A toymaker who got tariffed

Americans continue to face uncertainty following the Supreme Court’s ruling against the use of IEEPA to impose sweeping tariffs. I recently joined @vox.com Today, Explained to discuss the evolving tariff landscape and what to expect going forward: open.spotify.com/episode/0S72yebCkVoWSz63M8LA92

27.02.2026 22:05 —

👍 1

🔁 0

💬 0

📌 0

Targeting Russia’s shadow fleet is crucial to weakening its economy and ending its assault on Ukraine. @robin-j-brooks.bsky.social and I explain why in our recent op-ed in @kyivindependent.com. Our full analysis with Harold Koh here: www.brookings.edu/articles/sti...

24.02.2026 17:02 —

👍 15

🔁 7

💬 0

📌 0

Great to visit CAP to debate solutions to the affordability crisis. @tarasinc.bsky.social and I argued against price controls, while finding common ground with @bharatramamurti.bsky.social and @nealemahoney.bsky.social on the need for real action to make life more affordable. Watch:

10.02.2026 21:29 —

👍 3

🔁 2

💬 0

📌 0

It was a pleasure joining NPR’s @wamu.org 1A with the incomparable @richardrubindc.bsky.social to discuss how funding and personnel cuts in the first year of Trump’s second term have destabilized the IRS, reducing federal revenue and economic efficiency. Listen here: tinyurl.com/42rjmeye

21.01.2026 19:37 —

👍 2

🔁 0

💬 0

📌 0

Figure showing the in-migration, out-migration, and net immigration in the United States from 2020 to the present with projections for 2025 and 2026. Net immigration peaks in 2023 followed by a downturn, potentially reaching negatives in 2025 and 2026.

New report @taraelizwatson.bsky.social, @stanveuger.bsky.social, and @taraelizwatson.bsky.social examines the economic impact of Trump-era immigration policies. After 2025’s net negative migration, 2026 is projected to remain low or negative, weighing on growth. Read here: shorturl.at/q1jOM

13.01.2026 17:27 —

👍 5

🔁 2

💬 0

📌 0

YouTube video by Beerocracy! with Emily Gross

The Truth About The U.S. Economy

It was great to share a beer with Emily Gross on her show @beerocracy.bsky.social. We talked about the K-shaped economy, the affordability crisis, and much more. Watch our conversation here: www.youtube.com/watch?v=IT6i...

12.12.2025 19:40 —

👍 1

🔁 1

💬 0

📌 0

What the US economy looks like ahead of 2026

It's roughly made up of $30 trillion worth of goods, services, and economic activity.

Federal economic statistics are critical to understanding America’s economy. But after an unprecedented shutdown, data releases are delayed—or never collected. I joined NPR's @wamu.org 1A to explain what that means for U.S workers and businesses. the1a.org/segments/wha...

12.12.2025 19:02 —

👍 1

🔁 0

💬 0

📌 0

Long Run Fiscal Solvency and Its Consequences | Econofact Chats

Wendy Edelberg and Ben Harris on the likely consequences of rising debt, and its impact on people’s retirement, especially if there are cuts to Social Security.

@wendyedelberg.bsky.social and I recently joined @fletcherschool.bsky.social Professor Michael Klein on the @econofact.bsky.social podcast for a chat about the consequences of a rising national debt, and America’s prospects for long-run fiscal solvency. Listen here: econofact.org/podcast/long...

14.04.2025 15:52 —

👍 0

🔁 1

💬 0

📌 0

Where did Russia’s shadow fleet come from?

Most of Russia's shadow fleet of oil tankers comes from Western companies. This gives Europe leverage, Robin Brooks and Ben Harris explain.

In a new piece, @robin-j-brooks.bsky.social and I document the origins of Russia’s shadow fleet. Tracking the ownership history of 75 sanctioned ships, we find that nearly 60% of them previously had European owners. Read it here:

28.02.2025 15:14 —

👍 27

🔁 8

💬 1

📌 2

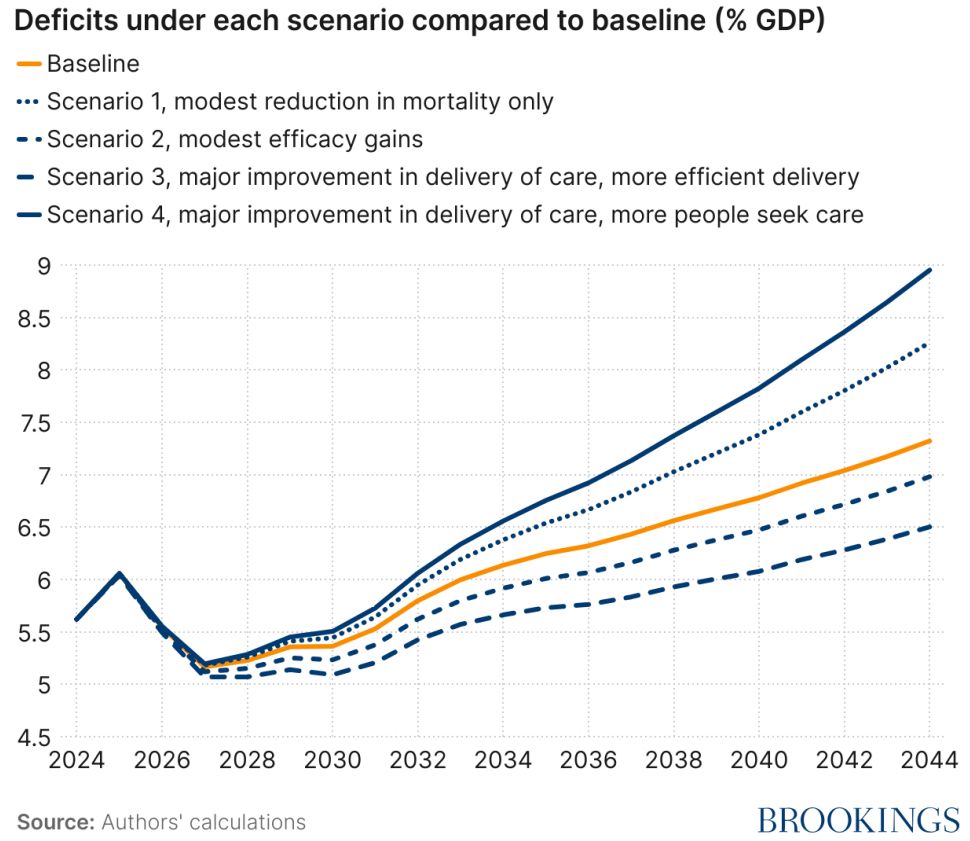

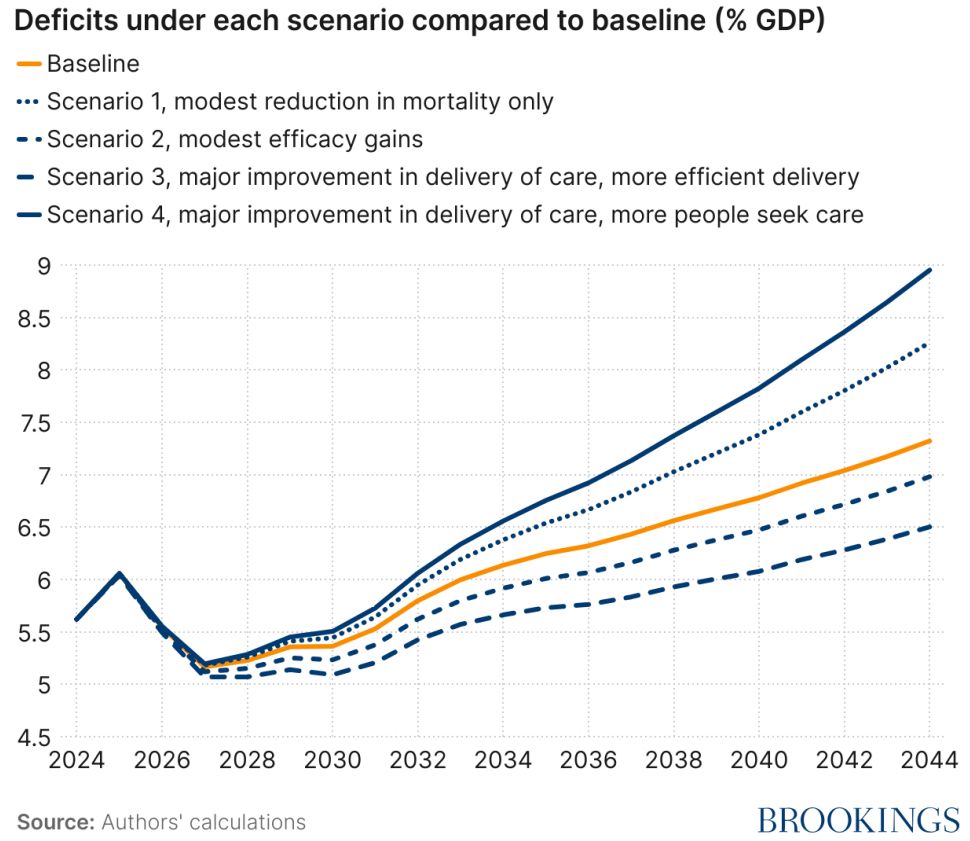

Alternatively, in our most optimistic scenario, in which AI reduces mortality while also lowering the costs and demand for healthcare, annual deficits fall by 0.8% of GDP in 2044, or about $500 billion per year.

20.02.2025 20:18 —

👍 0

🔁 0

💬 0

📌 0

If AI technology leads to a larger old-age population without substantially improving healthcare prices and efficiency, it could increase annual deficits. Our most pessimistic scenario puts 2044 deficits around 1.6% of GDP larger relative to the baseline—about $1 trillion.

20.02.2025 20:18 —

👍 1

🔁 0

💬 2

📌 0

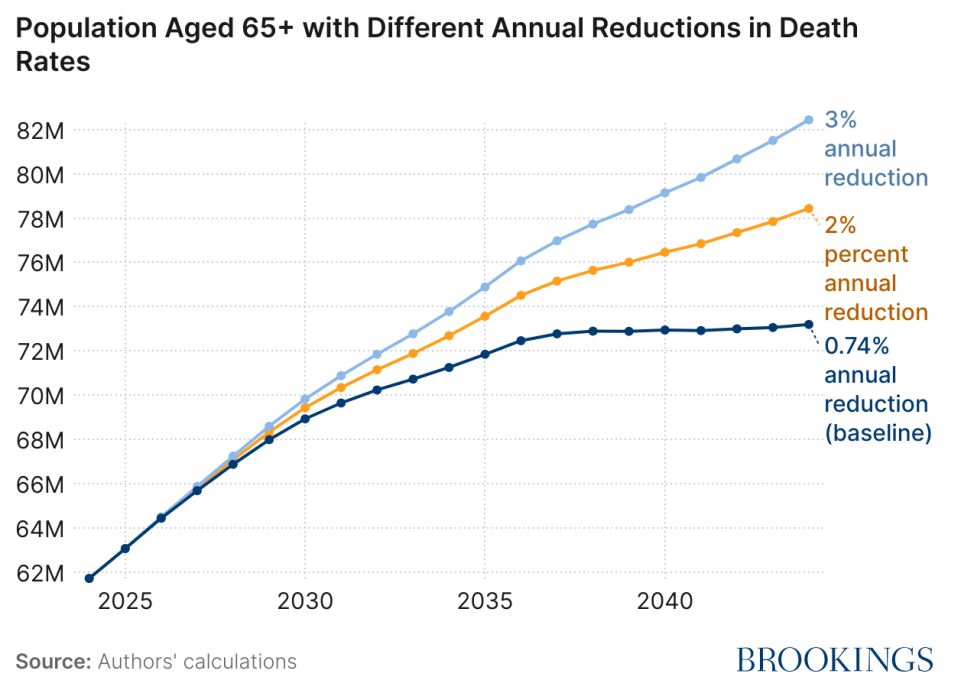

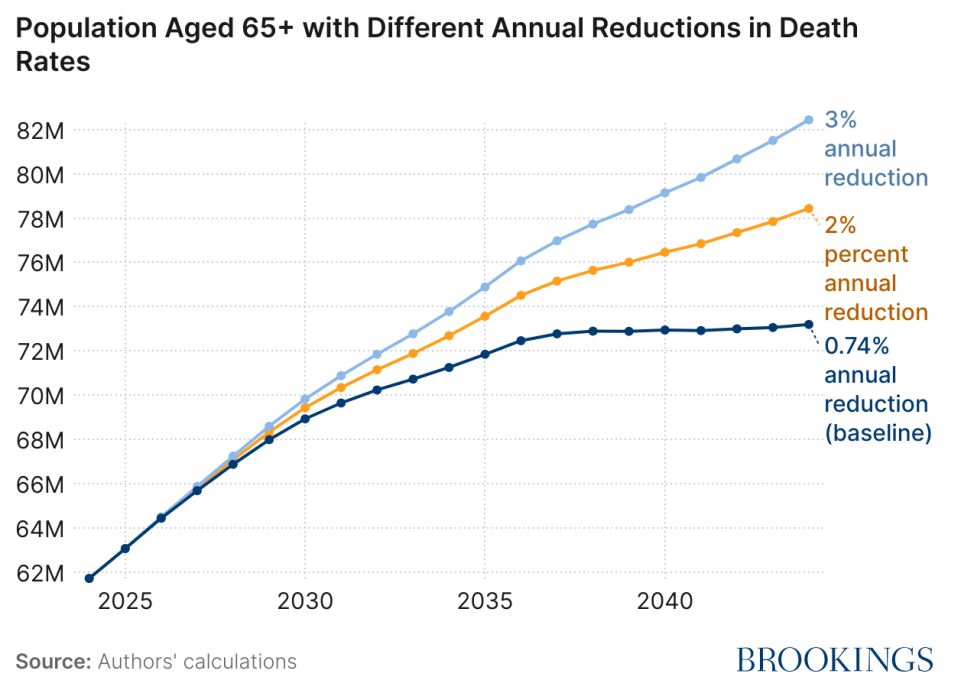

And of course, longer lifespans mean more people drawing from SS and Medicare. For example, if AI reduces mortality by 3% (as opposed to 0.74% in the baseline), the old-age population will rise from 73.2 million to 82.4 million in 2044.

20.02.2025 20:18 —

👍 1

🔁 0

💬 1

📌 0

A key takeaway is that this technological shock could be different from the internet boom—which boosted productivity and incomes—because AI could also lead to much longer lifespans.

20.02.2025 20:18 —

👍 0

🔁 0

💬 1

📌 0

Given the uncertainty around AI, we simulate four scenarios with varying effects of AI on mortality, population, the price of health care, and health care utilization.

20.02.2025 20:18 —

👍 0

🔁 0

💬 1

📌 0

The fiscal frontier

Benjamin H. Harris, Neil Mehrotra, and Eric So simulate the impact of AI on old-age entitlement spending via health care channels.

Today, Brookings released a report I wrote with Neil Mehrotra and Eric So modeling the impact of AI on old-age entitlement expenditures like Medicare and Social Security. Read it here: www.brookings.edu/articles/the...

20.02.2025 20:18 —

👍 7

🔁 1

💬 2

📌 0

Opinion | How Trump Could Get Us Into a Debt Crisis

A blowup will be sparked not by government spending but from political malpractice.

Check out today's @nytimes op-ed by @wendyedelberg.bsky.social and me arguing that the Trump Administration's reckless approach to fiscal policy raises the risk of a fiscal and financial crisis:

18.02.2025 22:43 —

👍 6

🔁 1

💬 0

📌 0

What are the risks of a rising federal debt?

Also, check out this Q&A which touches on the main results of our paper:

12.02.2025 17:47 —

👍 0

🔁 0

💬 0

📌 0

Assessing the risks and costs of the rising US federal debt

While imminent fiscal crisis is unlikely, the large and growing federal debt presents a number of long-term risks.

US Debt is ~100% of GDP, and the debt limit is getting closer. Congress is now marking-up a budget that will take on trillions in new debt. What are the true costs of debt? And should we worry about a fiscal crisis? Read my new paper with @wendyedelberg.bsky.social and Louise Sheiner here:

12.02.2025 17:47 —

👍 1

🔁 0

💬 1

📌 0

More sanctions on Russian oil tankers

Robin Brooks and Ben Harris investigate the oil price effects of the United States' January 2025 sanctions on Russian oil tankers.

In a new blog, Robin Brooks and I show that January 10th sanctions on 183 Russian tankers cover a massive 75 percent of oil exports from Russia’s Pacific ports. Despite targeting substantially more ships than all previous Russia sanctions combined, oil prices have barely risen.

30.01.2025 19:09 —

👍 3

🔁 0

💬 0

📌 1