Opinion | Oil Sanctions Would Hit Russia Harder Now Than in 2022

Demand is growing slowly while supply is increasing faster than usual. That’s bad news for Putin.

Putin is still financing his aggression by selling oil to China, India, and others. But today, global oil oversupply gives the West the best opportunity it has had to hit Russian oil while minimizing spillover risk to consumers. I wrote in @wsj.com: www.wsj.com/opinion/oil-...

14.05.2025 22:36 —

👍 6

🔁 0

💬 1

📌 1

Opinion | Trump’s Tariffs Are Bad for Business Investment

Even with his 90-day pause, the president’s approach doesn’t encourage companies to invest.

“When corporate leaders can be reasonably confident that the business climate isn’t subject to a drastic policy shift, like revved-up tariffs, they’re more likely to invest,” @ericvannostrand.bsky.social writes. “Trump’s existing and threatened tariffs undermine these conditions.”

15.04.2025 19:34 —

👍 5

🔁 1

💬 2

📌 0

Best piece of economic data this week: the great @avivaaron-dine.bsky.social will be an impactful voice promoting inclusive growth in the United States and relentlessly honest rigor in policy analysis more generally.

18.03.2025 00:02 —

👍 30

🔁 4

💬 1

📌 0

A terrific contribution to the growing discourse on building more by @briancdeese.bsky.social. His discussion of a "infrastructure-industrial complex" resonates w/ me having tried but large failed to nibble around the edges of it during the Obama infra bill. www.foreignaffairs.com/united-state...

13.03.2025 14:58 —

👍 27

🔁 8

💬 0

📌 0

I worry that many large endowment and pension fund managers won't get the joke.

11.03.2025 15:05 —

👍 43

🔁 6

💬 7

📌 1

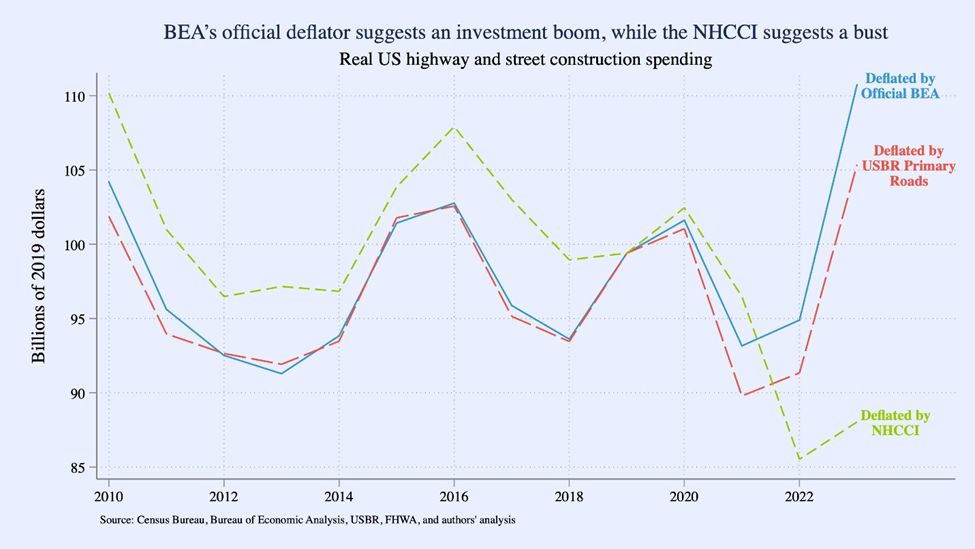

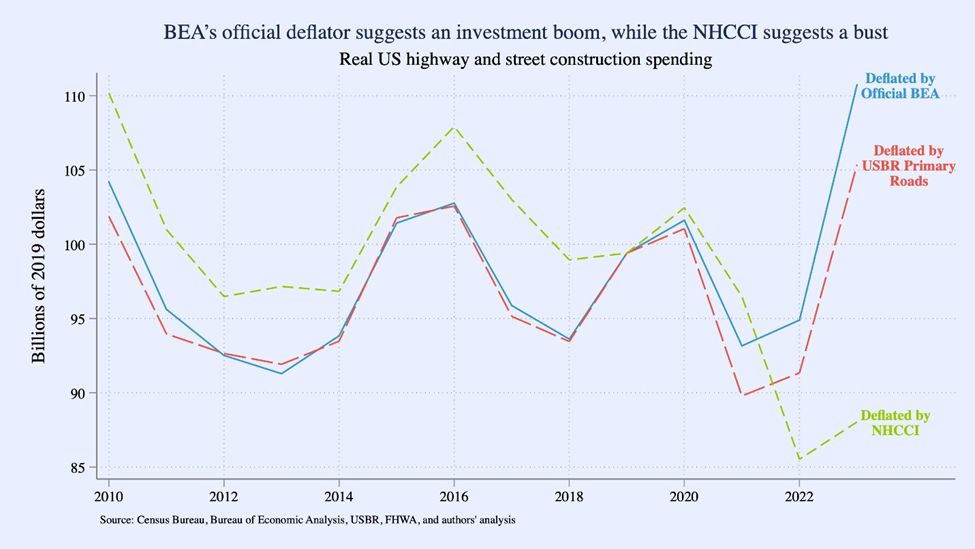

And I agree with @zliscow.bsky.social that deploying infra investment at low points in the business cycle would be more impactful for real outcomes than when demand is surging.

03.03.2025 22:21 —

👍 1

🔁 0

💬 0

📌 0

Even when we stop talking about deflator choices (which I’ll find sad), the big q is what lessons we can learn for future policy. I agree with @jasonfurman.bsky.social that including supply expansion in future infra bills (cutting red tape and making it easier to permit and build) is key.

03.03.2025 22:19 —

👍 1

🔁 1

💬 0

📌 0

I co-sign all of this and am grateful to @jasonfurman.bsky.social and @zliscow.bsky.social, from whom I’ve learned much over many years, for the engagement. It’s obvious that inflation reduced the impact of BIL investments. But this thread explains why we think that effect is smaller than J&Z do.

03.03.2025 22:18 —

👍 2

🔁 0

💬 0

📌 0

Given the renewed interest in national income accounting a brief primer on the role of government spending in GDP.

Short version: (1) critical to include govt for accounting identities but (2) can debate welfare-relevant metric or best forecasting "signal".

A 🧵.

03.03.2025 19:01 —

👍 57

🔁 19

💬 1

📌 2

Trump Paralyzes the U.S. Wind Power Industry

The president, who despises wind turbines, has paused federal permits and leasing for such projects, putting company plans in limbo.

U.S. businesses want to produce more clean energy and the Admin says no. This is a new supply constraint created by fiat to slow clean investment: the opposite of a pro-growth approach. We need less red tape and easier permitting for all kinds of energy production.

www.wsj.com/business/ene...

23.02.2025 20:14 —

👍 9

🔁 4

💬 1

📌 0

🚨NEW RESULTS (w/ Slattery & @wnober.bsky.social) When gov't engineers retire, projects take longer & costs (& cost overruns) go up. It’s harder to manage projects well w/ reduced staffing. Important to remember as DOGE cuts: reduced staffing can actually hurt efficiency.

Paper: tinyurl.com/yvy2jt93

21.02.2025 16:50 —

👍 676

🔁 208

💬 13

📌 11

@ericvannostrand.bsky.social & I are in @briefingbook.bsky.social on infrastructure.

Last week, @jasonfurman.bsky.social argued that real US infrastructure investment has fallen since the pandemic.

Eric & I find however that using BEA’s deflator, real highway spending is up 11% since 2019.

1/11

19.02.2025 14:48 —

👍 50

🔁 20

💬 4

📌 8

Far from the most important Treasury issue this month, of course.

20.02.2025 00:31 —

👍 5

🔁 0

💬 1

📌 0

The U.S. Post-Pandemic Recovery in Context

I. IntroductionAs we approach the fifth anniversary of the onset of the COVID-19 pandemic, the United States is experiencing robust economic growth and low unemployment. At the same time, inflation is...

In the last few days of Janet Yellen’s Treasury, my amazing team at the Office of Economic Policy published a retrospective on the U.S. recovery that unified much of our earlier work. But the Trump Treasury purged it. Here’s a Wayback Machine link: web.archive.org/web/20250117...

20.02.2025 00:29 —

👍 188

🔁 62

💬 3

📌 2

There’s a broader lesson in this piece from @ernietedeschi.bsky.social and me: wonkery that sounds like hair-splitting (which price index to use) can have big implications for macro conclusions (did infrastructure investment go way up or down?). The details matter for the big picture.

19.02.2025 21:11 —

👍 15

🔁 3

💬 1

📌 0