Options expiration Thurs/Friday could be the chaos trigger to start the selling down to the A-B targets, and a VIX temporarily back over 20.

14.05.2025 15:46 — 👍 0 🔁 0 💬 0 📌 0🏳️🌈🏳️🌈

@machumble.bsky.social

Dog lover and an investor

@machumble.bsky.social

Dog lover and an investor

Options expiration Thurs/Friday could be the chaos trigger to start the selling down to the A-B targets, and a VIX temporarily back over 20.

14.05.2025 15:46 — 👍 0 🔁 0 💬 0 📌 0Maybe 550? (-6%)

If there is a Trump pump, then 595-605 would be the end of this parabolic top before pullback.

The VIX on the pullback? Around 22-24 would be my guess That would put $UVIX around $35-37 at best, and would be a good place to do the usual exchange back from UVIX to $SVIX.

we had the fastest move from extreme fear (4) to extreme greed (72 on the CNN fear & greed index.

Where to on a pullback (assuming we are in a bull market)? A) Definitely retest the 200SMA (-3 %) B) Likely gap fill to the 565 area (-4%) C) Possible hit the line in the sand on 557 (-5%) D)

$SPY Seems to me like a change of trend is around the corner; the only thing that can continue the pump is another Trump deal announcement (which he is supposed to do on his return from Saudi Arabia today). Put/call ratio is in the dumps, as its back to the FOMO chase Also,

14.05.2025 15:46 — 👍 0 🔁 0 💬 1 📌 0

$NYFANG component - 10 stocks.

02.05.2025 16:48 — 👍 0 🔁 0 💬 0 📌 0

$TSLA

02.05.2025 15:07 — 👍 0 🔁 0 💬 0 📌 0

$TSLA next? Been fun so far.....$META $HOOD $PONY etc

02.05.2025 15:01 — 👍 0 🔁 0 💬 0 📌 0I have been slowly booking profits and raising cash as markets approach 570s zone

Currently my account is 93% cash as of last night.

Risk management!

$SPY 575 area is where high probabilities of strong reaction to the downside to occur technically because it is the area of multiple confluences (573 is 200 dMA , 578 is 100 dMA, horizontal resistance line etc).

02.05.2025 14:01 — 👍 1 🔁 0 💬 1 📌 0

$KRE $DPST -- regionals have broken the downtrend and are building a base with volume increasing.

02.05.2025 13:49 — 👍 0 🔁 0 💬 0 📌 0

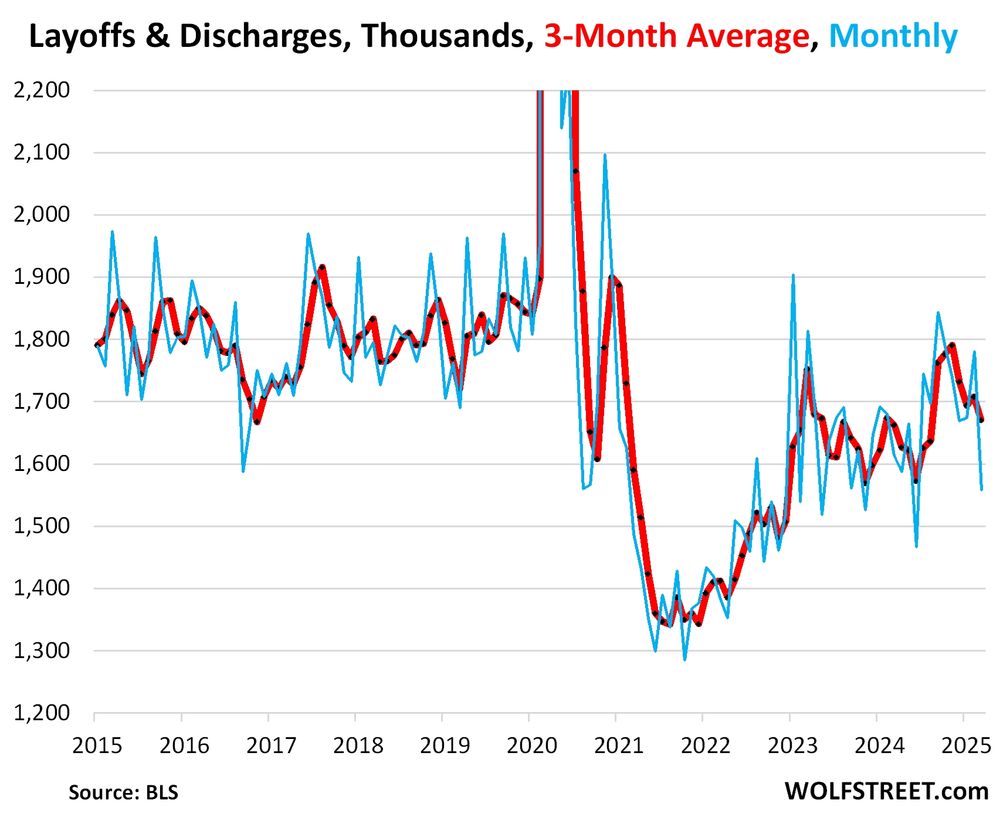

Despite All Moaning and Groaning: Layoffs & Discharges Plunge, Hires and Voluntary Quits Rise, Driven by Private Sector Strength. The labor market started regaining momentum in the fall of 2024, and it continued through March wolfstreet.com/2025/04/29/des.

29.04.2025 18:17 — 👍 0 🔁 0 💬 0 📌 0

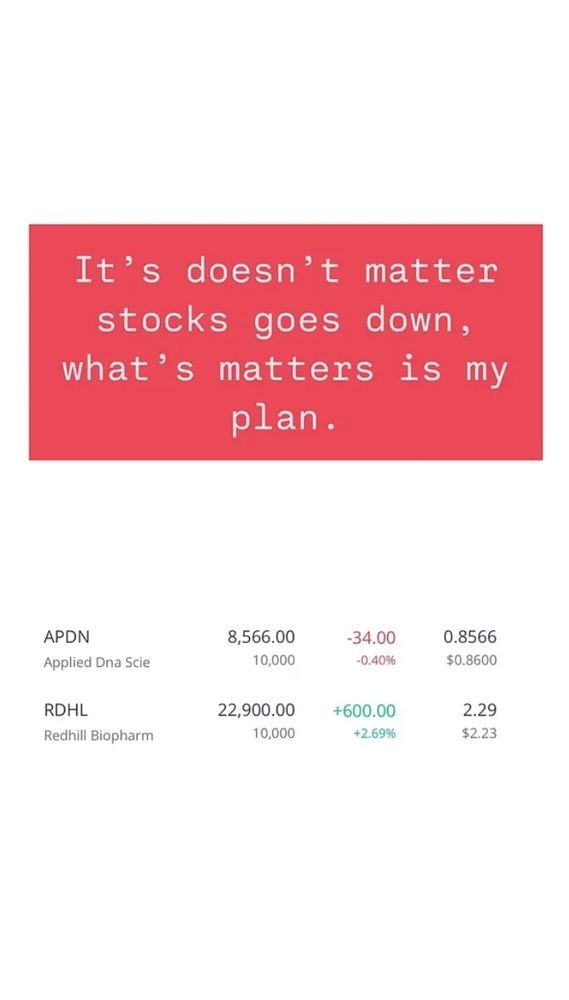

$APDN $RDHL so we see...

23.04.2025 21:01 — 👍 0 🔁 0 💬 0 📌 0

$RDHL $APDN.Still here and holding until next week or until my targets are met..

23.04.2025 14:03 — 👍 0 🔁 0 💬 0 📌 0Sieze the opportunity and buy some penny stocks

23.04.2025 00:11 — 👍 1 🔁 0 💬 0 📌 0You can buy both and leave for long term

22.04.2025 14:47 — 👍 0 🔁 0 💬 0 📌 0If you can buy a few penny stocks buy and leave for long term

22.04.2025 14:46 — 👍 0 🔁 0 💬 0 📌 0The risk is that the PE level drops significantly and trades closer to HOOD's 28.2x, which means SOFI trades at ~$14 based on my estimates. Therefore I maintain a Strong Buy rating on this✅

22.04.2025 14:21 — 👍 0 🔁 0 💬 0 📌 0

From a valuation perspective, $SOFI still trades like a bank at 3.8x NTM sales, down from +6x earlier in 2025.

2026 SOFI EPS forecast is $0.5, which means based on historical PE levels of ~40x, if SOFI meets expectations and trades at historical multiples, it will trade at $20.

immunotherapy drug entolimod and explored support for its export opportunities.

22.04.2025 14:19 — 👍 0 🔁 0 💬 0 📌 0Administration (FDA), which has generated positive interest in its bio and bioelectronics product candidates for potential military and defense applications.

In addition, the company said it has discussed the possibility of an accelerated approval process for its lead experimental

Today's Stock Recommendation

$TIVC

Entolimod is currently in a late-stage clinical trial for the treatment of acute radiation syndrome (ARS), a disease caused by high doses of ionizing radiation. TIVC said it has briefed the White House and the U.S. Food and Drug

calls now paid on what was free money profits yesterday; happy for you who follow my trades

22.04.2025 13:54 — 👍 0 🔁 0 💬 0 📌 0

$SPY as always, my honest advice on the one who did not panic yesterday and waited for close above $512.2 to validate pattern to go up; started taking profits in calls and yesterd ay took profits from last Thursday puts; trading goes both ways: longs and shorts,

22.04.2025 13:54 — 👍 0 🔁 0 💬 1 📌 0

Bitcoin is not just a BIT but WELL above its key daily moving averages.

It is sending a clear signal - I dont care.

Above 21EMA Above 50SMA

Bullish.

$BTC.X #Bitcoin

Stocks |am watching for swing trade when market acts "stable"

$MSTR SUBER $CLS $CELH SCVNA $DASH $IBIT $RKLB $ASTS $HOOD SCRWD STTWO $MELI

$NVDA gap closed.

21.04.2025 15:40 — 👍 0 🔁 0 💬 0 📌 0

$BHVN On Thursday, a big call came through and 1 alerted my premium subs before following. This morning, we locked in >25% gains

It doesn't what the environment is like, there is always an opportunity somewhere. $XBI $SPY

$BHVN On Thursday, a big call came through and 1 alerted my premium subs before following. This morning, we locked in >25% gains

It doesn't what the environment is like, there is always an opportunity somewhere. $XBI $SPY

since $spy 505 i called +5-10%. each times spy drop 3-5%. i have shorted $vxx 72-80-85-87.5-72-74 and cover for 5x +5-25%. msgs posted. vxx have decays. it lost 1-3$ per day vs spy. fear is lesser.

21.04.2025 14:47 — 👍 0 🔁 0 💬 0 📌 0

🚀We cannot intervene in market fluctuations, but we can find entry opportunities for you during fluctuations. Before the opening, we recommended $UPXI, 📈📈which has now risen by 478.65%📈📈

21.04.2025 13:52 — 👍 0 🔁 0 💬 0 📌 0