The image features illustrated family members outside a house, and people inside near a window. A person is seen blowing a whistle outside a basketball court. Text reads: "Meet family members Miranda, Joseph, Julian, and Alicia." Source: "How the Tax System Can Better Support All Families."

A stylized illustration shows diverse people with children in various activities. A prominent text reads, "As with their family, Primary caregivers who aren't parents or close relatives are ineligible to claim benefits for children in their care." The bottom notes the source: "How the tax system can better support all families."

A story based on real experiences and written by @taxpolicycenter.bsky.social explores why some #caregivers are ineligible to claim benefits for #children in their household—and steps Congress could take to help address this challenge.

Learn more. https://urbn.is/4c7UiI0

04.02.2026 17:55 — 👍 3 🔁 2 💬 0 📌 0

The US immigrant population generated more in taxes than they received in benefits from all levels of government every year from 1994 to 2023.

The Cato study provides the first-ever 30-year analysis of the fiscal effects of immigration on government budgets.

https://ow.ly/jy8a50Y8kM3

03.02.2026 17:27 — 👍 4384 🔁 2280 💬 80 📌 323

Illustration of diverse people engaged in various activities: a family of three, a young person with an adult walking, a young person playing soccer, and a young person playing piano while their caregiver watches.

Complex tax rules keep many #families from getting vital #tax benefits. New @taxpolicycenter.bsky.social #research highlights five fictional stories showing barriers—and evidence-backed solutions that Congress, the IRS, and others could pursue to help. https://urbn.is/3NP1miE

27.01.2026 17:06 — 👍 3 🔁 1 💬 0 📌 1

Check it out this new feature from @taxpolicycenter.bsky.social

and @urbaninstitute.bsky.social on how the tax system can better support all families. Such an impactful way to illustrate how tax policy actually plays out for families, and what could make it work better!

04.02.2026 12:01 — 👍 2 🔁 1 💬 0 📌 0

The IRS faces unprecedented leadership turnover | Brookings

Vanessa Williamson warns IRS turmoil, mass firings, and leadership losses threaten core taxpayer services nationwide.

Even more senior civil servants pushed out at IRS: www.washingtonpost.com/business/202...

More than two-thirds of IRS senior leadership has left or been removed since January. Unprecedented and dangerous.

15.08.2025 23:52 — 👍 19 🔁 10 💬 0 📌 0

In the Tax Bill that US Senators are considering: Taxpayer A making $19,000 a year would get a tax cut of $70 (a month's internet plan). Taxpayer B making $1.1 million a year would get a tax cut of $66,290 (a year's vacation home payments), 3x Taxpayer A's year-long earnings.

01.07.2025 12:58 — 👍 0 🔁 0 💬 1 📌 0

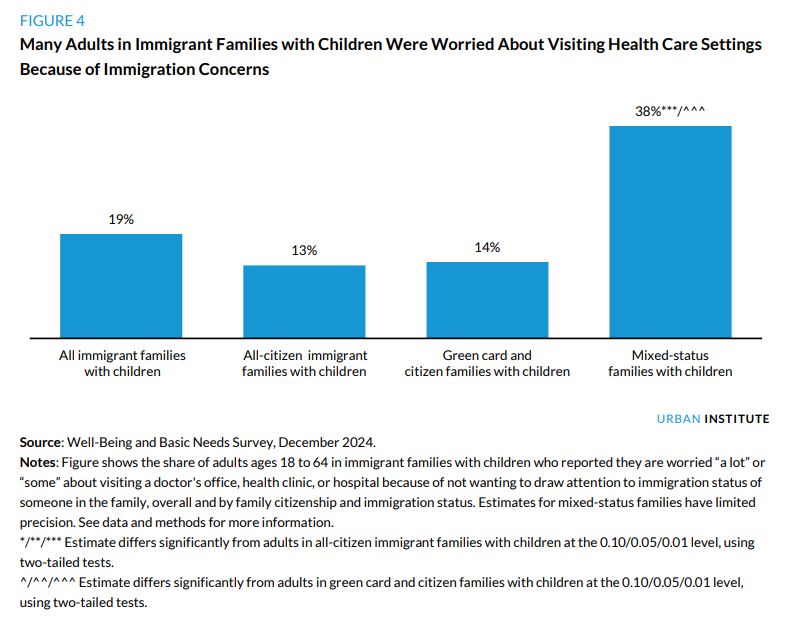

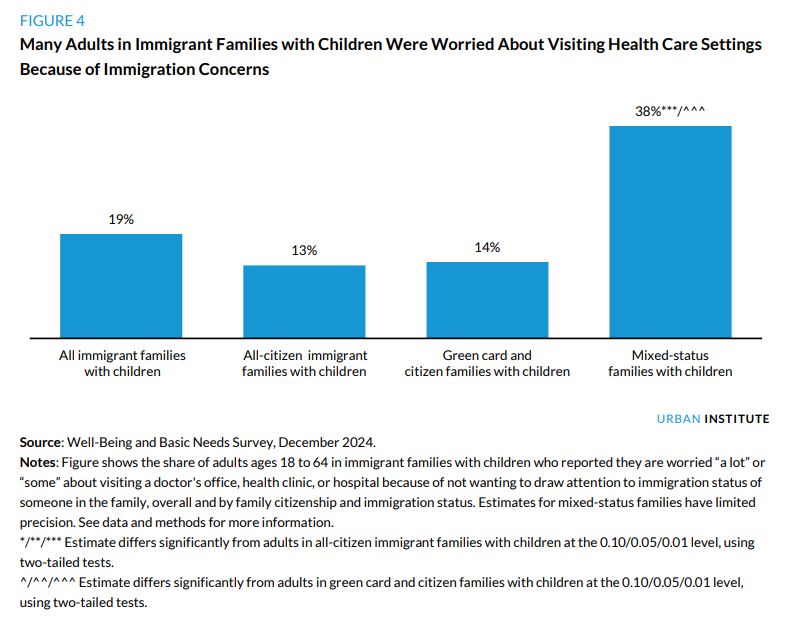

Figure 4 shows Many Adults in Immigrant Families with Children Were Worried About Visiting Health Care Settings Because of Immigration Concerns. A blue bar graph shows 19% for All immigrant families with children, 13% for All-citizen immigrant families with children, 14% for Green card and citizen families with children, and 38%***/^^^ for Mixed-status families with children. The Source is the Well-Being & Basic Needs Survey, December 2024. Figure shows the share of adults ages 18-64 in immigrant families w/ children who reported they are worried "a lot" or "some" about visiting a doctor's office, health clinic, or hospital because of not wanting to draw attention to immigration status of someone in the family, overall and by family citizenship and immigration status. */**/*** Estimate differs significantly from adults in all-citizen immigrant families with children at the 0.10/0.05/0.01 level, using 2-tailed tests. ^/^^/^^^ from adults in green card and citizen families with children.

Thread: A new Urban Institute analysis demonstrates the widespread prevalence of challenges faced by #immigrant #families with #children, particularly in meeting basic housing, food, and health needs and worries about immigration policies. urbn.is/4mzT0bw

29.05.2025 18:22 — 👍 7 🔁 3 💬 1 📌 0

“One Big Beautiful Bill” Child Tax Credit Would Exclude Millions of American Children

"As the US Senate considers the One Big Beautiful Bill Act, they could consider modifications to the Child Tax Credit changes that the US House of Representatives passed, so that American children are not left out of one of the nation’s most critical programs."

taxpolicycenter.org/taxvox/one-b...

29.05.2025 15:08 — 👍 1 🔁 0 💬 0 📌 0

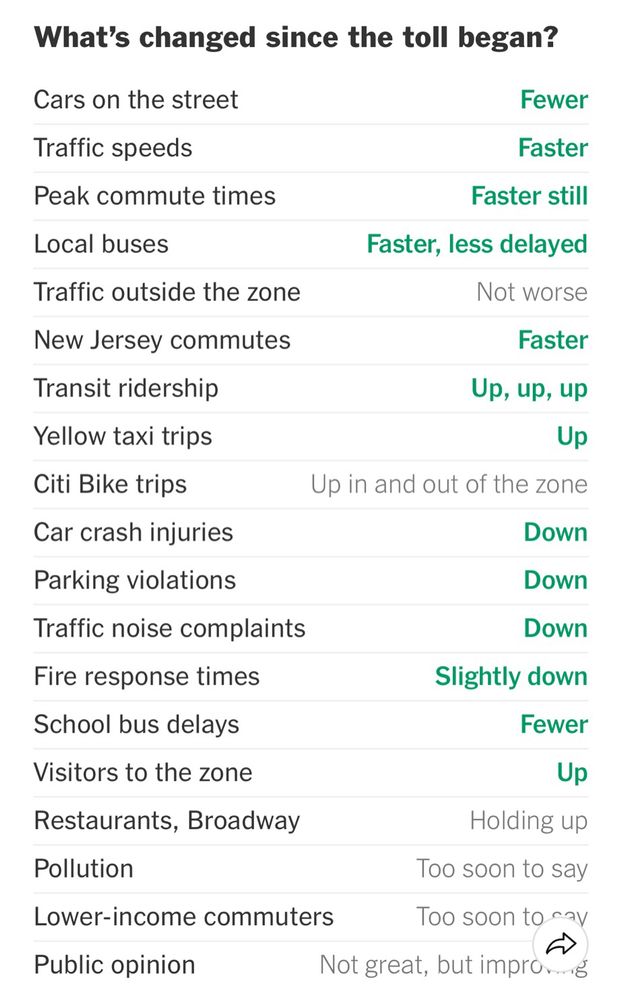

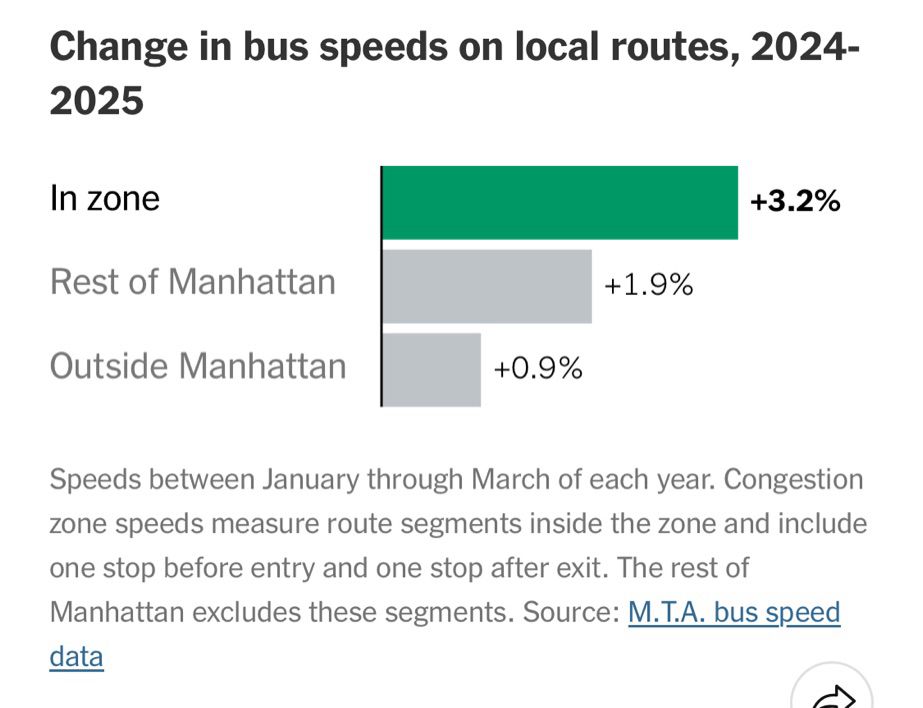

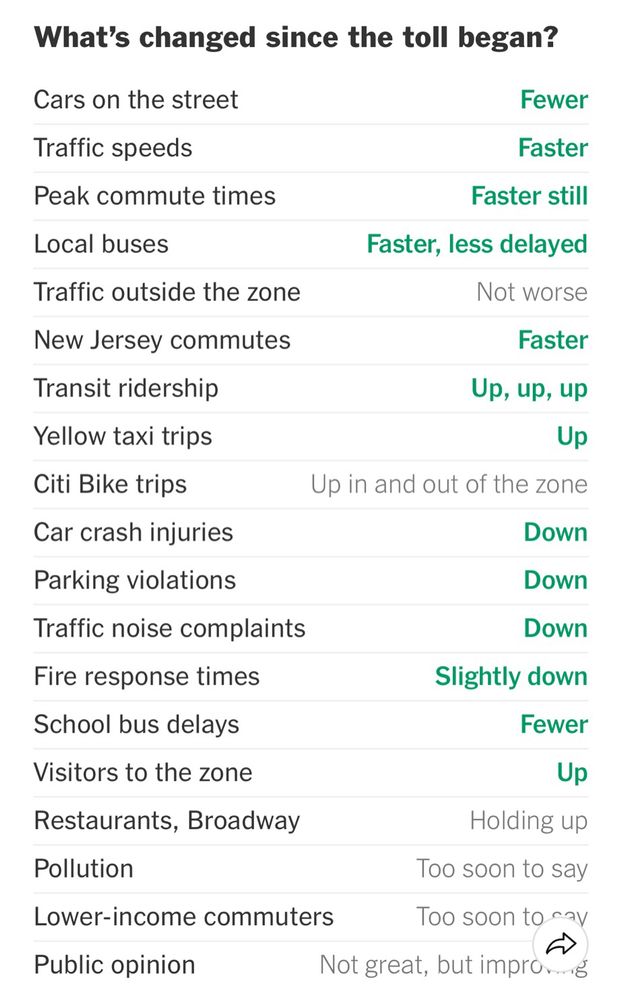

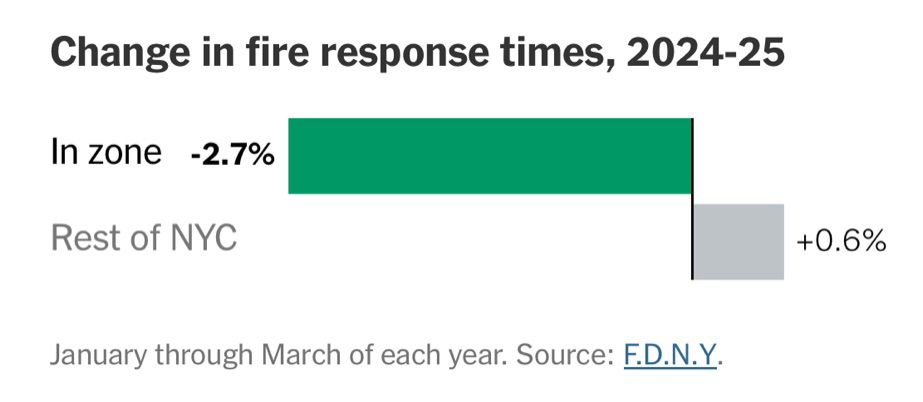

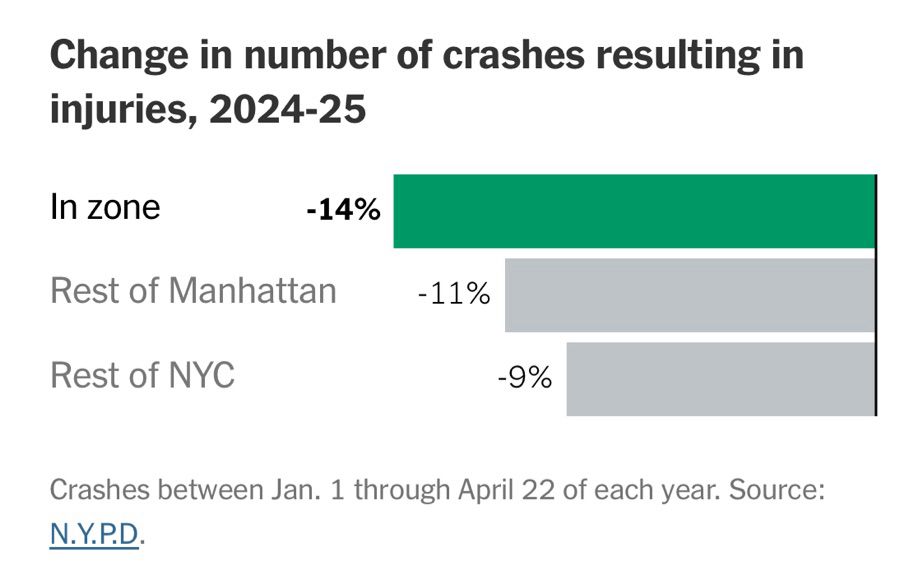

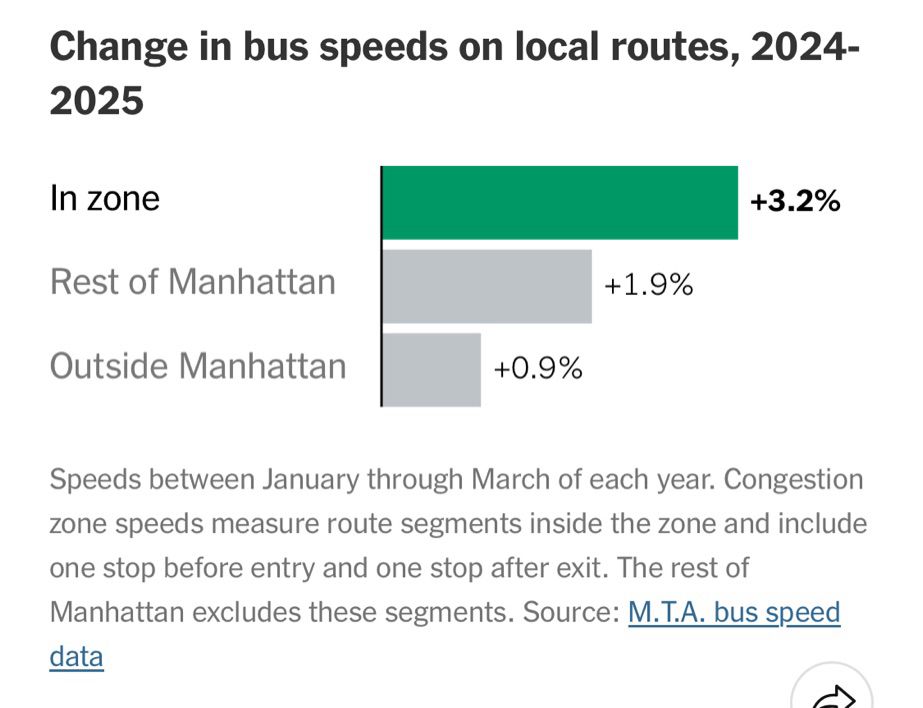

Congestion pricing has improved life in New York City by: reducing cars on the street, speeding traffic (especially at peak hours), speeding buses and making them more reliable, expanding transit ridership, reducing car crashes, reducing noise complaints, and increasing the number of visitors.

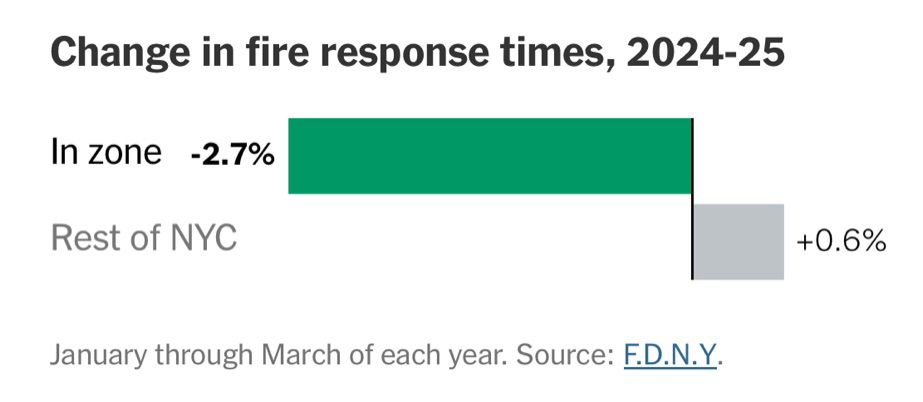

Fire response times fell in the NYC congestion zone, even as they increased in the rest of the city.

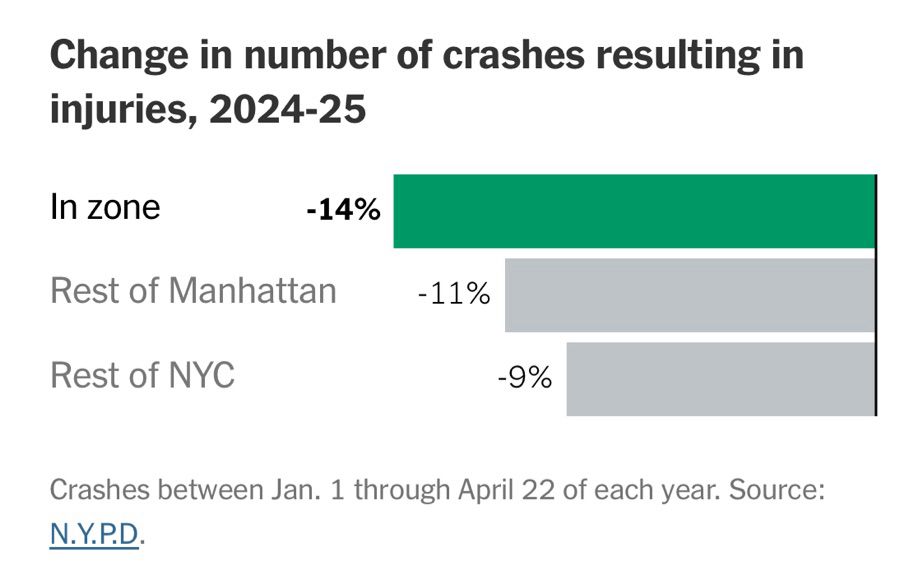

Car crashes with injuries fell citywide, but they fell especially dramatically in the congestion pricing zone from 2024 to 2025

Local buses have sped up dramatically in the congestion pricing zone.

NYC’s congestion pricing is a policy miracle: Less traffic, less noise, faster transit, more business sales, more transit revenue. And it hasn’t produced the negative effects outside the cordon zone we were afraid of.

www.nytimes.com/interactive/...

12.05.2025 12:10 — 👍 4393 🔁 1093 💬 65 📌 107

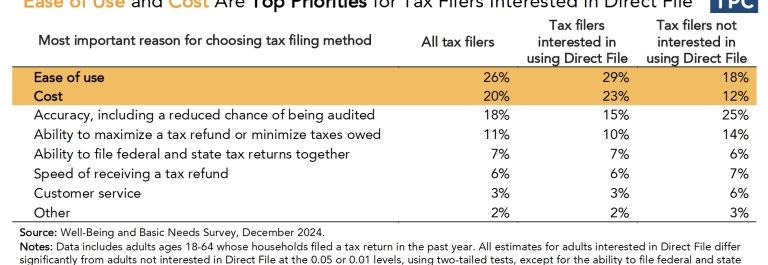

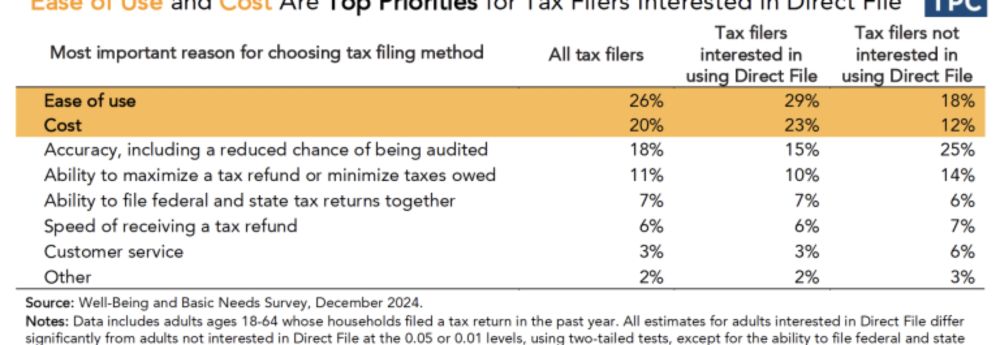

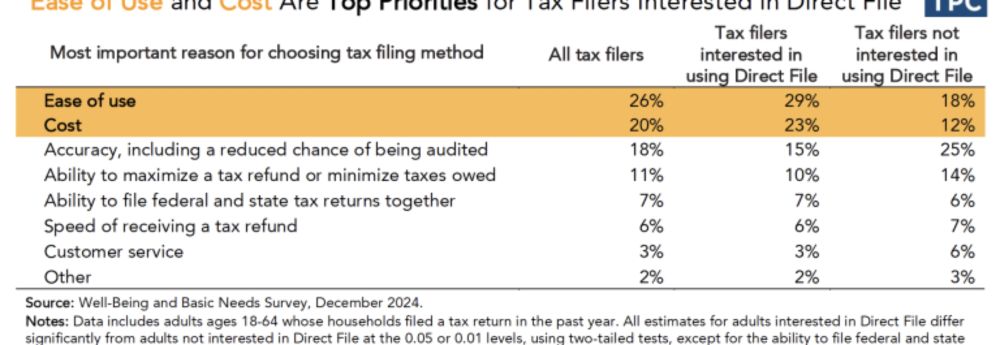

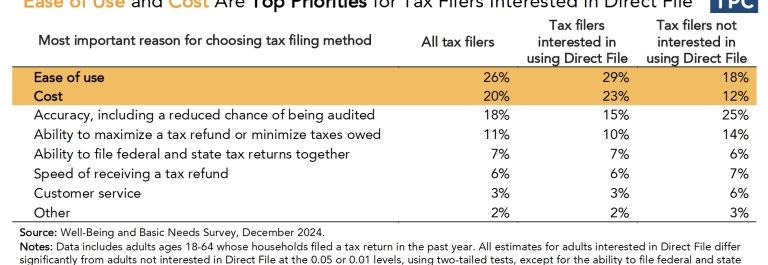

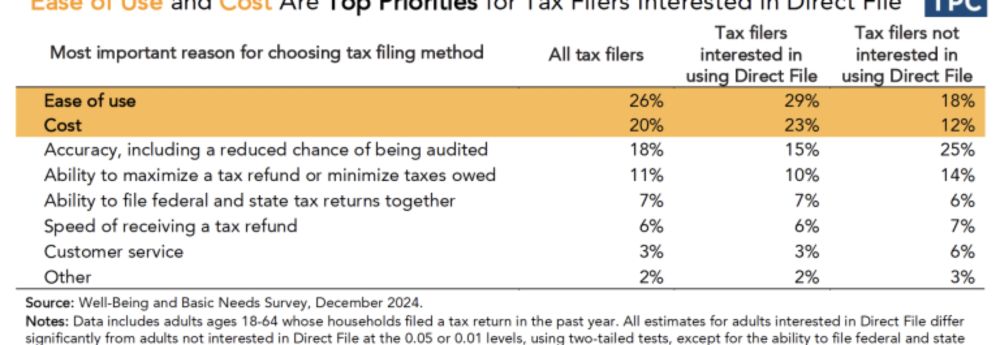

Most Americans Are Interested in Using IRS Direct File to Prepare and File Their Taxes

This factsheet uses December 2024 data from the Urban Institute’s Well-Being and Basic Needs Survey (WBNS) to examine interest in using Direct File.

Our research shows most Americans are interested in using IRS Direct File to file their taxes. Interest spans across income, race, age, education, region, those who recently filed for free or paid.

But news reports say the Administration plans to eliminate it.

taxpolicycenter.org/briefs/most-...

16.04.2025 23:47 — 👍 1 🔁 0 💬 0 📌 0

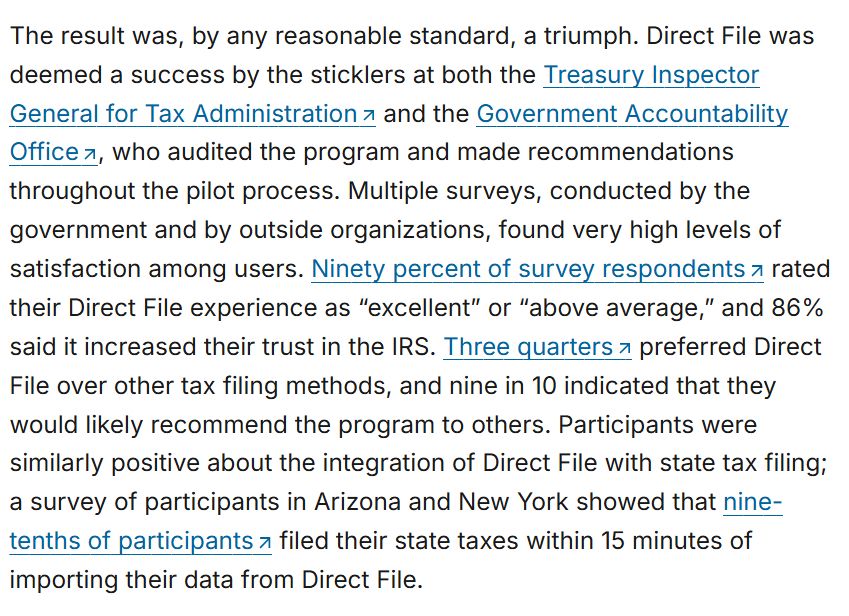

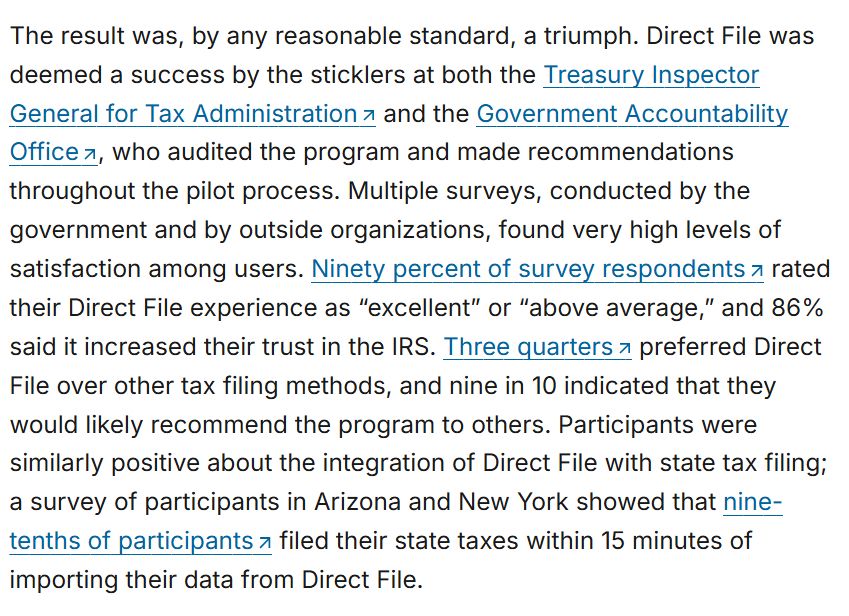

AP is reporting that the Trump Administration is eliminating Direct File, IRS's excellent free tax prep program.

Last month I wrote about the success of the Direct File pilot, and what the history of IRS can tell us about resisting attacks on American governance.

www.brookings.edu/articles/the...

16.04.2025 18:47 — 👍 10 🔁 4 💬 0 📌 0

Most Americans Are Interested in Using IRS Direct File to Prepare and File Their Taxes

This factsheet uses December 2024 data from the Urban Institute’s Well-Being and Basic Needs Survey (WBNS) to examine interest in using Direct File.

This #tax season, explore new findings from Urban’s Tax #Policy Center (TPC) that examine interest in using Direct File and what motivates respondents to choose their most recent tax filing methods to better understand their priorities when preparing and filing their #taxes.

01.04.2025 14:39 — 👍 3 🔁 2 💬 0 📌 0

My God: they are selling off federal buildings and no longer planning on collecting revenues.

Again, none of this is about efficiency. I know the IRS is not popular, but for every dollar invested it generates about $7 in returns. The goal is not to save money but to stop collecting it.

04.03.2025 23:34 — 👍 3910 🔁 1322 💬 124 📌 55

Five Facts About Fines and Fees Revenues

The latest data from the US Census Bureau can help policymakers, advocates, and other stakeholders understand where fines and fees fit in current revenues and design more effective and equitable polic...

Criminal legal fines and fees harm the families of those who can't pay and disproportionately affect people of color. But as my colleague @aravindb.bsky.social writes, they account for a tiny proportion of state and local revenues, calling into question why they continue to be levied.

06.12.2024 01:52 — 👍 6 🔁 2 💬 0 📌 0

How Do Fines and Fees Affect Families’ Well-Being?

Households facing court-related fines and fees were significantly more likely to report experiencing food insecurity or having trouble paying their medical bills.

🚨🚨 In new research from @urbaninstitute.bsky.social, we used national survey data to look at fines and fees (tickets, court admin. fees, incarceration costs), finding that they can increase financial strains and economic disparities, undermining family well-being 🏛 🚔

www.urban.org/urban-wire/h...

27.11.2024 15:04 — 👍 0 🔁 0 💬 0 📌 0

The Urban Institute on Bluesky

Join the conversation

One of the perks of working at Urban is the wide range of policy issues my colleagues care about - a complex web of topics that influence equity and well-being across communities. Follow along

go.bsky.app/8vqjVD2

27.11.2024 14:40 — 👍 18 🔁 9 💬 1 📌 1

the internet's uncle • waging a victorious 2-front war against cars and christmas • big fan of being a big fan of things • go read https://anildash.com

Senior researcher & journalist. @splcunion.bsky.social. Former internet person at @thebaffler.com. hannahgais@proton.me Signal: 334-315-8634 http://seedisclaimer.com. Newsletter: https://postsfromunderground.ghost.io/

Polling editor at CNN, keeping (cross)tabs on public opinion and the news. I like puns.

lol

prints :: http://www.oliverleach.com/contactpurchase-inquiry

Endowed chair of the Tocqueville-Rand Freedom Enterprise Markets Innovation Center (disputed). Bound but not protected, I lie but I do not pretend. 🚰 🏗

free palestine. 5-4 podcast. popular cradle podcast. seen some shit.

Buy my book, A PHYSICAL EDUCATION

a Marketplace and Scientific American pick for 2025!

science writer/author

Newsletter shesabeast.co

couchtobarbell.com

give me a sword, you cowards | half azn 🇯🇵 smol bean | queen of yap | pennsylvanian turned virginian | news editor @vpm.org

https://linktr.ee/meghin

I’m the founding executive editor of Heatmap News, a contributing Opinion writer for The New York Times, and the cohost of the Shift Key podcast.

📍NYC

Emmy-nominated TV writer and comedian. My new book “Good Game, No Rematch” is out April 1st. Newsletter: https://tinyurl.com/ytjvhjsb Email: mikedruckerisdead @ gmail .com

NOT a real doctor, it's a joke. Movies in particular, pop culture in general, politics, random thoughts.

i lost the ability to read in a freak clean and jerk accident in 1989. please be gentle. he/him

anarchist hellscape warlord arbitration consultant. drummer in tragic lovers. writes WORK IS FOUR LETTERS, DOGE IS FOUR LETTERS, poster emeritus for NORMAL MEN.

https://golikehellmachine.com

https://normalmenpodcast.com

https://tragiclovers.bandcamp.com

Your Jeopardy! pal. Author of THE COMPLETE KENNECTIONS (http://bit.ly/4qUcbhK) and a bunch of other stuff.

Senior Fellow at the American Immigration Council. Commenting generally on immigration law and policy. Retweets =/= endorsements, views are my own.

Econ professor at Michigan ● Senior fellow, Brookings ● Intro econ textbook author ● Think Like An Economist podcast ● An economist willing to admit that the glass really is half full ● Find me: https://linktr.ee/justinwolfers

Managing editor @lpeblog.bsky.social. Freelance academic editor. Posting from the land of enchantment.