@francescoravazzolo.bsky.social and I did it again! 5th Dolomiti Macro Meeting, this time in Pera di Fassa. www.unibz.it/assets/Event...

23.06.2025 22:30 — 👍 6 🔁 4 💬 0 📌 0@furlanetto.bsky.social

Principal Researcher at Norges Bank. Living in Oslo, originally from Treviso (via Lausanne and Barcelona). https://www.norges-bank.no/en/topics/Research/economists/Furlanetto-Francesco/ I express only my views and not necessarily those of Norges Bank.

@francescoravazzolo.bsky.social and I did it again! 5th Dolomiti Macro Meeting, this time in Pera di Fassa. www.unibz.it/assets/Event...

23.06.2025 22:30 — 👍 6 🔁 4 💬 0 📌 0Thanks to fantastic coauthors @dragobergholt.bsky.social Nicolo Maffei Faccioli, Pål Ulvedal and 👑Fabio Canova. Thanks to the editor and referees: the paper has improved. Last version: www.norges-bank.no/contentasset...

12.03.2025 16:09 — 👍 1 🔁 0 💬 0 📌 0🎢The roller coaster paper is conditionally accepted at the American Economic Journal: Macroeconomics. Our point: the inflation surge is mainly demand-driven and to establish this result it is important to check carefully the deterministic component of a SVAR 🎢

12.03.2025 16:09 — 👍 3 🔁 0 💬 1 📌 0

Norges Bank Spring Institute 2025 with @helenerey.bsky.social: beautiful days in a non beautiful time 🇺🇦

01.03.2025 10:51 — 👍 7 🔁 2 💬 0 📌 0

🥁🥁 NEW CONFERENCE ALERT 🥁🥁

Monetary Policy after the Inflation Surge

in Oslo on September 22-23 jointly organized with Deutsche Bundesbank and Danmarks Nationalbank. 12th Edition!

Keynote speakers: Corina Boar (NYU), Jordi Galí (CREI) and Vincent Sterk (UCL)

Submission deadline: March 16.

This year’s Dynare conference will be in Helsinki, Finland. Call for papers is open until 16th March. Do apply, share, and see you there! :)

17.02.2025 12:02 — 👍 7 🔁 3 💬 0 📌 0

Herman van Dijk was a familiar face and a leading example for all of us at Norges Bank. Herman has been a giant in Bayesian econometrics but also a great mentor. We went skiing, we had good dinners, we even wrote a paper together. Herman liked coming to Oslo and will be deeply missed.

28.01.2025 23:01 — 👍 0 🔁 0 💬 0 📌 0

🌎Does unilateral decarbonization pay for itself? In our new working paper, @adrienbilal.bsky.social and I analyze whether large economies like the U.S. and E.U. can justify broad decarbonization policies based purely on domestic economic benefits.

WP: nber.org/papers/w3336...

#econsky

Practical implication for humble users like me: Juan's old codes are still ok and we can keep using them! 😅2/2

17.01.2025 16:37 — 👍 1 🔁 0 💬 0 📌 0🥁🥁Important paper by Arias-RubioRamirez-Waggoner forthcoming in Econometrica 🥁🥁

econometricsociety.org/publications...

There has been a call for caution regarding the use of uniform priors on rotation matrices for Bayesian inference in SVARs. The paper challenges this claim. 1/2

🥁🥁Vox column alert 🥁🥁

on why the gender convergence matters for growth, productivity and employment with @dragobergholt.bsky.social and @fossoluca.bsky.social

cepr.org/voxeu/column...

Since I had the genius idea of posting it on Thanksgiving day, here you have again a short 🧵:

This is the outcome of @fossoluca.bsky.social PhD internship at Norges Bank which started in September 2020. The topic is extremely interesting, and we have tried to approach it using tools that we normally use for inflation or monetary policy. We hope you like the contamination. N/N

28.11.2024 13:48 — 👍 0 🔁 0 💬 0 📌 0Bonus result III: since gender trends are the main drivers of employment growth, the estimated crowding out of males is relatively small, as in Fukui-Nakamura @jonsteinsson.bsky.social Notably, crowding out is shock-specific and smaller in response to labor supply shocks. 10/N

28.11.2024 13:48 — 👍 1 🔁 0 💬 1 📌 0Bonus result II: the slowdown in the gender convergence explains in part the emergence of jobless recoveries. However, demographic factors and automation (together with import competition) play also a substantial role. 9/N

28.11.2024 13:48 — 👍 0 🔁 0 💬 1 📌 0

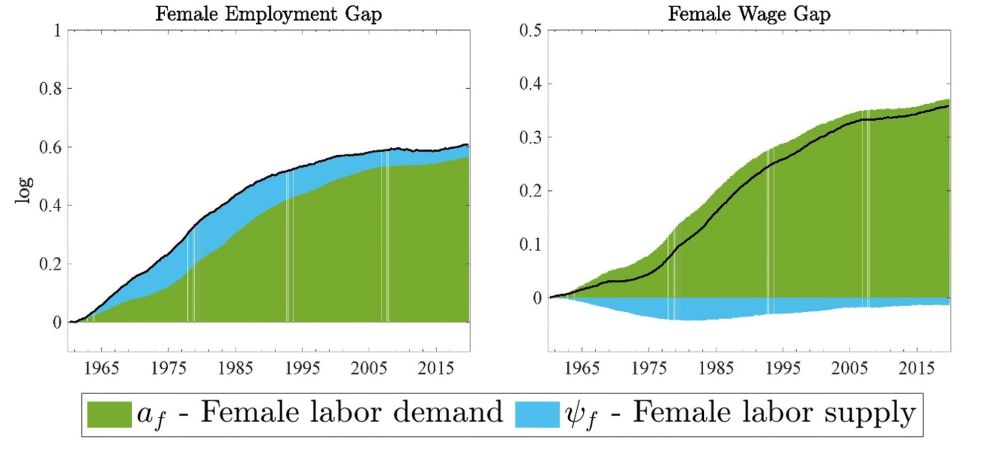

Bonus result I: the gender convergence is driven mainly by labor demand factors but labor supply factors become more important once we control for skills. There has been a large shock to the supply of skilled females over time. 8/N

28.11.2024 13:48 — 👍 0 🔁 0 💬 1 📌 0In fact, we use a SVAR model with common trends that so far has been used to estimate the star variables. We go one step further and link these star variables (like trend GDP growth or trend employment) to unobserved structural drivers (like gender trends). This is new. 7/N

28.11.2024 13:48 — 👍 0 🔁 0 💬 1 📌 0The finding that gender matters for macro connects us with the seminal papers by Hsieh-Hurst-Jones-Klenow and @heathcote.bsky.social -Storesletten-Violante. However, while they use calibrated structural models, we instead rely on a “let the data speak approach”. 6/N

28.11.2024 13:48 — 👍 0 🔁 0 💬 1 📌 0Is muted growth the new normal? Gender differences in the US labor market are still sizeable and thus ample pockets of growth are still available. However, further growth may prove more difficult than in the past because the gender convergence has a natural upward bound. 5/N

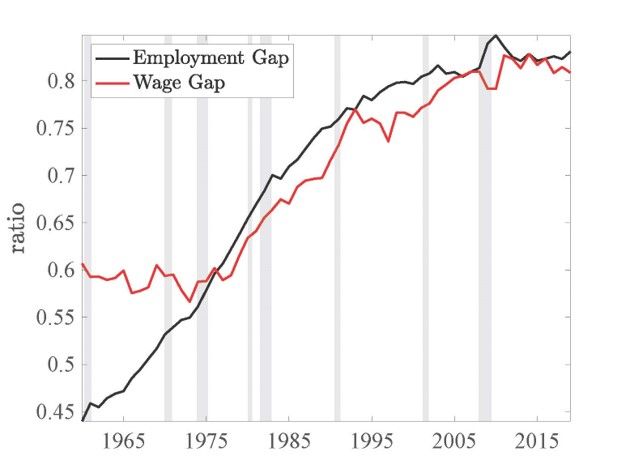

28.11.2024 13:48 — 👍 0 🔁 0 💬 1 📌 0The gender convergence stopped around 2000, with major negative effects on the macroeconomy: this explains around half of the overall decline in trend GDP growth and trend productivity growth between the 1990s and the 2010s. 4/N

28.11.2024 13:48 — 👍 0 🔁 0 💬 1 📌 0

We find that the trends driving the gender convergence (in green and light blue) have played a big role. During the 1970s, 80s and 90s, they account for 30-50% of trend GDP growth, 20-40% of trend productivity growth, and almost all the increase in trend employment. 3/N

28.11.2024 13:48 — 👍 0 🔁 0 💬 1 📌 0

Female-to-male ratios on employment rates and wages have increased substantially over time. However, this “grand convergence” stopped around 2000. Our key question:

Is the gender convergence important for the US macroeconomy? 2/N

🥁🥁 NEW PAPER ALERT 🥁🥁

“Macroeconomic Effects of the Gender Revolution”

joint with @dragobergholt.bsky.social and @fossoluca.bsky.social

Gender matters for macro! The quiet revolution had important effects on economic growth, productivity and employment. 1/N

www.norges-bank.no/contentasset...

Hei! Happy to be added 😊

27.11.2024 13:25 — 👍 2 🔁 0 💬 0 📌 0

SNDE-IIF workshop for junior researchers:

22.11.2024 06:18 — 👍 2 🔁 2 💬 0 📌 0

Lorenzo has a super promising research agenda that you can find on his webpage sites.google.com/view/lorenzo... Do not miss the chance to interview him!

Link to the paper: www.norges-bank.no/contentasset...

N/N

Norway seems clearly different from the US. What does this mean in terms of external validity? Well, highly complementary recent evidence by S. Ettmeier, F. Schorfheide et al. indicates that inequality is procyclical also in Germany. May be Norway is not so special after all. 10/N

19.11.2024 13:46 — 👍 1 🔁 0 💬 1 📌 0This is preliminary. More work has to be done on income risk, on the properties of the tails of the distributions (following @nwerquin.bsky.social et al) and on the implications for macro. We stress that these are the views of the authors and not necessarily those of Norges Bank. 9/N

19.11.2024 13:46 — 👍 0 🔁 0 💬 1 📌 0This procyclicality may dampen economic fluctuations driven by demand shocks and could provide an ex-post rationalization of why recessions (which are traditionally driven by demand shocks) have so limited macroeconomic effects in Norway. 8/N

19.11.2024 13:46 — 👍 0 🔁 0 💬 1 📌 0

The right tails of the distributions are very cyclical as in @fatihguvenen @serdarozkanEN et al However, poor households remain largely insulated from macro fluctuations, in stark contrast with results for the US. The tax and transfer system act as automatic stabilizers. 7/N

19.11.2024 13:46 — 👍 0 🔁 0 💬 1 📌 0

Our third result is that all measures of inequality are procyclical but this tendency is much more pronounced for disposable income and consumption. This is the case both unconditionally and in response to major business cycle shocks. Inequality is higher in good times! 6/N

19.11.2024 13:46 — 👍 1 🔁 0 💬 1 📌 0