"How do changes in the unemployment insurance system affect unemployment and labor market dynamics? This paper highlights the important role of changing separation rates."

New paper from Hartung, @macrophilip.bsky.social & @mokuhn.bsky.social:

www.restud.com/unemployment...

03.04.2025 19:59 —

👍 8

🔁 2

💬 0

📌 0

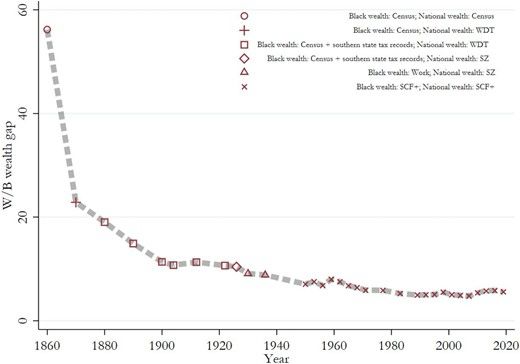

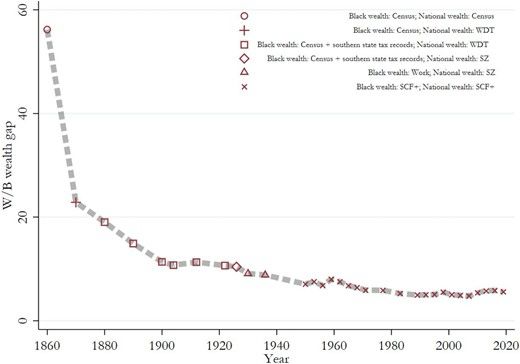

Wealth of Two Nations: The U.S. Racial Wealth Gap, 1860–2020*

Abstract. The racial wealth gap is the largest of the economic disparities between Black and white Americans, with a white-to-Black per capita wealth ratio

A stunning paper by Derenoncourt, Kim, Kuhn, @schularick.bsky.social!

“Since the 1980s, the wealth gap has widened again as capital gains have predominantly benefited white households, and convergence via income growth and savings has come to a halt.”

academic.oup.com/qje/article-...

22.03.2025 17:15 —

👍 20

🔁 7

💬 2

📌 0

Unemployment Insurance Reforms and Labor Market Dynamics∗

Abstract. A key question in labor market research is how the unemployment insurance system affects unemployment rates and labor market dynamics. We provide

Mightily impressive paper by @mokuhn.bsky.social and Philip Jung on the labour market effects of the German Hartz reforms — also highly relevant for political scientists interested in insider-outsider politics and labour market dualisation.

academic.oup.com/restud/advan...

26.03.2025 11:03 —

👍 10

🔁 5

💬 0

📌 0

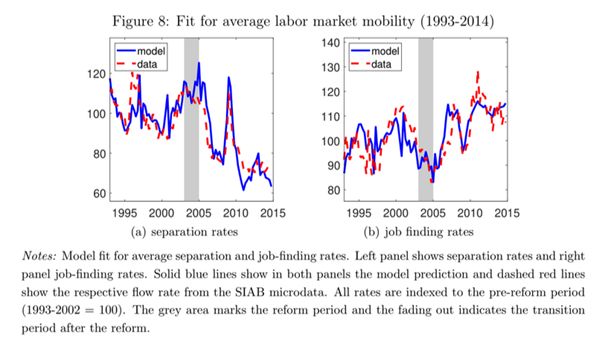

We provide a new answer to an old question in labor market research establishing separation rates as an important margin of adjustment after UI reforms. We also highlight the importance of the wage-job-stability trade off as adjustment mechanism! 10/10

👉 academic.oup.com/restud/artic...

27.03.2025 07:24 —

👍 0

🔁 0

💬 0

📌 0

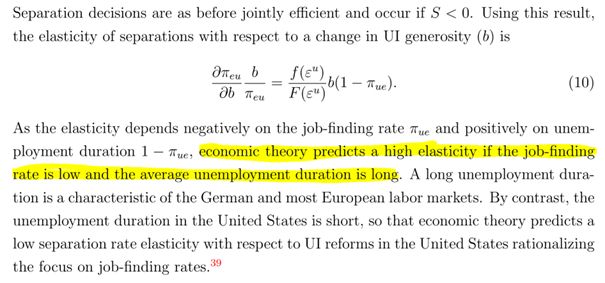

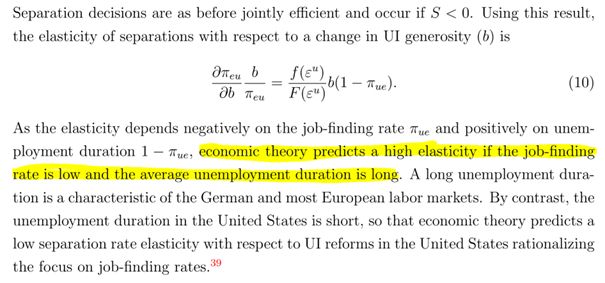

We show that we should expect such a strong reaction of separation rates after UI reforms in countries with low job-finding rates as in 🇩🇪 & most 🇪🇺 countries, while the main adjustment will come from job-finding rates in countries like the 🇺🇸 with high job-finding rates. 9/10

27.03.2025 07:24 —

👍 0

🔁 0

💬 1

📌 0

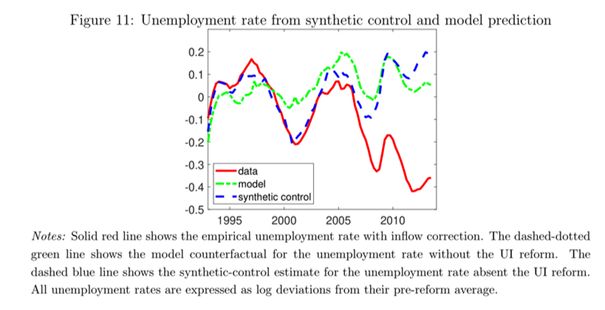

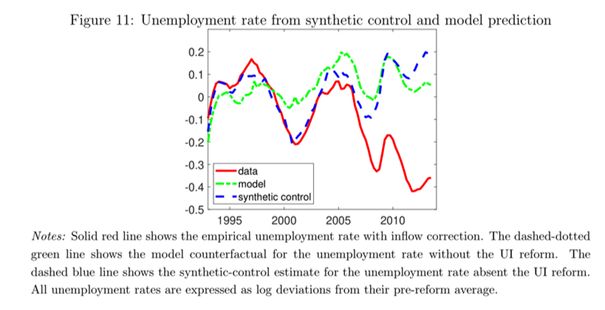

Without the UI reform, German unemployment rates would have been 50% higher a decade later. This model-based estimate is confirmed by an empirical estimate (synthetic control estimate). 8/10

27.03.2025 07:24 —

👍 0

🔁 0

💬 1

📌 0

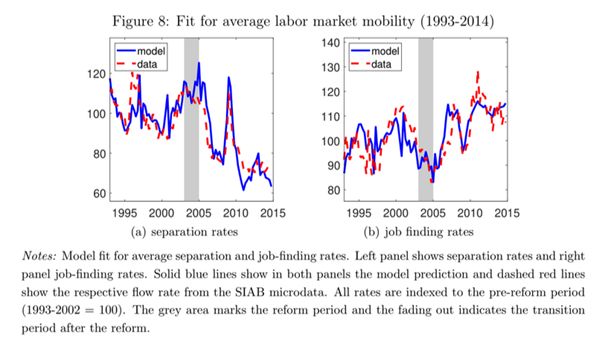

In the second part of the paper, we generalize our empirical findings based on economic theory. We develop a model with a frictional labor market and demonstrate that the predictions from theory match closely the empirical facts on average and with respect to heterogeneity. 7/10

27.03.2025 07:24 —

👍 0

🔁 0

💬 1

📌 0

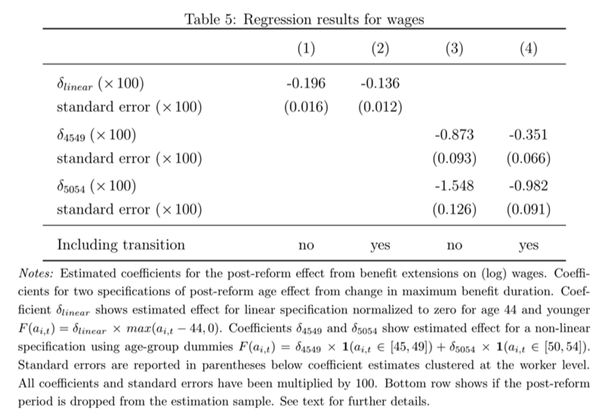

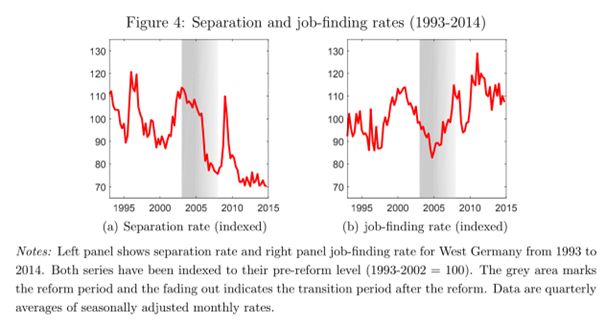

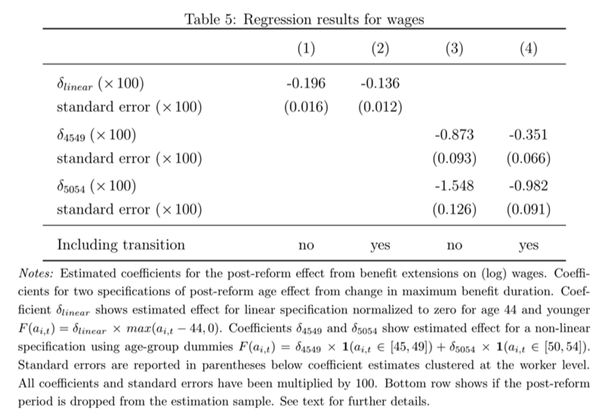

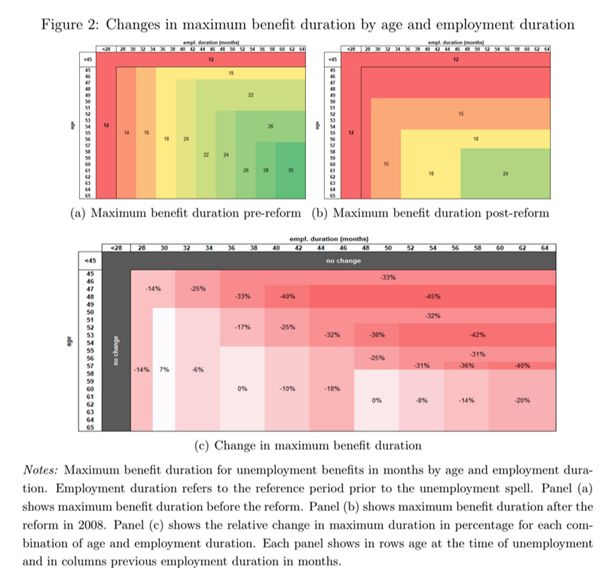

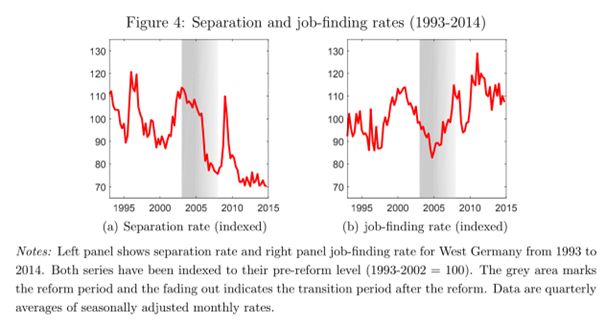

The mechanism is a trade-off between wages and job stability: long-term employed workers accepted wage declines for additional job stability to prevent unemployment. This wage-job-stability trade-off is known in theory but we demonstrate its empirical importance! 6/10

27.03.2025 07:24 —

👍 0

🔁 0

💬 1

📌 0

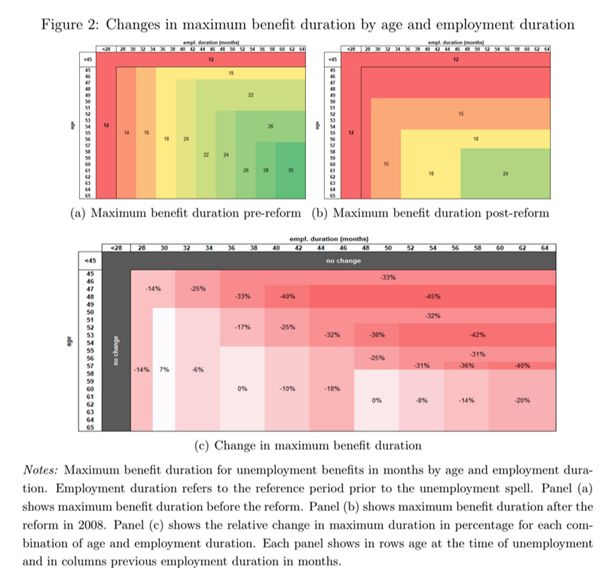

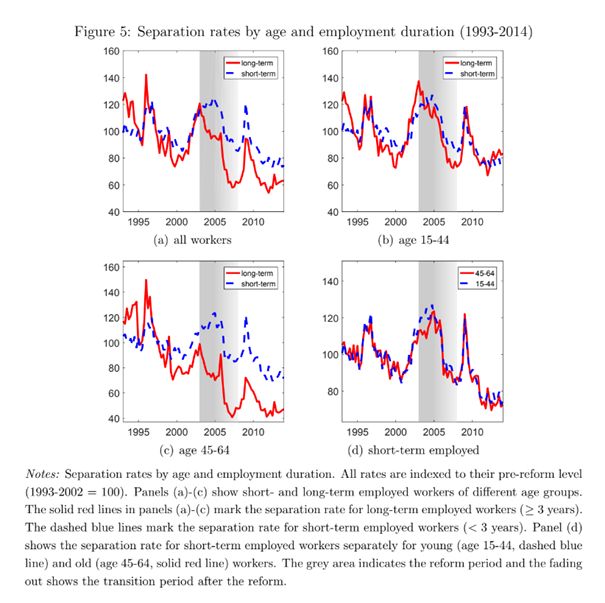

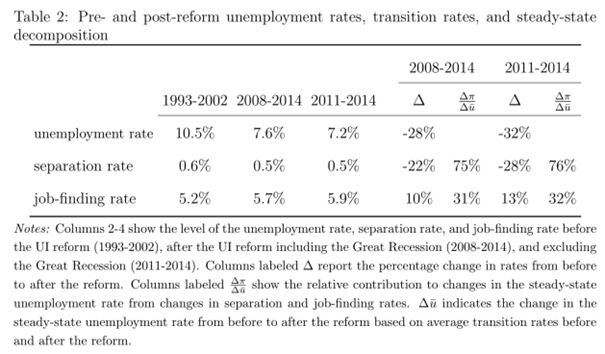

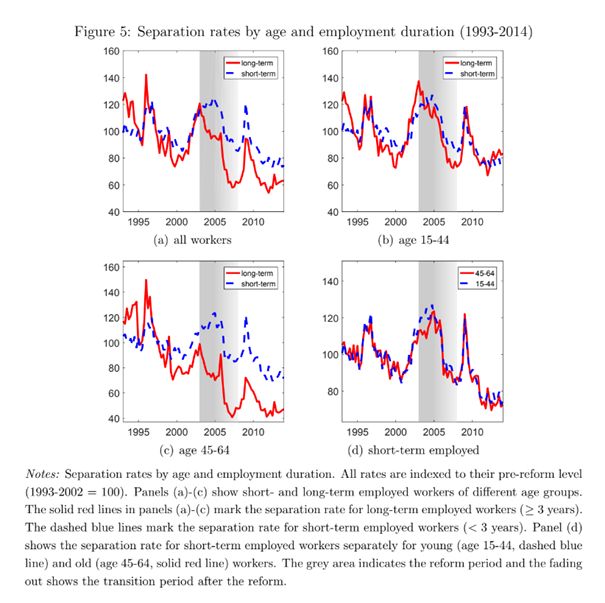

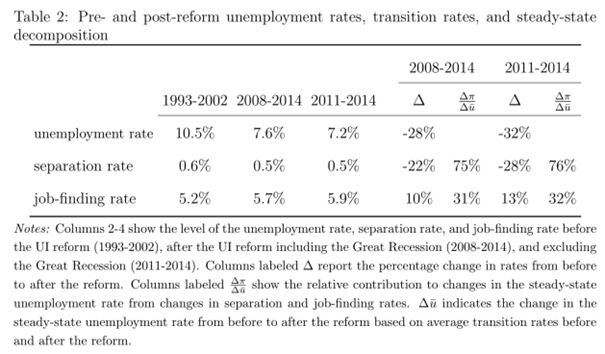

We provide causal evidence of the decline in UI generosity on the separation rate decline by exploiting that different worker groups have been differently affected by the reform (old and young workers, short- and long-term employed workers). 5/10

27.03.2025 07:24 —

👍 0

🔁 0

💬 1

📌 0

The decline is strongest for workers who we typically think of as the least affected by UI reforms: older and long-term employed workers. These workers constitute most of the employment in the German labor market. 4/10

27.03.2025 07:24 —

👍 0

🔁 0

💬 1

📌 0

Decomposing the decline in the unemployment rate in the decade after the reform, we find that 76% of the decline came from lower separation rates only about one-third of the decline came from higher job-finding rates. 3/10

27.03.2025 07:24 —

👍 0

🔁 0

💬 1

📌 0

We study this question based on the German Hartz reforms, one of the largest UI reforms in recent decades. After the reform unemployment has been in half. How? The key was not more jobs found (higher job-finding rates) but fewer jobs lost (lower separation rates). 2/10

27.03.2025 07:24 —

👍 1

🔁 0

💬 1

📌 0

Great to see our paper “Unemployment insurance reforms and labor market dynamics” out in The Review Economic Studies. With @macrophilip.bsky.social & Benjamin Hartung, we revisit the old question of labor market research of the effects of unemployment insurance reforms on unemployment rates. 1/10

27.03.2025 07:24 —

👍 19

🔁 5

💬 1

📌 0

Thanks to all the participants for joining the discussion!

@michaeldbauer.bsky.social @christian-bayer.bsky.social @bernothkerstin.bsky.social Peter Bofinger @bborn.bsky.social @grimmveronika.bsky.social Hans Peter Grüner Martin Hellwig Philipp Jung 2/3

17.03.2025 21:54 —

👍 4

🔁 1

💬 1

📌 0

Today I had another exchange with German-speaking economists on the challenges facing the German and euro area economy and what this implies for monetary policy @ecb.europa.eu. One focus was how to make sure that the German packages for defence and infrastructure will become a success. 1/3

17.03.2025 21:54 —

👍 24

🔁 4

💬 1

📌 0

@mokuhn.bsky.social Emanuel Mönch Ulrike Neyer @monika-schnitzer.com @schoefer.bsky.social @peterhtillmann.bsky.social @ulbrich-jens.bsky.social @wederdim.bsky.social 3/3

17.03.2025 21:54 —

👍 2

🔁 2

💬 0

📌 0

This week in the Macro @EPoS224 Seminar at @EconUniMannheim we have Adam Hal Spencer from @UniBonn presenting

"Labour Market Monopsony and the Dynamic Gains to Openness Reforms"

@minkikim.bsky.social @andreas-gulyas.bsky.social @mazkarate.bsky.social @anamoremaldo.bsky.social

11.03.2025 14:53 —

👍 1

🔁 0

💬 0

📌 0

We are extremely excited to welcome this week Mike Golosov from the University of Chicago to the Macro-CRC Seminar at the University of Mannheim

Mike will present "A Beckerian Theory of Taxation"

@minkikim.bsky.social @andreas-gulyas.bsky.social @mazkarate.bsky.social @anamoremaldo.bsky.social

24.02.2025 15:00 —

👍 3

🔁 2

💬 0

📌 0

Um die Deindustrialisierung zu stoppen, gibt es eine einfache Politik: Kauft mehr Panzer!

Es sichert Arbeitsplätze im Verarbeitenden Gewerbe & führt zu mehr Sicherheit in Europa!

@schularick.bsky.social

@clemensfuest.bsky.social

@robert-habeck.de

@ralphbollmann.bsky.social

22.02.2025 09:24 —

👍 3

🔁 0

💬 0

📌 0

Ich freue mich bereits auf die Diskussionsrunde nächste Woche an der Uni Mannheim zum Thema

"Politische und wirtschaftliche Weichenstellungen nach der Wahl"

www.uni-mannheim.de/newsroom/pre...

Mittwoch, 26. Februar 2025, 17:30 bis 19:15 Uhr in der Aula der Uni Mannheim.

21.02.2025 09:09 —

👍 1

🔁 0

💬 0

📌 0

In this week's Macro-CRC TR224 Seminar at Uni Mannheim Johannes Boehm will present

"The Network Origins of Firm Dynamics: Contracting Frictions and Dynamism with Long-Term Relationships"

@minkikim.bsky.social @andreas-gulyas.bsky.social @mazkarate.bsky.social @anamoremaldo.bsky.social

19.02.2025 07:49 —

👍 3

🔁 2

💬 0

📌 0

Congratulations @cmatthes.bsky.social

15.02.2025 14:28 —

👍 1

🔁 0

💬 0

📌 0

Workshop on Dynamic Macroeconomics

Young economics researchers--especially PhD students in Europe preparing for next year's job market--should apply for the Workshop on Dynamic Macroeconomics in Vigo, Spain, 8-10 July 2025. Submission deadline is 10 April.

workshop.webs.uvigo.es/index.html

14.02.2025 21:18 —

👍 23

🔁 9

💬 0

📌 0

We are excited to start our Macro CRC seminar series at Mannheim with Kjetil Storesletten presenting

“Fiscal Progressivity of the U.S. Federal and State Governments”

10.02.2025 11:16 —

👍 2

🔁 0

💬 0

📌 0

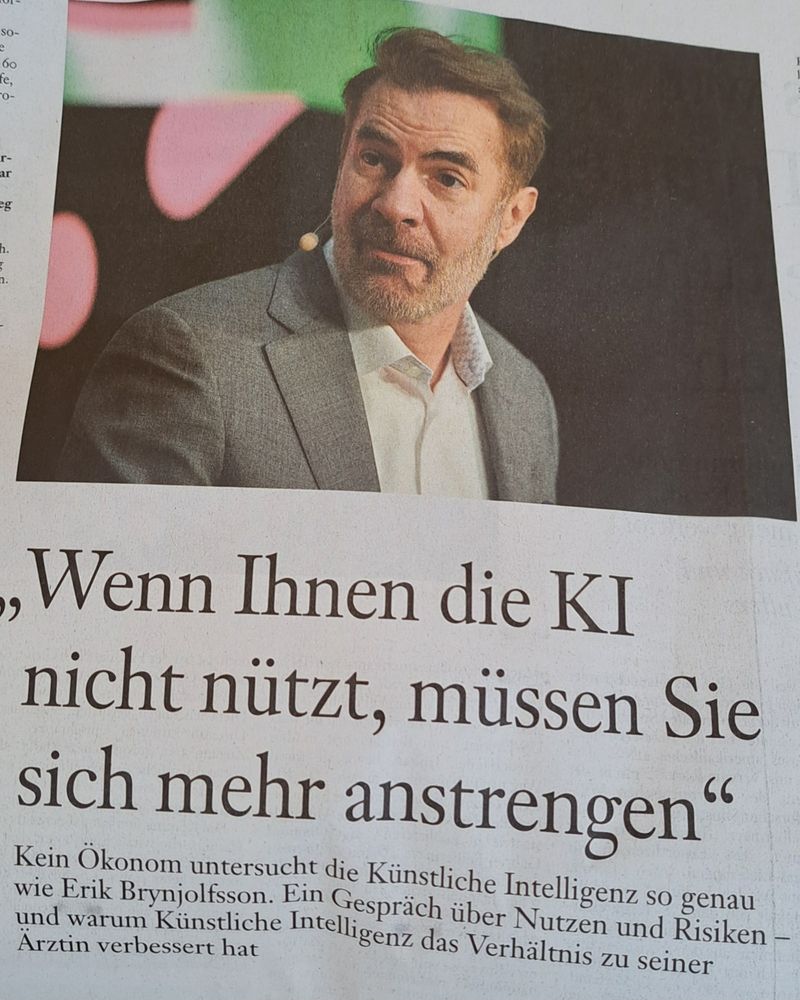

Tolles Interview heute in der FAS mit @erikbryn.bsky.social zur Künstlichen Intelligenz. Er betont auch wieder das zentrale Problem europäischer Politik: "Sie werden nie wirtschaftlichen Erfolg haben, wenn Sie alles einfrieren wollen." Es braucht Willen zur Veränderung!

@patrick-bernau.de

08.02.2025 09:38 —

👍 7

🔁 2

💬 1

📌 0

Moritz Kuhn

Moritz Kuhn

Professor

Department of Economics

University of Mannheim

L 7, 3-5, 68161 Mannheim, Germany

mokuhn@uni-mannheim.de

+49 621 181 1929

Office hours: please send an email (judith.price@uni-ma...

To all econ students on the market and advisors: I am thinking about filling an additional postdoc position at the University of Mannheim working on portfolio choice, wealth inequality, and labor markets. Interested? If yes, please let me know!

sites.google.com/site/kuhneco...

06.02.2025 17:34 —

👍 12

🔁 9

💬 0

📌 0

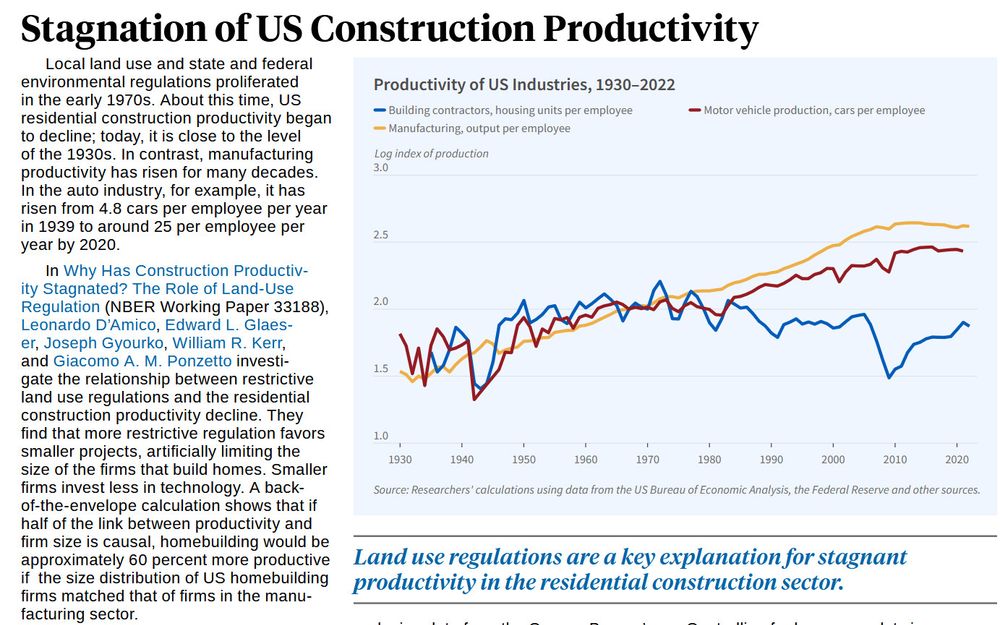

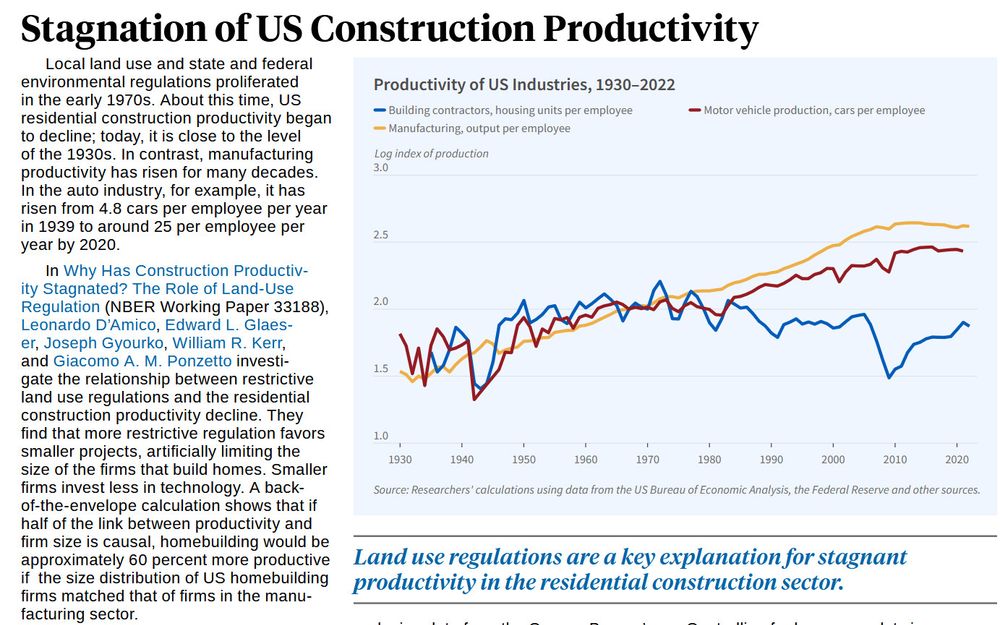

Diese Forschungsergebnisse könnten auch für die deutsche Politik von Interesse sein. Bauauflagen und Regulierung führen zu kleinen Firmen und weniger Wachstum im Bausektor.

www.nber.org/digest

Wer den Wohnungsmangel lösen will, muss Auflagen senken und Bauen einfacher machen

04.02.2025 06:43 —

👍 6

🔁 2

💬 0

📌 0

Opportunity & Inclusive Growth Institute | Federal Reserve Bank of Minneapolis

The OIGI at the Minneapolis Fed is a fantastic research initiative on inequality in the macroeconomy as one of the key macroeconomic topics of the 21st century.

www.minneapolisfed.org/institute

6/6

02.02.2025 19:52 —

👍 0

🔁 0

💬 0

📌 0

Army of Mortgagors: Long-Run Evidence on Credit Externalities and the Housing Market | Opportunity & Inclusive Growth Institute

(4) "Army of Mortgagors: Long-Run Evidence on Credit Externalities and the Housing Market" with Tobias Herbst and Farzad Saidi

www.minneapolisfed.org/research/ins... 5/6

02.02.2025 19:52 —

👍 0

🔁 0

💬 1

📌 0

Unemployment Risk, Portfolio Choice, and the Racial Wealth Gap | Opportunity & Inclusive Growth Institute

(3) "Unemployment Risk, Portfolio Choice, and the Racial Wealth Gap" with Ellora Derenoncourt, Chi Hyun Kim, and @schularick.bsky.social

www.minneapolisfed.org/research/ins... 4/6

02.02.2025 19:52 —

👍 0

🔁 0

💬 1

📌 0