🤓

23.12.2025 21:30 — 👍 6 🔁 0 💬 0 📌 0🤓

23.12.2025 21:30 — 👍 6 🔁 0 💬 0 📌 0Medline ended its IPO debut up 41% to $41/SH

17.12.2025 21:08 — 👍 4 🔁 0 💬 0 📌 0

"I didn’t fall in love with acting by watching TV or movies. Instead, I fell in love with the power to make people feel things."

www.wsj.com/real-estate/...

"Only about 11% of companies that have gone public through a SPAC merger since 2019 are trading above their issue price, and dozens went bust just months after listing on US stock exchanges."

www.bloomberg.com/news/article...

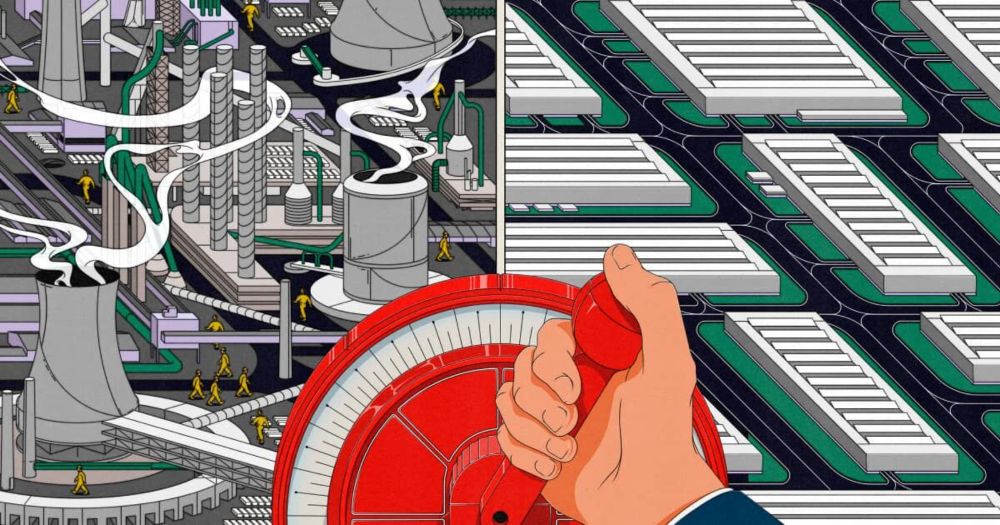

AI euphoria may be blinding Washington to the effects of its policies on the rest of the economy:

"This thing is so large that it’s breaking people’s mental models of how the economy works, and they’re making mistakes as a result"

www.bloomberg.com/news/feature...

The number of global rate cuts just one away from the post-financial crisis high, per BofA

24.10.2025 10:52 — 👍 58 🔁 14 💬 3 📌 3JPMorgan's Jamie Dimon: "If you open a newspaper any day of any year, there are serious issues the world's facing. I do think they're a little more serious today than they've been since World War II. It doesn't mean they don't resolve...but we should think about the future, in light of them."

16.10.2025 17:13 — 👍 27 🔁 2 💬 7 📌 0

Please tune in tomorrow on CNBC!

⏰ 7am ET: Carlyle CEO Harvey Schwartz

⏰ 12:40pm ET: JPMorgan CEO Jamie Dimon

⏰ 2pm ET: Morgan Stanley CEO Ted Pick

"We weren’t chasing hype for its own sake. We were trying to spark the feeling that draws people to Burning Man or the World Cup: the thrill of witnessing something unrepeatable."

www.nytimes.com/2025/08/21/o...

GOLDMAN SACHS: "Short interest for the median S&P 500 stock represents 2.3% of float, near the highest level since 2019." Goldman's Crowding Index remains near record highs and market breadth registers one of the narrowest levels in recent decades -- ripe conditions for short squeezes.

20.08.2025 14:04 — 👍 7 🔁 2 💬 0 📌 1

“I lost $400,000 in Yieldstreet. I consider myself moderately financially savvy, and I got duped by this company. I just worry that it’s going to keep happening to others.”

Great piece by @cnbc.com's Hugh Son

www.cnbc.com/2025/08/18/y...

Given that CoreWeave's multitude of investors are sitting on sizable paper gains, there's an incentive for many of them to sell at least some shares. I'm told by three sources that bankers are testing the market for a multitude of block sales that could be orchestrated before market open tomorrow🧵/2

14.08.2025 17:34 — 👍 5 🔁 0 💬 0 📌 0Shares of CoreWeave down 13%, in part, due to the anticipated flood of share supply that could pressure the stock in the short run. CoreWeave's lock-up on 83.7% of shares expires tonight -- not 180 days after its IPO, as is typical, but rather two trading days after this quarter's earnings. 🧵/1`

14.08.2025 17:33 — 👍 13 🔁 1 💬 2 📌 0

Busy week for the “S-word”. 👀

@marketwatch.com @opinion.bloomberg.com

OpenAI CEO Sam Altman to CNBC on *if* it were to ever go public:

"I get why people would like love for us to be public sooner. And I'm sure people also get the reality of we're in still a crazy position and it would be very hard for us to be public given just all of the realities of that."

Elon Musk, the perpetual vacation-ruiner of @matt-levine.bsky.social.

07.08.2025 18:43 — 👍 17 🔁 1 💬 1 📌 0We've already gotten some great questions. AMA on the deficit, starting in 10 mins!

07.08.2025 16:51 — 👍 75 🔁 7 💬 7 📌 0

NEW REPORT: J.P. Morgan’s Global Economic Research team believes it is increasingly likely that the U.S. effective tariff rate will settle close to the 22% rate initially announced on April 2, due, in part, to sector-specific Section 232 tariffs -- many of which have not yet been finalized.

06.08.2025 13:35 — 👍 8 🔁 2 💬 1 📌 0

Do you want to learn more about our nation's growing deficit and the implications for markets, the economy and geopolitics?

Join us this Thursday, August 7 at 1 PM ET on Reddit for an AMA with our senior banking and finance reporter Leslie Picker.

bit.ly/455vahl

Banks cannot provide services to individuals who have been indicted. So, they were unable to do business with President Trump.

President Trump said on CNBC earlier that he and other conservatives were discriminated against for political reasons.

JPMorgan statement after Trump's claims of discrimination:

“We don’t close accounts for political reasons, and we agree with President Trump that regulatory change is desperately needed. We commend the White House for addressing this issue and look forward to working with them to get this right.”

Statement from Blackstone:

29.07.2025 12:23 — 👍 7 🔁 1 💬 1 📌 0

Sam Altman's Three Scary AI Scenarios (via conversation at the Fed today):

(1) Bad guy gets superintelligence first

(2) Loss of control (AI is like…no, you can’t turn me off)

(3) Models accidentally take over the world

Sam Altman at Fed Capital Conference: "Every time you're wasting your time in any way every time you're kind of looking around the internet, you can't quite do the productive thing. I think we are in an under supply of labor to a degree that is going to look horrible in retrospect."

22.07.2025 17:08 — 👍 5 🔁 1 💬 1 📌 2

Looking forward to sitting down in DC with Michelle Bowman tomorrow -- her first-ever CNBC interview. No shortage of things to talk about. I hope you'll tune in!

21.07.2025 12:59 — 👍 6 🔁 0 💬 0 📌 0

This morning, on Squawk Box, we previewed the Japanese election on Sunday, why polls are causing the JGB long end to spike, and how that may soon catch the attention of bond vigilantes in the U.S.

www.cnbc.com/video/2025/0...

Bloomberg: "Across the five biggest US banks, trading revenue hit a new record in the first six months of 2025. Uncertainty around President Donald Trump’s tariffs drove a surge of activity...leading the desks to smash second-quarter revenue expectations."

www.bloomberg.com/news/article...

👏👏👏

16.07.2025 19:11 — 👍 1 🔁 0 💬 0 📌 0

Okay...hear me out. New season of "Severance." But the "innies" are investment-banking analysts. And the "outies" work in private equity.

Who needs a loyalty pledge...

Investment Banking Fees 2Q'25:

JPMorgan: +8% to $2.5B

Goldman Sachs: +26% to $2.2B

Morgan Stanley: -5% to $1.5B

BofA: -9% to $1.4B

Citi: +13% to $1.1B

Wells Fargo: +9% to $700M