Today's PCE release shows real wage growth is fading fast.

Overall: down from ~2.8% in Jan 2024 → ~1.5% now.

Lowest quartile: 3.0% → 0.9%.

HS-or-less: 2.9% → 1.1%.

The decline is hitting the least secure workers hardest.

@dralibustamante.bsky.social

Analyzing how today's economic and policy landscape impacts workers. #EconSky #Labor #WorkerPower

Today's PCE release shows real wage growth is fading fast.

Overall: down from ~2.8% in Jan 2024 → ~1.5% now.

Lowest quartile: 3.0% → 0.9%.

HS-or-less: 2.9% → 1.1%.

The decline is hitting the least secure workers hardest.

This labor market downturn is dragging real wage growth to a crawl, with the most financially vulnerable workers—those in low-wage jobs and with limited education—barely managing gains of around 1%. www.barrons.com/articles/wag...

05.09.2025 13:11 — 👍 0 🔁 0 💬 0 📌 0

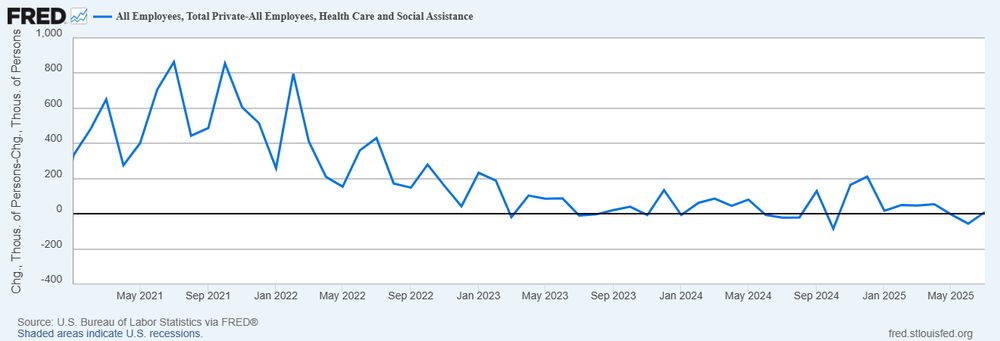

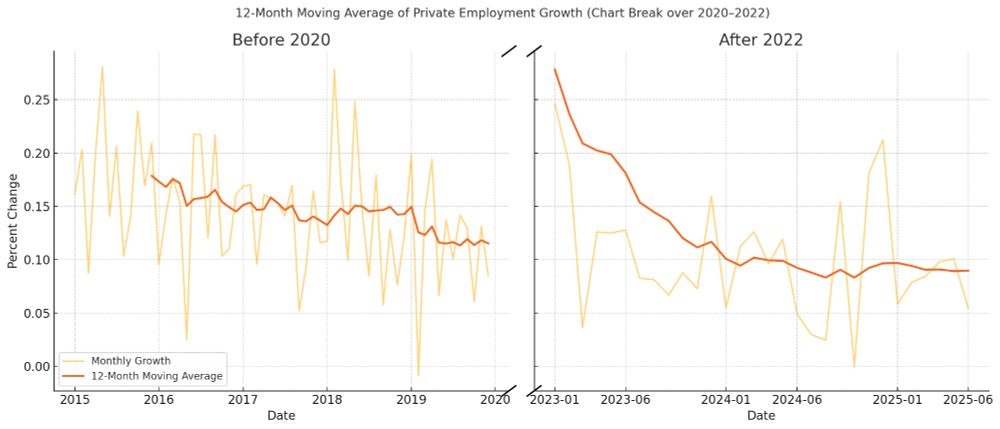

Employment gains saw an 86% decline over the last seven months! We had a bounce back last fall but it's unlikely that'll happen this year given the headwinds (e.g. self-induced bad economic environment).

05.09.2025 12:56 — 👍 23 🔁 4 💬 1 📌 0

Low-wage workers briefly broke four decades of wage stagnation - then saw those gains erased. On Labor Day, it’s worth asking: why does the business cycle always punish those at the bottom most? My new piece in Barron’s digs in.

www.barrons.com/articles/wag...

US workers are hurting! The US private sector added a monthly average of 39k jobs in the last 2 years and a monthly average of 17k since January when you remove healthcare and social assistance employment gains. It's a strong labor market mirage. www.barrons.com/articles/une...

01.08.2025 17:01 — 👍 4 🔁 2 💬 1 📌 0

The labor market isn’t as strong as we thought and it’s getting worst. Read why on @barrons.com

Spoiler: nominal wages are sticky and the vacancy-to-unemployment ratio shows workers moving to preserve real wages, not increased labor demand.

www.barrons.com/articles/une...

Missed the live discussion on worker power and the labor market? Don't worry. Here's the recording of today's Power Half-Hour.

It was a great pleasure to chat with some of the best in the labor space.

www.linkedin.com/events/thepo...

I think it's already much weaker than many believe. Job growth has been well below the pre-pandemic trend for the past year and it's getting worse. We're not seeing mass layoffs but low job growth and a diminishing labor force signal that this is a bad economy for American workers.

03.07.2025 15:37 — 👍 0 🔁 0 💬 0 📌 0Worst jobs report in recent years!

89% net job growth concentrated in just 2 industries (healthcare & social assistance + government)

-130k Labor force

+190k Long-term unemployed

+234k Marginally attached to labor force

This isn’t cyclical noise, the labor market is backsliding.

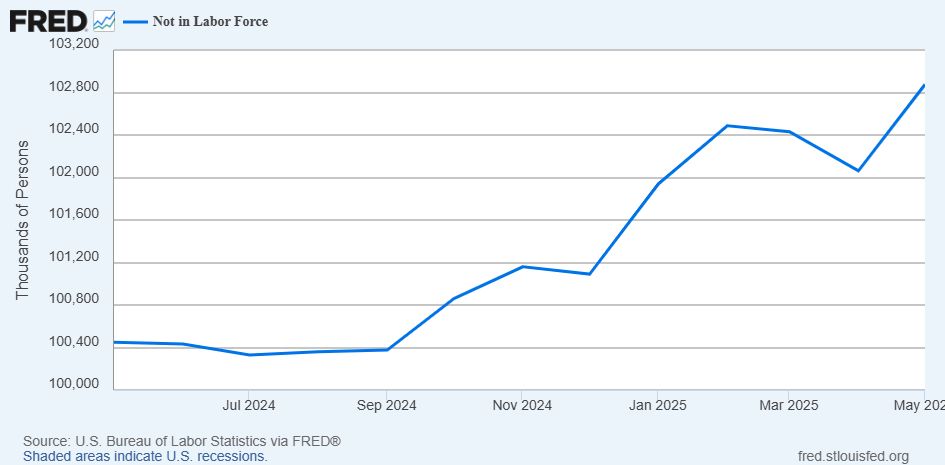

Flagging that # of people not in the labor force increased by 813k OTM and by 1.5 mill since last Sept. Low labor demand, evidenced by slow real wage growth + jobs stagnant/down in non-health related industries, has driven people out of the labor force en masse already. Happy to discuss further.

02.07.2025 23:12 — 👍 1 🔁 0 💬 1 📌 0

What if the 2021–24 labor market didn’t reflect growing worker power—but rather workers scrambling to recover lost purchasing power amid inflation and nominal wage rigidity? High job openings may have been a symptom of real wage erosion, not a tight labor market.

www.atlantafed.org/research/pub...

Two biggest stories below the topline figures showing that the labor market is getting worse:

1) U-6, the most encompassing measure of unemployment has 3-month average not seen since Nov. 2021.

2) professional and business services employment has lost 271k jobs since May 2023.

For context, real gross domestic income (GDI) decreased 0.2 percent this quarter, 2025Q1, in contrast to an increase of 5.2 percent in the last quarter, 2024Q4. 🤯

29.05.2025 12:53 — 👍 0 🔁 0 💬 0 📌 0The 0.2% decline in real GDI is an early warning sign of economic softening, especially when paired with slowing GDP and high interest rates. Points to underlying weakness not yet captured by spending data.

www.bea.gov/news/2025/gr...

The kicker is that nearly every state labor department and revenue agency doesn’t regularly collect formal occupational classifications (SOC). Basically, anyone can list their occupation as waiter and there’s no way of verifying whether that’s correct.

21.05.2025 02:10 — 👍 0 🔁 0 💬 1 📌 0Friends, this is my last month leading the Worker Power and Economic Security program at the Roosevelt Institute. Grateful to have worked alongside brilliant fellows and colleagues for the past 4 years. Optimistic about opportunities to come. Onward. ✊ #EconSky #Labor #WorkerPower

16.05.2025 15:56 — 👍 3 🔁 0 💬 0 📌 0Inflation policy requires effective housing policy. Shelter driving more than half of the inflation increase, up 4% OTY. Shelter inflation increased for the first time since last August. Tariffs and high interest rates are not helping. www.barrons.com/articles/wil...

13.05.2025 12:38 — 👍 0 🔁 0 💬 0 📌 0Good topline jobs figures but here are some red flags:

-Continued rise in long-term unemployed, 1.7 m and nearly 1 in 4 of all unemployed

-9k fewer federal workers, deferred resignations cliff still looming

-Professional + business services stopped losses but big structural losses in past 2 years

Surge in imports leads to decline, -0.3%, in real GDP in 2025Q1. For context, the US economy grew at a quarterly average of 2.5% last year.

www.bea.gov/news/2025/gr...

Must read on why we need economic democracy, an economy controlled by the many and not by the few, and how we get there. Perspectives from over 20 great progressive thinkers.

29.04.2025 13:50 — 👍 7 🔁 1 💬 0 📌 0Extremely excited to have, the one and only, Paul Krugman join the Roosevelt Institute.

15.04.2025 16:54 — 👍 25 🔁 5 💬 1 📌 0Unpacking CPI figures show a mixed picture on inflation:

-Shelter inflation slowed, finally but for how long.

-Food inflation still high, and being felt.

-Medical care inflation surged, red flag if it persists.

-Recreation and flight fare inflation dropped, consumer fears of downturn?

Stay tuned!

Uplifting the huge impact that the Raise the Wage Act of 2025 will directly have on 22+million workers! We have the power to improve the wellbeing of American workers without the gimmicks and pain of broad tariffs.

09.04.2025 14:16 — 👍 1 🔁 0 💬 0 📌 0The odds of recession increasingly drastic after US added 228k jobs last month encapsulates current US economic policy. The administration is doing everything it can to crash the economy but even bad economic policy has a lag. Also underscores strength of the economy the Trump admin inherited.

04.04.2025 12:58 — 👍 1 🔁 0 💬 0 📌 0Overall good jobs report today:

-Professional + business services stopped ongoing losses

-Leisure +hospitality had a big rebound

-Red flag is the rise in long-term unemployed

-Tick up in the unemployment rate is largely due to new entrants (teenagers)

-4k fewer federal workers due to DOGE

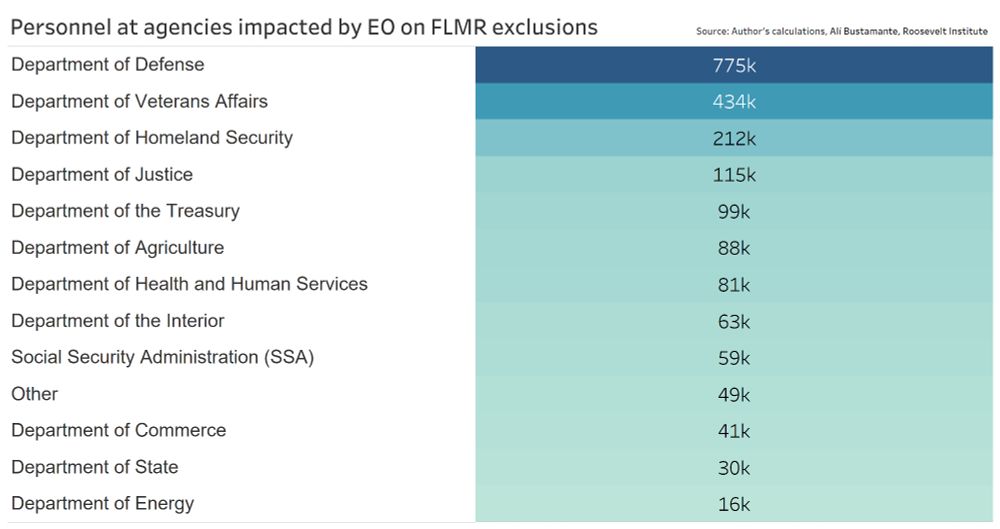

Here's a look at employment for those agencies impacted by last night's executive order gutting federal unions. Note: some sub agencies or departments were excluded from the EO.

28.03.2025 17:40 — 👍 1 🔁 0 💬 0 📌 0This EO impacts all workers at the Department of State, Department of Justice, and Department of Veterans Affairs, General Services Administration, EPA, NRC, FCC and most of the Department of Homeland Security (including USCIS, ICE, CISA, FEMA, Coast Guard).

28.03.2025 17:03 — 👍 5 🔁 1 💬 0 📌 0

Last night, the president issued an executive action where about 800k federal employees will lose rights to form unions, engage in collective bargaining, or file grievances over workplace conditions and disciplinary actions under the law. 1/2

www.whitehouse.gov/presidential...

One reason for stubbornly high inflation, spending by the top 10%. My take on why we need progressive taxation to bring down inflation. www.barrons.com/articles/ric...

12.03.2025 12:58 — 👍 3 🔁 2 💬 0 📌 1Great news inflation ticked downward but reasons to be concerned. Market uncertainty from tariffs may drive inflation up next month and housing (shelter) is still the main driver of inflation. Hard to see these concerns addressed in the short term and high interest rates aren't helping Americans.

12.03.2025 12:54 — 👍 1 🔁 0 💬 1 📌 0