RTC+B on your mind? Ours too. Join Tyba’s policy and optimization experts for a live webinar on what RTC+B means for #energystorage operations in ERCOT.

Register >> zoom.us/webinar/regi...

#energysky

@tybaenergy.bsky.social

Maximize the profitability of energy storage projects with an all-in-one bidding, dispatch, and optimization platform. tyba.ai

RTC+B on your mind? Ours too. Join Tyba’s policy and optimization experts for a live webinar on what RTC+B means for #energystorage operations in ERCOT.

Register >> zoom.us/webinar/regi...

#energysky

Fun weekend in #ERCOT. With outages creeping up as we enter shoulder season and low capacity available to SCED 3 evenings in a row - #energystorage had numerous arbitrage opportunities.

#energysky #🔋

H1'25 in #ERCOT was marked by low volatility and wide spreads between high & low performers.

📉 Avg RT energy prices only exceeded $500/MWh in 3 intervals

🔋 Top earners net $6.19/kW-mo, median earned $2.13

⭐ Top performer captured 90% of their DA TB2, median caught 46%

Deep dive >> bit.ly/3Vmh6dK

ERCOT Day-Ahead energy premium August 11-15

August 12th DA energy premium and bidding strategy

Last week DA energy cleared at a premium to RT in #ERCOT

⬆️ DA cleared $65-200/MWh higher than RT

↕️ Biggest spread was on 8/12: load forecast was high (83GW+) & wind forecast was low (~7GW)

ERCOT was bracing for scarcity that didn't materialized - and many operators are missing DA opportunities.

Tyba, White Pine Renewables, and PG&E collaborate on DIDF battery project in CAISO

Excited to see @maeveallsup.bsky.social feature the Distribution Infrastructure Deferral Framework (DIDF) projects we're optimizing in CAISO! An innovative new use case for batteries that can enhance grid reliability without sacrificing returns. #energysky

15.08.2025 15:58 — 👍 2 🔁 0 💬 0 📌 0

In May, market dynamics in #ERCOT didn’t follow the usual playbook.

AS comprised the majority of revenue (58%)

The most successful operators were dynamic – able to capture RT price spikes when they materialized (looking at you, May 16th), but prioritized AS when it made sense.

#energysky

Proud to partner with Avangrid to advance their storage modeling efforts.

📍 2,400 locations

🗺️ 7 ISOs

🔋 Simulated participation in DA, RT, and AS markets under varied market conditions

📈 Identified where batteries provide the greatest ROI

www.businesswire.com/news/home/20...

#energysky #storage

The clean energy industry will still move forward post #OBBB.

A reduction in new supply only leads to an increase in electricity prices... which means generation and storage assets increase in value. #energysky

www.tyba.ai/resources/in...

April in #ERCOT:

📈 Top 20 earners avg $4.75/kW, capturing 89% of DA TB2 and 64% of RT TB2

🔋 Top 20 performers (by TB2 capture) avg $4.39/kW, capturing 99% of DA TB2 and 71% of RT TB2

🕝 RT energy comprised 50% of fleet revenue (up from 43% in Q1 and 26% in 2024)

#energysky

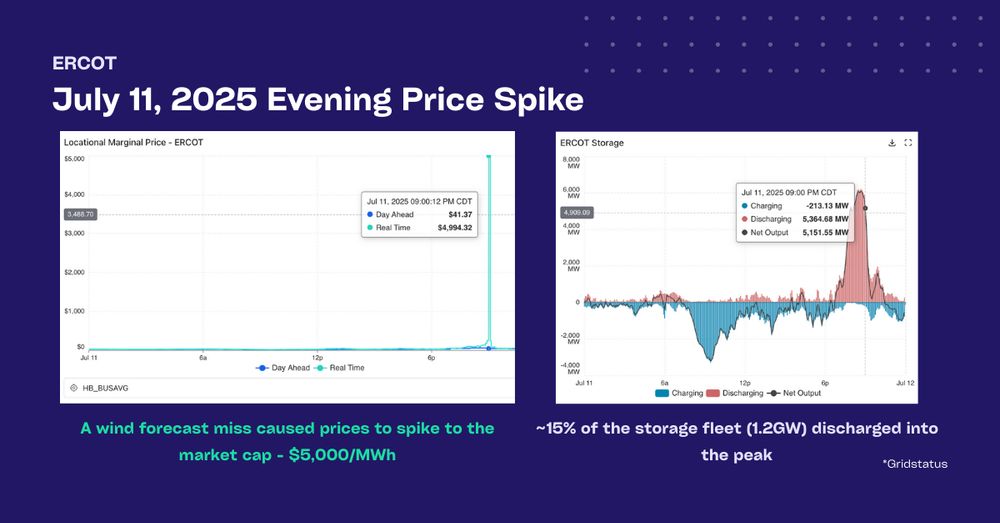

Who caught ERCOT's Friday night (9pm) price spike?

Caused by a wind miss (4-5 GW wind generation miss vs. DA forecasted P50 value), #ERCOT needed to quickly replace the capacity - RT energy prices shot up the market cap ($5K).

Check out the details of his talk: www.tyba.ai/resources/in...

10.07.2025 15:41 — 👍 0 🔁 0 💬 0 📌 0Yesterday, our CEO presented at FERC's conference.

Energy storage is fast becoming the grid’s most valuable resource — but realizing its full potential depends on:

⚡ Software to navigate market and grid complexity in real time

🎨 ISO and market design that unlocks and values its flexibility

Update: a price correction was officially issued. According to ERCOT, "during a software change deployment for the Market Management System (MMS), a software defect caused an unwarranted drop in Real-Time Online Reserves and Real-Time Offline Reserves, which resulted in an erroneous spike"

02.07.2025 18:21 — 👍 0 🔁 0 💬 0 📌 0

ERCOT Real-Time Prices, 3:40pm on July 30, 2025

Anyone catch the red-out across #ERCOT today? Around 3:40pm, LMPs were at the market cap ($5K) across TX 🔌💡

High prices were driven by RTORPA, an adder that pays if you're online with headroom to discharge. Batteries with SoC and no AS obligations get the full value of the adder. #energysky

We'd love to connect. We manage a number of hybrid projects today -- happy to share best practices.

26.06.2025 17:27 — 👍 0 🔁 0 💬 0 📌 0

Q1 2025 was mild for #BESS in ERCOT. Top line revenue was down, and the spread of outcomes was wide.

💵 Top earner net $16.06/kW, >3x median

📈 Top performer captured 99% of their DA TB2, ~2x median

💡 64%+ fleet revenue was made in energy products

Deep dive: www.tyba.ai/resources/ca...

#energysky

Program launch order: bit.ly/45YrdvR

25.06.2025 16:23 — 👍 0 🔁 0 💬 0 📌 0TODAY the prequalification window for NJ’s GSESP is open.

What to know:

⚡ NJ aims to contract 1GW of transmission-scale storage

📅 Winners will get a fixed $/MW-yr rate for 15-yrs

💲 Selection mainly based on bid price, consideration for community benefits

🔋 4-hr discharge, must COD within 30 months

March 2025 ERCOT breakdown: www.tyba.ai/resources/ca...

17.06.2025 20:45 — 👍 0 🔁 0 💬 0 📌 0Despite limited price spikes in #ERCOT, #energystorage leaned on energy arb for 69% of revenue in March.

At a glance:

📈 Top revenue generators earned $6.26/kW — over 3x the fleet median

🎯 Top performers captured 115% of its DA TB2, while the median came in around 48%

March 2025 breakdown ⬇️

Many ERCOT #🔋 operators know there can be a delay between go-live, and qualifying for AS. But, with a flexible optimizer, you can start generating revenue right away with RT energy-only. Given RT volatility - this provides major upside as you prepare for AS. #energysky

www.tyba.ai/resources/gu...

Any #energystorage folks thinking about the MA DOER RFP opening in July?

🔋 Seeking projects ranging in size from 40MW–1GW

💵 Projects will earn fixed annual payments per Clean Peak Energy Certificate (CPEC)

🙌 Battery owners retain operational control

Full breakdown: www.tyba.ai/resources/gu...

DA energy is becoming a bigger part of the revenue stack for #energystorage operators in ERCOT. In January, DA energy accounted for 26% of total storage revenue in ERCOT, up from just 9% in 2024.

But DA comes with increased risk.

How are operators managing this risk - or not?

#energysky #🔋

2024 wasn’t a record year for battery storage revenue — but smart operators stood out.

Top assets made $88.96/kW (2.5x median), with 65% of revenue from AS.

Winners shifted to energy arb, in keeping with evolving market dynamics.

More in our breakdown: www.tyba.ai/resources/ca...

#energysky #🔋

Operators that executed balanced strategies - including DA and AS performed better (captured a higher % of TB2) #🔋

- Top revenue generators mainly benefited from being at more volatile nodes

- Top performers captured more of the available opportunity by utilizing all available products

December 2024 in #ERCOT was fairly quiet, with storage assets making $1.18/kW (avg) & capturing 33% of RT TB2. Top 10 revenue generators made 81% of revenue from RT energy but captured only 51% of RT TB2 — meaning significant opportunity was left on the table #energysky

www.tyba.ai/resources/ca...

We dive into four real examples of PQ ekeing out incremental value from this past month - check it out and let us know your thoughts!

06.03.2025 17:04 — 👍 0 🔁 0 💬 0 📌 0How? There is always a price at which you’d be willing to buy/sell energy. Moments before each interval, the optimizer looks at an asset’s SOC, assesses future buying/selling opportunities (forecast based) – then configures and places multiple bids that offer a specific capacity for a given price.

06.03.2025 17:03 — 👍 0 🔁 0 💬 1 📌 0

With an increasing amount of #🔋 revenue tied to energy arbitrage, how can operators ensure they are selling the most capacity into the highest peaks and charging into the lowest troughs? Our Dynamic PQ Bidding is an algorithmic way to do just that.

#energysky

www.tyba.ai/resources/gu...

When assessing storage performance, how do you know what good looks like? Total revenue doesn’t tell the full story. In #ERCOT, every node has a different amount of volatility (ie. arbitrage opportunity). Optimal performance is maximizing opportunity capture.

#energysky