Join our public launch today!

02.12.2025 06:37 —

👍 0

🔁 0

💬 0

📌 0

Playing the capital market? Sustainable finance and the discursive construction of the Capital Markets Union as a common good

The Capital Markets Union (CMU) project aims to create more integrated capital markets in Europe. However, the project faces resistance, and despite ongoing efforts EU capital markets remain fragme...

@riccardobaioni.bsky.social, Nicolás Águila, Janina Urban, @paulahaufe.bsky.social, @simonschairer.bsky.social & @jwullweber.bsky.social discuss how the European Commission attempted to reinvigorate the stalled Capital Markets Union project by reframing it as a vehicle for green investments 👇

23.07.2025 11:28 —

👍 6

🔁 3

💬 0

📌 0

[tra:ce] Policy Report

Financing the green transition: Increasing bankability, phasing out carbon investments and funding ‘never bankable’ activities

Disclaimer: Many activities necessary for the green transition will never be bankable, and therefore will never be attractive for financial investors. As a result, the state should directly provide the necessary financing.

You can find our full policy report here: www.uni-wh.de/en/your-camp...

11.07.2025 13:10 —

👍 3

🔁 1

💬 0

📌 0

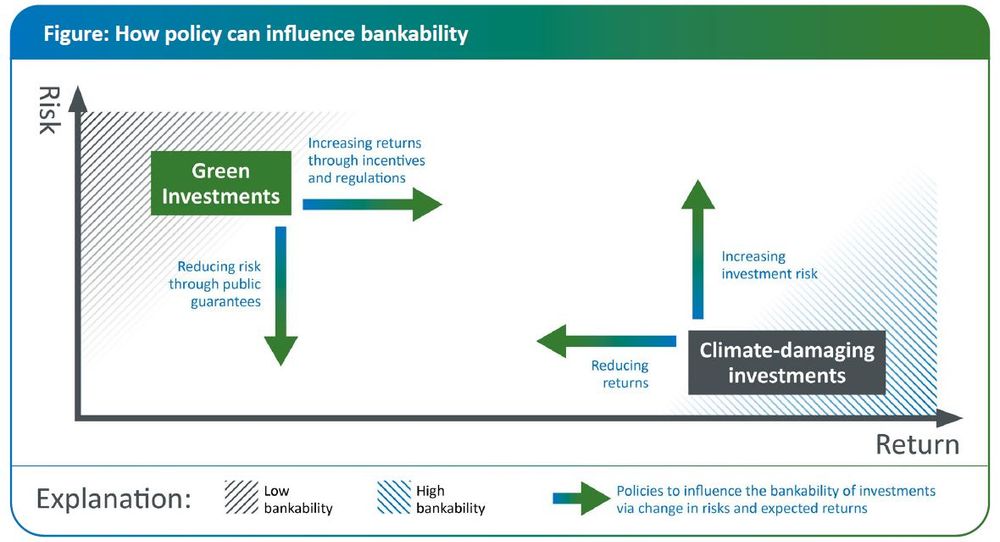

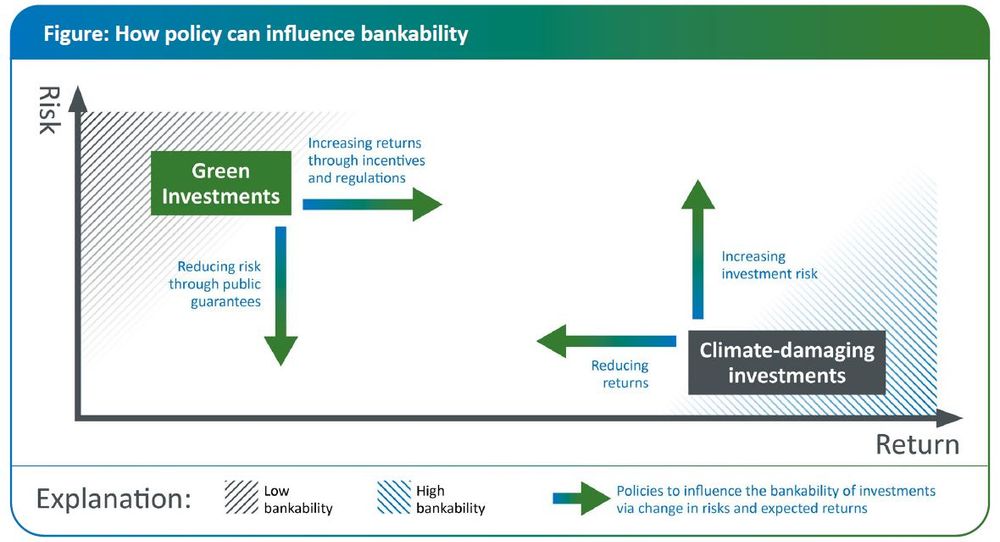

The figure illustrates how financial policies should function: Green investments require derisking policies and better financing conditions to become bankable. For greenhouse gas-emitting investments, policies should increase risk and decrease returns in order to reduce their bankability.

11.07.2025 13:10 —

👍 3

🔁 0

💬 1

📌 0

Figure from our #policy #report: 1. The main barrier to #financing the necessary activities for the sustainable transition is their lack of #bankability

2. High GHG-emitting activities remain #bankable and thus continue to attract financing from banks and shadow banks

www.uni-wh.de/en/your-camp...

11.07.2025 13:10 —

👍 7

🔁 5

💬 1

📌 0

#5 @naguila.bsky.social @paulahaufe.bsky.social @riccardobaioni.bsky.social @janinaurban @simonschairer.bsky.social @floriankern @janfichtner.bsky.social

03.07.2025 06:01 —

👍 1

🔁 0

💬 0

📌 0

#4 This taxonomy forms the basis for the projects’ policy recommendations that can increase the bankability of not-yet bankable firms and projects, decrease the bankability of high-GHG emitting ones, and expand financing for never bankable activities. @wbgu.bsky.social @ioew.bsky.social

03.07.2025 06:01 —

👍 1

🔁 0

💬 1

📌 0

#3 In other words, many green firms and projects are considered as ‘non-bankable’. Based on our analysis, we propose a classification that considers two criteria: 1) Is the investment green or does it generate high GHG emissions? 2) Is it bankable, not yet bankable, or never bankable?

03.07.2025 06:01 —

👍 0

🔁 0

💬 1

📌 0

#2 We show that the problem is not the lack of capital, but the lack of bankable green projects. Increases in green lending and investments by banks and other financial institutions remain negligible because green investments fail to meet the desired risk-return profiles of investors.

03.07.2025 06:01 —

👍 0

🔁 0

💬 1

📌 0

[tra:ce] Policy Report

Financing the green transition: Increasing bankability, phasing out carbon investments and funding ‘never bankable’ activities

Our #policy #paper has just been published: "Financing the #green #transition: Increasing #bankability, phasing out carbon investments and funding 'never bankable' activities". We ask: Why does a large green financing gap persist? What policies do we need to change it: www.uni-wh.de/en/your-camp...

03.07.2025 06:01 —

👍 6

🔁 5

💬 1

📌 1

Policy Report Launch: Financing the Green Transition

Presentation of the policy paper on improving bankability, exiting carbon investments and financing activities that were never bankable.

Public launch of our policy report "#Financing the #green #transition: Increasing #bankability, phasing out carbon #investments and funding 'never bankable' activities". Monday 30.6., 11:00 (CET) via Zoom. Comments: Silke Stremlau, Sustainable Finance Advisory Committee www.uni-wh.de/en/financing...

23.06.2025 09:50 —

👍 1

🔁 0

💬 0

📌 0

📣 Neues Impulspapier „Sicherheit: Worüber wir jetzt reden müssen“. Das vierseitige Papier zielt darauf ab, Debatten über Sicherheit und Nachhaltigkeit anzuregen.

www.wbgu.de/ip-sicherheit

@akhornidge.bsky.social

@alettabonn.bsky.social

@traidlhoffmann.bsky.social

@jwullweber.bsky.social

10.06.2025 11:36 —

👍 3

🔁 4

💬 0

📌 1

We are thrilled to announce the public #launch of our #policy #paper: "Financing the #green #transition: Increasing #bankability, phasing out carbon investments and funding 'never bankable' activities" @ioew.bsky.social Monday 30.06.2025, 11:00 (CET) www.uni-wh.de/die-finanzie...

12.06.2025 08:30 —

👍 8

🔁 6

💬 0

📌 0

📣 New WBGU discussion paper „Security: What we need to talk about". www.wbgu.de/dp-security

The aim of the four-pager is to stimulate debates on security and its relation to sustainability.

@akhornidge.bsky.social @alettabonn.bsky.social

@traidlhoffmann.bsky.social @jwullweber.bsky.social

10.06.2025 11:42 —

👍 3

🔁 3

💬 0

📌 0

Wir vergeben einen Jugend-Kreativpreis Nachhaltigkeit: "System change not climate change?"! Wie sieht eine nachhaltige und gerechte Welt aus – und was ist der Weg dorthin? Ob Text, Collage, Illustration, Kurzvideo oder Comic – deine Vision zählt. www.uni-wh.de/euer-campus/...

30.05.2025 11:01 —

👍 3

🔁 0

💬 0

📌 0

Nach den drei trockensten Monaten seit Beginn der Wetteraufzeichnung wichtiger denn je!

20.05.2025 09:17 —

👍 1

🔁 0

💬 0

📌 0

;-)

19.05.2025 09:18 —

👍 0

🔁 0

💬 0

📌 0

A great paper!

19.05.2025 08:36 —

👍 1

🔁 0

💬 1

📌 0

Our second [tra:ce] working paper, which addresses the challenges of financing green investments, is out: "The green banking gap: how bankability, business models, and regulations challenge banks' decarbonisation". Join our public paper launch on Monday, 26 May, 11h (CET)!

19.05.2025 08:28 —

👍 3

🔁 2

💬 0

📌 0

Alumni Newsletter

Aktuelle News für die ehemaligen Studierenden der UW/H im Alumni Newsletter.

Jetzt erst recht: den BA #Global #Sustainability: #Climate, #Justice, #Transformation studieren! www.uni-wh.de/unser-vibe/l...

02.04.2025 18:12 —

👍 1

🔁 0

💬 0

📌 0

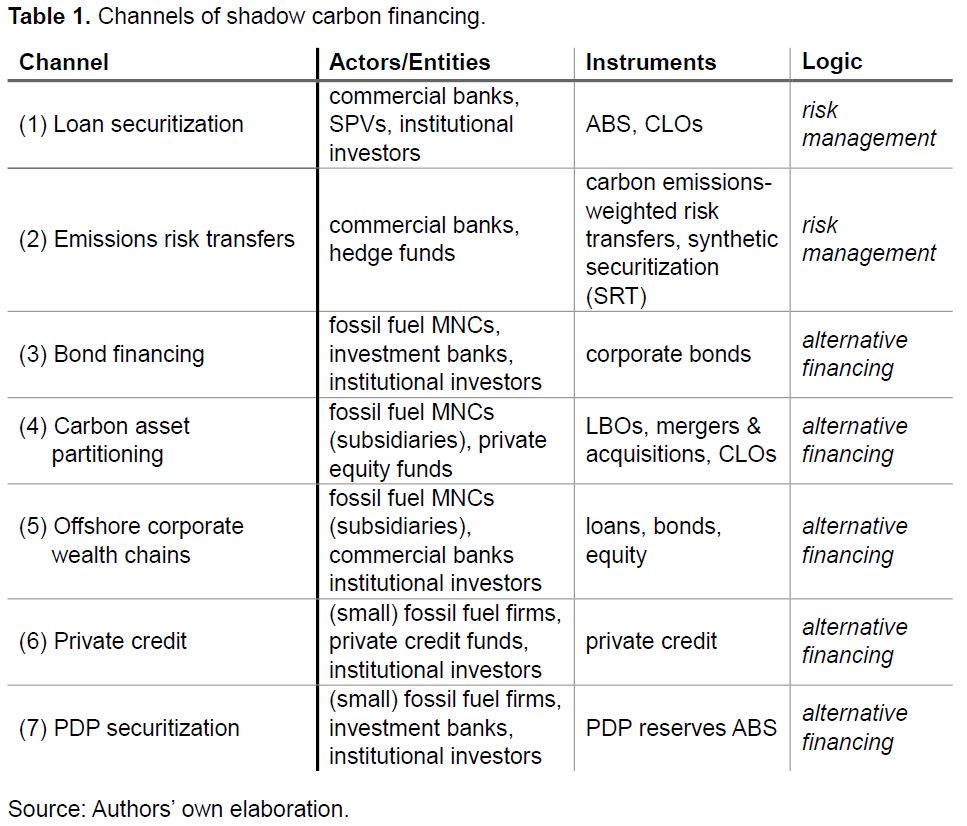

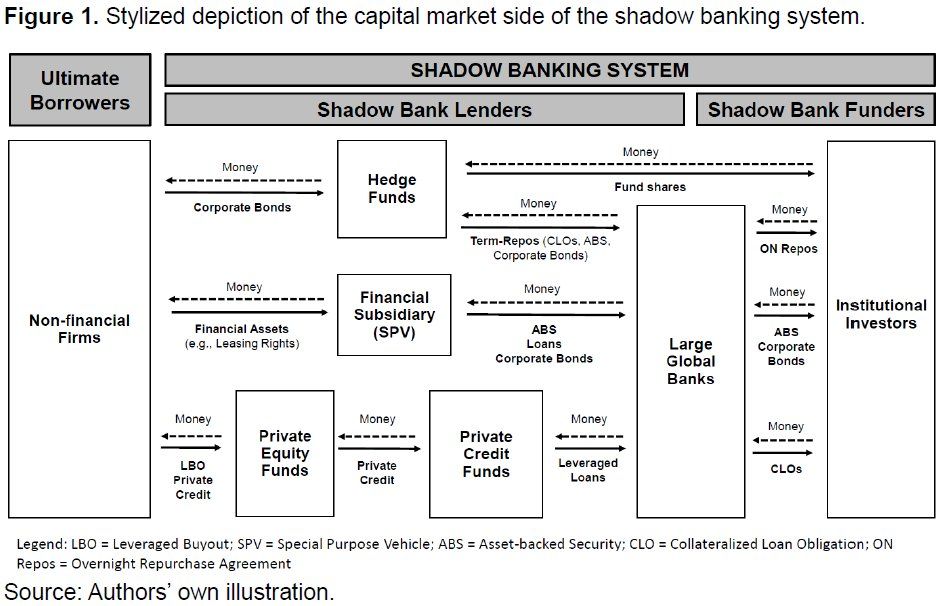

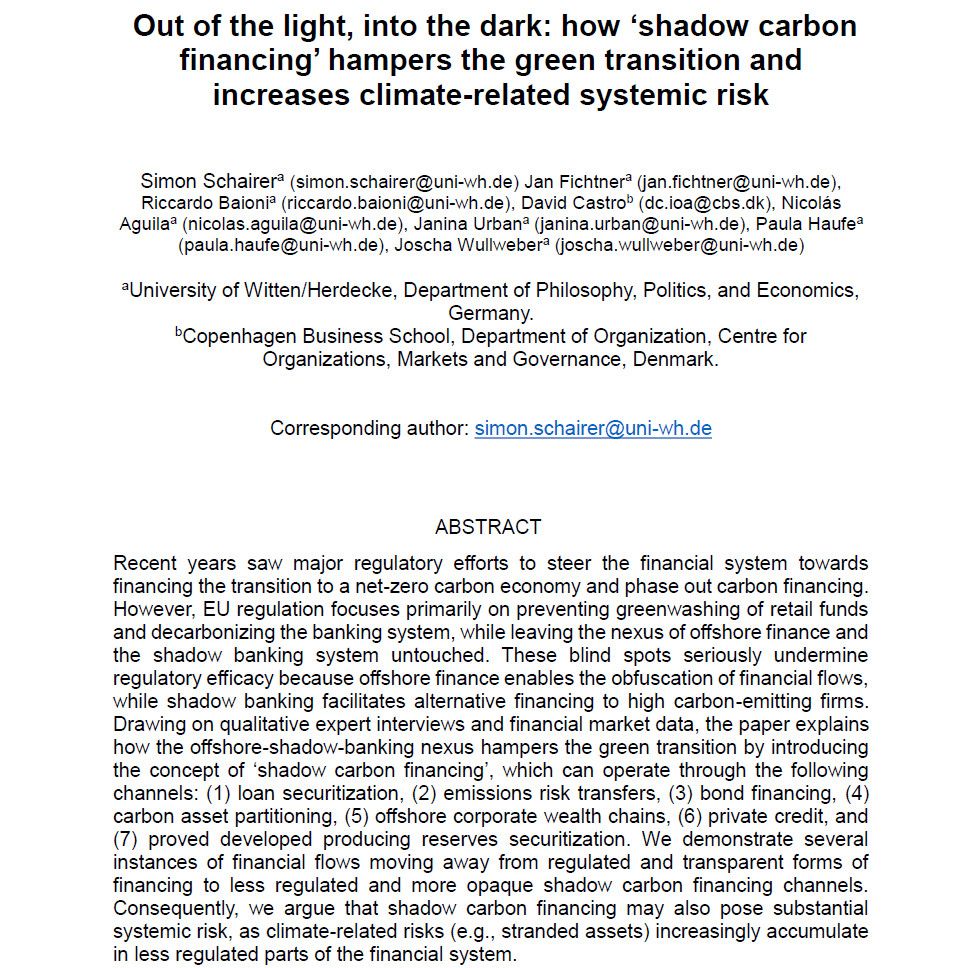

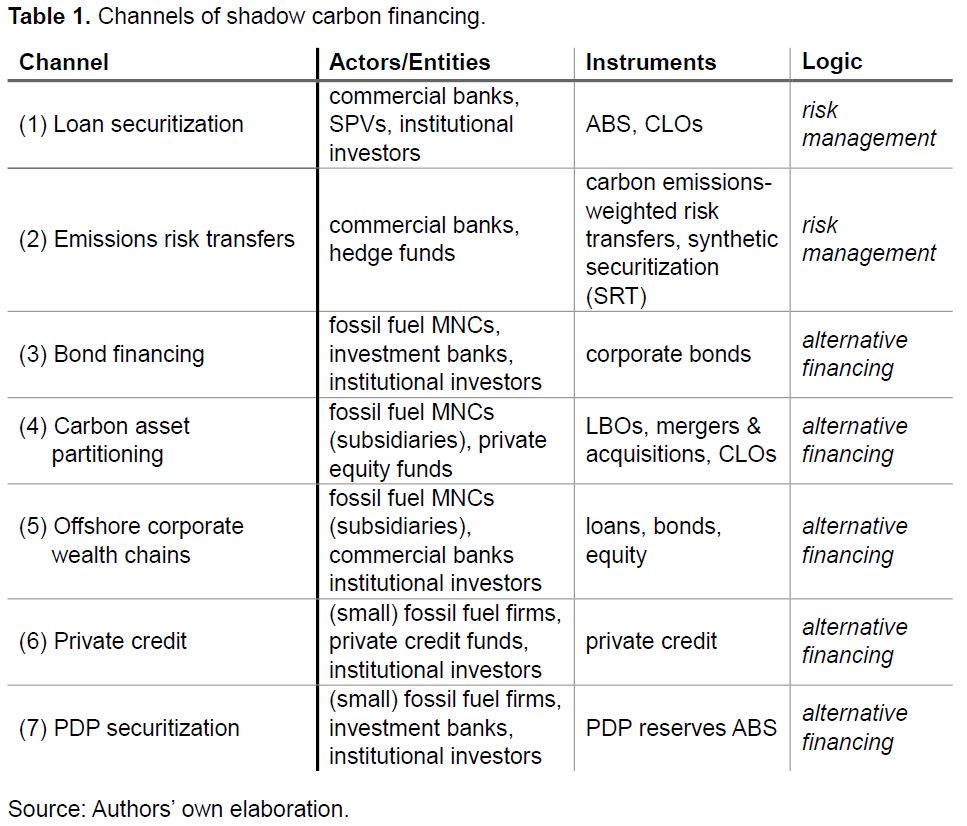

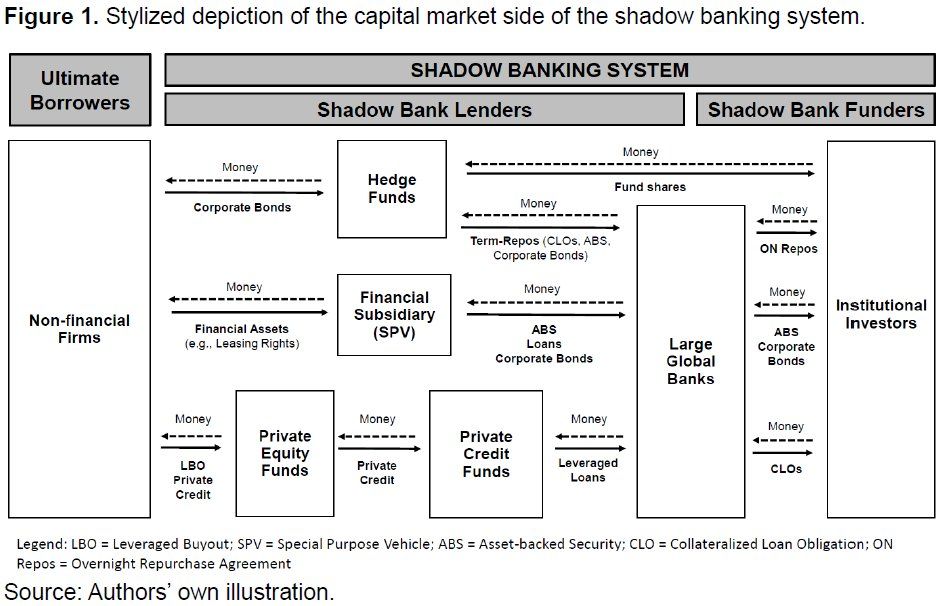

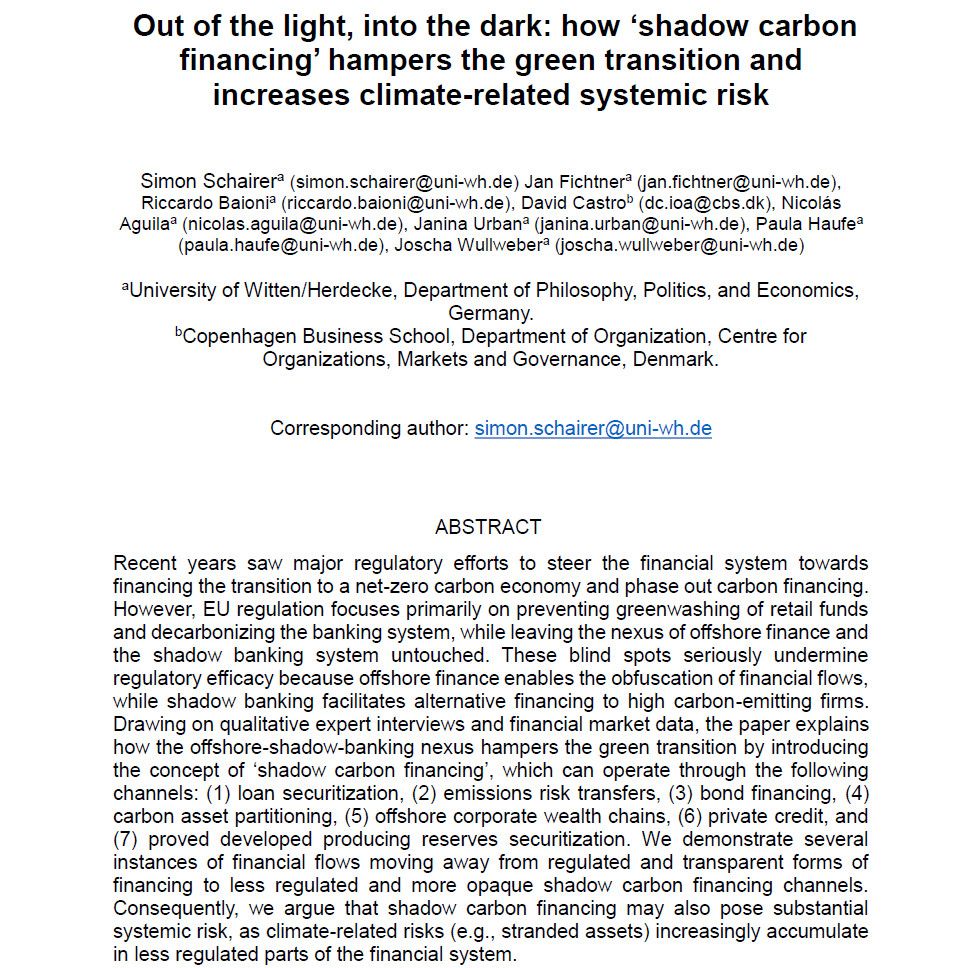

(1) loan securitization, (2) emissions risk transfers, (3) bond financing, (4) carbon asset partitioning, (5) offshore corporate wealth chains, (6) private credit, and (7) proved developed producing reserves securitization.

01.04.2025 10:34 —

👍 1

🔁 1

💬 1

📌 0

Drawing on qualitative expert interviews and financial market data, the paper explains how the offshore-shadow-banking nexus hampers the green transition by introducing the concept of ‘shadow carbon financing’, which can operate through the following seven channels:

01.04.2025 10:34 —

👍 2

🔁 1

💬 1

📌 0

These blind spots seriously undermine regulatory efficacy because offshore finance enables the obfuscation of financial flows, while shadow banking facilitates alternative financing to high carbon-emitting firms.

01.04.2025 10:34 —

👍 1

🔁 1

💬 1

📌 0

Recent years saw regulatory efforts to steer the financial system towards financing the transition to a net-zero economy and phase out carbon financing. However, EU regulation has left the nexus of offshore finance and the shadow banking system untouched.

01.04.2025 10:34 —

👍 2

🔁 1

💬 1

📌 0

🚨 New Working Paper published:

Out of the light, into the dark: how ‘shadow carbon financing’ hampers the green transition and increases climate-related systemic risk

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

A 🧵 with our main arguments:

01.04.2025 10:34 —

👍 15

🔁 14

💬 3

📌 2

Towards a Green International Monetary System

In this contribution to Bulletin 32, Nicolás Águila, Paula Haufe and Joscha Wullweber argue for the Ecor, a new international monetary tool, based on Keynes's Bancor, that could break the current impa...

Towards a Green International Monetary System: The Ecor and a Green World Central Bank

Nicolás Águila, @paulahaufe.bsky.social & @jwullweber.bsky.social argue for the Ecor, a new monetary tool that could break the current impasse surrounding climate transition financing.

isrf.org/blog/towards...

05.03.2025 16:10 —

👍 1

🔁 1

💬 1

📌 0

How can we finance a globally just sustainable transformation? In this piece with @naguila.bsky.social, @jwullweber.bsky.social we explore the need to reform the international monetary system for that purpose. Big thank you to @isrfoundation.bsky.social for publishing it and amazing editorial work👇

27.02.2025 13:02 —

👍 10

🔁 6

💬 0

📌 0

Towards a Green International Monetary System

In this contribution to Bulletin 32, Nicolás Águila, Paula Haufe and Joscha Wullweber argue for the Ecor, a new international monetary tool, based on Keynes's Bancor, that could break the current impa...

Towards a Green International Monetary System

Nicolás Águila, @paulahaufe.bsky.social and @jwullweber.bsky.social argue for the Ecor, a new international monetary tool, based on Keynes's Bancor, that could break the current impasse surrounding climate transition financing.

isrf.org/blog/towards...

27.02.2025 12:38 —

👍 3

🔁 4

💬 0

📌 1