Great podcast on "The Complete History & Strategy of Meta" by AcquiredFM.

acquired.fm/episodes/meta

Warning: It's 6 hours long😃

#investing #business

@initialreturn.bsky.social

Academic content on finance and investing for students and beginner investors. Visit initialreturn.com for free courses, tutorials, insights, and more.

Great podcast on "The Complete History & Strategy of Meta" by AcquiredFM.

acquired.fm/episodes/meta

Warning: It's 6 hours long😃

#investing #business

Corruption Perceptions Index 2023 has been published by

@anticorruption.bsky.social:

Denmark is perceived to be the least corrupt for the 6th time in a row (score: 90 out of 100).

US is ranked 24th (score: 69).

Check out our full video summary here: youtu.be/awhxGU2Z7fEThe

📈Blue-chip stocks are more liquid than stocks of smaller companies.

📈ETFs that track widely followed indices or asset classes are highly liquid as their shares can be traded on stock exchanges.

🏢Corporate Bonds issued by highly rated corporations tend to be liquid.

🧵3/3

💵Cash: The most liquid asset, can be readily used for transactions, it has universal acceptance.

💱Major Currencies: highly liquid due to their widespread use in global financial markets.

🏦Government Bonds issued by financially stable governments are considered liquid.

🧵2/3

💧 Liquidity can vary substantially across asset classes.

📃 Here's a curated list of the most liquid asset classes that keep the financial wheels turning.

🧐 Enjoy reading!

🧵 1/3

📈 Investing is like planting a seed. It takes patience, nurturing, and time to see it grow into a flourishing tree of wealth.

Embrace the journey, stay focused, and let compounding work its magic. Your future self will thank you. 🌱💰

🎓According to CAPM, a popular asset pricing model, it's optimal for investors to hold the "market portfolio".

🤨 But, what exactly is the market portfolio? Check out our post to find out.

buff.ly/3JKNXDg

"Price is what you pay, value is what you get." - Warren Buffett.

💲Value investors' strategy is to identify companies that trade below their true value.

"Price is what you pay, value is what you get." - Warren Buffett.

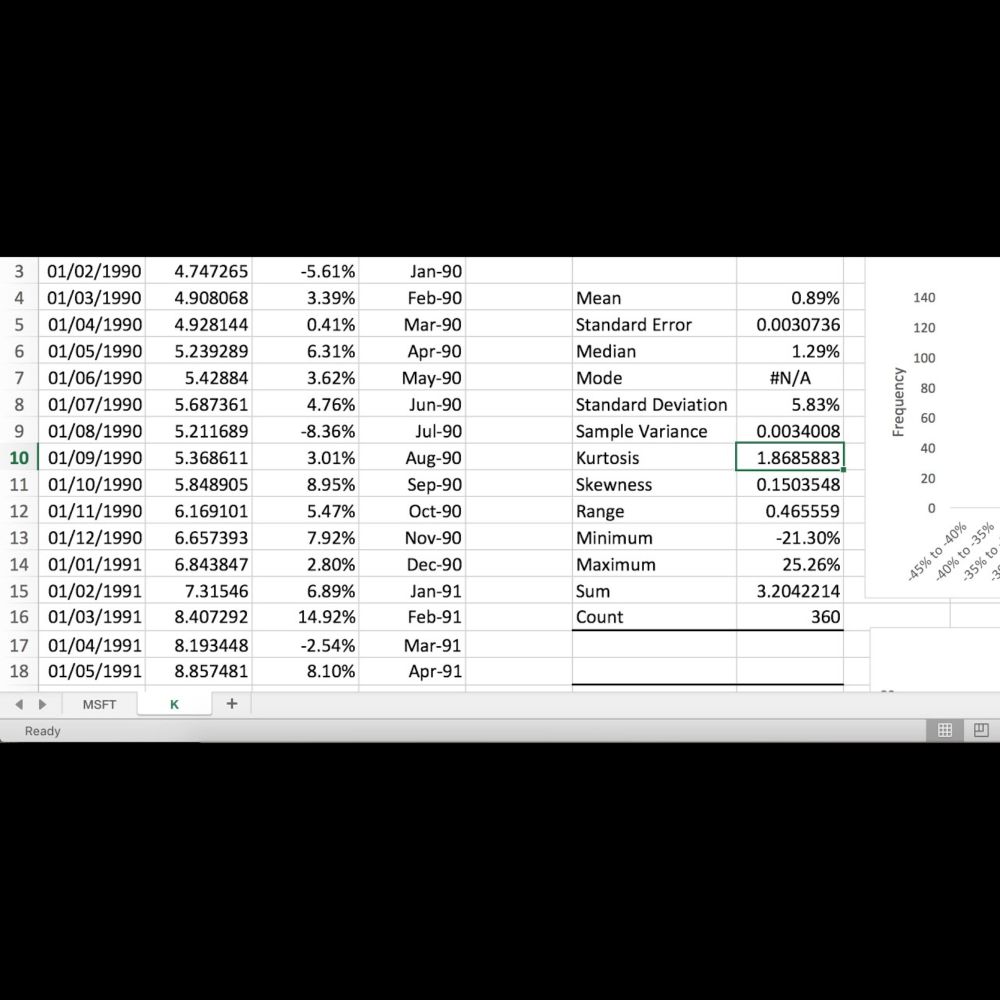

📽️Learn how to get descriptive statistics for stock returns using Excel.

youtu.be/MLl2hhcdILs

📈This is the fourth video in our series on analyzing stock returns.

#StockAnalysis #InvestingInsights

If you prefer a video summary, we've got you covered as well:

buff.ly/3JIaPn7

🧵 5/5

If you'd like to learn more about the bid-ask spread, feel free to read our dedicated post.

buff.ly/3PJxaV9

🧵 4/5

The bid-ask spread is the difference between the highest bid and the lowest ask.

It is a measure of liquidity as it captures round-trip transaction costs (the cost of turning over a position in a short interval).

Liquid stocks are characterized by low bid-ask spreads.

🧵 3/5

The bid price represents the buy side of a market. If the highest bid for a stock is $4, this's the price investors are "bidding" to buy the stock.

The ask price represents the sell side. If the lowest ask is $6, this's the price investors are "asking" to sell the stock.

🧵 2/5

📊 New to investing? Terms like bid prices, ask prices, and the bid-ask spread might seem daunting at first, but fear not! Here's a quick guide.💡

#Investing101 #BidAskSpread

🧵 1/5