📈 BCA's Chart Of The Week

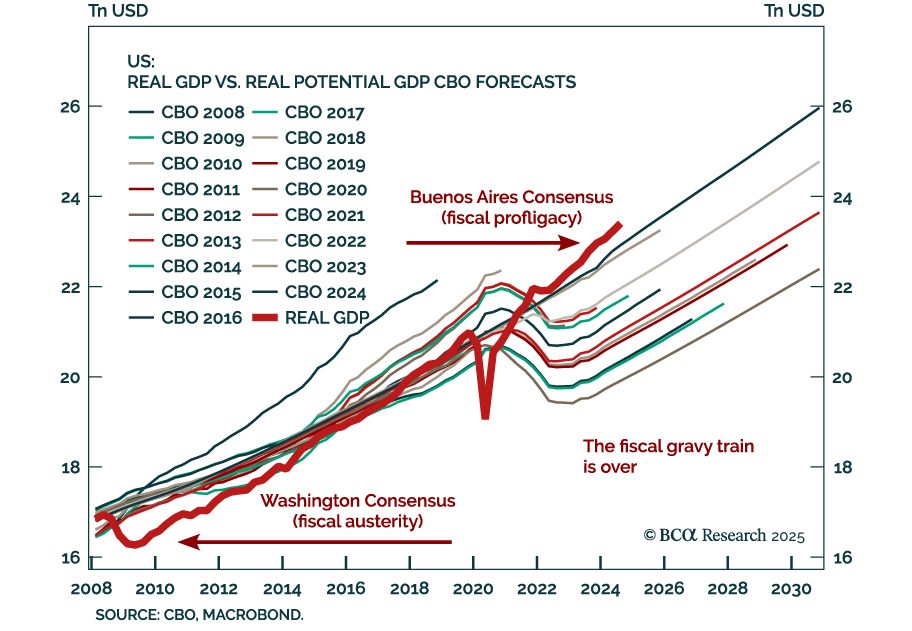

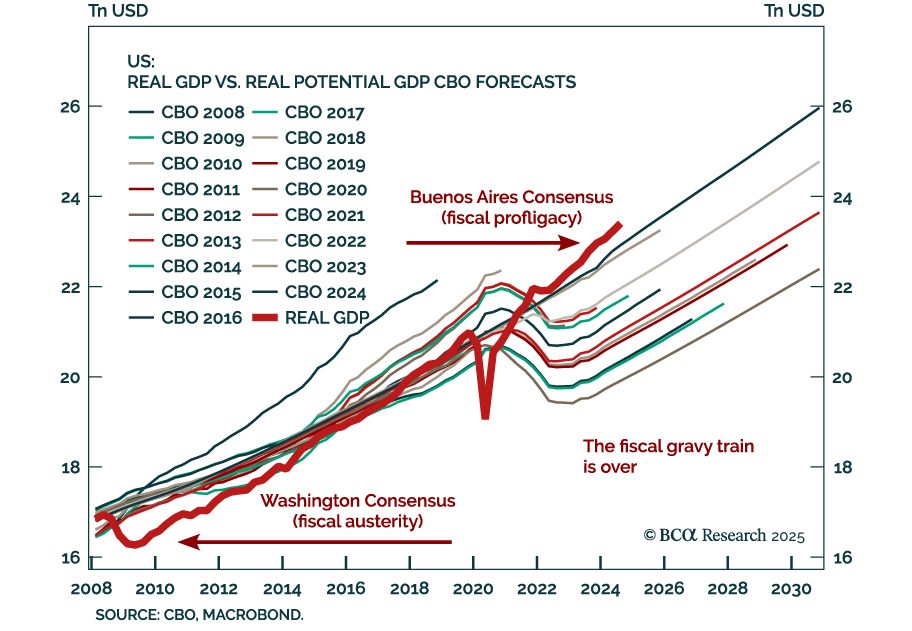

Our Chart Of The Week comes from Chief GeoMacro Strategist, Marko Papic. Marko highlights a seismic shift in #fiscalpolicy.

Marko sees a potential return to fiscal conservatism in 2025—a shift that could spell the end of US asset outperformance.

#BCACOTW

24.01.2025 22:49 — 👍 2 🔁 0 💬 0 📌 0

Bond yields are soaring—and that could pose a problem for Trump

If bond markets riot, some think it will encourage the president-elect to deliver scaled down versions of his campaign promises.

Is Donald Trump the "Human Steepener”? Our Chief GeoMacro Strategist, Marko Papic, thinks so.

➡️ For Marko, Trump's fiscal policies won't pan out as planned: "I think #PresidentTrump knows that borrowing rates need to come down.”

You can read the full piece here: bit.ly/4jlsocN

#FiscalPolicy

20.01.2025 17:09 — 👍 0 🔁 0 💬 0 📌 0

📈 BCA's Chart Of The Week

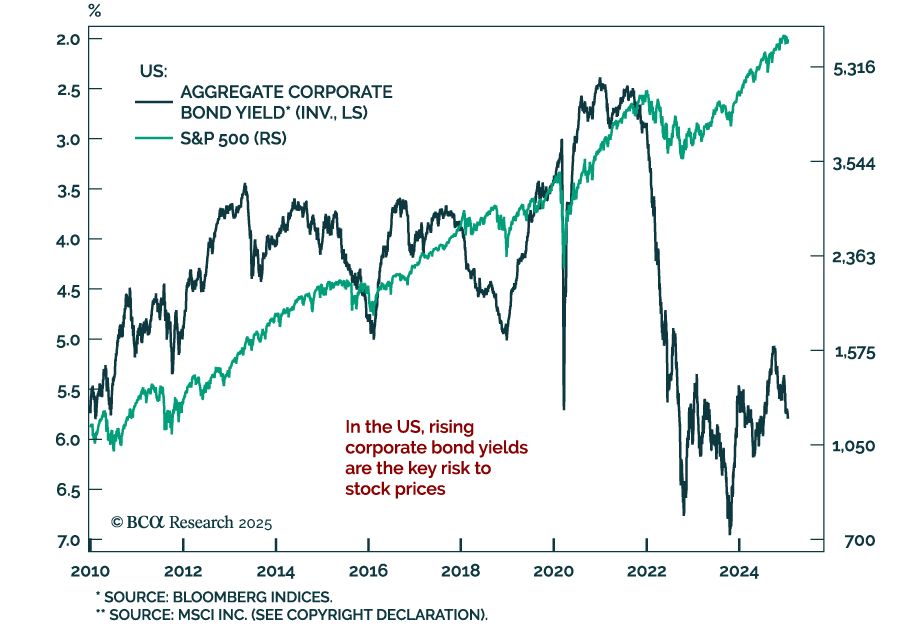

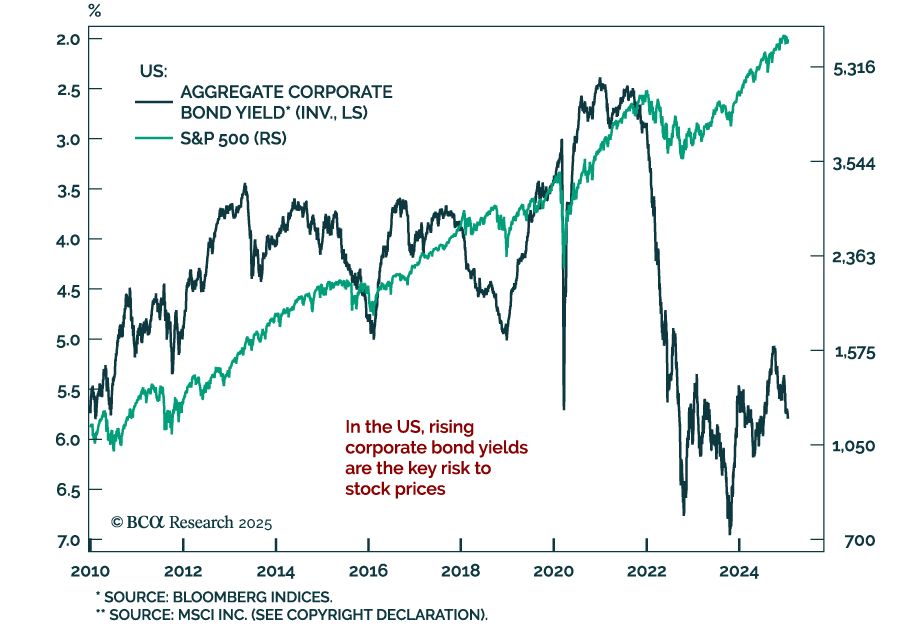

Our Chart Of The Week comes from Chief EM/China Strategist, Arthur Budaghyan. Arthur highlights a crucial risk to US #equities—rising corporate bond yields.

If equities hold up in the face of rising #bond yields, it would be unprecedented. Stay tuned.

17.01.2025 19:58 — 👍 0 🔁 0 💬 0 📌 0

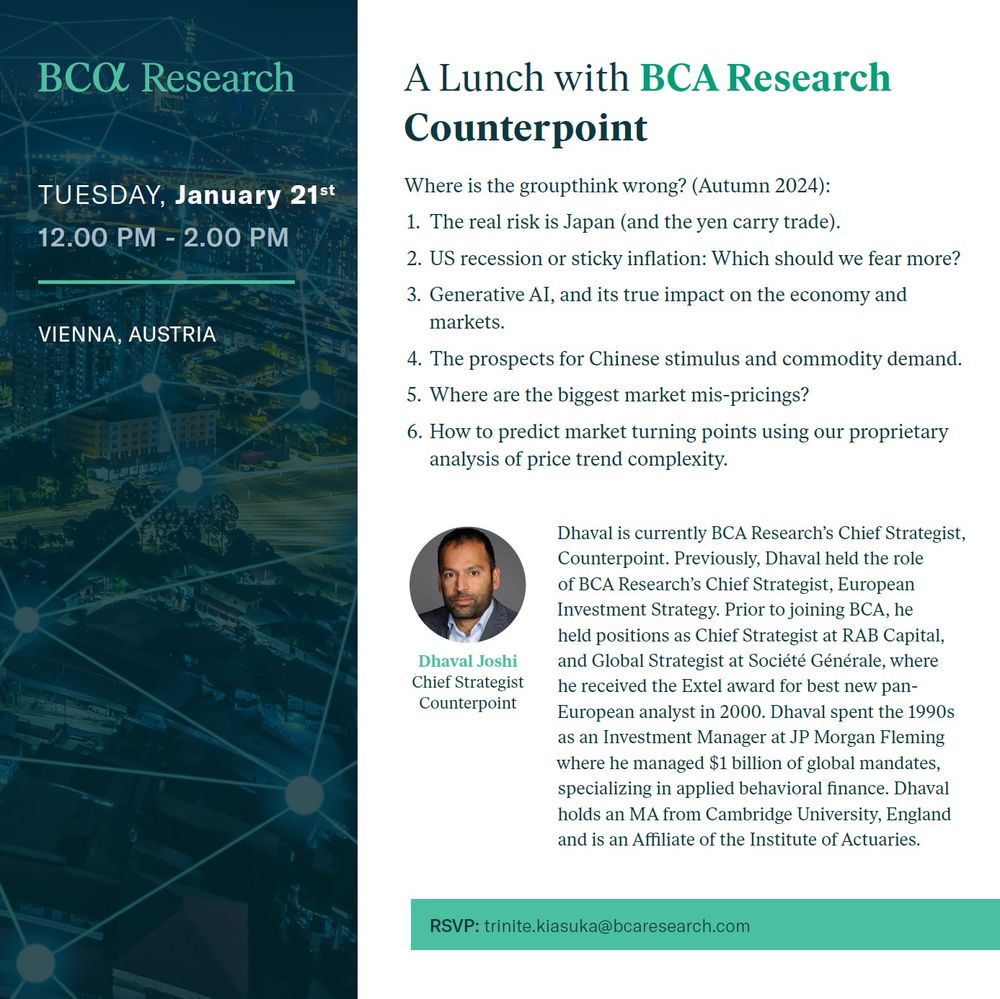

Join us for an exclusive lunch with Chief Strategist, Dhaval Joshi, in Vienna to gain insights into the key trends shaping the global economy and markets in 2025!

🗓 Date: Tuesday, January 21, 2025

⏰ Time: 12:00 PM - 2:00 PM

📍 Location: Vienna, Austria

Seats are limited—register now: bit.ly/4g25C6P

17.01.2025 16:37 — 👍 2 🔁 0 💬 0 📌 0

Breaking down the FOMC decision

The Federal Reserve began cutting rates in September. The December meeting is its last of 2024. Will the cutting continue, or will there be a pause? Join us live on Dec. 19 at 1 p.m., as Doug Peta, Ch...

Chief US Investment Strategist, Doug Peta, and The Bond Buyer Managing Editor, Gary Siegel, discussed the FOMC’s December meeting and the market implications of the committee’s renewed concerns about #inflation.

Watch the full interview: bit.ly/4jg9Hr9

03.01.2025 16:18 — 👍 0 🔁 0 💬 0 📌 0

Stock Bears Are Going Extinct. Time to Worry?

Strategists who got 2023 and 2024 wrong are extrapolating equity market strength into 2025. Recency bias can mislead.

Global Strategist, Peter Berezin, sits down with @bloomberg.com Jonathan Levin and discusses his outlook for the S&P 500 in 2025 and his expectations for a US recession. Peter is, by far, the most bearish strategist according to Bloomberg polls.

Read the full article here: bit.ly/3VZb2sk

#Markets

02.01.2025 20:19 — 👍 0 🔁 0 💬 0 📌 0

Join Chief Geopolitical Strategist, Matt Gertken, for an insightful lunch as he unpacks key geopolitical and economic trends shaping 2025.

📅 Date: January 22, 2025

🕛 Time: 12:00 PM - 1:30 PM (includes lunch + Q&A)

📍 Location: The Joule | 1530 Main St, Dallas, TX

Register here: bit.ly/40cyVio

27.12.2024 17:17 — 👍 0 🔁 0 💬 0 📌 0

“Trump won’t be able to spend what he likes, which will pose serious issues for his tax policies,” says Chief GeoMacro Strategist, Marko Papic to U.S. News’ Tim Smart.

Marko provides more insights on why the President-elect will have limited room to maneuver on #fiscalpolicies: bit.ly/4iPNY94

26.12.2024 17:00 — 👍 1 🔁 0 💬 0 📌 0

YouTube video by David Lin

Dow Has Worst Losing Streak Since 1978; Start Of Even Bigger Crash | Peter Berezin

Chief Global Strategist, Peter Berezin, discusses the outlook for #equities, monetary policy, and economic growth for 2025 with David Lin. Peter calls for a #recession next year and a "broad-based decline" in U.S. stocks.

Watch the full interview here: www.youtube.com/watch?v=8nkg...

24.12.2024 17:37 — 👍 1 🔁 0 💬 0 📌 0

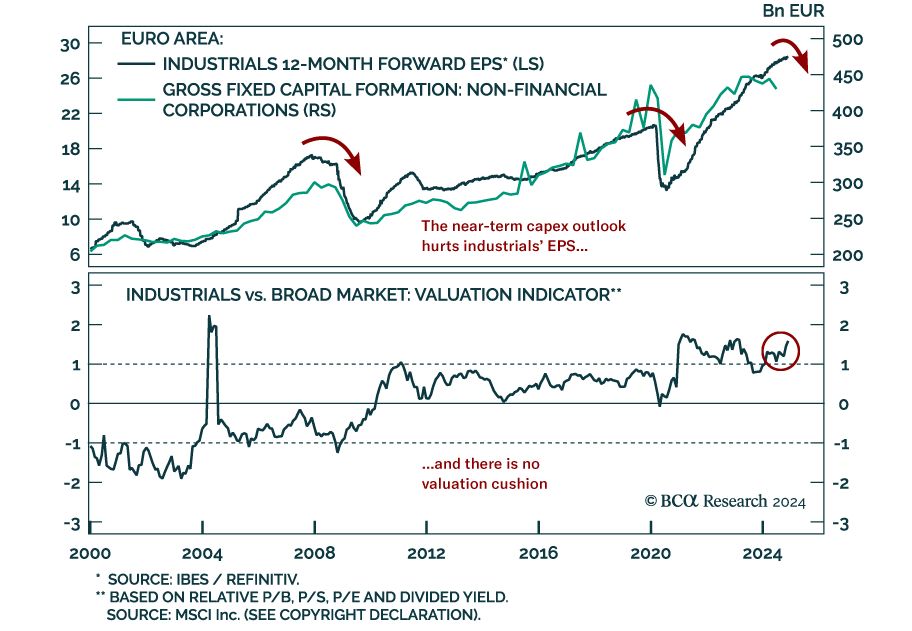

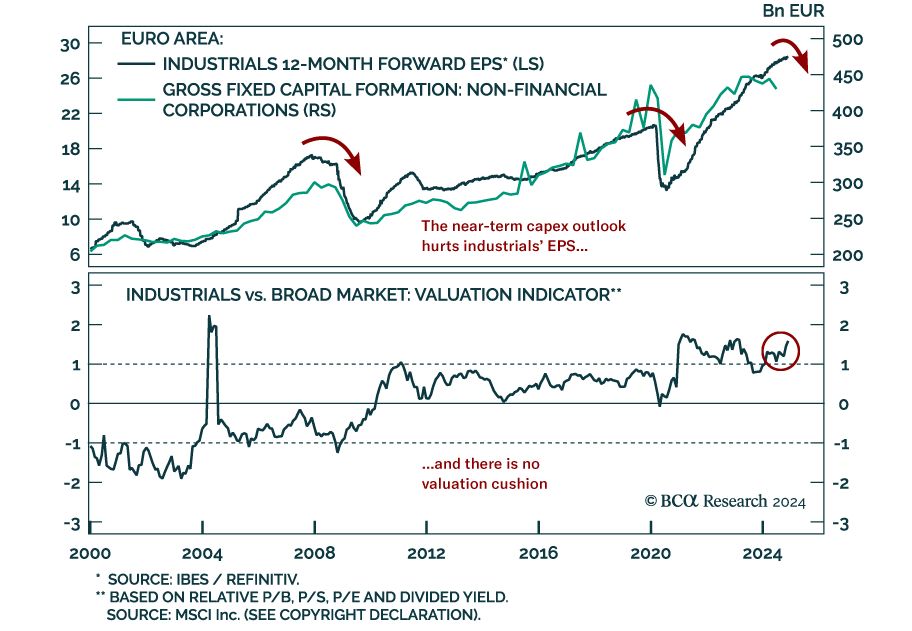

Chief European Investment Strategist, Mathieu Savary, sees a dimming outlook for #European #industrial stocks in the near term.

BCA expects a significant pullback in European industrials, adding to weakness in European #equities, particularly cyclical #stocks.

Learn more here: bit.ly/40Tz6jl

18.12.2024 20:10 — 👍 1 🔁 0 💬 0 📌 0

There are 3 reasons stocks are headed for a bear market in the first half of 2025, research firm says

Stocks are at risk heading into 2025, and historically high valuations mean that even slight disappointments could spark a painful decline.

Business Insider's Kelly Cloonan recently sat down with Chief US Investment Strategist, Doug Peta, to better understand why stocks are headed for a bear market in the first half of 2025.

Read the full article here: markets.businessinsider.com/news/stocks/...

#Markets #InvestmentStrategy #Macro

16.12.2024 19:09 — 👍 1 🔁 0 💬 0 📌 0

Thank you to all who attended our presentation in São Paulo last week with Chief Emerging Markets Strategist, Arthur Budaghyan.

To learn more about upcoming events with our strategists, please reach out to us at contactbca@bcaresearch.com.

12.12.2024 18:52 — 👍 0 🔁 0 💬 0 📌 0

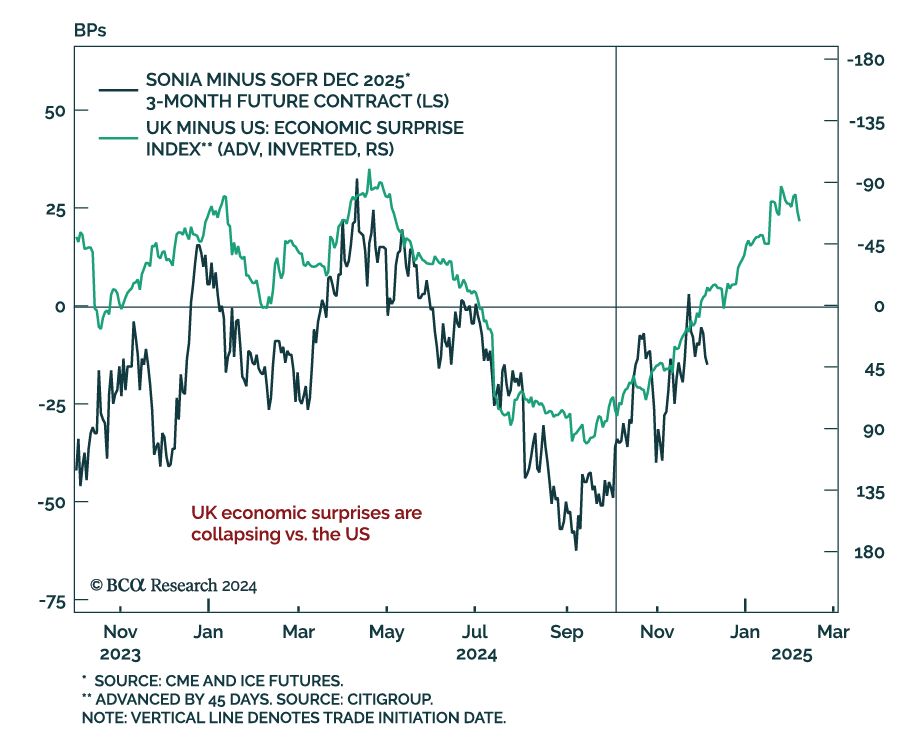

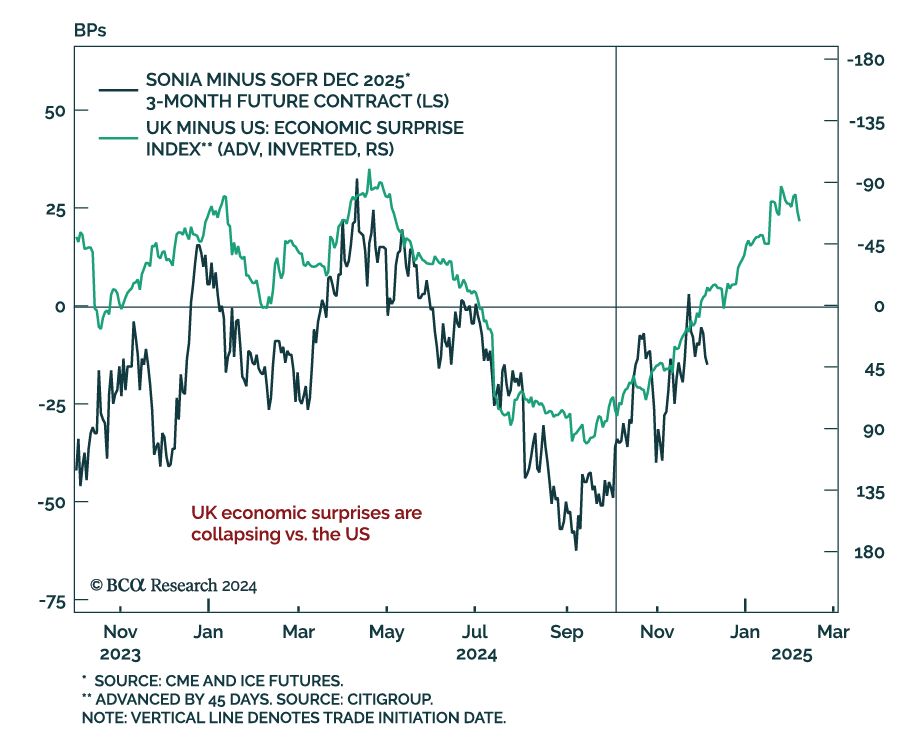

Our Chart Of The Week comes from Chester Ntonifor and Robert Timper, Foreign Exchange and Global Fixed Income strategists. As a high conviction trade, they are betting on UK weakness, through a long December 2025 3-month SONIA futures position vs. its SOFR counterpart, and by selling GBP rallies.

12.12.2024 18:51 — 👍 0 🔁 0 💬 0 📌 0

Reactions to France's government collapse after losing confidence vote

This is the first French government to be forced out by a no-confidence vote since 1962.

Chief European Investment Strategist, Mathieu Savary, says on #Reuters, "Paralysis will remain the dominant feature of French #politics for the next two years, which means that the debt is unlikely to be fundamentally addressed."

Read the article here: bit.ly/3D461rL

#France #Bonds

07.12.2024 19:31 — 👍 0 🔁 0 💬 0 📌 0

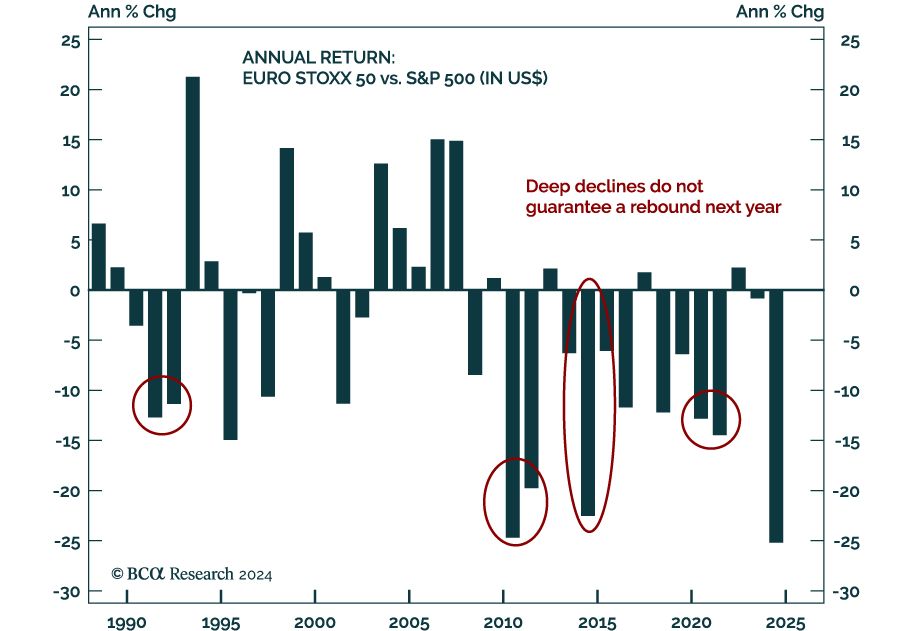

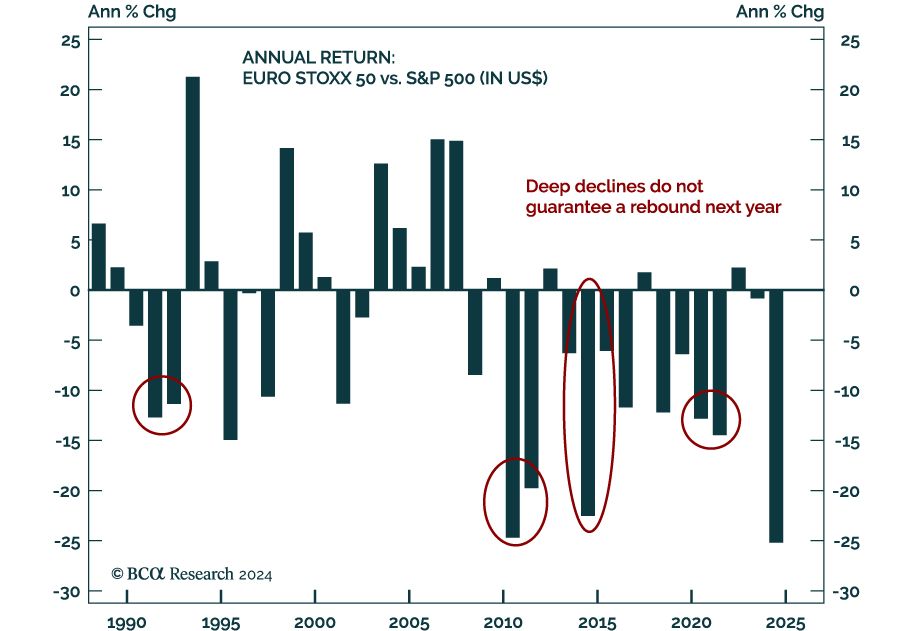

📈 BCA's Chart Of The Week

European #equities are enduring a historic underperformance, with the #EURO STOXX 50 trailing the S&P 500 by over 20% in common-currency terms in 2024, the second-worst gap in nearly 40 years.

Learn more about our European Investment Strategy service here: bit.ly/49j7Vk6

03.12.2024 20:54 — 👍 0 🔁 0 💬 0 📌 0

Gold will benefit from Trump-induced geopolitical uncertainty - BCA’s Ibrahim

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Commodity & Energy Strategist, Roukaya Ibrahim, says on KITCO News that "Gold is the major #commodity that is best suited to benefit from the new US administration’s policies. Increased global policy uncertainty will support demand for the yellow metal.” Read the article here: bit.ly/3ZqLlTt

#Gold

28.11.2024 16:05 — 👍 0 🔁 0 💬 0 📌 0

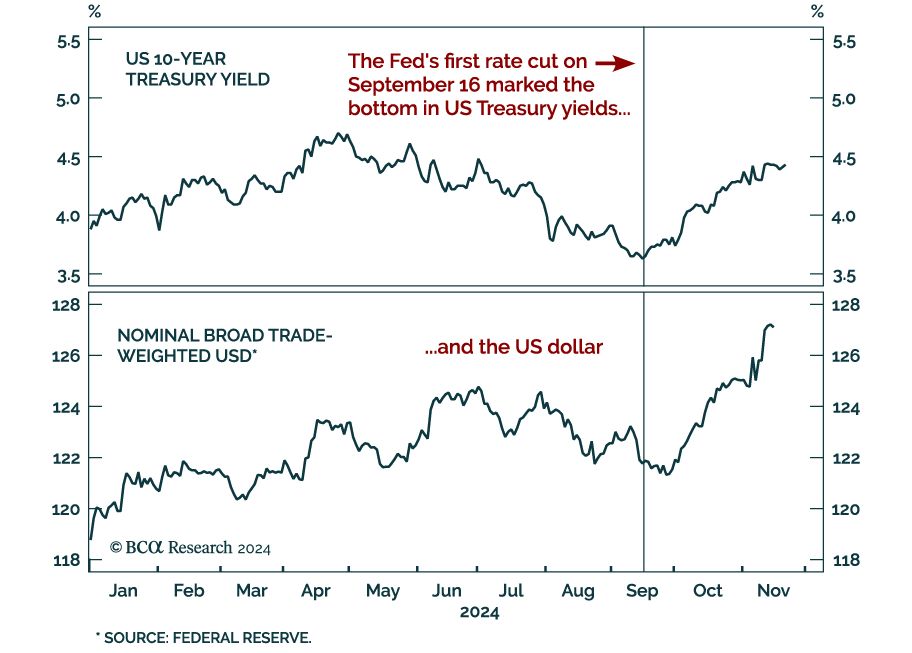

📈 BCA's Chart Of The Week

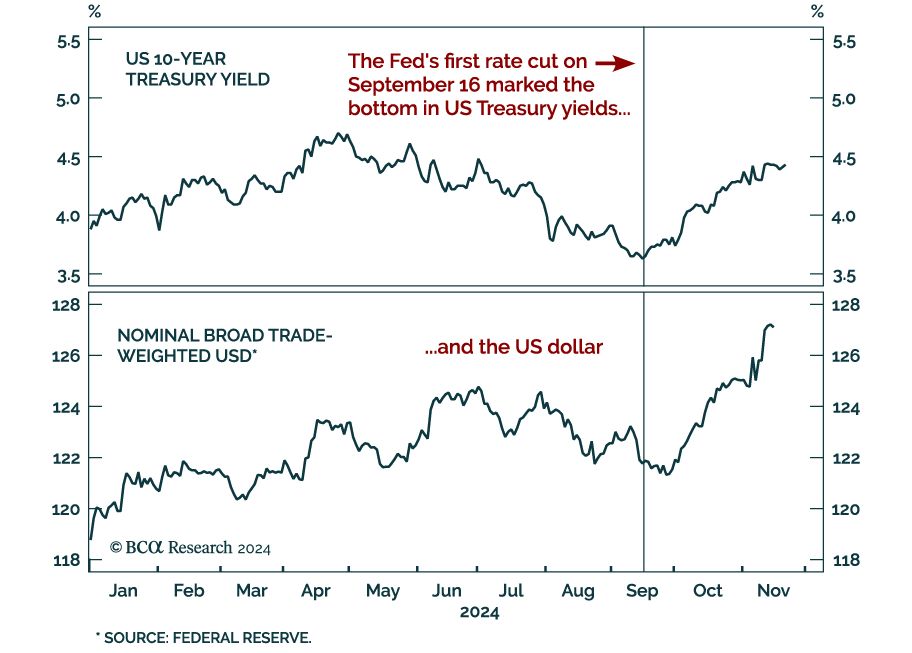

Why Did The US Dollar And Bond Yields Rise Since The Fed Cuts Interest Rates?

Arthur Budaghyan, BCA's Chief EM Strategist, highlighted in August that the Fed’s easing cycle would follow a “buy the rumor, sell the news” pattern.

#Charts #analysis #macro #emergingmarkets

26.11.2024 17:22 — 👍 0 🔁 0 💬 0 📌 0

📈 BCA's Chart Of The Week

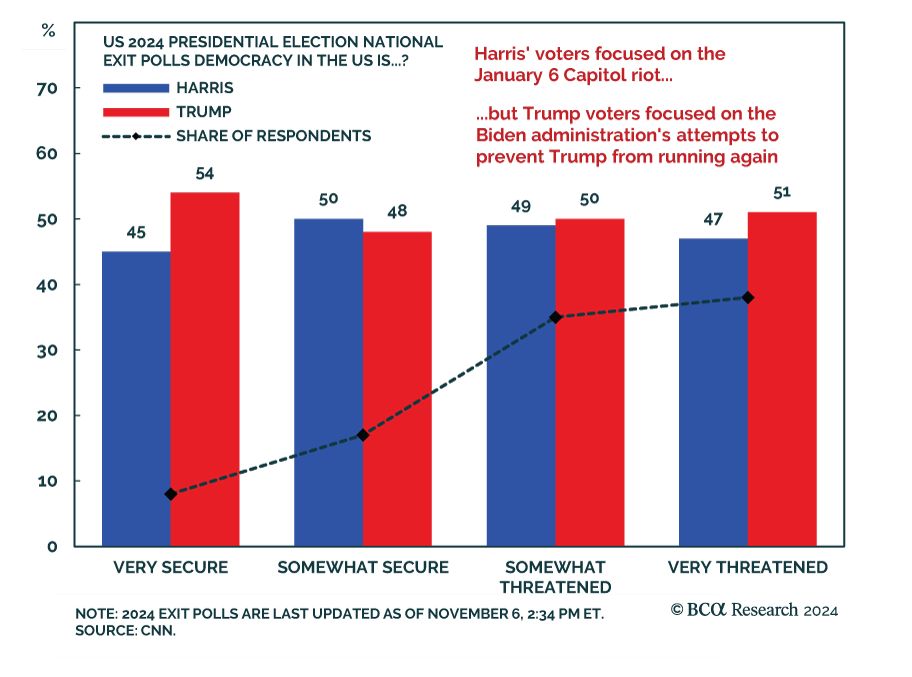

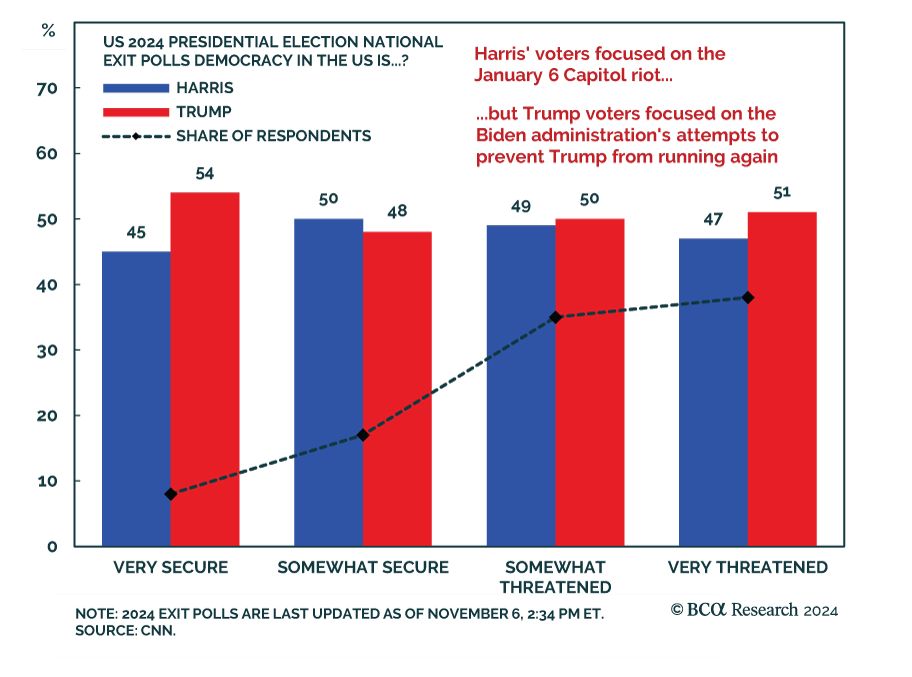

What Does Trump’s Victory Tell Us About The Stability Of The Constitutional System?

Our Chart of the Week from Matthew Gertken explores what Trump’s re-election reveals about U.S. political stability and the constitutional system.

Reach out to us here: bit.ly/40Tz6jl

20.11.2024 21:37 — 👍 0 🔁 0 💬 0 📌 0