Out of office until Jan2026 🐣☀️

09.07.2025 07:28 — 👍 4 🔁 0 💬 0 📌 0Out of office until Jan2026 🐣☀️

09.07.2025 07:28 — 👍 4 🔁 0 💬 0 📌 0

Please check out our new review in BioScience!

We describe how spatial climate analogs can be used in climate change research, impact assessment, decision-making, and communication.

#MacroEcology

#ClimateChange

#GlobalChange

1/4

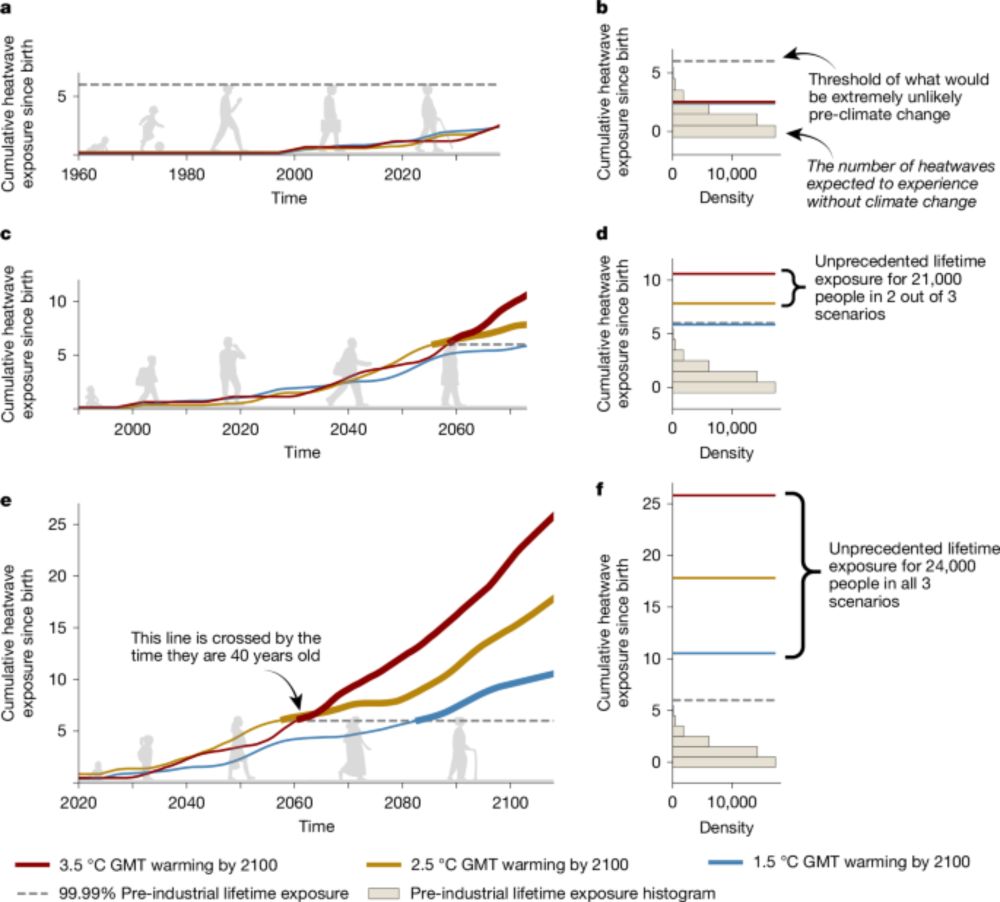

📢 Hot off the press: our new study in Nature, led by Luke Grant and @wimthiery.bsky.social, shows how climate change is redefining what it means to live an "unprecedented life"—facing climate extremes that would have been nearly impossible without human influence.

www.nature.com/articles/s41...

I had an honour to be featured in @joannasullivan.bsky.social 's series on women trailblazers ☀️ When one's feed seem to feature mostly doom&gloom these days, I hope my messages will add some hope and lighten your day 🌺

20.03.2025 13:30 — 👍 4 🔁 0 💬 0 📌 0

R bar vs. R star, the natural rate is fundamentally different from the neutral rate - Maurice Obstfeld + reforms a la Draghi, time has come? #ecbwatchers

12.03.2025 14:50 — 👍 2 🔁 0 💬 0 📌 0

Balance sheet would be close to 4 trillion, rather than 1 trln. Real need to discuss the design of Operational framework with ongoing @ecb.europa.eu strategy review #ECBwatchers

@positivemoneyeu.bsky.social wrote a paper on this @jordischroeder.bsky.social

www.datocms-assets.com/132494/17212...

5 lessons on QE:

1.QE can be complement&substitute for IR policy

2.QE macro effect more uncertain than IR, but duration extraction effect significant.

3.Few channels-signaling, liquidity provision..

Good 2have more tools, don't ditch them

Refreshing points by Lucrezia Reichlin #ecbwatchers

Next week, the new European Commission will put forward its clean industrial policy plans.

In a new paper, @ph-jaeg.bsky.social and I dig into what this strategy needs to deliver— backed by lots of brand-new *sectoral* data on the distribution of national subsidies.

Here are our main takeaways:

Climate-induced economic damages can lead to private-debt tipping points

Sounds interesting? Join us for our upcoming #Freitagsseminar w. Gaël Giraud.

📅 28th of February 2025

📍 #OeNB or online via Webex

Registration here: bit.ly/411oDRw

#Event

🚨 We’re hiring! 🚨 Come and join us as a Senior Researcher. Your skills & voice are needed now more than ever in the civil society space to drive change and progressive new economics! 🌍💡

#JobAlert #Economics #CivilSociety

positivemoney.org/vacancy/seni...

📢 Now Published in Issue! 📢

Our article on what politicians think about the ECB is now out in @jcms-eu.bsky.social

We surveyed Members of the European Parliament to uncover their views on the ECB

👉 Available at onlinelibrary.wiley.com/doi/10.1111/...

And a short thread here -->

Ireland collects much of the corporate tax revenue a more coherent US tax code would channel back across the Atlantic. Ireland could also be in the firing line as a major & growing contributor to the US trade deficit—now 4th in the world. By @phonohan.bsky.social: www.irishtimes.com/opinion/2025...

10.02.2025 18:46 — 👍 14 🔁 5 💬 2 📌 0

We highlight three own goals of failed internationalization:

1. Non-existent euro value chains locked the EU into disastrous dollar denominated fossil fuel imports

2. Wavering and weak ECB swap line policies (limited, conditional, unattractive)

3. That rare beast “a euro denominated safe asset”

Why does the largest trading bloc on the planet have a miniature-sized currency? With Trump, the EU will again much regret this.

🎈In a new working paper, @steffenmurau.bsky.social and I set out to theorise failure and develop a new IPE perspective that foregrounds offshore money.

A thread 🧵

On how we are giving up on climate one step at a time, review of Overshoot by @brettchristophers.bsky.social for @londonreview.bsky.social worth a read 👇🏻

02.02.2025 11:18 — 👍 1 🔁 0 💬 0 📌 0

👉25 bp cut today as expected, though it could have been more seeing negative growth in FR, DE and stagnation in IT.

Also, can we take the moment to appreciate that no political figure is threatening the @ecb.europa.eu to cut rates 👐

This independence could be put to good use towards the 🌎 🌱

🚨New paper by the Uni Witten SuFi Project in @finandsoc.bsky.social

Channels of influence in sustainable finance:

A framework for conceptualizing how private actors shape the green transition

www.cambridge.org/core/journal...

A 🧵 on our main arguments:

📢 We urge the #ECB to rethink its #climate and nature approach and support the green transition.

Read our open letter for more information.

This new roadmap should:

☑️ Introduce green lending facilities,

☑️ Implement climate criteria in its collateral framework,

☑️ Tilt the stock of securities in the remaining asset purchase portfolios.

4/5

Maintaining our #FossilFuel dependency leaves us vulnerable to future price shocks, as seen with the high inflation in recent years.

➡️ With 40 civil society organizations, we urge the ECB Governing Council to deliver an improved Climate Roadmap when concluding this year’s strategy assessment.

3/5

As the #ECB has repeated, a faster and orderly transition is essential for price and financial stability.

Indeed, as #climate change and nature degradation intensify, so will their impact on monetary policy and the whole financial system.

2/5

🔵 The 2025 review of the @ecb.europa.eu ’s monetary strategy policy is the perfect opportunity for the #ECB to take ambitious measures that integrate learnings and challenges four years after its first “Climate Roadmap”.

Why? ⤵️

1/5

Manifesto time ⌛️ @positivemoneyeu.bsky.social and 40 organisations provide a clear, detailed roadmap for the @ecb.europa.eu to green its monetary policy as we approach the critical mid-2025 milestone when the ECB will review its monetary policy strategy 👇 (positivemoney.org/update/no-st...)

29.01.2025 14:06 — 👍 5 🔁 2 💬 0 📌 0

Lots of the good work done by the @ec.europa.eu on EU Sustainable finance package in the last few years will now be weakened and watered down due to finance&corporate pressure #Omnibus

29.01.2025 10:56 — 👍 1 🔁 1 💬 0 📌 0

NEW PIECE: Another entry in the #MonetaryPolicy201 series, this time focusing on the question, does limiting purchases to the "open market" actually matter? The answer comes from a never before seen 1942 memo from the Fed's head of research at the time

www.crisesnotes.com/does-restric...

Our "Discrimination in the Formation of Academic Networks: A Field Experiment on #EconTwitter" with Pedro Sant'Anna and @brunoferman.bsky.social is now forthcoming in the

😀😀

American Economic Review Insights (@AEAjournals )

😀😀 papers.ssrn.com/sol3/papers....

And the battle still goes on 🤞🏻

24.01.2025 16:17 — 👍 2 🔁 0 💬 1 📌 0A week ago the ECON committee voted on the @ecb.europa.eu annual report. While it should be that the ECB is independent from politicization, it is not independent from democracy and the EP report matters 👇🏻

24.01.2025 08:54 — 👍 2 🔁 1 💬 0 📌 0

Banks are raking in superprofits each year, 2024>2023, these profits are going to dividend payments&share buybacks creating deeper rift between finance & the real economy, rich & poor. Must be great celebrations in Davos #WEF2025 while paying lip service to catchphrases, via @financialtimes.com

23.01.2025 08:29 — 👍 2 🔁 0 💬 0 📌 0

I’m very excited to have this open access article out in @ripejournal.bsky.social ! www.tandfonline.com/doi/full/10....

20.01.2025 15:56 — 👍 73 🔁 29 💬 5 📌 1