We have signed the Money and Pensions Service Savings Charter.

Read more here: bedfordcreditunion.org.uk/bedford-cred...

@bedfordcreditunion.bsky.social

A not-for-profit community bank for the residents of Bedfordshire 💜

We have signed the Money and Pensions Service Savings Charter.

Read more here: bedfordcreditunion.org.uk/bedford-cred...

If you need to borrow money to pay for childcare costs upfront, remember you can get your child benefit paid into your credit union account and borrow up to £1500. Don't turn to credit cards or high-cost lenders.

29.07.2025 11:24 — 👍 1 🔁 0 💬 0 📌 0

The cost of holiday clubs is now averaging £1076 per child, with a lot of clubs requiring payment upfront, while the childcare element of Universal Credit is paid in arrears.

www.bbc.co.uk/news/article...

Our Area of Common Bond now covers the whole of Bedfordshire 💜 Visit our website to check your postcode:

bedfordcreditunion.org.uk/area-of-comm...

Last week ABCUL joined leaders from across the co-operative and mutuals sector at a reception hosted at No.10 Downing Street to hear more about the Government’s renewed commitment to its manifesto pledge to double the size of the co-operative and mutuals sector.

www.abcul.coop/news/abcul-j...

On average, it takes four years for someone to reach out after borrowing from a loan shark. Fear, shame, or not realising it was a loan shark can all be barriers. But support is here—no pressure, no judgement.

📞 0300 555 2222

#StopLoanSharks #HereWhenYoureReady #SupportNotPressure

This week is #MentalHealthWeek and the theme this year is *Community*. And we think there's no better community than the one served by Bedfordshire's Community Bank 💜

Mental Health UK's Mental Health & Money Advice service helps people with financial advice. buff.ly/HklApHt

☀ Kick off the summer with PrizeSaver’s Summer Sizzler super draw with 5 prizes of £1000 💸

This is your chance to win £1000 to help you have a summer to remember – and all you need to do is save!

Find out how to take part here: buff.ly/e6EpItm

We spoke to FinTech Futures last month about how we keep up with technology in recent years:

www.fintechfutures.com/credit-union...

We have a mini repair cafe this Saturday at @bedfordcreditunion.bsky.social Cost of Living Fair 🛠️ at the Harpur Suite 10am-3pm. As always just turn up and queue!

25.03.2025 14:27 — 👍 3 🔁 1 💬 0 📌 0

Thank you to @bbcnewsofficial.bsky.social for covering our Cost of Living Fair- first one is tomorrow (29 March) at the Harpur Suite, Bedford

www.bbc.co.uk/news/article...

It's #debtawarenessweek (24-30 March) and StepChange Debt Charity are tackling the stigma of debt and encouraging people to get support and start the conversation about debt.

You can get free online advice with StepChange:

buff.ly/m7cjlvn

Or visit your local Citizen's Advice buff.ly/ooTzke7

We'll be at the Bedford Business Expo Tuesday 18th March to chat with local employers about how our Employer Deduction Scheme can help their workers. Come and say hello if you're attending!

14.03.2025 10:19 — 👍 2 🔁 0 💬 0 📌 0

📢 AGM NOTICE 📢

This year the AGM will be held on:

📅 Wednesday 19th March 2025

📍 The Wren Room, St. Mark’s Church and Community Centre, Calder Rise, Brickhill, Bedford MK41 7UY

🕢 7.30pm

Bedford Credit Union is owned by its members, and all members are entitled to attend our Annual General Meeting

NEWS. ENERGY PRICE CAP TO RISE AGAIN, 6.4% ON 1 APRIL. This follows the 1% rise in Jan and 10% last Oct. Here's my instant briefing (feel free to share) including WHAT TO DO. Lets start with the avg Direct Debit Cap... ELEC Standing charge 53.8p/day (from 60.97p) DOWN 11% Unit rate: 27.03p/KwH (from 24.86p) UP 8.7% GAS Standing charge: 32.67p/day (from 31.65p) UP 3.2% Unit rate: 6.99p/KwH (from 6.34p) UP 10% So for every £100 you pay for energy now, from April people will typically pay roughly £106.40. Yet in reality as the daily standing charge is dropping, some lower users (below £100/mth) will see only small rises, but those who use a lot (above £200/mth) will likely see 7%-10% increases. Those are averages but there is a lot of regional variation in prices (we're already building a calc on MSE to be available later today so you can see the direct impact) with London & NW Wales outliers as there electricity standing charges are rising.

HOW TO KNOW IF YOU'RE ON A CAPPED TARIFF If you're not on a fix or special deal you are likely on the Cap. It applies to firms standard default consumer tariffs, often called 'Standard Variable' or 'Flexible' tariffs. If you don't know assume you, like two third of homes probably are. THE PRICE CAP IS A PANTS CAP GET OFF IT IF YOU CAN - FIX NOW IF YOU HAVEN'T ALREADY The cheapest year-long standalone fixes right now are about 4% LESS than the current Cap, never mind once it rises in April, so if you get a good fix now you lock in at a cheaper rate for a year, get price certainty, save instantly and save relatively more once we get to April. You cheapest fix depends on where you live and how much you use, so do a comparison (the MSE cheapenergyclub.com is whole-of-market-by default) though I'd wait a couple of hours as I hear more tariffs are being launched. Remember though the savings comparison sites will show now are compared to the current cap, they will be bigger compared to April.

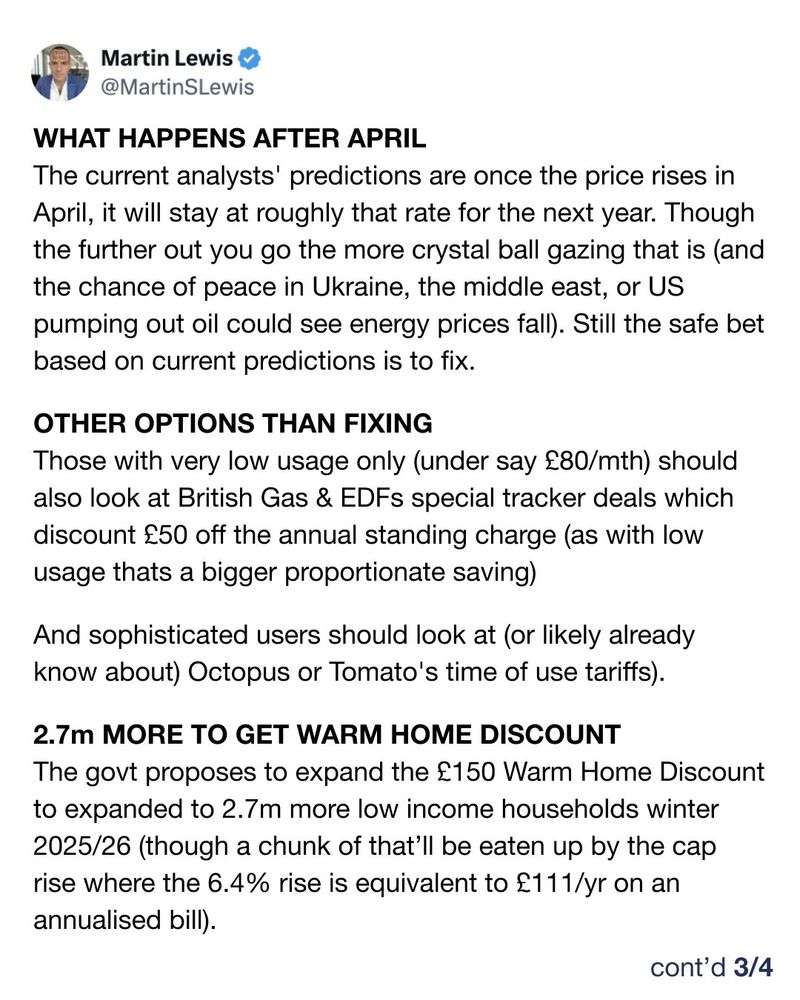

WHAT HAPPENS AFTER APRIL The current analysts' predictions are once the price rises in April, it will stay at roughly that rate for the next year. Though the further out you go the more crystal ball gazing that is (and the chance of peace in Ukraine, the middle east, or US pumping out oil could see energy prices fall). Still the safe bet based on current predictions is to fix. OTHER OPTIONS THAN FIXING Those with very low usage only (under say £80/mth) should also look at British Gas & EDFs special tracker deals which discount £50 off the annual standing charge (as with low usage thats a bigger proportionate saving) And sophisticated users should look at (or likely already know about) Octopus or Tomato's time of use tariffs). 2.7m MORE TO GET WARM HOME DISCOUNT The govt proposes to expand the £150 Warm Home Discount to expanded to 2.7m more low income households winter 2025/26 (though a chunk of that’ll be eaten up by the cap rise where the 6.4% rise is equivalent to £111/yr on an annualised bill).

It’ll be done by getting rid of the ‘high energy cost’ criteria for those on means tested benefits like Universal Credit (which helps working people and non working on low incomes). That’s good as it’s a terribly implemented system which left many, literally, unfairly out in the cold. There’s also a proposal on old energy debt support, which sound good, but needs reading so I’ll leave that for now. MORE TO COME These are my first thoughts, undoubtably more later, the MSE weekly email will have a full run through of top switchable tariffs when its out later today. And join me at 8pm tonight on ITV for The Martin Lewis Money Show Live when I'll be explaining all this in more detail and putting your questions to the Ofgem boss.

NEWS. Energy Price Cap to rise again 6.4% on 1 April. Here’s my instant briefing on what you should do…

25.02.2025 08:34 — 👍 172 🔁 53 💬 23 📌 3

On average, accounts hold around £2,212...

#Bedford #BedfordNews #Finances #Money #ChildTrustFund

Did you hear us on BBC 3 Counties Radio this morning, chatting to Andy Collins about free things to do this half term, and our free Cost of Living Fair?

If you missed us you can listen again here (we're 1.40 mins in):

We achieved a lot in 2024, and look forward to continuing supporting the Bedfordshire Community with savings and loans in 2025 💜

05.02.2025 12:38 — 👍 2 🔁 0 💬 0 📌 0

It's #EnergySaversWeek from 20th-26th January. Visit the link below to find out how you may be able to save energy in your home.

20.01.2025 10:00 — 👍 1 🔁 0 💬 0 📌 0Hunger in the UK isn't a food problem.

It's an income problem.

"More than one in three people in the East of England are struggling to keep up with household bills and credit commitments."

Bedford Credit Union can help the community to save for those tougher months and provide fair, affordable loans for those who may need them.

About to tackle the January sales to try and find some bargains? Bedford Credit Union are here to help you avoid the pitfalls and make some genuine savings 🛍

https://buff.ly/402UsbU

Have you ever been afraid to tell your friends that you can’t afford something? #Loudbudgeting is all about being honest when you talk about money, which can be especially tricky in the lead up to Christmas🎁

Find out how you can take part and keep your spending in check.

Christmas can also bring stress, worry and financial pressure.

Loan sharks recognise this, and it can be a time of year when they take advantage of the most vulnerable by pretending that they are helping out in a time of need.

https://buff.ly/4g2xQz6

Christmas doesn’t have to be all about spending money, Bedford Credit Union is here to help this Christmas with five low-cost thrifting and gifting ideas especially for Bedfordshire🎁

06.12.2024 12:00 — 👍 1 🔁 0 💬 0 📌 0

It is great to hear the government is bringing #financialexclusion into the spotlight.

We have provided banking services for people excluded from mainstream banking for over 25 years and support vulnerable people to build savings and access credit when needed 💜

www.gov.uk/government/n...