They say you should fear the person with only one book.

Lucky for them, I have two.

@semihuslu.bsky.social

Associate Professor of Finance at Johns Hopkins Carey

They say you should fear the person with only one book.

Lucky for them, I have two.

Call for applications - 12th finance research awards in memory of Hakan Orbay given by Sabanci Business School. Please share with your followers, colleagues or students. sbs.sabanciuniv.edu/en/hakan-orb...

17.07.2025 15:19 — 👍 1 🔁 0 💬 0 📌 0

Open Vault blog:

How Do Economists Decide What to Write About?

www.stlouisfed.org/open-vault/2...

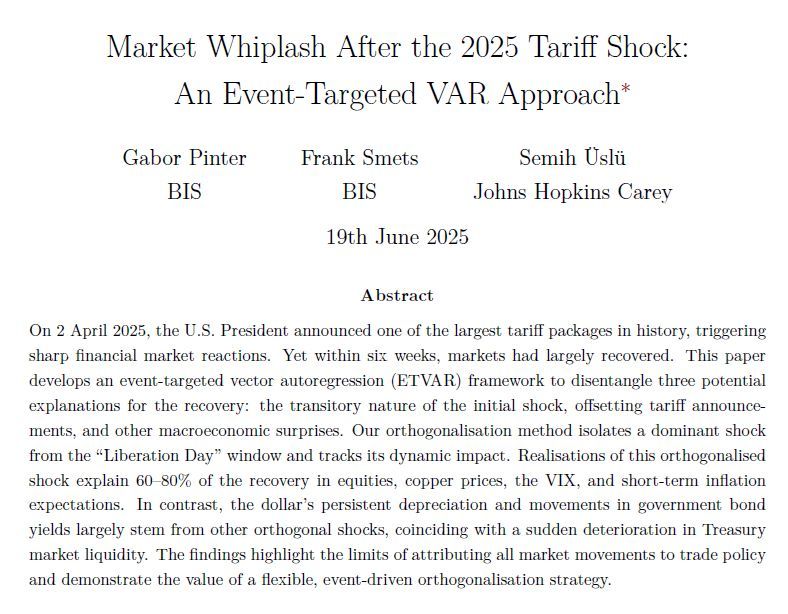

Our findings highlight the limits of attributing all market movements to trade policy, and demonstrate the value of a flexible, event-driven empirical strategy.

Link to the paper: papers.ssrn.com/sol3/papers....

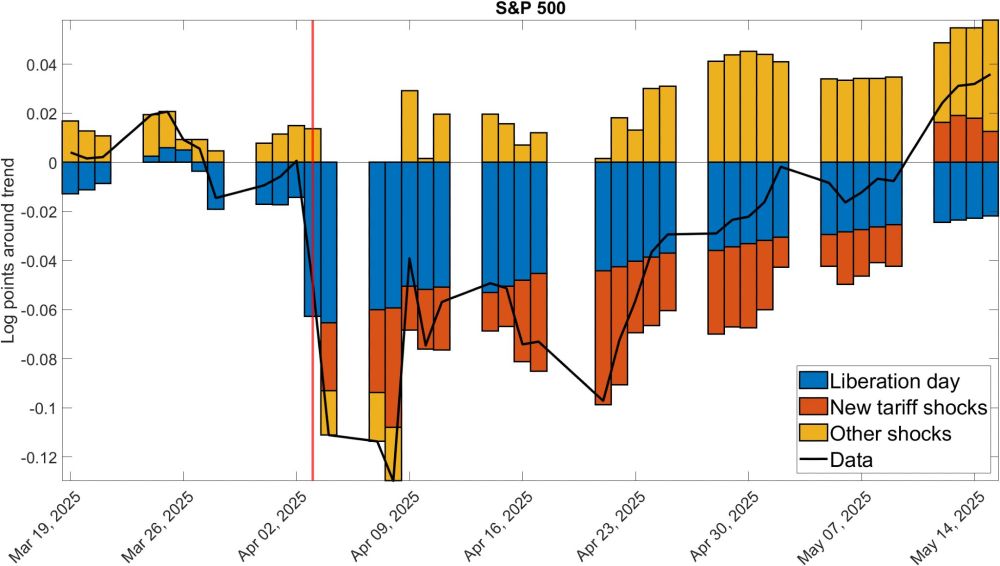

📊 Main findings from our decomposition:

-Over 60% of SP500 recovery came from tariff news.

-Under 40% reflected other macro surprises.

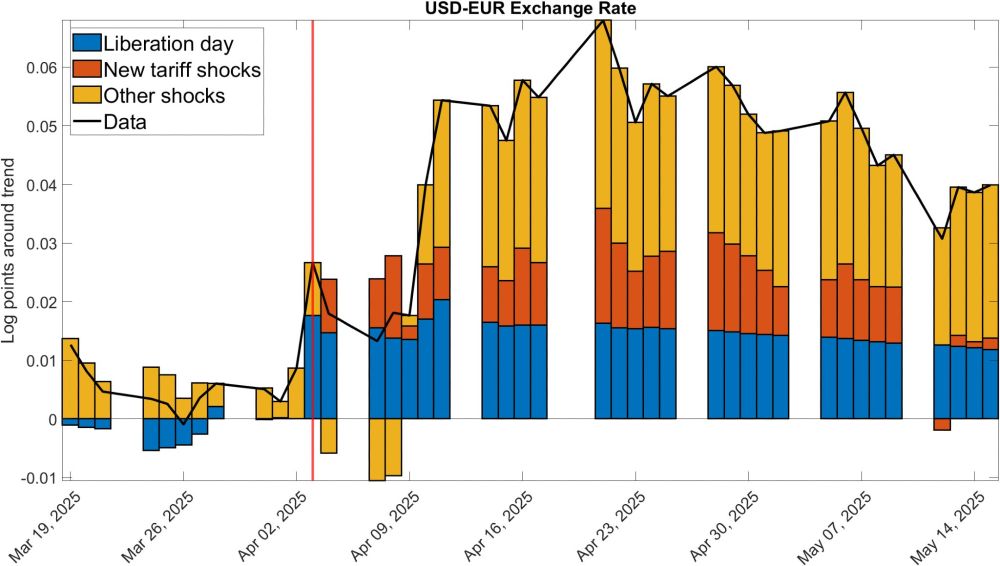

-In contrast, most dollar and yield moves stem from nontariff shocks tied to April 10–11 stress echoing concerns abt Treasury market functioning (Kashyap-Stein, 25).

Our method decomposes the rebound into three components (see selected charts above):

(1) The initial tariff shock,

(2) Subsequent realizations from the same shock distribution (e.g., the 90-day pause),

(3) Other orthogonal shocks (e.g., positive labour/CPI data surprises)

Why did financial markets stabilize so quickly despite the initial turmoil following the April 2, 2025 tariff announcements?

💡In a new paper with Gabor Pinter and Frank Smets, we develop an event-targeted vector autoregression (ETVAR) framework to disentangle the forces behind the rapid recovery.

Two-campus academic life

27.03.2025 14:54 — 👍 1 🔁 0 💬 0 📌 0

Ever seen the Schrodinger equation in an economics book? Don’t miss this great interview with Julien Hugonnier, @benjaminlester.bsky.social and Pierre-Olivier Weill about their forthcoming book on the economics of OTC markets.

24.03.2025 18:52 — 👍 3 🔁 1 💬 0 📌 0

Postdoc opportunity on industrial policies and related topics at the Reimagining the Economy program at Harvard www.hks.harvard.edu/centers/cid/...

18.02.2025 20:05 — 👍 30 🔁 21 💬 0 📌 3A non-technical summary of this paper is now available in Bank Underground, the Bank of England's research blog: bankunderground.co.uk/2025/02/13/w...

13.02.2025 18:14 — 👍 0 🔁 0 💬 0 📌 0ICYMI, webcasts of select sessions from the #ASSA2025 meeting in San Francisco on January 3-5 are now available to the public for viewing. #econsky aeaweb.org/conference/w...

23.01.2025 13:15 — 👍 7 🔁 8 💬 0 📌 1

UK government bond yields tend to rise in a two-day window before the scheduled arrival of macro news. What factors contribute to this phenomenon?

My joint work with Dong Lou, Gabor Pinter, and Danny Walker, now forthcoming at JFE, answers this question: authors.elsevier.com/c/1kQzZ,6wzy...

👋

23.01.2025 18:32 — 👍 1 🔁 0 💬 0 📌 0