We’re holding a lunch-out today to demand that @propublica management agree to a fair discipline and performance evaluation system. Just today, a member of our Bargaining Committee and Unit Council was fired as a result of ProPublica's flawed system.

12.08.2025 16:02 —

👍 66

🔁 25

💬 2

📌 4

Do you have information about Big Law spurning clients who might incur Trump's anger? Get in touch: molly.redden@propublica.org or on Signal at mollyredden.14

06.08.2025 13:59 —

👍 156

🔁 45

💬 2

📌 2

These GOP Lawmakers Referred Constituents to the CFPB for Help. Then They Voted to Gut the Agency.

Many of the same Republican lawmakers who have targeted the Consumer Financial Protection Bureau for cuts have collectively directed thousands of constituents’ complaints about banks, credit cards,…

NEW: Many of the same Republican lawmakers who have targeted the Consumer Financial Protection Bureau for cuts have collectively directed thousands of constituents’ complaints about banks, credit cards, loans and other products to the agency.

By @joeljacobs.bsky.social

06.08.2025 12:15 —

👍 666

🔁 255

💬 30

📌 27

Thursday, May 8, 2025

ProPublica management continues to deny steward representation

Yesterday morning, ProPublica management confirmed that it will deny steward representation to at least two more bargaining unit members it plans to discipline next week through the issuance of Performance Improvement Plans (PIPs).

This is part of a larger pattern: management has denied steward representation in every meeting where members were placed on PIPs. The plans are the first step in a disciplinary process that often leads to termination.

We have raised this issue repeatedly.

Last Thursday, more than 70% of our unit sent an open letter to ProPublica leadership, urging them to stop resisting core union protections including steward access, just cause and accountability in the disciplinary process.

This week, managers informed two employees that they would be placed on PIPs in meetings next week. Shortly afterward, ProPublica’s general counsel told Guild leadership that stewards will not be allowed in those meetings.

ProPublica’s disciplinary process remains opaque, inconsistently applied and shielded from scrutiny. Blocking stewards from these meetings is out of step with our industry and the principles of fairness and accountability the newsroom claims to uphold.

1/ 🚨 Yesterday, @propublica.org management confirmed that it will again deny steward representation at disciplinary meetings. Our full statement 👇

08.05.2025 20:41 —

👍 121

🔁 58

💬 5

📌 26

Have You Been Affected by Changes at the Department of Veterans Affairs? Tell Us About It.

Have you experienced setbacks in your care or benefits amid the changes at the Department of Veterans Affairs? ProPublica wants to hear from you.

Trump says he loves vets. He's promised to "put veterans first."

He's also planning to cut the agency that cares for more than nine million of them.

If you're a vet who gets care at VA -- or you work there -- *we want to hear from you.*

www.propublica.org/getinvolved/...

06.05.2025 10:59 —

👍 364

🔁 124

💬 11

📌 6

The Office That Investigates Disparities in Veterans’ Care Is Being “Liquidated”

The closure effectively hobbles the VA’s efforts to investigate and eliminate long-standing racial inequities that the department itself has acknowledged. “The consequences will be dire, wide-reaching...

NEW: The closure effectively hobbles the VA’s efforts to investigate and eliminate long-standing racial inequities that the department itself has acknowledged.

“The consequences will be dire, wide-reaching and deadly,” an advocate for Black veterans said.

By @vernalcoleman.bsky.social

11.03.2025 20:41 —

👍 1113

🔁 424

💬 23

📌 30

Strategically parked around the corner …

27.02.2025 14:57 —

👍 891

🔁 224

💬 7

📌 29

Take a listen to my colleague @joeljacobs.bsky.social talk about our @ProPublica tribal lending series on Oregon public radio www.ijpr.org/economy-and-...

13.02.2025 23:43 —

👍 11

🔁 2

💬 0

📌 0

For more, see our full tribal lending series here: www.propublica.org/series/despe...

Or check out my thread on our previous reporting 👇

15.01.2025 16:20 —

👍 6

🔁 1

💬 0

📌 0

Tribal Lenders Say They Can Charge Over 600% Interest. These States Stopped Them.

Online lenders tied to Native American tribes argue that they aren’t subject to state lending laws, but they backed away from operating in six states where attorneys have acted forcefully to protect…

NEW: Federal authorities have struggled to regulate tribal lending operations that offer short-term loans at crushing interest rates. But six states have shown that tribal immunity doesn’t prevent state officials from acting to protect consumers.

By @joeljacobs.bsky.social & @megomatz.bsky.social

15.01.2025 13:00 —

👍 248

🔁 52

💬 12

📌 7

THREAD: In 2023, I received an envelope with no return address. Inside was a flash drive containing tens of 1000s of secret files.

It came from a vigilante with a tumultuous past, who'd conducted a years-long undercover operation. He didn’t tell the FBI or his family. He only told me.

04.01.2025 12:48 —

👍 19507

🔁 7226

💬 867

📌 1159

11/ Read more: www.propublica.org/article/trib...

03.01.2025 00:20 —

👍 19

🔁 3

💬 1

📌 0

10/ Despite lawsuits, prosecutions and federal crackdown attempts, how has the industry managed to persist? With help from powerful lobbying groups that have spent millions.

“This is a very entrenched industry with a lot of dollars at stake,” said UNM law professor Nathalie Martin.

03.01.2025 00:20 —

👍 23

🔁 3

💬 1

📌 0

9/ In a statement to ProPublica last year, John Johnson Sr., LDF’s president, described the tribe’s lending business as “a narrative of empowerment, ethical business practice, and commitment to community enrichment.”

03.01.2025 00:20 —

👍 19

🔁 3

💬 1

📌 0

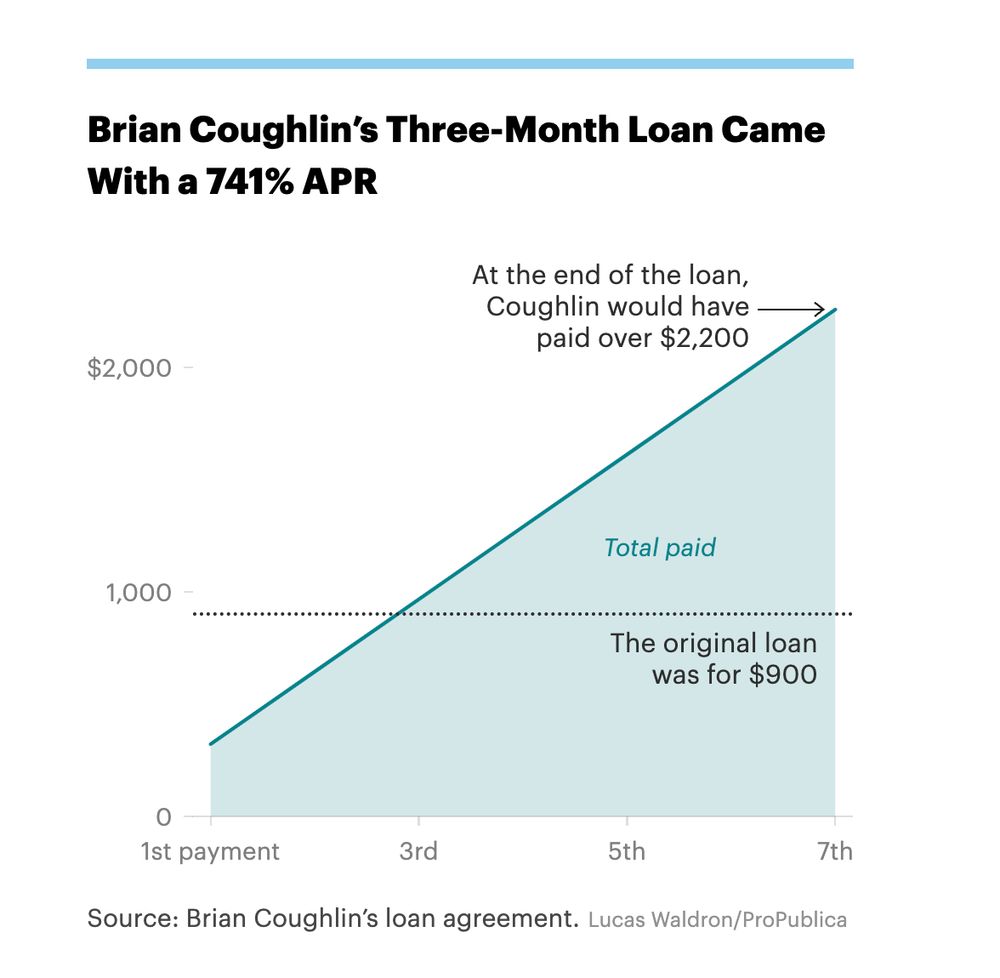

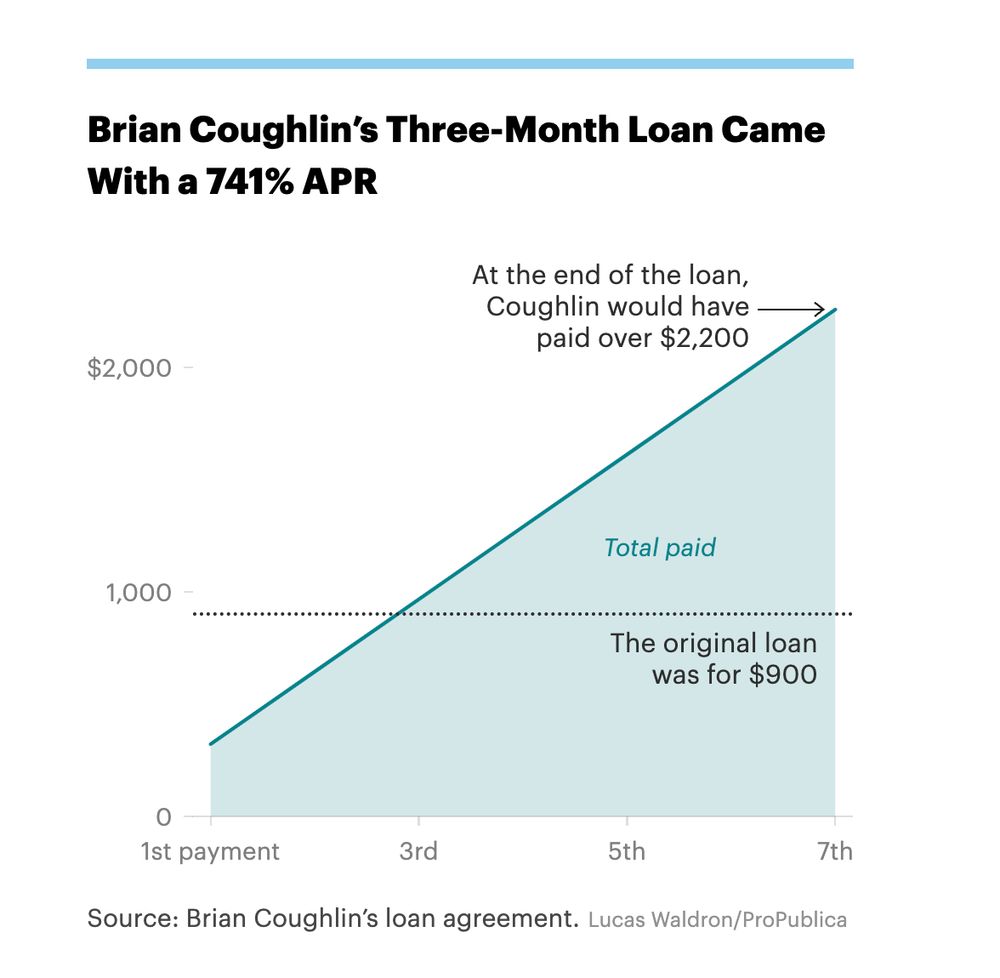

Line graph with a single line, labeled “Brian Coughlin’s Three-Month Loan Came With a 741% APR.” The x-axis ranges from the 1st payment to the 7th payment; the y-axis ranges from 0 dollars to $2000. Annotations read: “The original loan was for $900” and “At the end of the loan, Coughlin would have paid over $2,200.”

7/ In the Supreme Court case, a borrower with a 741% loan from LDF said that the incessant collection efforts by an LDF business partner — even after he declared bankruptcy — drove him to attempt suicide.

The business partner declined to comment.

03.01.2025 00:20 —

👍 102

🔁 14

💬 2

📌 2

A Wisconsin Tribe Built a Lending Empire Charging 600% Annual Rates to Borrowers

The Lac du Flambeau tribe is at the center of a $1 billion class-action settlement that comes after years of fending off claims of predatory lending practices.

5/ Only a few dozen tribes have entered the lending business, but the operations can become massive. In August, we reported on a WI tribe’s business, which settled a consumer lawsuit for $1.4 BILLION in debt relief and $37.4 million in payments: www.propublica.org/article/wisc...

03.01.2025 00:20 —

👍 105

🔁 12

💬 3

📌 2

4/ Industry defenders argue that the operations provide crucial revenue for tribes and valuable credit for borrowers.

But the sky-high interest rates and involvement of nontribal business partners have drawn scrutiny and legal trouble.

03.01.2025 00:20 —

👍 24

🔁 4

💬 1

📌 0

3/ The lenders’ websites are owned by Native American tribes, which are entitled to sovereign immunity. As a result, they claim that the businesses are not subject to state laws that cap interest rates.

03.01.2025 00:20 —

👍 23

🔁 3

💬 1

📌 0

2/ These short-term lenders have had tremendous reach: Our analysis found nearly 5% of bankruptcy cases nationwide included tribal loan debt, and an average of >1,800 complaints are routed to the FTC annually. But regulator and legislative reform efforts have repeatedly fallen short.

03.01.2025 00:20 —

👍 21

🔁 4

💬 1

📌 0