"But it’s not often remarked that ordinary Americans have already — and for years — been buying vast amounts of complex exposure to private equity risk.

"They’ve just been doing so (without realising it) through their boring old life cover and fixed annuities."

10.07.2025 23:48 —

👍 3

🔁 0

💬 0

📌 0

"All in all, 'democratising' access to private credit may undermine the very features that have sustained its growth."

09.07.2025 17:12 —

👍 4

🔁 2

💬 0

📌 0

Crypto, Startups and Banking Make a Scary Mix

Circle, Erebor and others look like they could run straight toward the Silicon Valley Bank trap.

The next must-have accessory for crypto and tech bros is far less sexy than a Lamborghini — it’s a banking license. But Circle, Erebor, Ripple and others will be too tied to hyper-volatile sectors, just like Silicon Valley Bank in 2023. Via @opinion.bloomberg.com www.bloomberg.com/opinion/arti...

07.07.2025 07:52 —

👍 6

🔁 4

💬 1

📌 1

Smart insights in here from @stevenkelly49.bsky.social who co-authored a great working paper this year on the 2023 mini-crisis. For a quick, deeper dive into that, i'd recommend his pod interview with @marcruby.bsky.social [subscription req'd] > www.netinterest.co/p/silicon-va...

07.07.2025 08:04 —

👍 4

🔁 1

💬 0

📌 0

4/ Second: Bank balance sheets are remarkable pieces of technology for bearing interest-rate risk.

Could household, corporate, or nonbank financial companies pull this off?

27.06.2025 03:14 —

👍 3

🔁 0

💬 1

📌 0

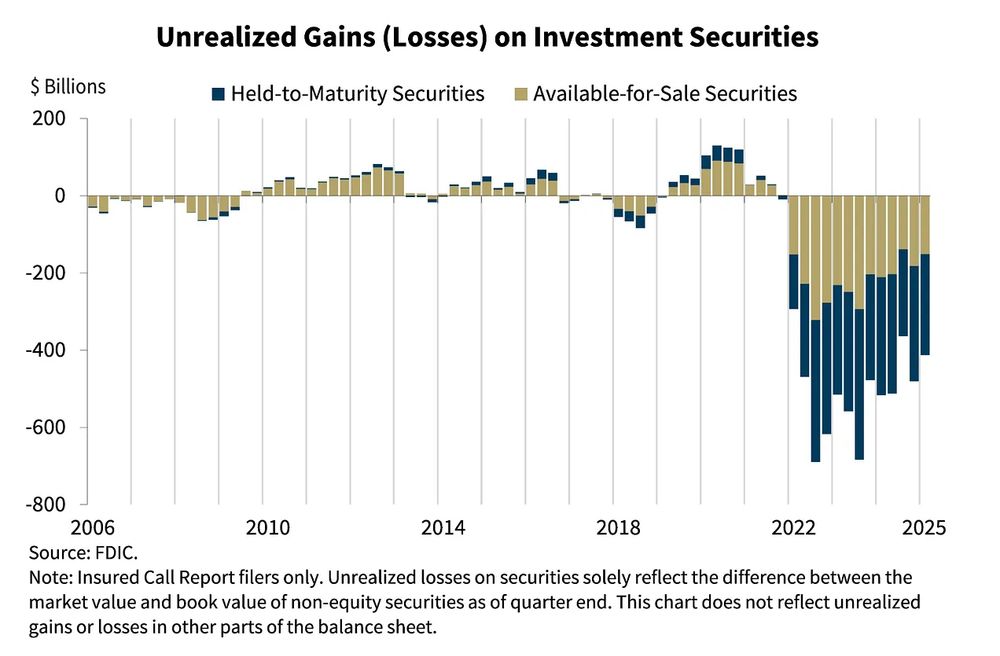

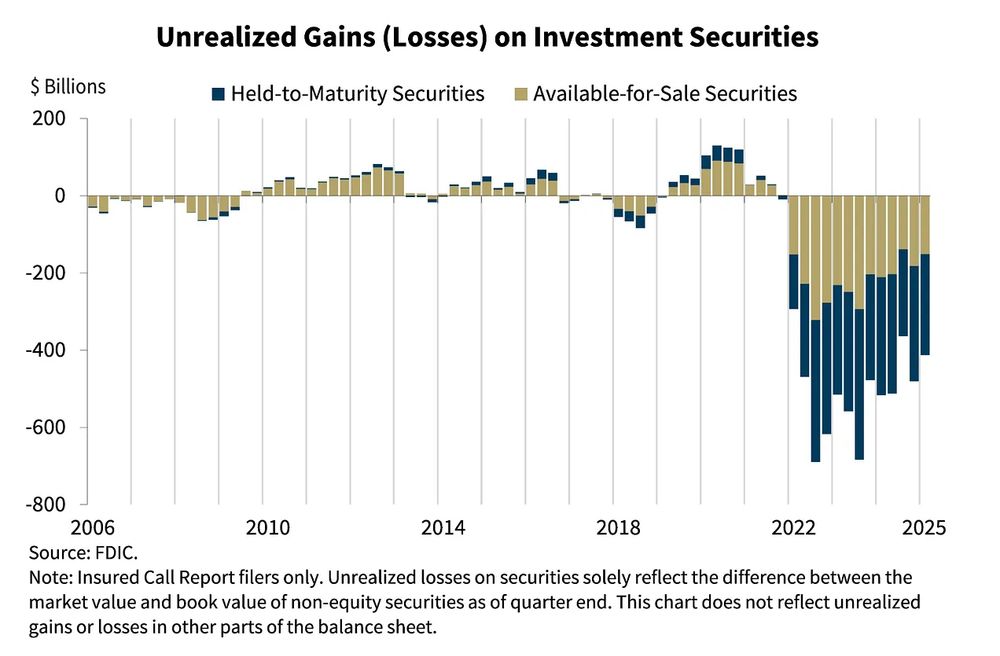

3/ First: Perhaps unrealized losses weren’t a good explanation for the Banking Crisis of 2023. (Apologies to those who’ve listened to me beat this drum since SVB’s failure.)

There’s lots of evidence on this in the piece, drawing heavily from this paper with Jonathan Rose:

27.06.2025 03:14 —

👍 1

🔁 0

💬 1

📌 0

2/ The scale of unrealized interest-rate losses got a lot of attention around the failure of SVB, but they have persisted longer than anyone expected—without another banking crisis.

High-level, this indicates two things.

27.06.2025 03:12 —

👍 1

🔁 0

💬 1

📌 0

When Should We Care About Unrealized Bank Losses?

What really happened in 2023?

A guest spot over at Odd Lots:

"When Should We Care About Unrealized Bank Losses?"

26.06.2025 18:24 —

👍 10

🔁 3

💬 2

📌 0

Proponents of each model often cite purported financial stability benefits—which are often correct—but each nonbank model comes with financial *instability* risks that are missing from the discourse.

The bank regulatory/support framework has mostly addressed these in banks.

16.06.2025 19:15 —

👍 1

🔁 0

💬 0

📌 0

Too kind, Paul! Glad you found it valuable

16.06.2025 15:42 —

👍 1

🔁 0

💬 0

📌 0

The Financial Stability Implications of Each Possible Stablecoin Reserves Model

There's always something

Smart, interesting stuff here from @stevenkelly49.bsky.social on stable coins and links with money markets/bills. (The quote below is a digression but a v important one IMO!)

open.substack.com/pub/withoutw...

16.06.2025 12:45 —

👍 2

🔁 2

💬 1

📌 0

The Financial Stability Implications of Each Possible Stablecoin Reserves Model

There's always something

New, short note: "The Financial Stability Implications of Each Possible Stablecoin Reserves Model"

15.06.2025 20:55 —

👍 10

🔁 4

💬 1

📌 0

"Lend freely, against good collateral, at a penalty rate"?

When rescuing an individual institution, only "lend freely" survives as good advice:

15.06.2025 17:38 —

👍 1

🔁 0

💬 0

📌 0

"Ad Hoc Emergency Liquidity Assistance in the 21st Century: Necessary, but Never Sufficient"

Our recent paper (w/ Vincient Arnold, Greg Feldberg, and Andrew Metrick) is now out as a policy brief with the European Money & Finance Forum:

www.suerf.org/publications...

13.06.2025 17:16 —

👍 4

🔁 1

💬 1

📌 0

Bank CFOs describing the Great Bank Re-Tranche phenomenon perfectly:

13.06.2025 02:05 —

👍 3

🔁 0

💬 1

📌 0

Expanding financing has allowed banks to benefit from these trends

The pivot reflects a broader industry trend that ppl like

@stevenkelly49.bsky.social + Huw van Steenis have dubbed the "re-tranching" of the banking system post 2008

This has seen banks act more as financiers than investors

09.06.2025 13:07 —

👍 1

🔁 1

💬 1

📌 0

How Goldman Sachs turned financing into a US$9bn powerhouse | IFR

People & Markets

Heady growth means financing now generates more revenue than investment banking

NEW: How Goldman Sachs turned financing into a $9bn powerhouse

Goldman's financing revenues now outstrip investment banking fees after >doubling since 2020

Profile of how the age-old business of lending money is transforming the investment bank 🧵

www.ifre.com/topic-codes/...

09.06.2025 10:47 —

👍 7

🔁 3

💬 1

📌 1

ECB Intensifies Scrutiny of Banks’ Exposure to Private Markets

The European Central Bank is escalating its scrutiny of lenders’ exposures to private markets amid concerns that the fast ascent of related asset classes raises substantial new risks.

“The regulatory scrutiny may indirectly dampen [private credit/equity] growth in Europe, according to bankers”

“This bank has had to turn down business with private credit players, also as a result of the lengthy interactions that are needed with the ECB”

03.06.2025 17:02 —

👍 1

🔁 0

💬 0

📌 0

UK lenders fret over risk-transfer market after BoE warning

Officials zeroing in on $1.1tn SRT market between banks and private capital investors

“Some bankers fear the BoE’s intervention could increase the cost of financing for investors in SRTs, slow the growth of the market and reduce lenders’ ability to use them to free up capital to support extra lending.”

03.06.2025 17:01 —

👍 0

🔁 0

💬 1

📌 0

Episode # 10000000 of “There’s a reason we have banks and structure them the way we do”

01.06.2025 20:58 —

👍 6

🔁 1

💬 2

📌 0

Will read asap!! Thanks for flagging, Iñaki! You are missed on the other site 💔

29.05.2025 06:05 —

👍 1

🔁 0

💬 1

📌 0

And the largest banks (those subject to the liquidity regs you note) have much less interest in these volatile depositors that a bring a suite of nonfinancial risks as well

28.05.2025 00:35 —

👍 2

🔁 0

💬 2

📌 0

Stablecoins do not make for a stable financial system

Applying the logistics of financial stability to the cryptoverse

There’s been a lot of discussion of this great article from @robarmstrong.bsky.social.

Here are a couple things I’ve written that were antecedents to my comments to him:

1) www.ft.com/content/0f97...

28.05.2025 00:31 —

👍 19

🔁 5

💬 1

📌 0

Stablecoins Deliver on Their Promise: Disrupting Banks

Like banks, but worse

It was a convo with the journo. But I’ve written along similar lines

here: www.ft.com/content/0f97...

and here: www.withoutwarningresearch.com/p/stablecoin...

28.05.2025 00:27 —

👍 2

🔁 0

💬 1

📌 0

But the type/riskiness of money changes. Imagine a stablecoin got inflows from every retail customer in America. That takes a bunch of stable, insured deposits and transforms them into a big, uninsured pot w: a fiduciary responsibility to run. @pauljdavies.bsky.social @dsquareddigest.bsky.social 4/4

28.05.2025 00:24 —

👍 3

🔁 0

💬 2

📌 0