SAP has overtaken Novo Nordisk as Europe's largest publicly listed company, with a market cap of €313.5bn.

24.03.2025 10:15 — 👍 3 🔁 1 💬 0 📌 0@schuldensuehner7.bsky.social

Holger Zschäpitz is market maniac @Welt and Author of 'Schulden ohne Sühne?' a book on states' addiction to debt. Pics: http://instagram.com/schuldensuehner

SAP has overtaken Novo Nordisk as Europe's largest publicly listed company, with a market cap of €313.5bn.

24.03.2025 10:15 — 👍 3 🔁 1 💬 0 📌 0

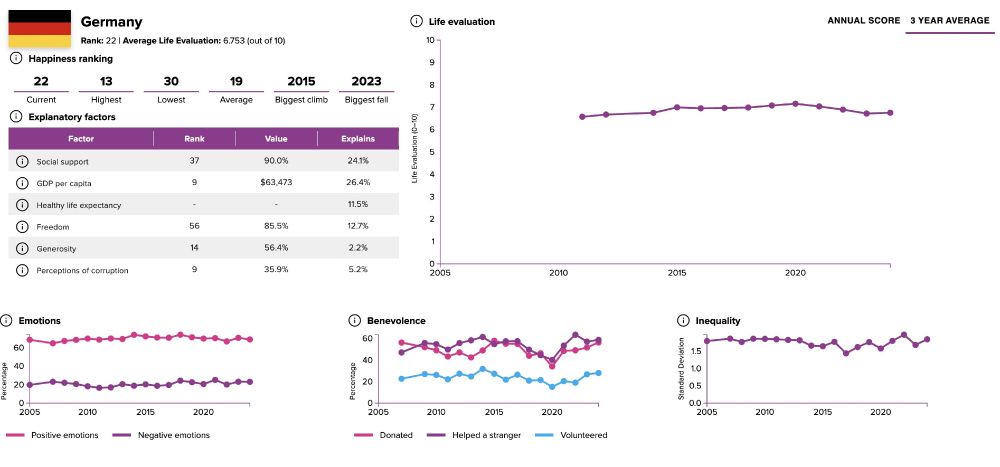

Good Morning from #Germany, which has climbed 2 spots in the World Happiness Ranking—from 24th to 22nd—but is still 3 places below the long-term average. And Germany is behind Mexico or the United Arab Emirates but is happier off than the US.

24.03.2025 07:56 — 👍 2 🔁 1 💬 0 📌 0

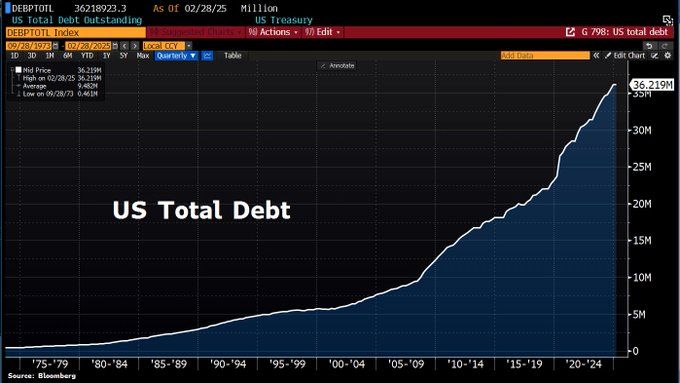

Tax revenue could drop by up to 10% this spring compared to 2024 – roughly a $500 billion shortfall – as companies and individuals change their behavior in response to what some call the White House’s attack on the IRS. According to several agency employees, the IRS has even

24.03.2025 07:55 — 👍 1 🔁 0 💬 0 📌 0

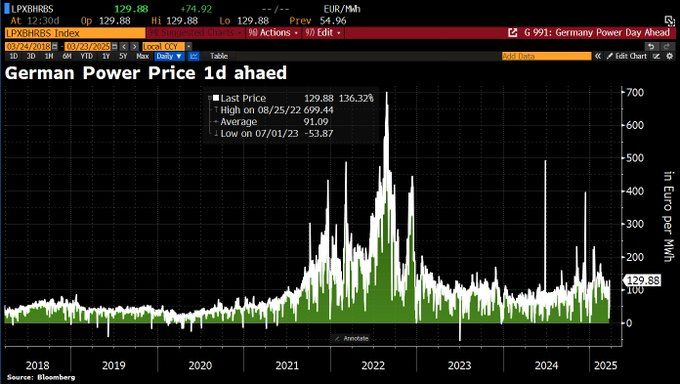

Good Morning from #Germany, where electricity prices remain highly volatile. Today’s day-ahead price surged by 136%, soaring above €100 per megawatt-hour, compared to just €15 on Friday.

24.03.2025 07:55 — 👍 1 🔁 0 💬 0 📌 0Yo wtf is Steph even human

23.03.2025 20:10 — 👍 4 🔁 0 💬 1 📌 0

Musk’s X suspends opposition accounts in #Turkey amid civil unrest. politico.eu/article/musk...

23.03.2025 13:46 — 👍 5 🔁 4 💬 0 📌 0

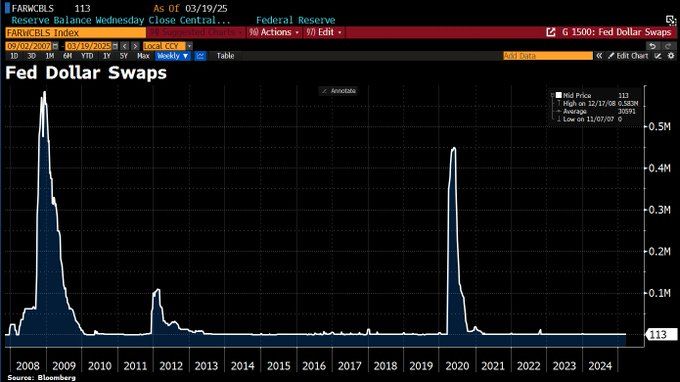

🌍 EU Banks' Dollar Dilemma

17% of Eurozone bank funding relies on USD (ECB study).

➡️ Fears grow over Fed support under Trump 🎢

➡️ Short-term dollar borrowing = risk if access falters

Is EU ready for a dollar crunch? #Banking #Markets

🌍 Deutsche Bank vs Wall Street

JPM=14x DB (vs 28x in 2019)

➡️ US Drama: Trump deregulation may backfire: market chaos slows IPOs/M&A 🎢

➡️ EU Edge: Debt-powered infrastructure boom fuels DB bets

Real shift or just noise? #BankingWars #Markets

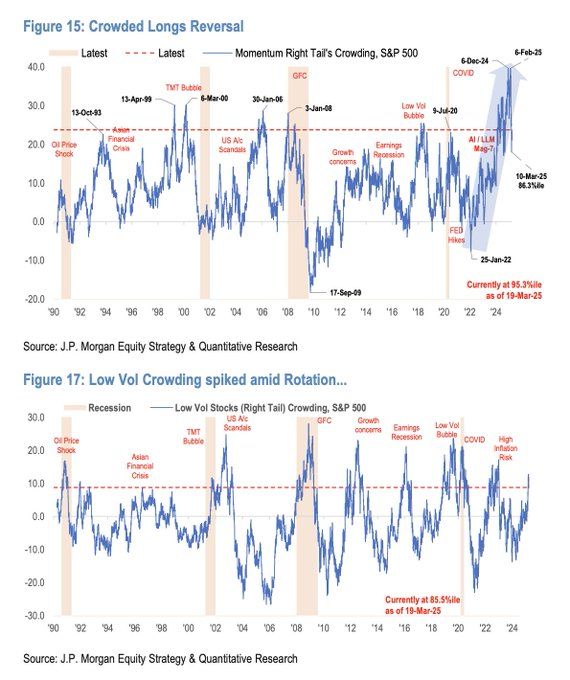

To put things into perspective: The Long Momentum factor has undergone one of the fastest unwinds in 40yrs, erasing the last 2yrs of gains in just three weeks, JPM says. At the same time, investors have been piling into low-volatility stocks rapidly.

23.03.2025 13:39 — 👍 4 🔁 1 💬 0 📌 0

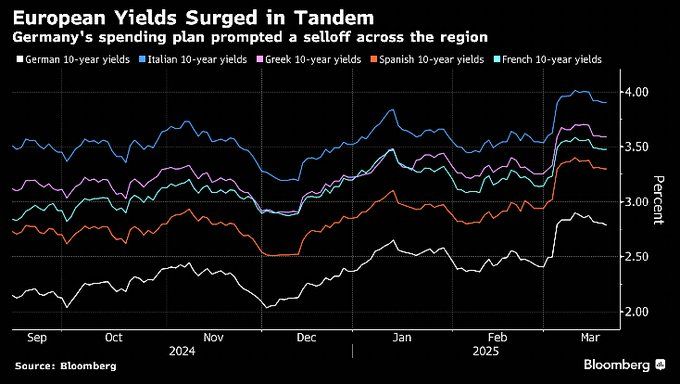

#Germany’s new era of big spending is driving up borrowing costs across Europe, sparking fresh concerns about fiscal stability—especially in highly indebted countries like #France, #Italy, #Greece, #Spain, and #Portugal. bloomberg.com/news/article...

21.03.2025 14:23 — 👍 0 🔁 0 💬 0 📌 0

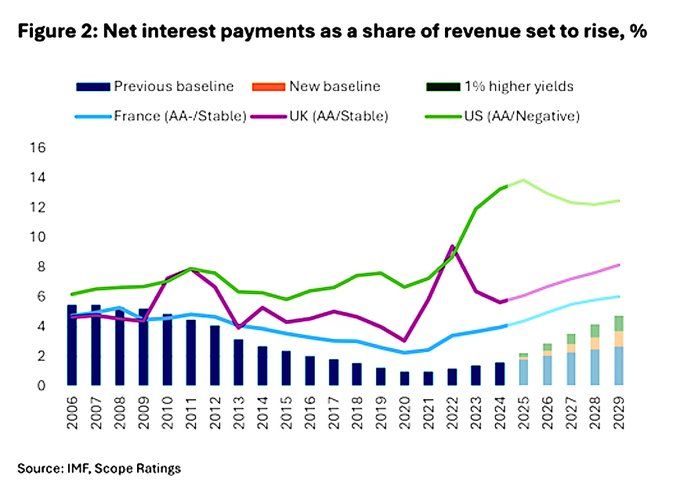

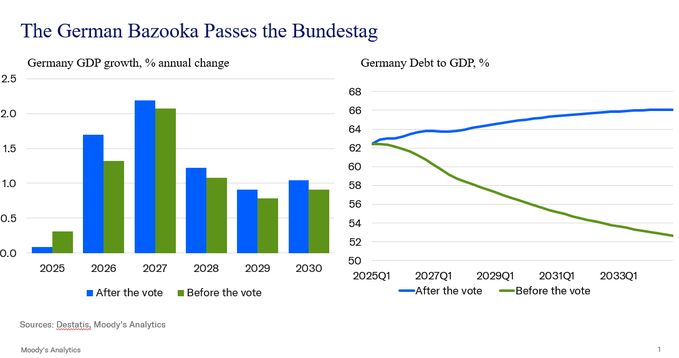

🇩🇪 Debt Brake Amendment Passed

Bundesrat approved spending bill (53 vs. 46 required votes), triggering higher debt/interest. But:

2024 interest/revenue: 1.6% (Scope: vs FR 4%, UK 5.7%, US 13.2%)

2029 forecast: 3.7% (↑ to 4.4% if yields +1%)

#DebtBrake #InterestCosts

🇩🇪 Debt Brake Amendment Passed

Bundesrat approved spending bill (53 vs. 46 required votes), triggering higher debt/interest. But:

2024 interest/revenue: 1.6% (Scope: vs FR 4%, UK 5.7%, US 13.2%)

2029 forecast: 3.7% (↑ to 4.4% if yields +1%)

#DebtBrake #InterestCosts

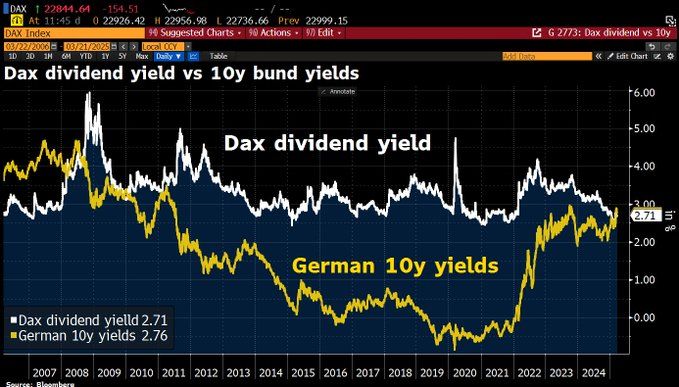

The FT asks today: Is this the beginning of a period of European exceptionalism in markets?

Sure, European stocks might narrow the valuation gap w/US stocks a bit, but true European exceptionalism isn’t happening. ft.com/content/012a...

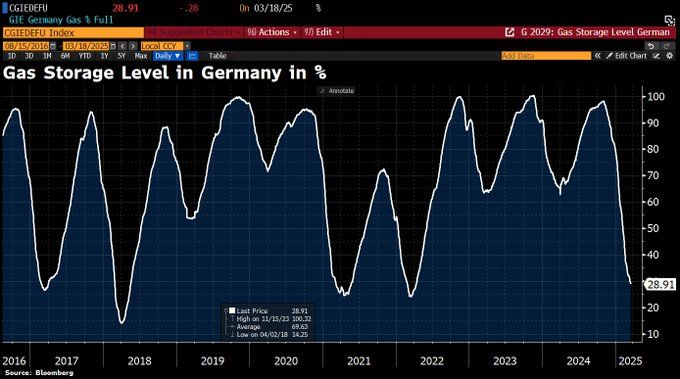

🇩🇪 Gasalarm: Speicher unter 30%!

Trotz kritischer Lage sinken Spotpreise – dank EU-Zielanpassung & möglichem Gas-Rückfluss. 🎯 Neue Deadline: 1.12. (bedingt), Ziel bleibt 90% bis 1.11. 🏭 Haushalte & Industrie zahlen weiter Speicherumlage.

#Energiekrise #EUEnergie

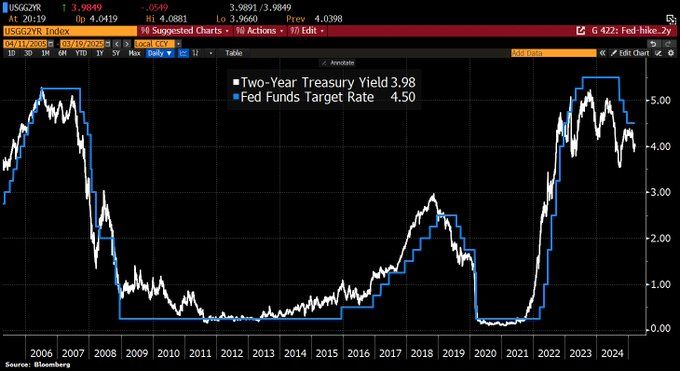

Looks like the markets see the #Fed meeting as dovish. 2y yields sink <4%.

19.03.2025 19:40 — 👍 0 🔁 0 💬 0 📌 0

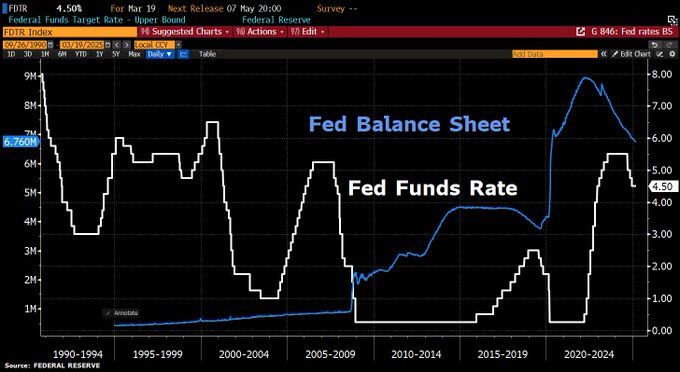

The Federal Reserve maintains interest rates at 4.25%-4.50% and slows balance sheet reduction to $50 billion. Stagflation risks rise as the 2025 GDP forecast is cut to 1.7%, with inflation expectations increased for both headline and core PCE.

19.03.2025 19:39 — 👍 3 🔁 1 💬 0 📌 0

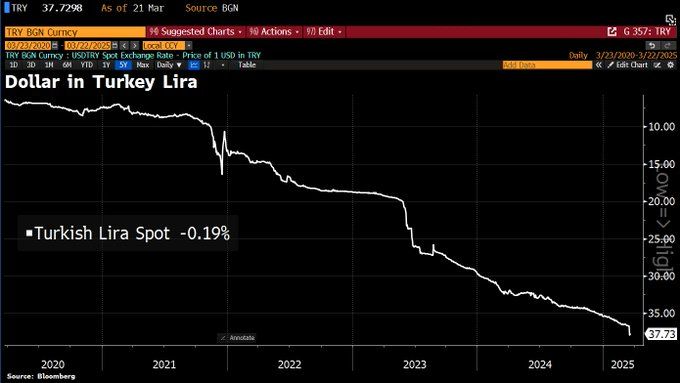

OUCH! #Turkey Lira in free fall as the arrest of Erdogan rival ups the political risk.

19.03.2025 09:58 — 👍 0 🔁 0 💬 0 📌 0

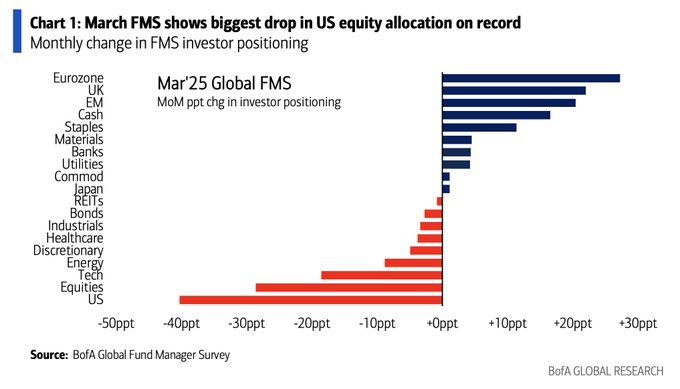

In case you missed it: The March BofA Fund Manager Survey shows the largest monthly drop ever in US equity allocation. Meanwhile, investment in Eurozone stocks has reached its highest level since July 2021.

19.03.2025 09:57 — 👍 0 🔁 0 💬 0 📌 0

Germany's relaxation of debt rules will increase medium-term debt, not decrease as expected. Extra spending boosts growth by only 0.1%, as much goes to defense with low economic multiplier.

19.03.2025 09:57 — 👍 0 🔁 0 💬 0 📌 0