UK Mansion Tax—The Beginning Of A British Wealth Tax Regime?

Rachel Reeves’ new mansion tax signals the UK’s shift toward wealth taxation—modest now, but with big implications for property, policy, and fairness.

The mansion tax "is as much symbolic as it is fiscal.. it establishes a political and administrative precedent."

This shift in the overton window is a key reason we proposed the mansion tax. It lays the groundwork for a wholesale proportional property tax or a more ambitous wealth tax in future

27.11.2025 23:47 — 👍 6 🔁 1 💬 0 📌 1

There are a lot of tax reform Reeves could make which address wealth and would be entirely justified and could also have growth benefits, e.g on CGT, investment income, property, pensions

These should come alongside taxes on middle earners

21.11.2025 11:41 — 👍 1 🔁 0 💬 0 📌 0

Wealth inequalities also map onto inequalities in income and so compound the overall feeling of inequality.

Also the CGT data here is only taxable gains. Doesn't account for gains on pensions or primary homes.

21.11.2025 11:41 — 👍 1 🔁 0 💬 1 📌 0

Capital gains, inheritance and investment income have all become more important, are spread v unequally, are not captured by the article's data, and are taxed less

Eg see below by Advani and Summers.

And the top 0.1% is often seen as the most egregious inequality

warwick.ac.uk/fac/soc/econ...

21.11.2025 11:41 — 👍 1 🔁 0 💬 1 📌 0

Britain’s tax system combines the worst of the US and Scandinavia

The UK’s experiment in eating the rich while shrinking the state has left everyone worse off

We do need higher tax on middle earners, but this analysis misses:

1) Wealth's importance vs income has ballooned & it's distributed twice as unequally

2) Wealth can boost income in ways this data doesn't capture

3) Income from wealth is taxed much less than income

www.ft.com/content/75ce...

21.11.2025 11:41 — 👍 1 🔁 0 💬 1 📌 0

Times letters: Chancellor’s tax raid on the middle classes

Write to letters@thetimes.co.ukSir, At the Royal College of General Practitioners’ recent annual conference, I recounted something a GP approaching retirement told me: as in practices across the

These letters to The Times saying how bad it is that govt may be taxing NHS GPs (b/c Reeves may equalise NICs between employees & limited liability partnerships (LLPs))

Ridiculous and untrue. The reported reform would NOT apply to NHS GPs as they cannot be LLPs!

www.thetimes.com/comment/lett...

23.10.2025 08:32 — 👍 0 🔁 0 💬 0 📌 0

Rachel Reeves’s second budget needs a narrative of fairness to justify tax rises | Heather Stewart

The chancellor should reach for the language of solidarity and social justice that this government tends to recoil from

Spot on from @guardianheather.bsky.social in @theguardian.com, quoting @centaxuk.bsky.social, @demos-uk.bsky.social, @resfoundation.bsky.social and @theifs.bsky.social. The right tax reforms, well designed and communicated, can raise revenue, reduce wealth inequality, boost fairness AND drive growth

06.10.2025 14:29 — 👍 10 🔁 7 💬 1 📌 0

Great to see our tax research featured in the Guardian yesterday!

Check out the report for more details👇

demos.co.uk/research/sol...

06.10.2025 09:26 — 👍 0 🔁 0 💬 0 📌 0

Older people to face steep costs for future-proofing homes

80% of homeowners aged over 50 willing to improve and adapt home to live independently for longer

Half (51%) of those expecting to make changes in their home expect to spend £5,000 or more on the impr...

Only if they trade up in the same region right? So people still gain if they (1) keep their home till death and give it as inheritance (if its sold by the inheritor, which inherited homes tend to) or (2) move to a region with lower house price rises. That's likely to be a v significant % of people

02.10.2025 22:39 — 👍 2 🔁 0 💬 0 📌 0

Don't think this is right? A London buyer in 2010 may have paid a premium due to lower council tax, but their house price has since continued to grow faster than elsewhere while their council tax hasn't (= a gain).

As long as house prices continue to diverge more than CT bills, homeowners gain

02.10.2025 18:18 — 👍 0 🔁 0 💬 1 📌 0

We also have papers coming out on:

(1) The Story to Tell about Tax Rises - how to frame tax rises to gain public trust, based on tests of mock-up BBC articles announcing tax rises

(2) The Attitudes of Small Businesses to tax rises, based on a representative survey of SMEs.

Keep your eyes peeled

29.09.2025 07:14 — 👍 0 🔁 0 💬 0 📌 0

These reforms would help sort the fiscal mess. BUT if we do want 'national renewal' (essential if govt is to rebuild public trust) much more is needed

Are broad-based tax rises needed? Would the damage to public trust be worth it in the long run? We discuss these questions in an upcoming paper

29.09.2025 07:14 — 👍 0 🔁 0 💬 1 📌 0

Solving the Tax Puzzle: Eight popular, pragmatic, pro-growth tax reforms to plug the fiscal hole

Demos is Britain’s leading cross-party think-tank. We produce original research, publish innovative thinkers and host thought-provoking events.

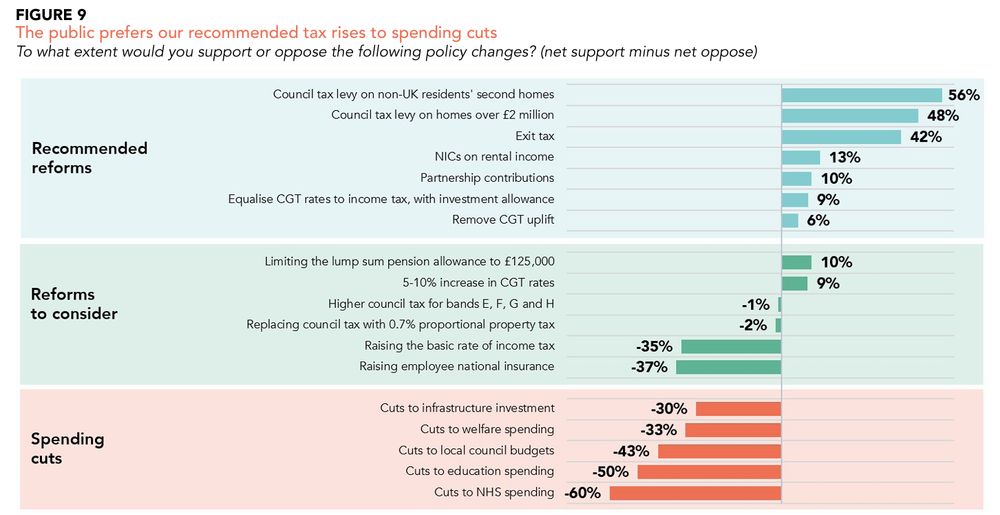

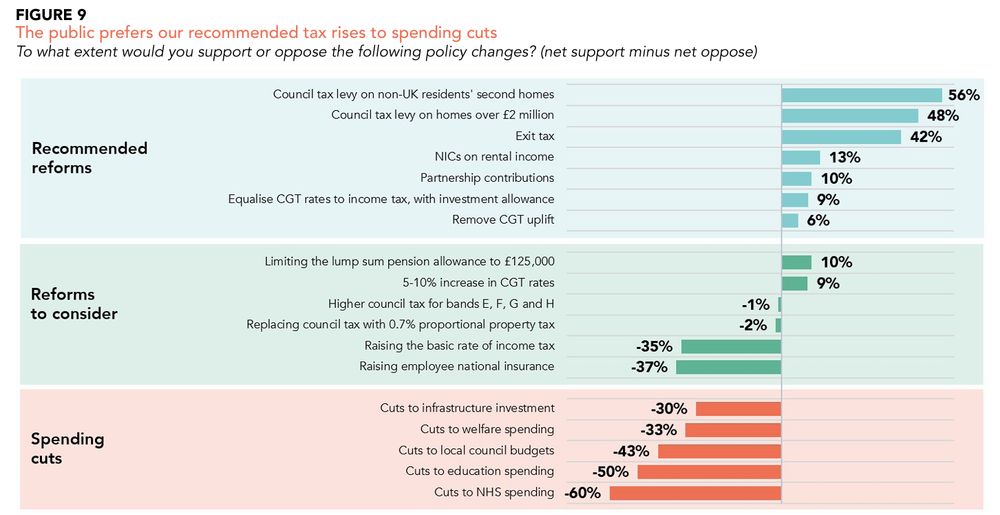

So, a set of popular, pragmatic and pro-growth tax reforms could not just to plug the fiscal hole, improve the tax system and avoid raising the headline rates of broad-based taxes...

They could boost public confidence in government at the same time

Read the detail here:

demos.co.uk/research/sol...

29.09.2025 07:14 — 👍 0 🔁 0 💬 1 📌 0

Support is also seen among key electoral target groups

29.09.2025 07:14 — 👍 0 🔁 0 💬 1 📌 0

... or with arguments for and against the reform

29.09.2025 07:14 — 👍 0 🔁 0 💬 1 📌 0

... with contextual data about what the reforms does and how much it raises...

29.09.2025 07:14 — 👍 0 🔁 0 💬 1 📌 0

The changes would also be popular, whether you present people with a one-line summary (as below)...

29.09.2025 07:14 — 👍 0 🔁 0 💬 1 📌 0

The changes would benefit economic growth by:

(1) broadening neutrality in the tax system

(2) introducing new allowances to encourage investment,

(3) ending disortionary incentives to shift income into capital gains, move abroad or hold onto assets until death

29.09.2025 07:14 — 👍 0 🔁 0 💬 1 📌 0

By (1) tackling tax advantages for landlords and partners relative to employees, (2) ending harmful and distortive incentives in capital gains tax, (3) ensuring high-value properties pay a fair share & (4) properly taxing the social harms of gambling, govt could raise up to £21.3 billion

29.09.2025 07:14 — 👍 2 🔁 0 💬 1 📌 0

There's lots of 'national renewal' chatter at Labour conference, but this obviously needs BIG public investment. The elephant in many rooms (or pods?) is the fiscal mess standing in the way...

We've just laid out a path to sort that mess w/o any broken promises 🧵

www.thetimes.com/business-mon...

29.09.2025 07:14 — 👍 0 🔁 1 💬 1 📌 0

Some great opporutnities currently open to join an incredible team at Demos! Check them out👇

17.04.2025 13:49 — 👍 3 🔁 0 💬 0 📌 0

- Budget tax rises raising £36bn: drives 18% of Labour defectors away

- Cut winter fuel payments raising £1.5bn: drives 35%(!) of Labour defectors away

The public really, really do not like spending cuts!

24.01.2025 13:54 — 👍 2 🔁 0 💬 0 📌 0

Really enjoyed appearing on the @financialfairness.bsky.social podcast last month, discussing the recent changes to inheritance tax

Check it out below👇!

10.01.2025 12:10 — 👍 3 🔁 1 💬 1 📌 0

Politics, policy, public attitudes. Work in polling and comms. Director, Persuasion UK. ex- Shelter, civil service and various other things. 🏳️🌈

https://persuasionuk.org/about

https://strongmessagehere.substack.com/

Green Party Leader (England & Wales)

London Assembly Member.

Chair of London's Fire Committee.

🏳️🌈

https://podcasts.apple.com/podcast/id1837201724?i=1000724643828

Chief Executive, Resolution Foundation

Financial journalist at The Times and The Sunday Times. Wincott Foundation Young journalist of the year nominee 2023. Mortgage rates and meltdowns about sports teams

Opiner for Financial Times in London. Globalisation, econ, snark. RT≠👍. Views own. alan.beattie@ft.com. Sign up to my FT Trade Secrets newsletter https://subs.ft.com/spa3_tradesecrets?segmentId=357afa03-959c-93ed-0842-58e2115025d4.

Research and policy for the bravest people in England and Wales. Former senior UK government comms official and adviser. Happiest in a focus group. Once a journalist. Further back, a historian. Halberdier. Bristol City FC.

Research Director at the Resolution Foundation. Previous lives at the Bank of England and in the civil service. Focussed mainly on macroeconomics (mainly).

Read Vulture Capitalism ⬇️

https://linktr.ee/Grace.blakeley

FT Alphaville reporter. Ex-“veteran” fund manager. Resolution Foundation Assoc. Baring Foundation Trustee.

Director of @britishfuture.bsky.social

Author How to be a Patriot https://harpercollins.co.uk/products/how-to-be-a-patriot-why-love-of-country-can-end-our-very-british-culture-war-sunder-katwala?variant=40518936559694

Evertonian

Co-founder and CEO, Zinc Innovation Partners - helping turn science into real-world change. Fomerly Demos, UAL, MMHPI, No10. Adviser at Future Governance Forum, Family Business UK, Door10 Recruitment. Writes at https://howtorunacountry.substack.com/

Economist at VIVE and University of Bristol.

Co-editor at Economics of Education Review.

Website: www.hhsievertsen.net

Sharing papers I read does not mean I agree with their approach and conclusion.

jack of like six to seven trades / journalist, author, radio person, accidental art dealer, etc / marie.s.leconte@gmail.com

Economics writer. Author.

Expect history, economics, finance and other stuff.

Wrote Two Hundred Years of Muddling Through.

Blood and Treasure, on the economics of war, out now.

Menswear writer. Editor at Put This On. Words at The New York Times, The Washington Post, The Financial Times, Esquire, and Mr. Porter.

If you have a style question, search:

https://dieworkwear.com/ | https://putthison.com/start-here/

Data journalist, Financial Times | Visiting Fellow, London School of Economics

joel.suss@ft.com

Researcher, likes data, graphs, infographics and telling stories with data. PhD in political analysis from Sussex uni - like all social science subjects. Mainly post about political analysis and my research within the Hastings & Rye area. Fabian member.

Senior Editor (Politics), New Statesman

Subscribe to my daily briefing Morning Call here: https://morningcall.substack.com/subscribe

Policy. Political economy. Increasing bewilderment.

"The Three Economies" Substack here: https://open.substack.com/pub/anthonypainter

#ynwa