The Federal Tax System Explained

Tax administrators and the courts play a critical and often overlooked role in the tax system. This project focuses on these institutions and the impact of their work.

Our new project features a series of explainers breaking down tax administration, regulation, and litigation. It focuses on the critical and often overlooked role of tax administrators and courts—and the real-world impacts of their decisions. taxlawcenter.org/the-federal-...

06.02.2026 19:08 — 👍 2 🔁 1 💬 0 📌 0

Includes useful advice on avoiding the types of tax scams that we warned about previously: taxlawcenter.org/blog/here-co....

29.01.2026 15:27 — 👍 2 🔁 0 💬 0 📌 0

Great resource:

23.01.2026 14:50 — 👍 2 🔁 0 💬 0 📌 0

Congress agreed over the weekend to cut the IRS's base budget by a reported $1 billion. This would be a serious policy mistake at a time when the IRS remains severely depleted. Honest taxpayers deserve better.

12.01.2026 15:43 — 👍 24 🔁 19 💬 4 📌 1

Taxing Inheritances Under the Income Tax is a Great Idea

Alicia Munnell picked up on Ray Madoff and Lily's work recently, too: crr.bc.edu/taxing-inher...

19.12.2025 15:49 — 👍 0 🔁 0 💬 1 📌 0

Opinion | Tax the Rich and Their Heirs (Published 2020)

Faculty Director @lilybatch.bsky.social also wrote for the @nytimes.com in 2020 about the issue of income going untaxed across generations www.nytimes.com/2020/06/24/o...

19.12.2025 15:48 — 👍 0 🔁 0 💬 1 📌 0

Opinion | Mitt Romney: Tax the Rich, Like Me

Has Mitt Romney been reading the @taxlawcenter.org Tealbook of options to broaden the tax base? www.nytimes.com/2025/12/19/o...

19.12.2025 15:42 — 👍 15 🔁 5 💬 1 📌 0

“Decreasing criminal enforcement across all types of taxpayers would signal an indifference to cheating and insults the millions of honest filers who pay the taxes they owe,” said David Hubbert, a senior fellow at the Tax Law Center.

11.12.2025 19:57 — 👍 5 🔁 4 💬 0 📌 0

EXCLUSIVE: Federal tax prosecutions fell to their lowest level in decades this year, declining more than 27% from the year before as the Trump administration cut the ranks of attorneys and agents who pursue those cases, a Reuters examination has found.

www.reuters.com/world/tax-pr...

10.12.2025 11:38 — 👍 406 🔁 209 💬 20 📌 41

Excellent analysis from @taxlawcenter.org team outlining legal and revenue loss risks associated with the Treasury's gradual erosion of the corporate alternative minimum tax.

I'll add: this also puts the US further out of line with globally agreed minimum tax standards.

02.12.2025 21:23 — 👍 1 🔁 1 💬 0 📌 1

Five Questions for IRS CEO Frank Bisignano

The IRS has a new leader – maybe he can tell us whats happening

NEW from me & Ellis Chen on IRS oversight. What do we know and what we need to know about:

> IRS criminal investigations partnering with ICE

> what the 25% staffing cut means for tax refunds

> what has happened to IRS high-wealth audits

> Palantir's new contracts & your data privacy

12.11.2025 18:15 — 👍 65 🔁 29 💬 0 📌 2

Tuning in for SCOTUS oral argument on tariffs today? @justsecurity.org @taxlawcenter.org's Kelsey Merrick with a primer on how using tariffs to raise revenue is a choice for Congress, not the President.

05.11.2025 13:26 — 👍 3 🔁 1 💬 0 📌 0

Tuning in for SCOTUS oral argument on tariffs today? @justsecurity.org @taxlawcenter.org's Kelsey Merrick with a primer on how using tariffs to raise revenue is a choice for Congress, not the President.

05.11.2025 13:26 — 👍 3 🔁 1 💬 0 📌 0

The Use of Tariffs to Raise Revenue is a Choice for Congress

Congress did not write IEEPA to allow a President to replace the income tax system with a patchwork of tariffs that they can impose, adjust, or suspend at will.

On Wednesday, SCOTUS will weigh whether the President can use IEEPA to unilaterally impose tariffs.

Kelsey Merrick argues Congress intentionally ended tariffs as a major revenue source decades ago and never delegated that choice to the President.

www.justsecurity.org/123833/tarif...

03.11.2025 14:03 — 👍 68 🔁 32 💬 4 📌 2

Flyer for an event titled "OBBBA & The Missed Opportunity for Tax Reform," taking place on Tuesday, October 28th from 10:30 - 11:30 am ET. The flyer lists the panelists: Wendy Edelberg (The Brookings Institution), Jason Furman (Harvard University), Chye-Ching Huang (The Tax Law Center), Jessica Riedl (The Manhattan Institute), Kyle Pomerleau (American Enterprise Institute), and Adam Tarleton (Brooks Pierce). The flyer includes logos for Tax Law Center at NYU Law and NYU Law. It has a green and blue background.

On 10/28, join us for a panel discussion highlighting how OBBBA missed substantial opportunities to improve the tax system and falls far short of the "tax reform" that many across the political spectrum have long called for. nyu.zoom.us/webinar/regi...

22.10.2025 14:30 — 👍 0 🔁 1 💬 1 📌 0

Fun fact: You can write clarinet lessons off on your taxes! (with a note from your dentist) It’s one of thousands of exemptions

I look at why U.S. taxes are so complicated for @marketplace.org with @dashching.bsky.social & Larry Zelenak @dukelaw.bsky.social

www.marketplace.org/story/2025/1...

10.10.2025 13:51 — 👍 49 🔁 10 💬 1 📌 0

Could be a big deal for many filers, including those who are elderly, disabled, rural, and unbanked:

28.08.2025 16:35 — 👍 0 🔁 0 💬 1 📌 0

Organizational chart of the IRS noting turnover, vacancies, staff placed on leave and positions eliminated.

New from me at @brookings.edu:

Unprecedented, dangerous turnover at IRS: Of 31 top positions, 15 have turned over since January, 2 have been placed on leave, 2 are vacant and 3 are slated for elimination.

www.brookings.edu/articles/the...

12.08.2025 21:44 — 👍 20 🔁 14 💬 1 📌 0

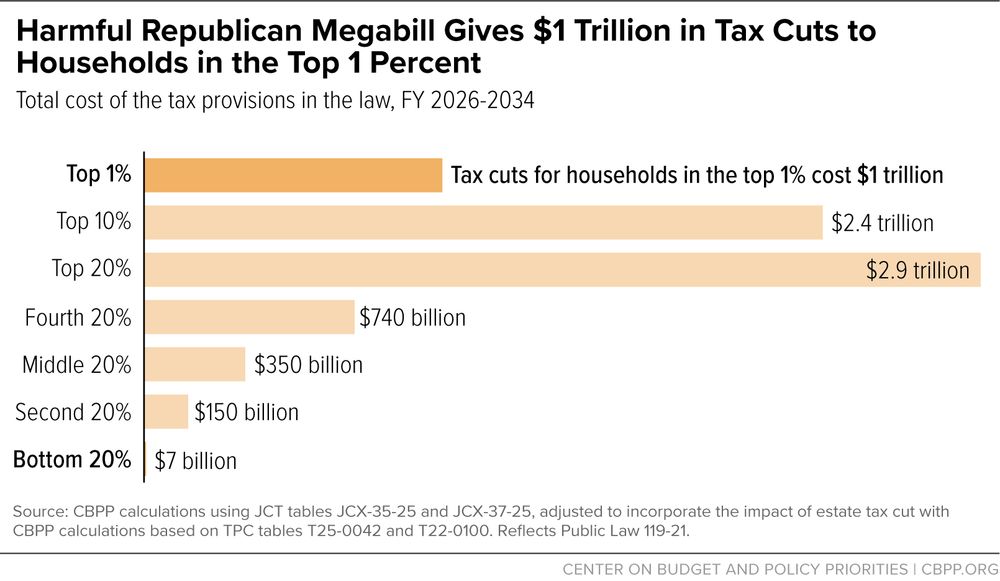

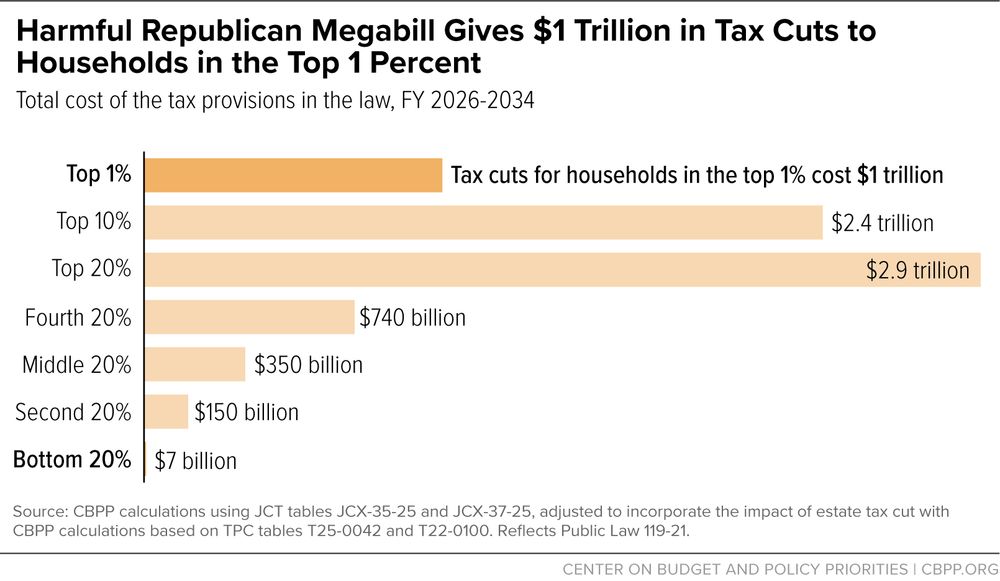

Our analysis of the full Joint Committee on Taxation tables of the flawed GOP megabill: a $1T tax cut for the top 1% and a staggering $2.4T tax cut for the top 10%.

Tax cuts of around $500B for households in the bottom 60%--the very folks who also face the brunt of cuts to Medicaid and SNAP.

31.07.2025 13:02 — 👍 30 🔁 13 💬 2 📌 1

Eliminating multi-language services would make it harder for taxpayers to comply with their tax obligations, set honest taxpayers up to fail and needlessly put tax revenue at risk. The IRS should not move forward with this harmful idea that has no sound tax administration purpose.

25.07.2025 15:24 — 👍 5 🔁 3 💬 1 📌 0

We are excited to launch a project to remake federal tax administration. Effective tax administration is critical to the federal government, but has recently faced drastic challenges over the last six months.

17.07.2025 18:17 — 👍 2 🔁 2 💬 1 📌 0

This piece confirms grave risk to all taxpayers from DHS efforts to get its hands on legally protected IRS data, risking targeting of US citizens, mistaken arrests, and rampant violations of privacy rights and civil liberties

15.07.2025 20:58 — 👍 3 🔁 1 💬 1 📌 0

Correcting the Social Security Administration About The Big Budget Bill

The misleading communication from SSA may add to the confusion many older adults already feel about the complex retirement insurance program.

TPC corrects the record on taxes on Social Security benefits.

Trump Admin claimed "nearly 90% of Social Security beneficiaries will no longer pay fed income taxes on their bens"

50.9% of filers w/SS bens paid the tax before

47.3% now

Only 3.6% no longer pay

taxpolicycenter.org/taxvox/corre...

10.07.2025 14:19 — 👍 26 🔁 25 💬 0 📌 2

Conventional wisdom had been that no-one can litigate to block these unlawful regulatory giveaways, despite harm to the rule of law, deficits, & the tax system.

But Hemel & Kamin set out above, if you look hard enough, there are potential litigants.

At @taxlawcenter.org, we're looking hard.

10.07.2025 13:29 — 👍 1 🔁 0 💬 2 📌 0

The False Promise of Presidential Indexation

The Trump Administration faces mounting pressure from conservative thinkers and activists — including calls from its own National Economic Council director — to

In both icebergs, many of the asks will be for things that are either clearly unlawful, or at the very least aren't the best interpretation of the law.

E.g. see @danielhemel.bsky.social @davidkamin.bsky.social on cap gains indexation papers.ssrn.com/sol3/papers....

10.07.2025 13:27 — 👍 0 🔁 0 💬 1 📌 0

Journalist at the Financial Times

Contact: lee.harris@ft.com

senior reporter at the guardian us / julia.wong@theguardian.com / juliacarriewong.11 on Signal

Professor, Harris School of Public Policy, Director, Stone Center for Research on Wealth Inequality and Mobility, University of Chicago

Fmr FBI Special Agent, lawyer, @JacksonYale. Tiger(ish) mom. Legal and national security analyst. Editor @just_security. Steam mop influencer. Views mine.

https://asharangappa.substack.com

Tech exec, former TTS Director at GSA, former @moveon.org CTO, @scsatcmu.bsky.social grad, bio/pics: https://annlewis.tech/ (Personal account)

Former U.S. Chief Data Scientist

GP Great Point Ventures

Devoted Health, RelateIQ, LinkedIn

I build things

Chasing Wonder, Engineer, Author, ORD Camp Instigator, Feminist. Previously: Founder & CTO of Tock, Xoogler, Ex-Apple. He/Him.

Optimizing for kindness

wonder.voyage

debuggingteams.com

Author of "The Price of Democracy: The Revolutionary Power of Taxation in American History." Senior Fellow, Brookings Institution & Tax Policy Center.

Senior Writer at The Spinoff.

Reporter, newsletters @ProPublica.org. Public History grad student @loyolahistdept.bsky.social. Fellow, New America US@250 initiative. Floridian in the Midwest.

Tax planner, diver, runner, afghan maker. Team pancake.

Analyzing economic policy, advancing racial equity, and making progress on my TBR pile

Micah 6:8

Journalist & Pulitzer finalist Historian. Fmr ed, @PoliticoMag & @washingtonian. Author of "Watergate: A New History" and "The Only Plane in the Sky" and other books. garrett.graff AT gmail OR ProtonMail. Subscribe to my newsletter: Doomsdayscenario.co

Reporter at Law360 and co-host of Law360’s Pro Say podcast. Unit chair of Law360’s union. NewsGuild of New York member organizer. Here to unionize the contestants on The Bachelor.

Producer & Off-air Reporter covering Congress at NBC News. Partner, dad, photographer.

Health policy at HCSC. Former NAIC, AHIP

Helping states and communities power their economies with clean energy. Director of Finance at S2 Strategies

Covering Sacramento business for Abridged @KVIE. Former Sacramento reporter for @BLaw @tax. Penn Stater. Elements of Style fan. She/her

Law and tax commentary editor at Bloomberg Industry Group. Fan of: running, yoga, coffee, cocktails, K-dramas.