The world’s 60 largest banks hold $1.6 trillion USD in credit exposure tied to fossil-fuel activities - new @financewatch.bsky.social research:

www.finance-watch.org/policy-porta...

@jesselgriffiths.bsky.social

CEO - Finance Innovation Lab. Advocating for transformative change to UK & global finance rules for social & environmental justice. Ex: Eurodad / Bretton Woods Project / ActionAid/ ODI Global.

The world’s 60 largest banks hold $1.6 trillion USD in credit exposure tied to fossil-fuel activities - new @financewatch.bsky.social research:

www.finance-watch.org/policy-porta...

Something quick & important to do today: write to your MP asking them to support rule changes to divest all pensions from fossil fuel expansion:

actionnetwork.org/letters/writ...

Come and help us transform UK finance rules for social and economic justice - we're looking for new board members! Especially those with expertise in policy, comms or fundraising.

DM if you want to chat about it. Full deeds here:

financeinnovationlab.org/wp-content/u...

My latest Changing Finance roundup is out:

🌱 Why the UK’s approach to greening finance is failing

⚠️ Could private credit spark the next financial crisis?

💸 The gender wealth & pensions gaps

🌍 Who really owns Britain?

Read it here 👉 financeinnovationlab.org/changing-fin...

📢Volunteer recruitment📢 Could you help @TheFinanceLab transform the financial system for the better? Apply to join our board of trustees! Find out more and apply.

app.beapplied.com/apply/yg7lao...

Closes 15 October 2025.

72% of EU companies have a high dependency on at least one ecosystem service, and most of the ecosystem footprint is supported by just 100 banks (of the 2500 banks analyzed). Nice short summary of new academic paper:

www.linkedin.com/feed/update/...

The gender wealth gap in the UK is 21% - new @womensbudgetgrp.bsky.social research

www.wbg.org.uk/wp-content/u...

Nearly all of this is due to pensions wealth. Another reason why we need fundamental reform of the pensions system:

financeinnovationlab.org/our-work/fai...

"The Global anti-financial crime system is broken" - Sobering from @rusi.bsky.social

Good on the problem of relying on FIs as police. There's a deeper systemic issue: a system designed to service international capital is likely to be easy for criminals to use.

www.rusi.org/explore-our-...

"The crypto crises are coming" - thanks to new US legislation.

Crypto is also a boon for money launderers and serves little economic purpose.... so we should be using regulation to curb it, not encourage it, as the UK is threatening to do.

www.project-syndicate.org/commentary/u...

Want to volunteer your time and expertise to help us fundamentally change UK finance rules?

Apply to be a trustee of Finance Innovation Lab - DM me if you'd like to chat, and thanks for sharing!

More diets here: financeinnovationlab.org/join-our-tru...

Who Owns Britain? Super interesting and important work from @cmmonwealth.bsky.social

www.common-wealth.org/interactive/...

UK finance lobby’s growing influence threatens our interests - from @mickmcateer.bsky.social

www.opendemocracy.net/en/uk-financ...

@opendemocracy.net

Shocking: 98% of publicly listed companies 'lack credible climate transition plans'

Report from @tpicatlse.bsky.social examining 2000+ companies = 3/4 of global publicly listed equities.

[Why we need govts + regulators to step up]

www.transitionpathwayinitiative.org/publications...

3 reasons why lighter crypto regulation is a bad idea:

1. High risk of financial crisis

2. "Cryptoassets are increasingly used for laundering all forms of proceeds of crime." (NRA)

3. Crypto = speculative asset, not a support for investment

www.ft.com/content/3b81...

5 reasons why the financial-risk based approach to climate change has failed - @jryancollins.bsky.social

1. Uncertainty not risk

2. Single materiality

3. Complexity & opacity of system

4. Conflicts of interest

5. Prices not only things affecting lending/ investment

medium.com/iipp-blog/th...

Dangerous financial sector deregulation alert : a new proposal to stop financial sector regulators from considering non-statutory issues, including environmental impacts, or impacts on financial exclusion, when setting most rules for the system:

www.linkedin.com/feed/update/...

Timely advice for UK from a Fed. Reserve Governor on financial crises:

".... lessons for policymakers: maintain a through-the-cycle perspective rather than believing "this time is different"; resist pressure to loosen regulations during boom times. "

uk.investing.com/news/economy...

The government's new Financial Services Growth and Competitiveness strategy risks undermining its industrial policy & growth mission.

Here's my analysis:

www.linkedin.com/pulse/govern...

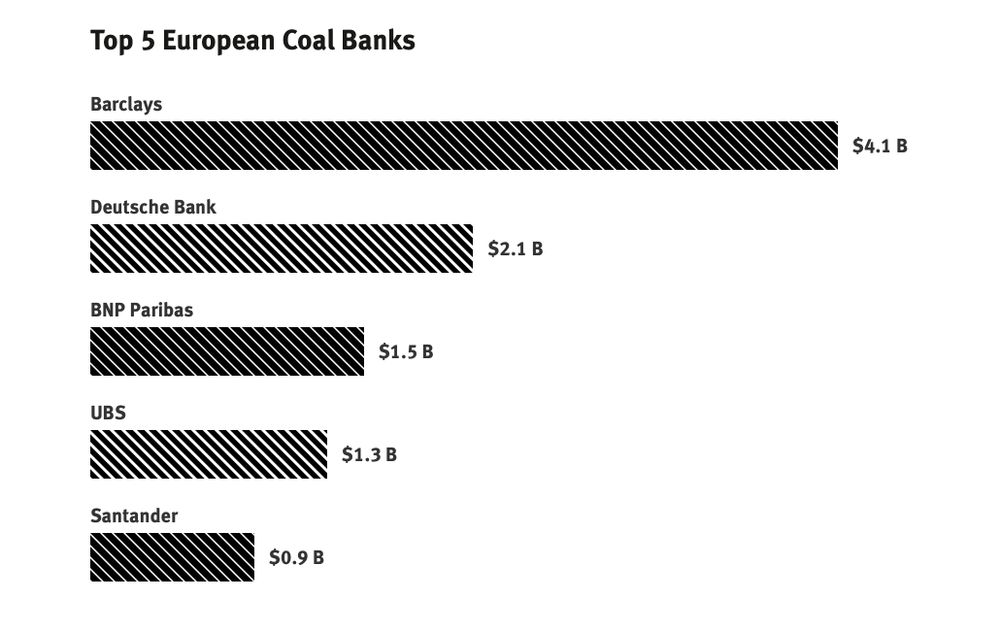

Barclays is the bigger financer of coal in Europe - new report.

www.stillbankingoncoal.org/report/europe

💰 UK pensions (£3trn) are still backing fossil fuels—even as climate shocks threaten to wreck the economy and our retirements.

We back an amendment to the Pensions Schemes Bill to ban thermal coal + review fossil fuel risk.

Here's my NZI piece on this: lnkd.in/es9cc4gY

#ClimateRisk #Pensions

How the next financial crisis starts on.ft.com/46dSz0R

26.06.2025 06:21 — 👍 0 🔁 0 💬 0 📌 0How the next financial crisis starts - long read focussing on the impact of physical risk on insurers, and how this could lead to property price falls that could trigger a crisis

26.06.2025 06:20 — 👍 0 🔁 0 💬 1 📌 0📘 Bottom line:

This is a thoughtful strategy with promising signs — but it’s not yet the step change we need.

Major gaps on inequality, financial resilience, and the role of finance.

Would love to hear how others are interpreting it.

#IndustrialStrategy #Finance #UKPolicy

🤝 Partners named, but barely engaged

Trade unions get a mention. Civil society? Once.

Real transformation needs deeper, lasting engagement — not just business and Whitehall.

And if we’re serious about regional growth — where’s the plan for regional banks?

Other countries use them to support SMEs and local economies.

In the UK, SME lending has fallen. We need more than tweaks — we need structural reform.

A Fair Banking Act should be on the table.

🏗️ Public investment and regional finance: not bold enough

Scaling up the British Business Bank & National Wealth Fund is good. But they’re still small.

Let them operate as real banks, able to leverage their capital and issue bonds. That would change the game.

There’s enthusiasm for fintech, deregulation and capital markets.

But no mention of financial crises — which are baked into our current system — or of the UK’s role in enabling dirty money and tax dodging.

🏦 Finance is a priority — but should it be?

It’s listed as a key sector, but the strategy ignores a major tension:

Do we want finance to serve global capital or UK investment?

These aren’t the same — and often conflict.

🌱 Growth — but what kind?

It’s all-in on growth and productivity — but says little about inclusive or sustainable growth.

The real drivers of the cost of living crisis — wealth inequality, income gaps, uneven opportunity — barely get a mention.

📘 At 140+ pages, the strategy clearly tries to break from business-as-usual: more long-termism, state capacity, sector focus. There’s much to like — and much still unresolved. I'll focus on the role of the financial sector in the strategy.

24.06.2025 07:58 — 👍 1 🔁 0 💬 1 📌 0