Thank you, Louis!

11.07.2025 21:16 — 👍 1 🔁 0 💬 0 📌 0Thank you, Louis!

11.07.2025 21:16 — 👍 1 🔁 0 💬 0 📌 0What a success! Congratulations to everybody involved, and especially to my colleagues at @econtribute.bsky.social! You are indeed excellent! @dfg.de

23.05.2025 07:47 — 👍 6 🔁 2 💬 0 📌 0I don't think there is a contradiction. In 2022 we had to react strongly to avoid inflation expectations becoming entrenched. In such a situation, central banks have to respond even if this leads to a deep contraction (as the Phillips curve is flat).

20.05.2025 11:54 — 👍 2 🔁 1 💬 1 📌 0

Thanks for listening in [in German]! 8/8 podcasts.apple.com/de/podcast/w...

20.05.2025 06:55 — 👍 5 🔁 1 💬 1 📌 0In recent years, we have learned that we cannot “look through” supply-side shocks if they are persistent and threaten to de-anchor inflation expectations. When the inflation regime changes, we must be ready to respond swiftly. #MonetaryPolicyStrategy 7/8

20.05.2025 06:55 — 👍 5 🔁 0 💬 1 📌 0The easing of the German debt brake and the infrastructure package can help overcome the structural crisis and strengthen defence capabilities. Funds need to be spent wisely to foster growth. This should be accompanied by comprehensive structural reforms. 6/8

20.05.2025 06:55 — 👍 0 🔁 0 💬 1 📌 0#CapitalMarketsUnion should focus on risk capital, which is crucial for driving innovation. We need to address the entire value chain: from the start-up phase through the growth phase, all the way to the exit stage within European capital markets. 5/8

20.05.2025 06:55 — 👍 2 🔁 0 💬 1 📌 0A new European growth narrative is emerging, and there is momentum to embark on reforms. One promising way to foster integration is the #28thRegime, which would allow firms, e.g. start-ups, to operate all over the EU under similar conditions. 4/8

20.05.2025 06:55 — 👍 1 🔁 1 💬 1 📌 0After April 2, the euro area became a safe haven, leading to an appreciation of the euro, which signalled increased confidence. We are facing a historical opportunity to foster the international role of the euro. 3/8

20.05.2025 06:55 — 👍 2 🔁 0 💬 1 📌 0

Disinflation is on track, but new shocks are posing new challenges. Tariffs may be disinflationary in the short run but pose upside risks over the medium term. Therefore, we should keep a #SteadyHand, as I argued in a recent speech. #Hoover 2/8 www.ecb.europa.eu/press/key/da...

20.05.2025 06:55 — 👍 1 🔁 0 💬 1 📌 0It was a pleasure to join @mickbroecker.bsky.social & his colleagues in the #TableToday podcast. We covered a lot of ground: monetary policy and inflation, the impact of tariffs, the emergence of a new European growth narrative, and fiscal challenges, with the following key messages. 1/8

20.05.2025 06:55 — 👍 13 🔁 3 💬 1 📌 0

Please note that this blog is a follow-up to a previous blog published in February 2024 titled “The dynamics of PEPP reinvestments”, which explains in more detail how we implemented PEPP reinvestment: www.ecb.europa.eu/press/blog/d... 6/6

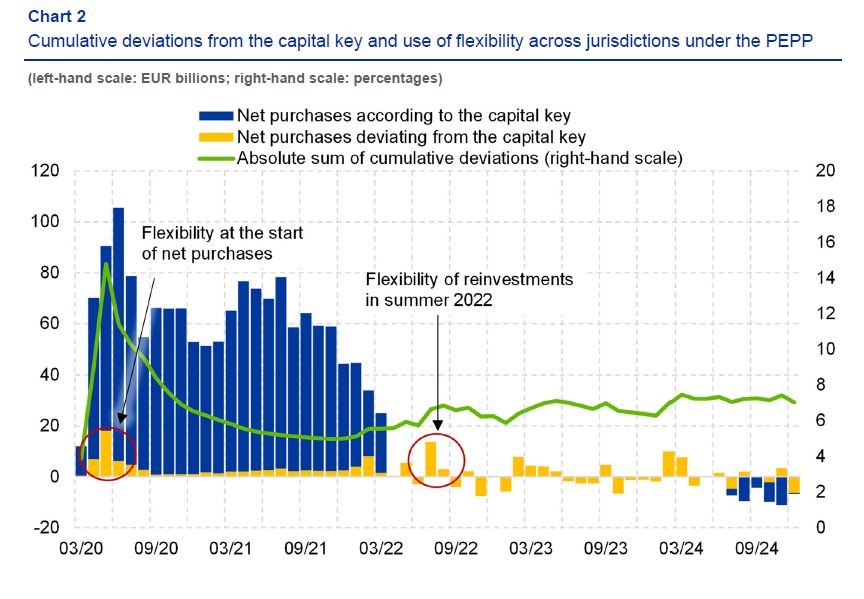

02.05.2025 08:40 — 👍 3 🔁 1 💬 0 📌 0PEPP implementation proceeded smoothly over the entire period. Flexibility was used only rarely, and deviations from the Eurosystem capital key swiftly receded. Looking ahead, the PEPP portfolio will continue to decline at a measured and predictable pace. 5/6

02.05.2025 08:40 — 👍 4 🔁 1 💬 1 📌 0

As regards the use of flexibility, the vast majority of purchases were conducted in line with the capital key. Besides technical factors, deviations occurred at the start of the PEPP in 2020 and in the summer of 2022, responding to risks to the transmission of monetary policy (red circles). 4/6

02.05.2025 08:40 — 👍 1 🔁 0 💬 1 📌 0

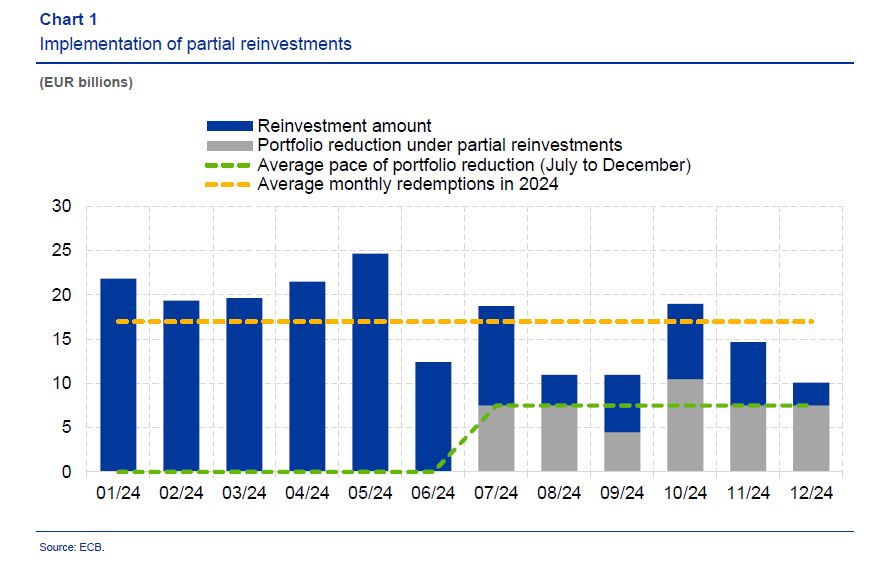

The new data give more insights into the implementation during the reinvestment phase. It shows how the Eurosystem balanced its market presence, taking seasonal patterns of redemptions and issuance into account. 3/6

02.05.2025 08:40 — 👍 1 🔁 0 💬 1 📌 0

In January 2025, the Eurosystem further increased the programme’s transparency by offering additional backward and forward-looking data. This includes historical monthly data for purchases since the start of the programme and forward-looking redemption data: www.ecb.europa.eu/mopo/impleme... 2/6

02.05.2025 08:40 — 👍 2 🔁 0 💬 1 📌 0In a recent #ECBblog post, jointly with our Heads of Market Operations, Imène Rahmouni-Rousseau, we take stock of the implementation of the pandemic emergency purchase programme (PEPP) after we ended reinvestment at the end of 2024. 1/6

02.05.2025 08:40 — 👍 11 🔁 2 💬 1 📌 0

P.S.: As always, the full speech and slides are on the ECB's website.

A special thanks to @andrespicer.bsky.social, @vassoioannidou.bsky.social and Bayes Business School as whole for welcoming me so warmly!

Summing up, financial literacy tends to strengthen the transmission of central bank policies to the real economy. This can support policy effectiveness, enhance public trust in central banks and help people make better financial decisions. 22/22

30.03.2025 15:42 — 👍 2 🔁 1 💬 1 📌 1Financial literacy is also a cornerstone of the #SavingsAndInvestmentUnion. Under its 1st pillar, it aims to encourage citizens to invest in capital markets, which can contribute to financing part of the investment needed for the green and digital transitions. 21/22 eur-lex.europa.eu/legal-conten...

30.03.2025 15:42 — 👍 0 🔁 0 💬 1 📌 0On International Women’s Day, the Eurosystem committed to five joint actions, also aimed at closing the gender gap in financial literacy. Such efforts can only complement, not replace, much broader efforts needed from governments and the education system. 20/22 www.ecb.europa.eu/ecb-and-you/...

30.03.2025 15:42 — 👍 0 🔁 0 💬 1 📌 0

At the ECB, we are taking active steps to foster financial literacy by expanding our communication efforts towards the general public. One example is our “Espresso Economics” channel on YouTube. 19/22 www.youtube.com/channel/UCRY...

30.03.2025 15:42 — 👍 1 🔁 1 💬 1 📌 0

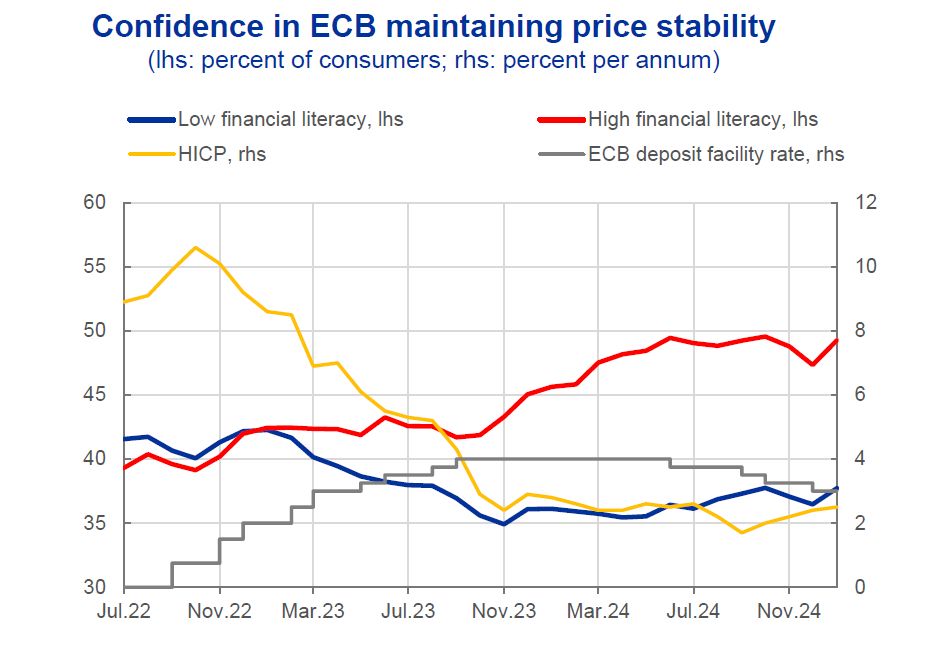

In the most recent inflationary episode, the share of households with high financial literacy that trusted the ECB to maintain price stability rose notably as interest rates rose and inflation came down, while less financially literate households lost confidence. 18/22

30.03.2025 15:42 — 👍 0 🔁 0 💬 1 📌 0

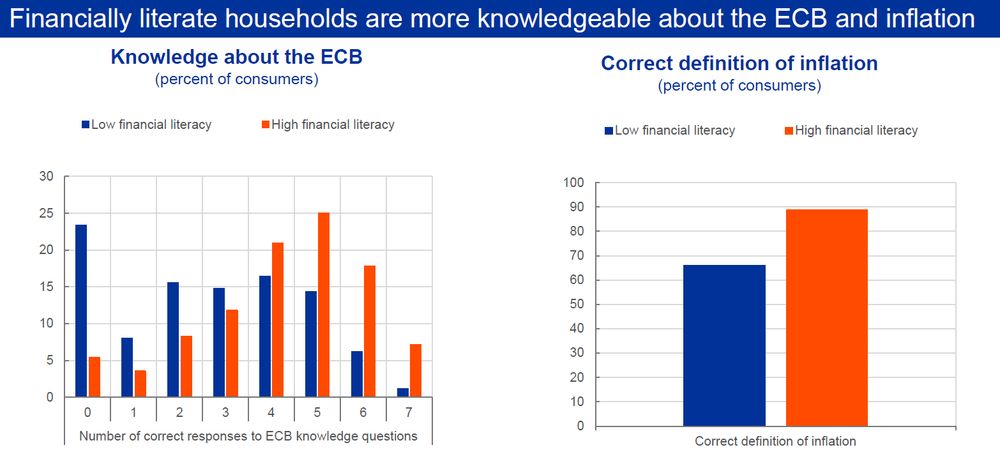

When people better understand monetary policy, they trust central banks more, which helps anchor inflation expectations. Financially literate households are more knowledgeable about the ECB and more likely to know the correct definition of inflation, affecting the ECB’s credibility. 17/22

30.03.2025 15:42 — 👍 0 🔁 0 💬 1 📌 0

To reach audiences beyond experts, the statement has been complemented by highly accessible, visualised statements, available in all EU languages. 16/22 www.ecb.europa.eu/press/press_...

30.03.2025 15:42 — 👍 0 🔁 0 💬 1 📌 0

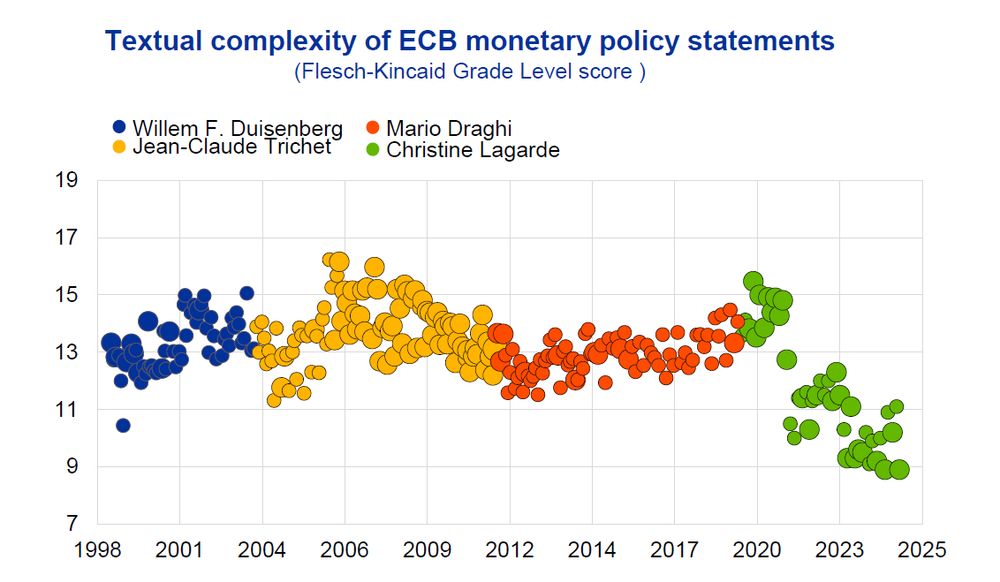

Since our 2021 monetary policy strategy review, we have put more emphasis on explaining our monetary policy decisions to the general public in an accessible way. Our new monetary policy statement is less complex, which increases its readability. 15/22

30.03.2025 15:42 — 👍 0 🔁 0 💬 1 📌 0

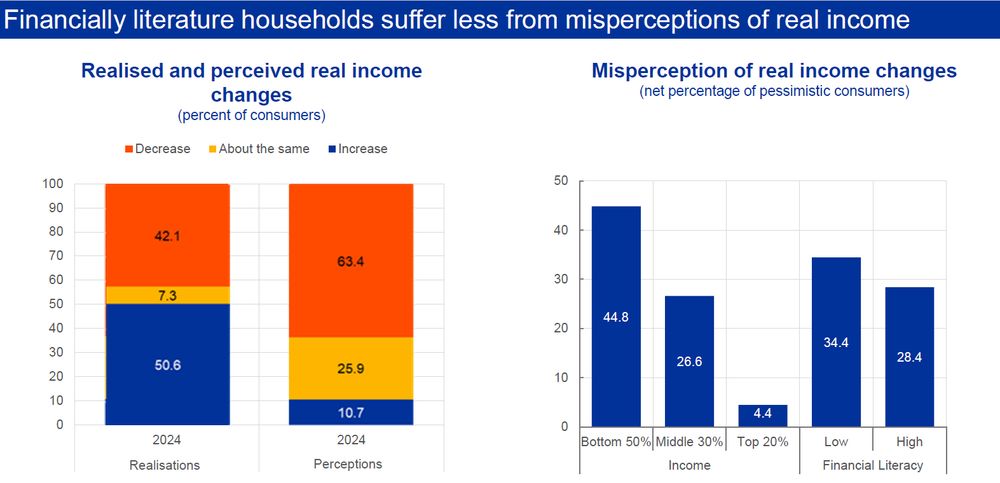

Financial literacy also affects household perceptions of real income. While 50% of households experienced positive real income growth in 2024, only 11% perceived that their real income had increased. The degree of misperception depends negatively on income and financial literacy. 14/22

30.03.2025 15:42 — 👍 0 🔁 0 💬 1 📌 0

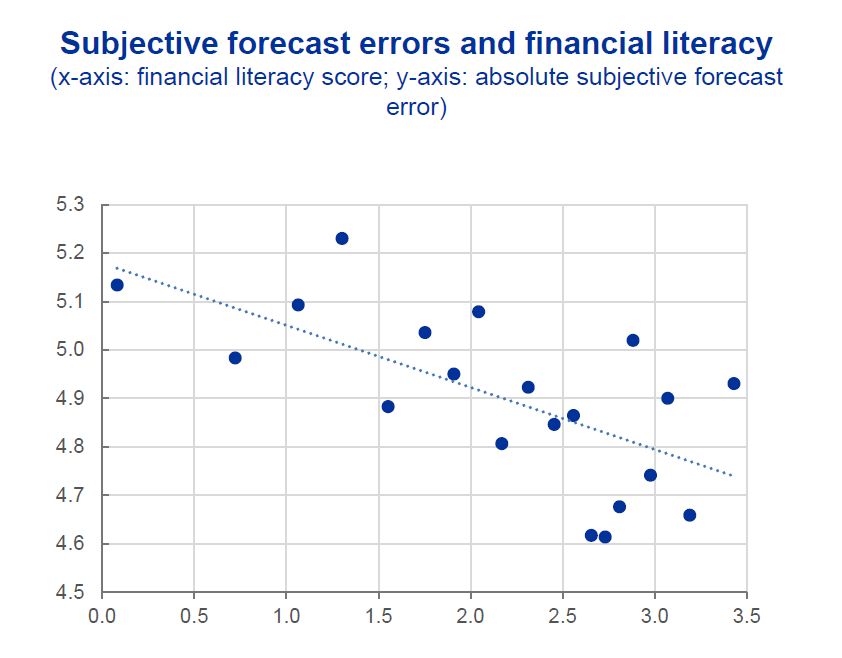

The observed differences in the formation of inflation expectations translate into lower subjective forecast errors for more financially literate people. Hence, households with higher levels of financial literacy tend to have more accurate inflation expectations. 13/22

30.03.2025 15:42 — 👍 0 🔁 0 💬 1 📌 0

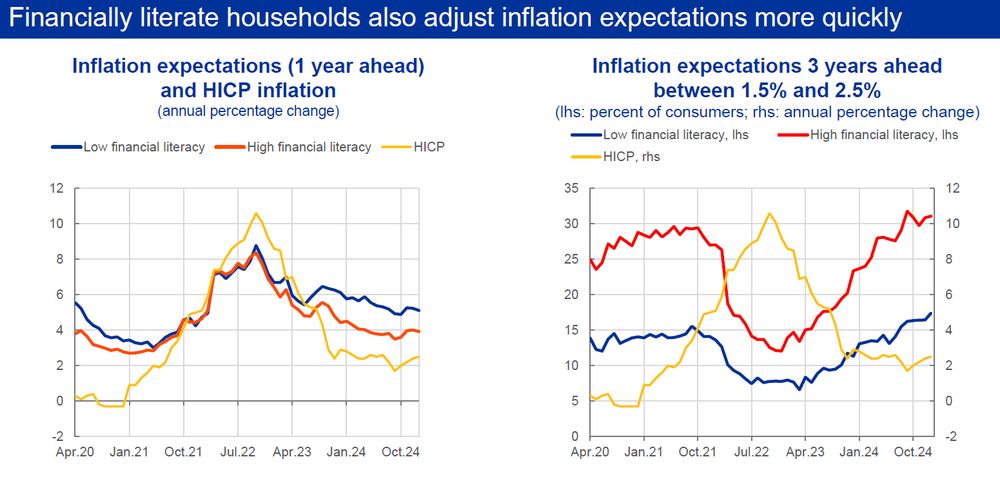

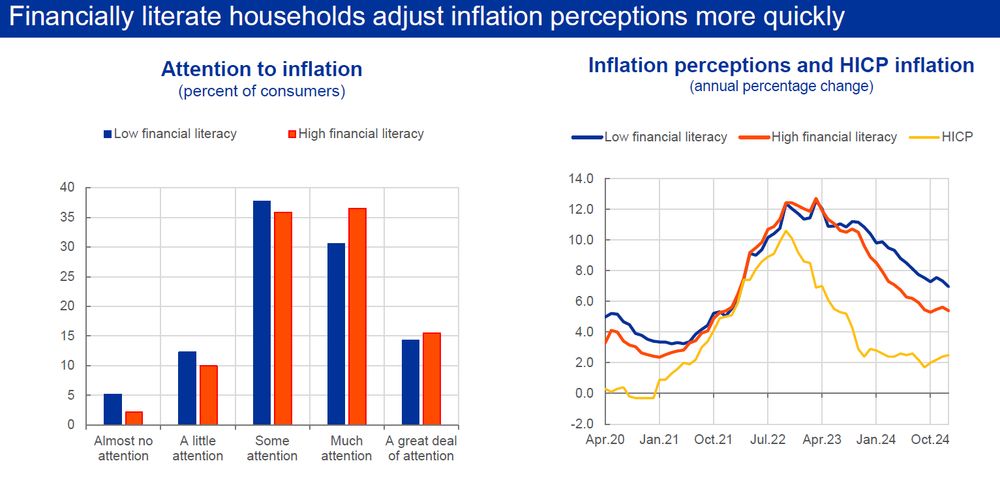

Similarly, inflation expectations of financially literate households have dropped more quickly. While the share of consumers with inflation expectations broadly anchored around 2% has been low overall, the financially literate are more responsive to actual inflation developments. 12/22

30.03.2025 15:42 — 👍 0 🔁 0 💬 1 📌 0

Survey evidence indicates that households with higher financial literacy pay more attention to inflation. However, even for financially literate people, inflation perceptions of past inflation are often very persistent, adapting slowly to actual inflation dynamics. 11/22

30.03.2025 15:42 — 👍 0 🔁 0 💬 1 📌 0