Not many details, but there were two new bank charter filings with the OCC last week that look interesting.

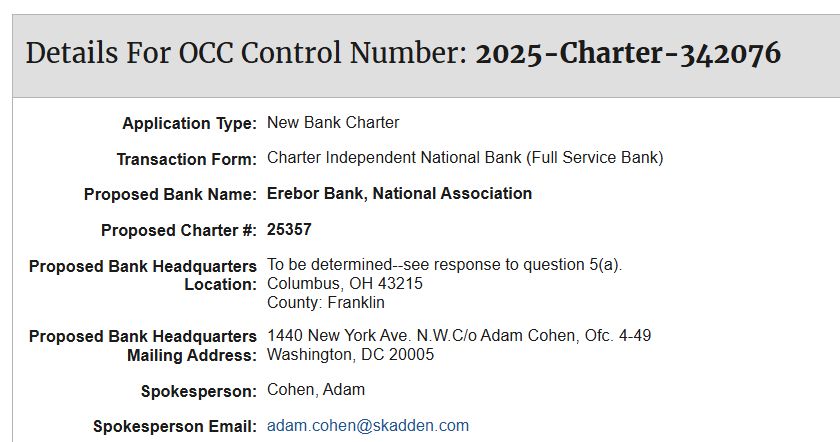

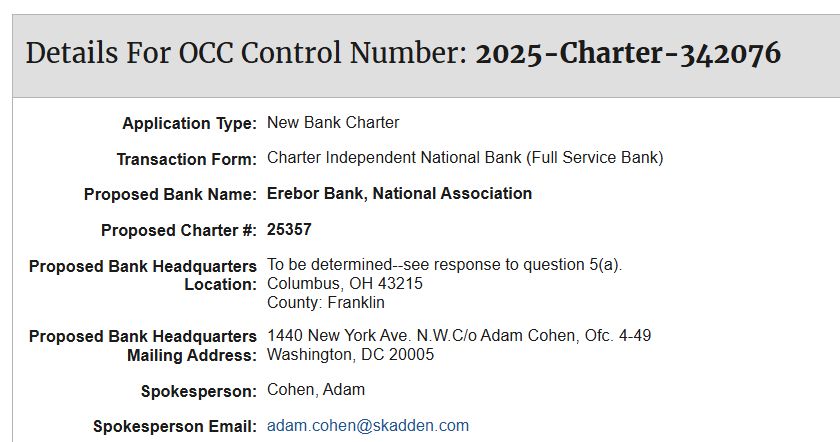

The first is for a proposed full service bank, to be called "Erebor Bank"

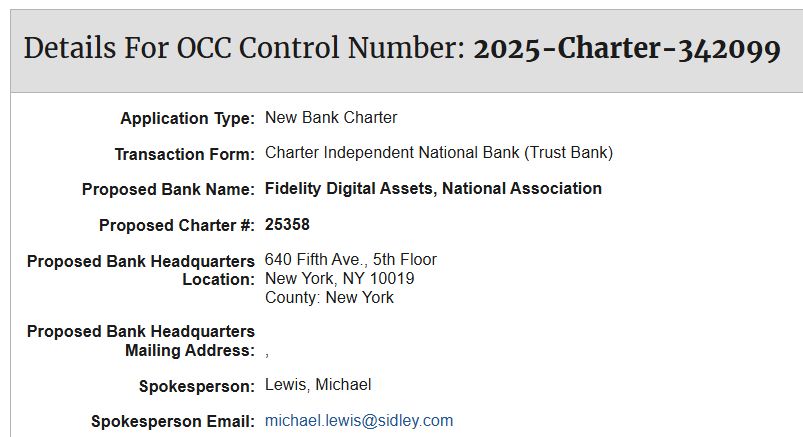

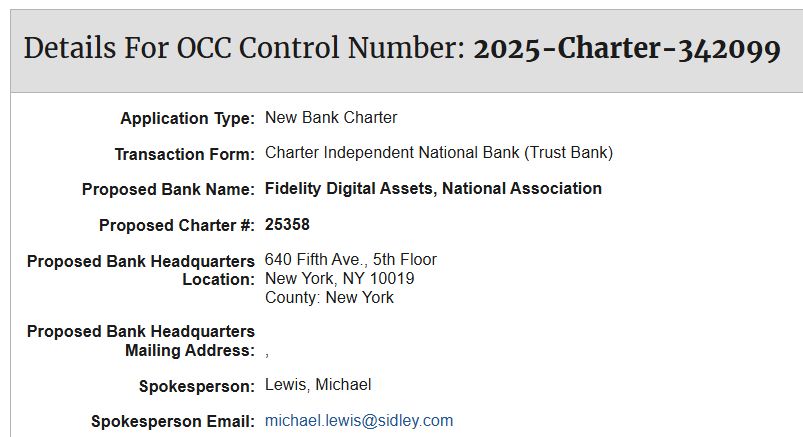

The second is a proposed national trust bank from Fidelity Digital Assets.

17.06.2025 14:47 — 👍 1 🔁 0 💬 0 📌 0

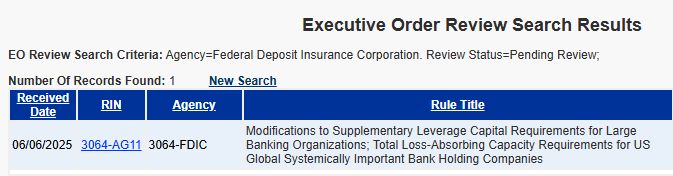

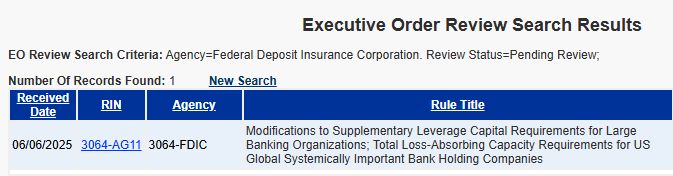

The FDIC has submitted an SLR-related proposal to the White House for OIRA review

07.06.2025 18:17 — 👍 0 🔁 0 💬 0 📌 0

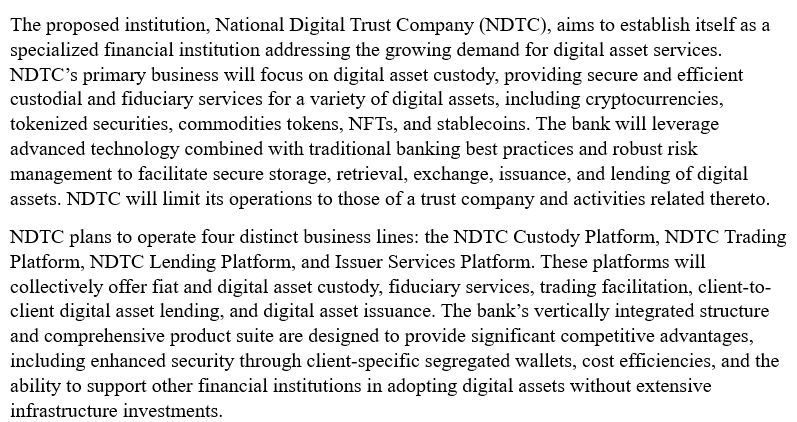

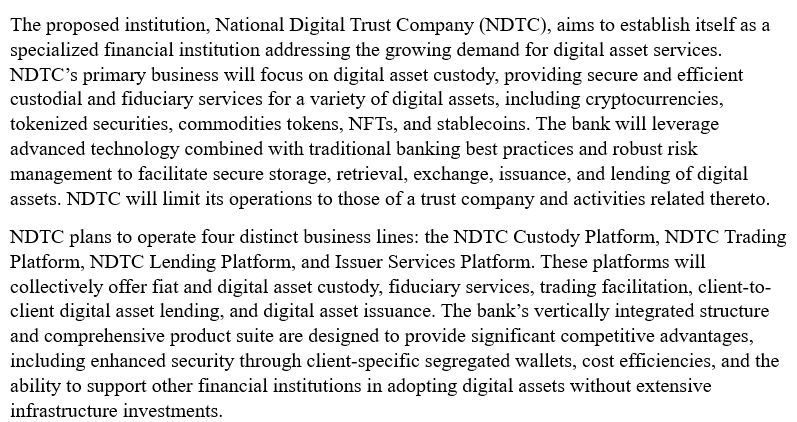

Protego Holdings has filed an application with the OCC to charter a new national trust bank. The proposed bank, to be called the National Digital Trust Company, would be a "a specialized financial institution addressing the growing demand for digital asset services"

drive.google.com/file/d/1GCji...

07.06.2025 02:56 — 👍 1 🔁 1 💬 0 📌 0

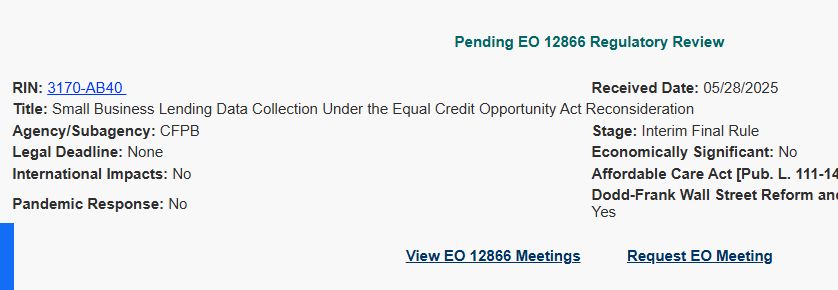

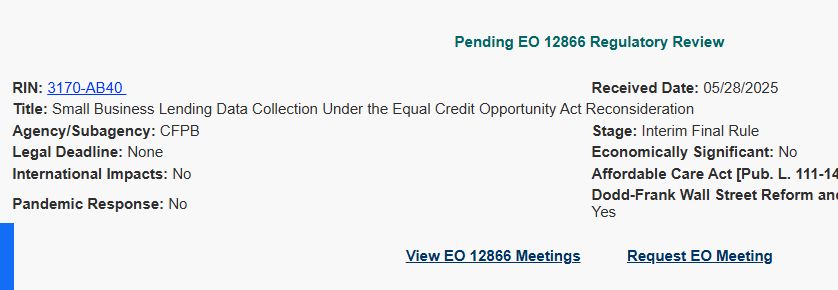

OIRA's website says that yesterday it received a proposal from the CFPB in relation to "reconsideration" of the 1071 rule. Notable both for the substance and because I am 99% sure this is the first time the CFPB has submitted a rule for review under the reg review EO www.reginfo.gov/public/do/eo...

29.05.2025 13:18 — 👍 0 🔁 0 💬 0 📌 0

In a draft Federal Register notice published this morning, the CFPB says it is withdrawing 67 guidance documents (listed in the notice) public-inspection.federalregister.gov/2025-08286.pdf

09.05.2025 13:06 — 👍 0 🔁 0 💬 0 📌 0

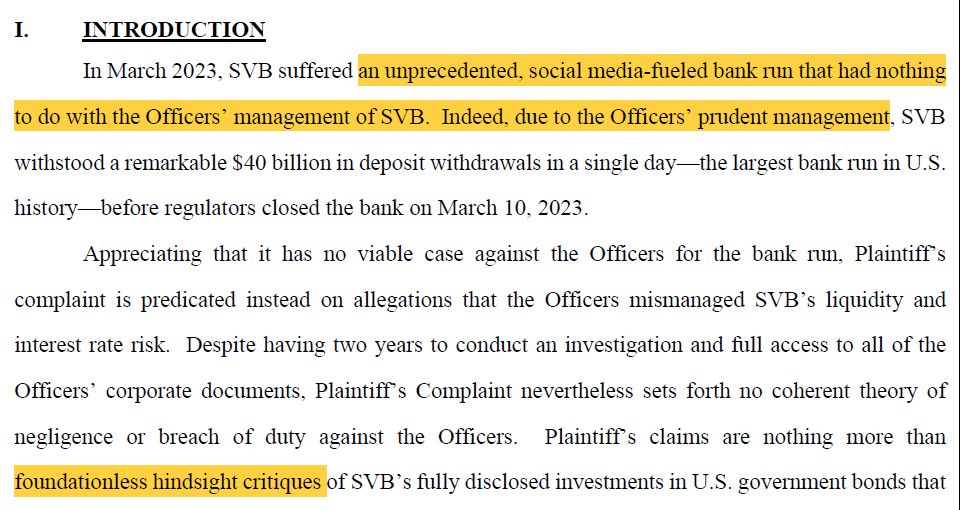

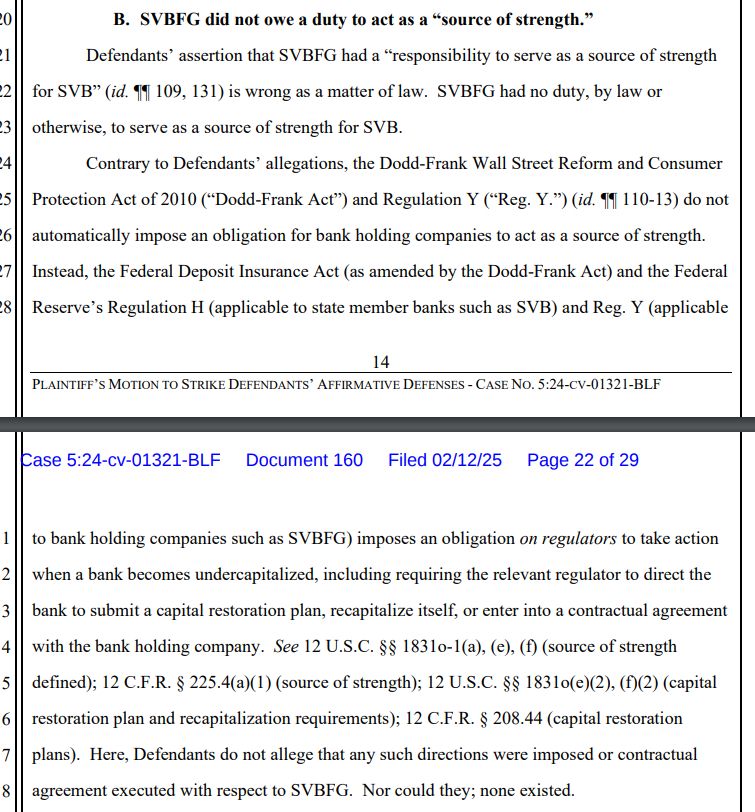

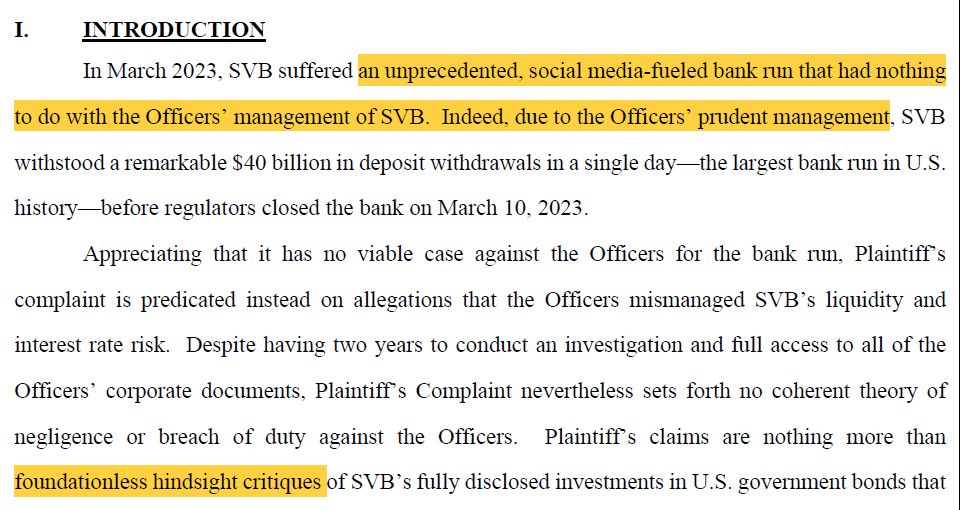

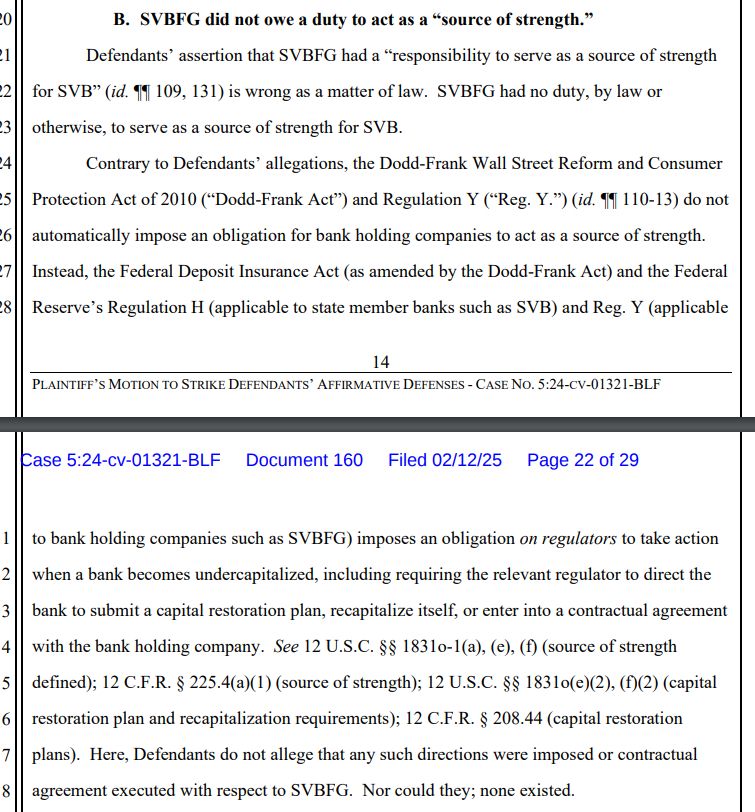

The run on Silicon Valley Bank had nothing to do with SVB's former officers, say SVB's former officers

storage.courtlistener.com/recap/gov.us...

17.04.2025 00:25 — 👍 0 🔁 0 💬 0 📌 0

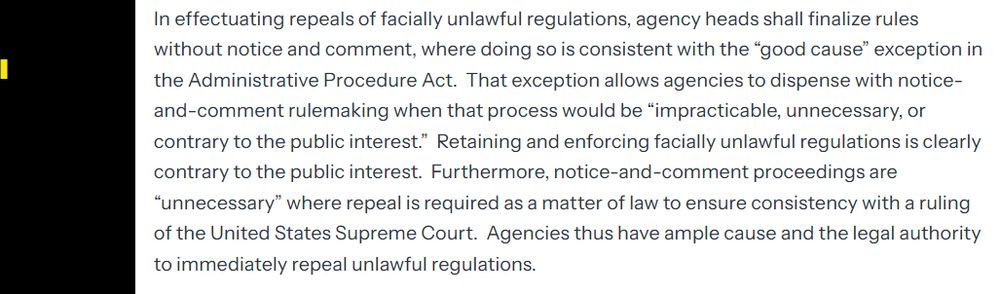

As for whether any financial regulators take the White House up on its suggestion to skip notice and comment, not sure that would pass a risk/reward test for me. (Why take the chance of having courts block something you otherwise had the authority to do?)

But see above re: the lack of imagination

09.04.2025 23:36 — 👍 2 🔁 0 💬 0 📌 0

I probably suffer from a lack of imagination, but my first blush reaction is that I'm not sure this memo will cause any financial regulators to seek to repeal/revise anything they weren't already to planning to revise.

09.04.2025 23:32 — 👍 0 🔁 0 💬 1 📌 0

Today the White House directed regulators to repeal rules they conclude are unlawful under recent Supreme Court decisions (e.g., Loper Bright, West Virginia v. EPA).

The memo claims that for such repeals notice and comment would not be required www.whitehouse.gov/presidential...

09.04.2025 23:29 — 👍 1 🔁 0 💬 1 📌 0

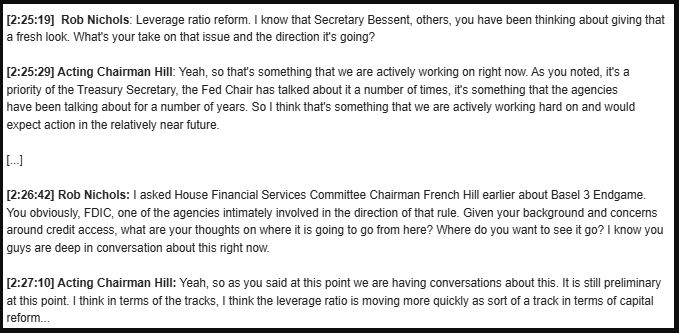

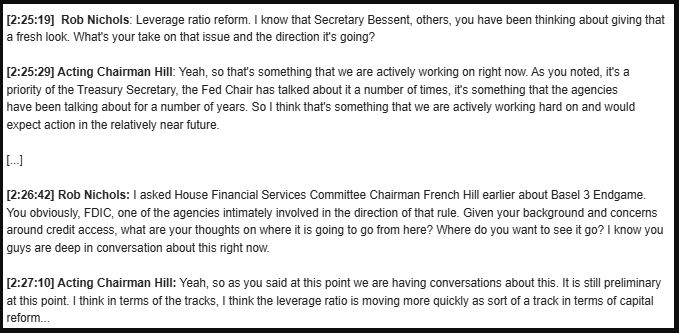

At an ABA event today, FDIC Chairman Hill said that he expects action on the Supplementary Leverage Ratio "in the relatively near future" (and very likely before action on the rest of the capital rules).

Video: x.com/ABABankers/s...

My rough transcript:

08.04.2025 15:32 — 👍 0 🔁 0 💬 0 📌 0

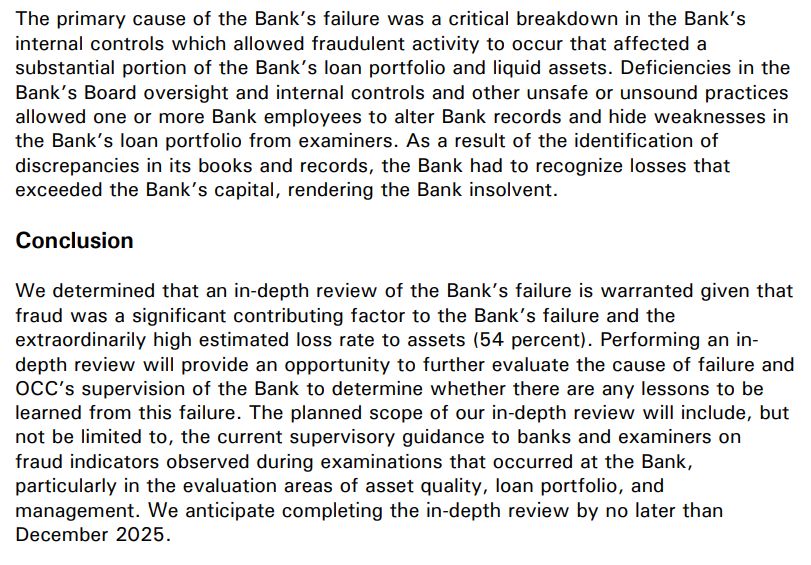

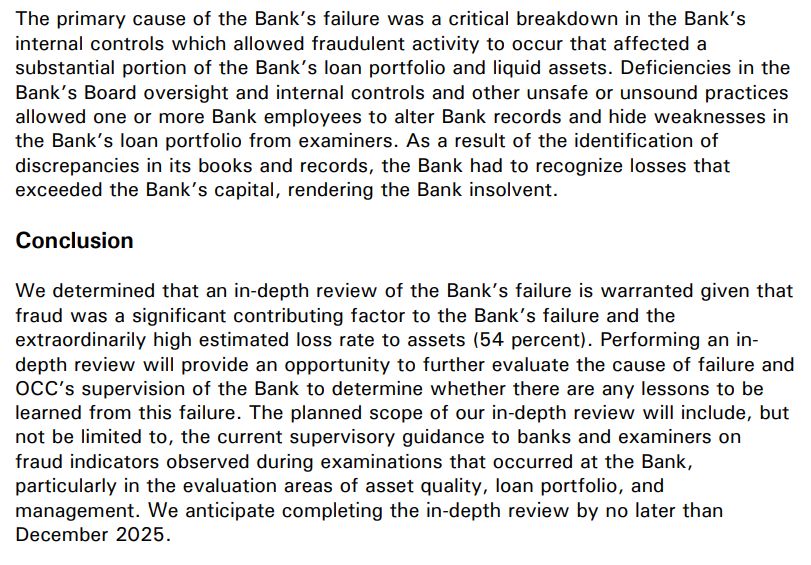

The Treasury Department's Office of Inspector General performed an initial review of the failure of the First National Bank of Lindsay and determined that a more in-depth review is warranted oig.treasury.gov/system/files...

31.03.2025 17:13 — 👍 0 🔁 0 💬 0 📌 0

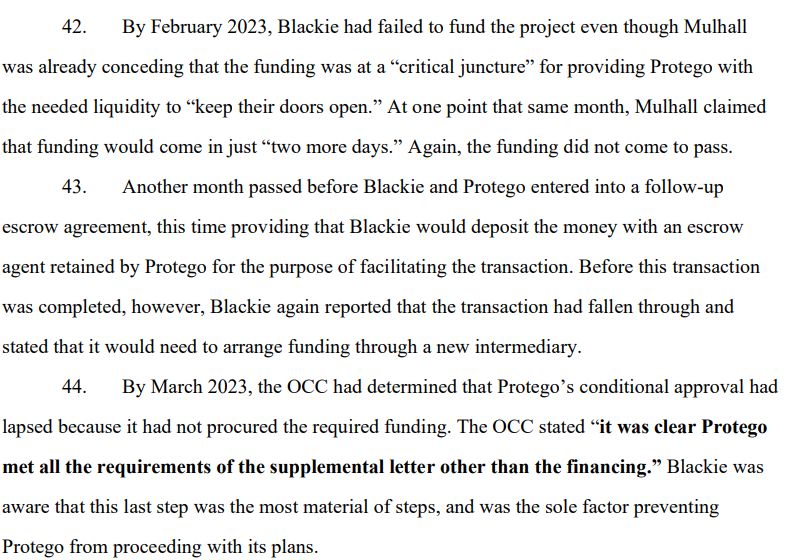

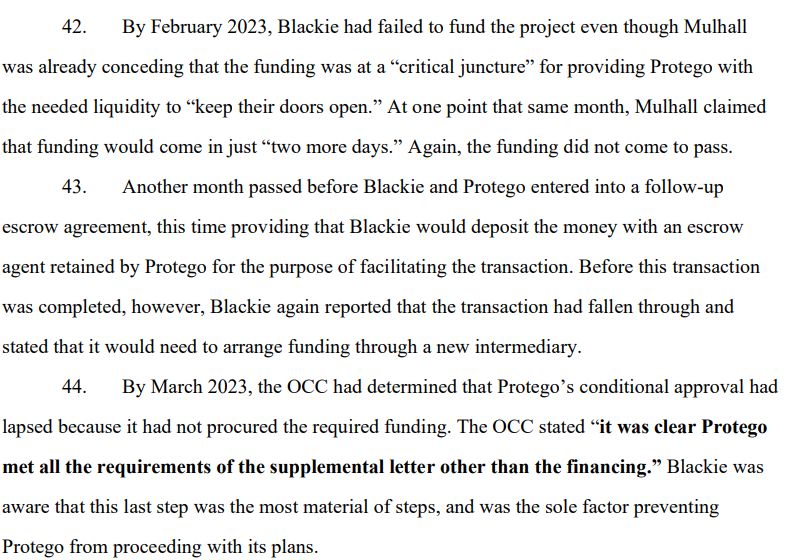

In early '21, the OCC conditionally approved Protego for a national trust bank charter. Approval expired in '23 after Protego didn't meet the OCC's conditions to open.

In a new lawsuit against Blackie Capital, Protego tells its version of what happened

courtlistener.com/docket/69798...

29.03.2025 00:14 — 👍 1 🔁 0 💬 0 📌 0

I had not been following this case at all, but potential implications for the FDIC, OCC and other financial regulators came up a few times during oral argument earlier today - e.g., in Justice Sotomayor's question here www.supremecourt.gov/oral_argumen...

27.03.2025 01:34 — 👍 1 🔁 0 💬 0 📌 0

Former CFPB GC Seth Frotman's prepared testimony for the HFSC hearing tomorrow docs.house.gov/meetings/BA/...

25.03.2025 17:44 — 👍 0 🔁 0 💬 0 📌 0

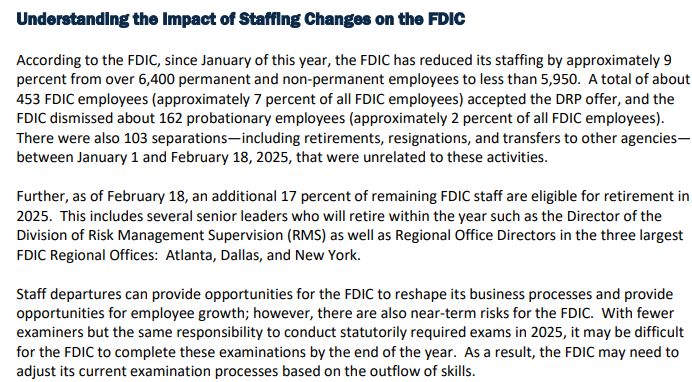

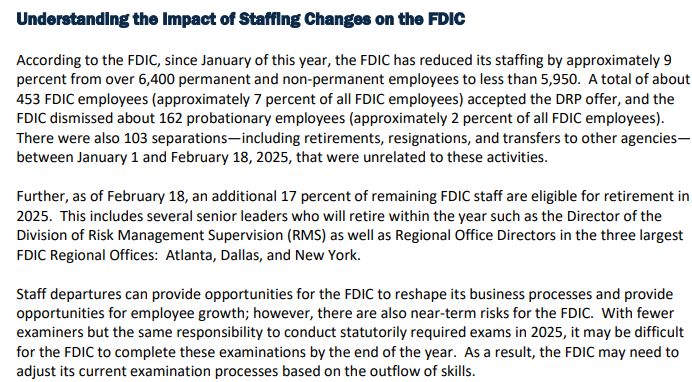

Commentary from the FDIC's Inspector General on the agency's current staffing situation

[p. 166 www.gao.gov/assets/gao-2... ]

20.03.2025 15:13 — 👍 0 🔁 0 💬 0 📌 0

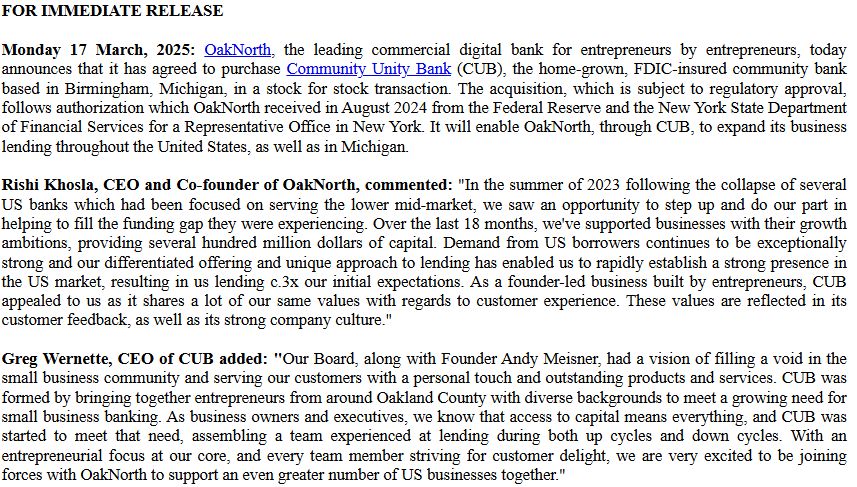

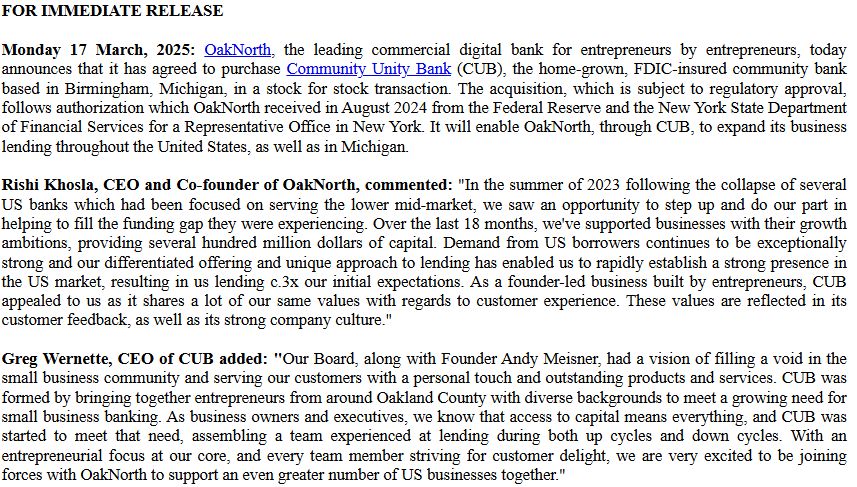

OakNorth Bank, the UK digital bank started in 2015, has signed an agreement to acquire a $64 million asset Michigan bank www.londonstockexchange.com/news-article...

17.03.2025 13:10 — 👍 0 🔁 0 💬 0 📌 0

Substantially the Same

Exploring one of the Congressional Review Act's many puzzles

If a rule is disapproved under the Congressional Review Act, an agency generally cannot adopt a new rule that is "substantially the same" as the old one.

What does this mean? No one really knows! But there may soon be a 6th Circuit decision on the issue bankregblog.substack.com/p/substantia...

05.03.2025 11:57 — 👍 1 🔁 0 💬 0 📌 0

Here's the Fed's committee page, updated today to reflect this change. www.federalreserve.gov/aboutthefed/...

01.03.2025 11:43 — 👍 0 🔁 0 💬 0 📌 0

Will be very interested to see the FDIC's response to this argument and, potentially, an ultimate court ruling on it. Could be a bigger deal than just this dispute over SVB storage.courtlistener.com/recap/gov.us...

15.02.2025 12:25 — 👍 0 🔁 0 💬 1 📌 0

One small but immediate impact of this: there was an oral argument involving the CFPB scheduled in the Fifth Circuit for *today*, but...

www.courtlistener.com/docket/68042...

03.02.2025 16:52 — 👍 0 🔁 0 💬 1 📌 0

In a future Democratic administration there may be less "encouraging" of the banking regulators and more outright directing

24.01.2025 19:48 — 👍 0 🔁 0 💬 0 📌 0

New posts!

On regulatory discussion in the 2019 FOMC transcripts released yesterday: bankregblog.substack.com/p/regulatory...

A look at allegations the FDIC made last night against Silicon Valley Bank's former officers and directors: bankregblog.substack.com/p/fdic-lays-...

11.01.2025 14:23 — 👍 0 🔁 0 💬 1 📌 0

Bank Insists It Experienced a Run in March 2022

A review of the year in supervisory appeals

If a bank receives a ratings downgrade or other adverse material supervisory determination, it can appeal that decision to its regulator. This post looks at a few of the more interesting appeal decisions published by the regulators in 2024.

bankregblog.substack.com/p/bank-insis...

30.12.2024 14:12 — 👍 0 🔁 0 💬 0 📌 0

FDIC Seeks Significant Fine from Small Kansas Bank

Allegations center on BSA/AML issues

The FDIC wants to impose a roughly $20 million fine against a tiny Kansas bank with less than $75 million in total assets. This Substack post looks at the FDIC's allegations and what might be leading the agency to seek such a large fine.

bankregblog.substack.com/p/fdic-seeks...

26.12.2024 12:38 — 👍 1 🔁 0 💬 0 📌 0

Current Unified Agenda of Regulatory and Deregulatory Actions

OIRA quietly released the Fall 2024 Unified Regulatory Agenda: www.reginfo.gov/public/do/eA...

It's always risky to take the banking regulators' agendas too literally, especially this time around, for obvious reasons. Still, a couple of interesting new entries...

15.12.2024 01:31 — 👍 0 🔁 0 💬 0 📌 0

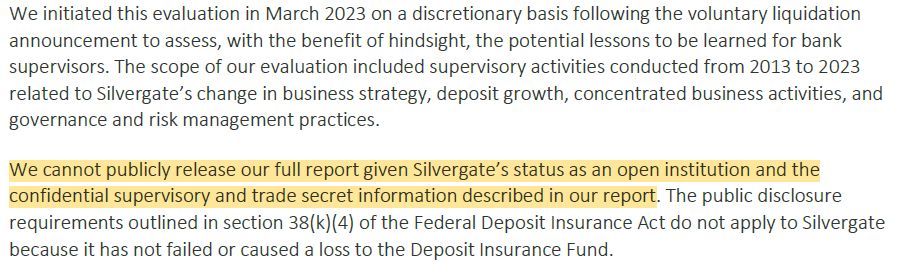

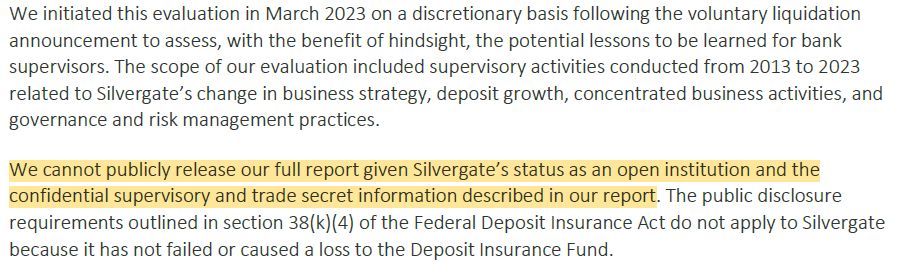

I find the pro-Silvergate arguments that have featured on X recently pretty unconvincing, but I'd still love to read a full version of this Fed IG report.

This justification for not releasing it was flimsy at the time, and makes even less sense now.

oig.federalreserve.gov/reports/boar...

08.12.2024 12:07 — 👍 0 🔁 0 💬 0 📌 0

Ninth Circuit Considers Master Account Arguments

Also: another Jarkesy case, FSOC concerns about credit union resolution, and more

New post:

*The most interesting comments and questions from Wednesday's Ninth Circuit's master account oral arguments

*A Kansas bank sues the FDIC to try to stop an enforcement action

*FSOC warns about large credit union resolution

*Other stuff

bankregblog.substack.com/p/ninth-circ...

07.12.2024 12:11 — 👍 0 🔁 0 💬 0 📌 0