Fact Sheet on the Wyden-Smith Tax Relief for American Workers and Families Act | The United States Senate Committee on Finance

Fact Sheet on the Wyden-Smith Tax Relief for American Workers and Families Act

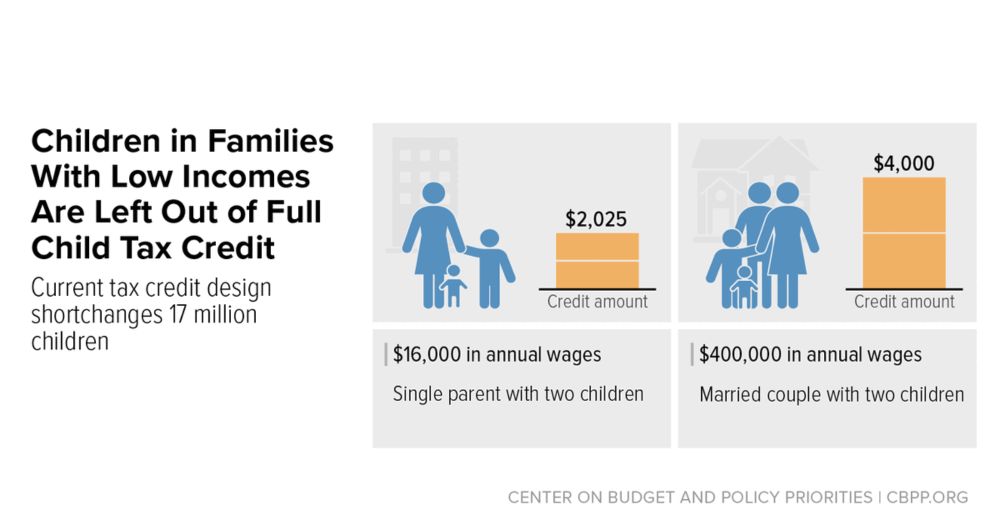

Less than a year ago, Chair Smith worked with Sen Wyden to promote investing in kids by expanding the #ChildTaxCredit for low-income families. finance.senate.gov/chairmans-ne... Where has that support gone? Today, Ways & Means wants to increase the #CTC for everyone _but_ these families.

14.05.2025 14:23 — 👍 3 🔁 0 💬 0 📌 0

Options to Reform the Child Tax Credit in the 2025 Tax Debate

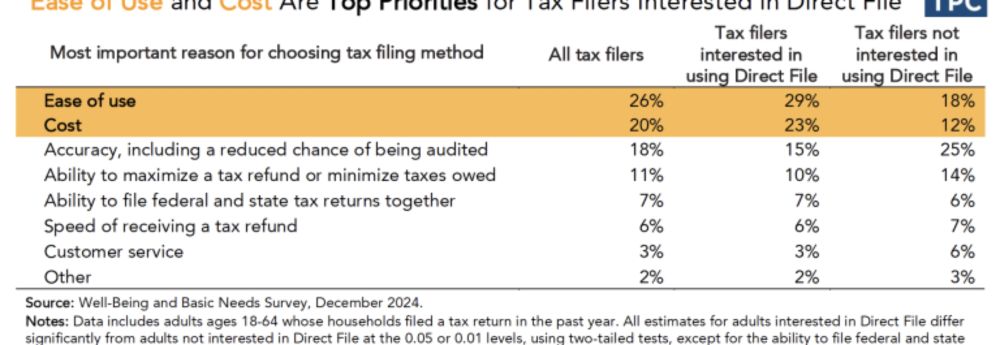

Options that increase the credit for low-income families increase how quickly the credit phases in. My colleagues and I explain here: taxpolicycenter.org/briefs/optio...

12.05.2025 14:42 — 👍 1 🔁 0 💬 0 📌 0

Tax News & Views Pauses for Soup Roundup

Canada, Mexico tariffs on "pause." China tariffs a go. DOGE "deletes" Direct File - from X. DOGE data access concerns. Soup.

Links include @cadystanton.bsky.social @taxnotes.bsky.social @richardrubindc.bsky.social @wsj.com @taxtweet.bsky.social @financialtimes.com @nytimes.com @politico.com @apnews.com @bloombergtax.com @punchbowlnews.bsky.social @elainemaag.bsky.social and more!

04.02.2025 16:58 — 👍 1 🔁 1 💬 0 📌 1

I.R.S. Expands Its Free Tax Filing Option (Gift Article)

The Direct File system will be open to millions of taxpayers in 25 states, up from 12 last year. But it’s unclear what will happen to the program next year.

The IRS #DirectFile program provides a free and fair way to file taxes for many. It gets high marks from users and its expansion should continue. This would improve filing options available to taxpayers. It's a great example of how government can work for people. www.nytimes.com/2025/01/24/y...

27.01.2025 16:13 — 👍 1 🔁 0 💬 0 📌 0

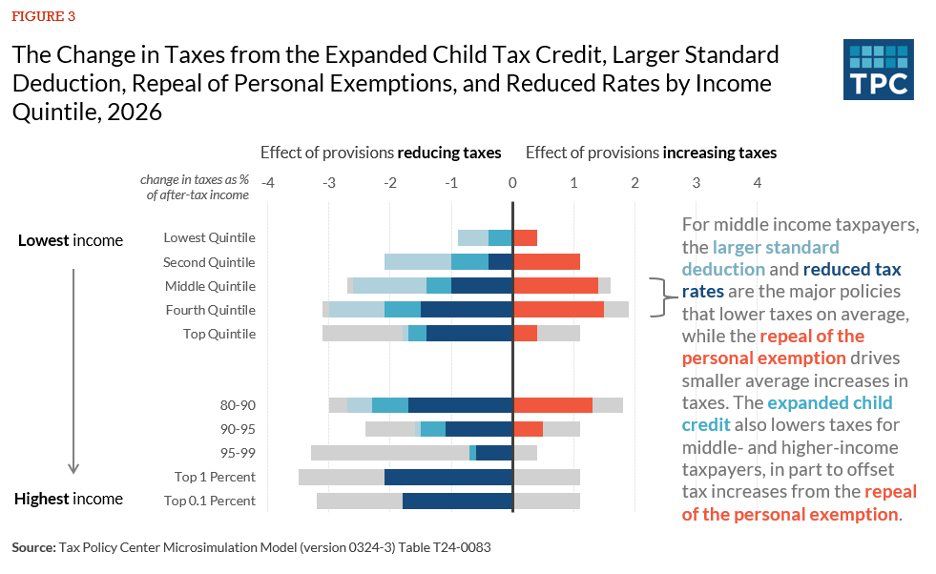

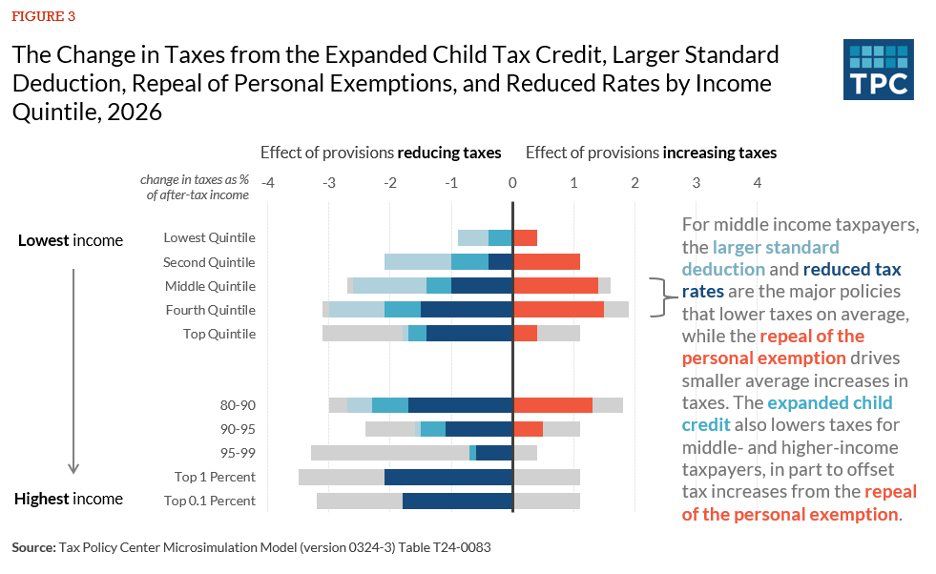

FYI @margothollick.bsky.social makes the coolest charts. The analysis of how the benefits of expiring TCJA provisions break down? Also cool! tpc.io/3BrvZ8f

19.12.2024 21:31 — 👍 4 🔁 1 💬 1 📌 0

Great point. It might well be that a slower speed limit has an add’l, though possibly counterintuitive benefit, of reducing average travel times.

18.11.2024 13:07 — 👍 0 🔁 0 💬 0 📌 0

The policy also has a cost, which is not mentioned. Every trip taken at the lower speed takes more time, which has some value. That cost may be small relative to the benefits cited, but it ought to be acknowledged. I’m wondering if that acknowledgment is an important piece of communication as well.

18.11.2024 12:51 — 👍 0 🔁 0 💬 1 📌 0

host of every single album, writer for the ringer

also posting here: instagram.com/noraprinciotti

🫶

I’m a book about women in today’s economy. Taylor Swift is my muse! Pre-Order here: https://a.co/d/9cmfJME 💚💛💜❤️🩵🖤🩷🤎🩶💙🤍(🧡)

Senior Lecturer at the Cohen Institute for Leadership and Public Service at the University of Maine. Researching and teaching about American political development and political history. Views are mine, not my employers. https://www.ryanlarochelle.com

I do research on taxes, budgets, fines and fees, fairness. Also like films/TV, cricket, reading, music, and food. Views my own.

Maximize opportunity and minimize injustice.

Labor economist at pro-worker Economic Policy Institute. Low tolerance for infighting. Otherwise happy to hear from you on this new-to-me site, especially if you make me laugh. Views my own. Daughter of a French-Canadian immigrant. No random DMs. (she/her)

🇵🇭🇺🇸 👾🖖🏽 siya/he/him; gringo filipino in the DMV, PhD ekomomista, union member, & marine; Vallejo born; #UCSC 🍌🐌, SF State🐊, UC Berkeley🐻. #NAFO 🇺🇦🇹🇼 #FTTB #DubNation #COYS. personal acct; skeets,likes,reposts are not views of employer or 🇺🇸 govt

mom, wife, millennial, applied linguist, public school advocate, pro vaxx, pro science, 🌈ally, pro choice • no DMs

Social policy researcher @povertycenter.bsky.social. Views are my own.

Historian, Educator, Storyteller. I create historical documentaries and podcasts, consult about New Deal art, and teach history & film at KCAI.

We are a research and policy center focused on children, youth, and families exposed to hardships that stem from poverty and housing instability. Our experts create sustainable solutions to support family well-being.

https://www.chapinhall.org/

The Hamilton Project at @brookings.edu produces research and policy proposals on how to create a growing economy that benefits more Americans. www.hamiltonproject.org

Thomas Jefferson HS for Science & Tech parents. Here to counter the false narratives about our HS that operatives keep inventing. (Pinned post has 25+ news articles & public info about what happened at our school.)

Energy and policy nerd, science and technology advocate, with a side of YIMBY-ism and film interest… Just hoping to be a net benefit to the planet : )

Based at @ucberkeleyofficial.bsky.social, O-Lab generates rigorous evidence to inform social policy and advance economic opportunity. #econsky #policysky

Learn more at olab.berkeley.edu, or find us at linkedin.com/company/berkeley-olab.