😂😂😂

#Markets #MarketTrends #MarketWatch #Stocks

@andreassteno.bsky.social

CIO @ Steno Global Macro Fund + CEO at Steno Research. Macro, investing and geopolitics. Host @ Real Vision

😂😂😂

#Markets #MarketTrends #MarketWatch #Stocks

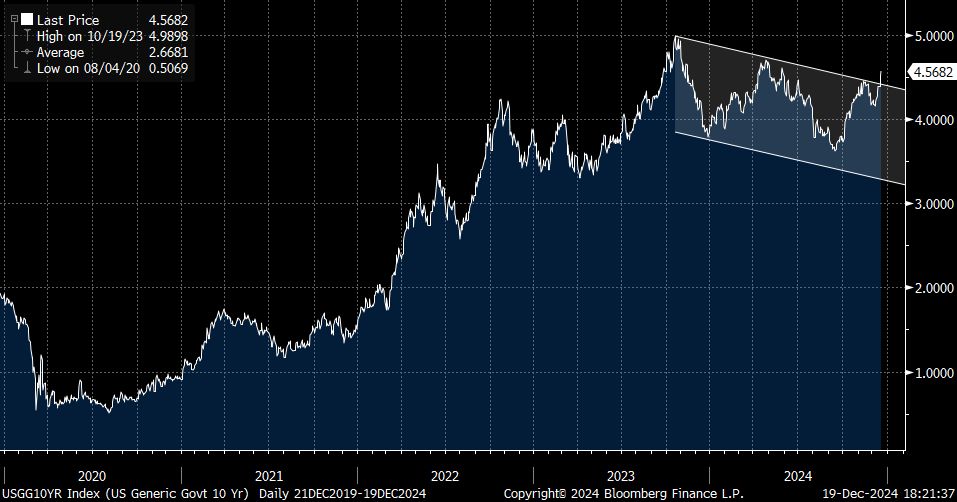

We have an approximate 36bps priced in for the Fed in 2025, which is incredible after 100bps during the autumn.

Will the US Economy really surprise to the upside of the Fed forecasts? I truly have my doubts, since they are pretty bullish after the readjustments in December

#MarketTrends #Finance

The Fed will have to restablish this downtrend (or the market will have to), otherwise risk assets are wobbly here

With the current housing data and data from the services sector, it is still a decent scenario, but everything is challenged here (including myself)

#MarketTrends #Economy #Finance

I don't really buy that this is an inflation fuelled bond yield rally.

Inflation expectations (traded) are fairly muted this year

It is a massive repricing of real-rate since September

#Bonds #Inflation #BondYields #MarketAnalysis #Finance #Investing #RealRates #EconomicTrends #MacroEconomics

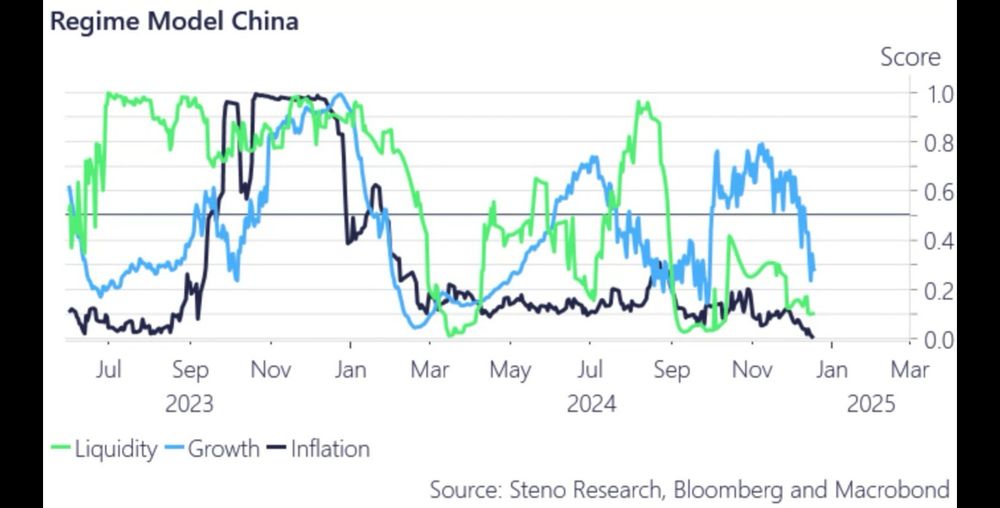

Full-blown meltdown in our Chinese nowcasts as well. I doubt that China can wait until March next year to adress all of this, it looks very dire

stenoresearch.com/the-drill-the-

#ChinaEconomy #Nowcasting #GlobalMarkets #EconomicOutlook #FinancialAnalysis #MarketTrends #GlobalEconomy #StenoResearch

Unless a new lock-down is around the corner, we don't fear that tariffs will lead to goodsflation again.

Goodsflation is nowhere to bee seen outside of pandemics, tarrifs or not.

#Goodsflation #Inflation #Economy #Tariffs #SupplyChain #MarketTrends #PandemicImpact #EconomicOutlook

Are we about to face a 2021 like market in 2025 with inflation on the rise with some bizarre assymetrical return profiles? It is growing increasingly likely. E.g. #Tesla has a strong assymetrical profile should this environment continue.

#2025Market #Inflation #EconomicTrends #StockMarket #Finance

Worth noting if you are a single stock guy. #Nasdaq100 #PLTR #MSTR #AXON #StockMarket #Investing #TechStocks #IndexRebalance

15.12.2024 13:09 — 👍 2 🔁 0 💬 0 📌 0

If you think Markets go up 20-25% in 2025, you agree with everyone else. I don’t think 2025 will be a home-run year for the very same reason. #StockMarket #2025Forecast #Investing #MarketTrends #ContrarianView #FinancialMarkets #TradingInsights #MarketOutlook #Economy

15.12.2024 00:56 — 👍 2 🔁 0 💬 0 📌 0

Markets have been offloading lond #bonds at lightning pace lately and there is no doubt that markets are net short #USD bonds

Here is what we told hedge funds this week – and how we’re trading it!

#BreakingNews #BondMarket #HedgeFunds #MarketTrends #TradingStrategy #ShortSelling #FinancialMarkets

Bond yields need to settle down here, or else we are talking about a whole new range admittedly. #BondYields #InterestRates #Treasuries #MarketTrends #YieldCurve #FixedIncome #EconomicOutlook #MacroAnalysis #RiskManagement #FinancialMarkets

13.12.2024 23:17 — 👍 5 🔁 0 💬 0 📌 0