For over half a century, the National Weather Service has operated 24/7. But after the U.S. Department of Government Efficiency pushed to shrink the federal workforce, that’s no longer possible in parts of the country.

17.05.2025 23:00 — 👍 9997 🔁 2785 💬 227 📌 114

This would be an obvious act of ethnic cleansing under international law.

16.05.2025 21:57 — 👍 3192 🔁 1238 💬 111 📌 37

There’s been lots of chatter about repealing taxation of Social Security benefits in the tax bill. Turns out Rs opted to increase the standard deduction for some seniors instead.

Will this increase help lower- and middle-income retirees?

Nope, and here’s why. 🧵

16.05.2025 17:47 — 👍 86 🔁 54 💬 4 📌 0

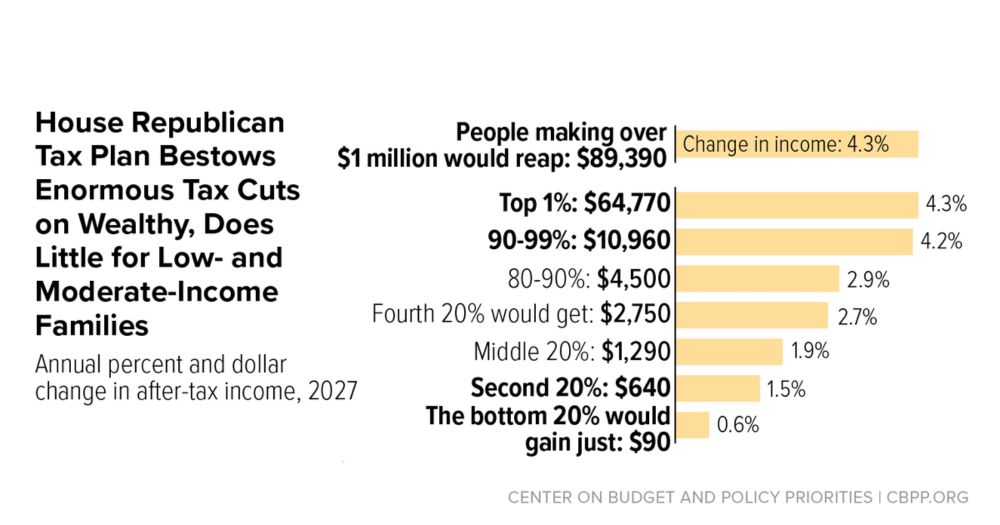

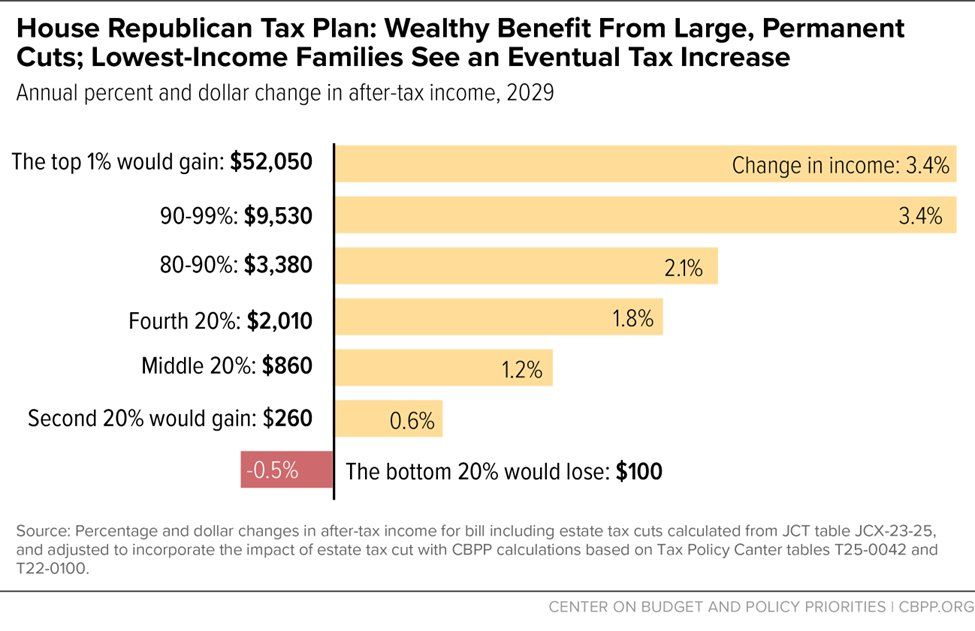

The good news: the deeply flawed House GOP budget bill containing the tradeoff below doesn’t have the votes.

The bad news: it doesn’t have the votes because the House Freedom Caucus is trying to make the yellow bar bigger and the SALT caucus is trying to make the red bar bigger.

16.05.2025 17:20 — 👍 23 🔁 11 💬 0 📌 1

As @taxlawcenter.org's Mike Kaercher notes in this piece, "The fact that there's even a question of whether the administration is violating these laws that prevent weaponization of the IRS is deeply troubling"

12.05.2025 19:27 — 👍 9 🔁 6 💬 0 📌 0

NEWS: Thanks to courageous West Virginia coal miner Harry Wiley and his brilliant attorney, Sam Petsonk, over 100 NIOSH workers in Morgantown, WV just got their jobs back and the crucial Coal Workers Surveillance Program will be restored.

They took on RFK and the Trump admin—and won. Story soon.

13.05.2025 22:54 — 👍 2514 🔁 534 💬 19 📌 18

Kennedy Center employees announce plans to unionize

Staffers asked the National Labor Relations Board to oversee a union vote. They criticized leaders at the arts center for layoffs and a lack of transparency under President Donald Trump.

“Staffers at the John F. Kennedy Center for the Performing Arts said Thursday that they plan to form a union in response to several waves of layoffs and what they describe as a lack of transparency from leaders at the arts institution, which President Donald Trump took over in February.”

16.05.2025 00:28 — 👍 92 🔁 25 💬 1 📌 0

The #SNAP cuts in the House Ag bill would hurt millions of people. It could be particularly devastating for families, retailers and others in rural America.

16.05.2025 00:20 — 👍 8 🔁 4 💬 0 📌 0

This is not a screenplay.

For some, these will be life or death situations. For many, these natural disasters will yield devastating loss.

We should have a FEMA ready, able and fully staffed to support the American public when it needs it most.

16.05.2025 00:26 — 👍 123 🔁 40 💬 4 📌 1

A West Virginia Coal Miner Just Saved NIOSH’s Black Lung Program

A federal judge ordered the restoration of jobs in the National Institute for Occupational Health and Safety’s Respiratory Health Division after a veteran coal miner filed a class action lawsuit argui...

When the Trump administration eviscerated the National Institute for Occupational Safety and Health office in Morgantown, WV in April, they abruptly shut down life-or-death services for coal miners with black lung.

One of those miners decided to fight back—and won.

inthesetimes.com/article/west...

15.05.2025 23:54 — 👍 869 🔁 284 💬 8 📌 17

Great new blog out from my colleague @brendanvduke.bsky.social

14.05.2025 21:49 — 👍 3 🔁 1 💬 0 📌 0

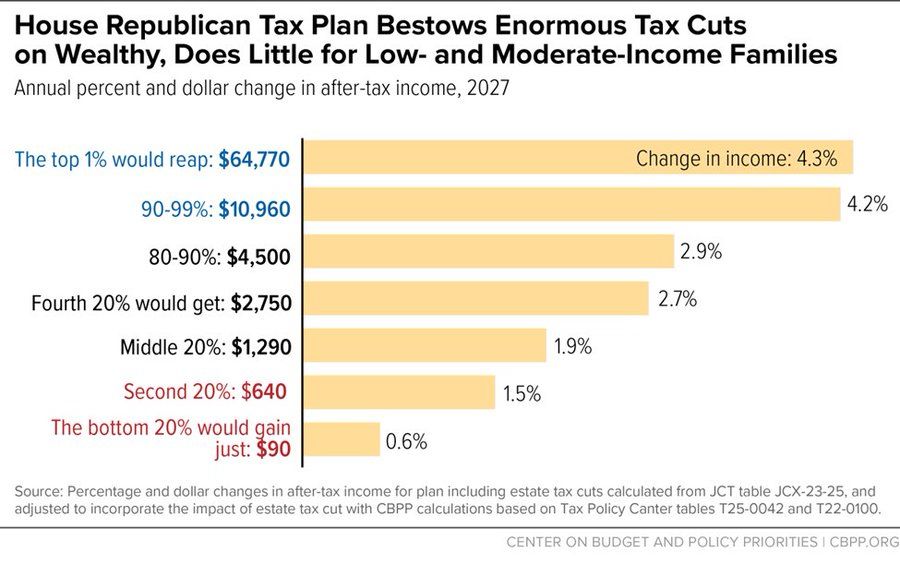

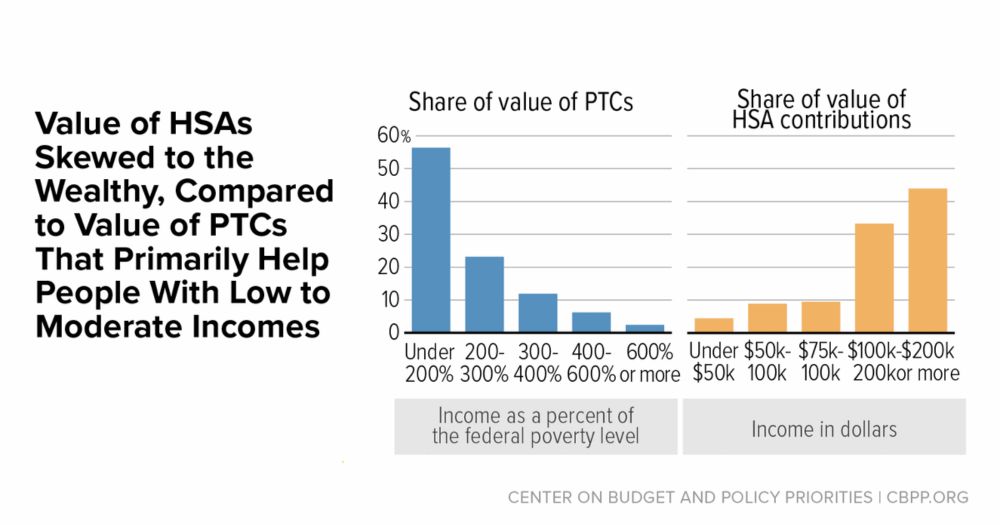

These #s don’t consider the expiration of the enhanced PTCs, which made ACA coverage far more affordable & increased coverage.

Despite extending profligate tax cuts for the wealthy, this is the 1 tax cut the W&M cmte doesn’t extend. 4M ppl will lose coverage as a result per CBO

14.05.2025 00:57 — 👍 14 🔁 3 💬 1 📌 0

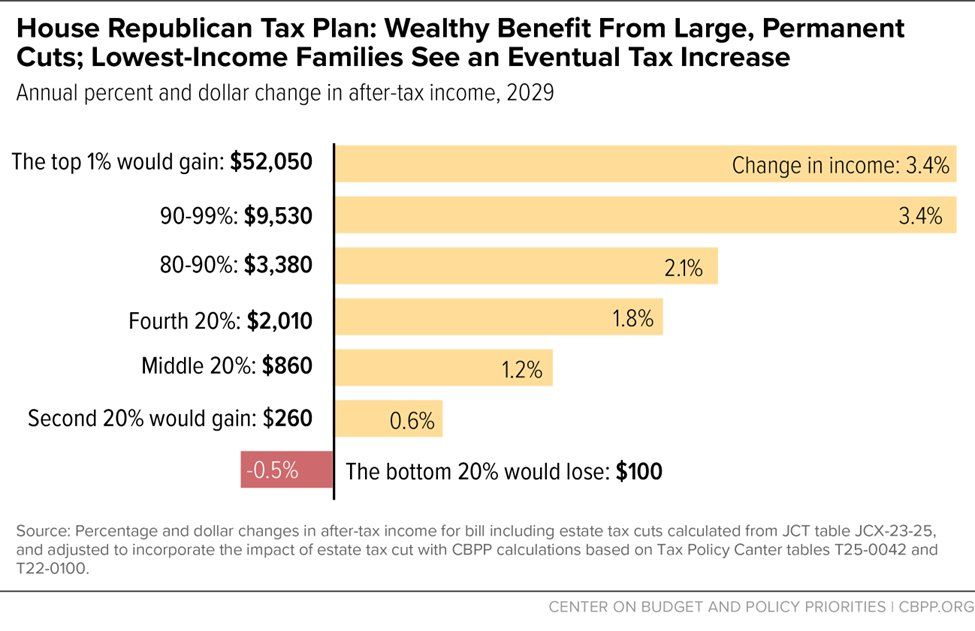

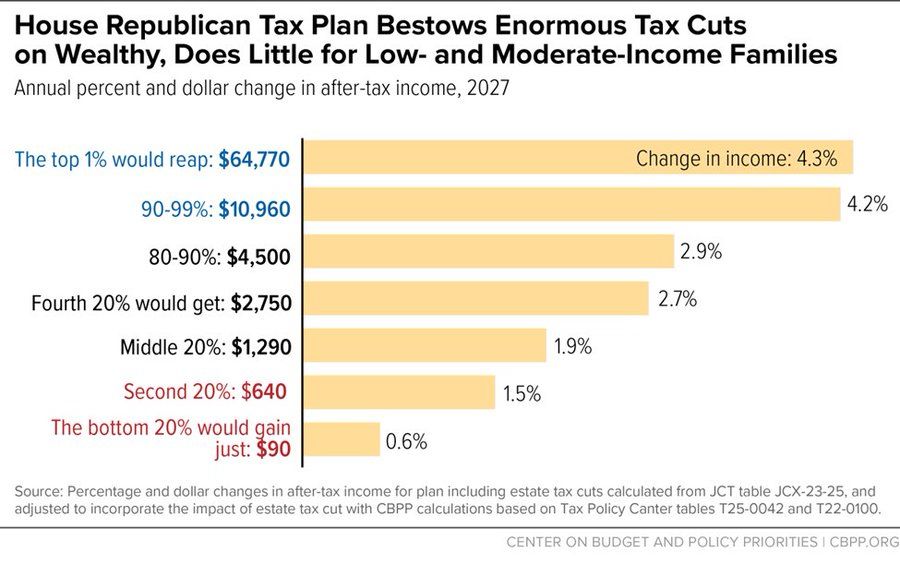

The bill is even more regressive when you look at 2029 when tax cuts for families expire & tax increases resulting from cuts to ACA premium tax credits grow larger.

14.05.2025 00:56 — 👍 20 🔁 7 💬 1 📌 0

The House GOP is taking a page from 2017 playbook & making the most regressive pieces permanent (i.e. estate tax/pass-thru deduction) while making new tax cuts for families temporary.

14.05.2025 00:56 — 👍 21 🔁 2 💬 1 📌 0

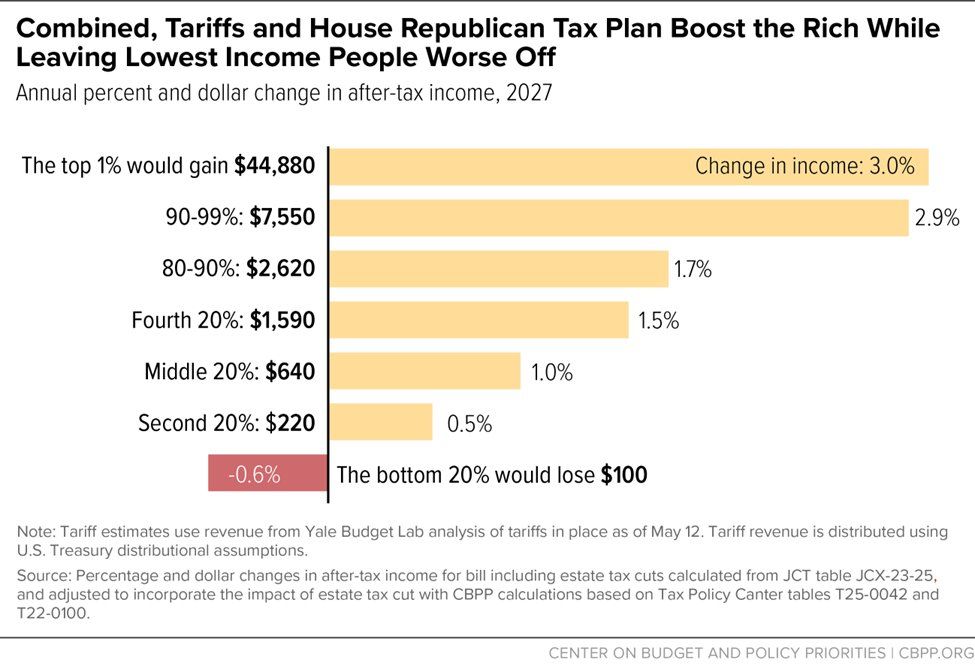

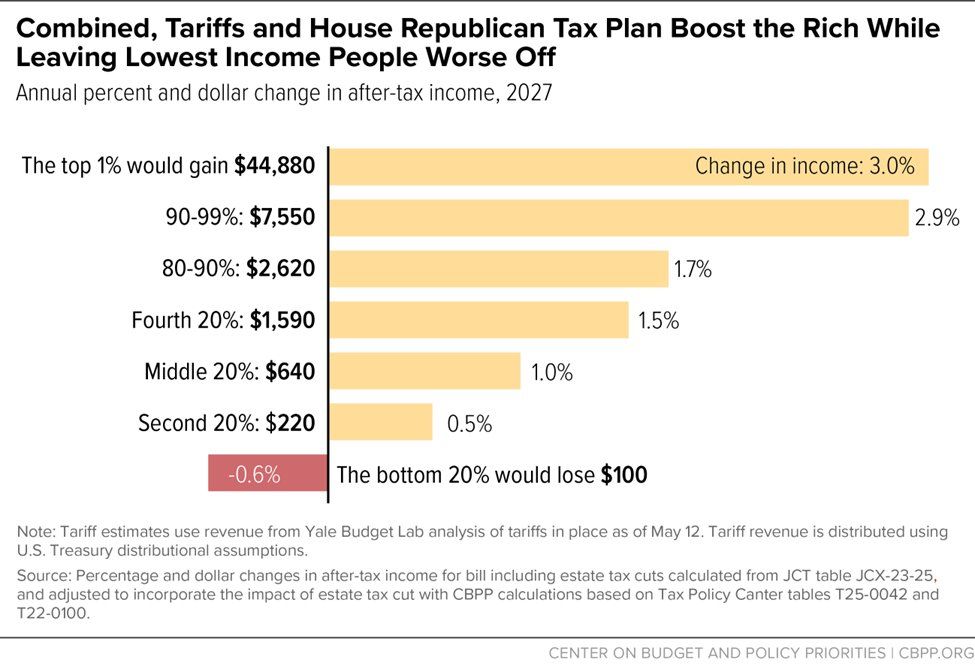

These new tax #s only provide a partial snapshot of the Trump/House R agenda. They do not include cuts to Medicaid, food & more, or tariffs.

We hope to have combined impacts soon–but even if you just add in the effects of the tariffs most families barely benefit if at all.

14.05.2025 00:56 — 👍 34 🔁 7 💬 1 📌 0

New @centeronbudget.bsky.social analysis of the draft GOP tax plan released yesterday:

Unsurprisingly, it provides enormous tax cuts for the wealthy—including an average annual $65k cut for the top 1%—while doing little for low- and moderate-income families in 2027 (and even less by 2029).

14.05.2025 00:55 — 👍 605 🔁 254 💬 29 📌 20

It’s deeply disappointing that House Republicans are planning to take food away from people who have fled their homes seeking safety in our nation and have completed rigorous processes to obtain refugee or asylum. Historically these humanitarian statuses have been supported by both parties.

13.05.2025 10:14 — 👍 2 🔁 2 💬 0 📌 0

My kid was home sick yesterday and I had to decide whether or not to send him to school today.

I'm lucky. That choice wouldn't cost my job or make me lose pay.

But if the GOP proposal passes low-income families would have to weigh all that and if staying home would jeopardize their ability to eat.

13.05.2025 14:16 — 👍 78 🔁 17 💬 1 📌 2

The new GOP proposal for SNAP cuts would take food off the table of 7 year olds if their parents can't report enough work hours. When my kids were 7, they were playing foursquare, learning math facts, and being silly.

Imagine getting LESS help to feed your kids if your boss cuts your hours.

13.05.2025 14:10 — 👍 219 🔁 56 💬 10 📌 3

Opinion | Now might be exactly the worst time to cut Medicaid and food stamps

Cutting the safety net could prolong an economic recession.

"This combination — top-heavy tax cuts financed by low-income benefit cuts — would add up to possibly the largest single transfer of wealth from poor to rich in U.S. history" says @bbkogan.bsky.social. Must-read this morning from @crampell.bsky.social www.washingtonpost.com/opinions/202...

13.05.2025 13:28 — 👍 423 🔁 217 💬 14 📌 7

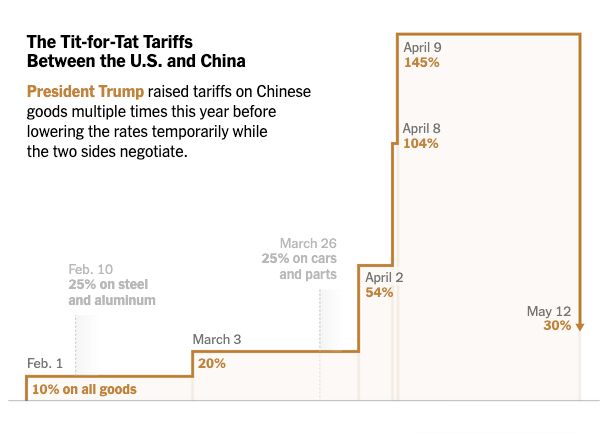

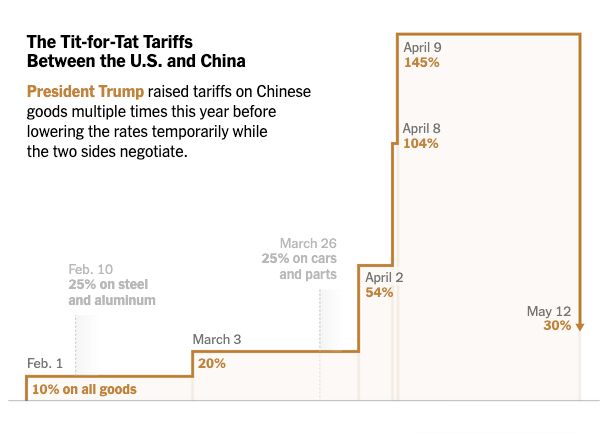

Excellent NYT graphic.

In the space of about 3 months, tariffs on China:

-- doubled;

-- went up ≈ 2.5X from there;

-- roughly doubled again;

-- went up ≈ 40% from there;

-- and now have dropped ≈ 80% from the peak -- but are still 3X what they were in February.

www.nytimes.com/article/trum...

12.05.2025 11:42 — 👍 4376 🔁 1689 💬 188 📌 199

“To watch these changes unfold without naming them for what they are is to participate in a collective amnesia about how knowledge infrastructures shape power relations."

13.05.2025 11:22 — 👍 1317 🔁 187 💬 2 📌 3

Hey, but at least the billionaires will get cuts!

13.05.2025 00:29 — 👍 0 🔁 1 💬 0 📌 0

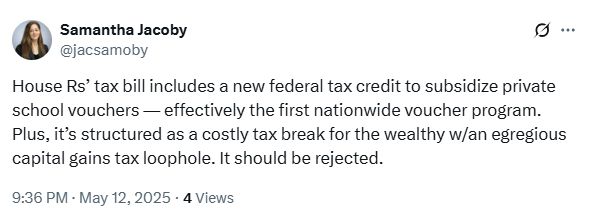

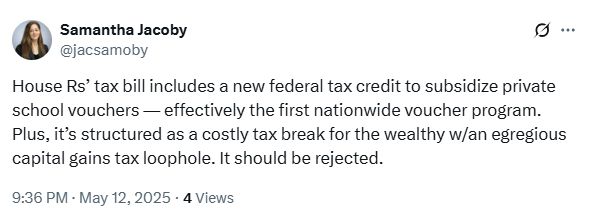

Samantha Jacoby on X: House Rs’ tax bill includes a new federal tax credit to subsidize private school vouchers — effectively the first nationwide voucher program. Plus, it’s structured as a costly tax break for the wealthy w/an egregious capital gains tax loophole. It should be rejected.

CBPP's Samantha Jacoby posted on X explaining how the House Republican tax bill's new federal tax credit to subsidize private school vouchers works: x.com/jacsamoby/st...

13.05.2025 01:41 — 👍 33 🔁 21 💬 0 📌 4

Make no mistake: The House Agriculture Committee's bill would cut millions of low-income people off SNAP entirely & slash food benefits for millions more. It's extreme. It's unprecedented. If enacted, it would be the single largest cut to food assistance in history.

13.05.2025 02:30 — 👍 136 🔁 44 💬 7 📌 0

We can’t afford to help families eat? And we think some people don’t “deserve” food? Why?

Oh, right! We have to give wealthy people and corporations tax cuts instead. Silly me.

Totally shameful!

13.05.2025 02:41 — 👍 3 🔁 2 💬 1 📌 0

We will have more analysis soon of these & other provisions. Bottom line: this bill would worsen hunger & hardship. If enacted, it would be the largest cut to #SNAP in history—taking food from struggling families to give tax cuts to the wealthy. Our leaders can & must do better.

13.05.2025 02:26 — 👍 42 🔁 9 💬 0 📌 0

Husband and father. Proudly serving as Illinois’ 43rd governor.

Investigations editor www.southsideweekly.com ✶ DM for Signal ✶ jim.daley@southsideweekly.com ✶ https://www.jim-daley.com/ ✶

Forklift-certified journalist in Chicago. Politics, courts & labor. Words in the Chicago Reader, Unraveled Press, The TRiiBE, Courthouse News Service and some other ones I forget right now. All opinions & bad jokes my own. DM me for news tips/Signal info.

Independent, reader supported investigative reporting from Chicago on policing and state violence. Occasionally: hate movements and conspiracism.

Support us: unraveledpress.com/support-unraveled/

📧 info@unraveledpress.com

📱 Signal: unraveled.66

Tomlinson Professor of Political Theory, Associate member of Philosophy, Coordinator of Research Group on Constitutional Studies, McGill.

Posts here speak only for myself.

Americo-Canadian; liberaltarian; aging geek.

http://jacobtlevy.com

Health and tax policy and law, private insurance, Marketplaces, 1332 waivers, admin burdens. Led ACA implementation at Treasury. Now Urban Institute, SHVS, and Yale Solomon Center.

baltimore 🚆 dc 🚆 baltimore • i make charts at Center on Budget • posts very much my own

Sr. Fellow @ Brookings, Executive Chair of Democracy Defenders Fund & Co-Founder of The Contrarian contrarian.substack.com Posts with "TN" are from Team Norm

Former head of Obama Auto Task Force. Wall Street financier. Contributing Writer to NY Times Op-Ed. Morning Joe Economic Analyst. 🌐

Tired person, fighter. Labor, data, DH, obsolete software, database history, etc. Seeing Like a Supply Chain out from Yale UP in fall 2026. Speaking for myself, not my employer.

Digital Strategist

Comms Expert/Coach

Abolitionist

Senior writer at Slate covering courts and the law. Co-host of the Amicus podcast. Dad.

Pulitzer prize-winning reporter @propublica covering reproductive health. Send news tips on Signal or cassandra.jaramillo@propublica.org

Climate/environment reporter at ProPublica. Cartoon me by Laila Milevski. Pro-cats, anti-carrots. Contact: lisasong.42 on Signal

I work with the fine folks at @itep.org. State/fed tax policy, corporate tax, financial accounting, dogs, surf, go Washington Spirit. Glass half empty but trying to fill it.

Hey there Mr. Blue

We're so pleased to be with you

House guy. DCoS @beyer.house.gov

Priors: Kamala Harris, Jennifer Wexton, et al.

Hendersonville, NC native

SciFi, Rock n Roll, he/him

Posts mine/dumb

Husband, dad, wonk with @kypolicy.bsky.social & runner (preferably on trails). Trying to bring Shalom to the commonwealth. The plural of anecdote is not data.

Senator for Massachusetts. Ranker on Senate Small Business Committee & HELP Primary Health & Retirement Security Subcommittee. Fighting for a Green New Deal.

Based at Georgetown University's McCourt School, CCF is a nonpartisan policy and research center with a mission to improve health coverage for kids & families.