It was a very stimulating conference with amazing projects studying climate, trade and industrial policies! Thank you for including my JMP on climate agreements on the program!

21.03.2025 21:33 —

👍 5

🔁 0

💬 0

📌 0

Thank you for reading until the end! The full paper can be found here:

thomasbourany.github.io/files/Bouran...

17.03.2025 16:27 —

👍 1

🔁 0

💬 0

📌 0

Quantifying climate damages and geographic spillovers (through migration and trade) is also challenging. Jordan

@jordanrk.bsky.social 's research focuses on estimating climate costs, studies model uncertainty, and explores the role of cities in adapting to global warming. Check out his work!

17.03.2025 16:27 —

👍 1

🔁 0

💬 1

📌 0

International agreements are crucial for effective action. We can improve welfare by optimally choosing the carbon tax, the tariffs to enforce agreements, and the optimal size of the "club" when countries can free ride, as I study in my JMP bsky.app/profile/tbou...

17.03.2025 16:27 —

👍 1

🔁 0

💬 1

📌 0

Moreover, renewable subsidies are less effective than carbon taxes. Coordinated policies like "climate clubs", i.e. carbon tax with tariffs (e.g. EU’s CBAM) generate global gains but unequal costs across countries depending on differences in climate, energy, and trade linkages

17.03.2025 16:27 —

👍 1

🔁 0

💬 1

📌 0

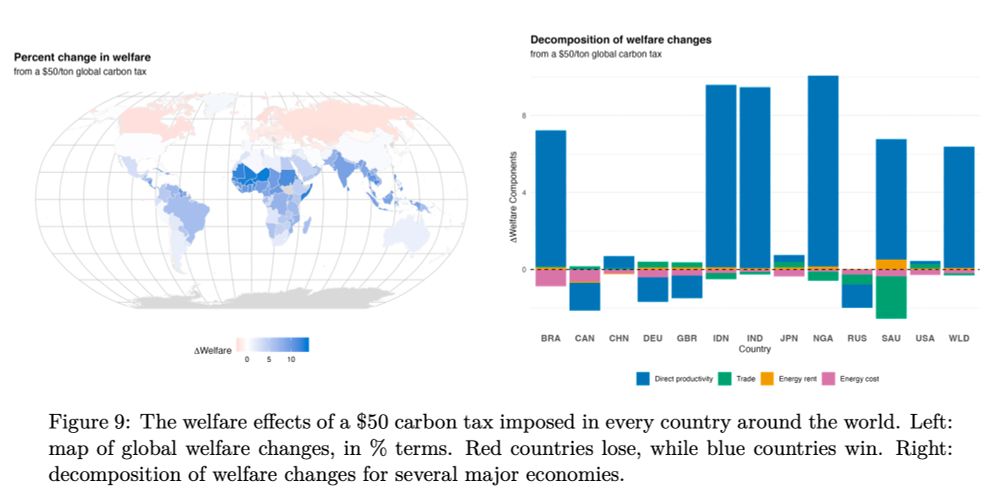

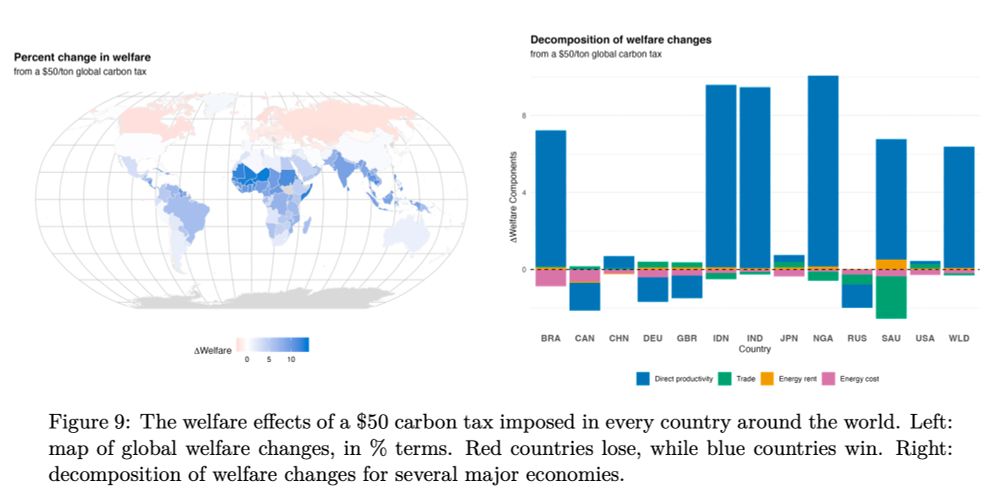

Global climate policies are most effective, reducing emissions by 4% with a $50 carbon tax. But they create stark redistributive effects: hot countries benefit from improved climate, while the strength of the substitution between coal, oil, and gas affects energy costs and rents

17.03.2025 16:27 —

👍 1

🔁 0

💬 1

📌 0

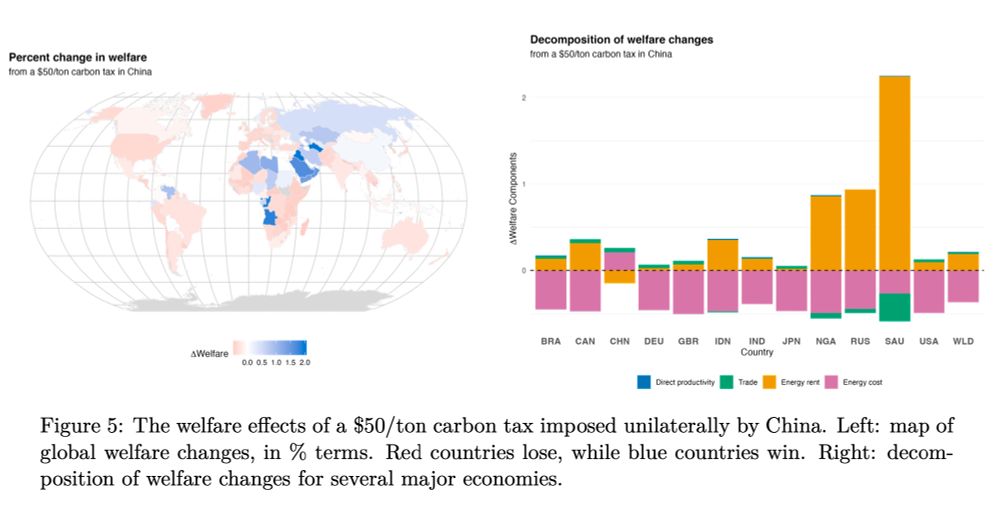

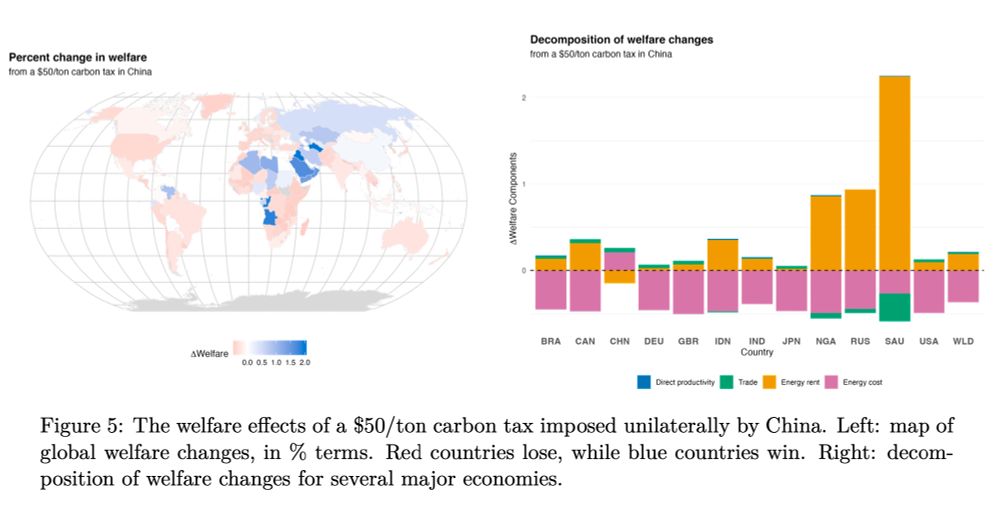

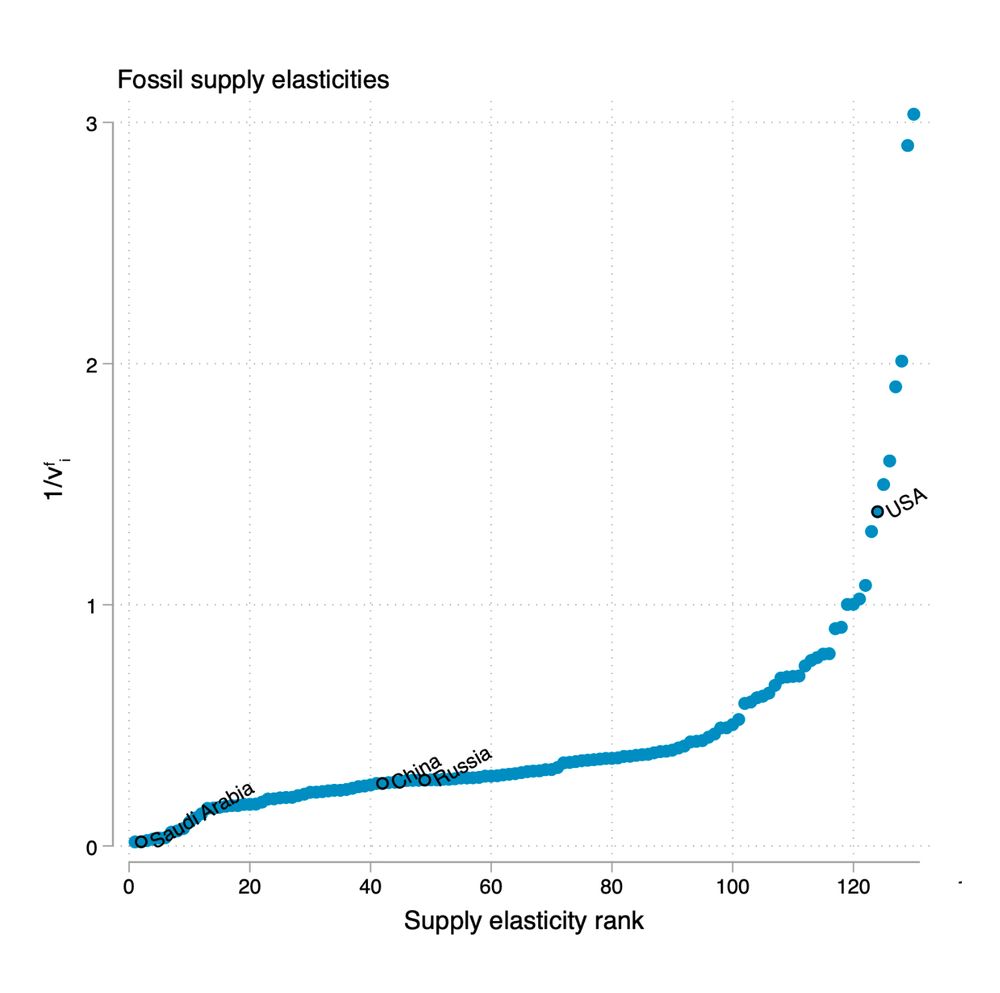

Carbon taxation affects countries differently based on their energy profile. China's reliance on coal means that carbon taxes shift consumption toward oil/gas, raising global fossil fuel prices. This benefits oil exporters like Saudi Arabia & Russia while hurting energy importers

17.03.2025 16:27 —

👍 1

🔁 0

💬 1

📌 0

Unilateral climate policies have limited effects on global emissions but create significant winners and losers through energy markets and international trade. The welfare effects of carbon leakage can be an order of magnitude larger than gains from emission reductions

17.03.2025 16:27 —

👍 1

🔁 0

💬 1

📌 0

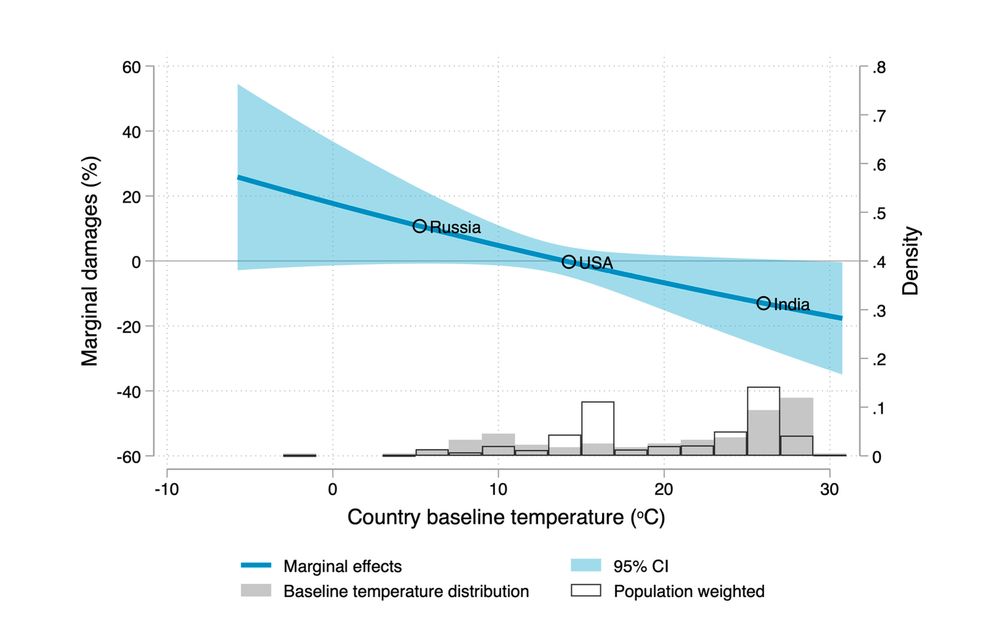

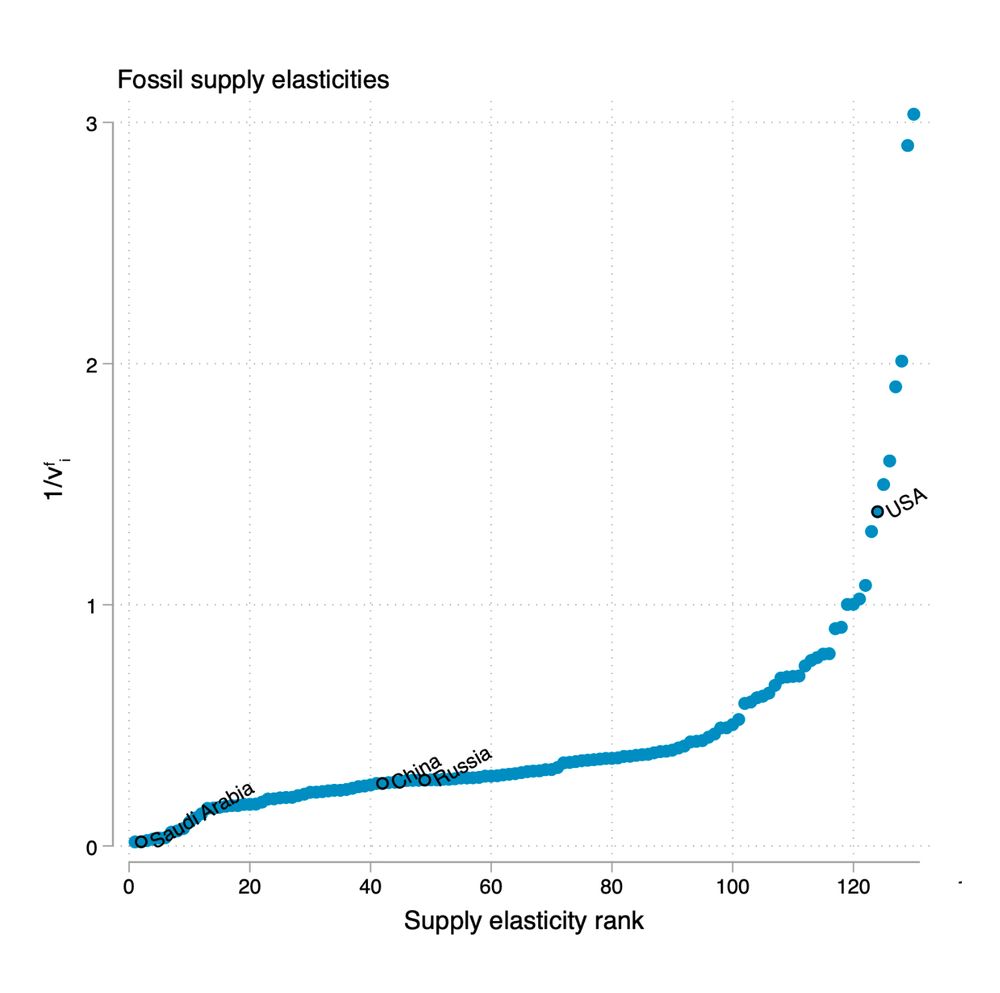

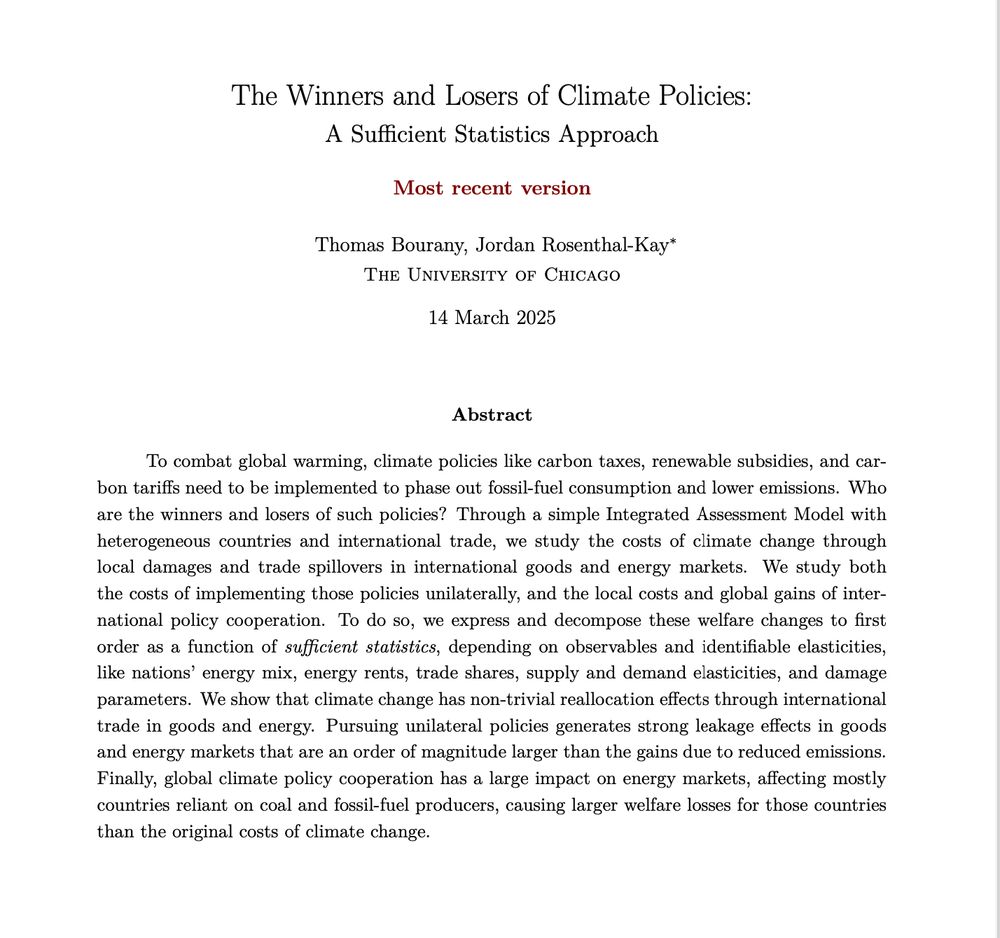

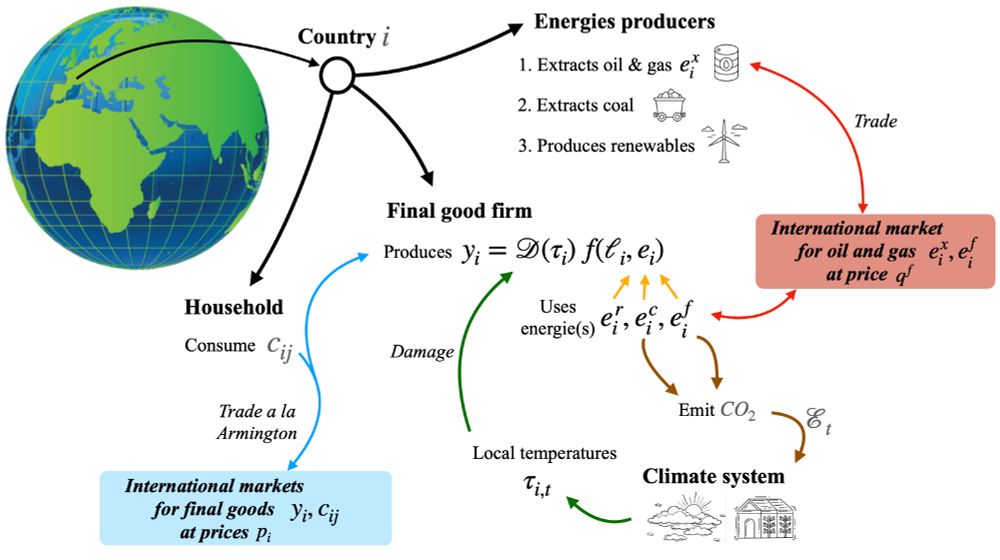

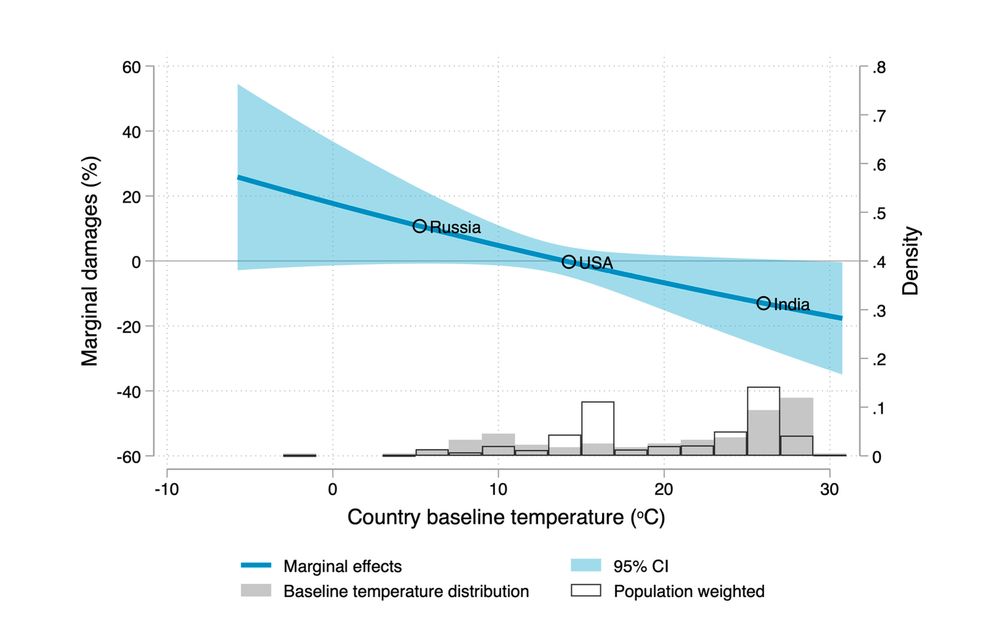

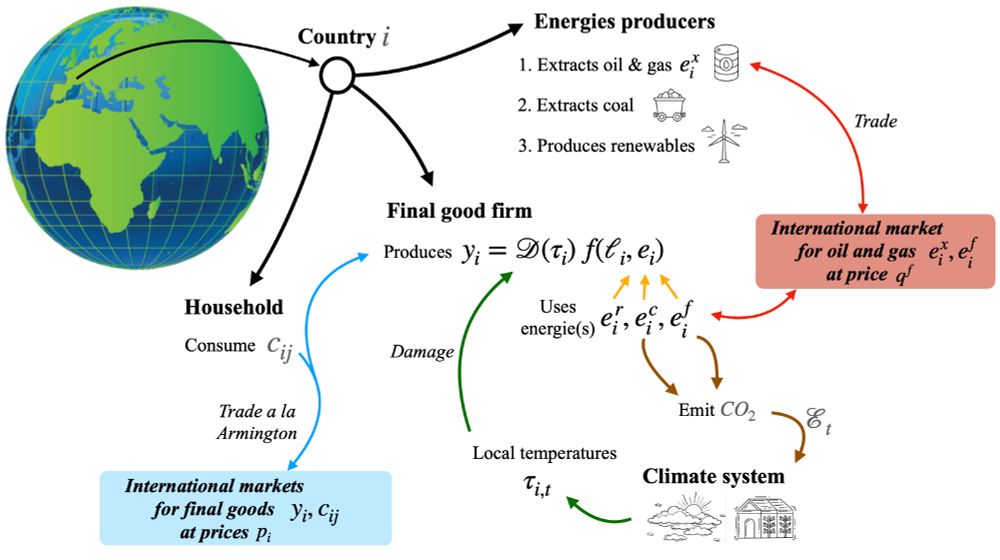

Aside from observable moments, such as countries' energy mix (in oil, gas, coal, renewable), international trade shares, or energy rents as a share of GDP, we estimate key parameters like the climate damage and fossil energy supply elasticities

17.03.2025 16:27 —

👍 1

🔁 0

💬 1

📌 0

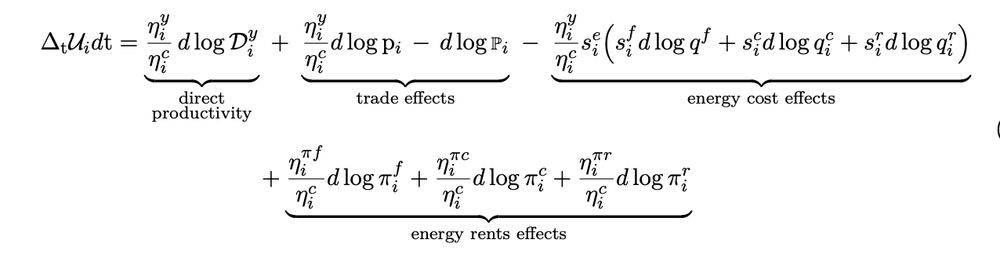

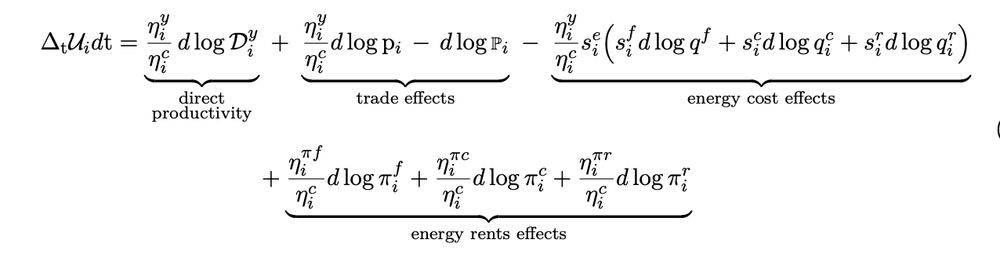

We do a log-linearization of this model to do a welfare decomposition of these policies into four channels: (i) climate damages or direct productivity, (ii) the terms-of-trade effects, (iii) the impact on energy prices and costs, (iv) the effect on profits/energy rents

17.03.2025 16:27 —

👍 1

🔁 0

💬 1

📌 0

We study these effects in a model with heterogeneous countries, trade, and energy markets to quantify the welfare effects of climate policies. We summarize them with "sufficient statistics" which only requires observable data moments (energy mix, trade shares) and key elasticities

17.03.2025 16:27 —

👍 1

🔁 0

💬 1

📌 0

One of the major drawbacks of carbon taxation is the “leakage effect”: (i) carbon taxes raise goods' prices, reallocating activity to countries without climate policies, and (ii) reducing fossil fuels demand lowers the price of oil and gas for other countries, which now consume and emit more

17.03.2025 16:27 —

👍 1

🔁 0

💬 1

📌 0

New Paper Alert🚨 “The Winners and Losers of Climate Policies: A Sufficient Statistics Approach” with Jordan Rosenthal-Kay @jordanrk.bsky.social

We study the spillovers of climate policies across countries through trade and energy markets #EconSky #ClimatePolicy #TradeLeakage #CBAM🧵1/10

17.03.2025 16:27 —

👍 9

🔁 3

💬 2

📌 0

Mass Layoffs Begin at NOAA

The cuts came just before a separate wave of departures was expected under the Trump administration’s so-called deferred resignation program.

I was sitting in NOAA's Boulder lab today when people got fired. Tears in the hallway. Security escort.

They fired a great young scientist.

Beyond the anti-science nonsense, letting smart & cheap new hires go is an incompetent way to cut costs.

www.nytimes.com/2025/02/27/c...

28.02.2025 00:26 —

👍 23

🔁 9

💬 3

📌 0

Very interesting conference on the Political Economics of Climate change at @stanforddoerr.bsky.social Thank you for allowing to present my JMP on climate agreements

07.02.2025 01:31 —

👍 5

🔁 1

💬 0

📌 0

Research & Work in progress

Thank you for reading until the end! Happy to chat more about these topics during this Job Market season and at upcoming conferences!

The job market paper and my research can be found here: thomasbourany.github.io/research/

#EconJMP #EconSky

03.12.2024 20:06 —

👍 0

🔁 0

💬 0

📌 0

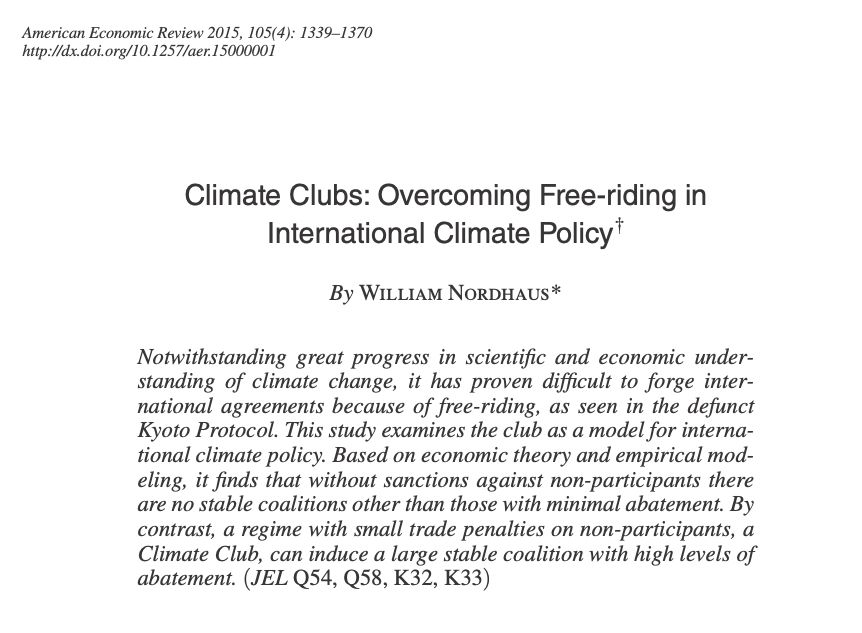

I stand on the shoulders of giants: Nordhaus, of course, and the amazing research on carbon taxation and the impacts of climate change by my advisors at UChicago,

@UChicago economics: Mike Golosov, Esteban Rossi-Hansberg, Lars Hansen, and Michael Greenstone (not yet converted to #EconSky)

11/10

03.12.2024 19:59 —

👍 1

🔁 0

💬 1

📌 0

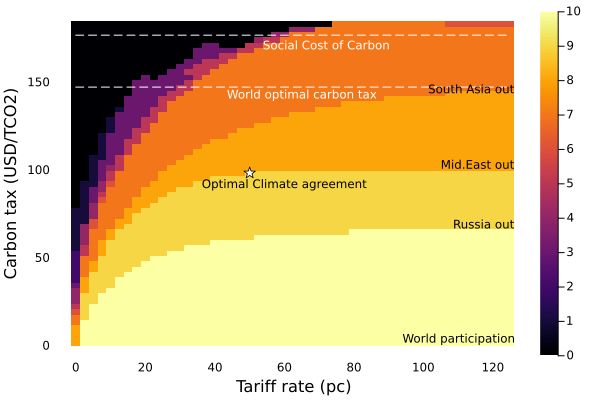

In the paper, I study additional policy instruments and extensions (transfers to developing countries, as discussed in COP28-29, fossil-fuel-specific sanctions, retaliation and trade wars, carbon tax Laffer curve, etc.). Happy to discuss them in more detail! 10/

03.12.2024 19:59 —

👍 2

🔁 0

💬 1

📌 0

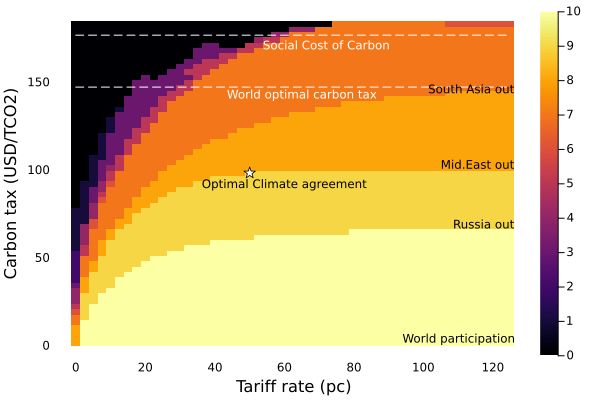

As a result, it is optimal to lower the carbon tax (from $150/tCO2 to ~$100) to encourage participation. But not too much! It is beneficial to leave Russia out of the club, otherwise we would need to decrease carbon tax so much that we lose the benefits of climate cooperation! 9/

03.12.2024 19:59 —

👍 1

🔁 0

💬 1

📌 0

The result is summarized in this graph: it shows the participation of different regions for various carbon taxes (y-axis) and trade tariffs (x-axis). We see that Russia, Gulf countries, and South Asia have little incentives to join a climate club for high carbon taxes, in spite of large tariffs 8/

03.12.2024 19:59 —

👍 1

🔁 0

💬 1

📌 0

This policy question is challenging: it involves solving jointly for the optimal policy (as in Public Finance) and the choice of countries (as in Combinatorial Discrete Choice problems) in a Nash Equilibria. I develop a method inspired by these two lit. to handle this problem 7/

03.12.2024 19:59 —

👍 3

🔁 0

💬 1

📌 0

I build a quantitative Integrated-Assessment Model, extended with heterogeneous countries, energy markets, and international trade. It replicates empirically realistic features that are at the heart of countries' decisions to join climate agreements (e.g. income, energy mix, gains from trade) 6/

03.12.2024 19:59 —

👍 1

🔁 0

💬 1

📌 0

This reveals a trade-off between an intensive margin - a small club with a high carbon tax (think of the EU) - and an extensive margin - a club with more countries, at the cost of lowering the carbon tax in order to encourage participation (e.g. a non-binding world agreement) 5/

03.12.2024 19:59 —

👍 1

🔁 0

💬 1

📌 0

In my Job Market Paper, I study the optimal design of such climate clubs: the optimal choice of the carbon tax and trade tariffs, and the choice of countries in the climate agreement, subject to strategic participation constraints when countries can deviate and leave the agreement 4/

03.12.2024 19:59 —

👍 1

🔁 0

💬 1

📌 0

Despite the pledges made at the COPs, climate agreements are usually non-binding. Nordhaus (AER 2015) suggested the idea of "Climate Clubs" where club members set a carbon tax on their emissions and impose trade tariffs on non-members: this encourages participation/cooperation 3/

03.12.2024 19:59 —

👍 1

🔁 0

💬 1

📌 0

Free-riding is a major obstacle to climate action: countries have no incentives to implement globally optimal climate policies. Moreover, free-riding is exacerbated by the redistributive effects of fossil-fuels taxation across countries and the heterogeneous impacts of climate change 2/

03.12.2024 19:59 —

👍 1

🔁 0

💬 1

📌 0

I'm excited to share my JMP "The Optimal Design of Climate Agreements" where I study carbon taxation and trade tariffs in the presence of free-riding incentives and inequality.

This is particularly related to the current discussions on trade policies and climate action

#EconSky #COP29 #Climate 🧵1/10

03.12.2024 19:59 —

👍 16

🔁 3

💬 3

📌 2

Also, thanks to @carbonbrief.org and @climatenews.bsky.social for following and summarizing the results of these debates!

29.11.2024 20:39 —

👍 1

🔁 0

💬 0

📌 0

Research & Work in progress

I explore some of these theoretical considerations in my Job Market Paper!

Looking forward to further climate policy debates and more ambitious objectives next year at Belém’s COP in Brazil!

thomasbourany.github.io/research/

29.11.2024 20:27 —

👍 2

🔁 0

💬 1

📌 0