I'll continue to make the case that policy resilience doesn't mean invincibility, and we shouldn't overinterpret when an otherwise effective policy succumbs to American Maosim.

bsky.app/profile/ilmi...

23.05.2025 21:35 — 👍 1 🔁 1 💬 0 📌 0

This is a logical fallacy. A resilient strategy is not an invincible one. IRA may fail but note it's over the shocked objections of the market. One cannot ignore the decades of tax credit extension, for example, and then cherry pick a black swan data point.

23.05.2025 15:37 — 👍 8 🔁 2 💬 2 📌 1

Awesome stuff in here. Turns out a lot of my favorite people are “LPE-adjacent”

23.05.2025 21:38 — 👍 7 🔁 1 💬 0 📌 0

Also, learning from this list that @jeffgordon.bsky.social and I are issue-mates for the second time in a row.

22.05.2025 18:57 — 👍 4 🔁 1 💬 1 📌 0

I assume the next step is we start publishing our own journal

23.05.2025 21:37 — 👍 1 🔁 0 💬 1 📌 0

Great reporting. For more detail on the public-private electricity generation structures available under new Mexican laws, I found this helpful: www.projectfinance.law/publications...

06.05.2025 16:50 — 👍 3 🔁 0 💬 0 📌 0

06.05.2025 16:20 — 👍 0 🔁 0 💬 0 📌 0

06.05.2025 16:20 — 👍 0 🔁 0 💬 0 📌 0

The Techno-Industrial Policy Playbook

Policies for kickstarting America’s techno-industrial renaissance

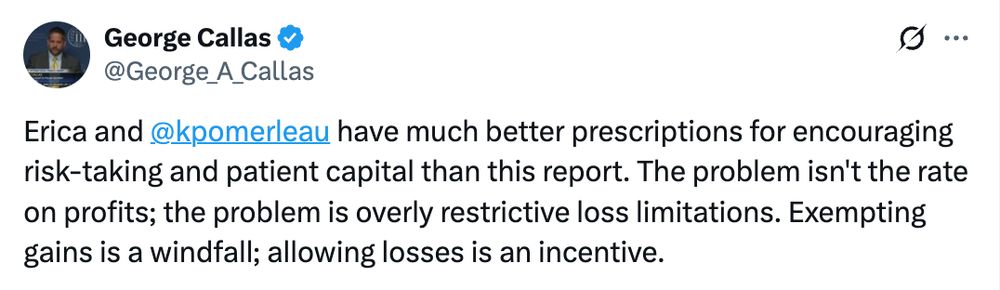

I like a number of the people involved in this, but it's amusing to see the Tax Foundation folks (who are ideologically aligned) ripping apart the tax policy chapter (by Oren Cass) over on Twitter for a number of basic factual and conceptual errors. Cass is reminding us all the value of expertise...

06.05.2025 16:14 — 👍 1 🔁 0 💬 1 📌 0

Very DC, even the grocery stores getting in on abundance discourse

29.04.2025 20:52 — 👍 3 🔁 0 💬 1 📌 0

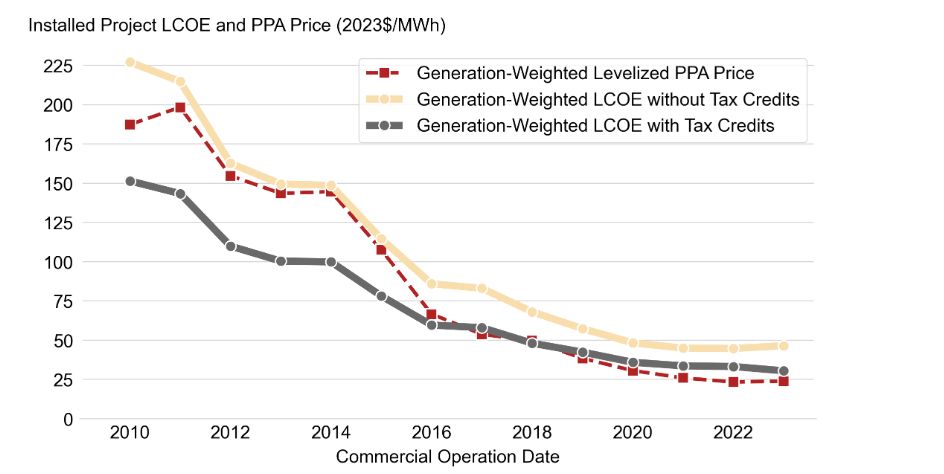

Yes of course, calling it cost of service was a joke meant to highlight the perhaps surprisingly tight relationship between (average, not marginal) cost and price here

23.04.2025 15:07 — 👍 2 🔁 0 💬 1 📌 0

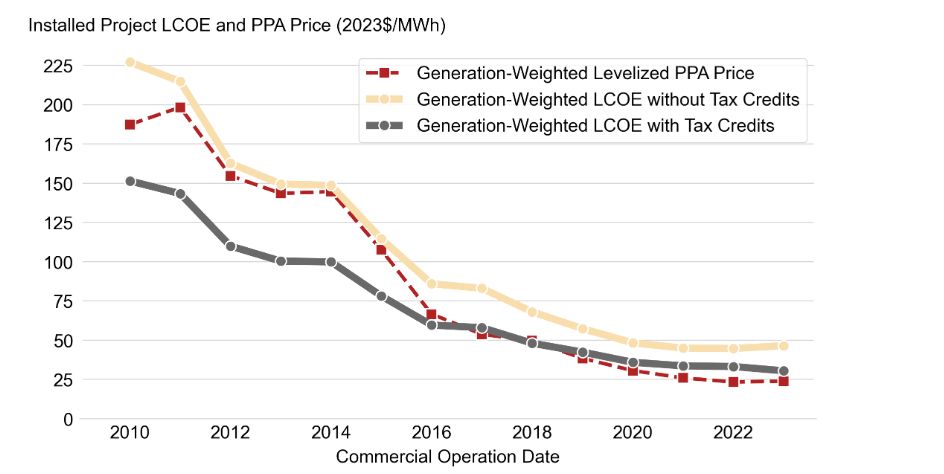

Yes, LCOE includes the capital investment. It doesn't include cushion for disruptions. And indeed recent PPA prices have risen along with supply chain disruptions etc. But I think the general point about lack of market power here stands.

23.04.2025 14:45 — 👍 2 🔁 0 💬 1 📌 0

Remarkable graph from Berkeley Lab's annual report on solar deployment (through 2023). PPA prices have closely tracked the cost of electricity, suggesting very low profit margins for merchant generators. Tempting to call it cost of service regulation.

23.04.2025 14:08 — 👍 9 🔁 1 💬 2 📌 0

Too kind! Thank you!

13.04.2025 21:27 — 👍 2 🔁 0 💬 0 📌 0

@lingchenscholar.bsky.social chatgpt is absolutely convinced that you have published an article about the local politics and regional rivalries of China's semiconductor industry. While this seems totally hallucinatory, I'm sure many of us would be grateful for such an article!

10.04.2025 21:23 — 👍 1 🔁 0 💬 1 📌 0

I think individual people are acting no differently than they would have on twitter but it adds up to something different because there aren’t many conservatives around. Not sure it’s something individuals can be expected to change.

10.04.2025 17:33 — 👍 17 🔁 0 💬 2 📌 0

Amazing opportunity for a creative litigator with interests in private law to break into legal academia and work with one of the smartest and most generous mentors imaginable (Daniel Markovits)

04.04.2025 02:27 — 👍 1 🔁 1 💬 0 📌 0

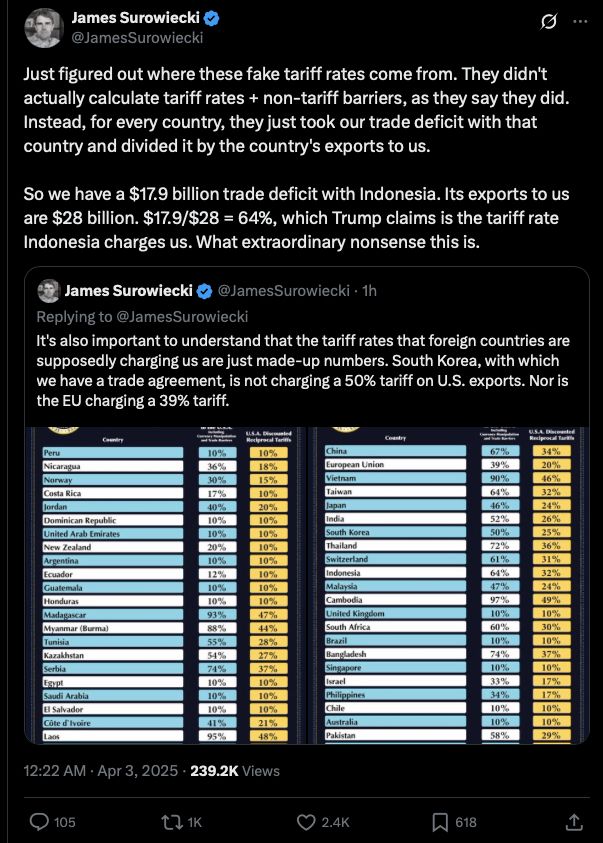

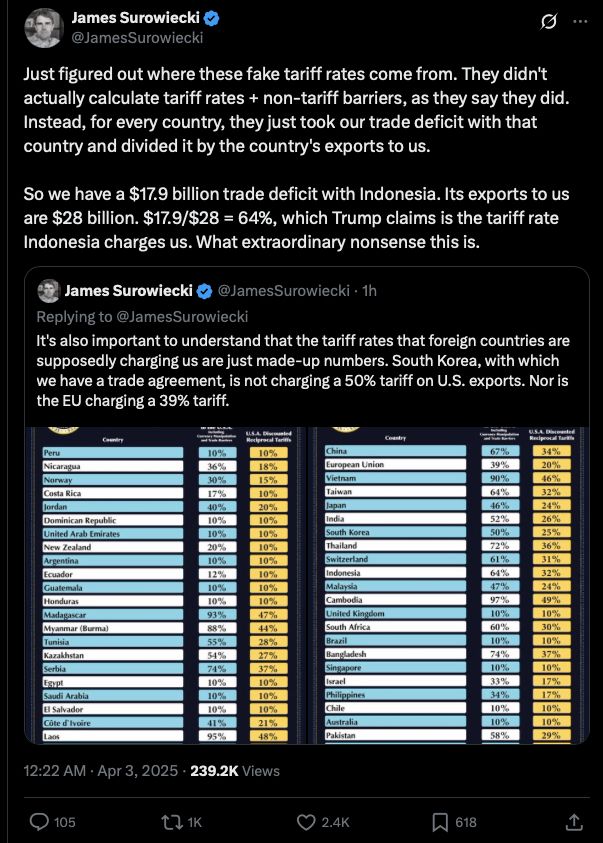

Wow this is wild.

James: "The Trump team didn't actually calculate tariff rates + non-tariff barriers, as they say they did. Instead, for every country, they just took our trade deficit with that country and divided it by the country's exports to us."

02.04.2025 22:46 — 👍 690 🔁 323 💬 32 📌 121

Happy to see commentary on industrial policy from people who were in the room. Sam rightly argues that Congress should allow agencies more iterative processes rather than linear waterfalls.This complements Bharat Ramamurti's point that incumbents lobbied for a slower process in the first place.

31.03.2025 11:04 — 👍 1 🔁 0 💬 0 📌 0

Let’s build this

27.03.2025 22:12 — 👍 1 🔁 0 💬 1 📌 0

Using the arm of the state to punish people for writing op-eds the government disagrees with is tyranny.

27.03.2025 21:33 — 👍 308 🔁 74 💬 2 📌 3

Obviously “current policy” is incoherent…but if it means you don’t need to cut the IRA and Medicaid…

27.03.2025 21:27 — 👍 0 🔁 0 💬 0 📌 0

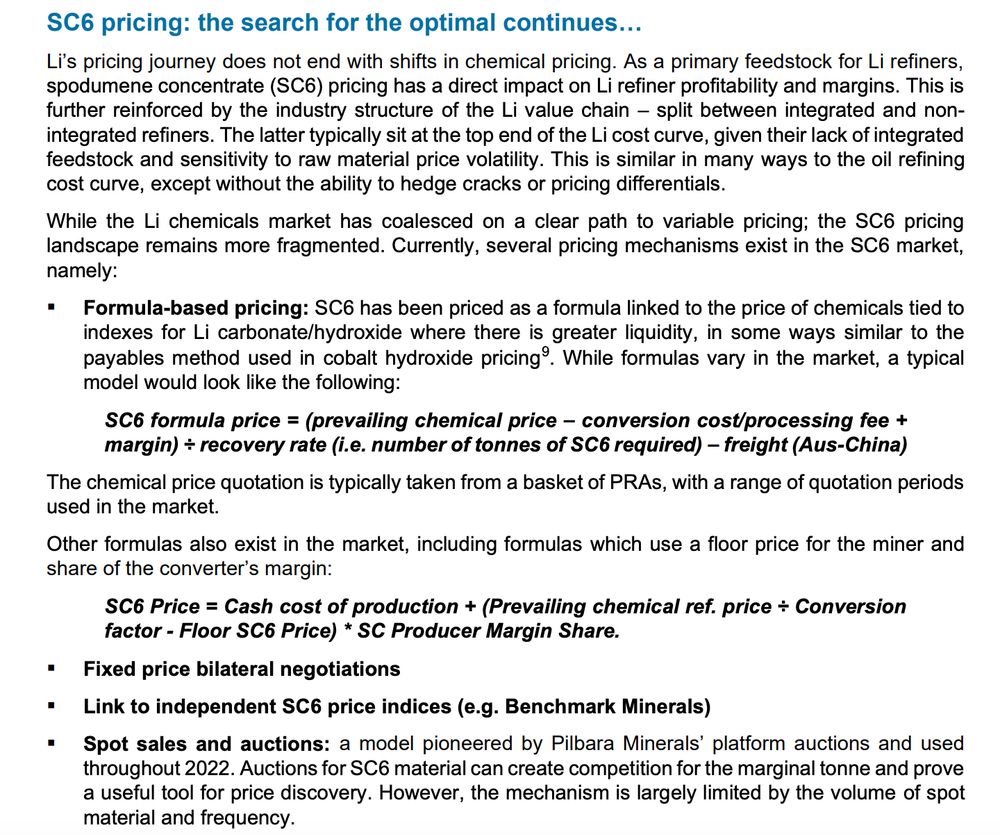

Extremely @nathantankus.bsky.social / @lookheron.bsky.social style report on the administrative complexity of lithium pricing. There is supply and demand if you zoom out far enough, but not sufficient to describe what's going on in the details. www.oxfordenergy.org/wpcms/wp-con...

26.03.2025 20:43 — 👍 13 🔁 6 💬 0 📌 0

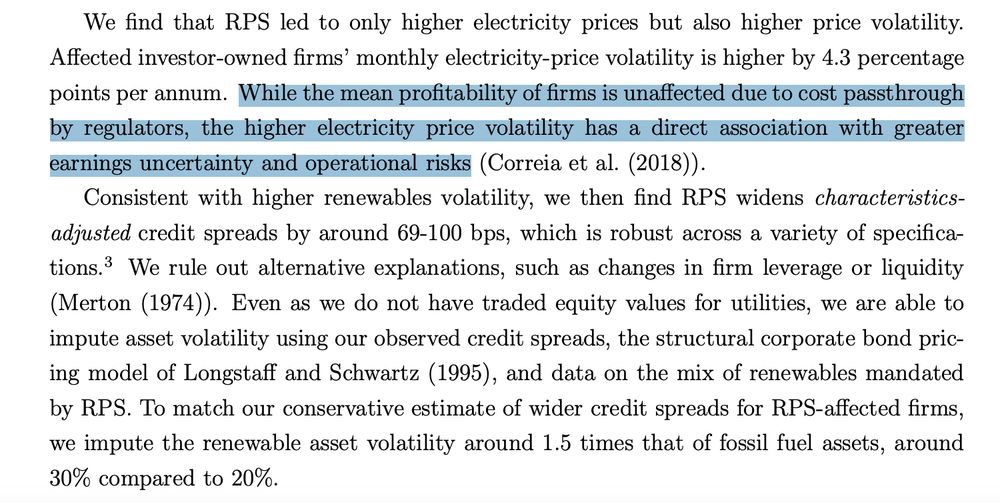

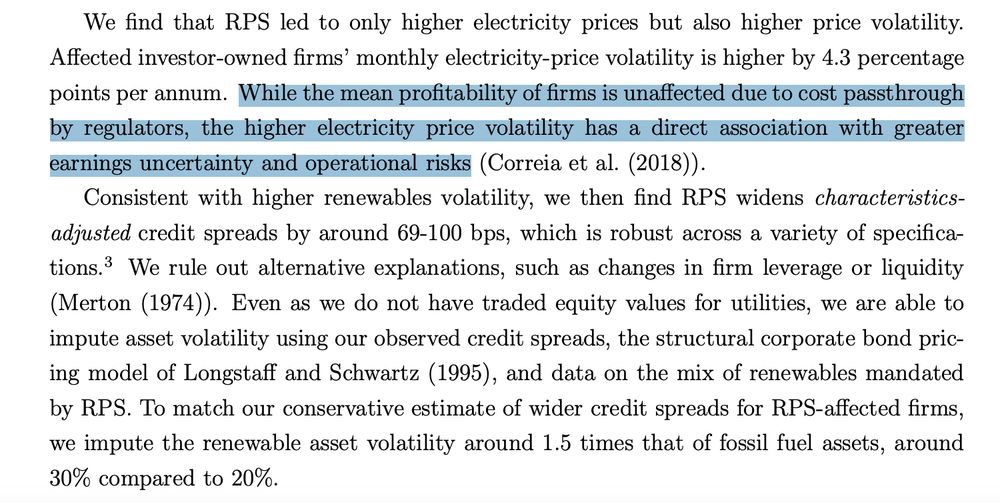

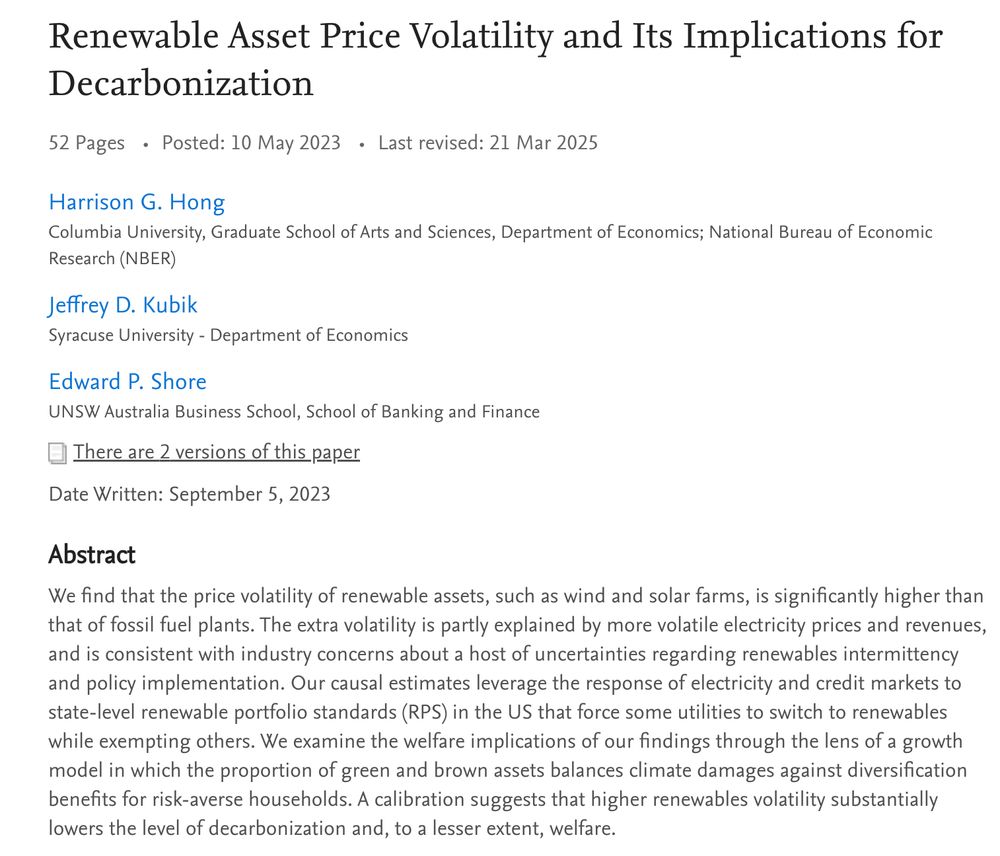

Though, I don't fully understand why credit spreads rise when utilities can pass through price volatility to customers. The citation is to something generic, not industry specific.

26.03.2025 19:32 — 👍 0 🔁 0 💬 0 📌 0

Why do we need to derisk investment in renewables? Because moving to renewables (here, exploiting variation in RPS) raises electric price volatility, which widens credit spreads. Better storage will mitigate the volatility, but price-smoothing policy can help too. papers.ssrn.com/sol3/papers....

26.03.2025 19:26 — 👍 2 🔁 0 💬 1 📌 0

Figuring out how to reshape governance incentives towards high-output, low-margin strategies strikes me as a key desideratum, undoing perhaps the elimination of what shareholders take to be managerial agency costs. 19/

26.03.2025 01:00 — 👍 0 🔁 1 💬 1 📌 0

Definitely. We think that legal scholars have recognized the resilience issue in finance more than in any other area, and to some extent this paper could be seen as transporting over capital risk regulation concepts to the non-financial economy. But we should get more explicit about the parallels.

26.03.2025 13:17 — 👍 1 🔁 0 💬 0 📌 0

Indeed this is exactly what most antitrust scholars say when we've shared the paper with them!

26.03.2025 13:14 — 👍 1 🔁 0 💬 0 📌 0

Academic Fellow, Vanderbilt Policy Accelerator (@vandylaw.bsky.social). Research networks, platforms, and utilities. Views are my own.

William Clayton Chair and Associate Professor at Johns Hopkins University SAIS. Political economy; state-business relations; economic, industrial and tax policies; authoritarian capitalism. https://www.lingchen-scholar.com/

law prof at USC Gould; ex appellate lawyer

job-talk paper: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4925020

Professor of Law & Energy Policy with a focus on climate change, energy governance, and equity.

Associate professor of economics at the University of Calgary. Former energy trader.

blakeshaffer.ca

https://drafts.interfluidity.com/

https://www.interfluidity.com/

https://tech.interfluidity.com/

https://zirk.us/@interfluidity

Senior reporter at @CybersecurityDive.bsky.social covering all things digital security. I also co-host @hothtakes.bsky.social. | Send me tips: bit.ly/contactejg

Associate Professor at Fordham Law School

law prof at Syracuse; political economy, innovation, industrial policy, US-China tech rivalry

Associate Professor at UF Law

Environmental & Natural Resources Law Prof

Conservation Geneticist

99% of posts will be shameless self-promotion ...

Lawyer. Extremely junior scholar. Legal interpretation, Fed Courts, the First Amendment, and Halakhic jurisprudence. Sartorially competent.

Consultant, Non-Resident Fellow, Quincy Institute for Responsible Statecraft, expertise in federal budget, defense and international affairs spending, programs and processes.

Formerly: Associate Director, OMB, Defense and International Affairs (Obama).

Political organizer, campaigner, strategist, writer, sociologist

Co-founder: Popular Comms, Beyond the Choir, Lancaster Stands Up, PA Stands Up, Mennonite Action

Member: UAW Local 4811, DSA

Author of https://hegemonyhowto.org/

Assistant Prof. at Georgia State University College of Law. Scholar working at the intersection of human rights and the environment. Alex Trebek called me a barracuda. She/her.

Co-founder of Grant Witness: https://grant-witness.us

Epidemiologist. Attorney. Social, legal, and environmental determinants of health.

On Signal: sdelaney.84

Professor of Political Science at Stanford | Exploring money in politics, campaigns and elections, ideology, the courts, and inequality | Author of The Judicial Tug of War cup.org/2LEoMrs | https://data4democracy.substack.com

Federal workers fighting back against DOGE

MAY DAY EVENTS

maydaystrong.org

JOIN OUR MOVEMENT ⤵️

savepublicservices.com

SAVE THE SSA/EPA/VA PETITIONS:

https://linktr.ee/funfedworkers

Associate Professor @ Mizzou Law, Faculty Scholar @ Middleton Center on Race, Citizenship & Justice. Teaching Crim Law & Family Law. Researching gender-based violence survivors’ interactions with criminal & family legal systems. Views my own.

06.05.2025 16:20 — 👍 0 🔁 0 💬 0 📌 0

06.05.2025 16:20 — 👍 0 🔁 0 💬 0 📌 0