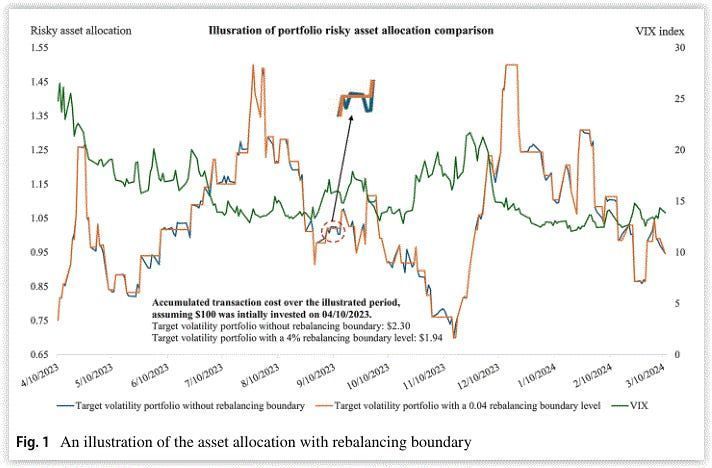

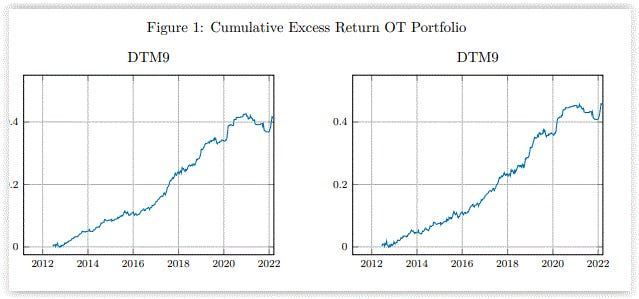

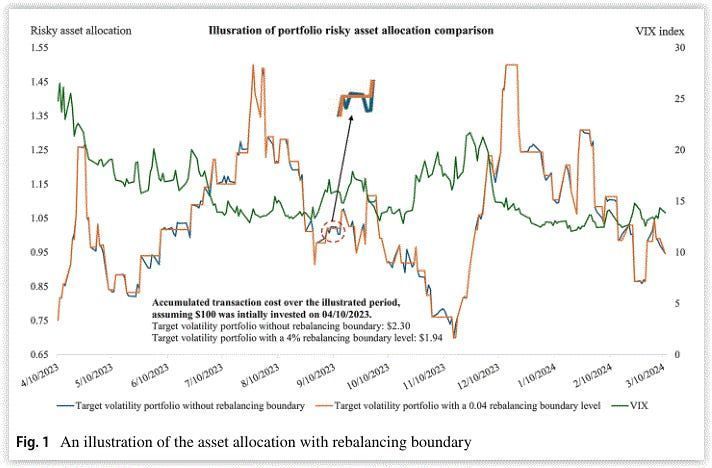

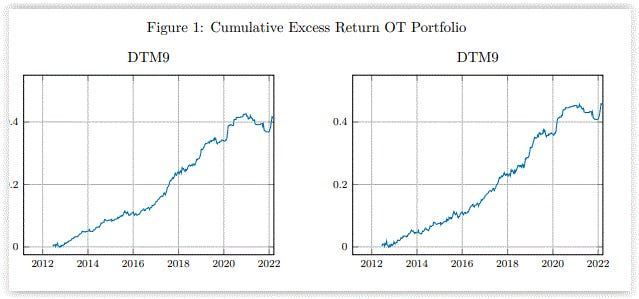

Reducing Transaction Costs in Volatility-Managed Portfolios

Volatility targeting is a risk and portfolio management technique that adjusts exposure based on changes in asset volatility.

Reducing Transaction Costs in Volatility-Managed Portfolios

#finance #trading #investing

Volatility targeting is a risk and portfolio management technique that adjusts exposure based on changes in asset volatility. We have discussed volatility targeting…

05.08.2025 21:56 — 👍 0 🔁 0 💬 0 📌 0

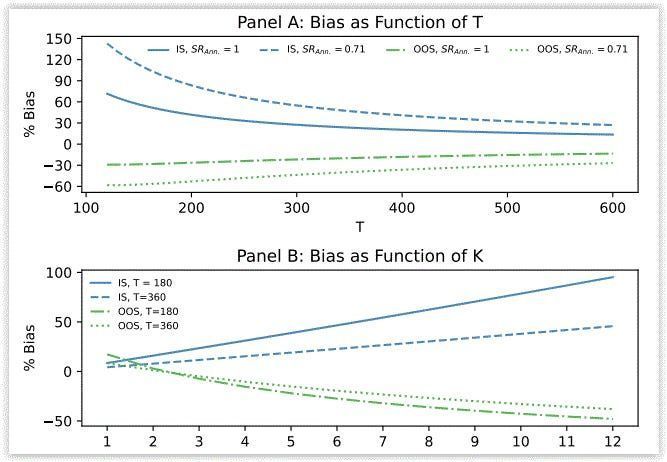

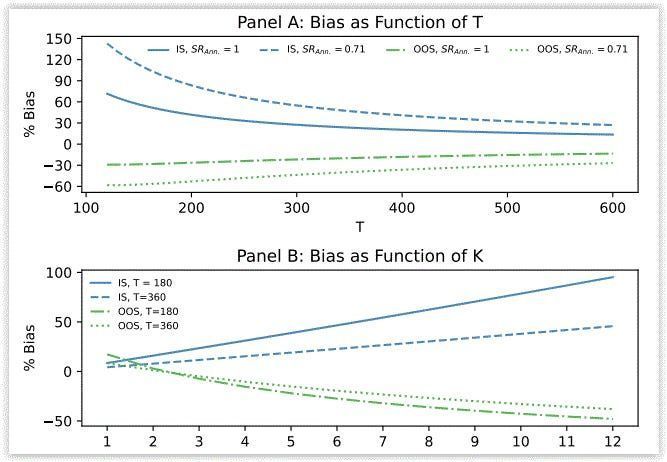

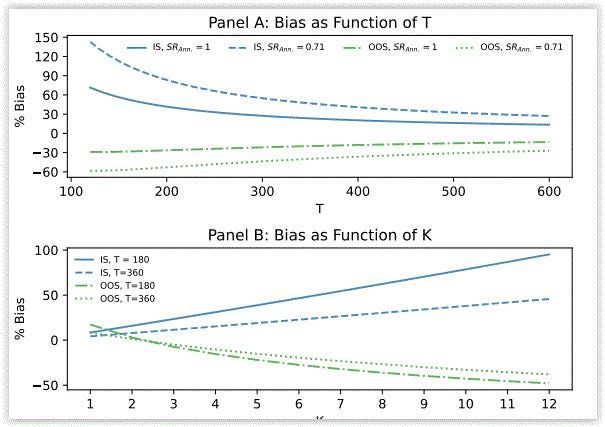

The Limits of Out-of-Sample Testing

Revisiting Out-of-Sample Accuracy in Trading Models

The Limits of Out-of-Sample Testing

#finance #trading #investing

In trading system design, out-of-sample (OOS) testing is a critical step to assess robustness. It is a necessary step, but not sufficient. In this edition, I'll explore some issues with OO…

04.08.2025 21:56 — 👍 0 🔁 0 💬 0 📌 0

Market Ecology and the Role of Trading Strategy Diversity in Market Stability

Market ecology refers to the complex interplay and dynamics among various participants, assets, and factors within financial markets.

Market Ecology and the Role of Trading Strategy Diversity in Market Stability

#finance #trading #investing

Market ecology refers to the complex interplay and dynamics among various participants, assets, and factors within financial markets. Just like in…

04.08.2025 09:20 — 👍 0 🔁 0 💬 0 📌 0

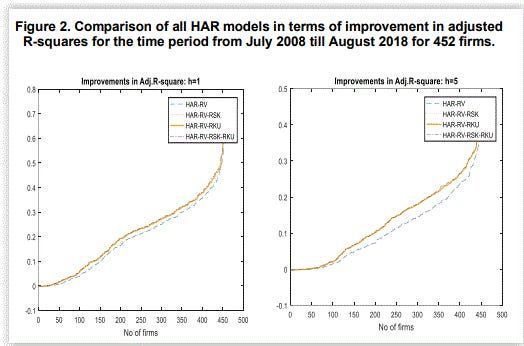

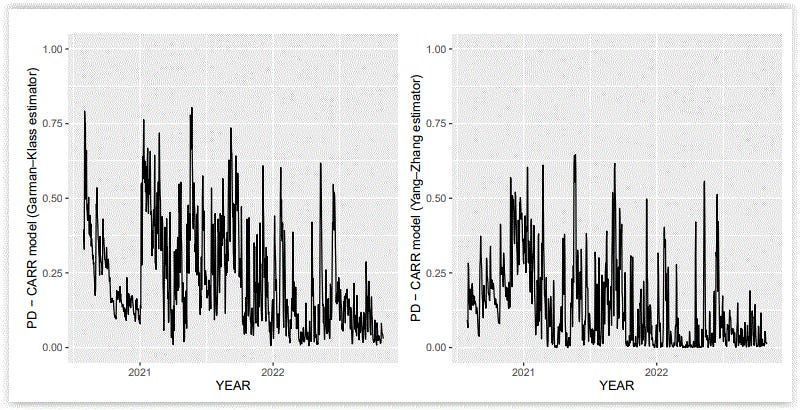

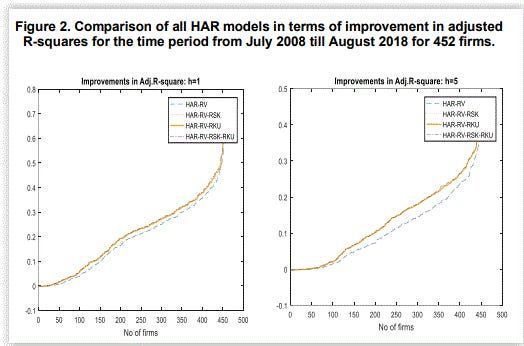

Predicting Realized Volatility Using Skewness and Kurtosis

Realized volatility refers to the actual volatility experienced by a financial asset over a specific period, typically computed using historical price data.

Predicting Realized Volatility Using Skewness and Kurtosis

#finance #trading #investing

Realized volatility refers to the actual volatility experienced by a financial asset over a specific period, typically computed using historical price data. By calcu…

03.08.2025 09:20 — 👍 0 🔁 0 💬 0 📌 0

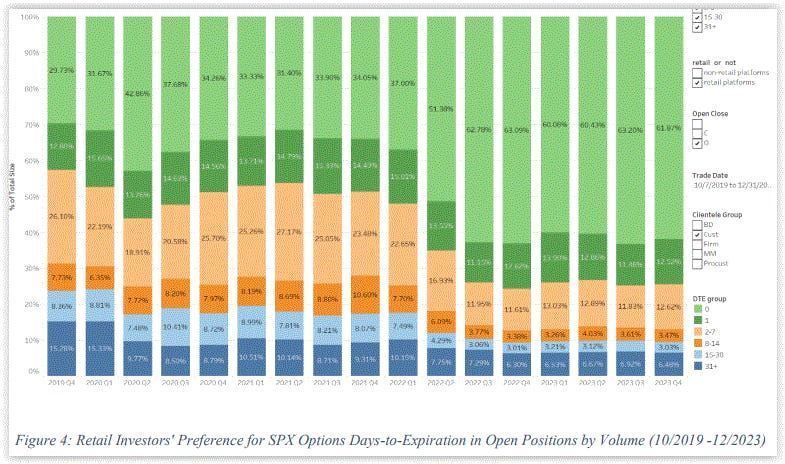

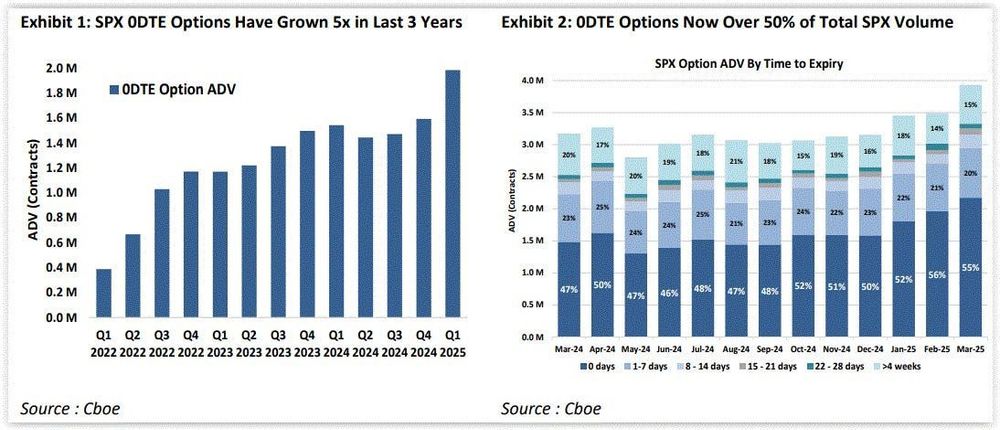

Good business for the exchange and retail brokers like Robinhood

02.08.2025 21:39 — 👍 1 🔁 0 💬 0 📌 0

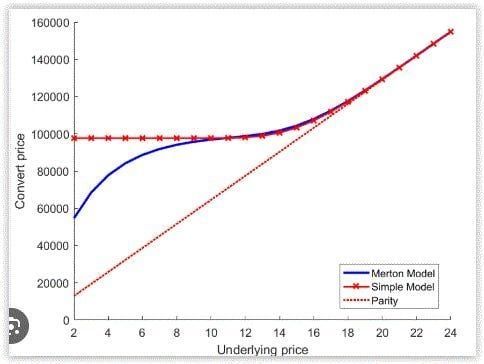

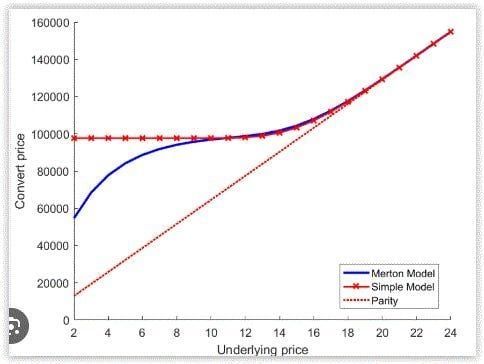

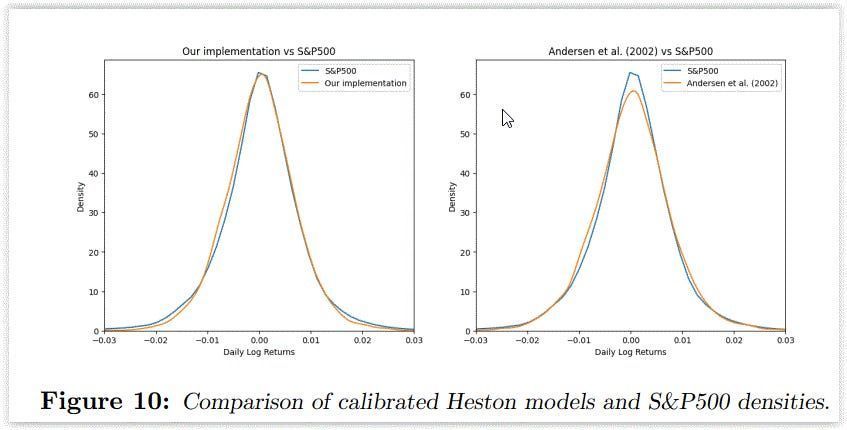

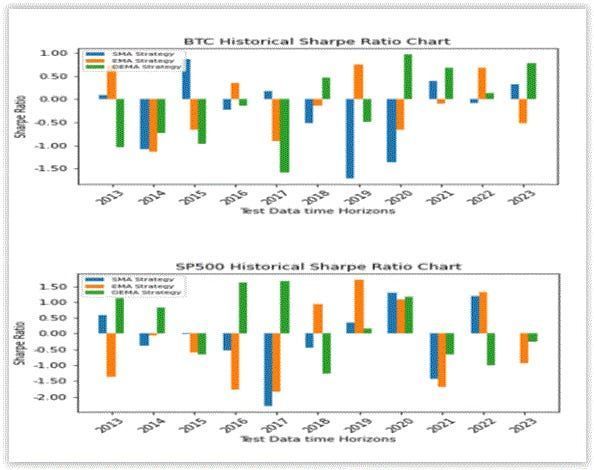

Depends on the market, but old model is still useful

02.08.2025 21:38 — 👍 1 🔁 0 💬 0 📌 0

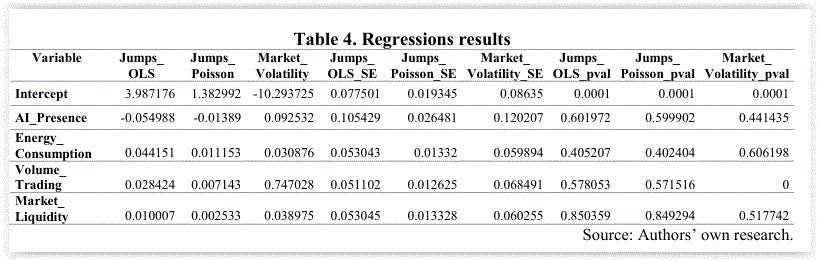

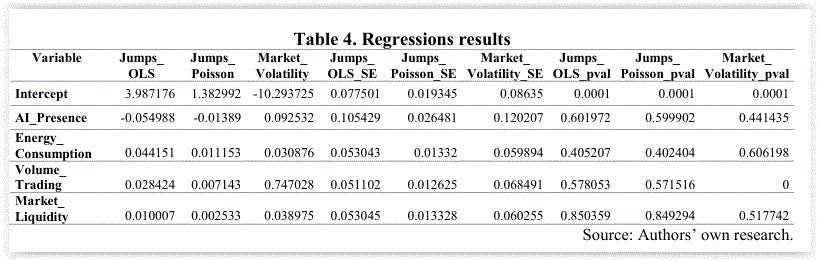

Jumps and Volatility Clustering in AI-Driven Markets

AI-assisted trading is a growing area in quantitative finance.

Jumps and Volatility Clustering in AI-Driven Markets

#finance #trading #investing

AI-assisted trading is a growing area in quantitative finance. However, concerns have emerged that it may destabilize markets. We recently discussed how trading strategies…

02.08.2025 09:20 — 👍 1 🔁 0 💬 0 📌 0

Lead-Lag Relationship Between Convertible Bonds and The Stock Markets

A convertible bond is a type of security that can be converted into a predetermined number of shares of the issuer’s common stock at certain times during its life.

Lead-Lag Relationship Between Convertible Bonds and The Stock Markets

#finance #trading #investing

A convertible bond is a type of security that can be converted into a predetermined number of shares of the issuer’s common stock at certain times during …

01.08.2025 09:20 — 👍 1 🔁 0 💬 0 📌 0

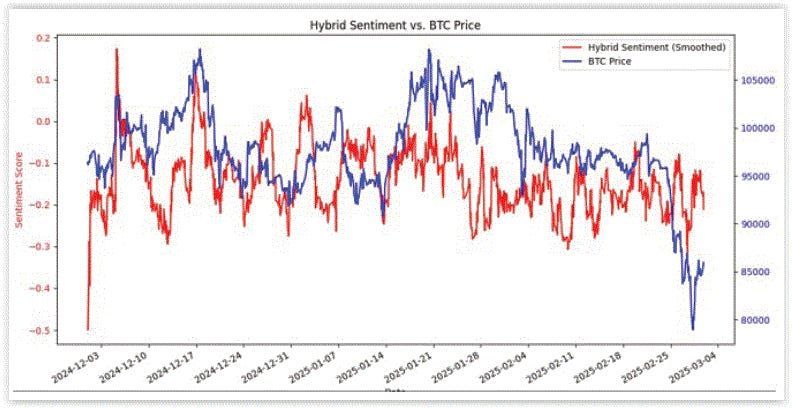

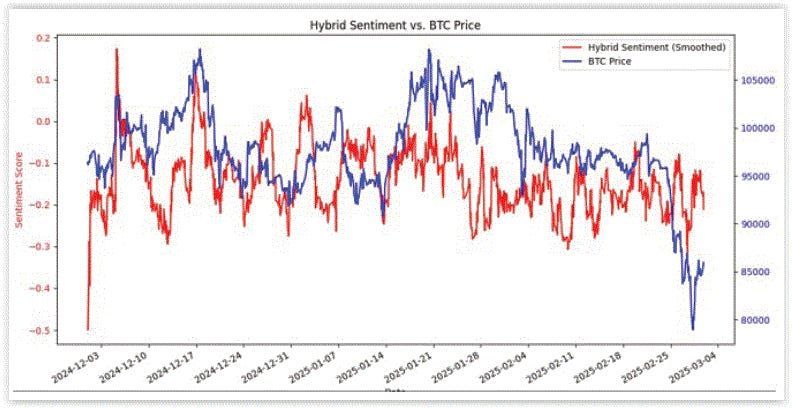

Analyzing Crypto Market Sentiment with Natural Language Processing

Sentiment analysis is a growing research area in quantitative finance, especially with the advancement of Large Language Models (LLMs) and Natural Language Processing (NLP).

Analyzing Crypto Market Sentiment with Natural Language Processing

#finance #trading #investing

Sentiment analysis is a growing research area in quantitative finance, especially with the advancement of Large Language Models (LLMs) and Natural Language P…

31.07.2025 09:20 — 👍 1 🔁 0 💬 0 📌 0

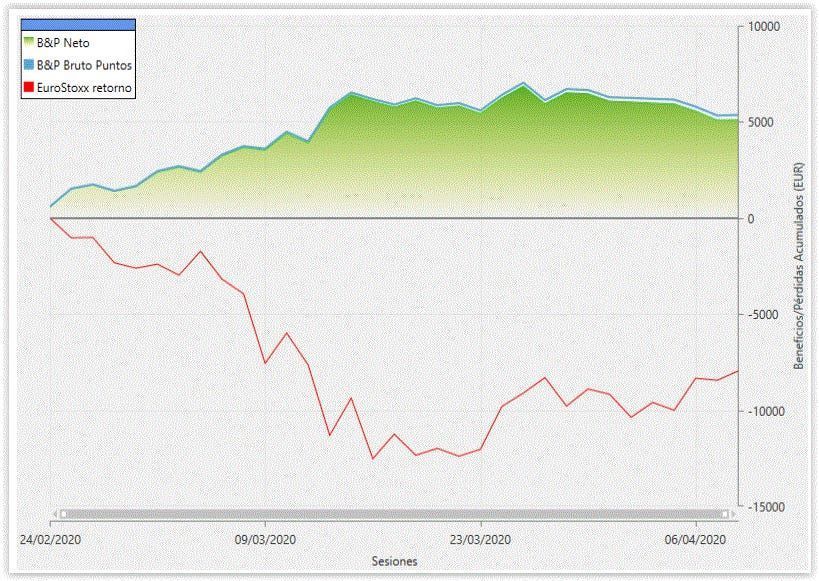

Is Pairs Trading Still Profitable?

Pairs trading involves identifying two related securities, typically stocks, that have historically exhibited a strong correlation in price movements.

Is Pairs Trading Still Profitable?

#finance #trading #investing

Pairs trading involves identifying two related securities, typically stocks, that have historically exhibited a strong correlation in price movements. Traders then look for deviations from …

29.07.2025 21:56 — 👍 1 🔁 0 💬 0 📌 0

Sentiment as Signal: Forecasting with Alternative Data and Generative AI

How to Use Alternative Data and LLMs to Generate Alpha

Sentiment as Signal: Forecasting with Alternative Data and Generative AI

#finance #trading #investing

Quantitative trading based on market sentiment is a less developed area compared to traditional approaches. With the explosion of social media, advance…

28.07.2025 21:56 — 👍 1 🔁 0 💬 0 📌 0

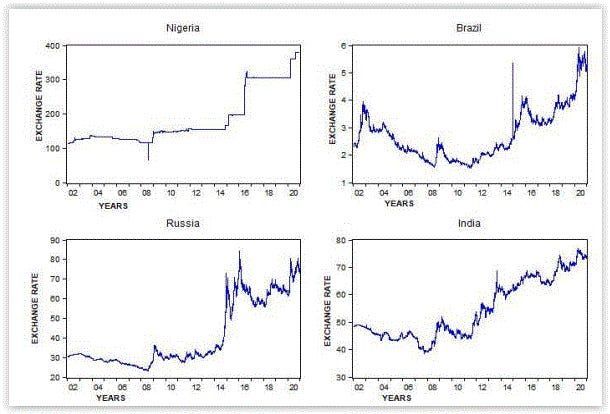

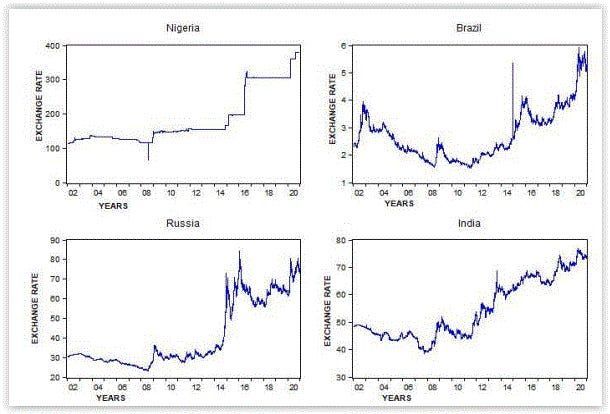

Volatility Spillover Between Developing Markets

Volatility spillover refers to the transmission of volatility shocks from one market or asset to another, leading to increased volatility in the receiving market.

Volatility Spillover Between Developing Markets

#finance #trading #investing

Volatility spillover refers to the transmission of volatility shocks from one market or asset to another, leading to increased volatility in the receiving market. These spillov…

28.07.2025 15:23 — 👍 1 🔁 0 💬 0 📌 0

Decomposing the Variance Risk Premium: Up and Down VRP

The variance risk premium (VRP) is a well-researched topic in quantitative finance.

Decomposing the Variance Risk Premium: Up and Down VRP

#finance #trading #investing

The variance risk premium (VRP) is a well-researched topic in quantitative finance. The VRP is the difference between the market-implied variance and the expected realiz…

27.07.2025 09:20 — 👍 1 🔁 0 💬 0 📌 0

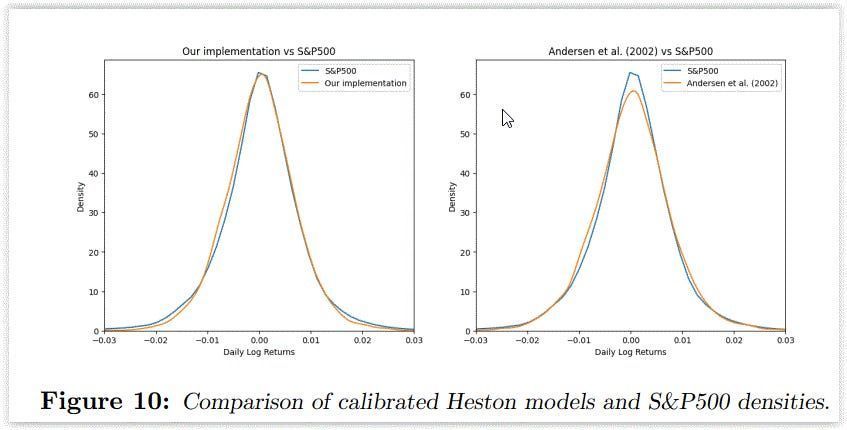

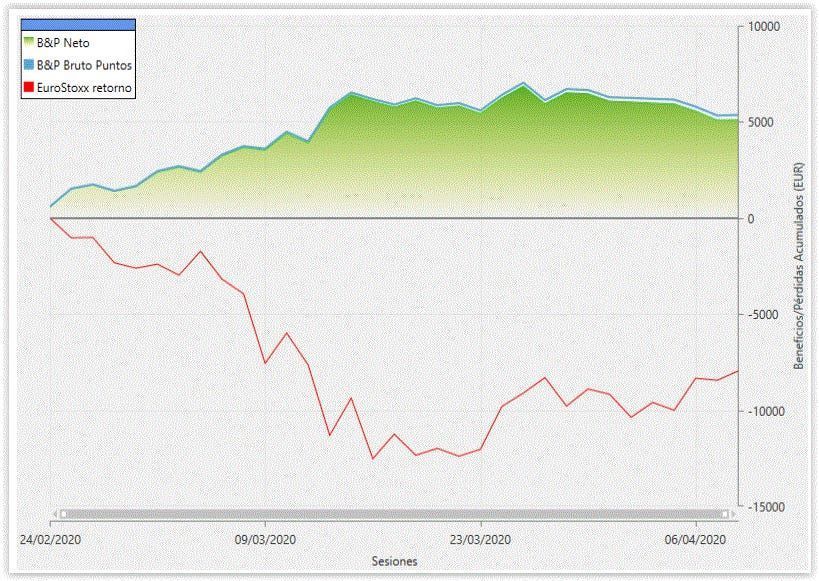

An Options Pricing Model for Non-Frictionless Markets

The traditional option pricing model assumes that the market is frictionless.

An Options Pricing Model for Non-Frictionless Markets

#finance #trading #investing

The traditional option pricing model assumes that the market is frictionless. However, a body of research has developed theories that do not make this assumption. Referen…

26.07.2025 09:20 — 👍 3 🔁 0 💬 1 📌 0

Use of the Real-World Measure in Portfolio Management

In the realm of finance, the risk-neutral measure takes precedence in pricing financial derivatives.

Use of the Real-World Measure in Portfolio Management

#finance #trading #investing

In the realm of finance, the risk-neutral measure takes precedence in pricing financial derivatives. However, the real-world measure remains significantly valuable and i…

25.07.2025 09:20 — 👍 1 🔁 0 💬 0 📌 0

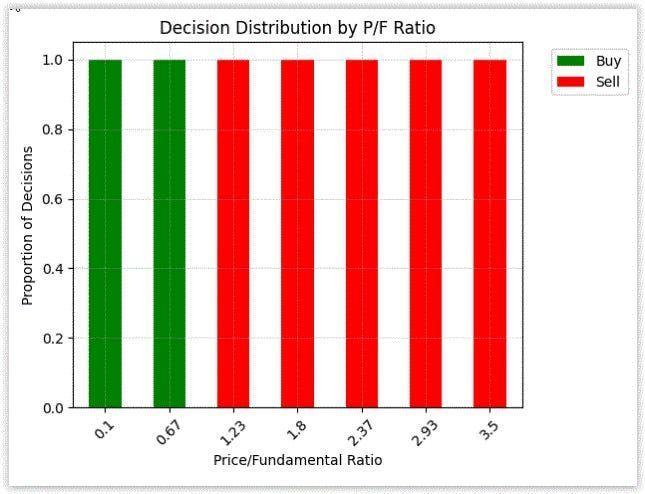

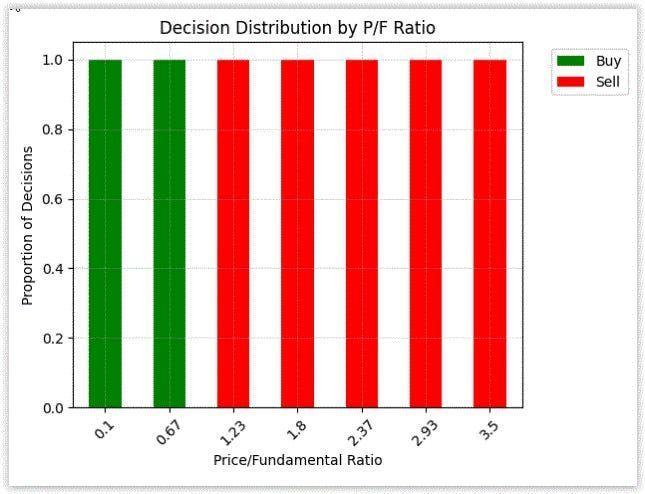

Can AI Trade? Modeling Investors with Large Language Models

Large language models (LLMs) are advanced artificial intelligence systems trained on vast amounts of text data to understand and generate human-like language.

Can AI Trade? Modeling Investors with Large Language Models

#finance #trading #investing

Large language models (LLMs) are advanced artificial intelligence systems trained on vast amounts of text data to understand and generate human-like language. LLMs …

24.07.2025 09:20 — 👍 1 🔁 0 💬 0 📌 0

Credit Risk Models for Cryptocurrencies

Credit risk is a fundamental aspect of financial risk management that arises from the possibility of borrowers or counterparties failing to meet their contractual obligations.

Credit Risk Models for Cryptocurrencies

#finance #trading #investing

Credit risk is a fundamental aspect of financial risk management that arises from the possibility of borrowers or counterparties failing to meet their contractual obligations. It refer…

23.07.2025 09:20 — 👍 1 🔁 0 💬 0 📌 0

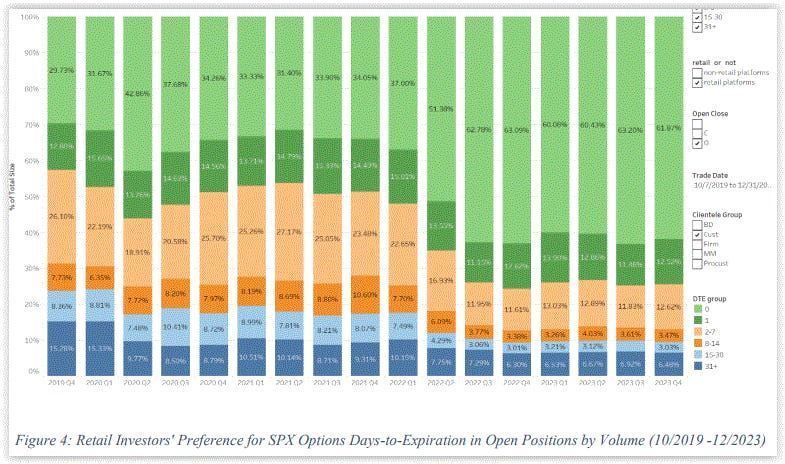

Behavioral Biases and Retail Options Trading

Key findings on retail investor behavior from recent market research

Behavioral Biases and Retail Options Trading

#finance #trading #investing

Behavioral finance is important, but it's not often discussed in quantitative trading. In this issue, I explore some aspects of behavioral finance.

Web-only posts Recap

Below is…

21.07.2025 21:56 — 👍 1 🔁 0 💬 0 📌 0

How to Deal with Missing Financial Data

In the financial industry, data plays a critical role in enabling managers to make informed decisions and manage risk effectively.

How to Deal with Missing Financial Data

#finance #trading #investing

In the financial industry, data plays a critical role in enabling managers to make informed decisions and manage risk effectively. Financial data can come from a wide range of sources…

21.07.2025 09:20 — 👍 1 🔁 0 💬 0 📌 0

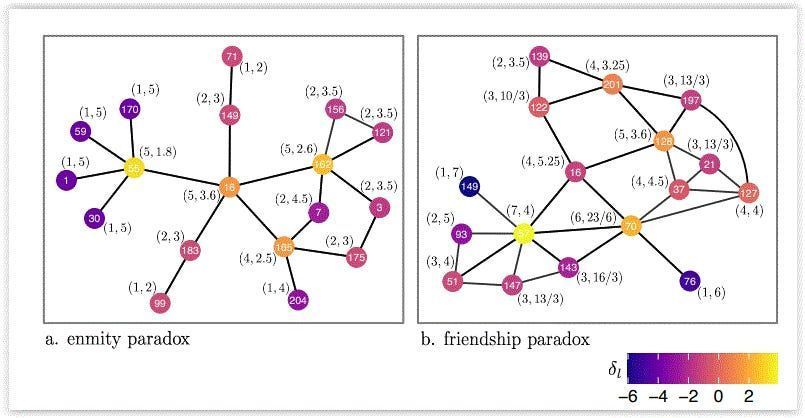

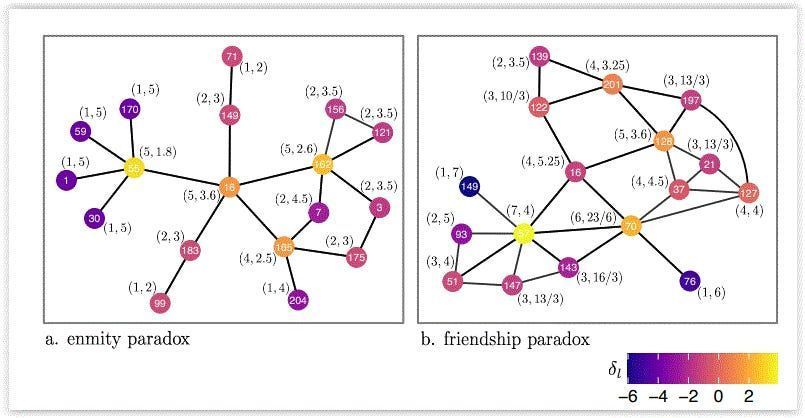

The Friendship and Enmity Paradoxes

The friendship paradox is a phenomenon in social network analysis that states that, on average, individuals tend to have fewer friends than their friends have.

The Friendship and Enmity Paradoxes

#finance #trading #investing

The friendship paradox is a phenomenon in social network analysis that states that, on average, individuals tend to have fewer friends than their friends have. This paradox arises from th…

20.07.2025 09:20 — 👍 1 🔁 0 💬 0 📌 0

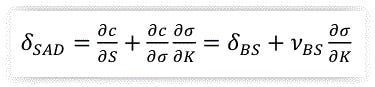

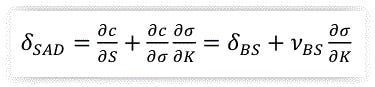

Improving Hedging with Skew-Adjusted Delta

Delta hedging is a method used to reduce or eliminate the directional risk of an options position.

Improving Hedging with Skew-Adjusted Delta

#finance #trading #investing

Delta hedging is a method used to reduce or eliminate the directional risk of an options position. In most delta hedging schemes, delta is calculated using the Black-Scholes-Merton …

19.07.2025 09:20 — 👍 1 🔁 0 💬 0 📌 0

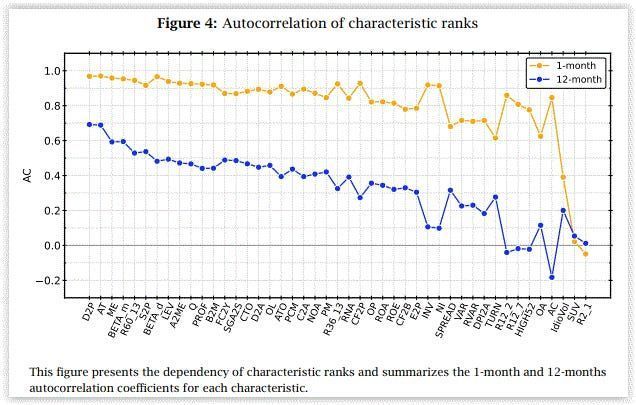

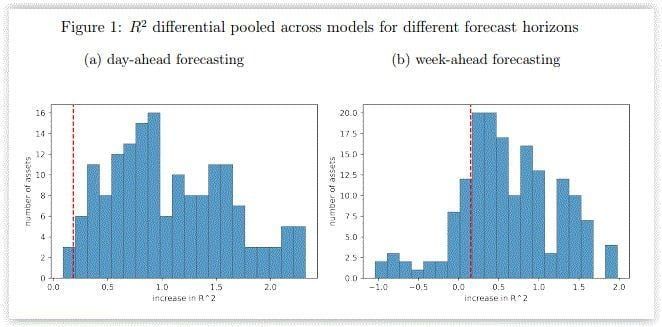

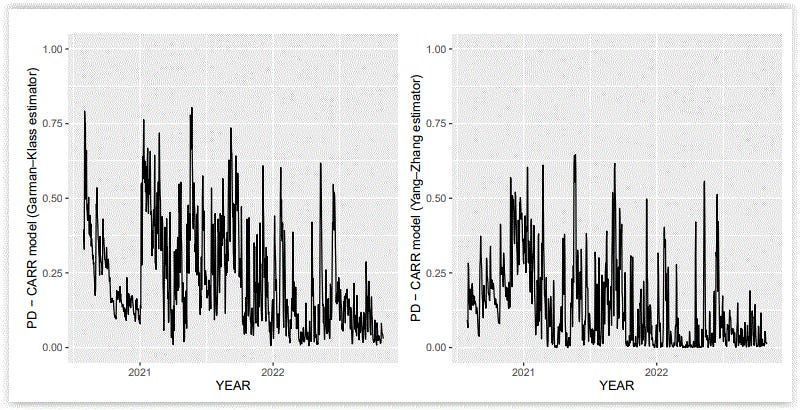

Incorporating Volume into Volatility Forecasting

Volatility forecasting plays an important role in finance.

Incorporating Volume into Volatility Forecasting

#finance #trading #investing

Volatility forecasting plays an important role in finance. Its importance lies in the fact that it enables us to effectively price options and plan trading and hedging activi…

18.07.2025 09:20 — 👍 1 🔁 0 💬 0 📌 0

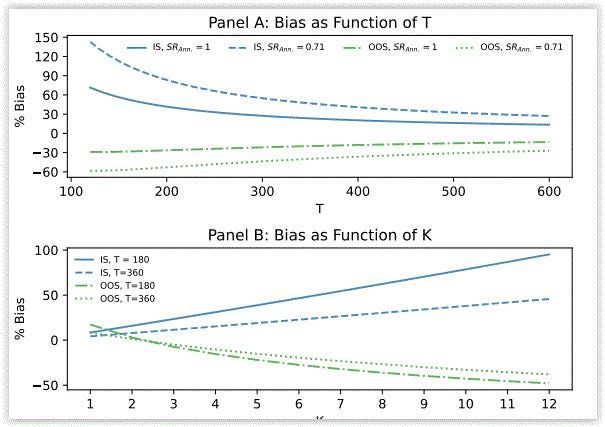

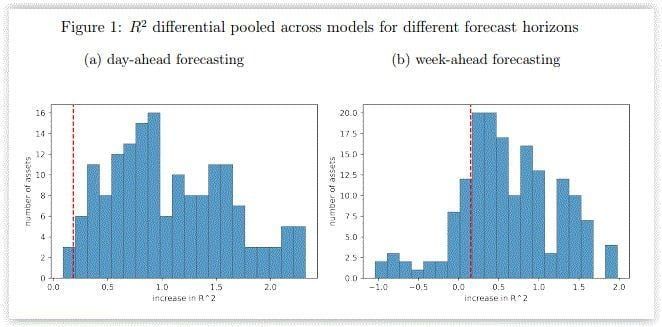

How Reliable Is Out-of-Sample Testing?

Out-of-sample testing is a critical component of designing and evaluating trading systems.

How Reliable Is Out-of-Sample Testing?

#finance #trading #investing

Out-of-sample testing is a critical component of designing and evaluating trading systems. Trading systems are often developed and optimized using historical data, which can lead to ove…

16.07.2025 21:56 — 👍 1 🔁 0 💬 0 📌 0

Can ChatGPT Predict the Stock Market?

ChatGPT is a large-scale language model developed by OpenAI.

Can ChatGPT Predict the Stock Market?

#finance #trading #investing

ChatGPT is a large-scale language model developed by OpenAI. It utilizes state-of-the-art deep learning techniques to generate human-like text responses based on the input it receives. T…

16.07.2025 09:20 — 👍 1 🔁 0 💬 0 📌 0

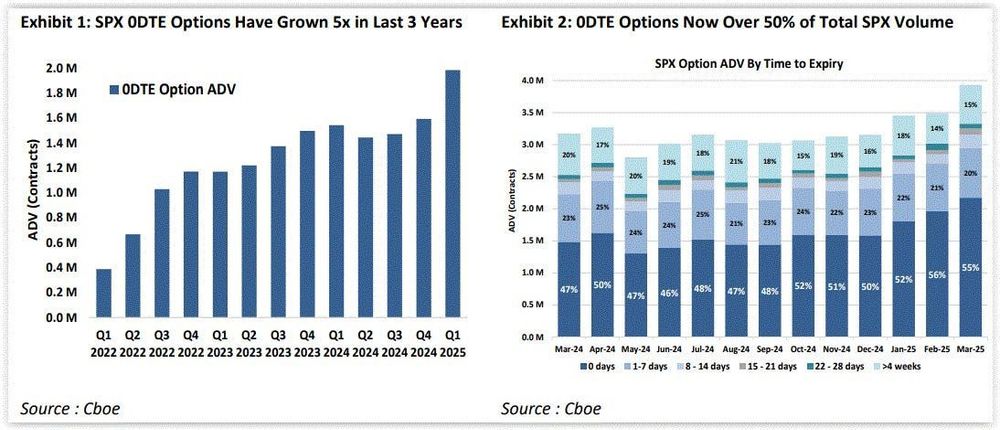

The Rise of 0DTE Options: Cause for Concern or Business as Usual?

0DTE Options Are Gaining Popularity—Do They Impact Market Stability?

The Rise of 0DTE Options: Cause for Concern or Business as Usual?

#finance #trading #investing

Zero DTE (Days to Expiration) options are contracts that expire on the same day they are traded. They were introduced in 2022 and have been gaining popularity…

14.07.2025 21:56 — 👍 2 🔁 0 💬 1 📌 0

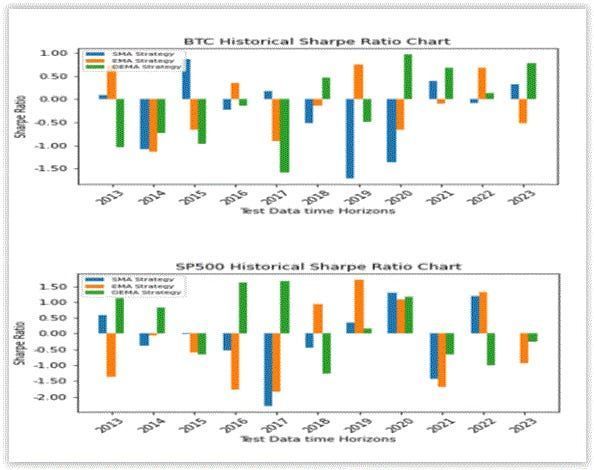

Bitcoin Trend Following Strategies vs. Traditional Indices: A Comparative Study

Trend following is an investment strategy that seeks to capture gains by identifying and trading in the direction of established market trends.

Bitcoin Trend Following Strategies vs. Traditional Indices: A Comparative Study

#finance #trading #investing

Trend following is an investment strategy that seeks to capture gains by identifying and trading in the direction of established market trends. …

14.07.2025 09:20 — 👍 7 🔁 0 💬 0 📌 0

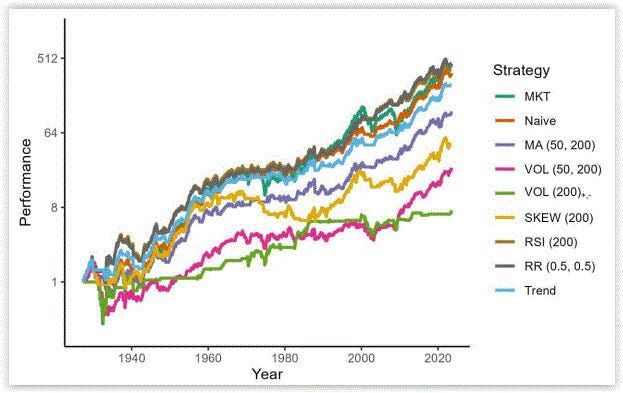

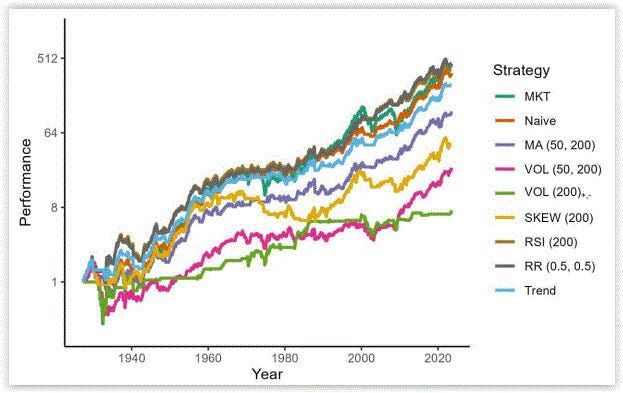

Enhancing Market Timing Strategies Through the Use of Macroeconomic Indicators

Market timing refers to the practice of attempting to predict future market movements in order to buy or sell securities at the most advantageous times.

Enhancing Market Timing Strategies Through the Use of Macroeconomic Indicators

#finance #trading #investing

Market timing refers to the practice of attempting to predict future market movements in order to buy or sell securities at the most advantageous…

12.07.2025 21:56 — 👍 1 🔁 0 💬 0 📌 0

Public Policy Executive Representing Securities Regulators | Adjunct Associate Professor | Focused on AI, Crypto, and Financial Regulation | Grateful American | Personal Account

Econometrics, data science, transport, statistics. #rstats. Beholden to three teenage roommates who don’t even pay rent.

Dutch website with research into investment opportunities. Focus on dividend stocks and speculations in the commodity sector.

Former US govt supercomputing geek and hater of fascist kleptocracies

Engineering | Finances | Complex System Dynamics

HPC | AI | QC | HFT |

Infrastructure, Construction, Energy, Defense, FinTech, BioTech.

I'm Harvey Sax. CoFounder of Alpha Wealth Funds, & Portfolio Mgr of The Insiders Fund since '10. Offering unique perspective from experience across all investment table positions.

Investment veteran, IPO, opinionated. https://www.theinsidersfund.com/

Passionate crypto developer with a deep focus on Web 3 and DeFi. Dedicated to building decentralized solutions and pushing the boundaries of blockchain technology

Hedge fund quantitative, physics once upon a time. Generally curious, mostly wrong

Mostly posting gifs.

Work: Volatility trader. Occasional college professor. Ex film/video streaming exec.

Life: Married, dad to some girls and a cat named Wanda. Canadian. Real nerdy.

#Algo stock trader for 5 years, other trading for 28 years.

Other interests photography with my Fuji #X100S.

Barefoot runner of some 16 years.

Guitar strummer

https://save-your-change.org Save your Change, save the World

I help investors add an additional 5-figure per month income stream, in 5 hours per week, with conservative options trading. www.abundantlyerica.com

I know very little but am interested in much. Degenerate book fiend. Markets, Materials science, Gene editing, Pharmacology, Boxer dog breeder.

We share backtested strategies daily.

Get Two Free Trading Strategies. (Backtested) 👇🏻

http://quantifiedstrategies.com/guide

http://youtube.com/@QuantifiedStrategies

Interested in trading ETFs and investing.

http://sugradh.com

Husband, father, entrepreneur. Former trader, hedge fund manager, & food business owner. Founder of verbatimfinancial.com Pronounced, St-oy, like boy. For the regs: posts ≠ advice

Standing on the shoulders of midgets.

I was here to discuss investing, books and music, but my country is on fire.

StockQuakes is an AI-powered tool that analyzes over 5000 stocks daily to find investment opportunities.

Newsletter: stockquakes.substack.com

Website: www.stockquakes.com