SPY Thrusting Pattern: Bearish Edge Holds, QHI 60–80 Sample Thin

Nov 7

All conds: mean -1.6%, median -0.5% | Predicted declines 56.4% (n=55)

In QHI 60–80: mean -1.3%, median -2.7% | Predicted declines 60.0% (n=5)

Result: Bearish edge persists, but QHI 60–80 sample is low confidence.

10.11.2025 08:59 — 👍 0 🔁 0 💬 0 📌 0

Late-stage optimism persists — SPY 1M returns in Greed zone trail the baseline.

QHI at 61.5, Greed zone, 17th consecutive down day.

SPY 1M returns: 0.69% vs 1.25% baseline.

Current QHI is 20.6% below 1M avg, 29.2% below 3M avg.

Greed streak: 13 days, longer than usual.

10.11.2025 08:56 — 👍 0 🔁 0 💬 0 📌 0

Stretched optimism holds — SPY 1M returns trail the baseline in Greed.

QHI sits at 68.8, Greed zone, marking the 15th consecutive down day — a rare streak, now at a 3-month low.

SPY 1M returns in Greed: 0.68% vs. 1.25% baseline.

Greed zone streak now 11 days, right in line with typical duration.

06.11.2025 12:45 — 👍 0 🔁 0 💬 0 📌 0

Clean Energy Surges, Gold Miners Rally - Real Estate, Min Volatility Flat – Wednesday

Performance Breakdown

Top 2 (by %)

ICLN +5.42%: Bullish Momentum – Positive Sentiment

GDX +3.5%: Bullish Mom – Positive Sent

Bottom 2

USMV +0.14%: Neutral Mom – Neutral Sent

VNQ +0.09%: Neutral Mom – Neutral Sent

06.11.2025 11:54 — 👍 0 🔁 0 💬 0 📌 0

High Yield Climbs While Long Treasuries Retreat – Wednesday

Market Moves:

Top 2 (by %):

JNK +0.09%: Bullish Momentum – Neutral Sentiment

BNDX -0.08%: Bullish Momentum – Neutral Sentiment

Bottom 2:

TIP -0.37%: Bullish Momentum – Neutral Sentiment

TLT -1.09%: Bullish Momentum – Neutral Sentiment

06.11.2025 11:47 — 👍 0 🔁 0 💬 0 📌 0

Small-Cap Surges, Large-Cap Growth Trails – Wednesday

Performance Breakdown:

Top 2 (by %):

SLYV +1.84%: Bullish Momentum – Positive Sentiment

SLYG +1.51%: Neutral Momentum – Neutral Sentiment

Bottom 2:

EFIV +0.14%: Bullish Momentum – Positive Sentiment

IWF +0.12%: Bullish Mom. – Positive Sent.

06.11.2025 11:40 — 👍 0 🔁 0 💬 0 📌 0

SPY Medium White Candle: Bullish Edge Shrinks in QHI 60–80

Nov 5

All conds: mean 0.78%, median 1.37% | Gains 65.1%

QHI 60–80: mean 0.44%, median 0.73% | Gains 56.7%

Result: Bullish edge shrinks in QHI 60–80; lower accuracy, softer tail risk.

06.11.2025 07:50 — 👍 0 🔁 0 💬 0 📌 0

Stretched optimism holds — SPY 1M returns trail the baseline in Greed.

QHI sits at 70.2, Greed zone, with a 14-day down streak — longest since August and deeper than 83% of past runs.

SPY 1M returns in Greed: 0.68% vs. 1.25% baseline. QHI is now 19.8% below its 3M average, marking a new low.

05.11.2025 12:34 — 👍 0 🔁 0 💬 0 📌 0

Bitcoin Drops, Gold Miners Retreat – Tuesday

Daily Snapshot:

Top 2 (by %):

VNQ +0.17%: Neutral Momentum – Neutral Sentiment

USMV +0.08%: Neutral Momentum – Neutral Sentiment

Bottom 2:

GDX -4.24%: Bullish Momentum – Positive Sentiment

IBIT -5.53%: Neutral Momentum – Neutral Sentiment

05.11.2025 11:32 — 👍 0 🔁 0 💬 0 📌 0

Long Treasuries Edge Up While EM Bonds Retreat – Tuesday

Market Summary:

Top 2 (by %):

TLT +0.22%: Bullish Momentum – Neutral Sentiment

LQD +0.14%: Bullish Momentum – Neutral Sentiment

Bottom 2:

BNDX -0.08%: Bullish Momentum – Neutral Sentiment

EMB -0.11%: Bullish Momentum – Positive Sentiment

05.11.2025 11:31 — 👍 0 🔁 0 💬 0 📌 0

Dividend ETFs Hold Ground While Growth Leaders Retreat – Tuesday

What Happened:

Top 2 (by %):

DVY -0.38%: Bullish Momentum – Neutral Sentiment

SDY -0.01%: Neutral Momentum – Neutral Sentiment

Bottom 2:

SPYG -1.81%: Bullish Momentum – Positive Sentiment

QQQ -2.03%: Bullish Mom – Positive Sent

05.11.2025 11:27 — 👍 0 🔁 0 💬 0 📌 0

SPY Short Black Candle: Bearish Signal Fails, Positive Returns Persist

Nov 4

All conds: mean 1.1% | Predicted declines 33.4%

In QHI 60–80: mean 0.9% | Predicted declines 36.3%

Bearish failed; QHI 60–80 kept returns positive, tail risk remains.

05.11.2025 10:40 — 👍 0 🔁 0 💬 0 📌 0

SPY Medium Black Candle: Bearish Signal Fails, QHI 60–80 No Help

Nov 3

All conds: mean 1.2%, median 1.6% | Predicted declines 32.1%

In QHI 60–80: mean 0.7%, median 1.3% | Predicted declines 34.2%

Fact: Bearish failed overall; QHI 60–80 did not improve accuracy or risk.

04.11.2025 13:12 — 👍 0 🔁 0 💬 0 📌 0

Late-stage optimism holds — SPY 1M returns trail the baseline in Greed.

Quantlake Herd Index sits at 71.7, Greed zone, 13th consecutive down day.

SPY 1M returns in Greed: 0.68% vs 1.25% baseline.

QHI is now 18% below its 3M average, but still 16% above the 12M mean.

04.11.2025 13:03 — 👍 0 🔁 0 💬 0 📌 0

Clean Energy Surges, Bitcoin Retreats – Monday

Market Moves:

Top 2 (by %):

ICLN +1.73%: Bullish Momentum – Positive Sentiment

SMH +0.85%: Bullish Momentum – Positive Sentiment

Bottom 2:

IBB -1.2%: Bullish Momentum – Positive Sentiment

IBIT -2.84%: Neutral Momentum – Neutral Sentiment

04.11.2025 12:54 — 👍 0 🔁 0 💬 0 📌 0

Short-Term vs EM Divergence – Monday

What Happened:

Top 2 (by %):

VCSH -0.03%: Bullish Momentum – Neutral Sentiment

VGIT -0.03%: Bullish Momentum – Neutral Sentiment

Bottom 2:

JNK -0.29%: Bullish Momentum – Neutral Sentiment

EMB -0.29%: Bullish Momentum – Positive Sentiment

04.11.2025 12:51 — 👍 0 🔁 0 💬 0 📌 0

S&P Growth ETFs Surge, Dividend Names Retreat – Monday

What Happened:

Top 2 (by %):

SPYG +0.50%: Bullish Momentum – Positive Sentiment

IWF +0.49%: Bullish Momentum – Positive Sentiment

Bottom 2:

VYM -0.60%: Bullish Momentum – Positive Sentiment

SDY -0.83%: Neutral Momentum – Neutral Sentiment

04.11.2025 12:43 — 👍 0 🔁 0 💬 0 📌 0

Classic update for October: growth-tilted models led—Global Buffett-Inspired +1.9% (19.3% YTD). Balanced 60/40 gained ~1.7% vs AOR 1.5%. Defensive Moderate and Conservative added 0.8% vs AOM 1.2%.

03.11.2025 13:23 — 👍 0 🔁 0 💬 0 📌 0

Bitcoin Climbs While Gold Miners Retreat – Friday

What Happened:

Top 2 (by %):

IBIT +3.15%: Neutral Momentum – Neutral Sentiment

ICLN +1.59%: Bullish Momentum – Positive Sentiment

Bottom 2:

PFF -0.32%: Neutral Momentum – Neutral Sentiment

GDX -1.15%: Bullish Momentum – Positive Sentiment

03.11.2025 12:56 — 👍 0 🔁 0 💬 0 📌 0

Long Treasuries Retreat While EM Bonds Climb – Friday

Daily Snapshot:

Top 2 (by %):

EMB +0.19%: Bullish Momentum – Positive Sentiment

TIP +0.16%: Bullish Momentum – Neutral Sentiment

Bottom 2:

TLT -0.3%: Bullish Momentum – Neutral Sentiment

LQD -0.4%: Bullish Momentum – Neutral Sentiment

03.11.2025 12:53 — 👍 0 🔁 0 💬 0 📌 0

Mid-Caps Surge, Emerging Markets Retreat – Friday

Performance Breakdown:

Top 2 (by %):

MDYG +0.60%: Bullish Momentum – Positive Sentiment

IWM +0.56%: Bullish Momentum – Positive Sentiment

Bottom 2:

EFIV -0.34%: Bullish Momentum – Positive Sentiment

VWO -0.40%: Bullish Momentum – Positive Sentiment

03.11.2025 12:52 — 👍 0 🔁 0 💬 0 📌 0

Late-stage Greed persists — SPY 1M returns lag baseline.

QHI at 72.4, Greed zone, 12-day down streak.

SPY 1M return in Greed: 0.68% vs 1.25% baseline.

QHI at new 3M low, -17.5% from 3M avg.

Greed streak now 8 days, near average duration.

03.11.2025 11:59 — 👍 0 🔁 0 💬 0 📌 0

SPY Medium Black Candle: Bearish Signal Fails, Gains Persist in QHI 60–80

Oct 31

All conds: mean 1.2%, median 1.6% | Predicted declines 32.1%

In QHI 60–80: mean 0.7%, median 1.3% | Predicted declines 34.2%

Bearish failed; QHI 60–80 saw reduced gains, but tail risk stayed high.

03.11.2025 08:05 — 👍 0 🔁 0 💬 0 📌 0

Gold Steadies as Real Estate Slips

Based on 3-month ROC rankings, gold, clean energy, and semiconductors remain in the top decile of the past year.

Real estate and crypto lag, near the lower quartile.

Commodities and innovation maintain leadership.

02.11.2025 21:18 — 👍 1 🔁 0 💬 0 📌 0

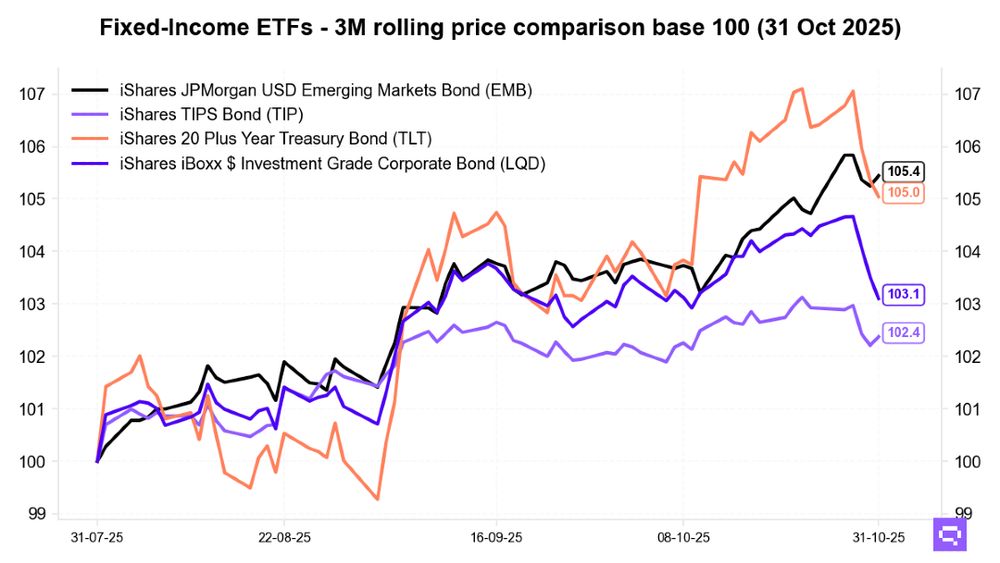

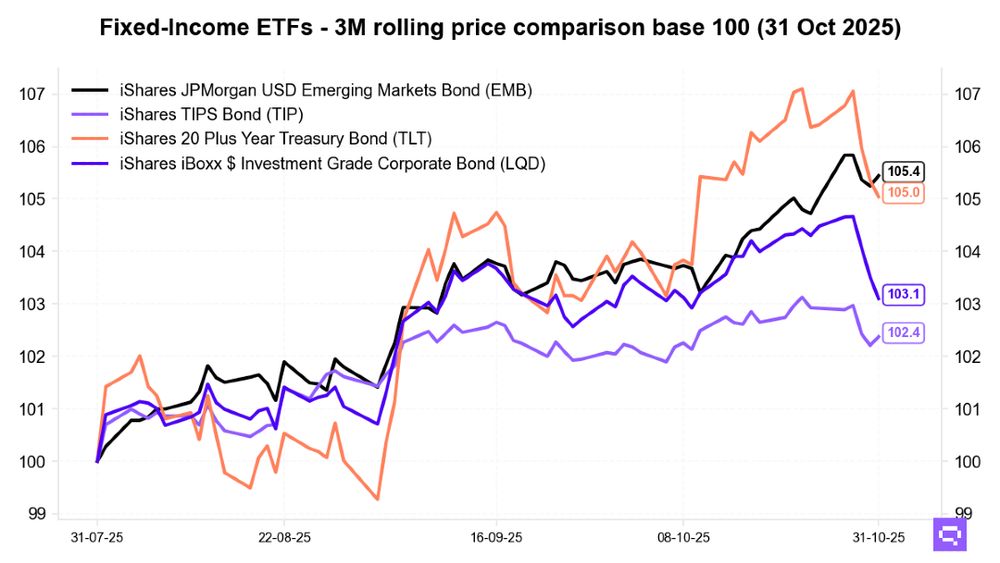

Fixed Income Split: EM Bonds Lead, Treasuries Fade

Based on 3-month ROC rankings, the iShares JPMorgan USD Emerging Markets Bond ETF leads with 5.1%, still within the 80th percentile of the past year.

Long Treasuries and investment-grade credit slipped, showing sharp week-over-week cooling.

02.11.2025 21:05 — 👍 0 🔁 0 💬 0 📌 0

3-month ROC snapshot: the iShares Russell 2000 ETF (IWM) rose +14.9%, narrowing the gap with the Invesco QQQ Trust (+13.7%) and iShares Russell 1000 Growth ETF (+12.5%).

Small-cap and value funds such as the SPDR S&P 600 Small Cap Value ETF (SLYV) now share leadership once dominated by mega-caps.

02.11.2025 21:01 — 👍 0 🔁 0 💬 0 📌 0

Long Treasuries Retreat While Global Bonds Edge Higher – Thursday

Daily Snapshot:

Top 2 (by %):

BNDX +0.06%: Bullish Momentum – Neutral Sentiment

VGIT -0.05%: Bullish Momentum – Neutral Sentiment

Bottom 2:

LQD -0.53%: Bullish Momentum – Positive Sentiment

TLT -0.58%: Bullish Mom. – Positive Sent.

31.10.2025 11:51 — 👍 0 🔁 0 💬 0 📌 0

Dividend ETFs Hold Ground as Growth Leaders Retreat – Thursday

What Happened:

Top 2 (by %):

SDY +0.16%: Bullish Momentum – Neutral Sentiment

VYM -0.40%: Bullish Momentum – Neutral Sentiment

Bottom 2:

QQQ -1.53%: Bullish Momentum – Positive Sentiment

SPYG -1.54%: Bullish Momentum – Positive Sentiment

31.10.2025 11:49 — 👍 0 🔁 0 💬 0 📌 0

Emotional investors sell winners and cling to losers

Disciplined investors rebalance

Research shows most investors lock in gains too quickly and let losses ride

That’s drift, not discipline. Vanguard proves rebalancing cuts volatility by ~16%—a calm reset, not a gamble

Time to review your portfolio

31.10.2025 11:15 — 👍 0 🔁 0 💬 0 📌 0

SPY Medium Black Candle: Bearish Signal Fails in Greed

Oct 30

All conds: mean 1.2%, | Predicted declines 32.2%

In QHI 60–80: mean 0.7%, | Predicted declines 34.2%

Bearish signal failed—prices rose on average, tail risk persists in greed.

31.10.2025 10:03 — 👍 0 🔁 0 💬 0 📌 0