Here is the recording of the excellent virtual seminar by

Adrien Auclert. Check it out, you'll get both a valuable primer on the HANK modeling approach *and* new contributions on firm and investment heterogeneity!

Thank you Adrien, we all learned a lot!

cepr.org/multimedia/v...

10.02.2026 20:52 —

👍 2

🔁 0

💬 0

📌 0

https://sffed.us/CMR

This research is part of the Center for Monetary Research at the Federal Reserve Bank of San Francisco:

sffed.us/CMR

16.12.2025 21:07 —

👍 1

🔁 0

💬 0

📌 0

Thanks to my excellent coauthors Miguel Acosta, andreaajello.bsky.social, Francesca Loria, and Silvia Miranda-Agrippino!

16.12.2025 21:07 —

👍 1

🔁 0

💬 1

📌 0

We also find that monetary policy has significant effects on market-based inflation and dividend expectations that are consistent with conventional transmission channels. Term structure responses peak at longer horizons, suggesting there are signals about the reaction function.

16.12.2025 21:07 —

👍 0

🔁 0

💬 1

📌 0

In our working paper "Financial Market Effects of FOMC Communication: Evidence from a New Event-Study Database" we describe the USMPD in detail and document new empirical results. For example, large policy surprises have made a comeback, and press conferences play a key role...

16.12.2025 21:07 —

👍 0

🔁 0

💬 1

📌 0

The USMPD contains market reactions to all official FOMC communication events since 1994, including statements, post-meeting press conferences and minutes releases. It also includes data and code for high-frequency monetary policy surprises.

16.12.2025 21:07 —

👍 0

🔁 0

💬 1

📌 0

📢 New Data & Paper 📢

We released the U.S. Monetary Policy Event Study Database, a public, transparent, and regularly updated dataset of high-frequency financial market reactions to all official FOMC communication since 1994.

Data: sffed.us/USMPD

Paper: frbsf.org/research-and...

16.12.2025 21:07 —

👍 8

🔁 2

💬 1

📌 1

Excellent VSME talk by Jordi Gali, who provided a new perspective on monetary policy rules based on his Keynes Lectures and discussion at Jackson Hole of Emi Nakamura's paper. He makes a compelling case for rules for long-term real rates. Video here:

www.youtube.com/watch?v=UrbH...

11.11.2025 16:12 —

👍 3

🔁 1

💬 0

📌 0

The Center for Monetary Research: First Year in Review - San Francisco Fed

To mark the first year since the Center for Monetary Research’s launch, the San Francisco Fed reviews the Center’s research activities and events.

We launched the Center for Monetary Research about one year ago. The first year brought a flurry of activities, research, and new data&indicators. Special highlight:

Adrien Auclert receiving the inaugural Janet Yellen Award! My blog post has a review and outlook:

www.frbsf.org/research-and...

04.11.2025 22:13 —

👍 1

🔁 0

💬 0

📌 0

Very excited that our third monthly VSME is coming up this Thursday. We'll hear from Jordi Gali about monetary policy in the New Keynesian model.

Please join us on Zoom at 11am Eastern / 5pm CET! Webinar registration here:

cepr-org.zoom.us/webinar/regi...

04.11.2025 22:12 —

👍 2

🔁 0

💬 0

📌 0

We hope you had a nice summer, the Virtual Seminar on Monetary Economics is now in session! Please join us this Thursday at 8am PT / 11am ET for our first seminar! Zoom webinar registration here: cepr-org.zoom.us/webinar/regi...

02.09.2025 20:52 —

👍 3

🔁 0

💬 0

📌 0

In a nutshell, the paper proposes a taxonomy for economic risks and uncertainties, reviews various measures and models available for quantitative assessments, and discusses ways how central banks can communicate uncertainty to the public. 2/3

26.08.2025 20:05 —

👍 2

🔁 0

💬 1

📌 0

Accounting for Uncertainty and Risks in Monetary Policy

The Federal Reserve Board of Governors in Washington DC.

🧵It was a great pleasure to work with excellent colleagues across the @federalreserve.gov on a paper for the FOMC framework review. Thanks to my coauthors Travis Berge, Giuseppe Fiori, Francesca Loria, Molin Zhong. You can find the paper here:

www.federalreserve.gov/econres/feds... 1/3

26.08.2025 20:05 —

👍 2

🔁 1

💬 1

📌 0

Interested in top-notch research in monetary economics? Join us for this new online seminar series, co-hosted CEPR's Monetary Economics and Fluctuations program and our Center for Monetary Research! @ivanwerning.bsky.social will kick things off on Sep-4.

Sign up: cepr-org.zoom.us/webinar/regi...

31.07.2025 15:11 —

👍 1

🔁 1

💬 0

📌 0

Call for Papers: 2nd Annual Conference on Macro-Finance Research - San Francisco Fed

Submissions due by May 31, 2025, for the 2nd Annual Conference on Macro-Finance Research, to be held in San Francisco on October 10, 2025.

🚨Friendly reminder that Saturday, May 31 is the deadline to submit (a) papers to our fall macro-finance conference and (b) nominations for the new Janet Yellen Award for Monetary Research, both initiatives of our new Center for Monetary Research. Details are here: www.frbsf.org/news-and-med...

27.05.2025 23:12 —

👍 2

🔁 1

💬 0

📌 0

Subscriptions - San Francisco Fed

Subscribe to our mailing lists to learn more about what’s happening in the Twelfth District. Receive the latest news, information, research, and insights on

🚀Stay ahead of the curve! If you're interested in events, new papers, and data updates of our Center for Monetary Research, you can sign up for the quarterly newsletter here: frbsf.org/subscription...

#MonetaryPolicy #MacroFinance #CentralBanking #EconSky

19.05.2025 19:01 —

👍 3

🔁 0

💬 0

📌 0

Second Thomas Laubach Research Conference

economic Conference - The Federal Reserve Board of Governors in Washington DC.

Excellent papers at the Second Thomas Laubach Conference of the @federalreserve.bsky.social Follow Ben Bernanke's presentation on Central Bank Communication live now, or watch the recording later. Great stuff!

www.federalreserve.gov/conferences/...

16.05.2025 13:51 —

👍 3

🔁 1

💬 0

📌 0

The nominee should have received their Ph.D. within the last ten years, but exceptions due to career breaks are possible. Please send nominations to CMR@sf.frb.org by May 31, 2025. Nominations should include a brief justification and the nominee’s CV. Self-nominations are accepted.

13.05.2025 20:50 —

👍 0

🔁 0

💬 1

📌 0

📢Call for Nominations📢

The SF Fed and its Center for Monetary Research are launching the new Janet Yellen Award!

This award will be given annually to an exceptional early-career researcher who has made significant and policy-relevant contributions to macro-finance and/or monetary economics.

13.05.2025 20:50 —

👍 9

🔁 6

💬 1

📌 0

Call for Papers: 2nd Annual Conference on Macro-Finance Research - San Francisco Fed

Submissions due by May 31, 2025, for the 2nd Annual Conference on Macro-Finance Research, to be held in San Francisco on October 10, 2025.

The SF Fed's Center for Monetary Research is hosting our 2nd Annual Macro-Finance Conference this fall. If you have a recent paper on the linkages between financial markets, monetary policy, and the macroeconomy, please submit by May 31!

www.frbsf.org/news-and-med...

07.05.2025 05:19 —

👍 1

🔁 1

💬 0

📌 0

Our Center for Monetary Research is cosponsoring a session at the 2025 CEBRA meeting. Do you have a recent working paper on international macro-finance/monetary issues? Then please submit to Session 14 of this CfP! Deadline is March 20. We look forward to your submissions! #CEBRA2025 #CFP #EconSky

14.03.2025 15:58 —

👍 3

🔁 0

💬 0

📌 0

Submission deadline for our fixed income conference is this Friday, January 31. Our keynote speaker will be Annette Vissing-Jorgensen. If you have a new paper in this area, please consider submitting it!

27.01.2025 21:06 —

👍 2

🔁 0

💬 0

📌 0

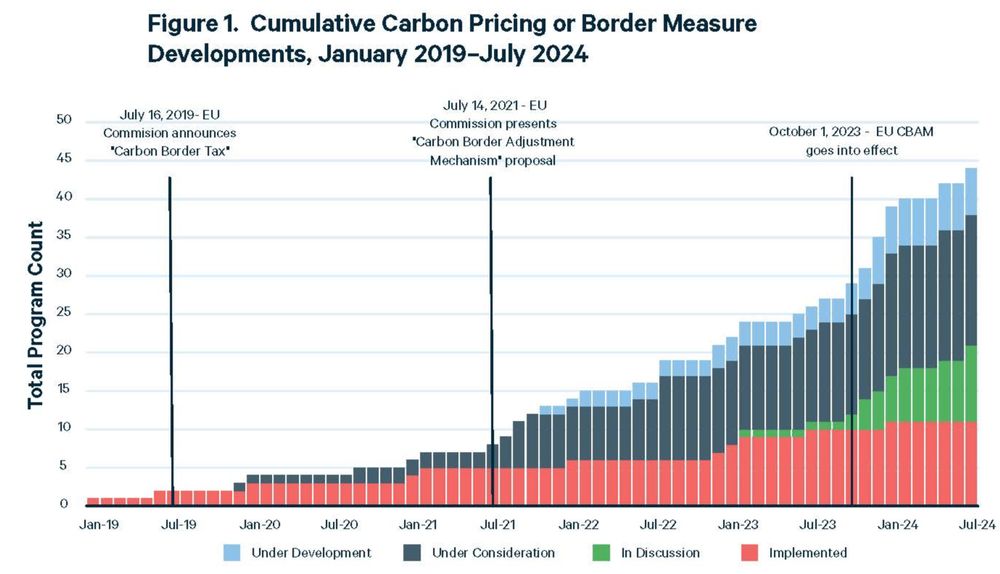

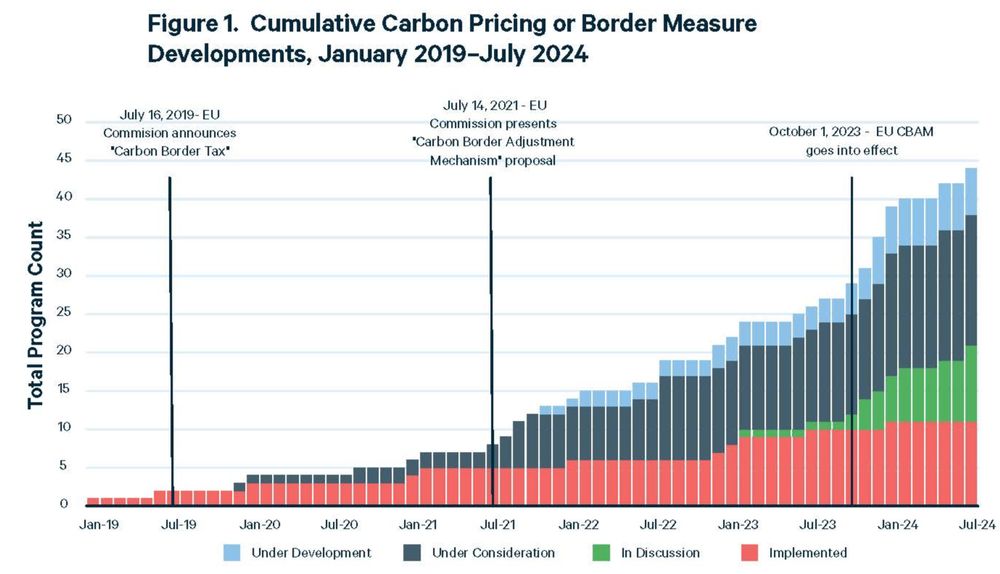

Thank you @cwolfram.bsky.social for a fantastic presentation on CBAM in today's Virtual Seminar on Climate Economics. The slides and recording are here: www.frbsf.org/news-and-med...

Also worth checking out this @rff.org policy brief: www.rff.org/publications...

16.01.2025 22:05 —

👍 6

🔁 4

💬 0

📌 1

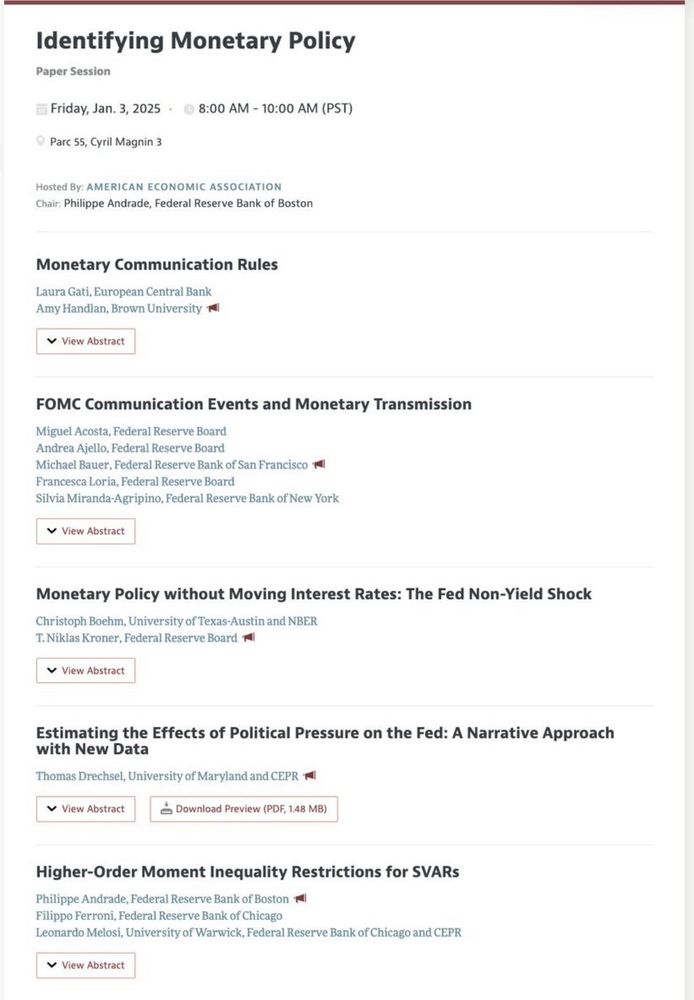

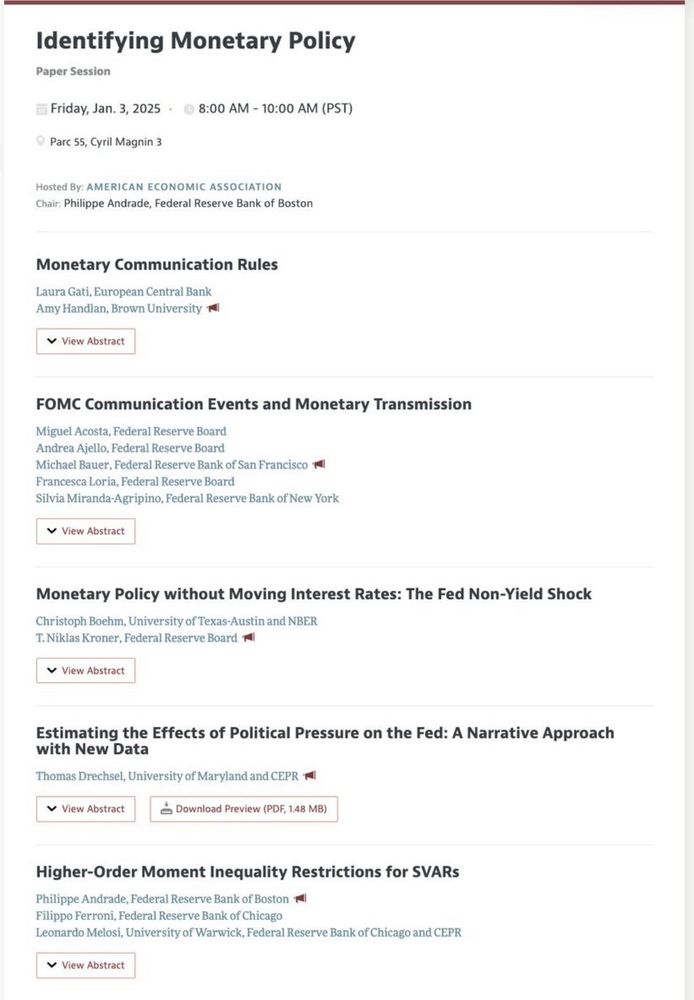

At the AEA meetings in San Francisco?

Check out this nice session on Friday morning: "Identifying Monetary Policy"

With presentations by Amy Handlan @michaeldbauer.bsky.social @kronerniklas.bsky.social myself and Philippe Andrade

Thank you Philippe for organizing! #ASSA2025

02.01.2025 14:48 —

👍 11

🔁 1

💬 0

📌 1

Philippe Aghion, INSEAD Transition to Green Technology along the Supply Chain - San Francisco Fed

<p> </p>

The Virtual Seminar on Climate Economics is finishing the year strong, with a talk by Philippe Agion from INSEAD on "Transition to Green Technology along the Supply Chain". Join us Thursday at 11am ET on Zoom!

www.frbsf.org/news-and-med...

18.12.2024 17:31 —

👍 1

🔁 1

💬 0

📌 0