate economist | Guest professor Environmental and Political Economics @humboldtuni.bsky.social | Head @pecan-research.bsky.social

Climate Change economist. IPCC AR6 and AR7 mitigation report author.

The International Renewable Energy Agency supports countries in their transition to a sustainable energy future.

Our World in Data is a free, nonprofit website with a mission to increase understanding of the world’s largest problems and drive informed action to solve them. Based out of Oxford University (@ox.ac.uk), founded by @maxroser.bsky.social.

You have 80,000 hours in your career.

This makes it your best opportunity to have a positive impact on the world.

https://80000hours.org

💡💚 We're growing a movement around tackling climate change and environmental challenges as effectively as possible, based on evidence, careful analysis, and science. Join us!

Find opportunities: www.effectiveenvironmentalism.org

PhD in Energy Economics @ TU München | Visiting PhD @ MIT

prev. MPhil @ Tinbergen Institute, BSc @ Maastricht University

interested in electricity markets & climate policy 🌍

https://jboeschemeier.github.io/

The first & longest-running environmental economics consultancy in the UK: Since 1992.

Provide operational support for the UK Network for Environmental Economists @uknee.bsky.social

#naturalcapitalaccounting #policy #valuation #chemicals #greenfinance

A place for discussion of environmental economics, policy, business, and finance. Evidence for a sustainable transition.

Conferences, webinars, newsletters, membership & more: https://www.uknee.org.uk/

Non-profit supported by @eftec.bsky.social

Econ PhD student at Nova SBE. Working on Climate Change and Biodiversity. Big fan of the mountains and the great outdoors.

INRAE Research Fellow - Environmental economics

https://martinjegard.github.io/