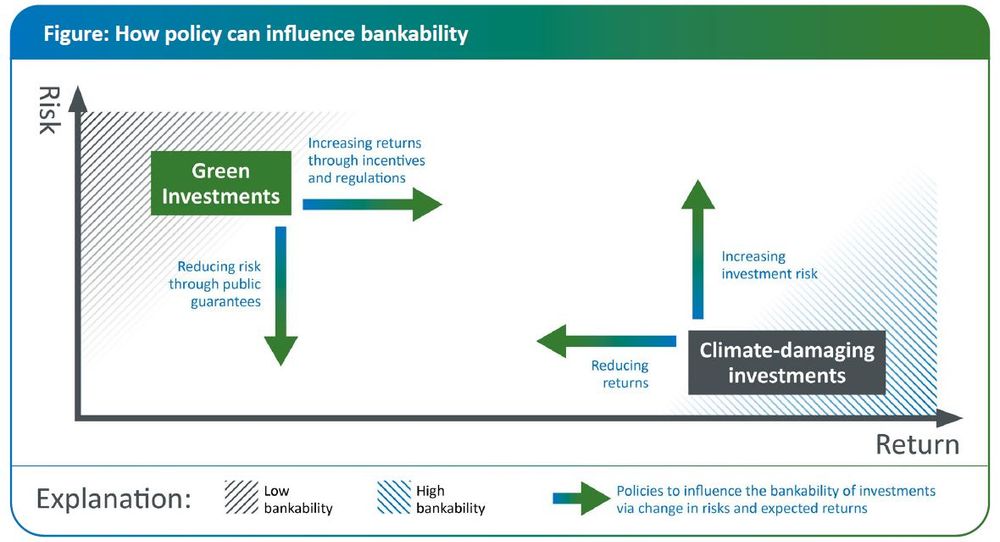

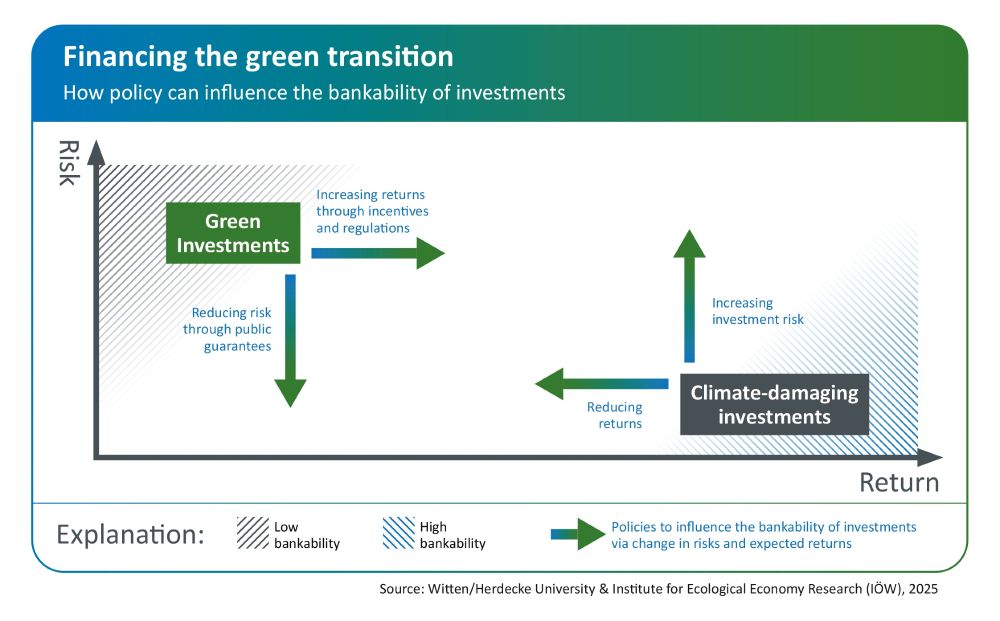

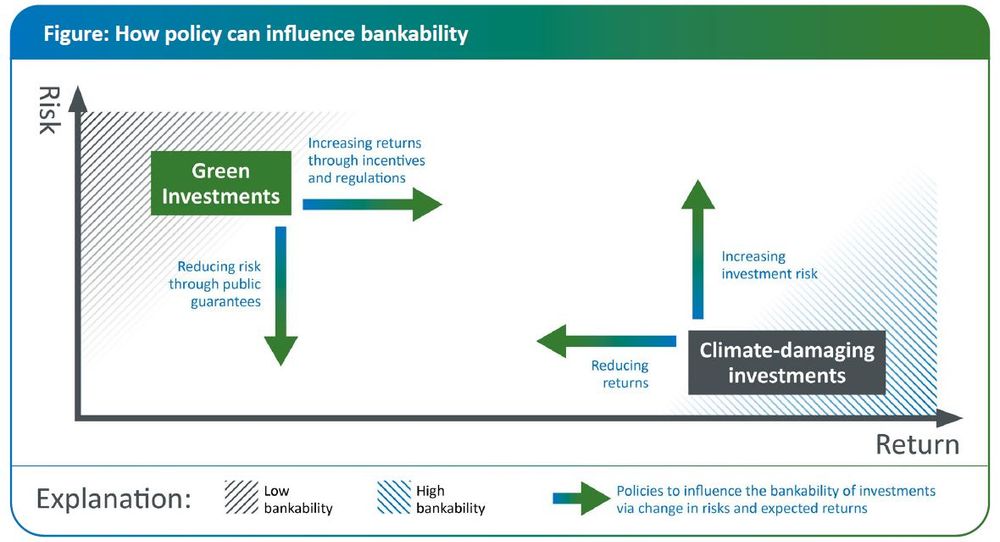

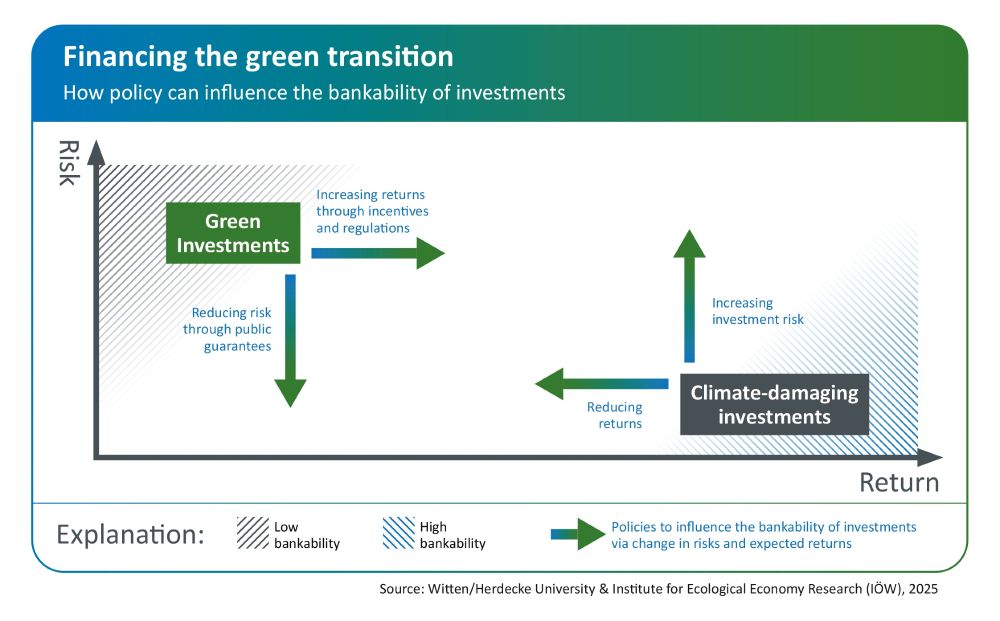

Figure from our #policy #report: 1. The main barrier to #financing the necessary activities for the sustainable transition is their lack of #bankability

2. High GHG-emitting activities remain #bankable and thus continue to attract financing from banks and shadow banks

www.uni-wh.de/en/your-camp...

11.07.2025 13:10 — 👍 5 🔁 5 💬 1 📌 0

[tra:ce] Policy Report

Financing the green transition: Increasing bankability, phasing out carbon investments and funding ‘never bankable’ activities

Disclaimer: Many activities necessary for the green transition will never be bankable, and therefore will never be attractive for financial investors. As a result, the state should directly provide the necessary financing.

You can find our full policy report here: www.uni-wh.de/en/your-camp...

11.07.2025 13:10 — 👍 3 🔁 1 💬 0 📌 0

[tra:ce] Policy Report

Financing the green transition: Increasing bankability, phasing out carbon investments and funding ‘never bankable’ activities

Our #policy #paper has just been published: "Financing the #green #transition: Increasing #bankability, phasing out carbon investments and funding 'never bankable' activities". We ask: Why does a large green financing gap persist? What policies do we need to change it: www.uni-wh.de/en/your-camp...

03.07.2025 06:01 — 👍 6 🔁 5 💬 1 📌 1

[tra:ce] Policy Report

Financing the green transition: Increasing bankability, phasing out carbon investments and funding ‘never bankable’ activities

How can political decision-makers strengthen sustainable and climate-friendly investments - and at the same time effectively prevent climate-damaging financial flows? The latest [tra:ce] Policy Report takes a closer look at this question.

Further information:

www.uni-wh.de/en/your-camp...

30.06.2025 12:07 — 👍 3 🔁 2 💬 0 📌 1

🚨 Do check out this very timely Policy Report on "Financing the green transition" 👇

30.06.2025 13:22 — 👍 8 🔁 6 💬 1 📌 0

The figure shows how policies can influence the bankability of investments. Public guarantees can reduce the risk for green investments and incentives and regulations can increase the returns of green investments. The returns of climate-damaging investments can be reduced and the investment risk increased.

How can we redirect financial flows towards a #sustainable, climate-friendly #economy? 💶 🌍

The policy brief “Financing the green transition”, published as part of a research project by Witten/Herdecke University and the IÖW addresses this question.

More information: www.ioew.de/en/news/arti...

30.06.2025 13:37 — 👍 6 🔁 3 💬 1 📌 0

Are you an Early Career Researcher in #IPE and would like to get feedback on a draft, a book proposal or on how the publishing process works? Then consider applying👇

w/ @johannespetry.bsky.social @silviaweko.bsky.social @florencedafe.bsky.social

16.06.2025 12:21 — 👍 11 🔁 8 💬 0 📌 0

⚠️ Denunciamos penalmente a Sergio Neiffert, jefe de la SIDE, y a Diego Kravetz, director general de Operaciones, por sus responsabilidades en la aprobación de un Plan de Inteligencia Nacional (PIN) y el dictado de una orden operativa contrarios a la ley.🧵⬇️

19.06.2025 21:05 — 👍 68 🔁 34 💬 1 📌 2

Industrial Policy and Imperial Realignment | Phenomenal World

Asymmetries in global development

New essay on Industrial Policy and Imperial Realignment, co-written with comrades @jacktaggart.bsky.social and @tomchodor.bsky.social for @phenomenalworld.bsky.social www.phenomenalworld.org/analysis/ind...

@campolis.bsky.social

14.06.2025 10:41 — 👍 32 🔁 15 💬 1 📌 2

Home - Open Letter Against the rise of Fascism in 2025

The 2025 letter has been signed by over 400 academics, including 31 Nobel Prize winners. Join them in defending democracy. Our goal The letter is a collective denunciation of the mounting threats to a...

En 1925, Benedetto Croce lanzó el Manifesto de intelectuales anti-fascistas en Italia. Un siglo después, 400 académicos de todo el mundo, incluyendo 31 Premios Nobel, publican una nueva carta abierta contra el retorno del fascismo. Leer y adherir aquí:

stopreturnfascism.org

14.06.2025 12:54 — 👍 4 🔁 3 💬 0 📌 0

We are thrilled to announce the public #launch of our #policy #paper: "Financing the #green #transition: Increasing #bankability, phasing out carbon investments and funding 'never bankable' activities" @ioew.bsky.social Monday 30.06.2025, 11:00 (CET) www.uni-wh.de/die-finanzie...

12.06.2025 08:30 — 👍 7 🔁 6 💬 0 📌 0

America’s Braudelian Autumn | Benjamin Braun & Cédric Durand

Factions of capital in the second Trump administration

"the antinomies of Trumponomics are on full display, and without obvious resolution" with @benbraun.bsky.social @phenomenalworld.bsky.social

www.phenomenalworld.org/analysis/ame...

06.06.2025 12:05 — 👍 10 🔁 5 💬 1 📌 0

If you want to know more about banks and the green transition, you can register here for our WP launch event with comments by Mareike Beck and Christoph Scherrer: www.uni-wh.de/en/trace-wor...

22.05.2025 10:49 — 👍 0 🔁 0 💬 0 📌 0

🚨 Publication Alert 🚨

Out now in @jei-publication.bsky.social with @steffenmurau.bsky.social @agutersandu.bsky.social and Armin Haas:

Issuing EU debt despite fiscal rules, what we can learn from the limitations of the EU covid recovery fund, and what it all has to do with a famous cat ⬇️

🧵

20.05.2025 08:28 — 👍 42 🔁 13 💬 3 📌 1

Our book is now available to order! We will be organising some book talks in the upcoming academic year to discuss these embryonic ideas on decolonising economics.

@ingridhk.bsky.social

@cacrisalves.bsky.social @devikadutt.bsky.social

19.05.2025 22:10 — 👍 25 🔁 6 💬 2 📌 0

Page Cannot be Found

En tiempos de negacionismo y catástrofes climáticas, nuevo artículo en co-autoría de Nicolás Águila (Adjunto Ciepp-University of Witten/Herdecke): "The green banking gap: how bankability, business models, and regulations challenge banks' decarbonisation"

papers.ssrn.com/sol3/papers.cf

19.05.2025 13:42 — 👍 2 🔁 1 💬 0 📌 0

Our book is *finally* available for pre-order! It'll ship next week on May 30th 😱 Been a long time coming, very curious about what you all will think.

@devikadutt.bsky.social

@cacrisalves.bsky.social @surbhikesar.bsky.social

19.05.2025 11:32 — 👍 83 🔁 33 💬 2 📌 5

Our second [tra:ce] working paper, which addresses the challenges of financing green investments, is out: "The green banking gap: how bankability, business models, and regulations challenge banks' decarbonisation". Join our public paper launch on Monday, 26 May, 11h (CET)!

19.05.2025 08:28 — 👍 3 🔁 2 💬 0 📌 0

[tra:ce] Working Paper Series Nr. 2

Ein Vortrag über die Möglichkeiten eines grünen Bankensystems

If you want to know more, you can register here for our launch event with comments by Mareike Beck and Christoph Scherrer: www.uni-wh.de/trace-workin... @paulahaufe.bsky.social @riccardobaioni.bsky.social @janfichtner.bsky.social @simonschairer.bsky.social @jwullweber.bsky.social

19.05.2025 07:32 — 👍 4 🔁 1 💬 0 📌 0

Third, financial regulation is biased against green assets, making green lending expensive. Additionally, sufi regulation makes the issuance of green products too costly, complex, and burdensome. Finally, policy uncertainty does not incentivise green lending or divesting from dirty activities.

19.05.2025 07:32 — 👍 1 🔁 0 💬 1 📌 0

b) Even when they lend, banks provided loans in the past to high-GHG-emitting activities which take time to be repaid and disappear from their balance sheets. Moreover, banks prioritise long-term relationships with their high-GHG-emitting customers, so they prefer to engage rather than divest.

19.05.2025 07:32 — 👍 1 🔁 0 💬 1 📌 0

Second, business model entails two dimensions. a) banks have tended to shift their business away from corporate and project lending towards market-based activities and the provision of financial services. Consequently, they avoid using their balance sheets, including for green lending.

19.05.2025 07:32 — 👍 1 🔁 0 💬 1 📌 0

First, banks consider many green firms and projects as non-bankable because of their low profits and high risks, so they do not lend to them. Moreover, they still regard many high-GHG-emitting activities as bankable due to their high profits and low risks, so they continue financing them.

19.05.2025 07:32 — 👍 2 🔁 0 💬 1 📌 0

Finally out #openaccess! Why does the largest trading bloc on the planet have a miniature-sized currency? With Trump, the EU will again much regret this.

🎈We set out to theorise failure and develop a new IPE perspective that foregrounds offshore money.

Quick thread 🧵

12.05.2025 10:21 — 👍 33 🔁 15 💬 1 📌 1

Unbankable Transitions | Rosie Collington

How the politics of investability determine climate financing

Wall Street won’t rewild the planet. Or decarbonize mining. Or defossilize agriculture.

For @phenomenalworld.bsky.social I unpack why chasing investability harms climate goals in sectors beyond energy & transport - & what states can do with derisking failures www.phenomenalworld.org/analysis/unb...

09.05.2025 09:58 — 👍 122 🔁 47 💬 3 📌 2

Lecturer at University of Exeter | Political Economy | Latin American Politics

https://dasilvapp.github.io/

Das Institut für ökologische Wirtschaftsforschung (IÖW) ist ein führendes wissenschaftliches Institut der praxisorientierten Nachhaltigkeitsforschung.

https://www.ioew.de | https://www.postwachstum.de | https://www.oekologisches-wirtschaften.de

Economic Sociologist | Visiting Professor at Leuphana University (Lüneburg) & Head of the Research Group “Monetary Sovereignty” at the Hamburg Institute for Social Research

First-of-its-kind radical initiative that seeks to diversify & decolonise Economics, both in terms of identity and approach. One without the other isn't enough. https://d-econ.org/

econ student @EPOG | plural econ, macro-finance, balance sheets, a better world | eng+ger | 🏳️🌈 | views my own

periodic posting on political economy issues, mostly charts, some shirts, weekly kittens. Sic semper tyrannis.

El CIEPP es un centro de investigación y difusión de conocimientos en ciencias sociales. Está constituido como una Asociación Civil sin fines de lucro, fundada en 1989 con sede en la Ciudad Autónoma de Buenos Aires (Argentina).

Waitress turned Congresswoman for the Bronx and Queens. Grassroots elected, small-dollar supported. A better world is possible.

ocasiocortez.com

Here for a sustainable planet, macro and monetary policy. 🏳️🌈 Works in Energy Policy. Econ. of Climate transformation policy alum in Rome/ Paris (EPOG), PPE at UW/H. FKA @GatoStruck on Twitter.

cels.org.ar

derechos humanos

Lawprof, author of the Code of the Capital, music & nature lover

PhD researcher - Research Fellow SuFi Project @UniWH - political economy green transition

Indian-American. Director of Energy at Center for Public Enterprise. PhD Candidate at UMass Economics. Macro + Finance + Industrial Policy + Decarbonization + Grids + Investment

https://publicenterprise.org/author/chirag/

PhD student @ubeconomics.bsky.social

No Marxist!

Typically on two wheels or two boards.

Interests: Environment, Public Sector, Ecological Marxism

Posts in en / de, may try fr / da / ca / es

JEPP is a flagship journal covering public policy, Europ. politics & the EU | Edited by B.Rittberger | https://www.tandfonline.com/journals/rjpp20 | https://www.linkedin.com/company/jepp/ | https://www.facebook.com/profile.php?id=61573881511255

The UK's leading feminist economics think tank. We put feminism into economics and economics into feminism.

Press queries: press@wbg.org.uk

wbg.org.uk