Updated -- Analysis of Tax Provisions in the House Reconciliation Bill: National and State Level Estimates

23.05.2025 14:02 — 👍 7 🔁 1 💬 1 📌 0@marcoguz.bsky.social

state tax policy @itep.bsky.social 📍tacoma, wa #GoBills

Updated -- Analysis of Tax Provisions in the House Reconciliation Bill: National and State Level Estimates

23.05.2025 14:02 — 👍 7 🔁 1 💬 1 📌 0There’s been lots of chatter about repealing taxation of Social Security benefits in the tax bill. Turns out Rs opted to increase the standard deduction for some seniors instead.

Will this increase help lower- and middle-income retirees?

Nope, and here’s why. 🧵

A federal court says Alabama can't use a congressional map it found unconstitutional. The ruling comes in a voting rights case that resulted in the state getting a second Black member of Congress.

09.05.2025 16:05 — 👍 15624 🔁 3410 💬 238 📌 136

Tariffs. Deportations. Federal tax and budget cuts.

There are a range of federal actions coming together that will leave states with less money to meet their responsibilities.

State lawmakers should be ready.

itep.org/sharp-turn-i...

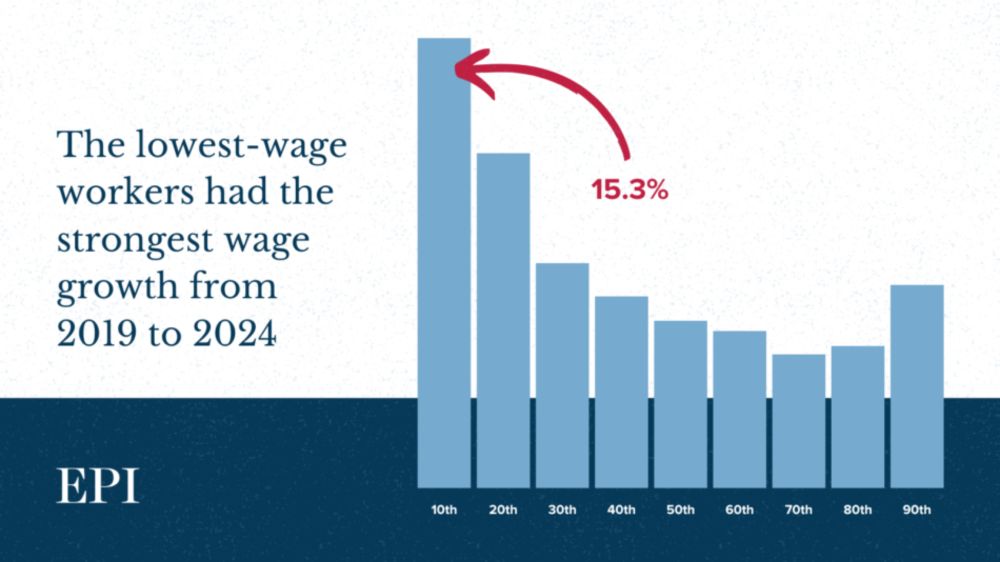

Lowest-paid workers saw 15.3% real wage growth from 2019-2024, a notable reversal from historic trends.

This was no accident: government COVID relief measures, a tight labor market & low unemployment gave low-wage workers better job opportunities & leverage.

www.epi.org/publication/...

New from @itep.org...

07.03.2025 21:11 — 👍 3 🔁 0 💬 0 📌 0Make America a Tax Cheat Haven!

05.03.2025 01:30 — 👍 233 🔁 58 💬 12 📌 3The massive budget cuts to health care, food assistance, & other services approved by House Republicans this week promise enormous harm to communities from coast to coast, as frontline leaders in the states have been loudly trying to say. Let’s take a tour of some examples🧵

27.02.2025 20:47 — 👍 15 🔁 15 💬 2 📌 1

IRS commissioners appointed by Reagan, H.W. Bush, Clinton, W. Bush, Obama, Trump, and Biden agree that Trump is making a huge mistake firing 6,700 IRS workers in the middle of tax season: www.nytimes.com/2025/02/24/o...

24.02.2025 14:35 — 👍 87 🔁 34 💬 3 📌 0

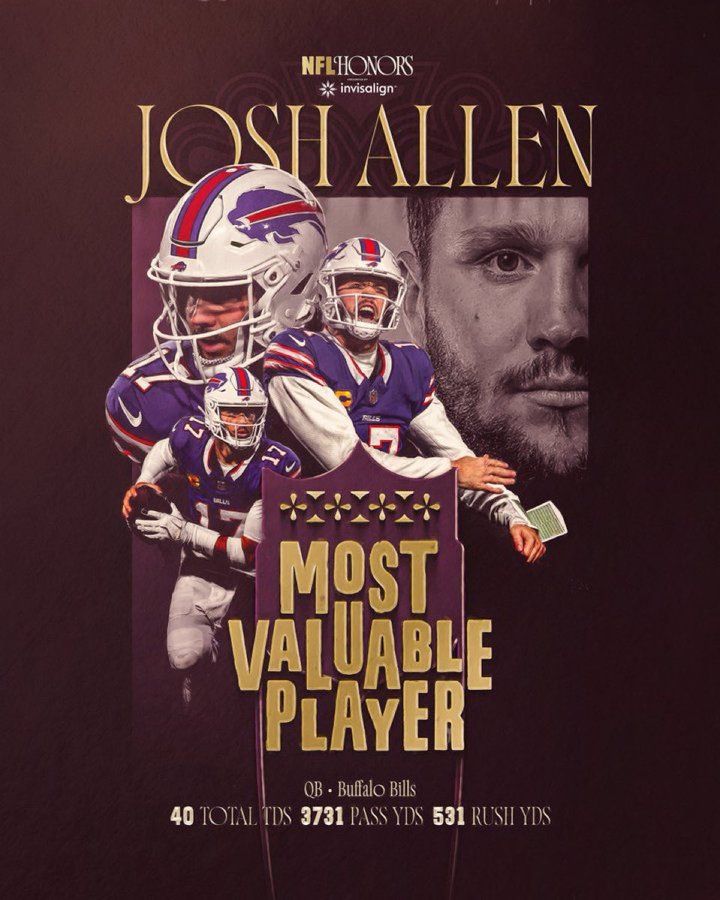

A stunner: Josh Allen is the MVP.

07.02.2025 03:42 — 👍 1789 🔁 165 💬 158 📌 106

New analysis from dcfpi.bsky.social with @nickjohnson4.bsky.social on how DC can ensure all businesses operating in the District pay their fair share of taxes and boost the economy by instituting a Business Activity Tax. www.dcfpi.org/all/a-busine...

05.02.2025 18:40 — 👍 7 🔁 5 💬 1 📌 1

Trump's immigration crackdown is not about law & order. He has a vendetta against immigrants who followed the law, too

His EOs threaten to punish legal immigrants by doubling their taxes (invoking a never-used 1934 law); expatriating their kids; and blocking them from the US entirely

wapo.st/4hkbEB6

What Mass Deportations Would Do to New York City’s Economy www.nytimes.com/2025/01/31/n...

31.01.2025 15:35 — 👍 1 🔁 0 💬 0 📌 0

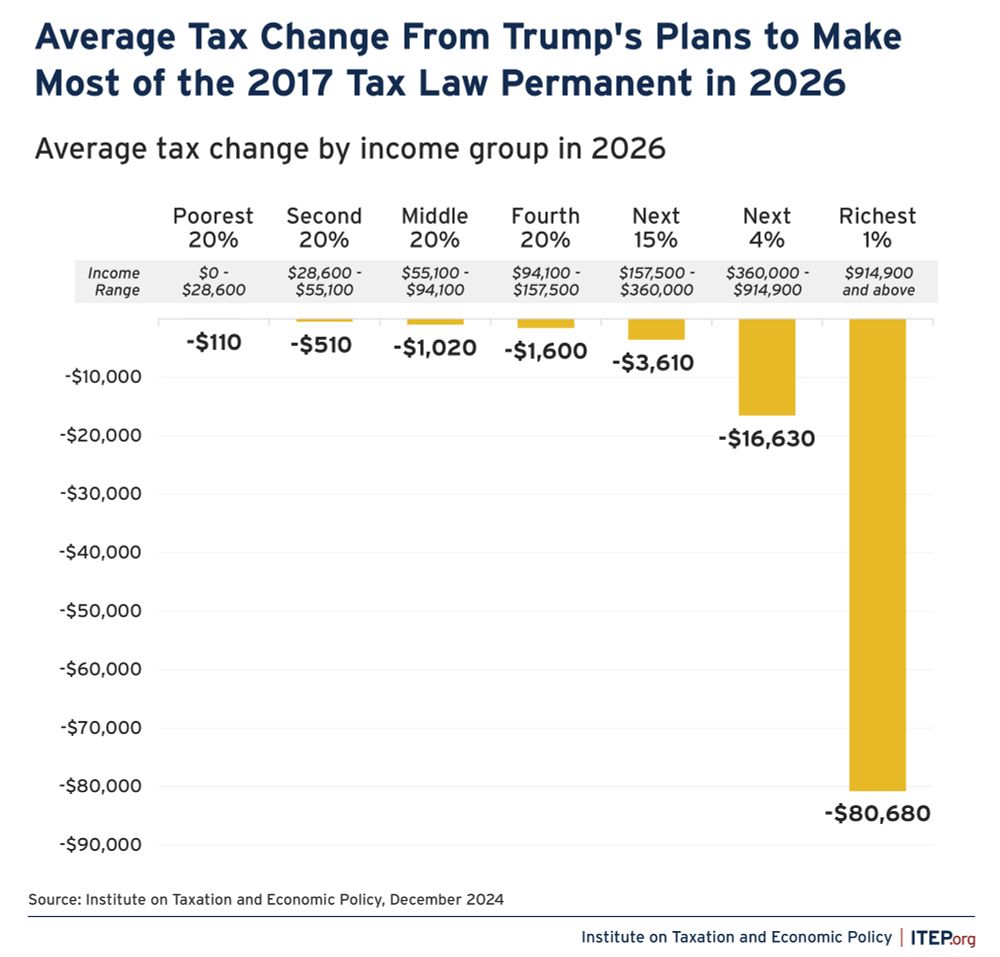

Trump’s plan to make most of his 2017 tax law permanent would disproportionately benefit the richest Americans.

The plan includes all major provisions except the $10,000 SALT cap which Trump has indicated he would not extend. itep.org/trump-tax-la...

New York Times Editor’s note: “Jimmy Carter died on Dec. 29, 2024. Roughly a year before he entered hospice care, he wrote his final New York Times Opinion essay. In it, he looked back on the Capitol riot and explained why he was so worried about American democracy.”

www.nytimes.com/2022/01/05/o...

US public life is increasingly dominated by people whose ravenous, bottomless, frantic need for attention trumps any ideological, moral, or political principle.

23.12.2024 21:08 — 👍 639 🔁 121 💬 21 📌 9

NEW: A host of billionaires — sports team owners, oil barons, Wall Street traders and others — have managed to avoid paying a tax on investment income.

propub.li/41EtbPK

Our readers had a ton of questions on immigration detention: where it takes place, who benefits, who makes profits, how can one push back?

So we turned to a great historian to answer your questions, and I learned *a ton* from her—from Reagan's role, to all the $$ sheriffs make, and so on:

In Washington, D.C., a tax on residents earning more than $250,000 a year is boosting the wages of child care workers. Two years in, it's proving to be a great investment.

13.12.2024 20:16 — 👍 8867 🔁 2167 💬 149 📌 207

Stripping funds from the IRS costs more than it saves.

Congress is considering cutting $20 billion in agency funding.

This would actually increase deficits by $46 billion due to a drop in the agency’s capacity to ensure wealthy people and corporations pay what they owe. itep.org/defunding-th...

A tweet from Benjamin Guggenheim that explains House Republicans are pushing to eliminate Direct File, the free tax filing service offered by the IRS.

Making it more expensive and more difficult to file your taxes is apparently a “day one” priority.

11.12.2024 16:30 — 👍 8 🔁 2 💬 1 📌 1

Really nice article.

Economists need to get their story straight on immigration on.ft.com/3ZnIZn8