Equal Weight S&P 500 has outperformed Cap Weight by 4.2% through 2/7.

That's the highest spread going back to 1992.

34 years.

Incredible.

Equal Weight S&P 500 has outperformed Cap Weight by 4.2% through 2/7.

That's the highest spread going back to 1992.

34 years.

Incredible.

If I had one visual to explain what is happening in markets, it is this one.

Mag7 breaking down relative to S&P 500.

Small Caps breaking out relative to S&P 500.

Could it be this simple?

Market internals currently signal "risk-on"

- 79% of Discretionary Sector Above 200D

- Only 35% Of Staples Sector Above 200D

The "spread" between the two is plotted below.

44% more Discretionary stocks above 200D.

"Risk-on" stocks rising while "risk-off" falling = bullish.

Total Returns Over Past Year:

S&P Pure Value: +22%

S&P Pure Growth: +16%

Over 600 bps of outperformance in value stocks.

Narrow market?

This suggests otherwise. 👇

Using intraday data - but still.

08.01.2026 19:55 — 👍 0 🔁 0 💬 0 📌 0

I have never seen a day in the market like this.

08.01.2026 19:55 — 👍 0 🔁 0 💬 1 📌 0

Wall Street's strategists are too cautious on the year ahead's stock market returns 70% of the time - @mattcerminaro.bsky.social

chartkidmatt.com/p/25-years-o...

🙏🙏🙏

10.12.2025 23:40 — 👍 0 🔁 0 💬 0 📌 0🙏🙏

01.12.2025 23:10 — 👍 1 🔁 0 💬 0 📌 0

"The black dots show where each sector’s forward P/E stood at the S&P 500’s 10/29 short-term peak. The grey dots show where they stood at the 11/20 short-term trough. Valuation compression in 8 of 10 sectors shown, but most notably in Tech."

@mattcerminaro.bsky.social

Google's forward PE looks like a meme stock.

Nearly doubled off the low.

👇

Five years ago in November of 2020, Ed @yardeniresearch.bsky.social coined the phrase “Roaring 2020’s" as his forecast for the decade. Good call.

Ed stopped by tonight to lay out his case for S&P 500 10,000 by year-end. Real people on The Street listen to Ed.

www.youtube.com/watch?v=wCki...

Google is now more expensive than Nvidia.

Look at the spread between their Forward P/E ratios.

Wow. 👇

Google is now more expensive than Nvidia.

Look at the spread between their Forward P/E ratios.

Wow. 👇

for daily market insights from working, registered professionals, follow the whole Ritholtz Starter Pack here. We specialize in sane, reasonable investment commentary. May we meet you?

bsky.app/start/did:pl...

👊👊👊

24.11.2025 16:19 — 👍 0 🔁 0 💬 0 📌 0

We haven’t had a meaningful bear market in nearly 20 years. You might think “surely, this must end soon.” Historically, you would be wrong about the *must* part. The length of a bull market doesn’t have to obey your feelings or mine.

Chart @mattcerminaro.bsky.social via @bencarlson007.bsky.social

🆓 Sunday links: how gambling became frictionless, falling homicide rates, and the best books of 2025. abnormalreturns.com/2025/11/23/s...

image: awealthofcommonsense.com/2025/11/do-w...

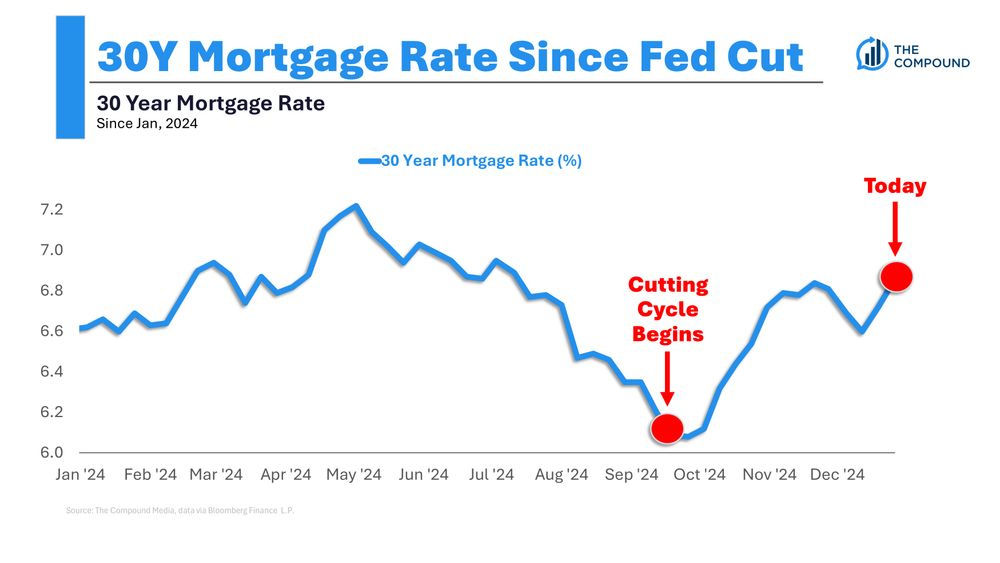

At what point do 7%+ mortgage rates and a lack of housing activity become a big problem for the economy?

awealthofcommonsense.com/2025/01/is-t...

The Best Books I Read in 2024

awealthofcommonsense.com/2024/12/the-...

We are seeing capitulatory, bear market low type oversold readings in the middle of a strong bull market.

Look at this metric:

- % S&P 500 with RSI below 30 (yesterday): 31.5%

- % S&P 500 with RSI below 30 (9/30/22) : 31.9%

👇

Can't lie we went crazy on the show tonight. Now live, let us know what you think

www.youtube.com/watch?v=--l_...

A high P/E is not a stock market sell signal ⚠️ www.tker.co/p/valuations...

15.12.2024 14:11 — 👍 29 🔁 6 💬 0 📌 5

Rick Rieder is BlackRock’s CIO of Global Fixed Income and Head of the Global Allocation Team, overseeing roughly $2.4T in assets.

Just don’t call him a Bond King.

Brand new epic edition of The Compound and Friends. We love you, Merry Christmas 🎄

podcasts.thecompoundnews.com/show/TCAF/is...

🐂The avg bull market has 8 5% pullbacks.

👉 We have had 5 in the current bull run.

Meaning, it would be normal if we saw several more pullbacks before this bull market ends.

👇

It's Forecast SZN on Wall Street and every firm has their S&P 500 target for 2025. Strategists are expecting a gain of somewhere between 7% and 17%. But allow me to blow your mind: The average gain for stocks in an up year over the last hundred years is actually +21%! @bencarlson007.bsky.social

11.12.2024 14:28 — 👍 94 🔁 13 💬 11 📌 1

This one is interesting.

- Blue bars are sector returns YTD

- Red dots are avg return of stock within sector

- Bottom shows over/under performance of the average stock vs its sector.

The best sectors YTD also have their average stocks underperforming sharply.

👇

The 4 types of investment mistakes:

1. Annoying mistakes (investing in underperforming funds)

2. Self-inflicted mistakes (high fees, over-trading, etc)

3. Painful mistakes (sell at the bottom of a bear market)

4. Endgame mistakes (fraud, losing it all)

awealthofcommonsense.com/2024/12/the-...

Five charts you need to see for 2025 ⬇️⬇️⬇️

1️⃣ The S&P 500 has gained 20%+ for two straight years

Three 20%+ years hasn't happened outside of the 1990

But are stocks doomed? Not necessarily.

Big gains happen more often than you think.

The NASDAQ is -0.50% today.

But the internals paint a rosier picture.

- 55% of stocks are advancing in the index.

Not as "risk off" within.

👇