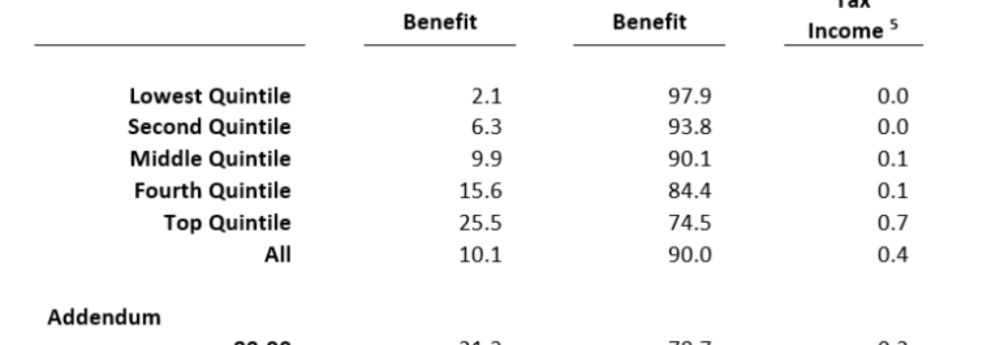

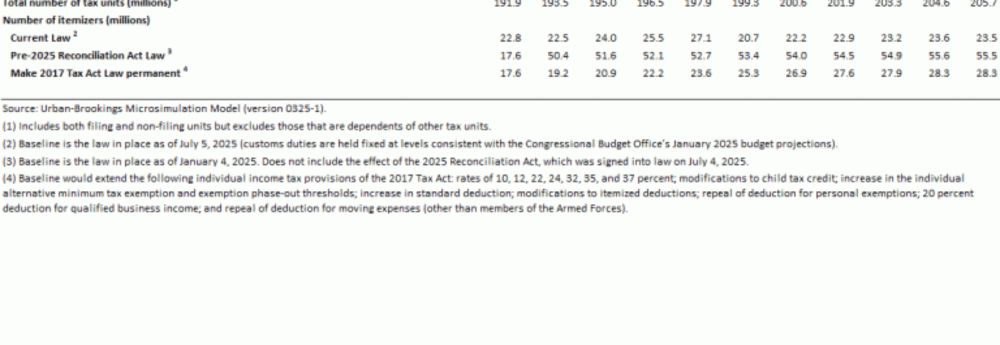

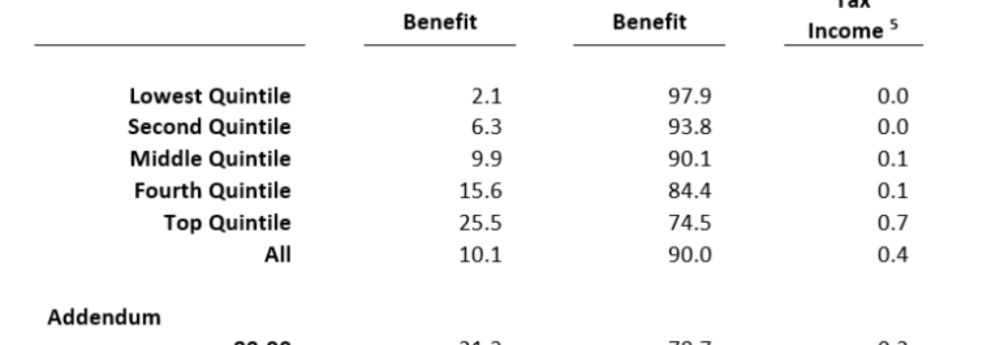

The new budget reconciliation law makes the income tax deduction for pass-through businesses permanent. Who actually benefits from the tax break? We explore the data. taxpolicycenter.org/fiscal-facts...

17.07.2025 18:35 — 👍 0 🔁 0 💬 0 📌 0@taxpolicycenter.bsky.social

We aim to help policymakers, journalists and the public understand tax and fiscal policy decision-making at the federal, state, and local level. See more at https://taxpolicycenter.org/

The new budget reconciliation law makes the income tax deduction for pass-through businesses permanent. Who actually benefits from the tax break? We explore the data. taxpolicycenter.org/fiscal-facts...

17.07.2025 18:35 — 👍 0 🔁 0 💬 0 📌 0

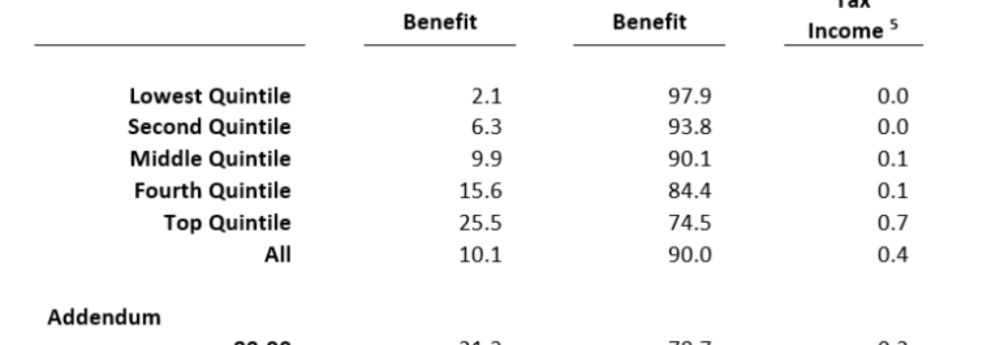

Tax filing is simples when taking the standard deduction instead of itemizing. Supporters of the 2017 tax cuts lauded how it reduced the number of itemizers from 30% to 10%. The OBBBA moves in the other direction; an additional 5M returns will itemize this year. taxpolicycenter.org/model-estima...

16.07.2025 20:55 — 👍 1 🔁 0 💬 0 📌 0

Sen. Cynthia Lummis (R-WY) has reintroduced crypto tax legislation that would make mining and staking rewards tax-free until the tokens are sold. taxpolicycenter.org/taxvox/probl...

16.07.2025 17:46 — 👍 0 🔁 0 💬 0 📌 0

The OBBBA will require Treasury to issue about two dozen new tax regulations to clarify implementation of the law. Doing that while cutting the IRS's budget presents a serious challenge. taxpolicycenter.org/taxvox/cutti...

15.07.2025 17:33 — 👍 1 🔁 0 💬 0 📌 0

The Social Security Administration recently put out an announcement that the OBBBA "eliminates taxes" on Social Security benefits for 90% recipients. Is that true? taxpolicycenter.org/taxvox/corre...

10.07.2025 20:03 — 👍 0 🔁 0 💬 0 📌 0

OBBBA makes permanent the tax deduction for pass-through businesses. Pass-through earnings are taxed on the individual tax returns of the business owners. Learn more about who benefits from this tax break: taxpolicycenter.org/fiscal-facts...

09.07.2025 16:34 — 👍 0 🔁 0 💬 0 📌 0

chart showing scheduled tariff rate increases going into effect on August 1 for a variety of consumer goods

Starting August 1, tariffs will increase significantly on a number of consumer goods taxpolicycenter.org/taxvox/too-m...

08.07.2025 18:20 — 👍 0 🔁 0 💬 0 📌 0

The legislation also includes cuts to various safety net programs, including SNAP and Medicaid. You can read more on those provisions in analyses by our @urbaninstitute.bsky.social colleagues www.urban.org/projects/res...

03.07.2025 18:14 — 👍 1 🔁 0 💬 0 📌 0

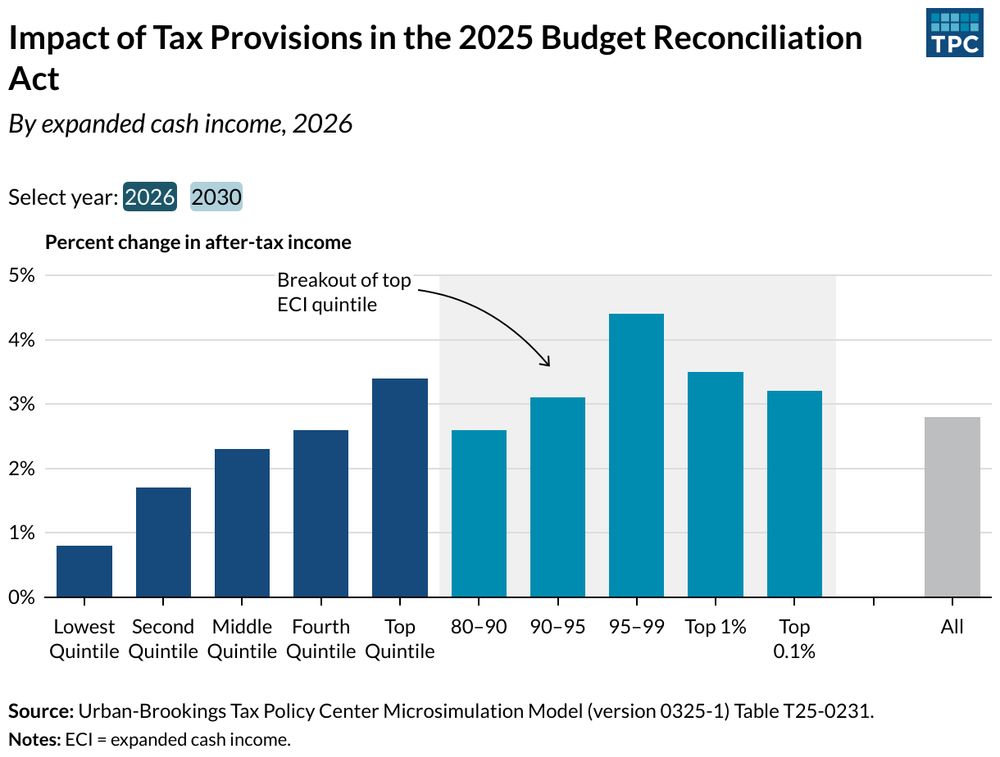

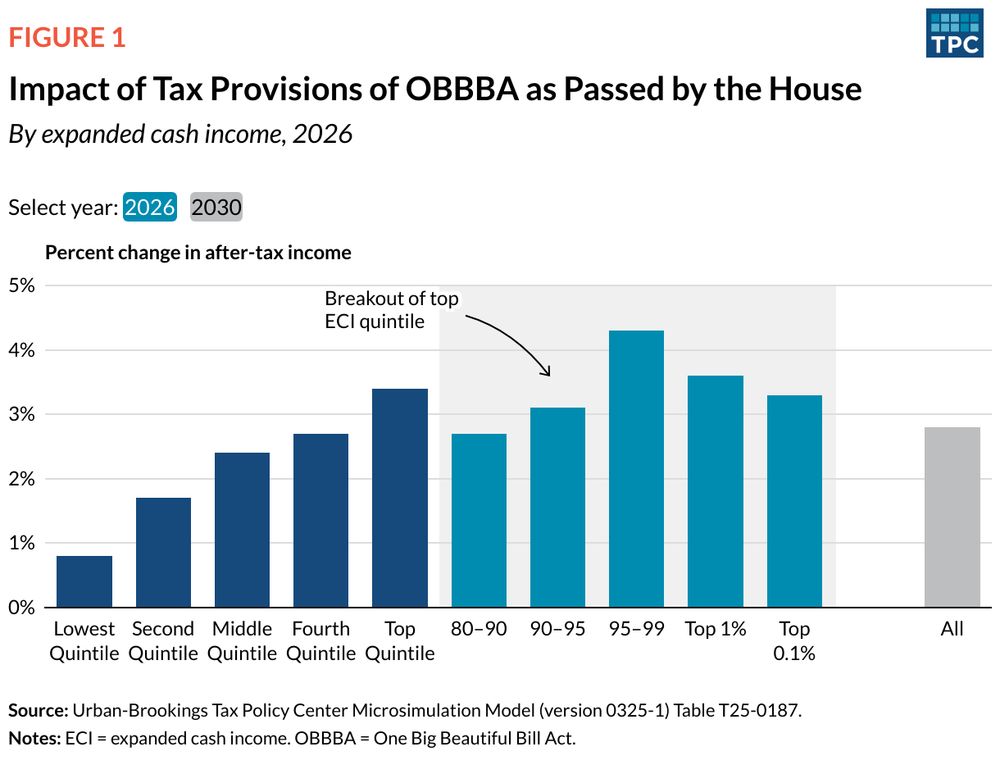

OBBBA is set to pass the House soon and head to the president's desk. Here is how the tax provisions in the final version will impact households taxpolicycenter.org/tax-model-an...

03.07.2025 18:13 — 👍 1 🔁 0 💬 1 📌 0Court-ordered fines and fees can be difficult to afford for some households. Some states are starting to take affordability into account, but a recent survey finds few people have their financial situation taken into account. taxpolicycenter.org/fact-sheets/...

27.06.2025 17:00 — 👍 0 🔁 0 💬 0 📌 0

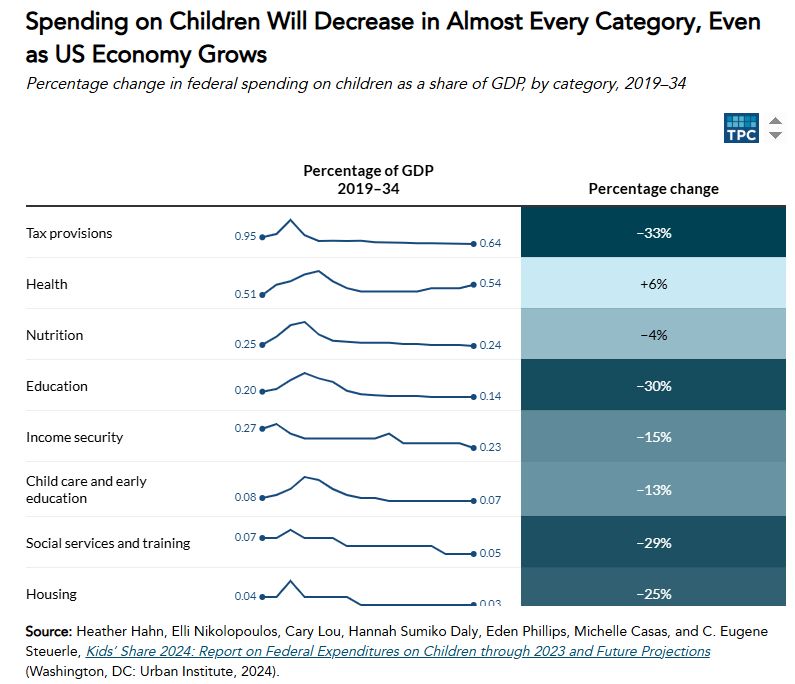

chart showing changes in federal spending on children in various categories for the 2019-34 time period

Proposed cuts to safety net programs offered by congressional Republicans could further reduce the small portion of the federal budget that goes to supporting children. taxpolicycenter.org/briefs/propo...

26.06.2025 18:26 — 👍 0 🔁 0 💬 0 📌 0

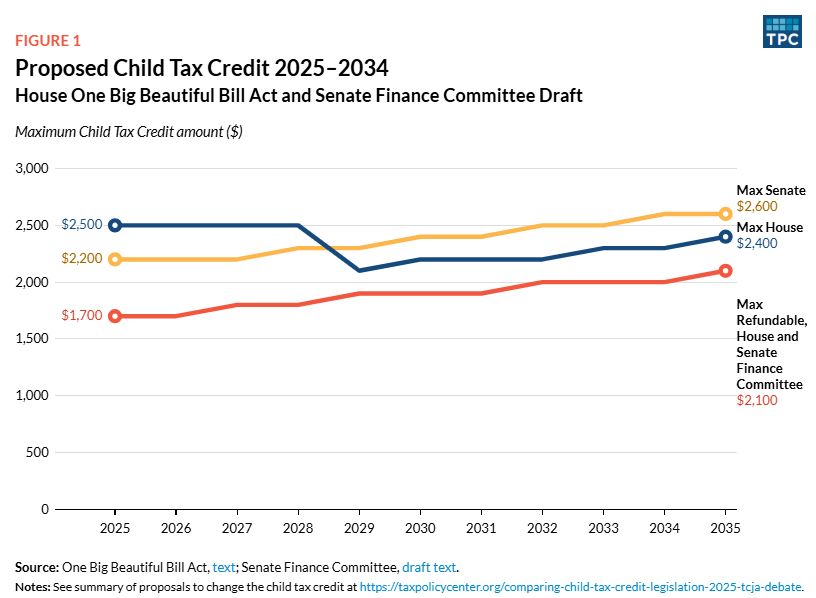

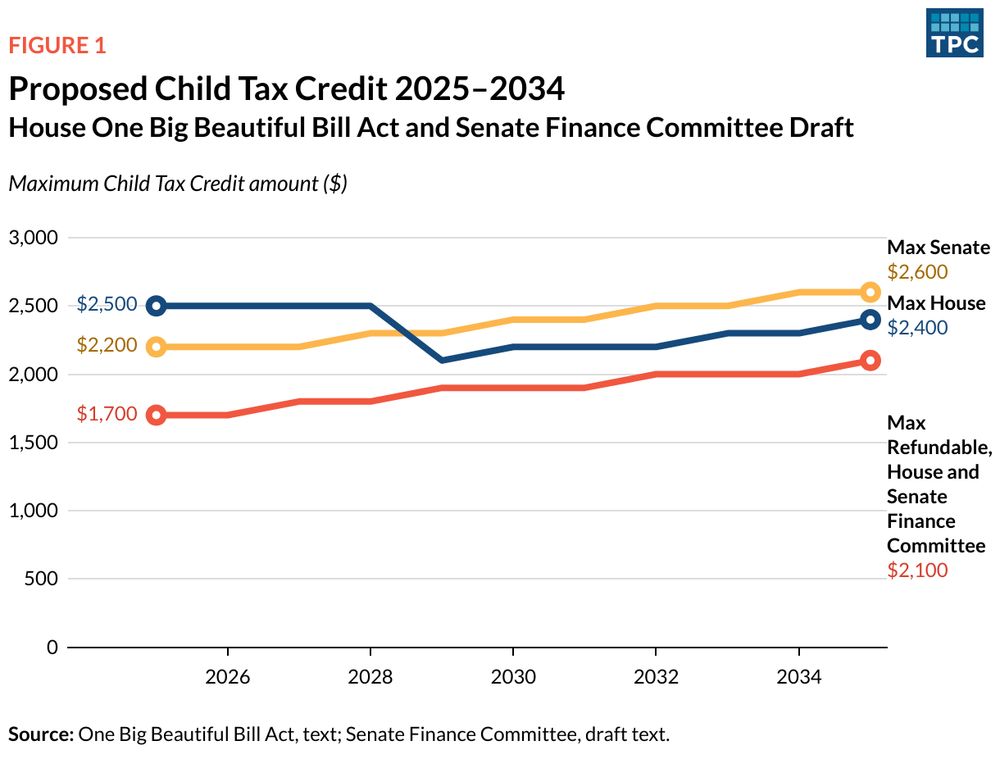

Figure 1 shows Proposed Child Tax Credit 2024-2034 for the House One Big Beautiful Bill Act and Senate Finance Committee Draft.

As part of the budget reconciliation, both the House and Senate have proposed plans that would increase the maximum #child #tax credit and help offset program cuts that would affect low-income #families. Learn more in a @taxpolicycenter.bsky.social TaxVox post. urbn.is/3TGiFSH

26.06.2025 14:06 — 👍 3 🔁 2 💬 0 📌 0

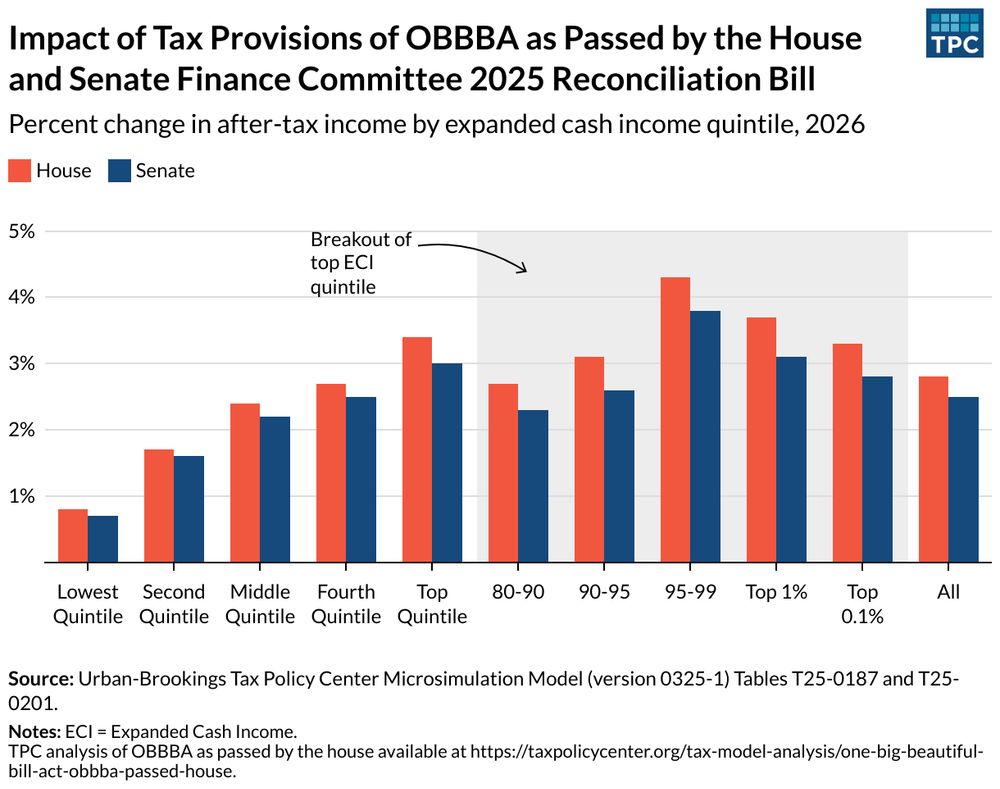

The Senate Finance Committee's version of OBBBA differs from the House plan. TPC has model results on the Senate version and compares the two. taxpolicycenter.org/taxvox/tpc-f...

25.06.2025 18:26 — 👍 0 🔁 0 💬 0 📌 0

chart comparing how the House and Senate versions of the "One Big Beautiful Bill Act" would change the child tax credit

The House and Senate versions of the OBBBA both call for expanding the child tax credit. But neither would assist the 17 million children in families that don't qualify for the full benefit. See how the proposals compare: taxpolicycenter.org/taxvox/house...

25.06.2025 14:13 — 👍 0 🔁 0 💬 0 📌 0

More evidence pushing back on the idea that a more generous child tax credit for low-income families would discourage work: taxpolicycenter.org/taxvox/ctc-r...

23.06.2025 21:22 — 👍 0 🔁 0 💬 0 📌 0

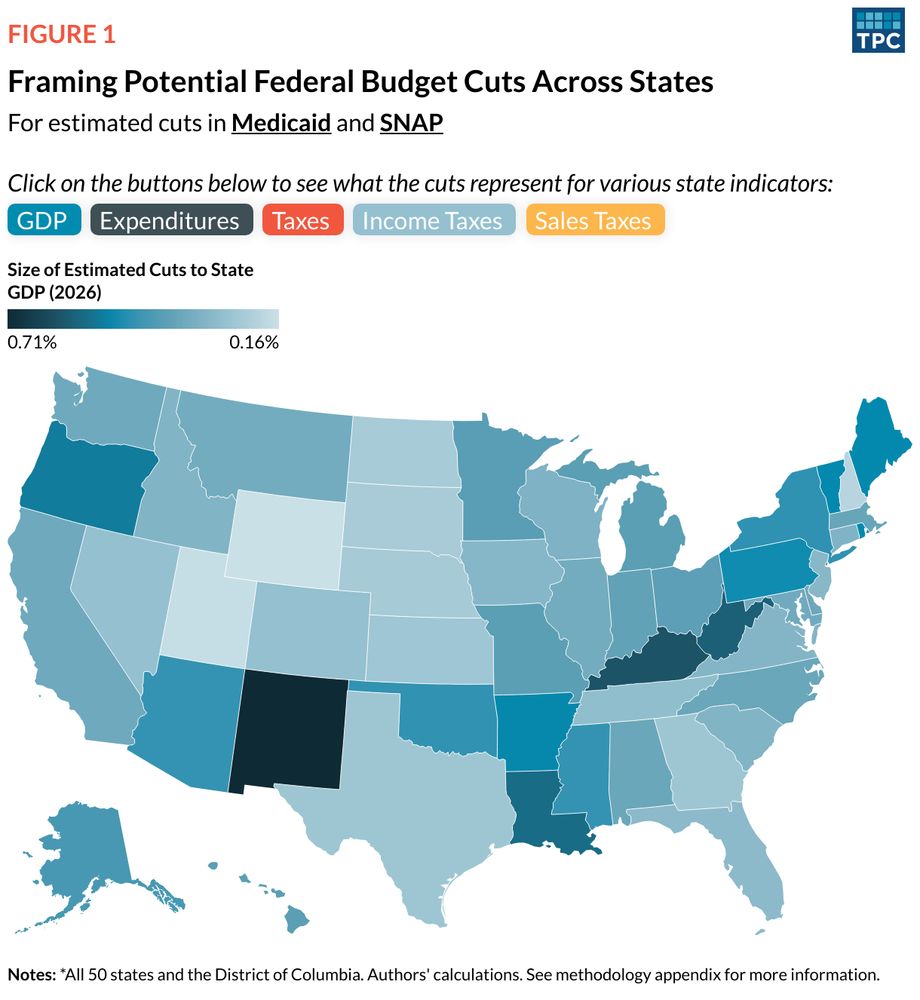

Data map showing how much proposed federal benefit cuts could impact each state

If Congress cuts its support for social safety net programs and states are left to pick up the slack, the result could be reduced benefits and higher taxes. taxpolicycenter.org/features/how...

20.06.2025 16:34 — 👍 1 🔁 1 💬 1 📌 0

The Earned Income Tax Credit is designed to reduce poverty and encourage work. But a provision in the OBBBA might deter eligible people from claiming the credit while making administration more costly. taxpolicycenter.org/taxvox/one-b...

18.06.2025 18:52 — 👍 0 🔁 0 💬 0 📌 0

Because of budget constraints, the District of Columbia is considering eliminating its child tax credit. TPC's Elaine Maag submitted written testimony to city policymakers explaining why the CTC provides a good return on investment. taxpolicycenter.org/testimonys/d...

18.06.2025 13:39 — 👍 0 🔁 0 💬 0 📌 0

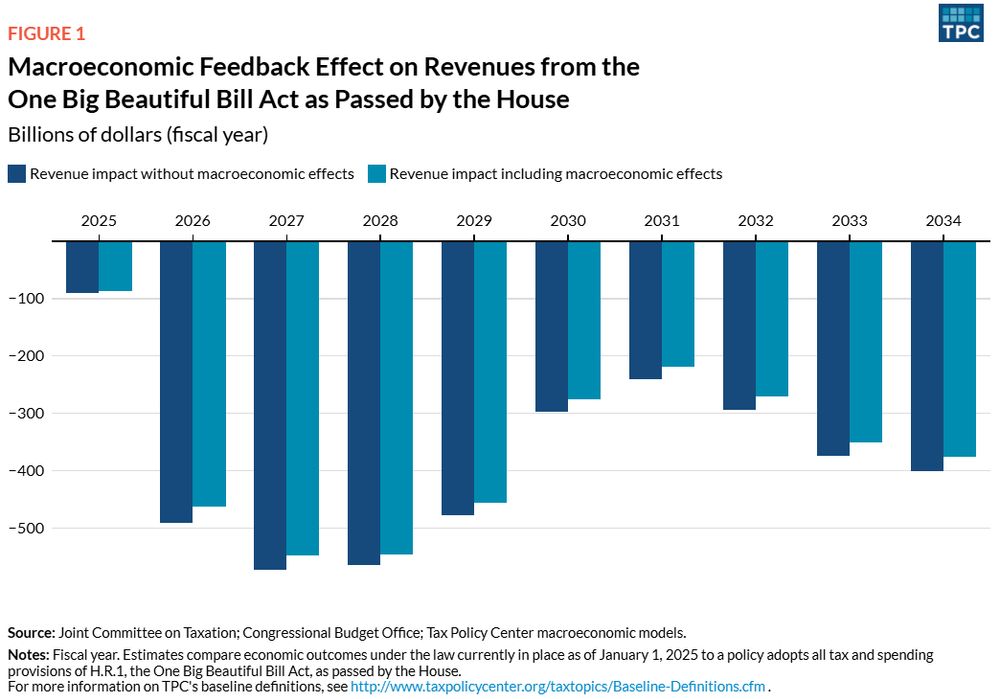

a chart showing the year by year revenue loss under House Republicans 2025 tax and spending plan

The economic growth from the fiscal plan passed by House Republicans would pay for only a small portion of the lost revenue. taxpolicycenter.org/taxvox/house...

17.06.2025 20:45 — 👍 0 🔁 0 💬 0 📌 0If you sell crypto assets or use cryptocurrencies to make purchases, you need to report any resulting gains and losses on your tax return taxpolicycenter.org/fiscal-facts...

13.06.2025 16:01 — 👍 0 🔁 0 💬 0 📌 0

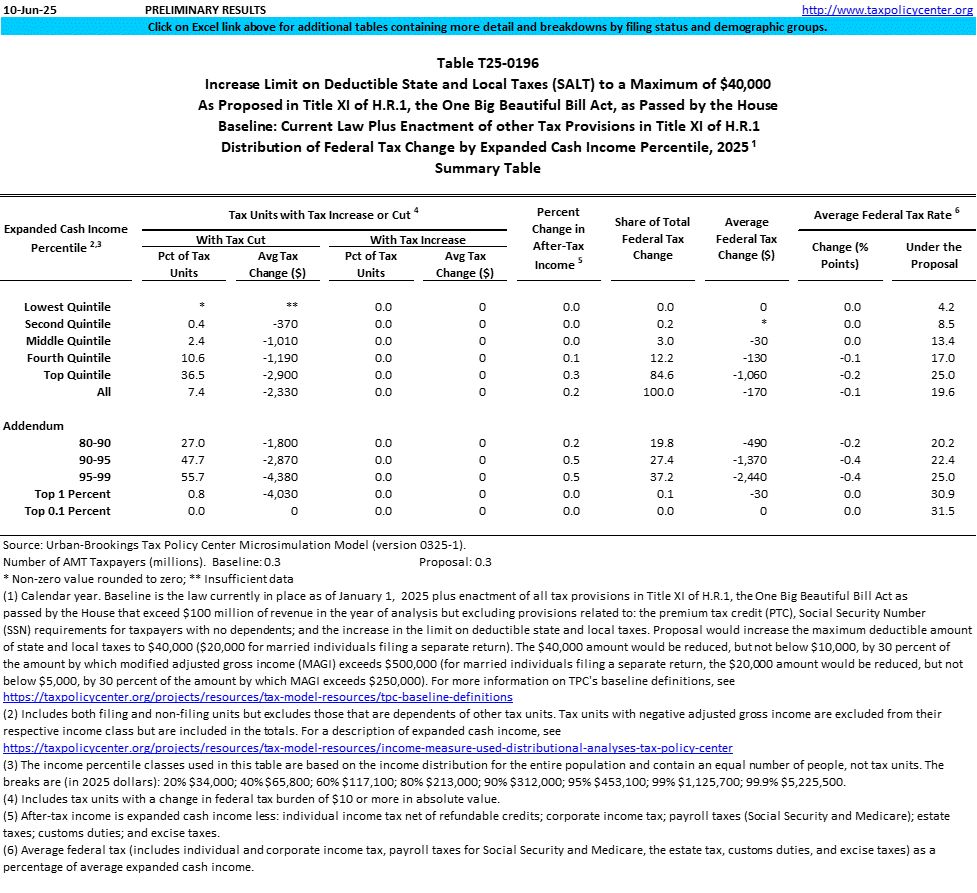

The OBBBA would raise the cap on state and local tax deductions from $10K to $40K, with an income phasedown starting at $500,000. Those making between $450K and $1.1 million would see the biggest benefits.

12.06.2025 17:05 — 👍 0 🔁 0 💬 0 📌 0

Congressional Republicans have argued that the "One Big Beautiful Bill Act" will lead to a surge in economic growth. There are reasons to be skeptical. taxpolicycenter.org/taxvox/dont-...

10.06.2025 16:23 — 👍 2 🔁 0 💬 0 📌 1

Trying to figure out what congressional Republicans are planning to do with taxes? Our landing page on the 2025 tax debate has lots of resources on the cost, who would benefit, and more: taxpolicycenter.org/features/202...

05.06.2025 19:04 — 👍 1 🔁 0 💬 0 📌 0