Look for choppy stock market action in the coming days until the data flow resumes.

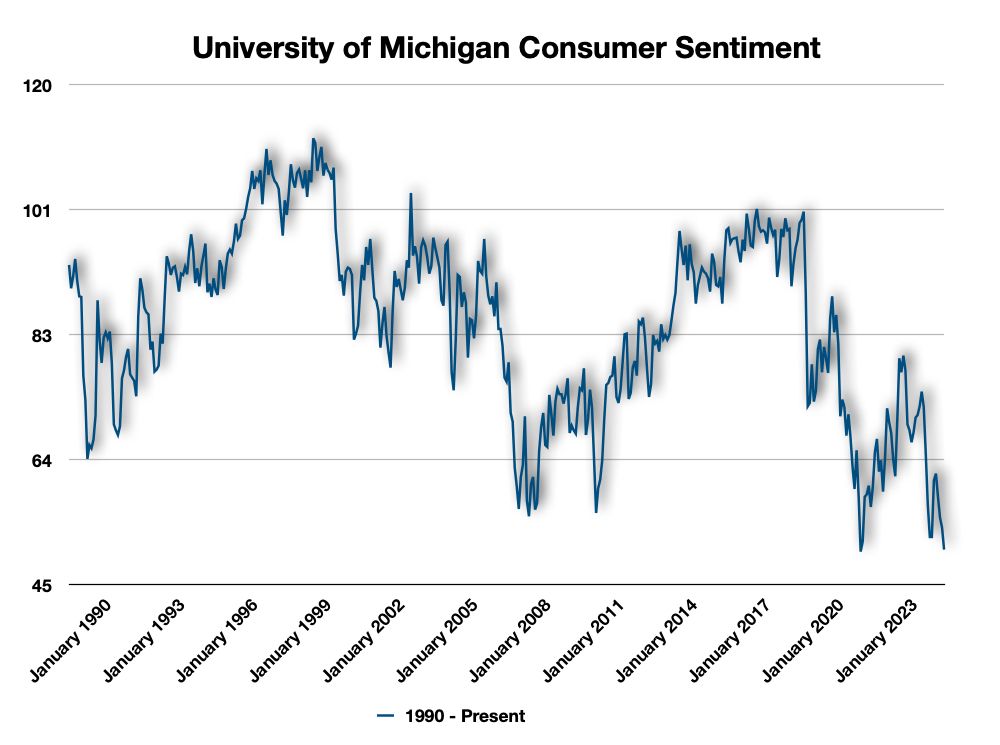

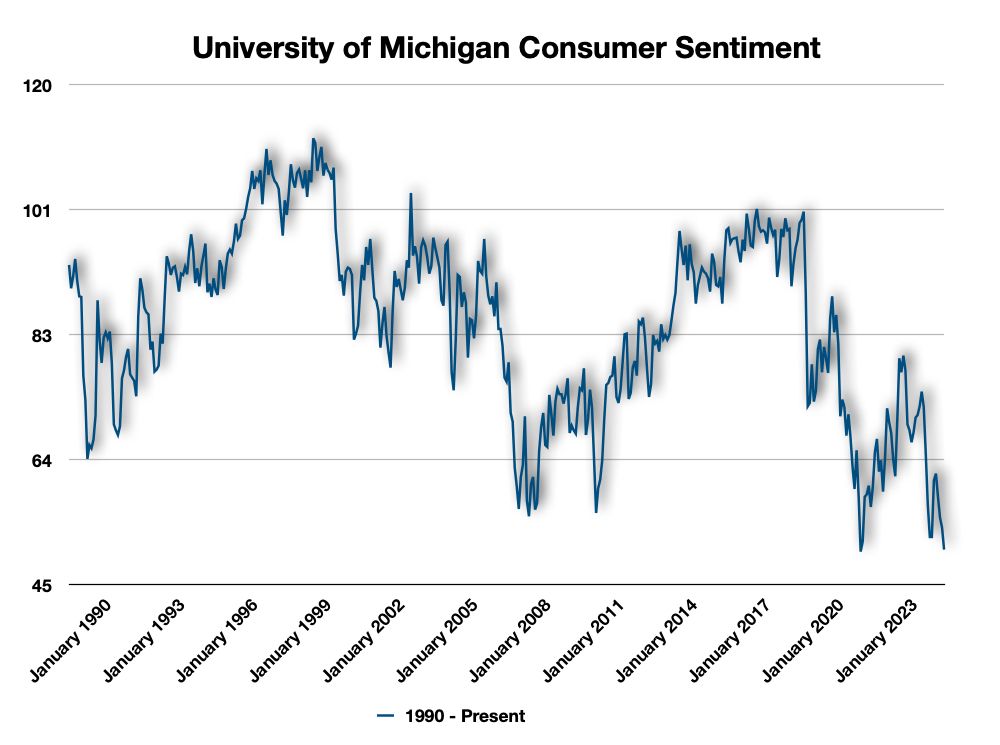

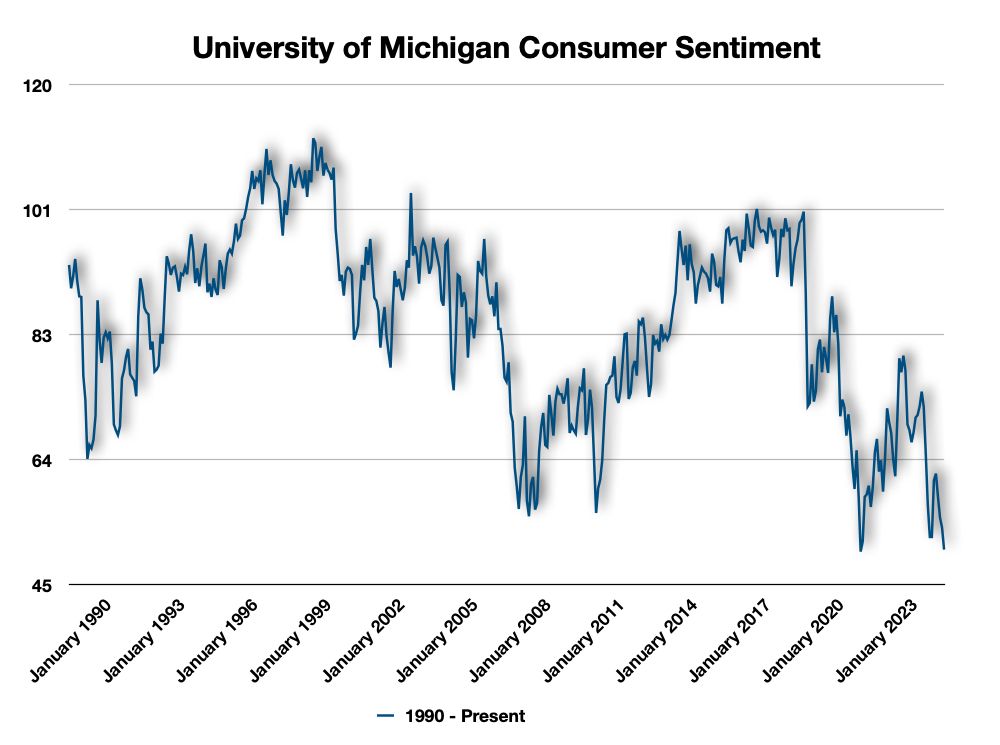

Given that, the consumer looks taxed and weary of the future as we saw in the University of Michigan Consumer Sentiment index last week.

@dhtayloranalysis.bsky.social

Economic Indicators & Stock Market Analysis

Look for choppy stock market action in the coming days until the data flow resumes.

Given that, the consumer looks taxed and weary of the future as we saw in the University of Michigan Consumer Sentiment index last week.

The CME Fed Cut prediction is showing balanced for December.

The Fed is flying blind—the resumption of data from the shutdown will take time. Without reasonable data, the Fed makes no moves in December, and for that, the stock market sold off.

#FinSky

#EconSky

The Michigan Consumer Sentiment Index is at its 2nd-worst reading in history. This week, I am looking to the Consumer Staple sector of the S&P 500, the only sector in the red this year.

This will show the difference in the AI economy v. consumers.

#EconSky

#FinSKly

The employment situation remains sideways with no real impact yet from tariff taxation. Initial claims and continuing claims have not moved much.

Unemployment will move as Federal workers who've taken voluntary furloughs start to show up in data, just not jobless claims

#EconSky

#FinSky

The M2 Money Supply growth declined for the month of August, and this portends economic contraction in the economy.

Money supply is driven by business growth and consumer expenditures via fractional banking. If supply declines, growth follows.

#EconSky

#FinSky

The next major economic release will be is Tuesday with M2 Money Supply. If the pace of money growth slows, this shows continued decrease in economic activity from the tariffs. This is more of a leading indicator, and one of the key economic data points.

#FinSKy

#EconSky

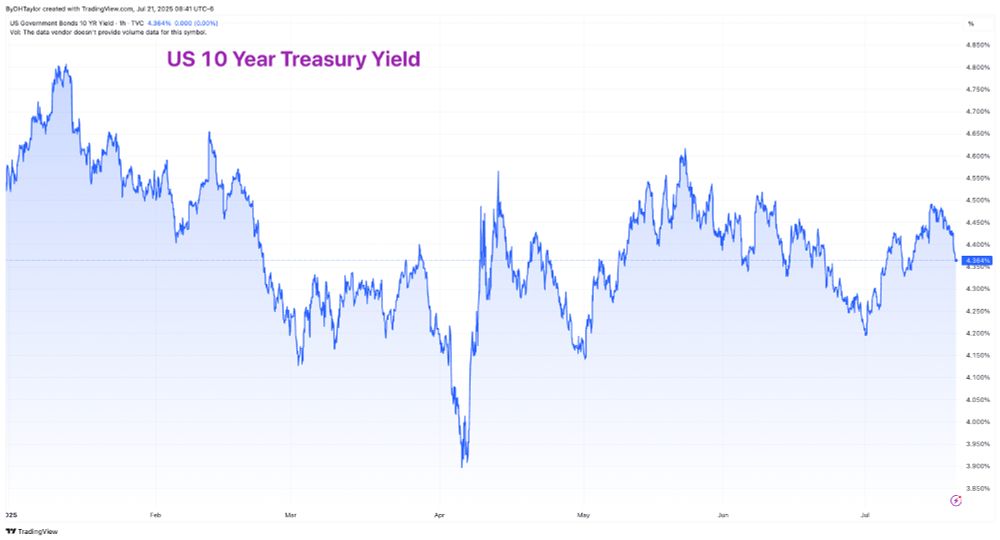

The US 10-year Treasury yield is moving lower to start the week on increased likelihood of rate cuts amidst slowing private-sector employment. But if the economy slows, there will be less tax take by the government which will drive interest rates up

#FinSky

#EconSky

Trump is imposing a 50% tariff on Brazilian goods as a punishment for the trial of Bolsonaro. Coffee futures had been much higher earlier on fears of a poor harvest. So, while the price of coffee did move higher on the latest news, it is inconsequential in the overall picture.

#FinSky

#EconSky

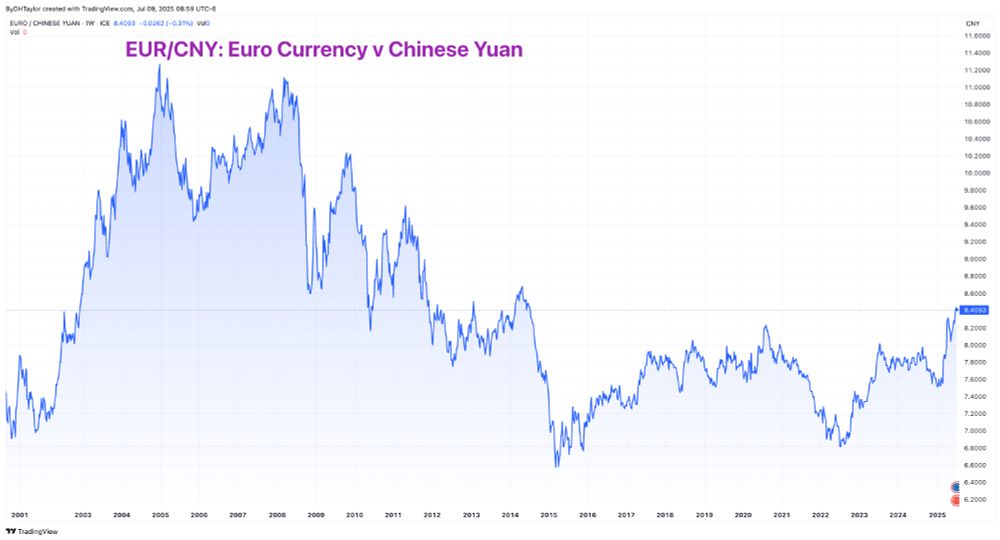

Euro currency has soared since January as the US dollar has sold off. Versus the Chinese yuan, this will improve terms of trade for European consumers and businesses buy raw materials.

But, eventually, the ECBN may take note and make changes.

#FinSky

#EconSky

Copper soared to a new all-time high. Tariff threats have driven the price of the industrial metal higher on price hikes.

Copper typically follows economic expansion. However, tariffs are an anomaly, and the price of copper is artificially inflated as a result.

#EconSky

#FinSky

The stock market rallied Thursday after non-farm payrolls showed continued strong numbers.

In the meantime, tariffs are back in consideration with a slew of activity likely to occur this week as the deadline looms.

The Big Beautiful Bill passed: bond market has taken notice.

#EconSky

#FinSky

The US Dollar Index continues to slide lower as investors leave for other opportunities. Whereas during the COVID-led inflation, investors flocked to the US, now those funds are finding other opportunities. The US economy will react in kind.

#FinSKy

#EconSky

The stock market has rallied to new all-time highs after April's selloff. The leading sector? Industrials. AXON is up 1,000% in five years with many others seeing big triple-digit returns over the same time period.

#FinSky

#EconSky

Inflation edged higher. Tariffs, however, will worsen this trend. That, in turn, will push unemploynet upward. While the Federal Reserve will act to maintain employment growth, the balance will shift in favor of slower economic growth.

#FinSky

#EconSky

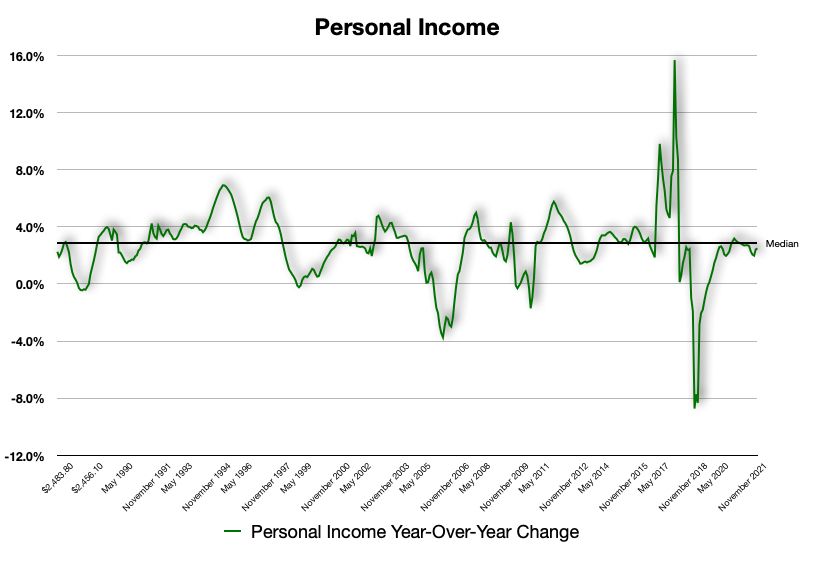

Personal incomes & expendtures declined month-over-month, but are still positive year-over-year. However, that pace is declining. This is the future of the US economic growth rate. Factor in tariffs, the economy grows less rapidly

#FinSKy

#EconSky

The stock market is up 5.25% year-to-date. Some sectors are outperforming the broader market. Then, if you break down the individual sectors, you see some stocks outperform within. This potentially leads a tale of two economies with cracks under the surface

#EconSky

#FinSky

The stock market, via SPY ETF, cleared its February all-time highs—QQQ ETF, a.k.a., the Nasdaq, did so yesterday. There are still headwinds for the economy and stock market with the full impact of tariffs hitting. For now, stocks are soaring.

#EconSky

#FinSky

The US Dollar index continues to slide. The latest is fear that Trump will install a "Tes-Man" that will push the economy outside of prudent policies. Along with unfavorable fiscal policies, the combination threatens to derail the US economy

#FinSky

#EconSky

The yield curve has moved since the last month on comments the Fed will likely move interest rates soon. The chart shows the change in the yield curve from the previous month. The budget bill, however, will pressure the long end of the curve in the future

#FinSky

#EconSky

Despite a lot of geopolitical risks, the US 10-Year Treasury yield remains contained. Now, the yield will be driven more so by US fiscal & monetary policies. Look for the next budget to add considerable debt which will drive yields higher.

#FinSky

#EconSky

Oil prices continue lower today as the fear of supply disruptions abates. How much lower can oil prices go? Considering economic trends due to tariffs, prices may continue to move lower over time, but the big move is over.

#EconSky

#FinSky

Oil prices initially shot up on the US attacks on Iran. The market doesn't believe anything further will come of this, and already the price of oil is lower than Friday's close—No expectations of the Strait closure exist, either.

#FinSKy

#EconSky

The consumer is slowing the pace of its expenditures. Right now, the stock market is more focused on the Iran & Israeli conflict to see what escalations will happen. In the meantime, the economy will take center stage.

#EconSky

#FinSky

open.substack.com/pub/dhtaylor...

The year-over-year change in retail sales growth is declining.

Tariffs will force consumers to restrict expenditures.

But, the pace of growth had already been slackening.

If consumers place expenditures on a lower gear, the economy will follow.

#FinSky

#EconSky

Very quietly on Friday, the University of Michigan Consumer Sentiment was released—during fears of the Iran/Israel escalation.

The UofM number improved significantly from its near all-time low.

Now, we await retail sales to see what tariff impacts there are on consumers

#FinSKy

#EconSky

The stock market sold on Friday, and bond yields moved higher off the Iran/Israel conflict.

Coming this week are key economic events.

#EconSky

#FinSky

open.substack.com/pub/dhtaylor...

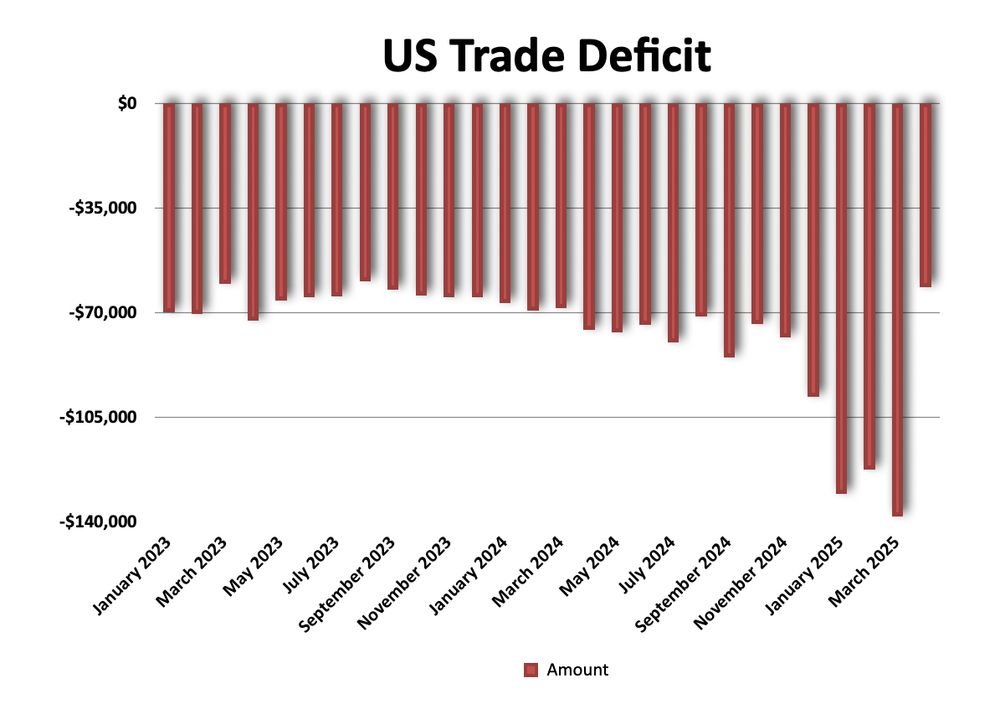

No big surprise that the trade balance reversed for the month of May from all-time lows.

Inflation has yet to materialize in data from tariffs. With all of the manufacturers and suppliers pre-ordering ahead of the tariffs, there is room before prices need to increase.

#EconSky

#FinSky

Interest rates are little changed post-CPI data release. However, the longer trend continues, and the concerns of higher deficits in the United States as well as the rest of the world are pressuring interest rates higher.

#EconSky

#FinSky

Core inflation moved sideways for May. Tariffs will push price pressures up, but gradually—most consumers & companies are either deferring expenditures or pre-ordered.

Then the tariffs go away via court-order ruling.

#FinSky

#EconSky

The yield curve is inverted. This tells us the bond market's expectations for future inflation. The dip in the middle tells the market believes the Fed will lower interest rates. In the meantime, they remain on hold.

#FinSky

#EconSky