Panel : Fiscal Policy at a Crossroads : France, Germany, and Europe's New Priorities

Formulaire d'inscription au panel organisé par l'Institut Avant-garde et Dezernat Zukunft, membres du European Macro Policy Network (EMPN).

Le vendredi 28 novembre de 10h à 12h.

Salle Jean Jaurès, É...

🔎 Évènement : Panel - Fiscal Policy at a Crossroads

Avec :

- @gregclaeys.bsky.social

- Dorothée Rouzet

- Armin Steinbach

- Modération : @philippasigl.bsky.social

🗓 Vendredi 28 novembre 2025, 10h–12h

📍 Salle Jean Jaurès, ENS – 29 rue d’Ulm, Paris

🇪🇺 En anglais

Inscrivez-vous !

03.11.2025 14:13 —

👍 12

🔁 13

💬 1

📌 2

YouTube video by Hertie School

Research meets Politics: How should we invest in European defence? A Franco-German Perspective

We thank our panelists @gregclaeys.bsky.social, Thomas Röwekamp, @sabine-thillaye.bsky.social and @guntramwolff.bsky.social as well as our moderator Monika Sus and Ambassador Delattre for this insightful debate! You can watch the full #PariserPlatzDialogue event here👉 www.youtube.com/watch?v=ovIx...

16.10.2025 14:34 —

👍 4

🔁 3

💬 0

📌 1

Human blood 8.5% ?

28.03.2025 10:17 —

👍 3

🔁 0

💬 2

📌 0

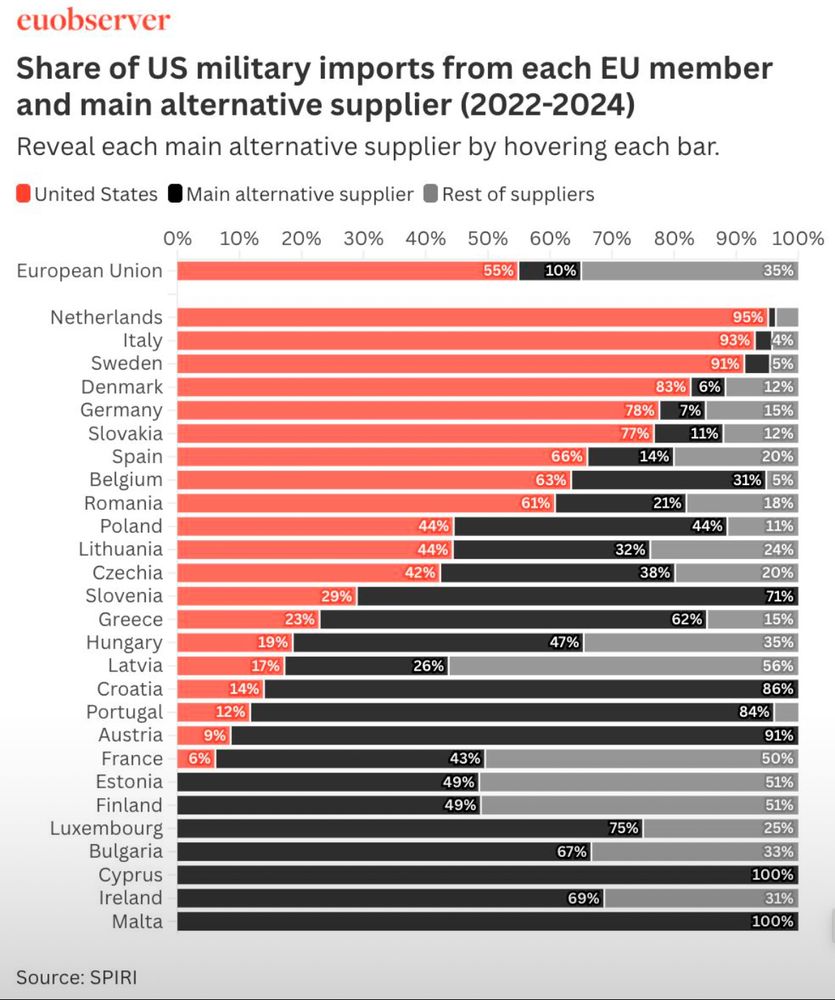

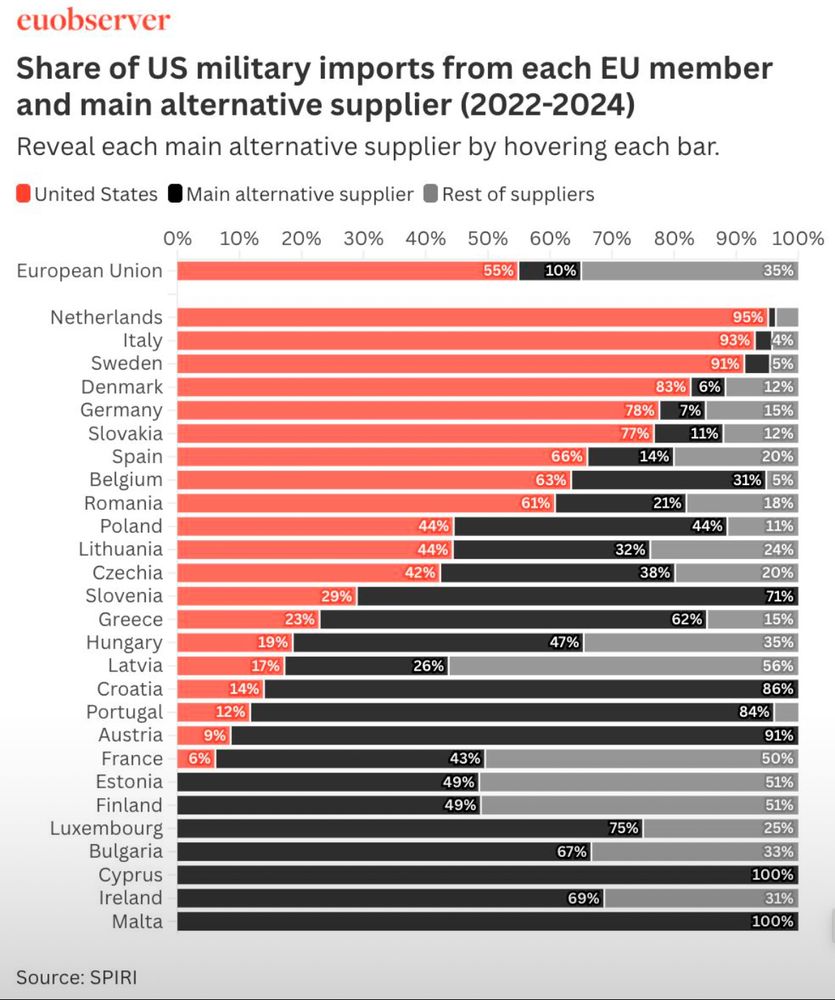

Do you want to better understand EU’s rearming attempt?

Best explainer by @euobserver.com laying down the baseline of EU-27 military imports

euobserver.com/eu-and-the-w...

19.03.2025 10:26 —

👍 33

🔁 22

💬 3

📌 3

The debate over how much of the (1,5, 150, soon more) €bn should be spent on EU vs non-EU defence manufacturers is about to move decisively in France's direction

Macron just has to sit back at this point. Trump is winning the argument for him 🇪🇺🇫🇷

09.03.2025 10:09 —

👍 591

🔁 132

💬 20

📌 12

In the pandemic timeline, we are now in early April 2020. This is when the Commission put SURE on the table (and around the same time, the fiscal rules were unplugged). Five weeks later, Macron and Merkel put NGEU on the table. This is where this should be headed eventually as well.

04.03.2025 09:07 —

👍 51

🔁 4

💬 2

📌 1

Well, as America implodes from within, it’d be a *great* time for the EU to finally do official Eurobonds. It’d likely be very attractive as a safe haven given the destruction of US hegemony & spillover to US T-bills. Bonus: Eurobonds can finance a desperately needed European security build up! 🇪🇺💶 ‼️

28.02.2025 20:37 —

👍 1229

🔁 296

💬 17

📌 31

Lots of over-engineered debt brake proposals around. Nothing easy off the shelf. Except….

….Just getting rid of it.

Fits really well in the spirit of deregulation, folks, come on!

One regulation less. Beautiful. And less duplicative because we have EU fiscal rules!

25.02.2025 12:19 —

👍 43

🔁 8

💬 4

📌 0

Cela semble absurde, et j’ai été choqué la première fois que je l’ai compris, mais la France – il n'y a pas d'autre mot – est bien un paradis fiscal pour milliardaire

Explications détaillées 🧵

07.02.2025 14:55 —

👍 1972

🔁 1371

💬 39

📌 97

Deputy director

Deadline for applications: 16 March 2025, 23:59 CET

Opportunity of a lifetime: Bruegel is looking for its next Deputy Director. Don't hesitate to apply or share with your networks: www.bruegel.org/careers/depu...

05.02.2025 09:56 —

👍 9

🔁 4

💬 0

📌 0

How German industry can survive the second China shock

China's industrial subsidies and aggressive export-led growth are undercutting German manufacturing. To defend its automotive and engineering sectors, Germany must finally get tough on China with trad...

Deindustrialisation angst grips Germany.

In a new study, Brad Setser and I unpack how badly Germany's trading relationship with China has backfired, and how its industry might weather the second China shock.

With terrific accompanying reporting in Handelsblatt/FT.

1/

www.cer.eu/publications...

16.01.2025 15:05 —

👍 122

🔁 44

💬 5

📌 26

La Gouvernement a rendu public l'avis du Conseil d'Etat sur l'interprétation de l'article 45 de la LOLF et la possibilité de déposer un projet de loi spéciale (PLS).

(J'ai supprimé un précédent tweet erroné).

Bref thread:

www.conseil-etat.fr/avis-consult...

10.12.2024 15:15 —

👍 17

🔁 15

💬 1

📌 3

Opinion | My Last Column: Finding Hope in an Age of Resentment

Where have all the good vibes gone?

End of an era: @pkrugman.bsky.social's last column in the @nytimes.com one of the first econ bloggers I followed frequently when I became interested in economic policy. I still remember looking forward to his next column during the great financial crisis www.nytimes.com/2024/12/09/o...

10.12.2024 11:18 —

👍 3

🔁 0

💬 0

📌 0

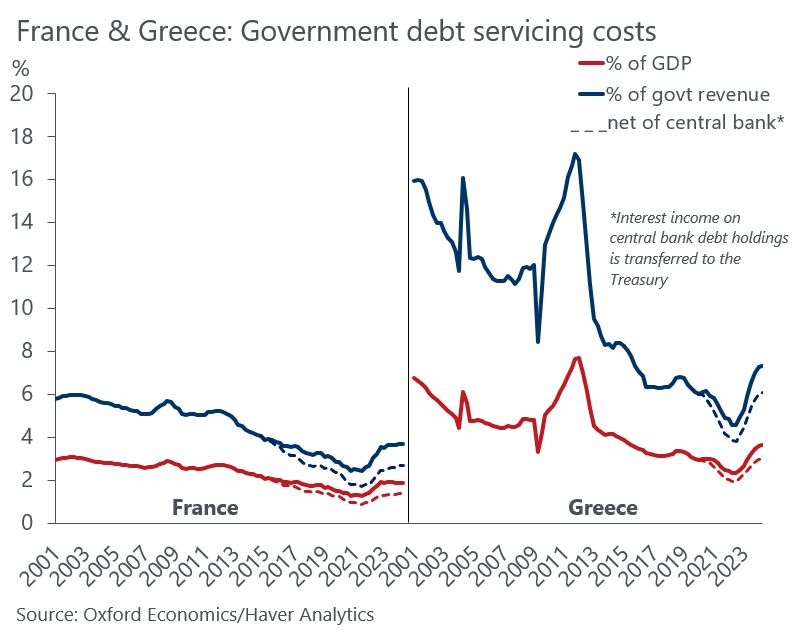

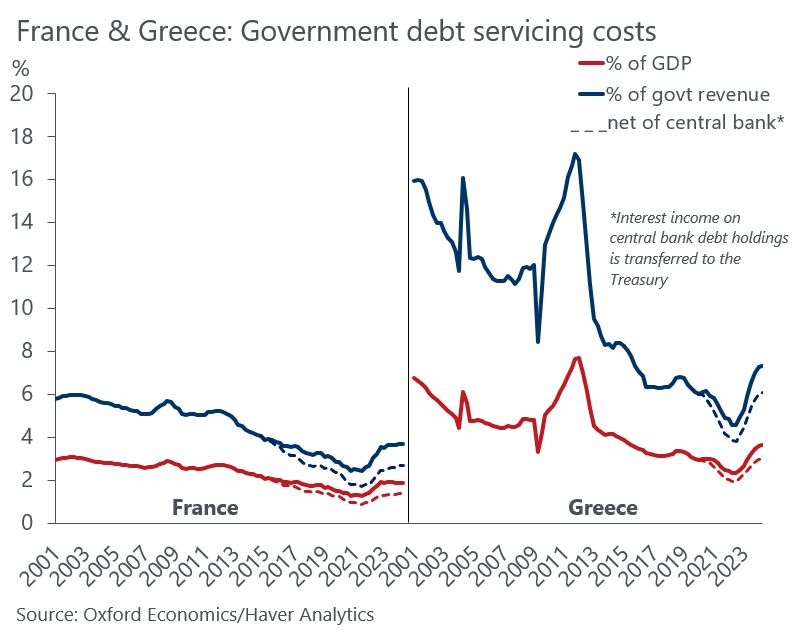

At the height of the €zone crisis, the 🇬🇷 government was spending nearly 20% of all its revenue on interest payments.

🇫🇷 is now spending around 4% on interest payments.

04.12.2024 07:31 —

👍 8

🔁 6

💬 0

📌 0

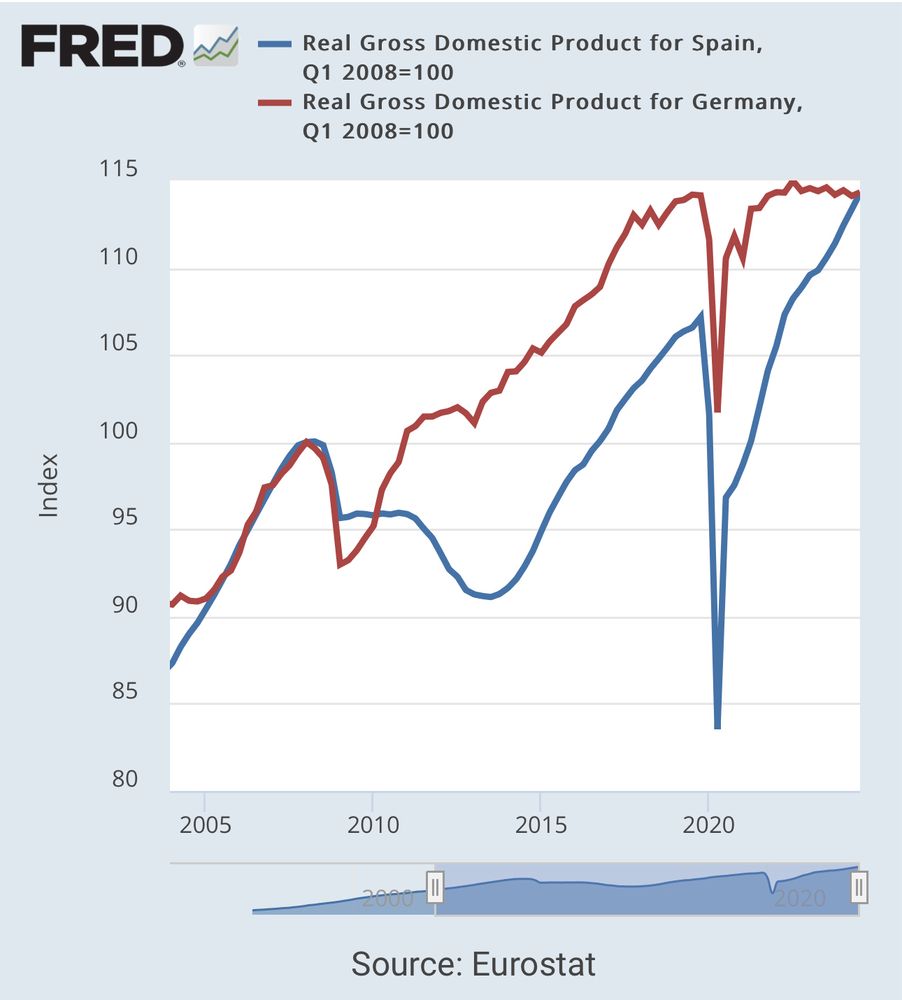

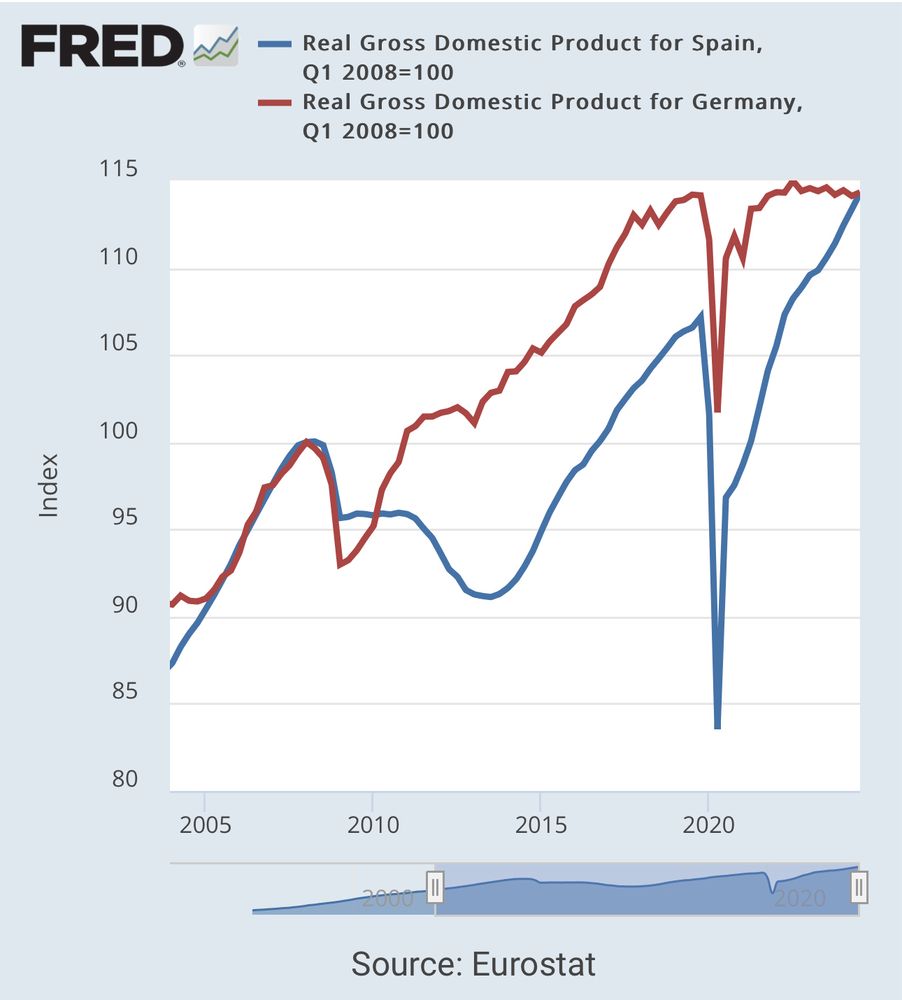

A graph comparing Spanish and German gdp, which diverge in 2008 but reconverge between 2017-2024

Here’s a crazy fact for you: Spain and Germany have now seen basically the exact same amount of economic growth post-2008. Would have been unthinkable to people during most of the 2010s. Spain has seen ~10 percentage points more cumulative growth since 2017.

23.11.2024 09:26 —

👍 1459

🔁 279

💬 49

📌 50