#JEPQ (Growth Stocks) - Largest trade since inception 45 minutes before the big FOMC reveal. Top holdings include #NVDA, #MSFT, #AAPL.

Anything is possible, but trades of such size at ATH are not usually consistent with bullish outcomes.

@volumeleaders.bsky.social

Context, analytics, and visuals pertaining to institutional trades. Email: info@volumeleaders.com Web: https://www.volumeleaders.com Twitter: https://twitter.com/volumeleaders YouTube: https://www.youtube.com/@volumeleaders

#JEPQ (Growth Stocks) - Largest trade since inception 45 minutes before the big FOMC reveal. Top holdings include #NVDA, #MSFT, #AAPL.

Anything is possible, but trades of such size at ATH are not usually consistent with bullish outcomes.

#NXT

28.10.2025 02:32 — 👍 0 🔁 0 💬 0 📌 0

#UPRO (3x #SPY) - The 4th largest trade since inception landed today at the close after a strong rally over the last few sessions. It presents best as a long position being closed. The most common outcome after a trade such as this is a nominal new high followed by a reversal.

28.10.2025 02:20 — 👍 0 🔁 0 💬 0 📌 0

#NVDL (2x #NVDA) - Three highly ranked trades bunched up here together, with price dipping below two of them today. Failure to remain above these prints would suggest they were long exits.

volumeleaders.com/register

#CONL (2x #COIN)

22.07.2025 01:38 — 👍 0 🔁 0 💬 0 📌 0

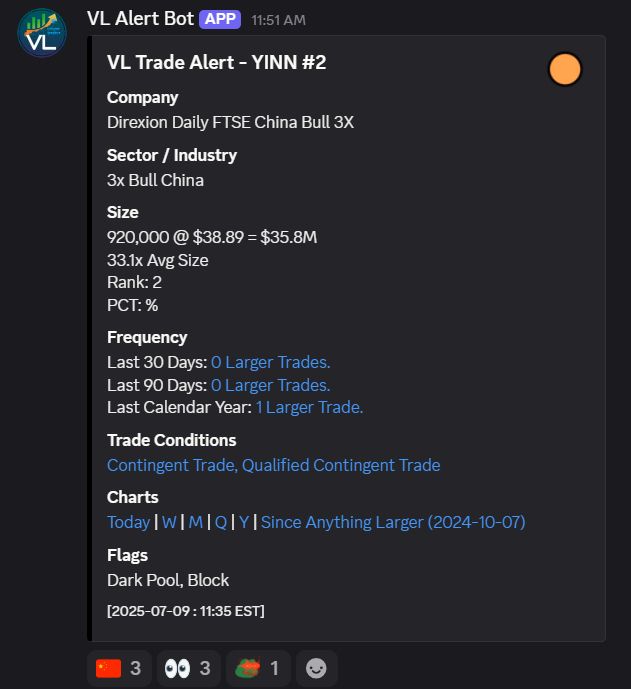

#YINN (3x #FXI)

09.07.2025 17:30 — 👍 0 🔁 0 💬 0 📌 0

#PDBA - Largest trade since inception today.

08.07.2025 01:34 — 👍 0 🔁 0 💬 0 📌 0

#UPRO, #SPXL (3x #SPY) - Institutions are once again trading leverage w/ size. Meanwhile, price has made its first lower high / lower low in several sessions.

volumeleaders.com/register

#EEM - The largest position since March 26, 2021 printed 10 days ago.

Exactly 10.5M @ $47.99. Price overshot a bit and is now testing the print. Breaking below the level at which the #24 ranked print arrived would suggest further bearish resolution in the near term.

volumeleaders.com/register

#UPRO (3x #SPY) - Thursday's close finished with three highly ranked trades near the HOD as price arrived at the +2 ATR ribbon on the 4-hour #ES chart. This zone has been behaved as strong resistance the last several times price has interacted with it.

volumeleaders.com/register

#TLT - Treasuries remain bearish in the near term as #3 signaled a local high was being made back on June 27. Several sessions later we can see price has resolved below the red zone where several highly ranked levels reside.

volumeleaders.com/register

#UPRO (3x #SPY) - Thursday's close finished with three highly ranked trades near the HOD as price arrived at the +2 ATR ribbon on the 4-hour #ES chart. This zone has been behaved as strong resistance the last several times price has interacted with it.

volumeleaders.com/register

#SPXL - More has arrived. 2nd largest since inception.

volumeleaders.com/register

#SPXL (3x #SPY) - #6 (and more) printed at the close today suggesting an outsized move for tomorrow.

23.06.2025 20:34 — 👍 1 🔁 0 💬 0 📌 0

#SPXS, #SPXU, #SOXL, #SOXS, #QID (2x Inverse #QQQ)

05.05.2025 00:23 — 👍 1 🔁 0 💬 0 📌 0

#SPXL (3x #SPY) - The largest print since inception has arrived after nine straight green days. Analysis attached.

Additional commentary regarding #SPXS, #SOXL, #SOXS, #QID (2x Inverse #QQQ) included in the comments.

#QQQ - Hope I don't jinx it...

t.co/6htjntJORg

#SPY, #QQQ, #IWM - The latest VL newsletter is out for subs.

If you're newsletter-curious, it's published every Sunday and all archived posts are free and available at the following URL. No account required.

www.volumeleaders.com/newsletter

Issue 35 of Market Momentum is available. We talk Bull & Bear cases for #SPOT, #ENPH & #PDD, look at the latest investor sentiment readings, review the latest institutional positioning in #SPY, #QQQ, #IWM & #DIA & examine institutional order flow by sector.

Link: www.volumeleaders.com/newsletter

I'm only confident in saying I think that institutions went through an awful lot of trouble since December, and I don't see them doing that just for a simple correction and resumption of the underlying trend.

volumeleaders.com/register

That 2022 high lasted a while and I expect this one to last a while too. How long it may last and how far we may drop is way way *way* beyond my level of expertise.

28.02.2025 06:30 — 👍 0 🔁 0 💬 1 📌 0One difference was 2021's distribution was most easily spotted in megacaps like #NVDA whereas this time they're hitting the #SPY -esque investment vehicles most. Why that may be is anybody's guess.

28.02.2025 06:29 — 👍 0 🔁 0 💬 1 📌 0The last few months remind me of late 2021 more than any other period. Similar structure. Similar pattern of prolonged large trades in a range with a false breakout above the range followed by a swift reversal to the bottom of the range and beyond.

28.02.2025 06:28 — 👍 0 🔁 0 💬 1 📌 0But those trades didn't just come in #SPY and #QQQ, these trades came in the long-term investment vehicles. These are ETFs held by long term investors. Long term vehicles are traded at long term targets. They don't day trade these things. Not usually.

28.02.2025 06:28 — 👍 0 🔁 0 💬 1 📌 0What we watched over the last two months was different than what we saw in July, or even in April or any other time in recent history except for one. This was deliberate. Enormous volumes. Prolonged time spent in a defined range. Day after day of unusually large, highly ranked trades.

28.02.2025 06:27 — 👍 0 🔁 0 💬 1 📌 0Price bottomed Aug 5 and rebounded just as fast as it fell. Of course there was some selling at/near that high, but there wasn't much in the way of a "process" that preceded that correction.

28.02.2025 06:26 — 👍 0 🔁 0 💬 1 📌 0As an example, the 13% August 2024 correction in $QQQ lasted a few weeks and was not preceded by any meaningful distribution. Price made a high on July 9, large bear leverage arrived, and then price reversed on July 10.

28.02.2025 06:25 — 👍 0 🔁 0 💬 1 📌 0Even if we correct for another few weeks, too much money changed hands at these highs.

In my opinion, that time spent distributing is going to have longer term implications, and it'll be a while before we see another ATH.

$QQQ is 8% off its high. #SPY is 4.5% off its high. So far, everything seems "normal" and "healthy." But it's difficult for me to accept that institutions spent 2+ months dumping long-term investment vehicles for a garden-variety correction that lasts a week and a half.

28.02.2025 06:24 — 👍 0 🔁 0 💬 1 📌 0 I don't see this as a correction that runs its course in a few weeks and resolves back up into another leg higher to new ATH.

Here's why.