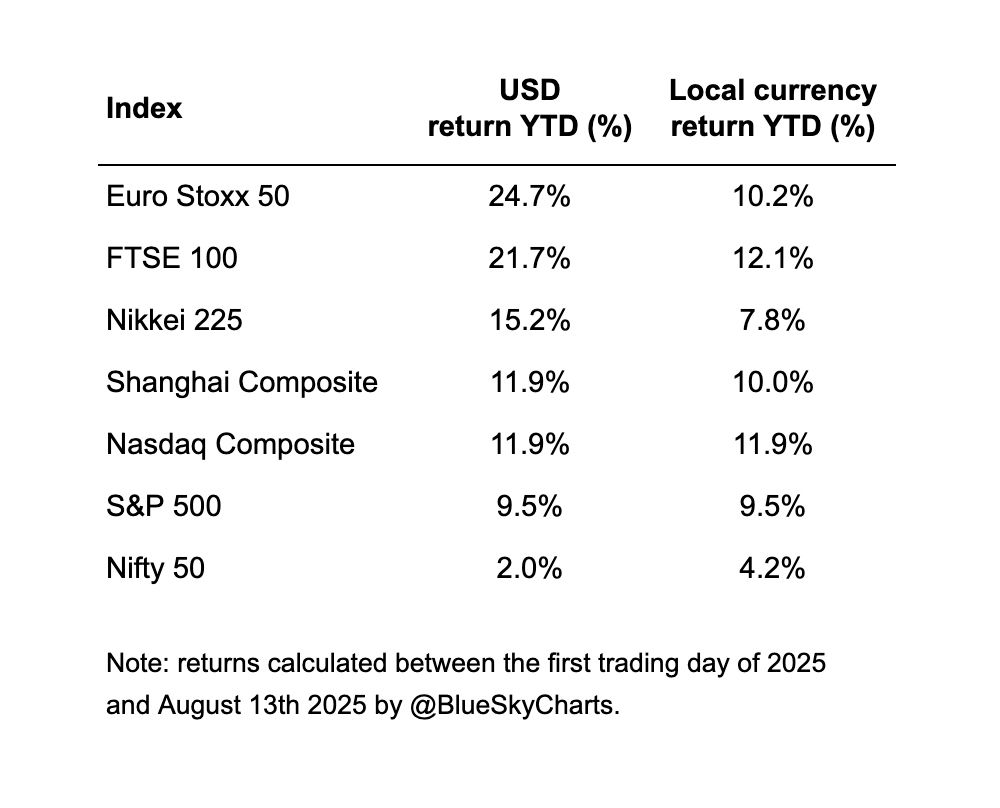

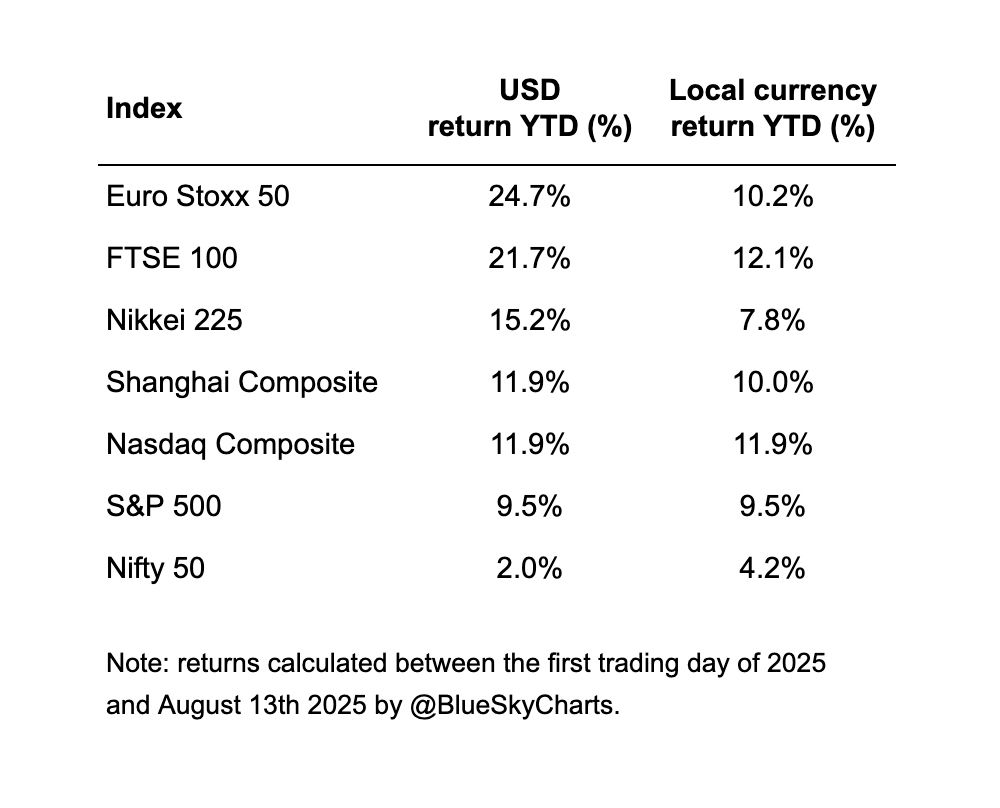

The UK's #FTSE 100 is delivering super-charged returns - up 12.1% in GBP, and 21.7% in USD. The Euro Stoxx 50 isn't far behind, up 10.2% in EUR, and 24.7% in USD. For US investors, a weaker dollar is adding rocket fuel to overseas returns - further #USD weakness could supercharge EM #stocks.

14.08.2025 12:30 — 👍 1 🔁 0 💬 0 📌 0

#UK #Employment - Shoddy employment statistics aren't unique to the US. The UK's Labour Force Survey (LFS) has been plagued with problems since 2023. Falling response rates - as low as 21.3% in Q1 2025 - have raised concerns about the quality of the UK's employment and unemployment data.

14.08.2025 10:16 — 👍 1 🔁 0 💬 0 📌 0

#KWEB - A bullish setup is brewing in Chinese tech stocks. The KWEB ETF is approaching a breakout from a rounding bottom pattern. Look for a close above $38.50 to go long, with upside between $43 and $50. China stimulus & easing tech crackdowns support a rebound. Valuations attractive vs. US tech.

13.08.2025 18:41 — 👍 2 🔁 0 💬 0 📌 0

#Nasdaq – Breakout or fakeout in the Nasdaq vs S&P? Since late 2002, the Nasdaq has outperformed the S&P and is now breaking above a multi-decade trendline stretching back to 2000 (black). A textbook cup-and-handle pattern (blue) points to further upside in the NDX/SPX ratio. #trading #stocks

12.08.2025 12:47 — 👍 3 🔁 0 💬 0 📌 0

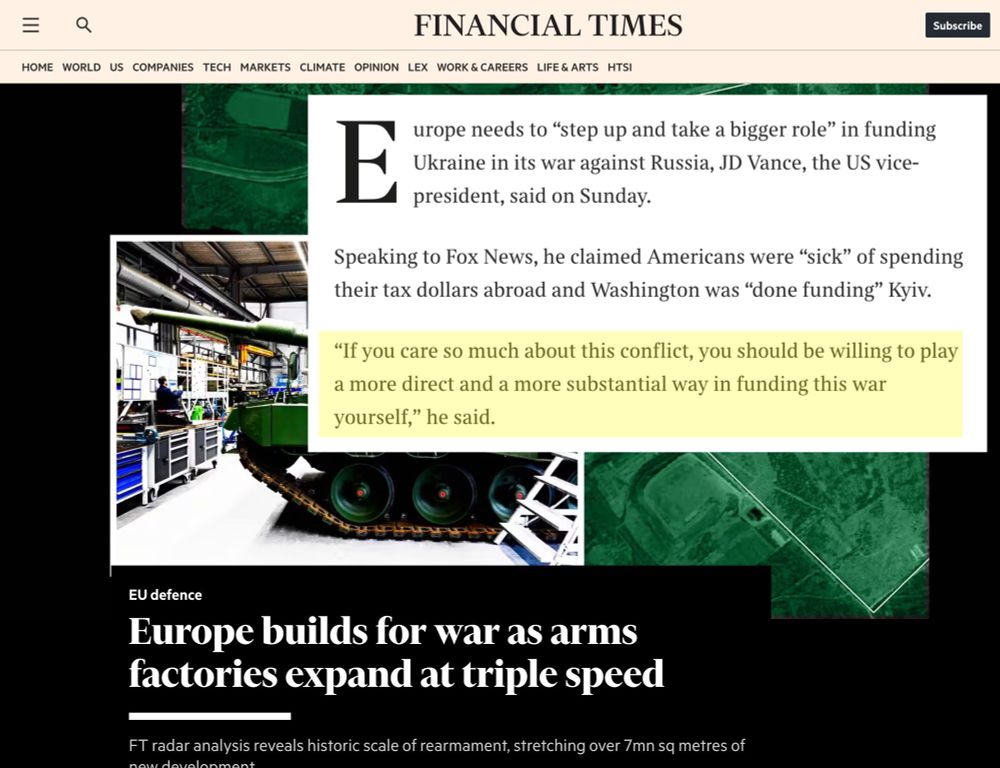

#Ukraine – With the Trump-Putin summit days away, JD Vance’s call for Europe to "step up" in funding the war signals Washington may be preparing to bow out and hand the baton to Europe. Backed by its allies, Ukraine will likely reject any deal struck without it, while Europe seems set to fight on.

12.08.2025 12:44 — 👍 4 🔁 0 💬 0 📌 0

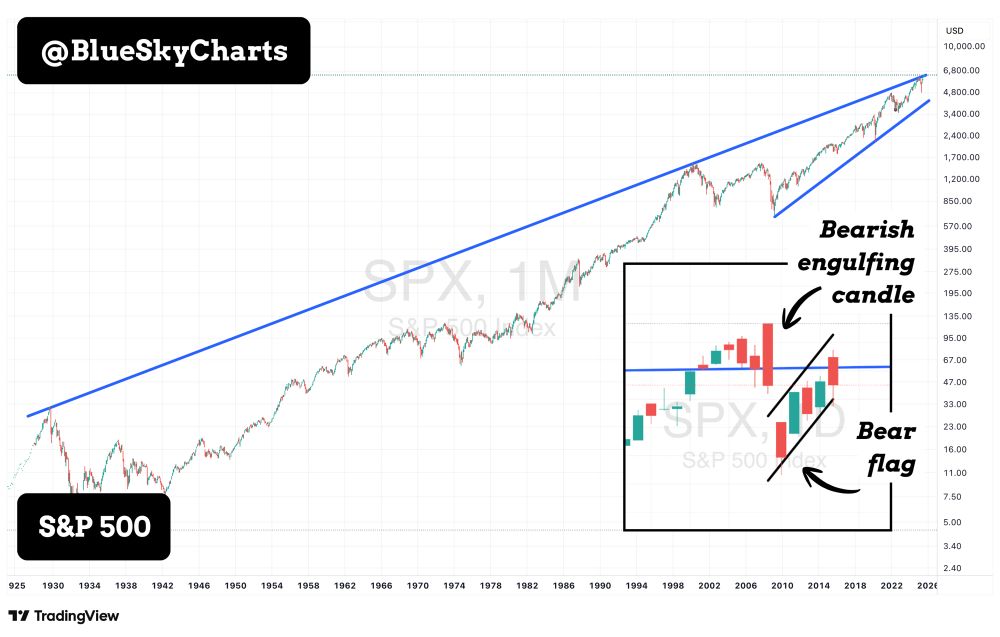

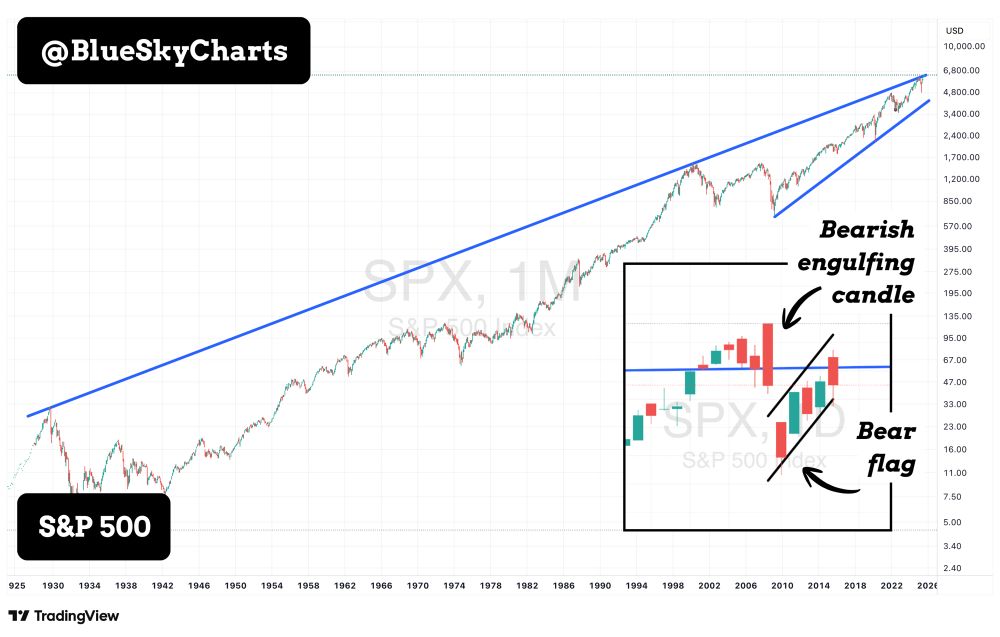

#stocks - If it looks like a top, trades like a top, and sells off like a top… it’s probably a top. Yesterday’s session saw stocks gap higher, only to fade through the day. The S&P 500 is carving out a bear flag (black) beneath a century-long trendline (blue) in play since 1929. #SPX #trading

08.08.2025 10:13 — 👍 5 🔁 1 💬 1 📌 0

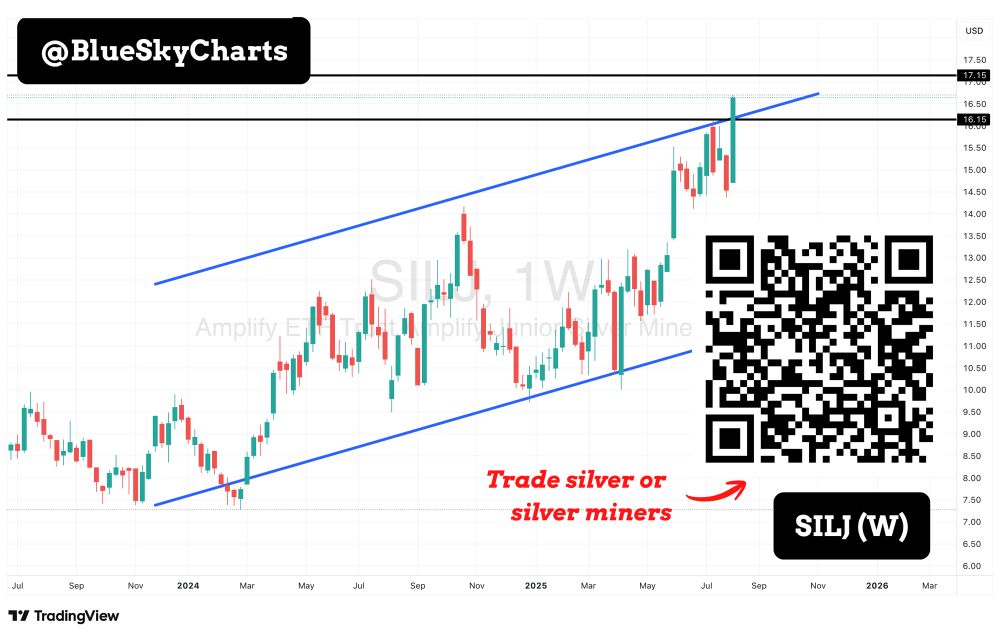

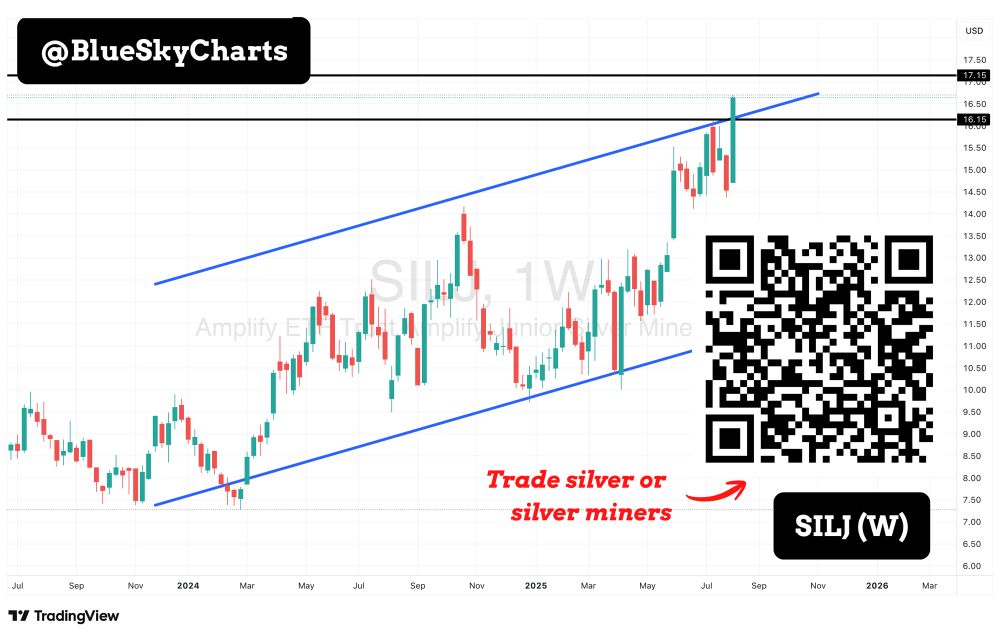

#SILJ – Silver miners have just broken out of a multi-year ascending parallel channel (blue) and are now trading at levels last seen over a decade ago (black lines). With little overhead resistance, SILJ could soon enter price discovery mode. #silver #miners #trading #breakout #chartanalysis #SILJ

07.08.2025 20:03 — 👍 1 🔁 0 💬 0 📌 0

#USD - Anti-dollar trades are all moving up pre-market off the back of weak continuing jobless claims data. Look for breakouts to the upside in #BTCUSD #EURUSD #gold #silver #XAUUSD #XAGUSD

07.08.2025 13:18 — 👍 1 🔁 0 💬 0 📌 0

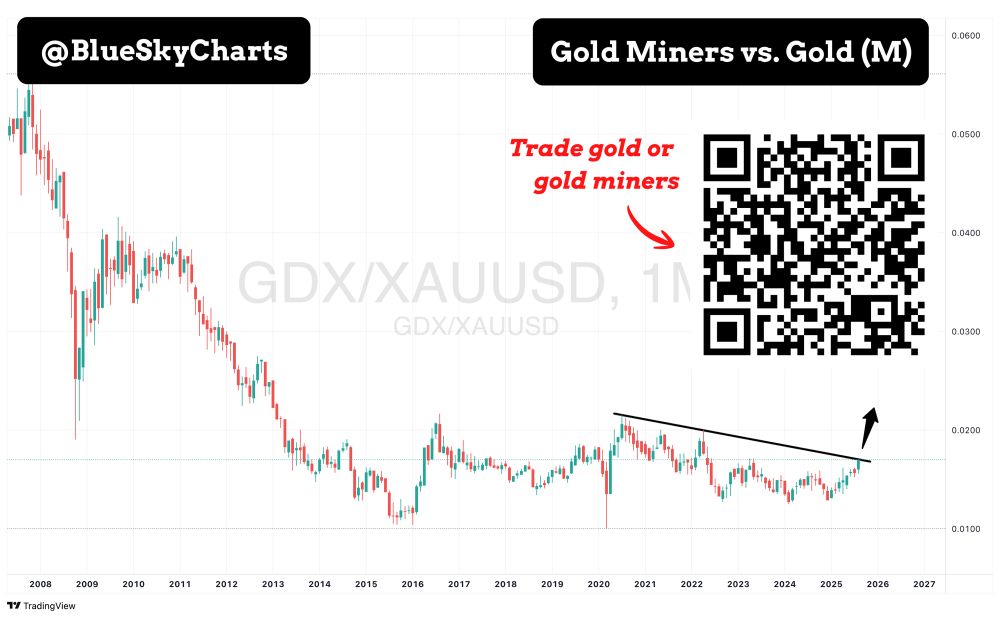

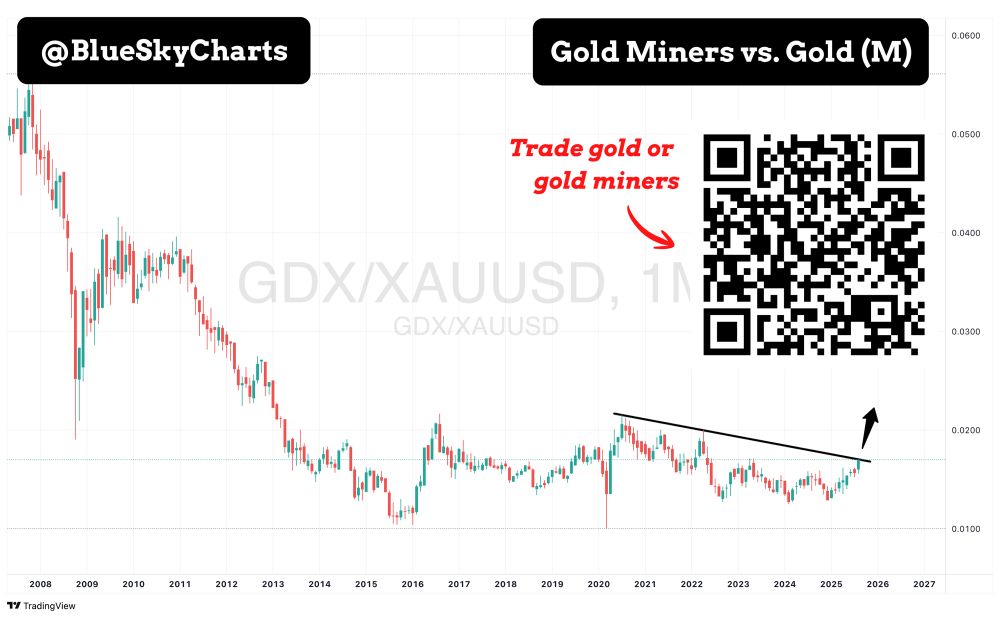

If you missed #gold's big breakout, here's your opportunity to ride the second wave. Gold miners are cheap relative to gold and have the potential to significantly outperform. The #GDX / #XAUUSD ratio is coiling beneath a decade-long descending trendline, with pressure building to the upside.

07.08.2025 12:01 — 👍 1 🔁 0 💬 0 📌 0

History shows that gold shines when stocks falter, as was apparent in the global financial crisis of 2008. #gold #XAUUSD

06.08.2025 09:37 — 👍 1 🔁 0 💬 0 📌 0

#DXY – The dollar's rebound from oversold conditions continues into August, even as the US reports weak employment figures and an ISM contraction. #EURUSD and #GBPUSD are retracing towards their breakouts from long-term descending trendlines (black), in what appears to be a classic retest move

06.08.2025 09:09 — 👍 2 🔁 0 💬 0 📌 0