The use of leaked data is becoming increasingly common in empirical research. The authors discuss the ethical, legal, and privacy hurdles these projects face and offer a practical roadmap for researchers seeking to enter the field.

15.01.2026 19:35 —

👍 0

🔁 0

💬 0

📌 0

Safely opening Pandora’s box: a guide for researchers working with leaked data

Recently published in @itaxjournal.bsky.social "Safely opening Pandora’s box: a guide for researchers working with leaked data" by Annette Alstadsæter, Matthew Collin ( @mattcollin.bsky.social ) & Andreas Økland (@andokl.bsky.social)

Available at: rdcu.be/eZfQl

15.01.2026 19:35 —

👍 7

🔁 4

💬 1

📌 0

Fiscal competition for FDI is often viewed as harmful and criticized as a “race to the bottom.” This study shows that, under sufficient economic integration, such competition can instead foster the development of transport infrastructure and lead to welfare improvements.

14.01.2026 21:45 —

👍 0

🔁 0

💬 0

📌 0

Client Challenge

Recently published in @itaxjournal.bsky.social "Beneficial fiscal competition for foreign direct investment: transport infrastructure and economic integration" by Shigeo Morita & Hirofumi Okoshi

Available at: rdcu.be/eY6JW

14.01.2026 21:45 —

👍 0

🔁 0

💬 1

📌 0

Female representation in politics has real policy effects. In Italy, before the pandemic female mayors spent more on childcare than male ones. It took a major crisis for male mayors to close the gap, especially where schools closed longer and re-election incentives were stronger.

13.01.2026 22:20 —

👍 2

🔁 1

💬 0

📌 0

Client Challenge

Recently published in @itaxjournal.bsky.social "Who cares about childcare? Covid-19 and gender differences in local public spending" Alda Marchese (@usiidep.bsky.social), @paolaprofeta.bsky.social (Bocconi University), Giulia Savio (University of Turin)

Available at: rdcu.be/eYVQm

13.01.2026 22:20 —

👍 0

🔁 0

💬 1

📌 0

Tax audits systematically increase firms' reported revenues, profits, and labor costs, thereby enhancing tax compliance and tax revenues. Bankruptcies rise among firms with detected tax deficits, indicating that audits help eliminate non-compliant firms from the market.

12.01.2026 21:23 —

👍 0

🔁 0

💬 0

📌 0

Client Challenge

Recently published in @itaxjournal.bsky.social "Tax enforcement and firm performance: real and reporting responses to risk-based tax audits" by Jarkko Harju, Kaisa Kotakorpi, @tuomasmatikka.bsky.social & @annikanivala.bsky.social

Available at: rdcu.be/eYKVH

12.01.2026 21:23 —

👍 2

🔁 2

💬 1

📌 0

During COVID-19, in 2021, EU tax-benefit systems absorbed about 67% of income losses (ISC=67) on average. Income protection was very similar for employees and the self-employed on average, but much more heterogeneous for the self-employed across and within countries.

09.01.2026 16:56 —

👍 0

🔁 0

💬 0

📌 0

Client Challenge

Recently published in @itaxjournal.bsky.social "The rising tide lifts all boats? Income support measures for employees and self-employed during the COVID-19 pandemic" by @chrimic1.bsky.social, @silviadepoli.bsky.social & Viginta Ivaškaitė‑Tamošiūnė

Available at: rdcu.be/eYmdR

09.01.2026 16:56 —

👍 1

🔁 1

💬 1

📌 0

Does mayors’ expertise affect their performance? Using RD estimations for close mixed-background races in 1,933 mayor elections in Hesse, the paper shows that public administrator mayors attract more investment grants than other mayors when aligned with the council.

08.01.2026 19:56 —

👍 0

🔁 0

💬 0

📌 0

Client Challenge

Recently published in @itaxjournal.bsky.social "Public administrators as politicians in office" by Zohal Hessami @zohalhessami.bsky.social, Timo Häcker & Maximilian Thomas

Available at: rdcu.be/eYdMe

08.01.2026 19:56 —

👍 1

🔁 0

💬 1

📌 0

Tax lotteries incentivize consumers to ask for receipts, but effectiveness depends on design. Prizes are skewed toward high-income taxpayers, business owners, and the self-employed, driven by greater transaction volumes. These groups alter their behavior the least after winning.

03.10.2025 20:20 —

👍 0

🔁 0

💬 0

📌 0

Characteristics and responses of winners in the Greek tax lottery

Recently published in @itaxjournal.bsky.social "Characteristics and responses of winners in the Greek tax lottery" by Panayiotis Nicolaides

Available at: rdcu.be/eJnj8

03.10.2025 20:20 —

👍 2

🔁 0

💬 1

📌 1

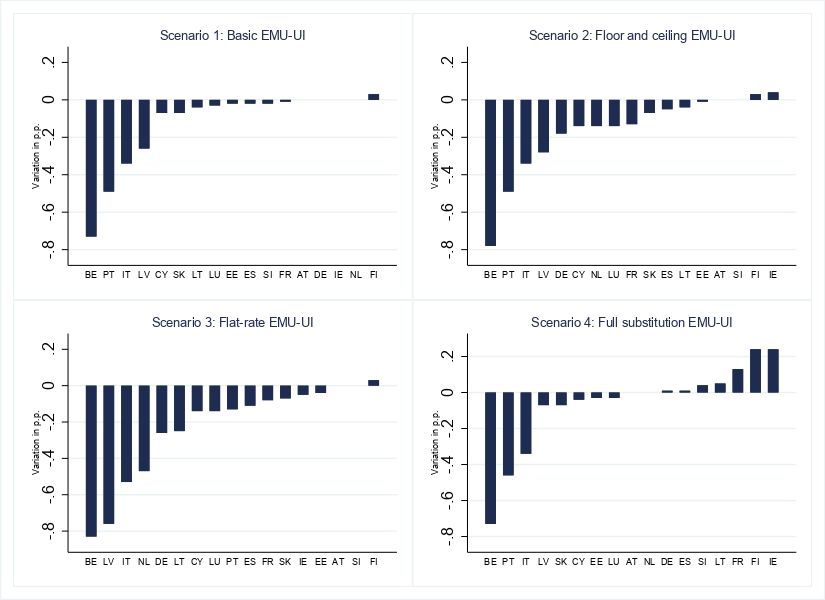

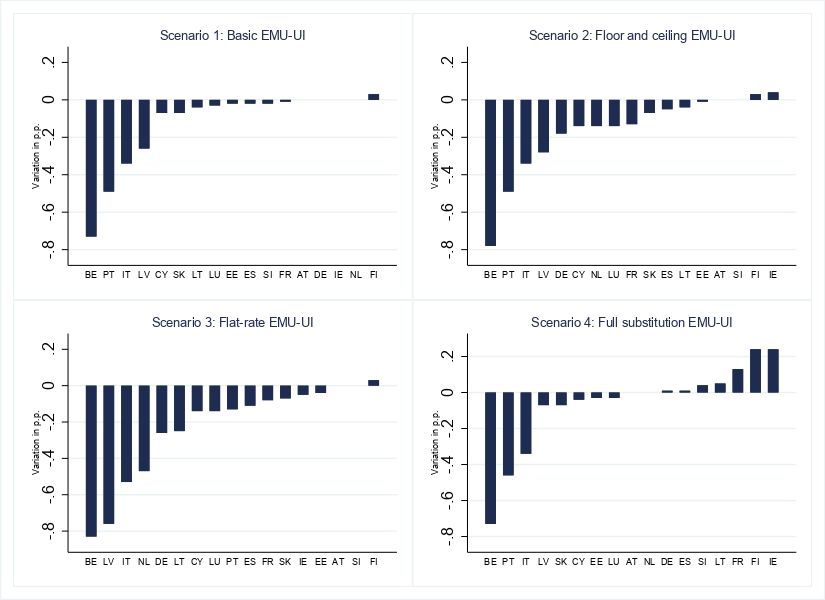

Simulations of a common unemployment benefit system across European countries indicate that a common replacement rate, paired with country-specific floors and ceilings, reduces poverty while keeping labour supply responses and budgetary costs modest.

02.10.2025 16:39 —

👍 0

🔁 0

💬 0

📌 0

The impact of a European unemployment benefit scheme on labour supply and income distribution

Recently published in @itaxjournal.bsky.social "The impact of a European unemployment benefit scheme on labour supply and income distribution" by Mathieu Lefebvre & Agathe Simon

Available at: rdcu.be/eJaAZ

02.10.2025 16:39 —

👍 2

🔁 1

💬 1

📌 0

Uganda’s 2012–13 tax reform increased revenue and modestly reduced inequality. Reported incomes of most top 1% stayed unchanged, though high earners in small firms reduced their incomes, with some employers shifting wages into dividends to lower tax.

01.10.2025 17:33 —

👍 0

🔁 0

💬 0

📌 0

Taxpayer response to greater progressivity: evidence from personal income tax reform in Uganda

Recently published in @itaxjournal.bsky.social

"Taxpayer response to greater progressivity: evidence from personal income tax reform in Uganda" by Maria Jouste, Tina Kaidu Barugahara, Joseph Ayo Okello, Jukka Pirttilä & Pia Rattenhuber

Available at: rdcu.be/eI3rM

01.10.2025 17:33 —

👍 2

🔁 0

💬 1

📌 0

In China, many firms evade social insurance payments. The Golden Tax Project Phase III (GTPIII) — a digital tax upgrade — helped boost companies’ participation and payment rates by improving data sharing and closing loopholes. Gains were biggest among small, low-profit firms.

01.10.2025 17:25 —

👍 0

🔁 0

💬 0

📌 0

Digitalization of tax collection and enterprises’ social security compliance

Recently published in @itaxjournal.bsky.social

"Digitalization of tax collection and enterprises’ social security compliance" by Changlin Yu & Yanming Li

Available at: rdcu.be/eITit

01.10.2025 17:25 —

👍 1

🔁 0

💬 1

📌 0

Bastani's new paper provides a guide to the Marginal Value of Public Funds (MVPF), bridging theory and practice, and showing how to translate tax elasticities into welfare conclusions. It reorients the discussion, shifting focus from public spending to tax policy.

26.09.2025 15:20 —

👍 1

🔁 0

💬 0

📌 0

The marginal value of public funds: a brief guide and application to tax policy

Recently published in @itaxjournal.bsky.social

"The marginal value of public funds: a brief guide and application to tax policy" by Spencer Bastani

Available at: rdcu.be/eIl3e

26.09.2025 15:20 —

👍 1

🔁 0

💬 1

📌 0

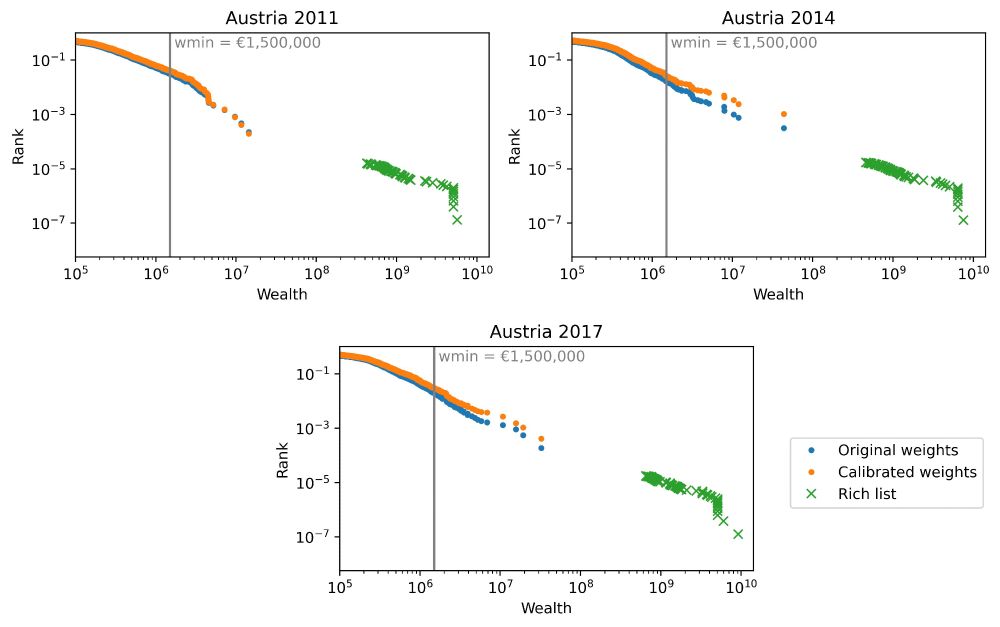

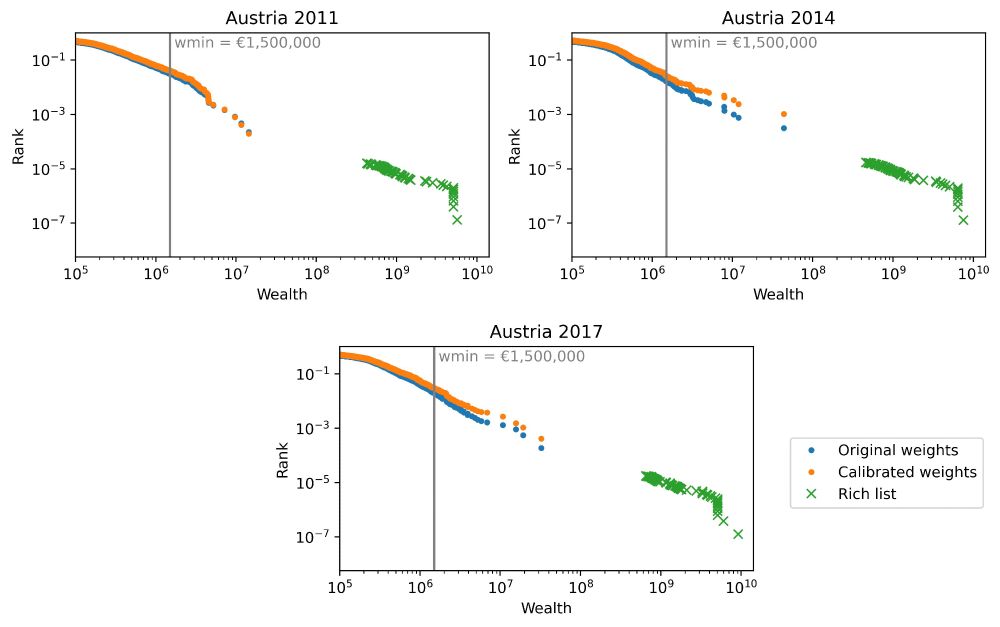

Wealth surveys suffer from the 'missing rich' problem. This paper proposes a new method to improve representativeness by calibrating the survey’s income distribution using income tax data.

08.07.2025 13:23 —

👍 0

🔁 0

💬 0

📌 0

Wealth survey calibration using income tax data

Recently published in @itaxjournal.bsky.social

"Wealth survey calibration using income tax data" by Daniel Kolář

Available at: rdcu.be/evkMu

08.07.2025 13:23 —

👍 0

🔁 0

💬 1

📌 0

Donald Trump killed the OECD’s 2-Pillar reform of international corporate taxation. The Achilles heel of Pillar 1 has been the need for a Multinational Tax Convention. Instead, the reform this paper proposes extends Article 12B of the UN Model Tax Convention.

02.07.2025 19:51 —

👍 0

🔁 0

💬 0

📌 0

Residual profit splitting: a theory-based approach to tax multinationals

Recently published in @itaxjournal.bsky.social

"Residual profit splitting: a theory-based approach to tax multinationals" by Wolfram F. Richter

Available at: rdcu.be/euxad

02.07.2025 19:51 —

👍 0

🔁 0

💬 1

📌 0

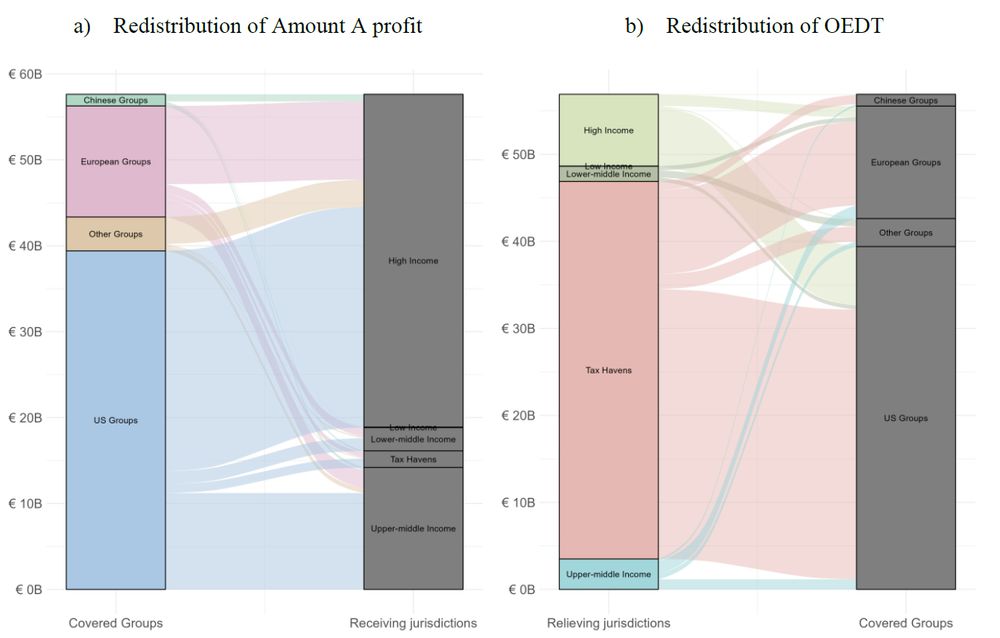

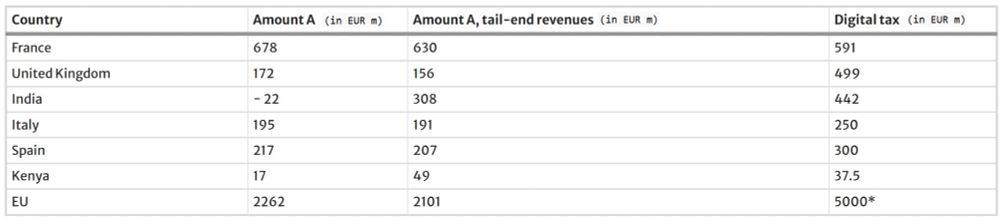

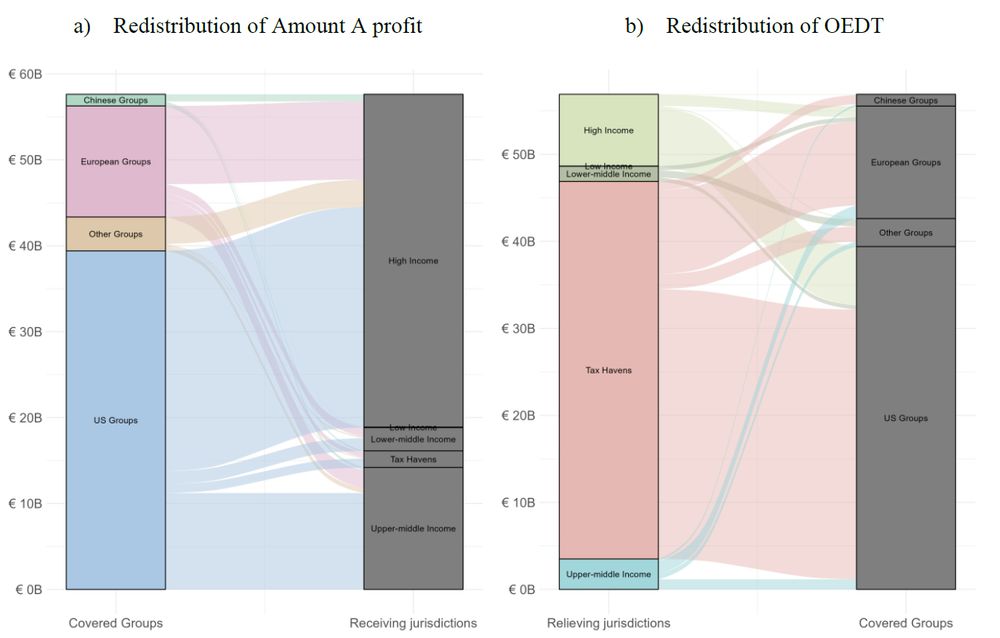

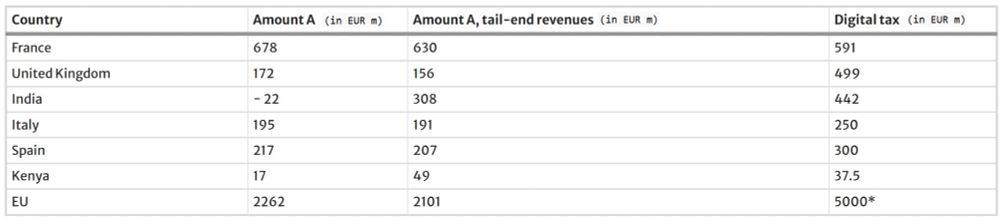

Pillar 1 Amount A reallocates taxing rights on the largest/most profitable MNEs based on final consumers' location. In 2022, it would yield €10.9B. High-income countries gain the most while tax havens bear the brunt of the cost. Net benefits compared to DSTs are ambiguous.

01.07.2025 15:06 —

👍 0

🔁 0

💬 0

📌 0

Tax revenue from Pillar One Amount A: country-by-country estimates

Recently published in @itaxjournal.bsky.social

"Tax revenue from Pillar One Amount A: country-by-country estimates" Mona Barake & Elvin Le Pouhaër

Available at: rdcu.be/eujVD

01.07.2025 15:06 —

👍 0

🔁 0

💬 1

📌 0

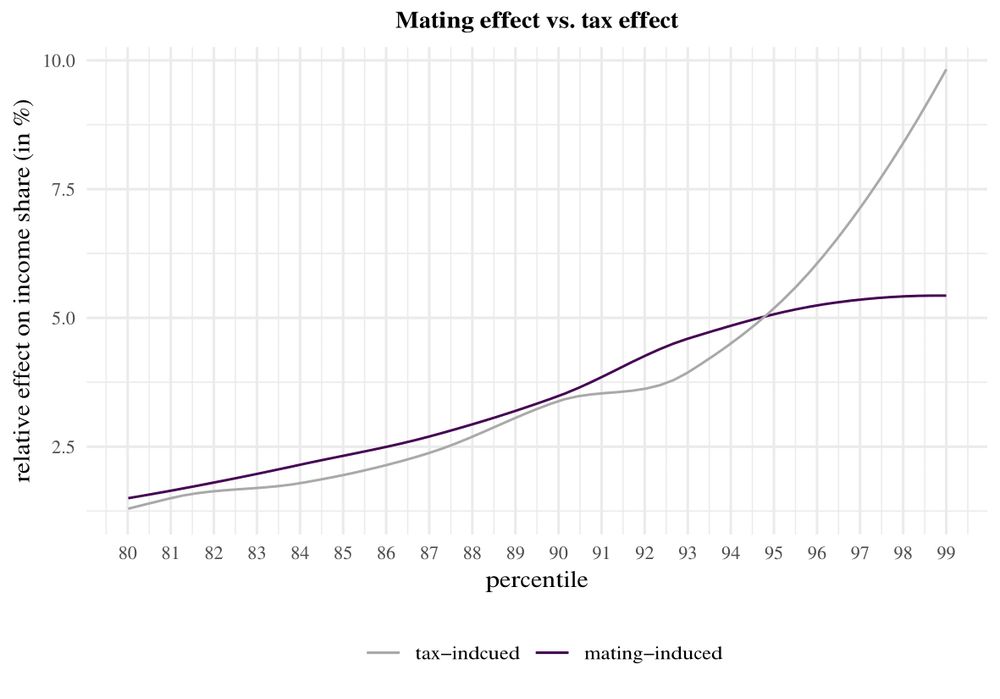

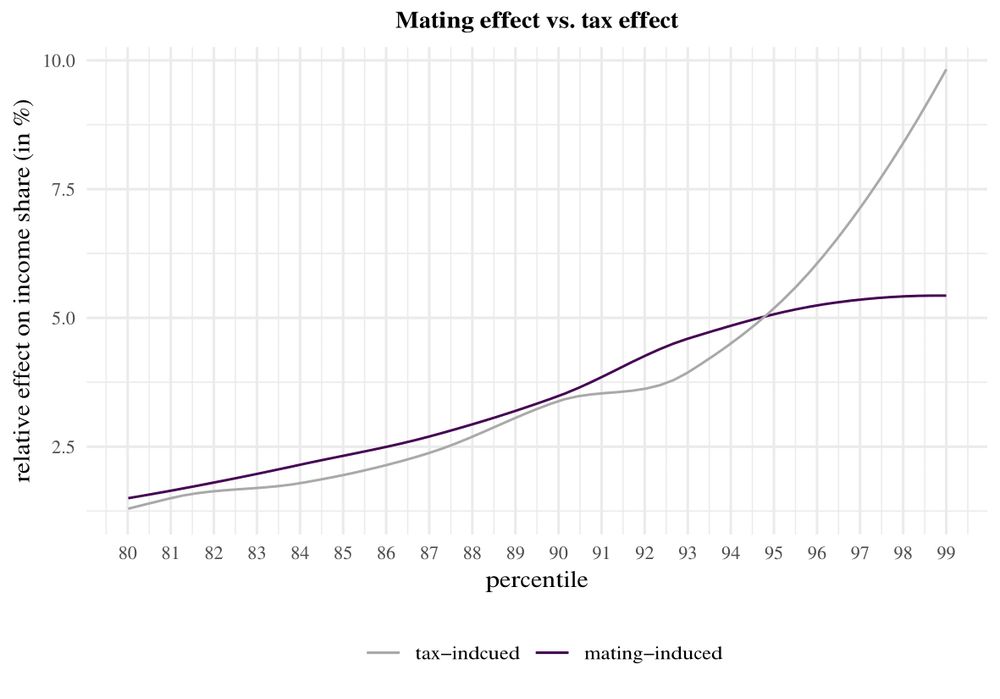

We show how marital sorting in Switzerland offsets parts of the tax system’s redistributive effect - intensifying income inequality.

30.06.2025 08:49 —

👍 0

🔁 0

💬 0

📌 0

Tax redistribution offset? Effect of marital choices on income inequality

Recently published in @itaxjournal.bsky.social

"Tax redistribution offset? Effect of marital choices on income inequality" by Melanie Häner-Müller, Michele Salvi & Christoph A. Schaltegger

Available at: rdcu.be/et416

30.06.2025 08:49 —

👍 0

🔁 0

💬 1

📌 0