💥 Romania President today signs 2% VAT rise 1 Aug 2025

Happy weekend all lovers of VAT 😍

Richard Asquith

@richard-asquith.bsky.social

Tax tech chap. Spreading global fiscal chatter

@richard-asquith.bsky.social

Tax tech chap. Spreading global fiscal chatter

💥 Romania President today signs 2% VAT rise 1 Aug 2025

Happy weekend all lovers of VAT 😍

Highly unlikely Italian VAT assessments on social media platforms will stand. Impossible to calculate - and is any tax owed to Italy or the US?

But does reflect global tax rules are soooo 20th Century

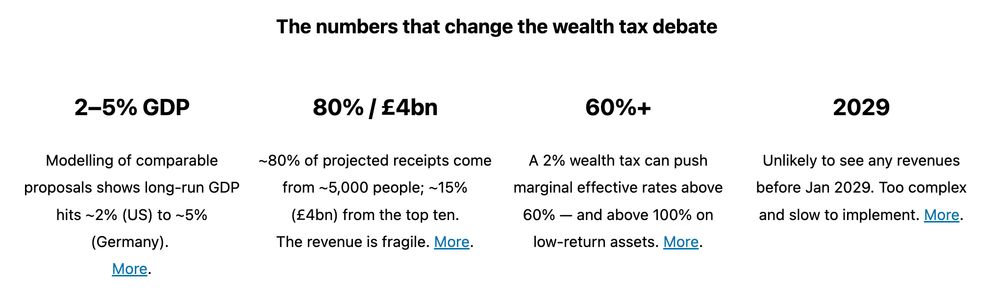

A UK wealth tax sounds simple: "tax the super‑rich, fund public services"

But it's not.

Our 16,000 word deep‑dive shows revenues are fragile, it puts growth, investment and jobs at risk, and there's no revenue before 2029.

Here’s the evidence:

Some of the legal proposals for the next EU multi-year budget are now published - own resources and MFF proposals (scroll down) - commission.europa.eu/strategy-and...

16.07.2025 19:41 — 👍 6 🔁 1 💬 0 📌 0

How to raise VAT when you said you wouldn't www.vatcalc.com/uk/uk-labour...

16.07.2025 17:08 — 👍 1 🔁 0 💬 1 📌 0Putin is running a classic war economy, pumped up on defence spending. Mirroring late 1930s Nazi model that needs continuing aggressive expansion or faces collapse

16.07.2025 06:29 — 👍 18 🔁 1 💬 1 📌 0

EU rejects Italian tax speculative VAT assessments on free social media platform services www.vatcalc.com/italy/italy-...

08.07.2025 11:19 — 👍 2 🔁 0 💬 1 📌 0

Outrageous no Bob Paisley

31.05.2025 10:33 — 👍 6 🔁 1 💬 0 📌 0

Germany comes out punching: drawing-up 10% Digital Services Tax. In Feb, President Trump launched review of such discriminatory taxes, with tariff threat www.vatcalc.com/germany/germ...

30.05.2025 12:39 — 👍 4 🔁 0 💬 0 📌 0

This will nearly double the price of my next stylish pair of pants www.vatcalc.com/eu/eu-mulls-...

20.05.2025 18:48 — 👍 1 🔁 0 💬 0 📌 0

EU's to review Italy's questions on LinkedIn, X & Meta/Facebook VAT liabilities on 'free' access to their platforms in exchange (barter) for users' data www.vatcalc.com/italy/italy-...

19.05.2025 18:43 — 👍 0 🔁 0 💬 0 📌 0

#AI is mopping-up VAT fraud www.vatcalc.com/malta/artifi...

15.05.2025 17:17 — 👍 0 🔁 0 💬 0 📌 0

EU threatens to reheat Digital Services Tax proposal as leverage to Trump tariffs. (Although I’m not sure of mechanism? ‘Enhanced Cooperation’? www.vatcalc.com/eu/european-...

15.04.2025 19:44 — 👍 1 🔁 0 💬 0 📌 0

🥳 🎉 Happy b'day VAT! It's had one or two detractors this year; but still looks wonderful for its age in 175 countries www.vatcalc.com/uncategorize...

10.04.2025 17:09 — 👍 2 🔁 0 💬 0 📌 0Is there opp for U.K. (and others) to displace US exporters in rest of world as trade lines redrawn?

06.04.2025 15:02 — 👍 0 🔁 0 💬 0 📌 0Eat my shorts, @explaintrade.com

04.04.2025 18:47 — 👍 2 🔁 0 💬 0 📌 0

Happy weekend all VAT lovers 😍

04.04.2025 18:35 — 👍 4 🔁 1 💬 2 📌 0Fun fact: organised US businesses don’t actually have to ever pay import VAT. UK & most EU states offer postponed VAT scheme where cash never handed over. Just bit of reporting in their VAT return

03.04.2025 05:34 — 👍 2 🔁 0 💬 0 📌 0He should definitely be doing bingo number calls …duck and dive autos at 25

02.04.2025 20:27 — 👍 0 🔁 0 💬 0 📌 0

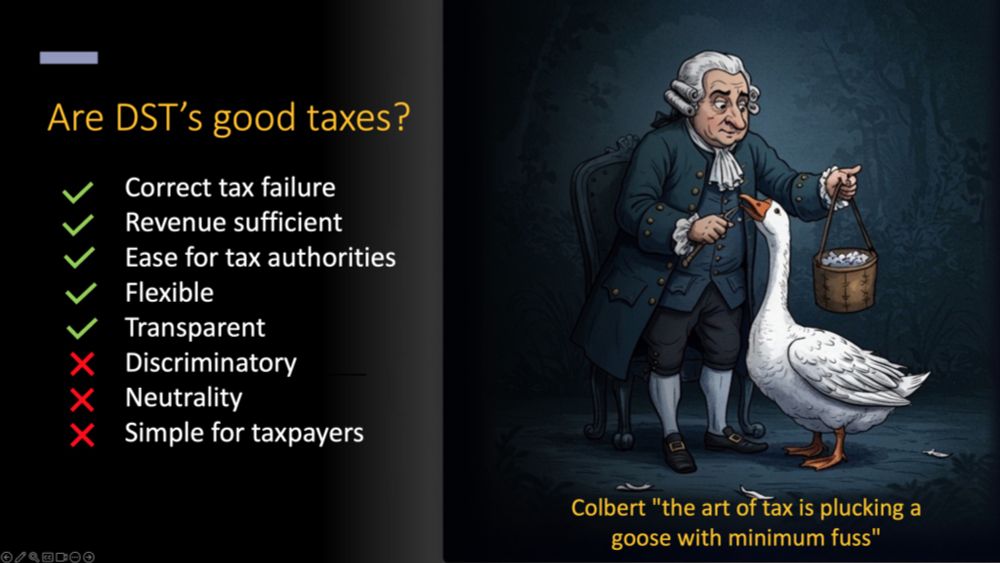

Digital Service Taxes - closing offshore tax loophole or illegal service import tariffs in disguise? www.vatcalc.com/global/are-d...

02.04.2025 18:35 — 👍 0 🔁 0 💬 0 📌 0

Fun fact: US businesses don't even have to pay import VAT. Many countries offer non-EU business imports facility to not pay a cent www.vatcalc.com/global/impor...

01.04.2025 16:05 — 👍 0 🔁 0 💬 0 📌 0

Fun fact: US firms don’t even have to pay import VAT www.vatcalc.com/global/impor...

31.03.2025 14:30 — 👍 0 🔁 0 💬 0 📌 0I do have some sympathy for fiscal devaluation argument from US. 175 countries with VAT use it to subsidise direct tax (payroll and corp taxes) cuts to boost their exports

Solution would be for US to adopt VAT. But we all know that’s never going to happen

£100k tax cliff becoming huge headache in tech sector. As tech venture, we’re having to restructure packages to attract / retain mid-career brightest talent that’ll keep us competitive in global market

27.03.2025 07:07 — 👍 14 🔁 1 💬 2 📌 1

Bolt ride-sharing today wins VAT ruling. Could spill over to gig employment taxes obligations www.vatcalc.com/united-kingd...

24.03.2025 20:50 — 👍 1 🔁 1 💬 0 📌 0

Whilst not ideal tax (Trump pulled out of OECD renegotiation), telling that other Europeans stepping up their DST’s www.vatcalc.com/belgium/belg....

24.03.2025 09:00 — 👍 1 🔁 0 💬 0 📌 0Because digital services may be provided offshore, direct to, so bypasses corporate income tax PE that goods & trad services subject to. If we allow that, the tax base erodes (hospitals, errr… extra tanks)

Again, I’m not DST cheerleader. My point is there’s a wider issue to debate

I’d agree DST’s are badly designed taxes; but they’re reaction to 20th Century global tax regime designed to tax cross-border goods. Foreign Digital service providers enjoy huge tax loophole. U.S. (quietly supported by China) walked out in Jan on OECD talks to resolve

23.03.2025 11:33 — 👍 1 🔁 0 💬 1 📌 0

UK ministers with Peter Mandelson scramble for Digital Services Tax compromise to avoid US retaliatory tariffs www.vatcalc.com/united-kingd...

23.03.2025 09:09 — 👍 3 🔁 2 💬 0 📌 0