A warm welcome to Bluesky! 👋 Essential reading for everybody keeping up with EU economic news and policy

05.03.2026 16:49 — 👍 9 🔁 4 💬 1 📌 0A warm welcome to Bluesky! 👋 Essential reading for everybody keeping up with EU economic news and policy

05.03.2026 16:49 — 👍 9 🔁 4 💬 1 📌 0

US economic growth slowed sharply late last year, according to GDP data, which the PMI suggest will remain sluggish into February to hint at a weak Q1. Read the press release at www.pmi.spglobal.com/Public/Home/...

20.02.2026 16:00 — 👍 1 🔁 1 💬 0 📌 0

The German economy is showing further encouraging signs of life, according to today's flash PMI data for February, with a 44-month high for the Manufacturing PMI and further upturn in growth of the services economy. GDP on course for a 0.3% quarterly rise in Q1. www.pmi.spglobal.com/Public/Home/...

20.02.2026 08:47 — 👍 3 🔁 2 💬 0 📌 0Turns out "juicy men embalmed her" was "deceived and then punctured". How?! Who knew that??

13.02.2026 20:52 — 👍 0 🔁 0 💬 0 📌 0

If only I'd had the internet as a kid... Turns out I'd guessed the vast majority of these lyrics incorrectly for a few decades...

13.02.2026 20:35 — 👍 2 🔁 0 💬 1 📌 0

UK GDP rose by a disappointingly meagre 0.1% in the fourth quarter. But that was in line with the signal from the PMI surveys (www.spglobal.com/marketintell...), which are sending a more encouraging picture for January. Next week's flash February data will be an important guide to Q1 performance.

12.02.2026 11:14 — 👍 2 🔁 2 💬 0 📌 0

Can't say it's not a surprise ...the flash PMI surveys for January are all now in, and look who's now reporting the strongest business growth ....

23.01.2026 15:53 — 👍 3 🔁 2 💬 0 📌 0

Surprisingly good PMI just out.

S&P Global's @chris-williamson.bsky.social reckons it's consistent with GDP growth around 0.4% qq, on the face of it

Signs of UK economic recovery gaining momentum at start of 2026 as flash PMI shows strongest upturn in business activity since April 2024 (but jobs continue to be lost) www.pmi.spglobal.com/Public/Home/...

23.01.2026 09:40 — 👍 5 🔁 4 💬 0 📌 0What no Ya-Ya's??

21.01.2026 13:08 — 👍 1 🔁 0 💬 0 📌 0

UBTech unveils ‘world’s first’ humanoid robot to autonomously swap its own battery (Aug 2025) roboticsandautomationnews.com/2025/08/01/u...

13.01.2026 10:21 — 👍 0 🔁 0 💬 0 📌 0We saw it over Xmas. We all loved it. Not one dull moment, with brilliant songs throughout.Amazing that they've made such a quirky and potentially dry story so entertaining. Can't recommend it highly enough!

11.01.2026 17:33 — 👍 0 🔁 0 💬 0 📌 0

Horrendous housing number on the UK construction PMI for December, out today

"Anecdotal evidence suggested that fragile confidence among

clients and subdued underlying demand had resulted in lower workloads at the end of the year."

World Service highly recommended especially if you also want a less parochial view of the world

31.12.2025 08:47 — 👍 4 🔁 0 💬 0 📌 0

BLS has an FAQ re:shutdown impacts to Nov. CPI released tomorrow. In short, Nov. CPI index values will be calculated by comparing Nov. prices to Oct. prices where available (from alternative/non-survey sources) and Sept. prices otherwise (most prices).

www.bls.gov/cpi/

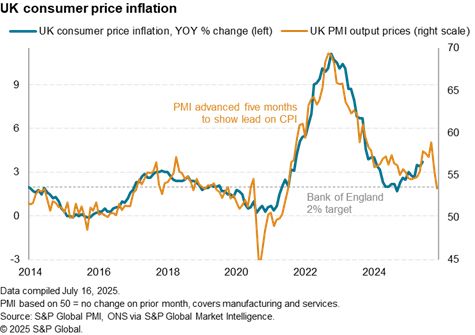

UK #inflation down to 8-month low of 3.2%, cooling in line with the advance signal from the #PMI with further slowing signalled in the months ahead

17.12.2025 10:49 — 👍 4 🔁 1 💬 0 📌 0

Some relief to the Chancellor as first #PMI release since the #Budget shows business confidence edging higher, contrasting with the slump seen after last year's Budget. www.pmi.spglobal.com/Public/Home/...

16.12.2025 09:44 — 👍 1 🔁 0 💬 0 📌 0UK households’ views on future finances sour to two-year low in December. Post #Budget data collected 4th – 8th December. www.pmi.spglobal.com/Public/Home/...

15.12.2025 09:48 — 👍 1 🔁 0 💬 0 📌 0

The BLS, Census, and BEA have announced more revised release dates for data delayed by the shutdown. GS

08.12.2025 13:58 — 👍 16 🔁 4 💬 0 📌 1

Wondering when you'll get your #BLS data?? The Friends of BLS have posted an FAQ about the impact of the shutdown on #BLSdata: www.friendsofbls.org/updates/2025...

#econsky @aaronsojourner.org @betseystevenson.bsky.social @justinwolfers.bsky.social @jasonfurman.bsky.social @jedkolko.bsky.social

This looks rather meaningful.

10.11.2025 09:40 — 👍 148 🔁 66 💬 8 📌 22

Disappointing UK PMI this morning with only a small bounce back after chunky fall in September. This is a key indicator for the BoE so the sliver of good news is that this probably keeps hopes of a rate cut alive for November.

24.10.2025 13:04 — 👍 2 🔁 2 💬 0 📌 0As a mancunian teenager, the stone roses were also a major part of the scene that year and was by far the most exciting sound we'd ever heard live, punching so much harder than the smiths

26.07.2025 20:01 — 👍 2 🔁 0 💬 0 📌 01972 often cited: exile on main st, harvest, Ziggy stardust, zep iv, tapestry all released plus all the other bands touring at their peaks - you can see why.

26.07.2025 19:38 — 👍 1 🔁 0 💬 0 📌 0Well out of my depth here but "science" is not set in stone. I think Einstein had something to say about Newton, but I only got as far as A level physics...

16.07.2025 19:33 — 👍 0 🔁 0 💬 0 📌 0

UK inflation rose from 3.4% to 3.7% in June, and the official annual % change data may rise further in the next couple of months, but the forward-looking PMI data suggest the worst of the recent upturn in underlying price pressures has already started easing

16.07.2025 12:05 — 👍 4 🔁 4 💬 0 📌 0

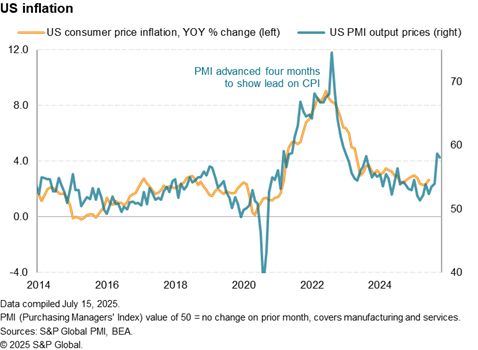

US CPI inflation up from 2.4% to 2.7% in June with further rises to come in the months ahead according to the S&P Global PMI

15.07.2025 14:17 — 👍 9 🔁 2 💬 0 📌 0Yes. No signs of global supply chain stress this year so far.

12.07.2025 17:36 — 👍 0 🔁 0 💬 2 📌 0

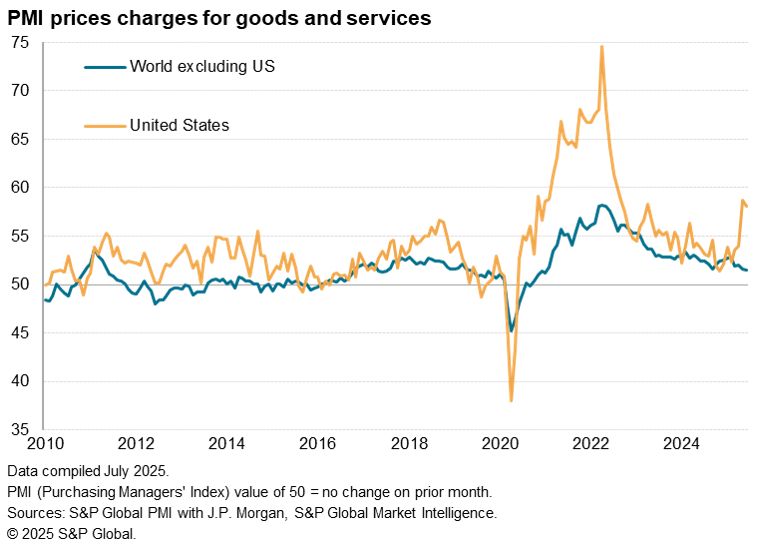

PMI surveys indicate elevated US price growth as tariffs drive inflation differential with rest of world

www.spglobal.com/marketintell...