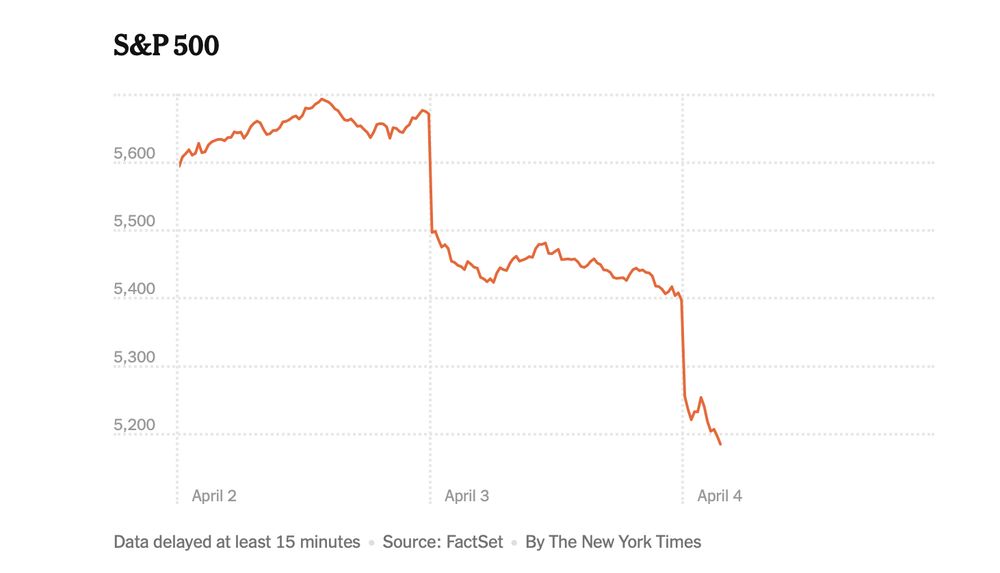

For reasons, checking in on foreign official holdings of US treasuries at the Fed. Now down $100 billion since 'Liberation day'. Note: That latest data point with the biggest weekly drop yet is from *before* Trump's attempted firing of the Fed governor.

Next release will be interesting (Thursday).

26.08.2025 14:20 — 👍 43 🔁 20 💬 2 📌 3

Picture of the article called 'The dark side of diversification: Passive finance and fossil-fuel investment'

What shapes fossil-fuel investment decisions?

What are pension funds’ climate considerations?

And how does the portfolio risk concept influence these issues?

Excited to see my paper "The dark side of diversification: Passive finance and fossil-fuel investment" published in @finandsoc.bsky.social!

🧵

23.07.2025 16:59 — 👍 21 🔁 10 💬 5 📌 0

Huge congrats and can't wait to read this!

23.07.2025 19:51 — 👍 1 🔁 0 💬 1 📌 0

Wow, huge congrats!

15.07.2025 18:54 — 👍 1 🔁 0 💬 0 📌 0

In the age of asset manager capitalism, do asset owners still matter? And what does this mean for the green transition?

@nataschavanderzwan.bsky.social and I investigate this through an in-depth study of how some of the most important asset owners - pension funds - invest.

Now out in SER!

🧵

26.06.2025 09:51 — 👍 69 🔁 33 💬 1 📌 3

I didn’t know that! A broader global comparison would be fascinating.

05.05.2025 13:20 — 👍 1 🔁 0 💬 2 📌 0

What explains the rise of doctors in Taiwan's party politics? In my first publication with Sida Liu, we argue that a symbiotic alliance between an empowered medical association and a weak political party facilitated the rise of doctor-politicians.

www.tandfonline.com/eprint/HD88W...

04.05.2025 00:26 — 👍 2 🔁 0 💬 2 📌 0

Pension groups cut back on pioneering private equity investments

Canadian pension funds are increasingly favouring partnerships with buyout firms

if @markcarneyforpm.bsky.social was serious about Canadian autonomy from the US, he'd get Canadian public pension funds to stop pouring money into US private equity funds whose bosses are embedded in the Trump Administration

www.ft.com/content/6e15...

22.04.2025 12:48 — 👍 24 🔁 9 💬 2 📌 0

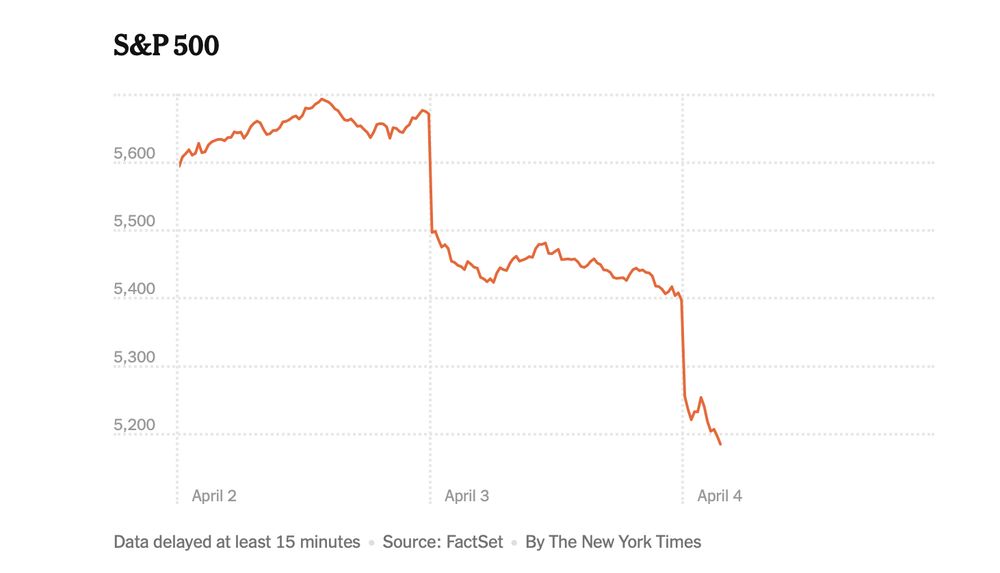

they should vote on social security privatization like right now

04.04.2025 14:48 — 👍 26 🔁 5 💬 3 📌 0

Born in Milan, lives in London. Macro-finance: Pension funds, emerging economies, capital flows and financialisation.

Post-doc @hertieschool.bsky.social | visiting fellow @granthamlse.bsky.social | political economy | central bank politics

Social Problems is a journal that brings to the fore influential sociological findings that may help better understand and deal with our complex social world.

An International Journal of Social Research

The American Journal of Sociology, founded in 1895 as the first journal in its discipline, is a peer-reviewed, bimonthly academic journal that publishes original research and book reviews.

Postdoc, Copenhagen Business School & Stockholm University.

Economic sociology, intellectual history, philosophy. Concerned about the climate crisis & finance capitalism. Researching their interrelation

Educational charity. Peer-reviewed sociology journal, public sociology magazine, podcasts, Connected Sociologies teaching resources, ECR opportunities.

https://www.thesociologicalreview.org

Political Economist at Institute of Public Administration, Leiden University | Sustainable Finance | Financialization | Politics of Investment | Pensions | http://nataschavanderzwan.com

Senior researcher @mpifg.bsky.social, studying private wealth, finance & the state in the climate crisis. #privatewealth | #impinv | #greenfinance | #strandedassets

Postdoctoral Fellow at Department of International Studies, American University of Sharjah @uoftsociology.bsky.social

Researching economic sociology, South-South trade and migration, race/ethnicity, Global China.

Website: angelamanxu.com

University of California Santa Cruz Prof. Director of Community Studies. Author: The Master’s Tools (Verso) + Dismantling Solidarity (Cornell). Likes: economic democracy, critical social theory, 2x2 tables.

We provide outstanding education in the changing social world, and state-of-the-art, public-facing research on social issues ➡️ www.lse.ac.uk/sociology

Political economist @ LSE | Finance, central banking & more | benjaminbraun.org

The California Public Employees' Retirement System (CalPERS) is the nation's largest public pension fund. Phone: 888-225-7377 | Intl: +1 916-795-3000

Website: https://www.calpers.ca.gov/

Est. 1972. Social science journal: economic and cultural relations, states and governance, & much more.

https://www.tandfonline.com/journals/reso20

Cross-disciplinary journal dedicated to interrogating the central role of finance in contemporary life. cambridge.org/core/journals/finance-and-society

The Society for the Advancement of Socio-Economics (SASE), founded by Amitai Etzioni in 1989, is an international, interdisciplinary organization with members across 50 countries.

2026 Conference in Bordeaux 🇫🇷