2026_LMW_call.pdf

Calling all macroeconomists! The 5th Lisbon Macro Workshop on August 28-29 at Nova SBE, with great papers and good discussions! Please apply! Call for papers here: drive.google.com/file/d/1Jzp6...

19.02.2026 17:50 — 👍 0 🔁 2 💬 0 📌 1

Thanks a lot for the invitation @lisbonmacro.bsky.social! Great conference, great people, great location.

30.08.2025 11:31 — 👍 2 🔁 1 💬 0 📌 0

A big thank you to all presenters and discussants for the insightful and productive discussions at this year’s workshop. Looking forward to seeing you all again next year!

31.08.2025 19:17 — 👍 1 🔁 2 💬 0 📌 1

John Kramer asks whether this mechanism generates strong business cycle amplification, and if second-order stabilization policies might deliver first-order growth benefits.

31.08.2025 19:14 — 👍 0 🔁 0 💬 0 📌 0

Seho Kim shows that lowering the economic cost of unemployment encourages workers to join riskier startups, increasing experimentation & productivity growth. In a firm dynamics model with labor frictions, lower vacancy creation costs further raise aggregate productivity.

31.08.2025 19:12 — 👍 0 🔁 0 💬 1 📌 0

@haominwang.bsky.social notes that in expansions, occupation switches may yield better skill matches. This may raise questions on frictions, promotions, and how policy shapes wage and occupation dynamics.

30.08.2025 12:08 — 👍 1 🔁 0 💬 0 📌 0

@lpvisschers.bsky.social documents that year-to-year earnings growth is cyclically skewed: flows & their returns shift over the cycle, especially in the tails. Occupational moves matter most and upward mobility is much higher in expansions.

30.08.2025 12:05 — 👍 0 🔁 0 💬 1 📌 0

Liangjie Wu urges linking the results to wage inequality & labor share debates, and notes the model offers a new mechanism for polarization beyond vertical worker categorization.

30.08.2025 10:33 — 👍 0 🔁 0 💬 0 📌 0

Jenny Ding maps households consumption into goods skill-intensity, showing that consumption has shifted toward skill intensive goods over time. A multi-industry GE model with K-skill complementarity decomposes rising wage inequality: 82% due to K accumulation.

30.08.2025 10:31 — 👍 0 🔁 0 💬 1 📌 0

@joachimjungherr.bsky.social asks: how does consumption in the model line up with micro evidence on MPCs vs APCs? Which observables best identify high-MPC agents? And how would adding an illiquid asset alongside a liquid one shift predictions?

30.08.2025 09:45 — 👍 0 🔁 1 💬 0 📌 0

@valeriop.bsky.social adds mental accounting to a HANK model to match wealth & MPCs. Wealthy households with high MPCs amplify consumption response to transfers but dampen response to rate cuts, implying lower gains from targeting low-liquid-wealth households.

30.08.2025 09:44 — 👍 0 🔁 0 💬 1 📌 0

@marek-ignaszak.bsky.social shows that similar patterns could arise under extreme financial frictions with two types of entrepreneurs: rich vs poor parents. Using IQ data can help distinguish whether transformative talent, rather than family background, drives differential growth.

29.08.2025 16:48 — 👍 1 🔁 1 💬 0 📌 0

Harun Alp presents a novel model of innovation and firm dynamics with occupational choice: transformative entrepreneurs who hire ≥1 R&D worker differ sharply from those who don’t. The framework helps evaluate how education, startup, & R&D policies affect talent allocation.

29.08.2025 16:45 — 👍 1 🔁 1 💬 1 📌 0

Riccardo Silvestrini points to decreasing returns to scale (DRS) as a key remaining source of heterogeneity between top and bottom firms. How much does DRS—shaping optimal firm size, especially in the right tail—matter relative to other sources?

29.08.2025 16:06 — 👍 0 🔁 0 💬 0 📌 0

@rafaguntin.bsky.social uncovers new facts on how firms reach the top 1% and set up a new macro model accounting for these firm dynamics. These dynamics shape macro outcomes: finance, tech frontier, r changes, taxation.

29.08.2025 16:02 — 👍 0 🔁 0 💬 1 📌 0

Anthony Savagar invites sharpening the welfare angle clearly documenting the trade-offs during shakeout would help clarify the forces behind optimal diffusion.

29.08.2025 15:40 — 👍 0 🔁 0 💬 0 📌 0

Tom Schmitz shows that ICT & AI spark a life cycle in downstream industries: early surge in entry & product innovation, later shift to process innovation & shakeout. Diffusion isn’t optimal: welfare improves by taxing process and subsidizing product innovation.

29.08.2025 15:39 — 👍 0 🔁 0 💬 1 📌 0

Sampreet Goraya asks about the social value of lock-in innovations. Is there an optimal degree of product differentiation? The model can be extended to link intermediate good differentiation with final good variety.

29.08.2025 14:28 — 👍 0 🔁 0 💬 0 📌 0

@luciacasal.bsky.social documents that firms increasingly pursue lock-in innovations with high private but low social value, rising markups. Taxing such innovations may boost productivity but is hard to implement; taxing markups is feasible and productivity enhancing, but raises markup dispersion.

29.08.2025 14:25 — 👍 0 🔁 0 💬 1 📌 0

Suzanne Bellue highlights that optimism in subjective beliefs affects not just life expectancy, but also income, asset returns, and mortality risk, suggesting the need to examine untargeted moments in the model.

29.08.2025 13:47 — 👍 0 🔁 0 💬 0 📌 0

@francescomaura.bsky.social shows that subjective life expectancy and financial literacy shape financial market entry and risk-taking. Eliciting survival expectations boosts wealth accumulation, while #FinancialLiteracy most effectively drives market participation.

29.08.2025 13:45 — 👍 0 🔁 0 💬 1 📌 1

Yasmine Van der Straten highlights the need to unpack why households differ in taking up buy-back: is it inattention, differing interest rate expectations, or liquidity needs?

29.08.2025 13:44 — 👍 0 🔁 0 💬 0 📌 0

Fabrice Tourre kicks off the workshop showing how #mortgage contract design shapes monetary transmission: in Denmark, buy-back options prevent the lock-in effects seen in the US.

29.08.2025 13:42 — 👍 0 🔁 0 💬 1 📌 0

Ready to start!!!

29.08.2025 09:23 — 👍 1 🔁 1 💬 0 📌 0

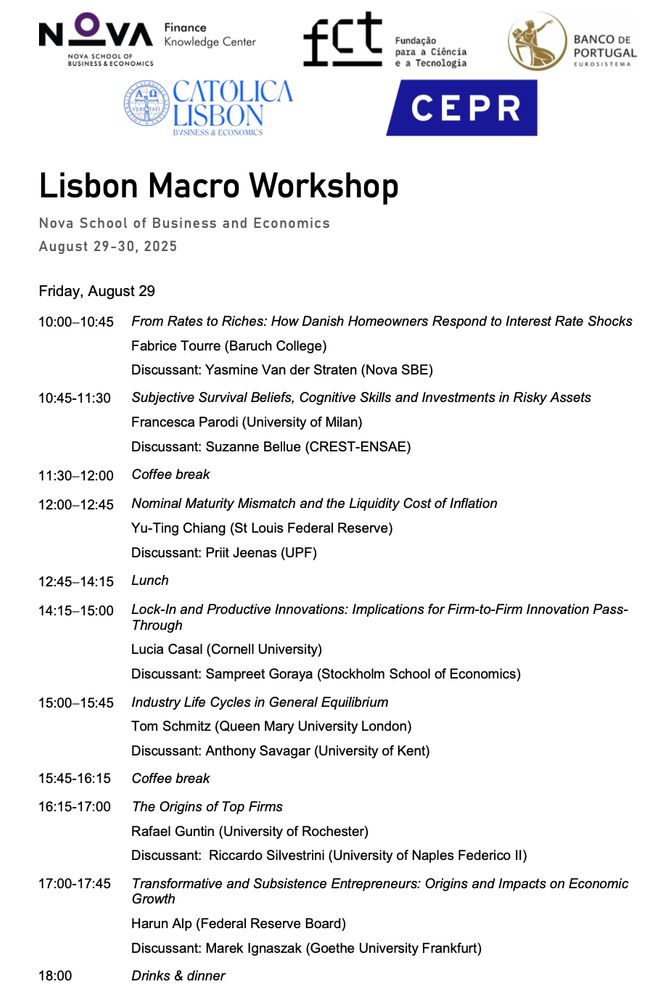

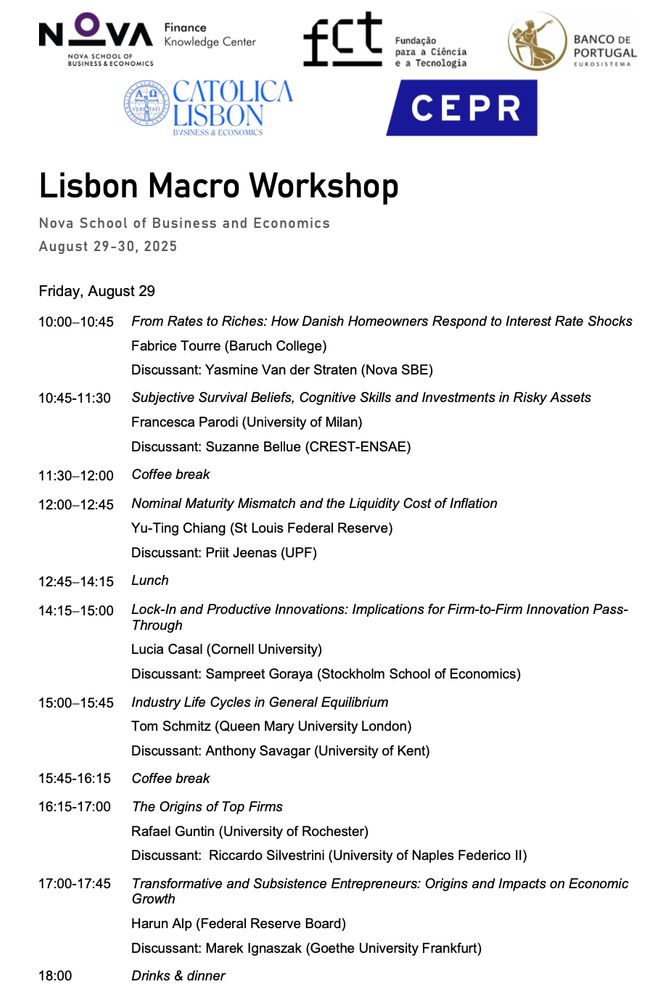

📢 Excited to announce the program for the Lisbon Macro Workshop 2025, taking place August 29–30 at Nova School of Business and Economics

📍 Lisbon

📅 Aug 29–30

🔗 nw.ax/l2U

@martacota.bsky.social @jeanne-c.bsky.social

07.07.2025 06:48 — 👍 2 🔁 2 💬 0 📌 2

The deadline is approaching! Send your paper by Sunday this week!

10.04.2025 09:47 — 👍 0 🔁 1 💬 0 📌 0

📢 Calling all macroeconomists! 📢

The 4th Lisbon Macro Workshop is happening on August 29-30! 🇵🇹

✨ Submit your paper by April 13 & join us in Lisbon

🔗 Submit here: hq.ax/l2L

Spread the word!

Org: @jeanne-c.bsky.social @martacota.bsky.social Nic Kozeniauskas, Laszlo Tetenyi @chiaralac.bsky.social

21.03.2025 15:11 — 👍 4 🔁 4 💬 0 📌 1

👋 Welcome to the official account of the Lisbon Macro Workshop at Católica Lisbon School of Business and Economics!

Webpage: nicjkoz.com/LisbonMacro/

21.03.2025 14:53 — 👍 0 🔁 0 💬 0 📌 0

Assistant Professor at Monash University | Macro, Monetary, Macro-Finance | DPhil at Oxford | He/him | Website: https://al-haas.github.io

Macro | AP @ Uni Copenhagen | CEPR

www.brigittehochmuth.net

PostDoc at Bocconi - AxA Research Lab on Gender Equality.

Research in ageing, gender and household finance

Macroeconomics, Sveriges Riksbank & University of Bonn

https://valeriopieroni.github.io/

Economics & Vermouth

Mexico City -- Brooklyn -- Barcelona

www.isaacbaley.com

Assistant Professor at the University of Copenhagen, formerly at the IIES in Stockholm - Interested in Macro, Monetary and Mobility

Macroeconomist, Bank of England.

sophiepiton.com

Assistant Professor of Economics at UTRGV. Labor Economics, Education Economics, Family Economics. Dominican.

elisataveras.com

Macroeconomist | Central Banking | Post-Doc @Uni Duisburg-Essen

Assistant Professor of Economics at the University of Western Ontario. Studying entrepreneurship, financial frictions, and wealth inequality.

he/him/his

https://sites.google.com/view/baxter-robinson/

Assistant Professor @ University of Mannheim | Macroeconomics, Family Economics, Economic Growth | https://www.anne-hannusch.com

Macroeconomist affiliated with the Department of Money and Macroeconomics at Goethe University Frankfurt and a member of the Frankfurt Quantitative Macro Group.

https://marekignaszak.github.io/

Research economist @ Bank of Portugal · Incoming VAP @ UF Econ

https://attilagyetvai.com

Italian macroeconomist. Former professional runner at Arma dei Carabinieri, now Associate Professor at Esade Business School

website: https://sites.google.com/site/omirachedi/

Economic Policy Advisor at St. Louis Fed. Opinions expressed my own. www.serdarozkan.me

Economist. Working on heterogeneous agent macro, firm dynamics, and monetary policy. Views are my own

cbustamante.co

Divemaster and Prof. of Economics. #Glasto #finoallafine

AP at Goethe University Frankfurt.

Macroeconomist interested in Gender, Family, and Labor Economics (among others).

https://sites.google.com/view/lidiacruces/home