In the latest Barbara Petrongolo (@ox.ac.uk & CEPR) discusses unanswered questions about #GenderInequality in work and why solving them benefits both fairness and productivity.

A new podcast form the @pse.bsky.social -CEPR Policy Forum series: cepr.org/multimedia/g...

#EconSky

01.08.2025 12:47 — 👍 7 🔁 4 💬 0 📌 0

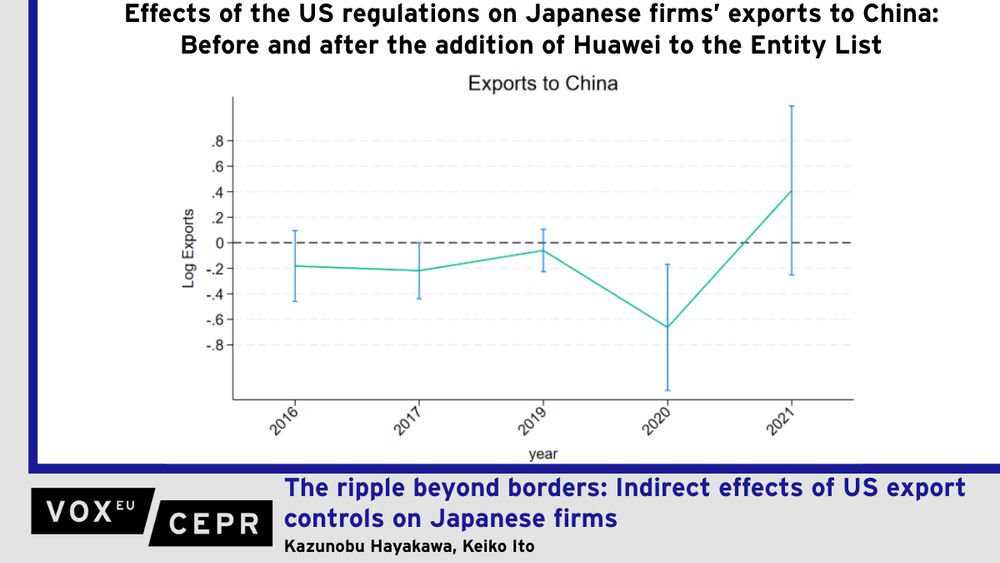

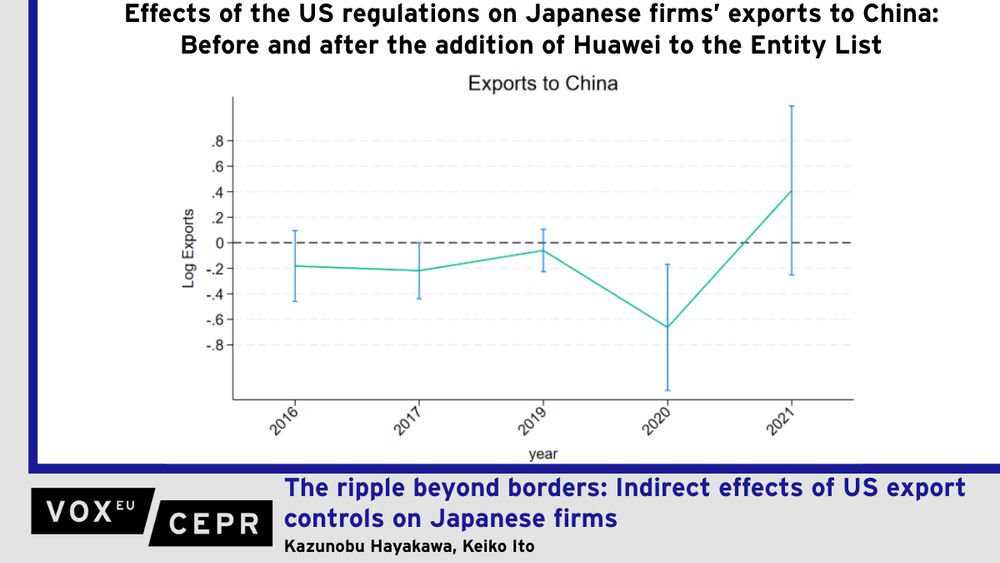

Graph of the effects of the US regulations on Japanese firms' exports to China: Before and after the addition of Huawei to the Entity List.

As part of the ongoing US-China trade war, since 2020 the US has restricted the exports of cutting-edge semiconductors from third countries to Huawei. This column analyses the indirect effects of US export regulations on exports of Huawei suppliers in Japan. Although Japan itself did not export cutting-edge semiconductors, exports of affected suppliers declined in 2020, particularly to unaffiliated firms in China. Furthermore, Japanese suppliers shifted exports to less risky destinations, with limited impact on overall firm performance. Thus, export restrictions can have wide-ranging effects on supply chains, beyond the targeted countries and products.

US restrictions on #exports of semiconductors from third countries to #Huawei led to Japanese suppliers of Huawei inputs to shift exports to less risky destinations, with limited impact on overall firm performance.

Kazunobu Hayakawa, Keiko Ito

cepr.org/voxeu/column...

#EconSky

01.08.2025 07:55 — 👍 4 🔁 2 💬 0 📌 0

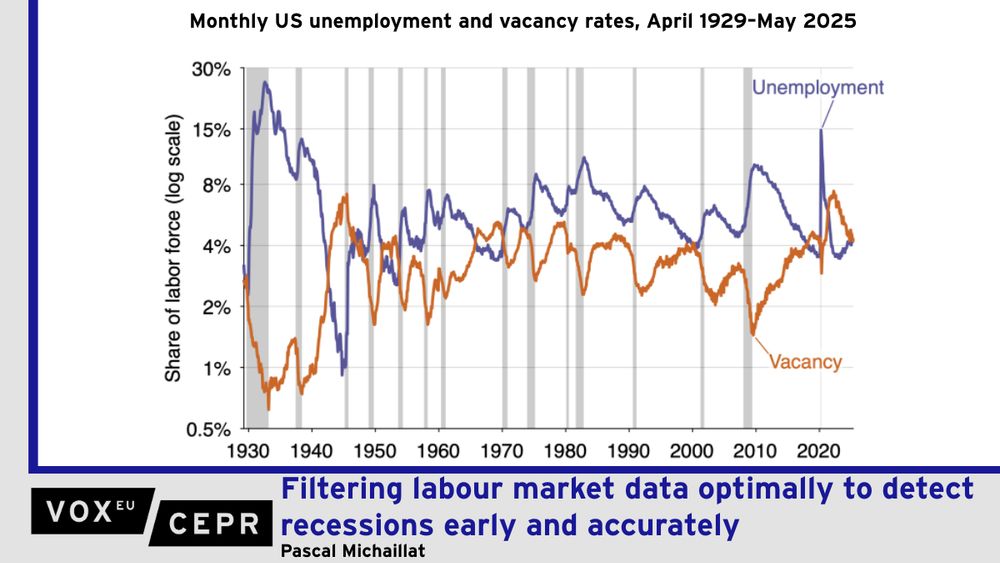

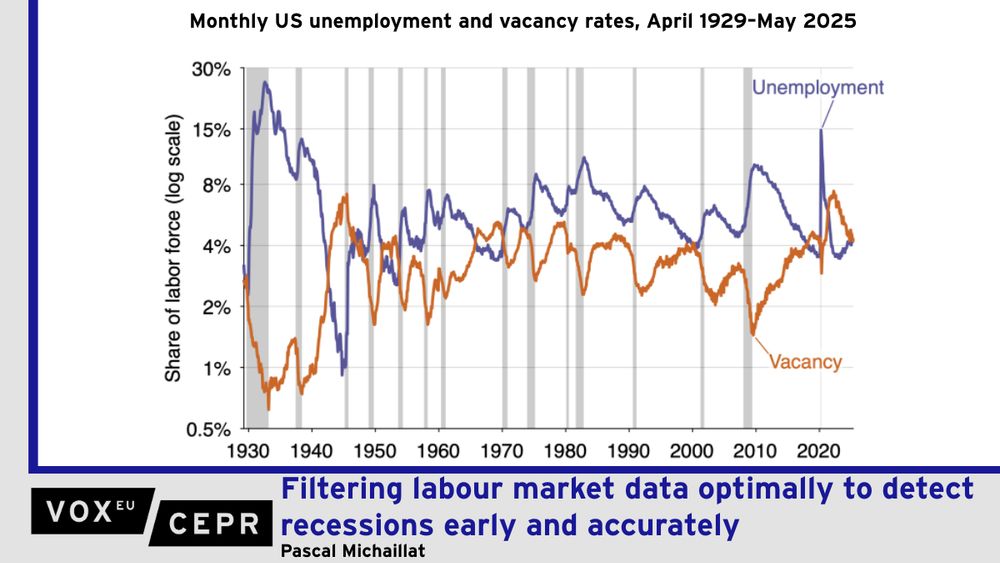

Graph of monthly US unemployment and vacancy rates, April 1929-May 2025.

The timely detection of recessions is critical for policymakers to make informed decisions. This column presents an algorithm for detecting recessions early using labour market data. By combining unemployment and vacancy rates, it shows that a less noisy signal can be obtained compared to relying on a single measure like industrial production. Current official prediction practices might benefit from greater emphasis on unemployment and vacancies, as the labour market is already sending an unambiguous signal of recession.

Pascal Michaillat presents an algorithm for detecting #recessions early using labour market data. By combining #unemployment rates and vacancy rates, it is less noisy than relying on a single measure like industrial production.

cepr.org/voxeu/column...

#EconSky

01.08.2025 07:54 — 👍 4 🔁 3 💬 0 📌 1

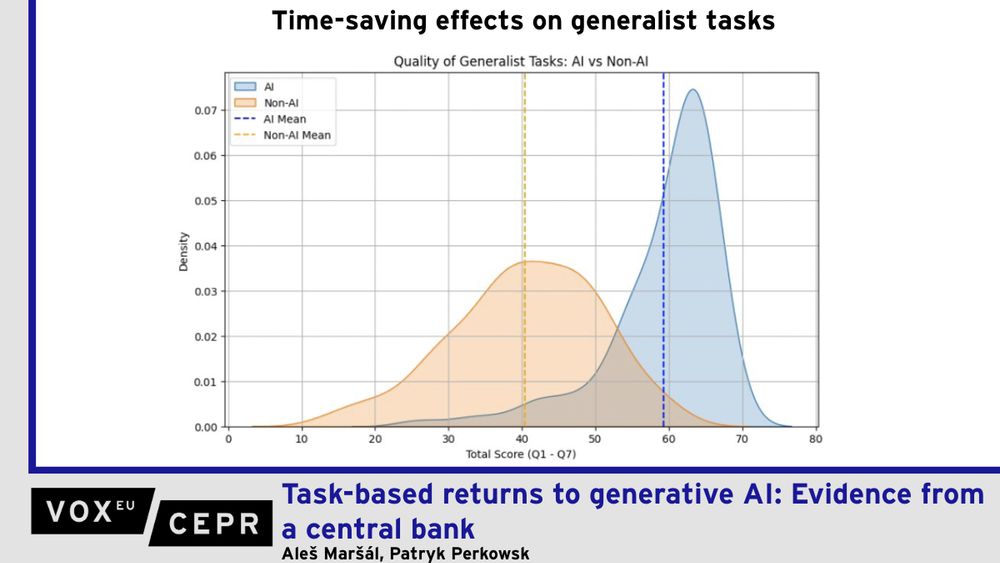

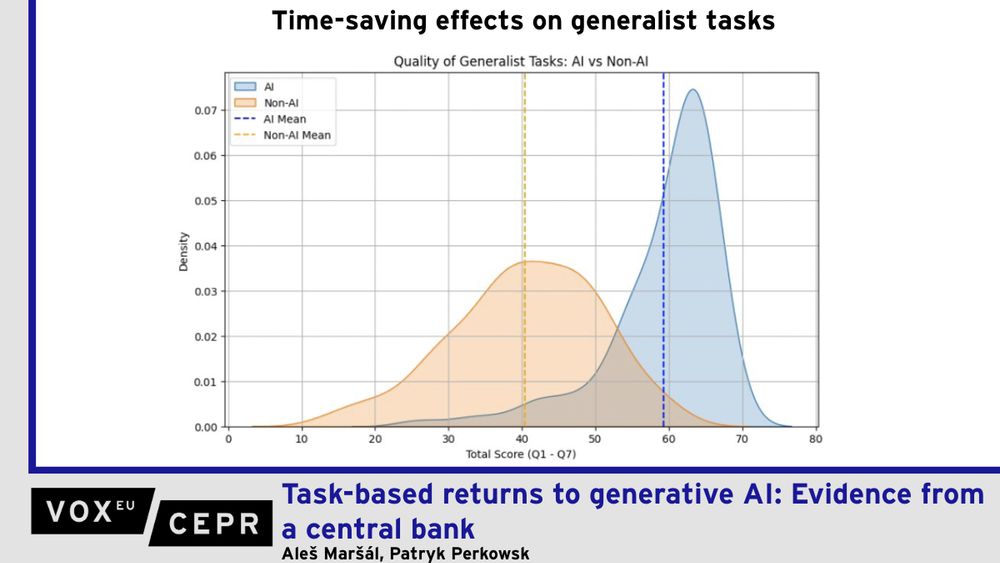

Aleš Maršál & @patryk22.bsky.social show that staff at the National Bank of Slovakia who were randomly assigned GPT-4o access improved output quality by up to 44% and cut completion time by 21%, with the largest gains on non-routine, domain-specific work.

cepr.org/voxeu/column...

#EconSky #AI

31.07.2025 08:20 — 👍 6 🔁 3 💬 0 📌 0

Economic research often treats tools such as tariffs, subsides, interest rates, monetary policy, and austerity measures as gender neutral. This column argues that when sex-disaggregated data and gender analysis are missing from models and policy decisions, the result is incomplete economic analysis and inequitable outcomes. What’s missing from economics isn’t just women’s voices, but women’s realities.

Navika Mehta argues that women's realities are still missing from economic research. When sex-disaggregated data and gender analysis are missing from economic models and policy decisions, the result is incomplete analysis and inequitable outcomes.

cepr.org/voxeu/column...

#EconSky

31.07.2025 08:17 — 👍 3 🔁 1 💬 0 📌 0

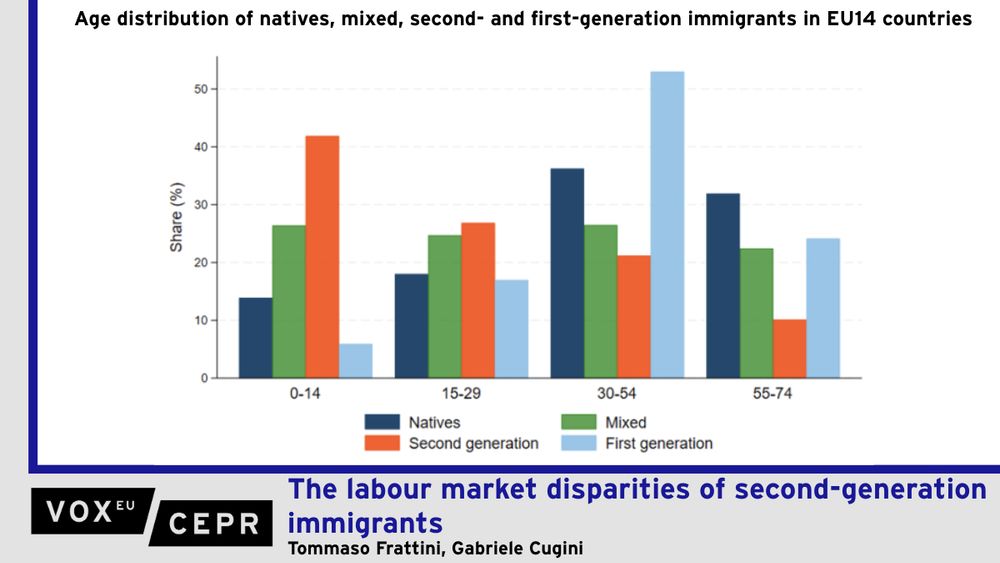

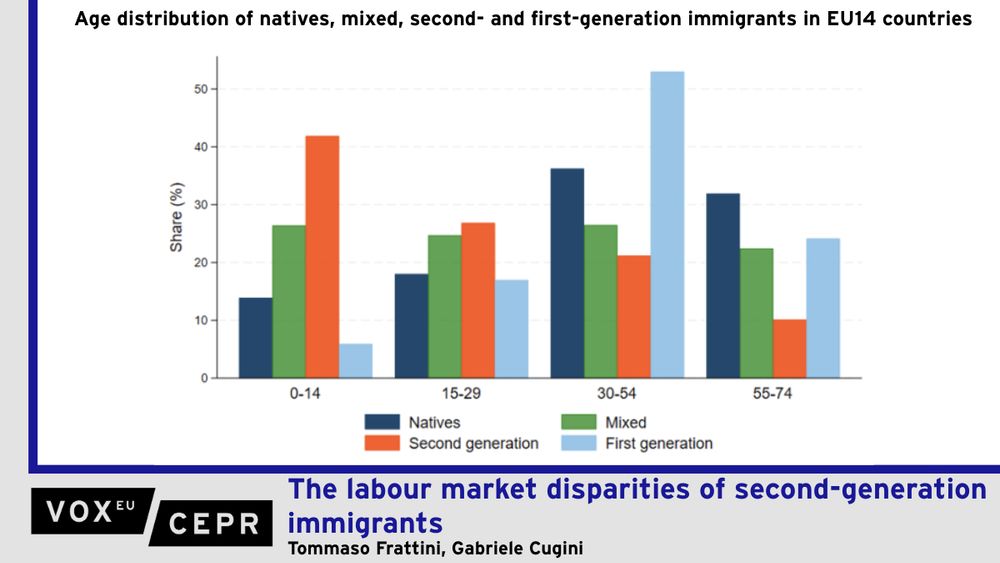

Graph of the age distribution of natives, mixed, second- and first-generation immigrants in EU14 countries. Second-generation immigrants make up the largest share of the 0-14 age group with more than 40%.

The successful integration of second-generation immigrants into education and employment is essential for Europe’s long-term social and economic cohesion. This column uses the results of the latest edition of the European Labour Force Survey to assess the demographic profile, educational attainment, and employment outcomes of second-generation immigrants, finding that they tend to be younger and less educated than the children of native-born parents. While this helps explain their concentration in low-quality jobs, it does not fully account for their lower overall employment rates. This suggests the existence of structural barriers that affect them regardless of their educational qualifications.

@tomfratti.bsky.social & Gabriele Cugini find that second-generation immigrants in Europe tend to be younger and less educated than the children of native-born parents and that structural barriers affect them regardless of their educational qualifications.

cepr.org/voxeu/column...

#EconSky

30.07.2025 07:48 — 👍 5 🔁 3 💬 0 📌 0

📢ReCIPE’s First Call for Compact Research Grants is now open! New deadline: 14 August. Proposals exploring the links between conflict & economic growth within ReCIPE research themes and in ReCIPE focus countries are welcome.

More information here: recipe.cepr.org/funding/comp...

#EconSky

29.07.2025 11:54 — 👍 6 🔁 4 💬 0 📌 0

📢ReCIPE’s First Call for PhD Research Grants is now open! New deadline: 14 August. We’re looking for research proposals from PhD students exploring the links b/w conflict & economic growth within ReCIPE research themes & in ReCIPE focus countries.

recipe.cepr.org/phd-research...

#EconSky

29.07.2025 11:56 — 👍 3 🔁 2 💬 0 📌 0

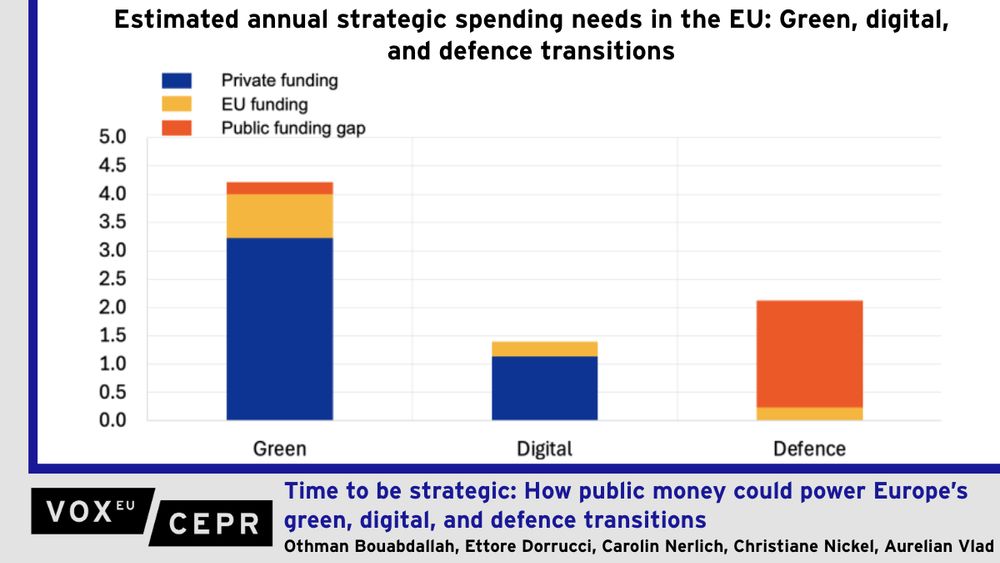

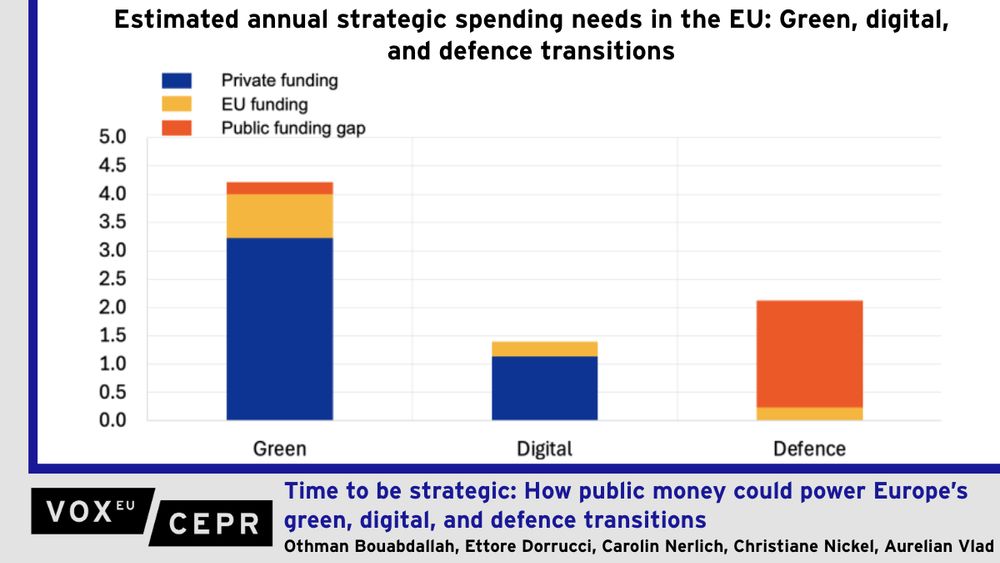

Chart of the estimated annual strategic spending needs in the EU: Green, digital, and defence transitions.

After the June NATO summit, Europe faces greater challenges in funding its green, digital, and defence transitions, as new defence commitments strain national and EU budgets. Balancing strategic priorities with debt sustainability is key. This column proposes a three-pronged strategy of (i) using existing fiscal tools, (ii) adopting additional national measures, and (iii) building a more cohesive and productive Europe.

As new defence commitments strain national and #EU budgets, balancing strategic priorities with debt sustainability is key. Othman Bouabdallah, Ettore Dorrucci, Carolin Nerlich, Christiane Nickel, & Aurelian Vlad propose a three-pronged strategy to do just that.

cepr.org/voxeu/column...

#EconSky

29.07.2025 08:19 — 👍 7 🔁 2 💬 0 📌 0

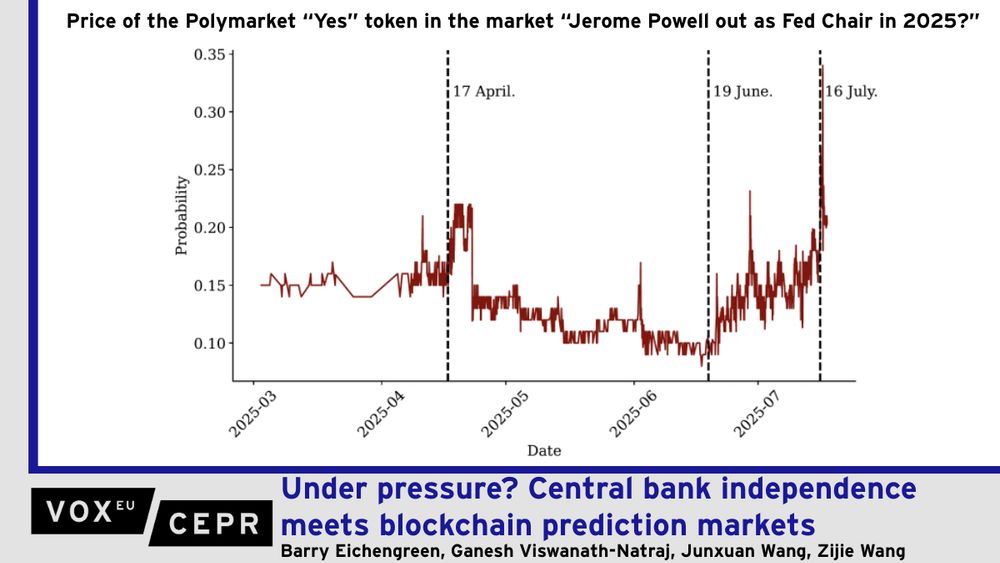

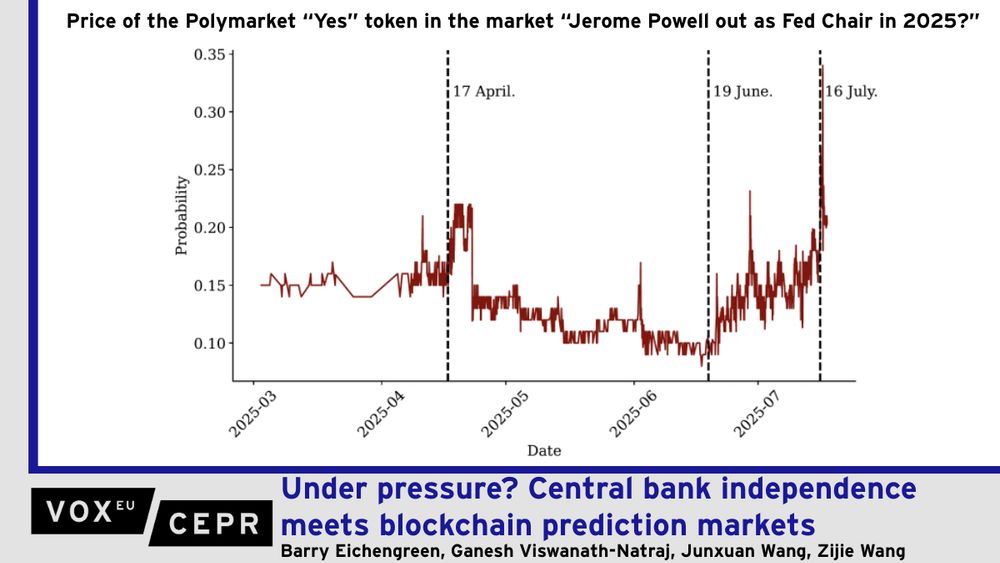

Graph of the price of the Polymarket "Yes" token in the market "Jerome Powell out as Fed Chair in 2025?".

The independence of monetary authorities from political interference is a foundational principle of modern central banking, and understanding whether threats to this independence affect expectations and beliefs is important. This column uses data from the Polymarket platform, where users trade on Federal Reserve interest rate decisions and possible replacement of Chair Powell, to examine how institutional credibility shapes investor expectations. Statements by Donald Trump casting the independence of the Federal Reserve into doubt translate into expectations of lower short-term interest rates but also higher long-term yields and greater expected recession risk.

Polymarket data show Donald Trump casting the independence of the Fed into doubt translates to expectations of lower short-term interest rates but also higher long-term yields and greater expected recession risk.

B Eichengreen, G Viswanath-Natraj, J Wang, Z Wang

cepr.org/voxeu/column...

#EconSky

29.07.2025 08:12 — 👍 4 🔁 1 💬 0 📌 0

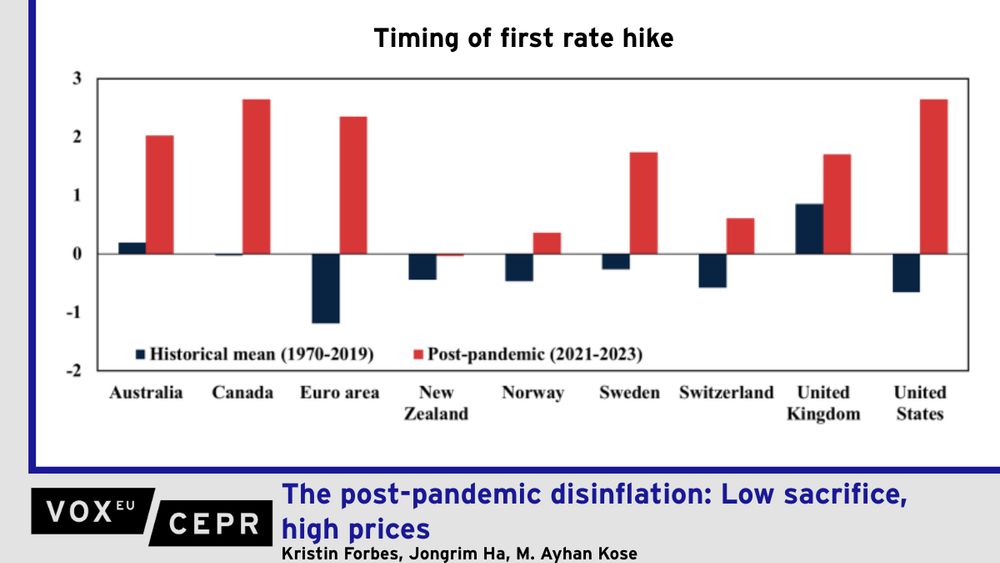

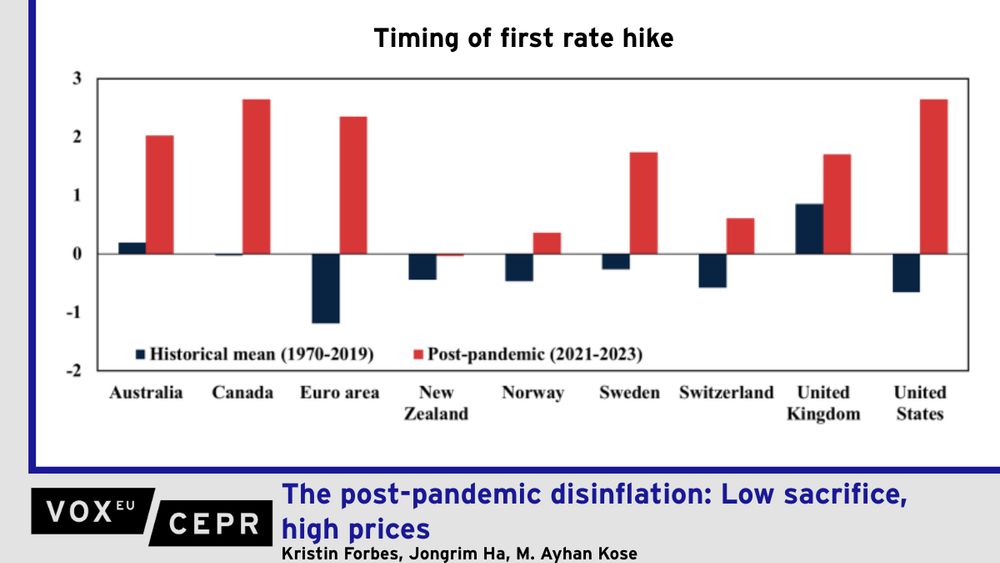

Graph showing the timing of first rate hike, both as a historical average and post-pandemic. It highlights the delayed adjustment of central banks after the pandemic.

By some criteria, the post-pandemic disinflation was a triumph for central banks in advanced economies: inflation fell sharply from 40-year highs while unemployment rates remained low, the combination of which generated historically low sacrifice ratios (output losses per inflation reduction). These standard metrics for success, however, ignore adjustments in the price level, which rose by more after the pandemic than over the past four decades. This column discusses lessons learned from the ‘start late and then sprint’ strategy for tightening monetary policy during this period, highlighting why the price level should receive more weight when central banks evaluate strategies for responding to inflation shocks – such as new tariffs – in the future.

Kristin Forbes, Jongrim Ha, & M. Ayhan Kose discuss lessons learned from the post-pandemic #monetarypolicy strategy and highlight why the price level should receive more weight when central banks evaluate future strategies for responding to inflation shocks.

cepr.org/voxeu/column...

#EconSky

28.07.2025 09:44 — 👍 4 🔁 3 💬 0 📌 0

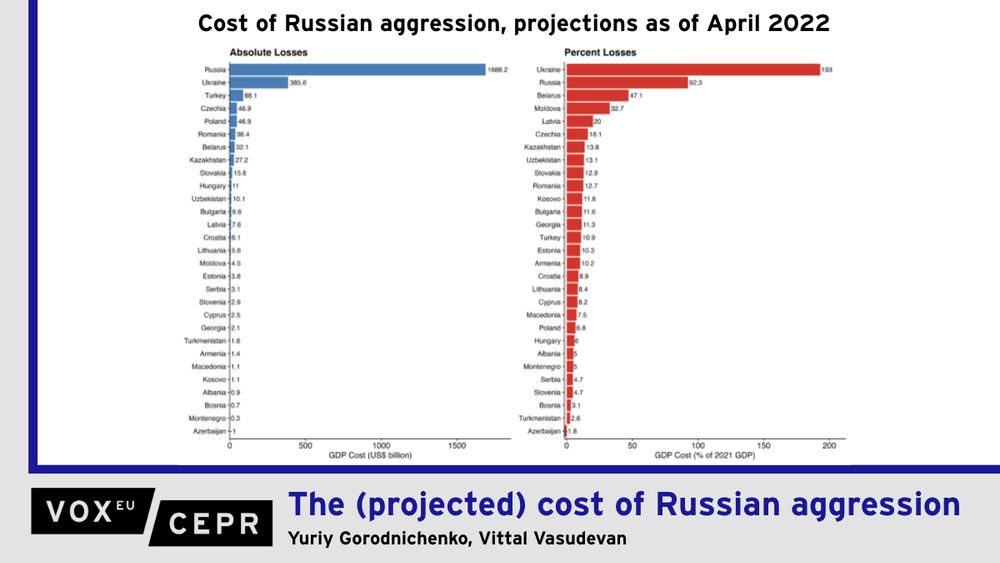

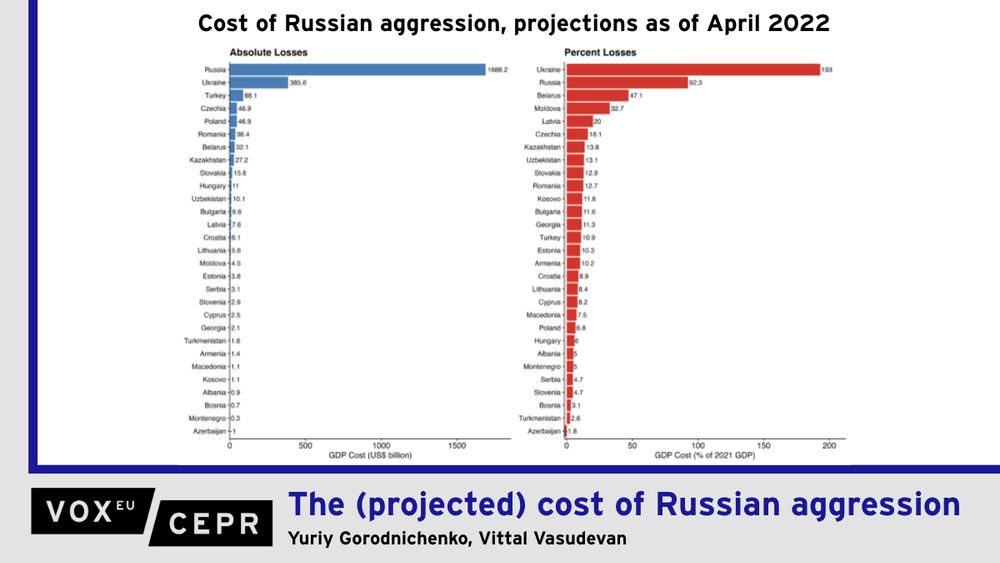

Chart showing the cost of Russian aggression as projections as of April 2022 for various countries as absolute losses and percent losses.

The 2022 Russian invasion of Ukraine marked an end to stability in Europe. This column analyses the economic effects for Ukraine, Russia, as well as spillovers on other countries, using professional forecast data from 29 nations. Forecasters predicted that the war would be highly stagflationary for Ukraine and Russia, lowering GDP and increasing the price level. The rest of Eastern Europe was expected to experience similar, but smaller, effects from the invasion. The estimates suggest the cost of the war is close to $2.4 trillion, but even this projection likely understates the full scale of economic harm.

Forecasts of the cost of the war in #Ukraine pointed to stagflation for Ukraine and Russia, as well as similar but smaller effects in the rest of Eastern Europe. The total cost of the war is estimated to be $2.4 trillion.

@ygorodnichenko.bsky.social, V Vasudevan

cepr.org/voxeu/column...

#EconSky

28.07.2025 09:41 — 👍 10 🔁 4 💬 0 📌 2

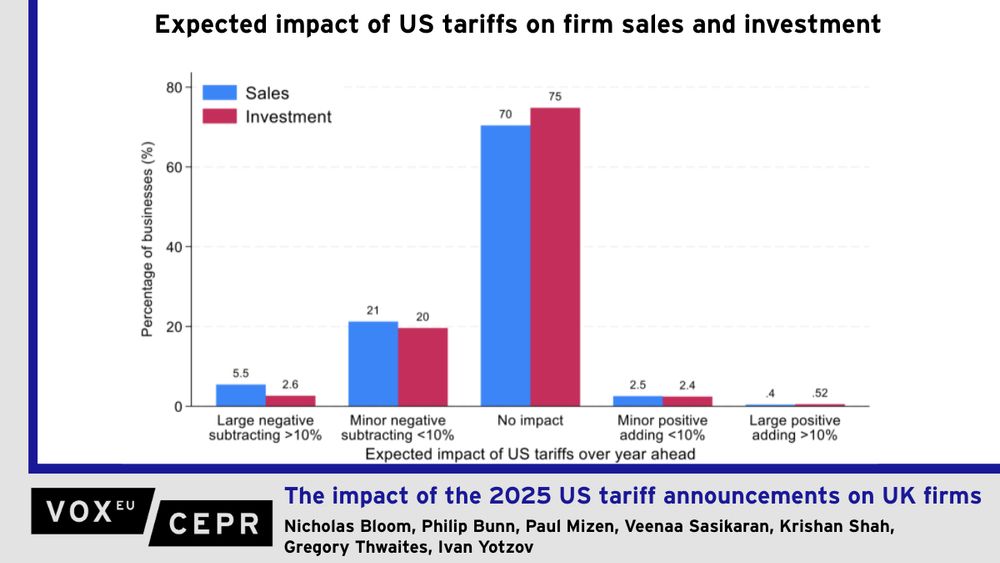

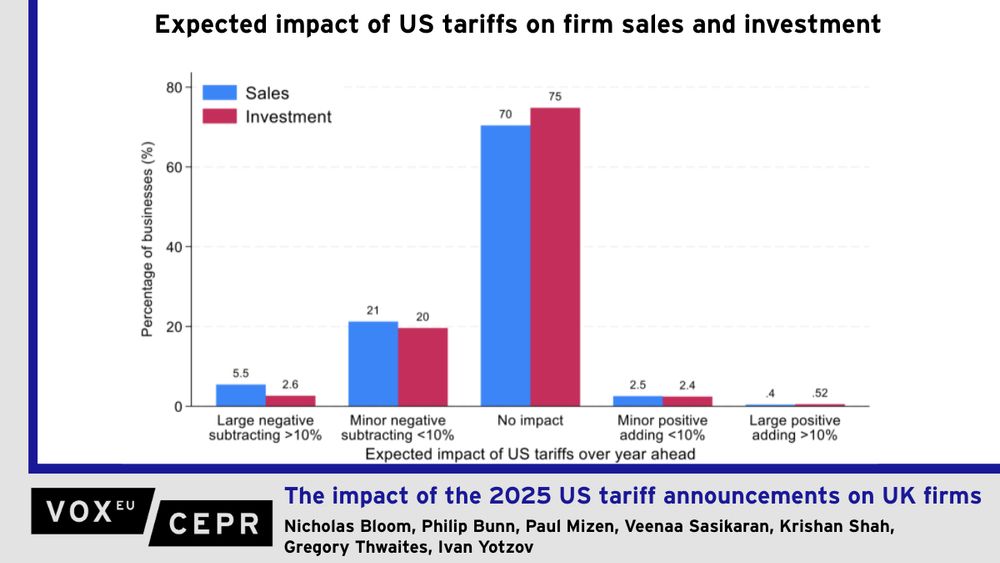

Chart showing the expected impact of US tariffs over the year ahead from survey data of UK firms. Around 75% expect no impact on sales or investment.

In the first half of 2025, the US and some of its trading partners announced significant changes to import tariffs. This column uses newly designed questions to study the impact of these changes on UK firms and to assess the level of trade uncertainty. On average, the majority of firms expect no material impact on their sales, investment, and prices; those that do expect it to be a relatively small negative impact. Tariffs are a new source of uncertainty for firms, although the level of uncertainty remains lower than for previous shocks such as Brexit, Covid-19, or the Russia-Ukraine war.

@paulmizen.bsky.social @iyotzov.bsky.social et al. study the impact of tariffs on UK firms. Using survey data, they find that, on average, the majority of firms expect no material impact on their sales, investment, and prices.

cepr.org/voxeu/column...

#EconSky

28.07.2025 09:30 — 👍 7 🔁 2 💬 0 📌 0

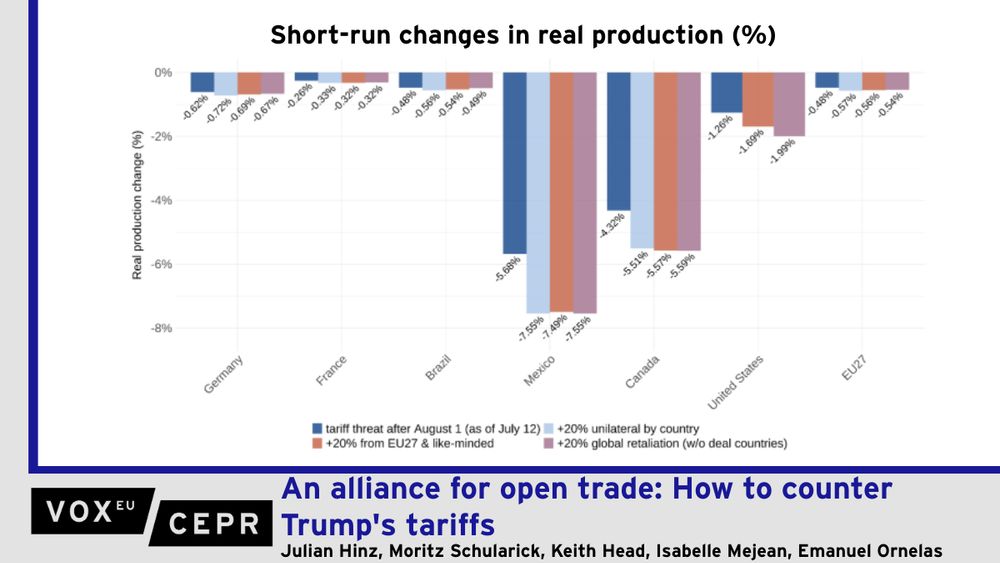

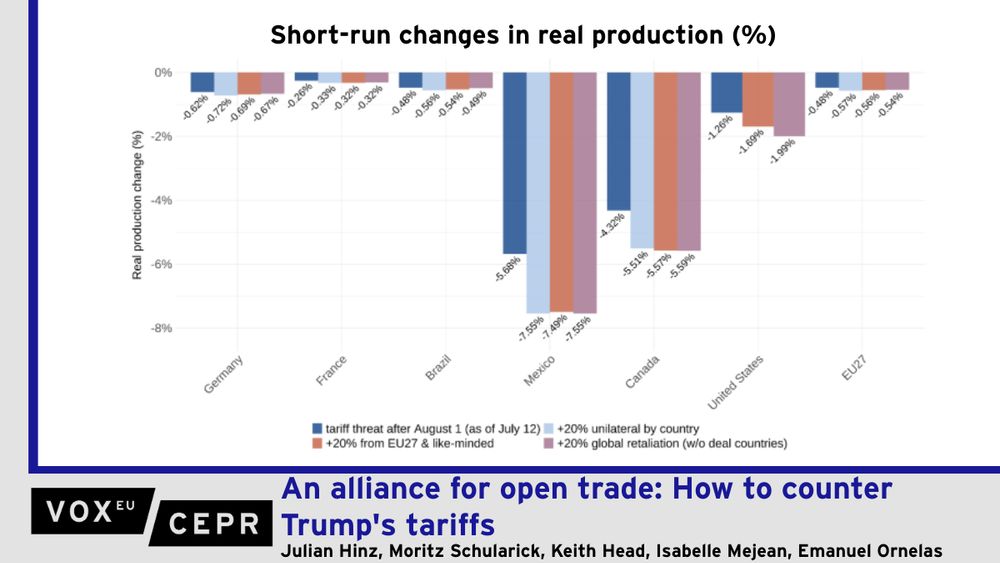

Chart of short-run changes in real production under different tariff scenarios for Germany, France, Brazil, Mexico, Canada, the US and the EU.

The US administration’s latest threat to impose sweeping new tariffs on many of its closest allies signals a renewed embrace of aggressive unilateralism and misunderstood economics. This column argues that the only effective response is a coordinated one. Unified retaliation by a coalition of like-minded countries made up of the EU, Canada, Mexico, Brazil, and South Korea – which together account for more than 50% of all US goods exports – would be impossible for Washington to ignore and would send a powerful message that the rules-based global trading system is worth defending.

J Hinz, @schularick.bsky.social, @ckhead.bsky.social, I Mejean, & @emanuelornelas.bsky.social argue the only effective response to Trump's #tariffs is a united one. Unified retaliation by the EU, Canada, Mexico, Brazil, & South Korea would be impossible to ignore.

cepr.org/voxeu/column...

#EconSky

28.07.2025 08:49 — 👍 14 🔁 10 💬 1 📌 3

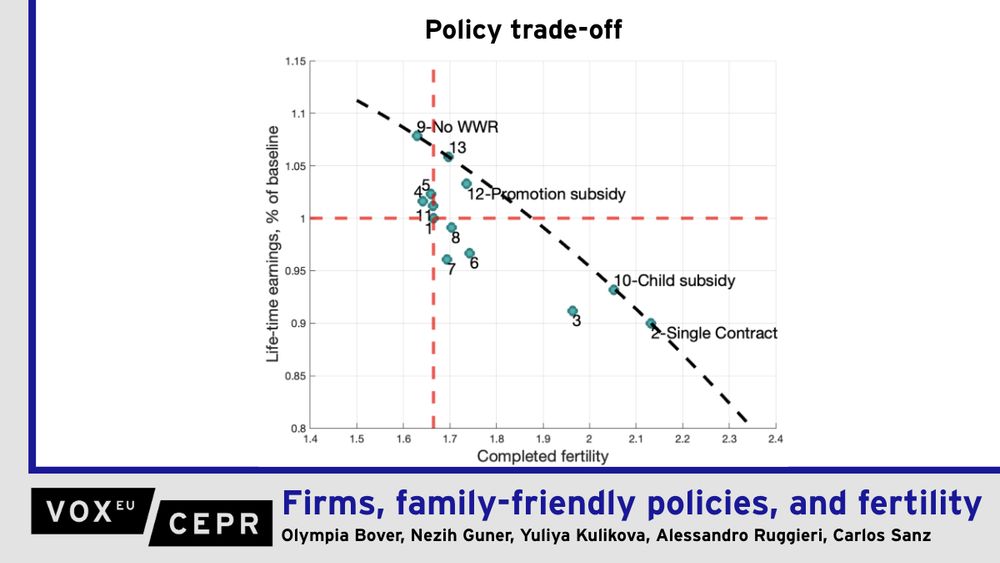

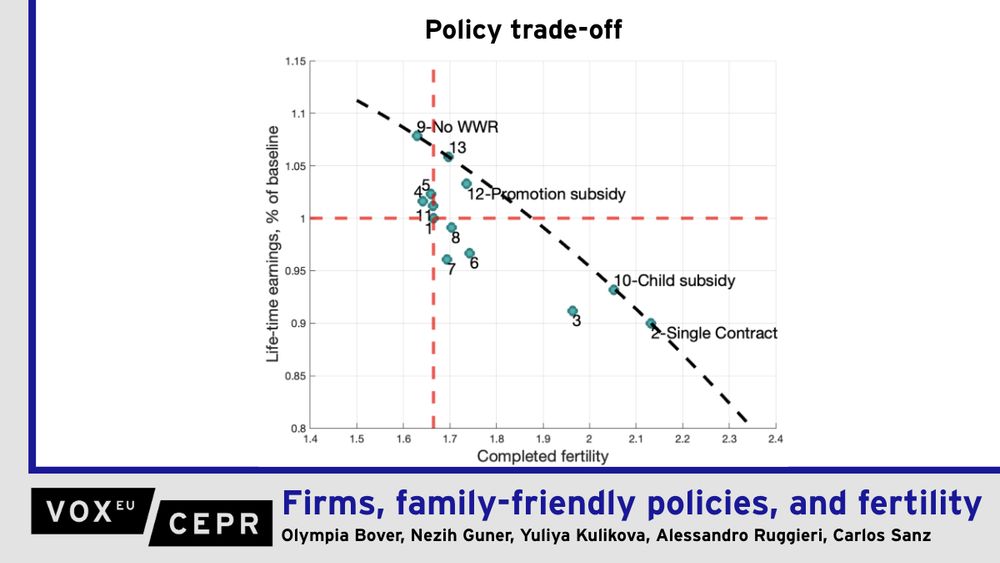

Graph showing the trade-off between life-time earnings and fertility for various types of family-friendly policies.

Family-friendly policies often aim to make it ‘easier’ to have children, yet little is known about how firms respond to such policies. This column develops a structural model of the labour market and applies it to administrative data from Spain to show that while family-friendly policies that provide job security increase fertility by making motherhood more compatible with continued employment, they can also lead firms to hire and promote fewer women in anticipation of the potential associated costs. Promotion subsidies, in contrast, can increase both fertility and the average lifetime earnings of women.

Data from #Spain show family-friendly policies that provide job security increase #fertility by making motherhood more compatible with #employment, but also can lead firms to hire and promote fewer women.

@olympiabover.bsky.social @ruggieriale.bsky.social et al.

cepr.org/voxeu/column...

#EconSky

28.07.2025 08:29 — 👍 4 🔁 3 💬 0 📌 0

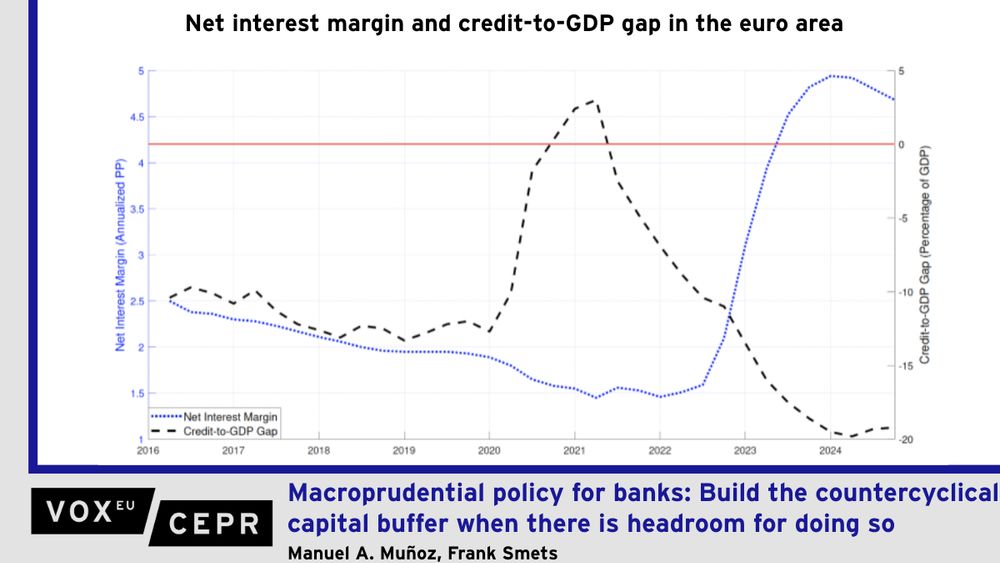

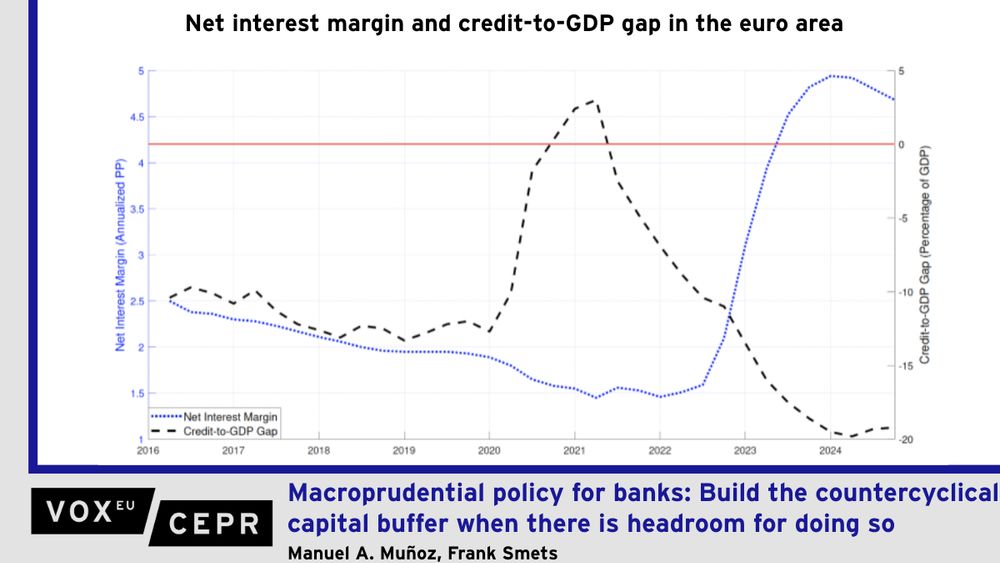

Graph of the net interest margin and credit-to-GDP gap in the euro area.

Numerous central banks started to build the countercyclical capital buffer as bank profitability began to soar during the recent tightening cycle. Recent evidence suggests that building the buffer when there is headroom for doing so does not harm lending in the short-term and tends to increase it at longer horizons. This column proposes a quantitative macro-banking model that captures such evidence and illustrates how it can be applied to calibrate the positive neutral countercyclical capital buffer. Optimal dynamic capital buffers build in response to expected upward shifts in bank net interest margins. In doing so, they mitigate externalities due to bank risk failure and collateral constraints.

Manuel A. Muñoz & Frank Smets propose a macro-banking model that helps to calibrate the positive neutral countercyclical capital buffer for central banks. An optimal buffer can mitigate externalities due to bank risk failure and collateral constraints.

cepr.org/voxeu/column...

#EconSky

28.07.2025 08:18 — 👍 4 🔁 2 💬 0 📌 0

Meet tomorrow’s economic leaders, today

@talknormal.co.uk talks to young researchers from @pse.bsky.social -CEPR Forum 2025:

Pelin Ozgul on AI & training

Nathan Vieira on short-time work

Deepakshi Singh on gender & droughts

🎧 Listen here: cepr.org/multimedia/n...

#EconSky

25.07.2025 14:29 — 👍 8 🔁 2 💬 0 📌 1

A key question in the context of a trade war is whether the burden of tariffs falls on foreign exporters or domestic importers. This column uses a firm-to-firm trade model with search frictions and French export data to study how cost shocks affect buying firms. It finds that while some buyers pay nothing, others face full pass-through or costly supplier switches, with the average incidence twice as large in markets with low versus high frictions. The authors suggest that policies could target high-friction markets or help buyers diversify after shocks.

Lookup fields should be configured in the field menu dropdown

Using French export data, François Fontaine, Julien Martin, and Isabelle Mejean find that cost shocks impact firms differently in markets with high vs low frictions. Some buyers pay nothing, while others face full pass-through or costly supplier switches.

cepr.org/voxeu/column...

#EconSky

24.07.2025 07:46 — 👍 5 🔁 2 💬 0 📌 1

Are global economic flows retreating, or rerouting?

In this new VoxTalks Economics, Michele Ruta (IMF) discusses insights from 'The State of Globalisation', a new CEPR publication, and the challenges ahead for trade and industrial strategy

w/ @talknormal.co.uk

🎧 cepr.org/multimedia/s...

#EconSky

23.07.2025 11:42 — 👍 5 🔁 1 💬 0 📌 0

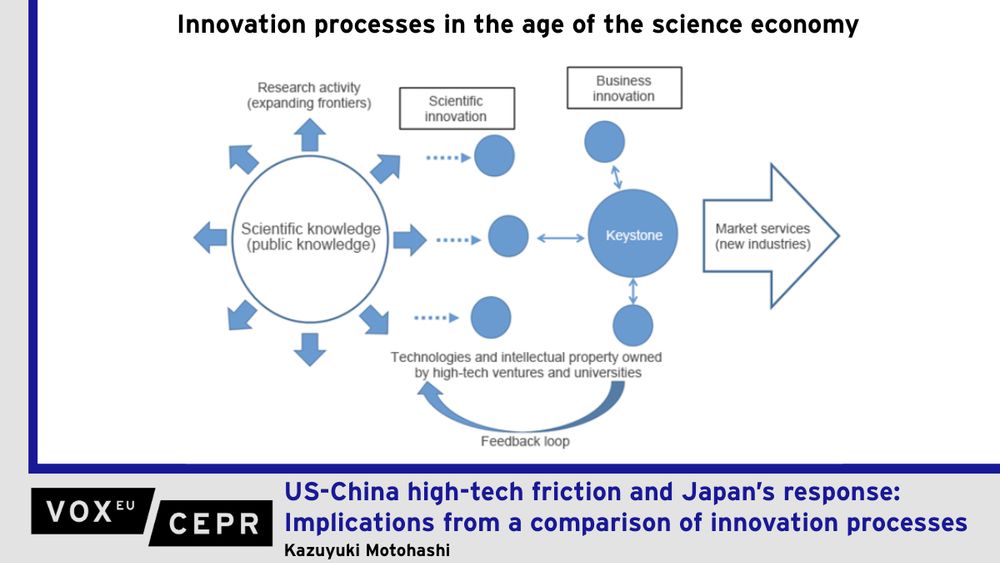

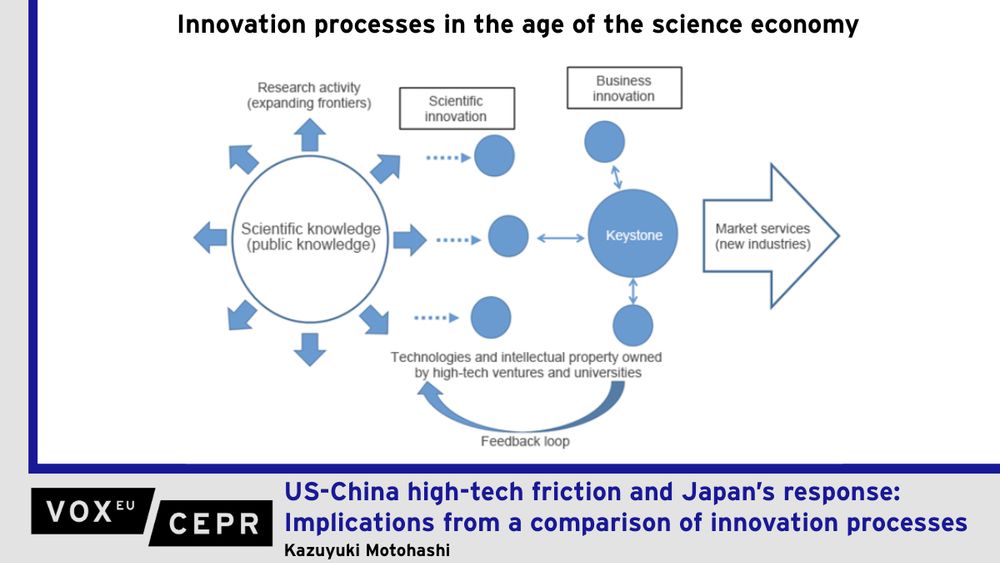

Diagram of innovation processes in the age of the science economy.

The competition being fought between the US and China in cutting-edge technology fields friction is also affecting basic research activities at universities and other public institutions. This column examines how innovation processes in Japan compare with those in the US and China, and argues that Japan must improve the incorporation of cutting-edge international research results into its leading-edge research. Adopting a closed approach to information in response to US and Chinese controls would further isolate Japan from global research trends and negatively impact its science and technology expertise relative to other countries, making it difficult to attract leading researchers from around the world.

Kazuyuki Motohashi argues that Japan must improve the incorporation of cutting-edge international research results into its leading-edge research. A closed approach would further isolate #Japan & negatively impact its science & tech expertise.

cepr.org/voxeu/column...

#EconSky

23.07.2025 08:03 — 👍 5 🔁 2 💬 0 📌 1

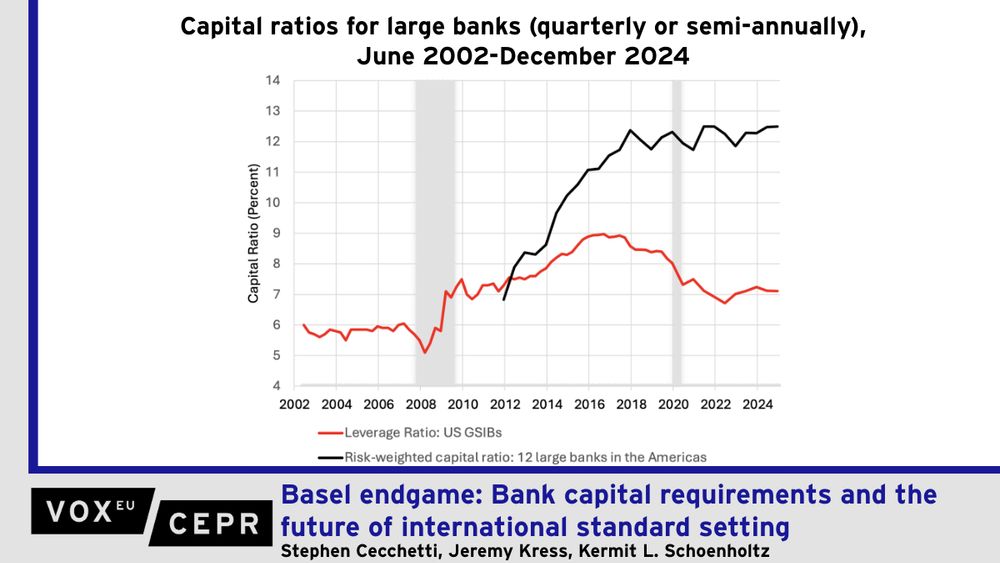

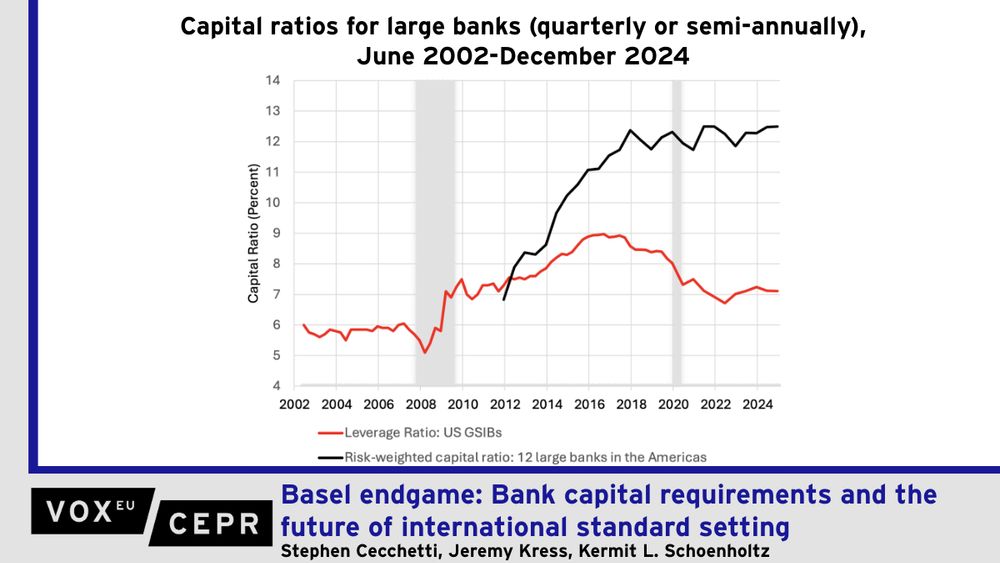

Graph of capital ratios for large banks, June 2002-December 2024

Since the 1970s, banking regulators have worked to set minimum standards for internationally active banks. The latest agreement, Basel III, was introduced following the 2008 financial crisis, but only partially adopted by the US in 2013. This column discusses the final set of rules (‘Basel endgame’) and their potential implications for the US economy and financial system. It argues that the US should, at a minimum, implement international standards in a capital-neutral manner to preserve decades of global regulatory cooperation. Raising capital requirements is also highly desirable but can be left for future consideration.

Stephen Cecchetti, @jeremykress.bsky.social , & Kermit L. Schoenholtz argue that the US should, at minimum, implement international Basel III standards in a capital-neutral manner to preserve decades of global regulatory cooperation.

cepr.org/voxeu/column...

#EconSky

23.07.2025 08:01 — 👍 5 🔁 3 💬 0 📌 0

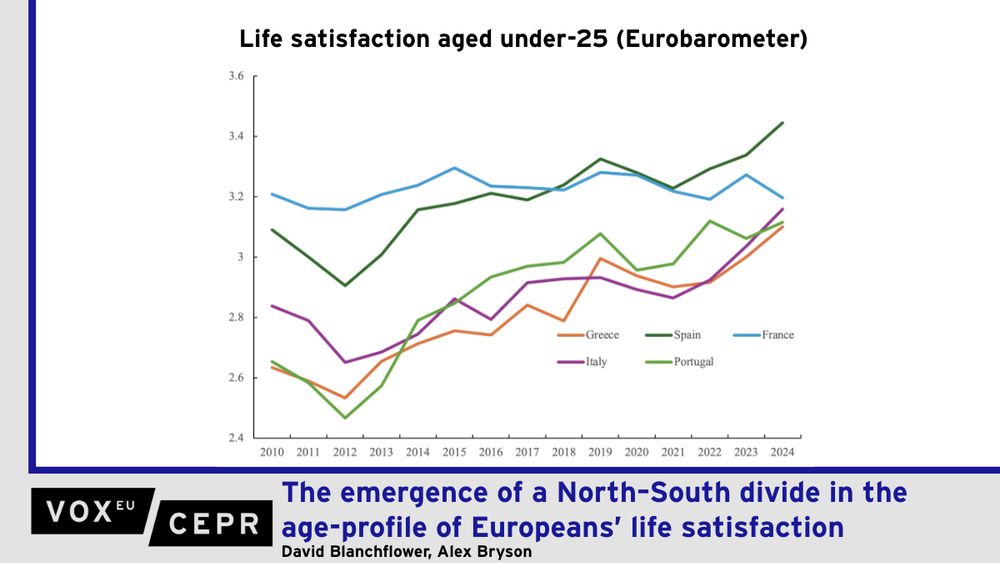

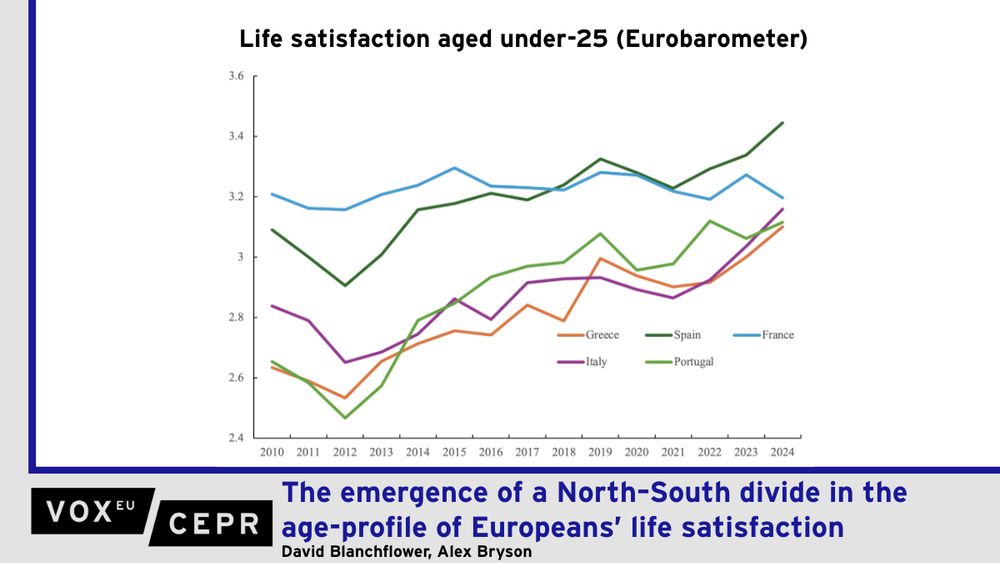

Graph showing life satisfaction aged under-25 in Greece, Spain, France, Italy, and Portugal.

The traditional U-shape in wellbeing, with people’s life satisfaction lowest in their late 40s or early 50s, appeared to have been replaced around 2013-15 by wellbeing rising with age, driven by a collapse in the wellbeing of the young. This column uses survey data from 21 European countries to show while that the U-shape has indeed disappeared, by 2020–2024 it was replaced by life satisfaction rising with age in Northern European countries but falling with age in Southern Europe where the young have been getting more satisfied with life, possibly due to improvements in the youth labour market.

Survey data from 21 European countries shows that life satisfaction is rising with age in Northern Europe, but falling with age in Southern Europe where the young have been getting more satisfied with life.

David Blanchflower & @alexbryson.bsky.social

cepr.org/voxeu/column...

#EconSky

22.07.2025 08:22 — 👍 4 🔁 2 💬 0 📌 0

State aid regulation is crucial to ensuring competitiveness in the EU Single Market, but enforcement remains challenging. Non-compliance by member states and foreign subsidies are ongoing concerns; however, detection is difficult. This column proposes an approach to identify suspect cases of hidden state aid recipients using machine learning algorithms. The predictions allow regulators to substantially narrow the pool of observations for further investigation by flagging firms that appear to behave as if they received public subsidies, but are not officially recorded. The authors’ analysis reveals heterogeneity in the incidence of suspect cases across countries, industries and firm size.

Guglielmo Barone & Marco Letta propose an approach to identify suspect cases of hidden state aid recipients using machine learning algorithms. Analysis reveals heterogeneity in the incidence of suspect cases across countries, industries, and firm size.

cepr.org/voxeu/column...

#EconSky

22.07.2025 08:19 — 👍 4 🔁 1 💬 0 📌 0

A 2016 Italian reform meant to reduce administrative burdens for micro-firms by simplifying reporting standards led to reduced access to bank credit without any measurable cost savings.

A Accetturo, A Baltrunaite, G Cariola, A Frigo, M Gallo

cepr.org/voxeu/column...

#EconSky

22.07.2025 08:18 — 👍 4 🔁 2 💬 0 📌 0

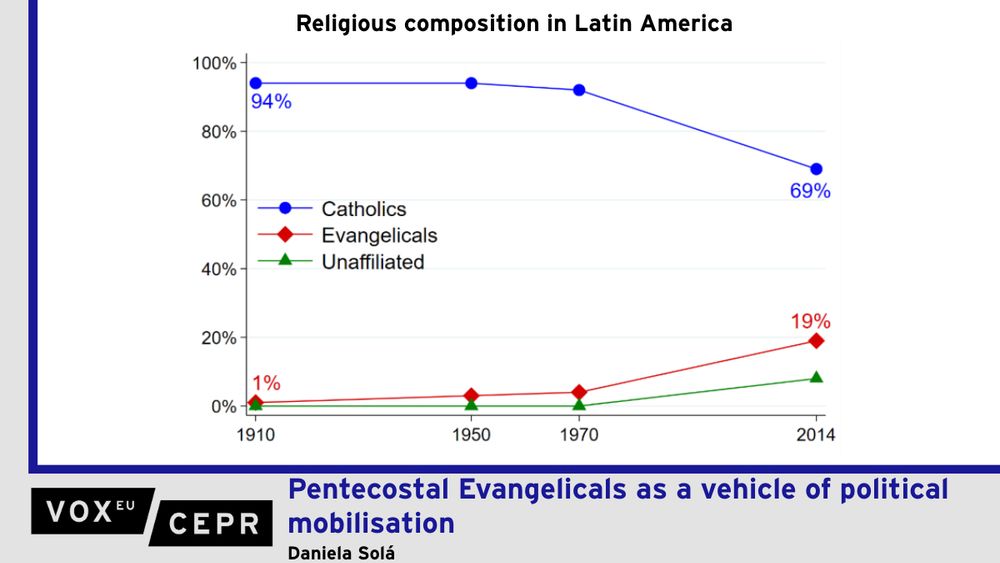

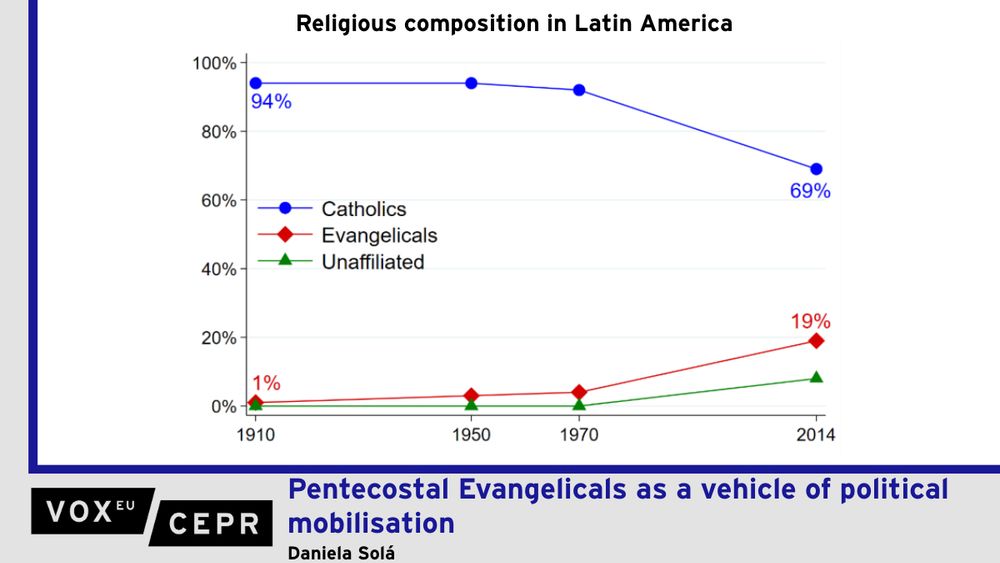

Graph showing the change in religious composition in Latin America over time. As of 2014, the percentage of Catholics has declined from 94% in 1910 to 69% and the percentage of Evangelicals has increased from 1% to 19%.

Pentecostal Evangelicals play a prominent role in Latin American politics, often supporting far-right candidates and promoting pastors to run for elections. This column presents evidence from Brazil showing that Pentecostal expansion, driven by the activities of the Summer Institute of Linguistics – a 20th century US evangelical organisation focused on Bible translation – increased electoral support for evangelical and far-right candidates. The findings underscore the significant role of religious actors in amplifying political movements.

Daniela Solá shows that Pentecostal expansion in #Brazil driven by the Summer Institute of Linguistics - a 20th century US evangelical organisation focused on Bible translations - increased electoral support for evangelical and #far-right candidates.

cepr.org/voxeu/column...

#EconSky

21.07.2025 08:28 — 👍 17 🔁 8 💬 1 📌 2

Artificial intelligence may reduce the need for physically demanding tasks, but it could also erode job satisfaction, intensify cognitive load, and amplify anxiety. This column reports research on survey data from Germany, which finds no evidence that AI exposure has harmed workers’ mental health or subjective wellbeing. But looking at self-reported use of AI tools in the workplace, there are indications of declining life and job satisfaction. This suggests the need to expand current debates beyond AI’s impact on employment, productivity and wages: if it transforms work in ways that affect stress, autonomy, purpose, or health, these dimensions must become central to technology policy and labour regulation.

German survey data shows no evidence that #AI exposure has harmed workers' #mentalhealth or subjective #wellbeing. However, self-reported use of AI tools in the workplace points to indications of declining life and job satisfaction.

O Giuntella, L Stella, J König

cepr.org/voxeu/column...

#EconSky

21.07.2025 08:26 — 👍 6 🔁 3 💬 0 📌 3

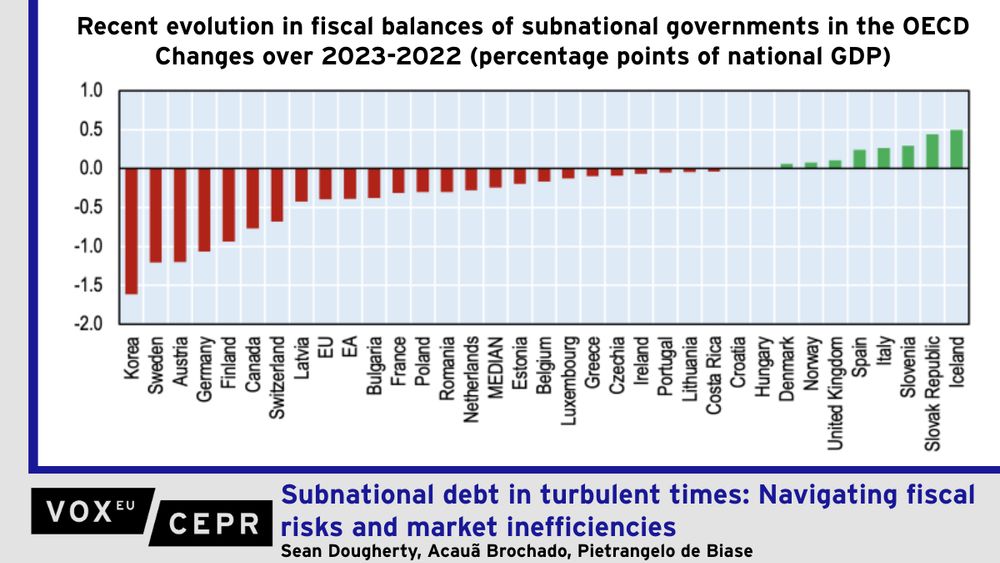

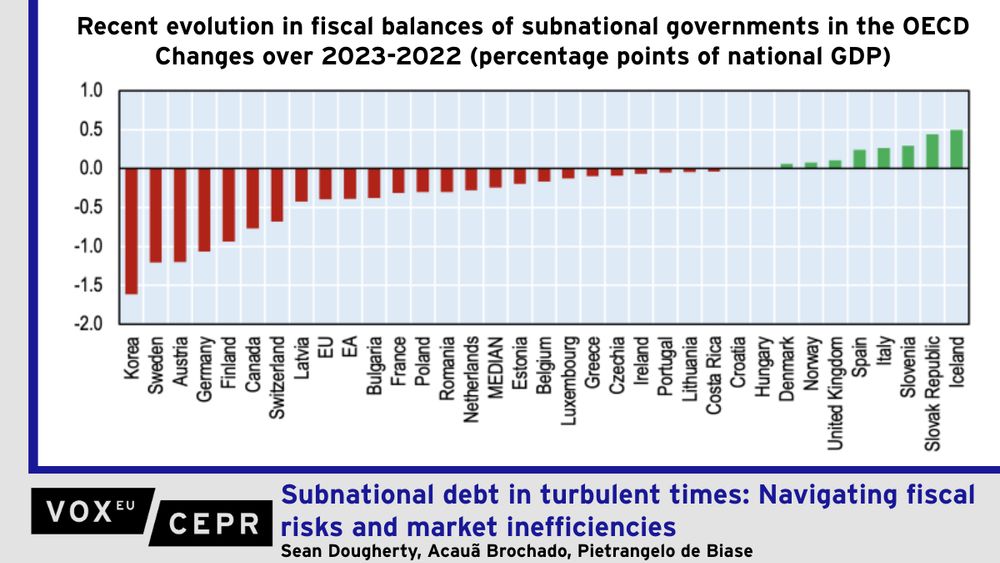

Subnational governments are crucial actors in delivering public services and addressing structural challenges but are often overlooked in fiscal policy debates. This column analyses the macroeconomic pressures faced by subnational governments and their respective bond markets. It shows that persistent inflation and tight monetary conditions continue to weigh on growth and public finances in many countries. Varying debt profiles and borrowing modalities further differentiate the fiscal challenges of different jurisdictions. Structural responses aimed at long-term sustainability must emphasise improved transparency, credible fiscal rules, and strengthened frameworks that delineate subnational fiscal responsibilities and central government support limits.

Varying debt profiles and borrowing modalities differentiate the fiscal challenges of different subnational jurisdictions as they deal with persistent inflation and tight monetary conditions.

Sean Dougherty, Acauã Brochado, Pietrangelo de Biase

cepr.org/voxeu/column...

#EconSky

21.07.2025 08:25 — 👍 3 🔁 1 💬 0 📌 0

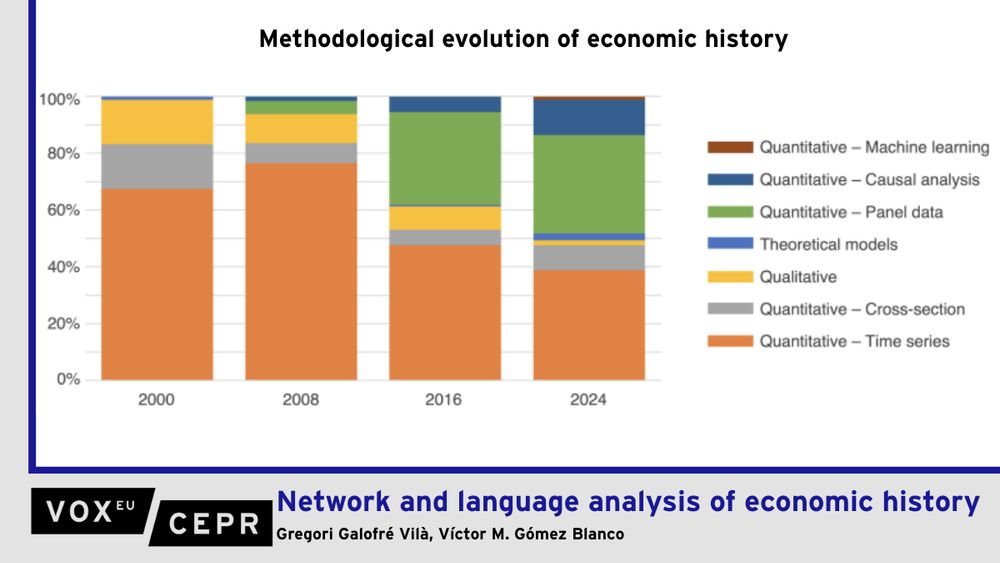

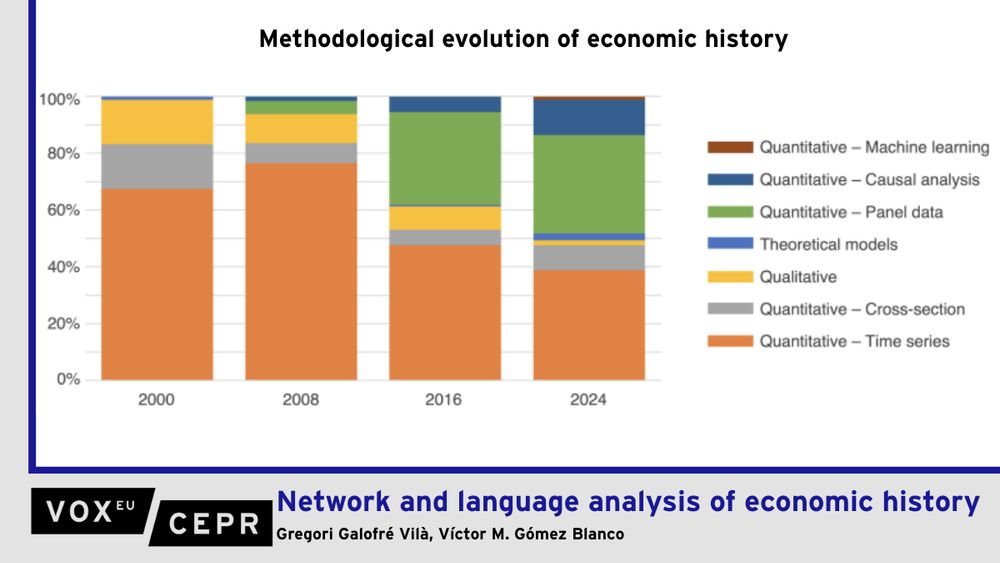

Chart showing the methodological evolution of economic history. The share of qualitative studies has drastically decreased since 2000 and quantitative studies using panel data and causal analysis have increased.

Economic history is increasingly able to provide us with evidence and inform pressing questions at the intersection of research and real-world decision-making. This column uses natural language processing and network analysis of articles from five leading journals over the past 25 years to identify a shift towards a more global, data-driven, and methodologically advanced field. It maps changing thematic priorities, institutional collaborations, and author networks, highlighting both a generational turnover and growing geographical diversity. It also reveals a strong move towards causal identification-based econometrics alongside a sharp decline in qualitative research, signalling both convergence and trade-offs in the discipline’s integration with mainstream economics.

@gregorigv.bsky.social & @victormgomezblanco.bsky.social use natural language processing and network analysis of economic history articles to identify a shift towards a more global, data-driven, and methodologically advanced field.

cepr.org/voxeu/column...

#EconSky

21.07.2025 08:24 — 👍 9 🔁 4 💬 0 📌 1

Graph of monthly stock return by profit shifting decile.

Profit shifting by multinational enterprises increases after-tax earnings but can expose firms to regulatory and reputational risks. This column uses data on variations in profit shifting between 2010 and 2020 alongside global stock return data to examine how stock markets price profit shifting. The authors find that a one standard deviation increase in profit shifting is associated with 6.4% higher monthly stock returns, indicating that stock markets require compensation for the underlying risks. The identified effects become significant only after the initiation of the Base Erosion and Profit Shifting programme and gain further strength following the implementation of the Tax Cuts and Jobs Act.

Fotis Delis, Manthos Delis, Sotirios Kokas, Luc Laeven & Steven Ongena find that an increase in profit shifting by multinational enterprises is associated with higher monthly stock returns, indicating that stock markets require compensation for the underlying risks.

cepr.org/voxeu/column...

#EconSky

21.07.2025 08:21 — 👍 2 🔁 1 💬 0 📌 0

📢 #CallForPapers - Future of Payments: CBDC, Digital Assets and Digital Capital Markets

Opportunity to present in Milan & publish in the Review of Finance

Submit by: 21 July

Organisers: Review of Finance, @ecb.europa.eu, Bocconi University & CEPR

Learn more: mailchi.mp/cepr/cfp-fut...

#EconSky

14.05.2025 11:50 — 👍 5 🔁 2 💬 0 📌 2