Thanks Steve. Have done New Orleans and Memphis and will finish in Nashville.

09.08.2025 11:47 — 👍 2 🔁 0 💬 0 📌 0

Is that a slightly older Clarence Boddicker of Robocop fame? 🤔

09.08.2025 11:02 — 👍 1 🔁 0 💬 1 📌 0

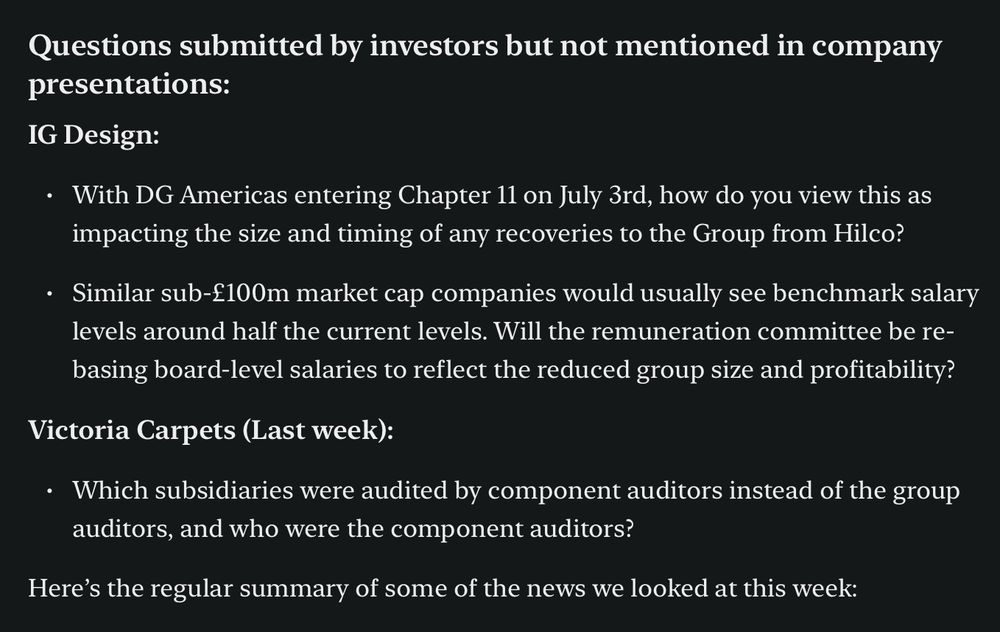

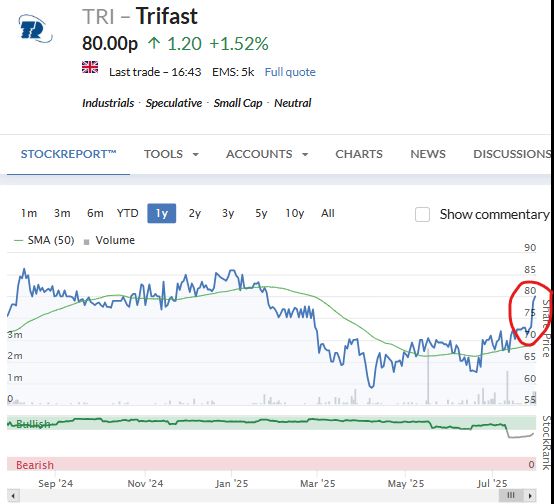

More recently, #TRI.L ignored my question about profit warning by broker (I was more eloquent in my actual wording!) and therefore had a double fail - delivering a warning by broker & then failure to fess up to it when given an opportunity!

05.08.2025 18:52 — 👍 3 🔁 0 💬 0 📌 0

Nice section @dangercapital.bsky.social on questions asked, but ignored by companies in meetings.

If #HZM had answered my question a couple of years ago this August about whether they had used any contingent fund monies or not, investors might have had pre-warning of the impending collapse of #HZM.

05.08.2025 18:49 — 👍 4 🔁 0 💬 1 📌 0

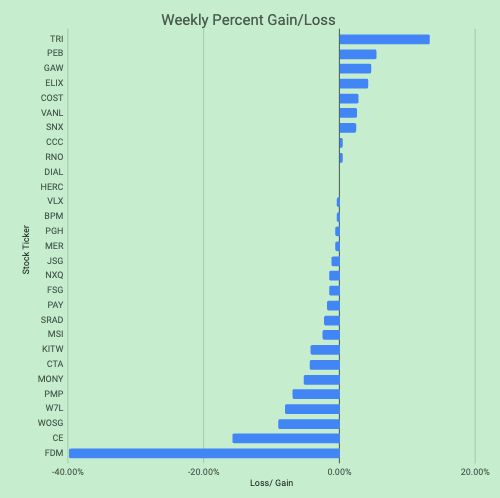

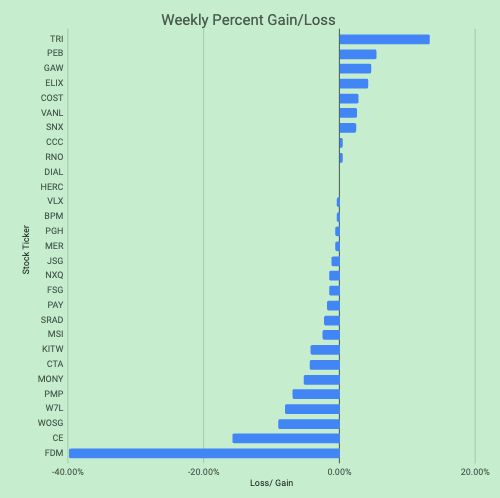

My portfolio is down 1.6% this week & up 13.1% Cal YTD.

9📈, 18📉 & 2 unchanged. Trades: Reduce: #RNO.L, Add: #PMP.L.

#TRI.L rises on interview with holders Harwood & #PEB.L continues to strengthen to multi-year highs. #FDM.L takes a heavy pw & #WOSG reacts to new tariff news.

Good w/e all! 🏃♂️😎

01.08.2025 16:30 — 👍 8 🔁 0 💬 0 📌 0

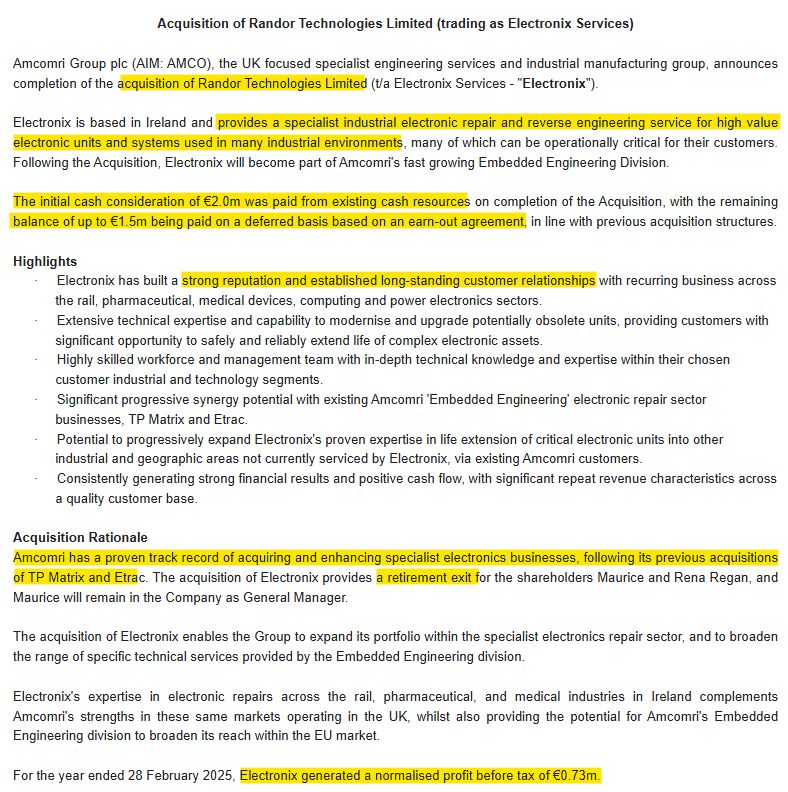

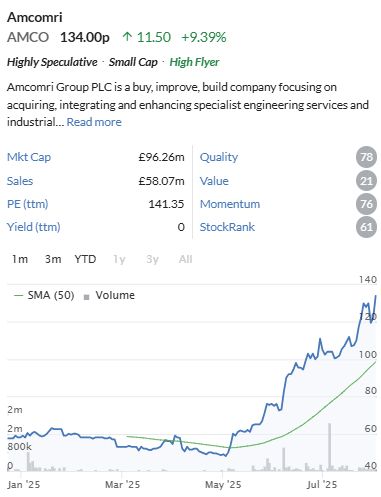

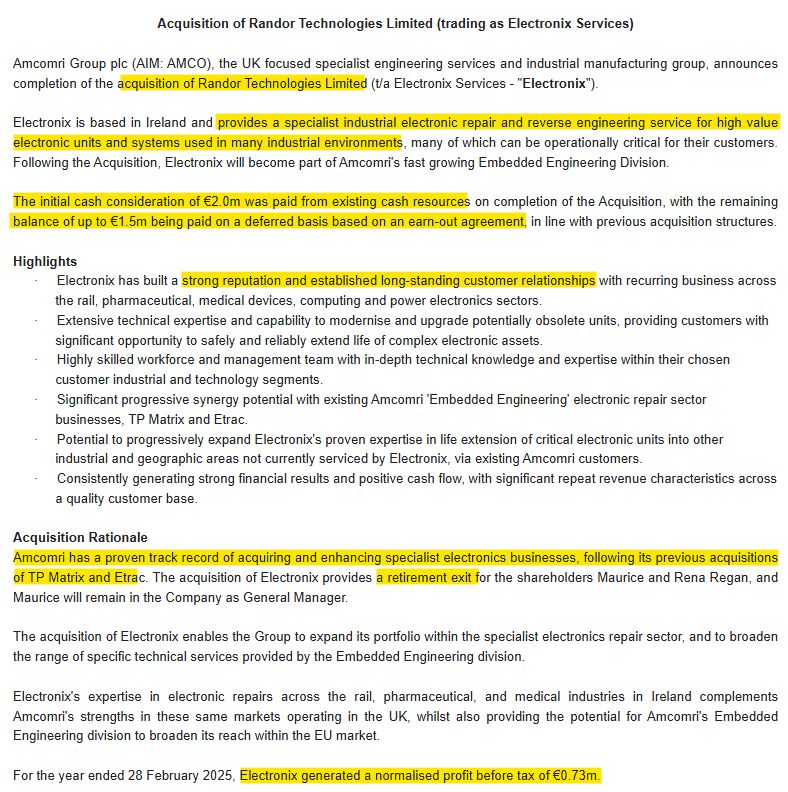

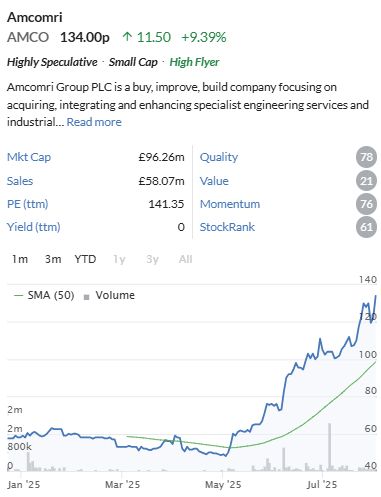

#AMCO.L - Acquisition

This company seems to have caught some investors eyes as it has powered ahead since listingat the turn of the year.

Today it makes what looks like a bolt on Acquisition buying a electronic repair & reverse engineering outfit for €2m + €1.5m earn-out.

SP up 9.4% yesterday 🤔

01.08.2025 06:30 — 👍 2 🔁 0 💬 0 📌 0

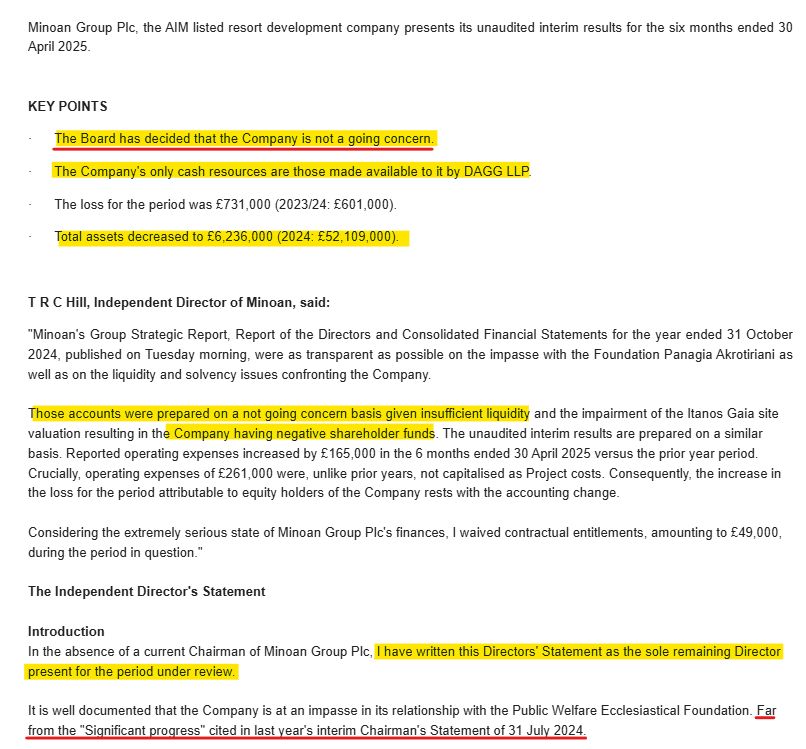

3/3

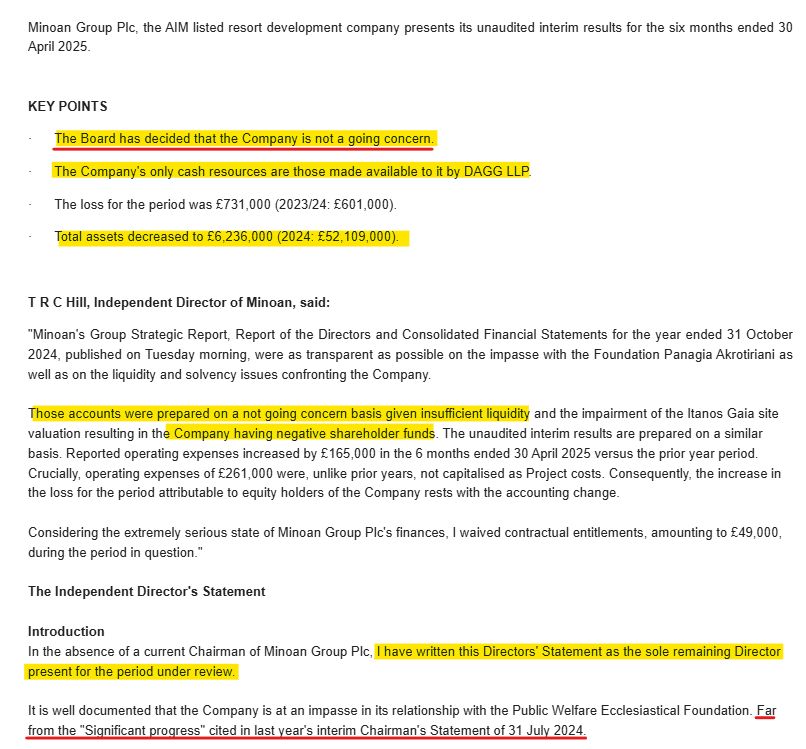

Today, the company's remaining director states, "The Board has decided that the Company is not a going concern."

➡️Accounts prepared on a not going concern basis.

➡️Negative shareholder funds.

➡️Group expected to shortly enter insolvency process.

01.08.2025 06:23 — 👍 1 🔁 0 💬 1 📌 0

2/3

and, if I understand right a key project which was described as the source of funding saw “no discernible progress has occurred in the ensuing eight years despite Minoan having incurred millions of pounds of costs”.

01.08.2025 06:23 — 👍 1 🔁 0 💬 1 📌 0

#MIN.L - Interims

I suggest a read of the Tuesday 2024 Finals for #MIN.L for a jaw-dropping insight into how £MM seem to have disappeared and left the company now bankrupt.

It declared losses of £47m, impairment of inventories of £42.5m, a swing from assets of £42.2m to liabilities of £4.2m,

1/3

01.08.2025 06:21 — 👍 1 🔁 0 💬 1 📌 0

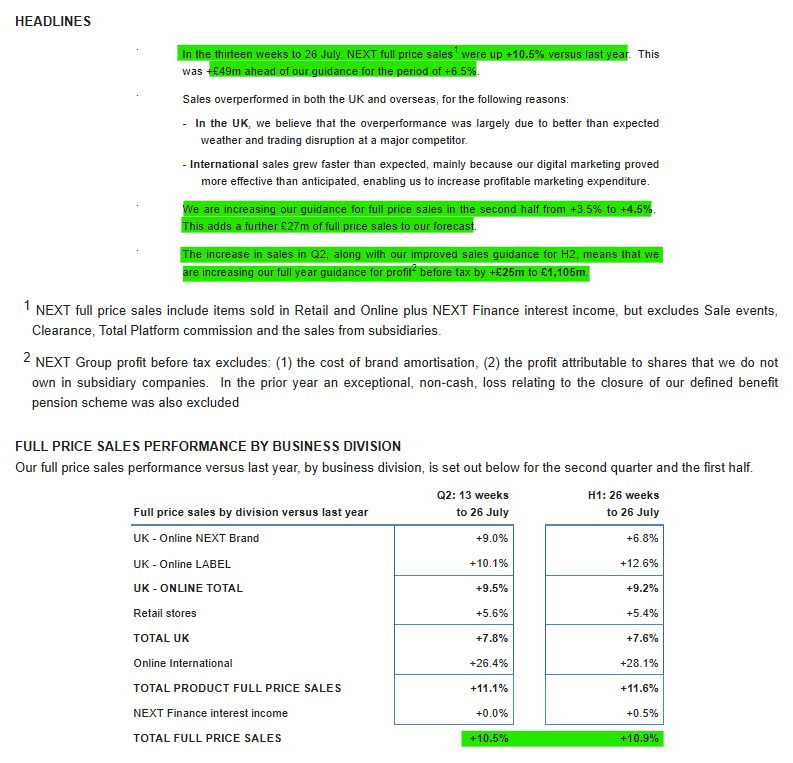

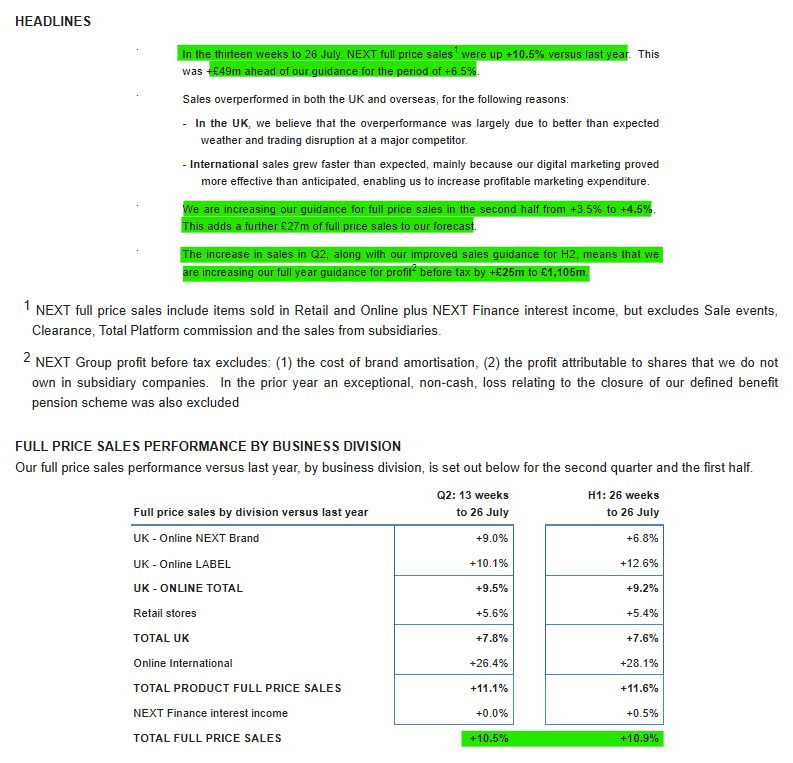

#NXT.L - Q2 TU

✅Reports Q2 sales up 10.5% vs guidance of 6.5%

✅Reasons: 1) UK - weather & M&S disruption, 2) Intl - marketing effectiveness.

✅Raises 2H Rev growth guidance from 3.5% to 4.5%. Result is £27m FY Rev boost & £25m PBT boost.

✅Special divi incoming for 2026.

31.07.2025 06:29 — 👍 3 🔁 0 💬 0 📌 0

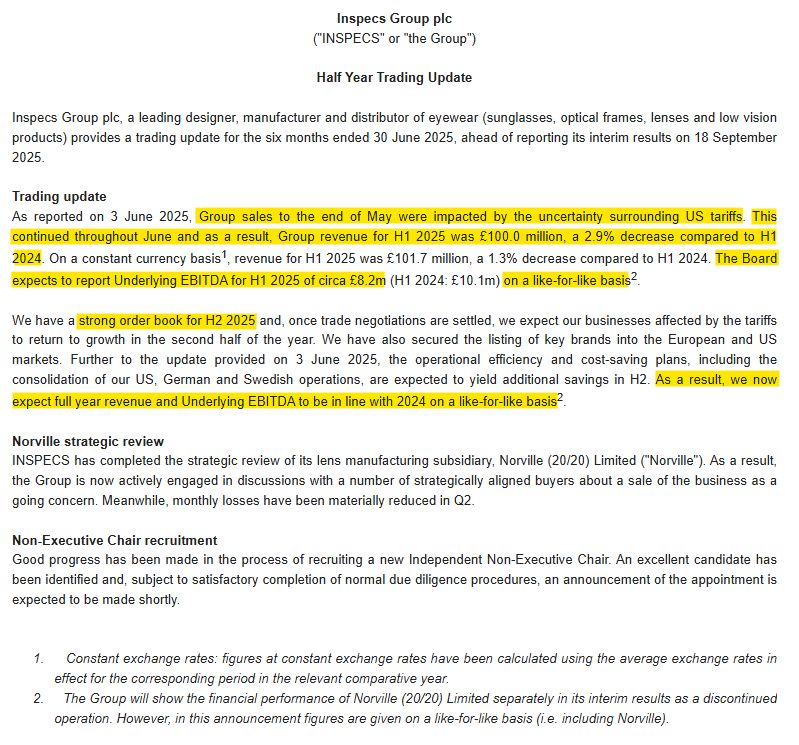

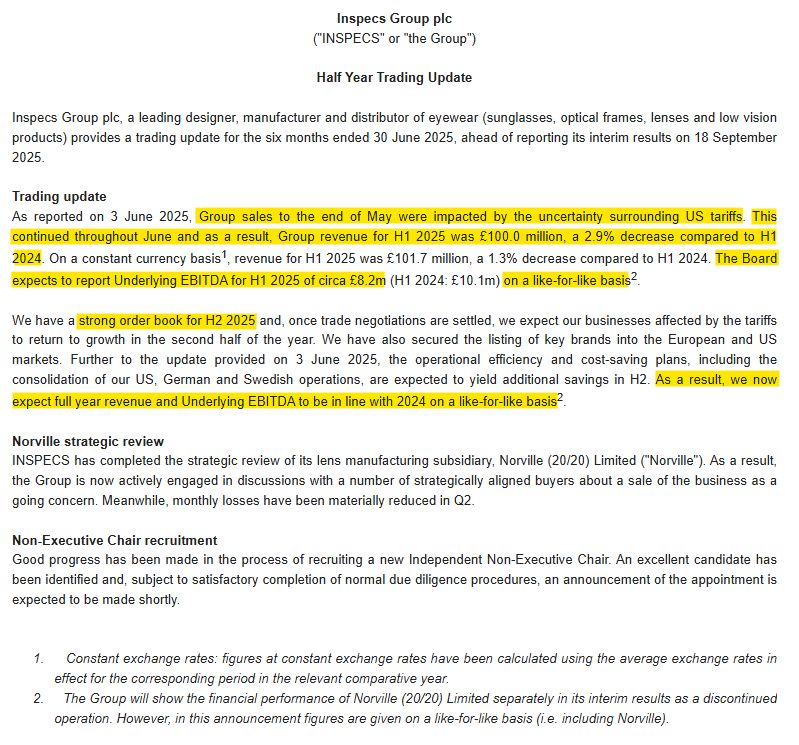

#SPEC.L - 1H TU

❌Warns by stealth, providing no market expectations & no info to help readers understand the impact of the discontinued business segment impact on guidance.

🚨"we now expect FY revenue and [adj BS Earnings] to be in line with 2024 on a like-for-like basis."

🚨Q2 impacted by tariffs.

31.07.2025 06:19 — 👍 1 🔁 0 💬 0 📌 0

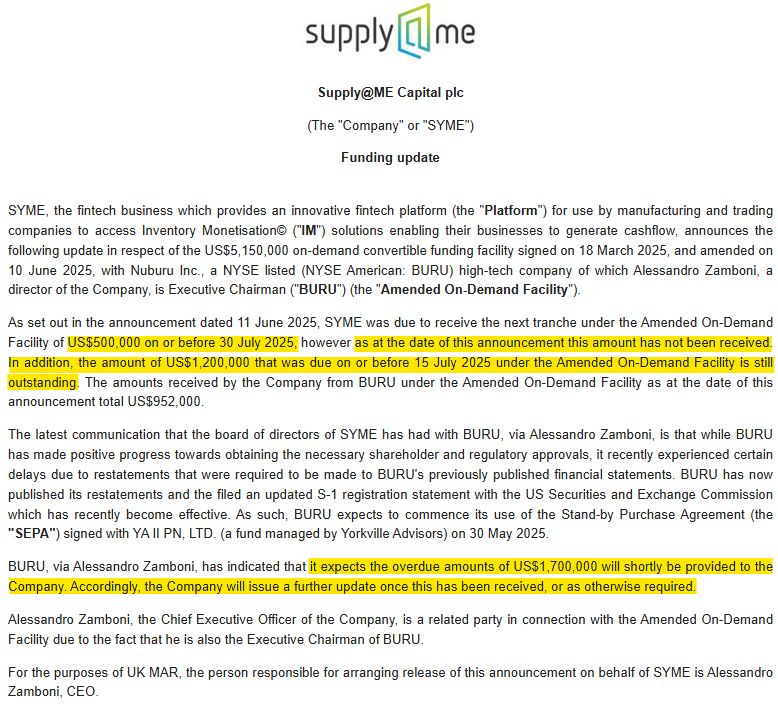

#SYME.L - Funding Update

RNS Translation: "The cheque is as good as in the post"

31.07.2025 06:11 — 👍 1 🔁 0 💬 0 📌 0

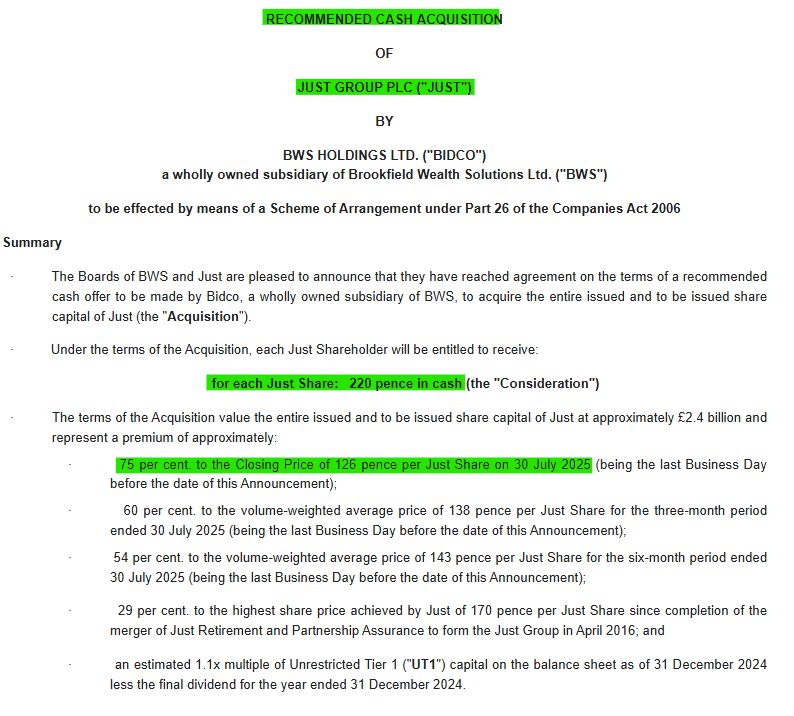

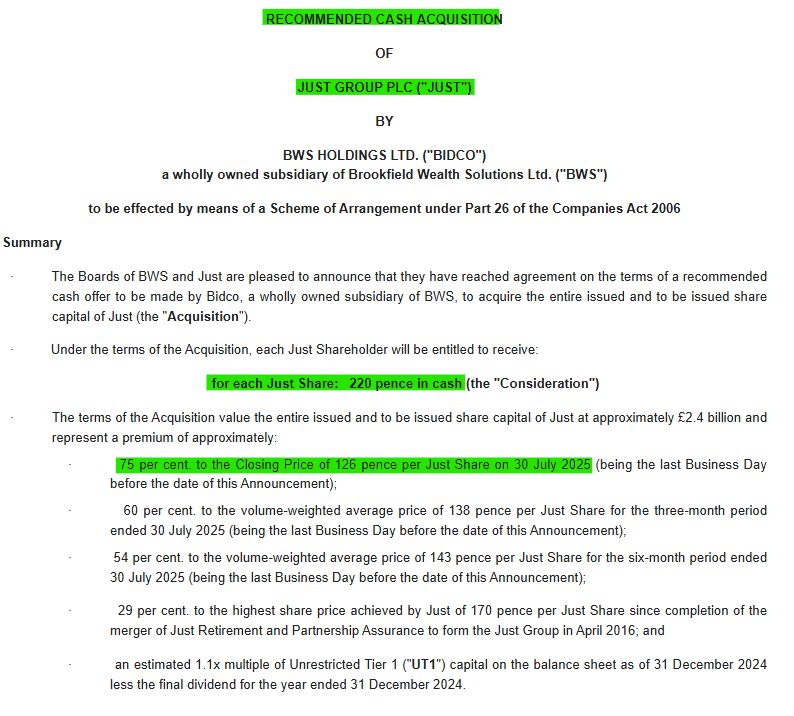

#JUST.L - Offer

Recommended cash offer at 220p - a 75% premium to closing price of 126p last night. Well done holders 👏

31.07.2025 06:07 — 👍 7 🔁 0 💬 1 📌 0

Quite some market moving abilities! 😮

30.07.2025 15:24 — 👍 0 🔁 0 💬 1 📌 0

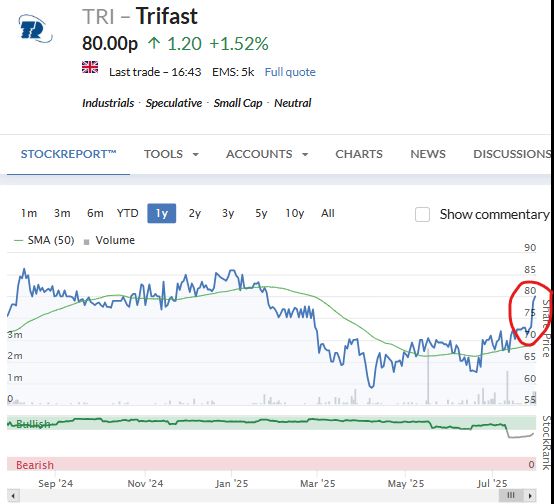

#TRI - Interesting SP movements over the past few days, seemingly on no new news. 🤔

30.07.2025 15:11 — 👍 0 🔁 0 💬 1 📌 0

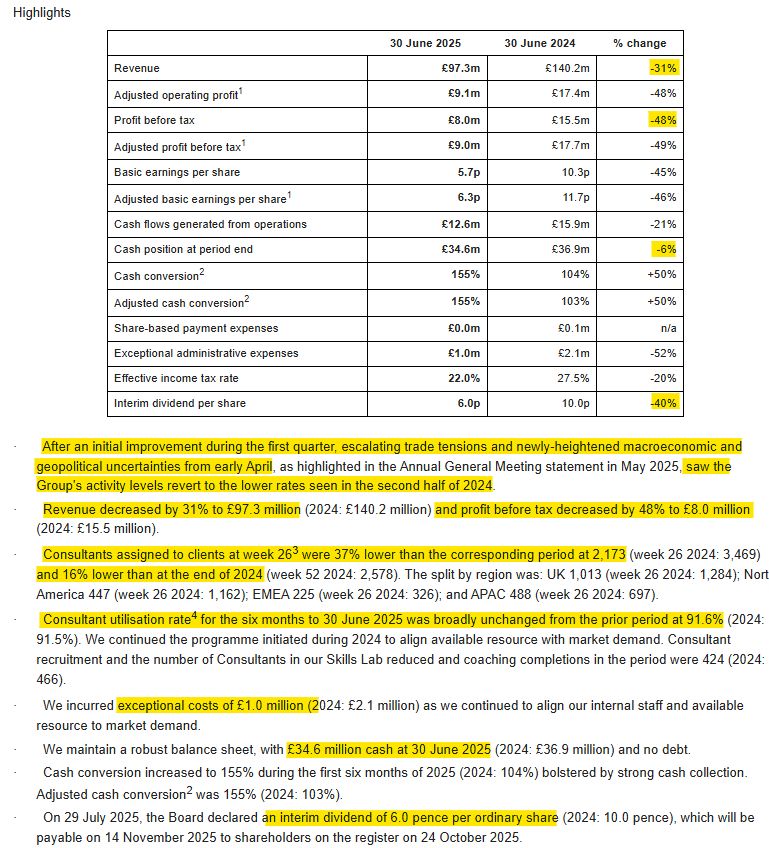

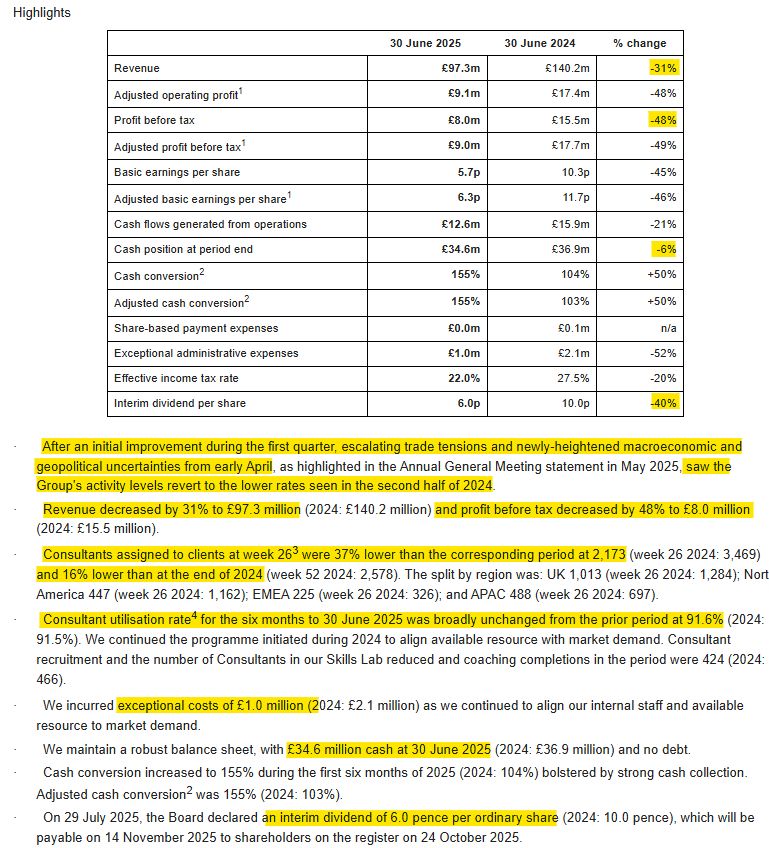

#FDM.L - Interims

🚨"the Board anticipates that the outcome for the year as a whole will be significantly lower than its previous expectations."

🚨Improvement in Q1, but drop-off in Q2 due to trade tensions & macro uncertainty.

➡️Further aligning of reource to market.

➡️Positioned for recovery.

30.07.2025 06:39 — 👍 3 🔁 0 💬 0 📌 0

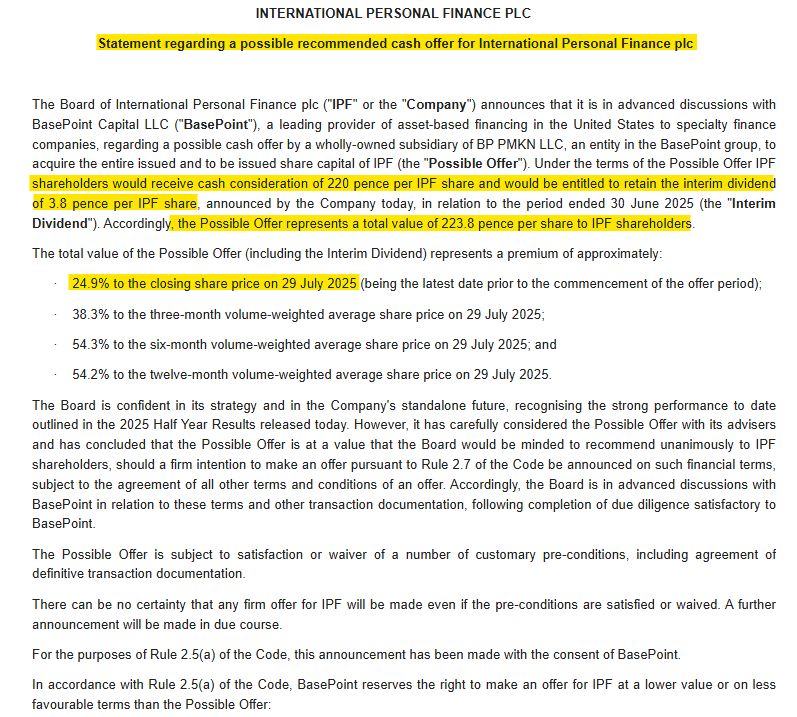

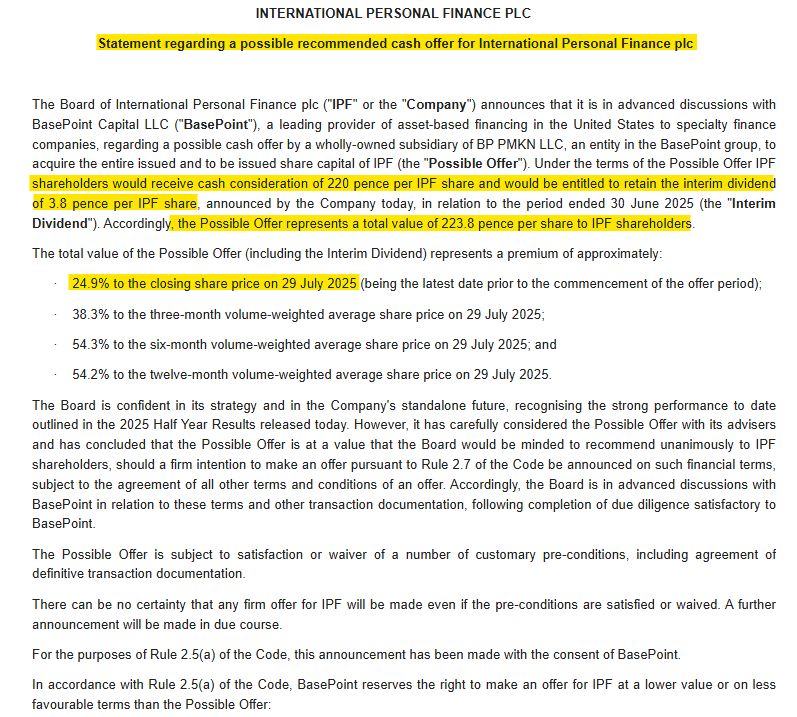

#IPF.L - Possible Offer

➡️Offer at 220p, plus shareholders keep 3.8p divi announced.

➡️Total value of 223.8p represents a 24.9% premium to closing price y'day

While the offer price looks a little light, the SP has been on a good run, so perhaps the offer is in the ballpark - what do holders think? 🤔

30.07.2025 06:16 — 👍 2 🔁 0 💬 0 📌 0

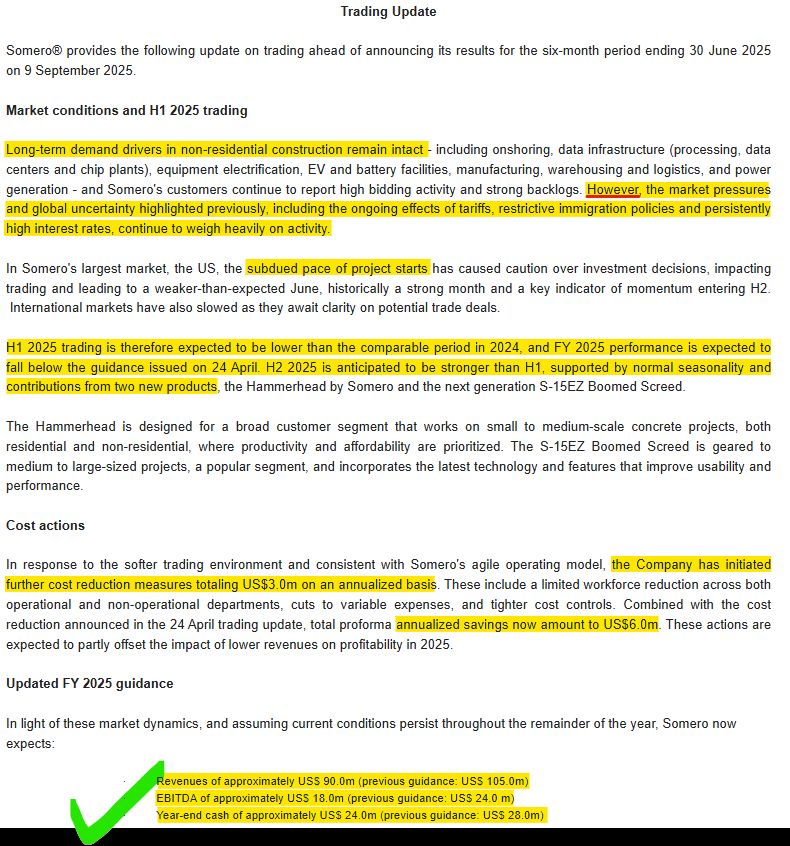

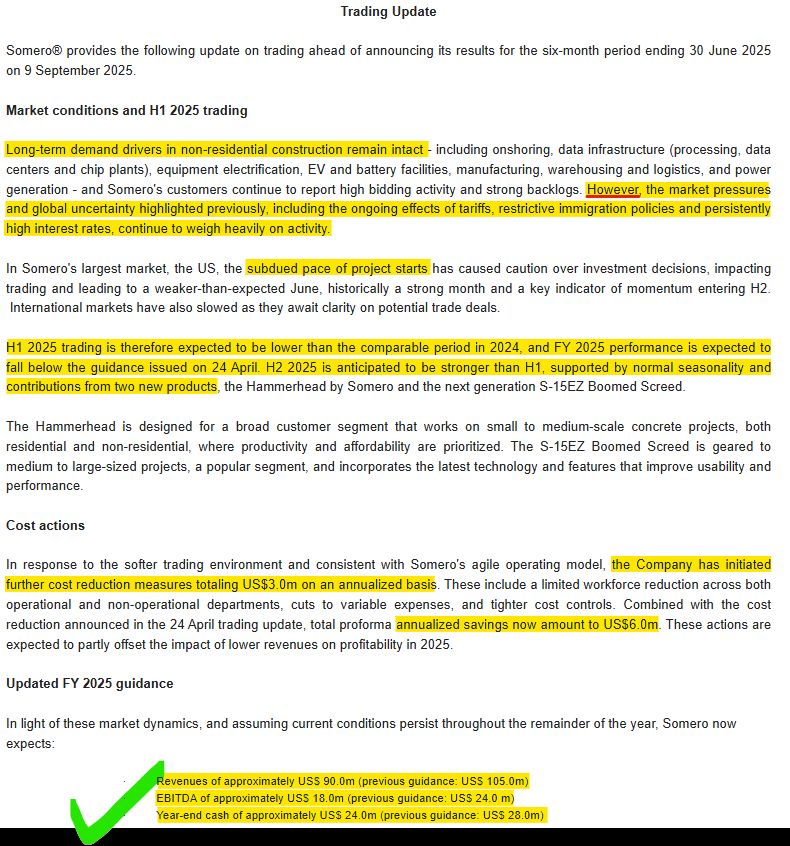

#SOM.L - TU

Somero has always been admirably clear on its guidance and today is no exception despite poor news.

🚨Warns of subdued pace of project starts impacting 1H performance & consequently, FY guidance.

🚨Drops Rev guidance by 14%, BS Earnings guidance by 25% & cash by 14%.

➡️Confident in LT.

30.07.2025 06:10 — 👍 4 🔁 0 💬 0 📌 0

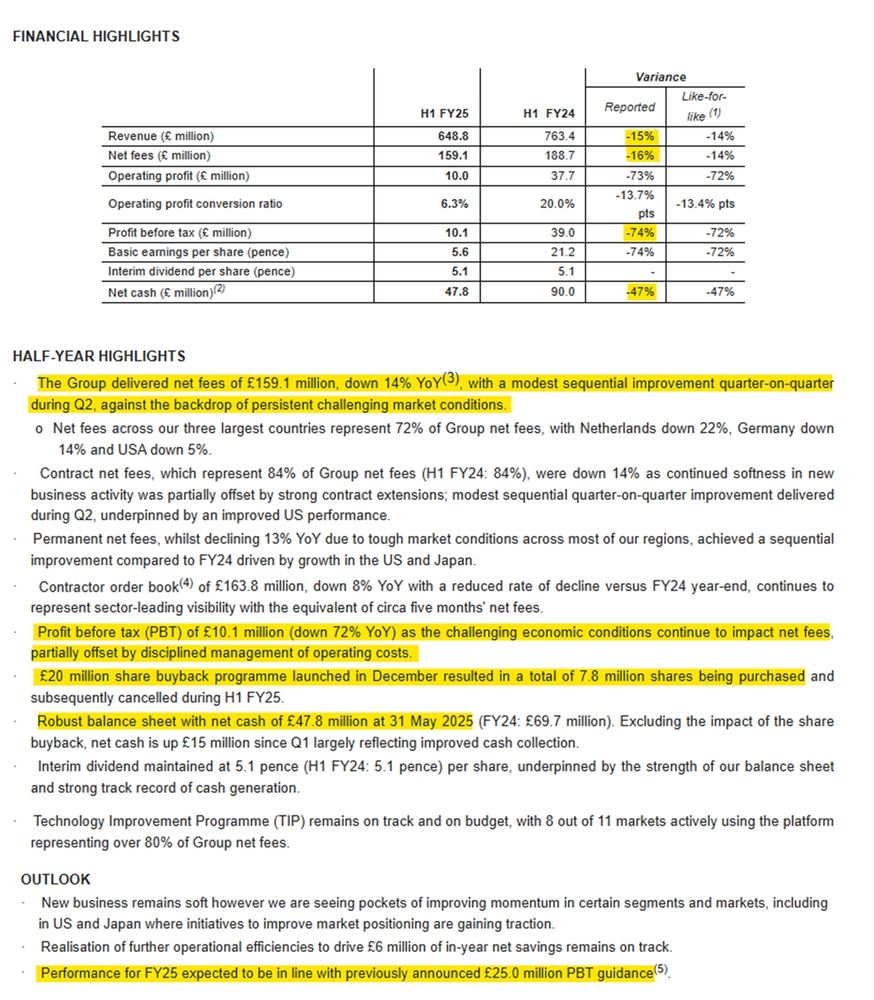

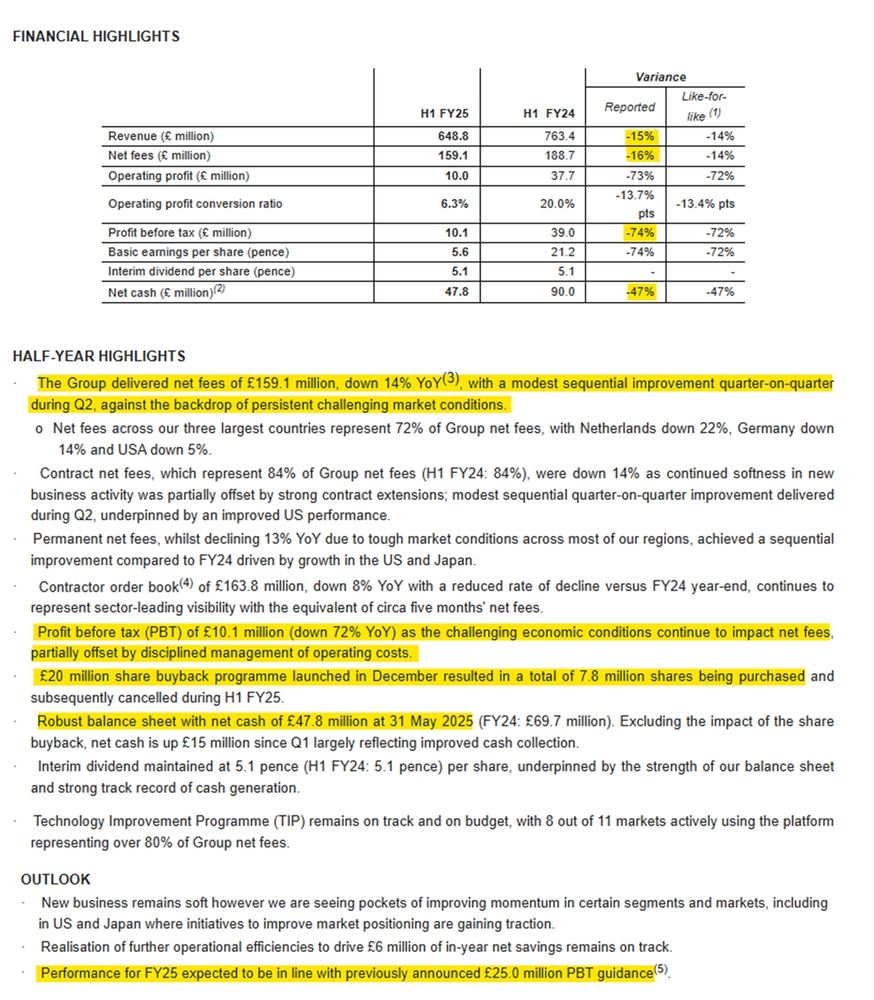

#STEM.L - Interims

➡️Tough results with NFI down 16%, PBT down 74%.

➡️Cash down 47% to £47.8m (in part due to buyback).

➡️Outlook: New business "soft", but expects to deliver guided £25m PBT.

29.07.2025 06:44 — 👍 2 🔁 0 💬 0 📌 0

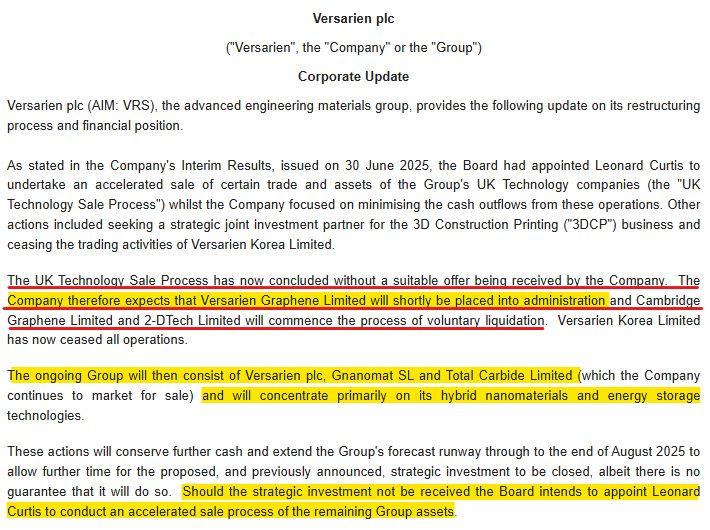

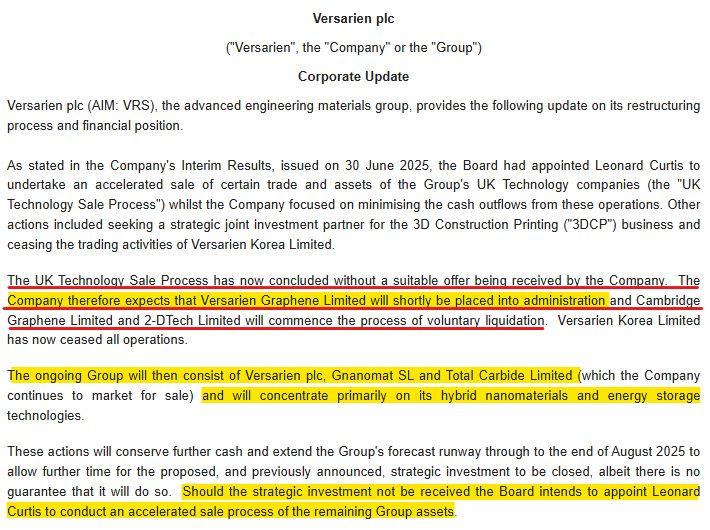

#VRS.L - Going, going,...

➡️Puts the UK company into administration with Group to follow by end of August (if monies awaited do not turn up).

➡️Quite why the company settled claims against the company by it's former CEO 7 days ago and paid him out when it is this close to insolvency beggers belief.

29.07.2025 06:38 — 👍 8 🔁 0 💬 0 📌 0

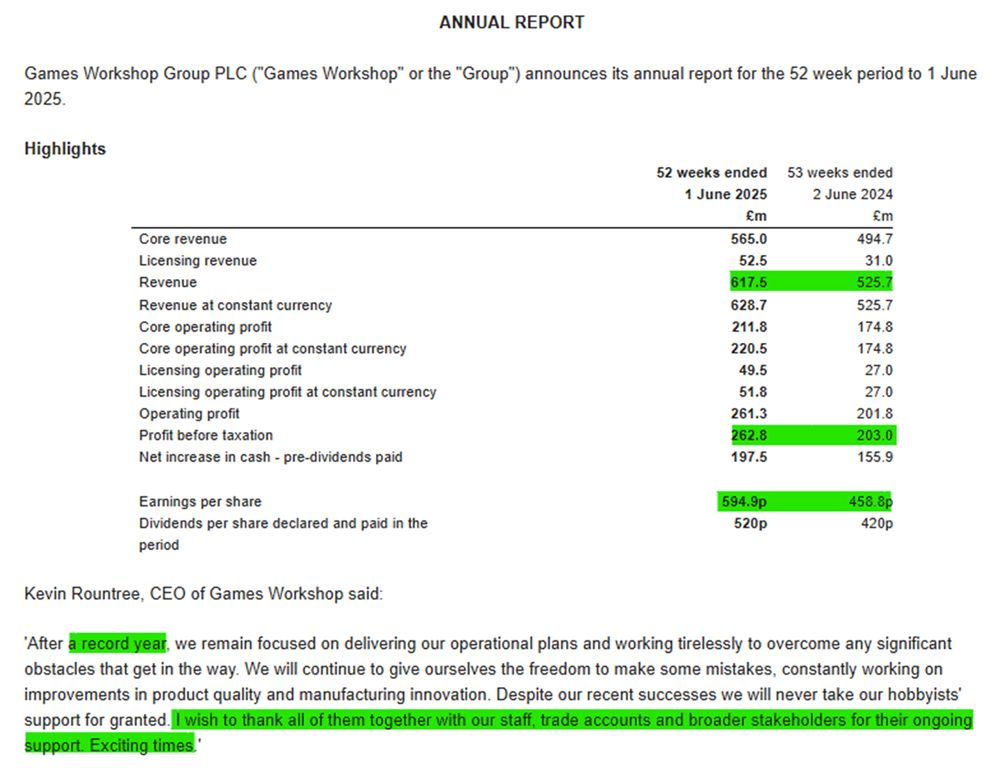

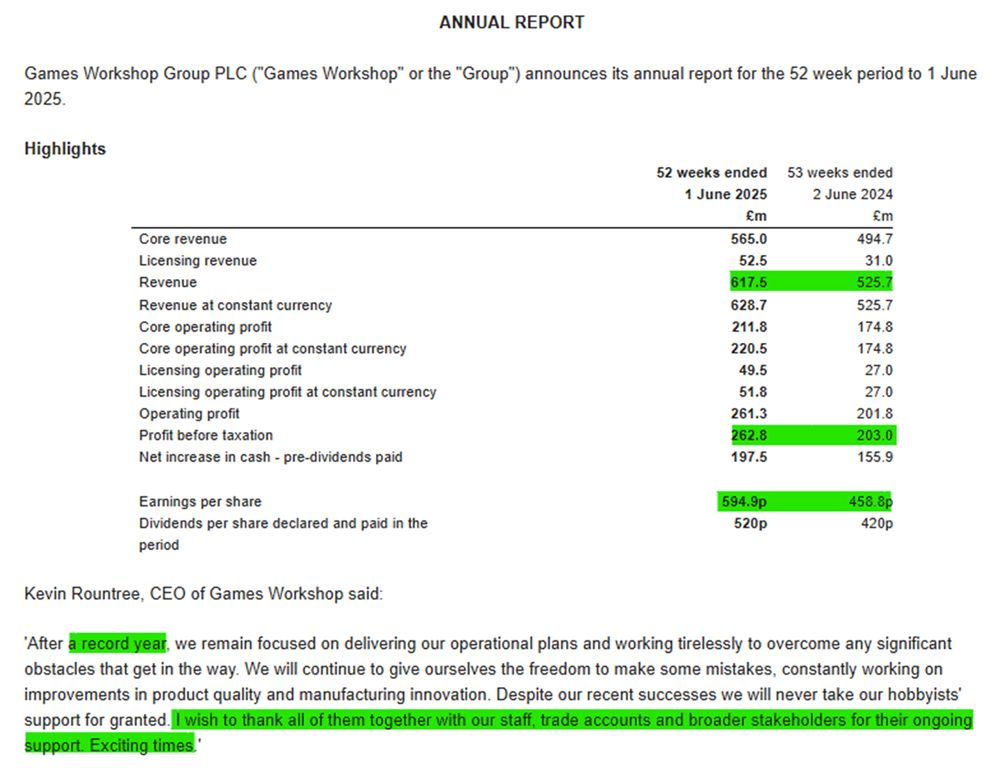

#GAW.L - Finals

Elephants can gallop:

✅Rev up 17.5%, PBT up 29.5%. EPS up 29.7%.

✅55p divi declared today.

➡️£12m tariff headwind to be managed pragmatically. New IT system incoming.

➡️6 initiative areas for FY26; Staff L&D, Growth, Customer Focus, Social Responsibility, Sustainability & Licensing.

29.07.2025 06:24 — 👍 8 🔁 0 💬 0 📌 0

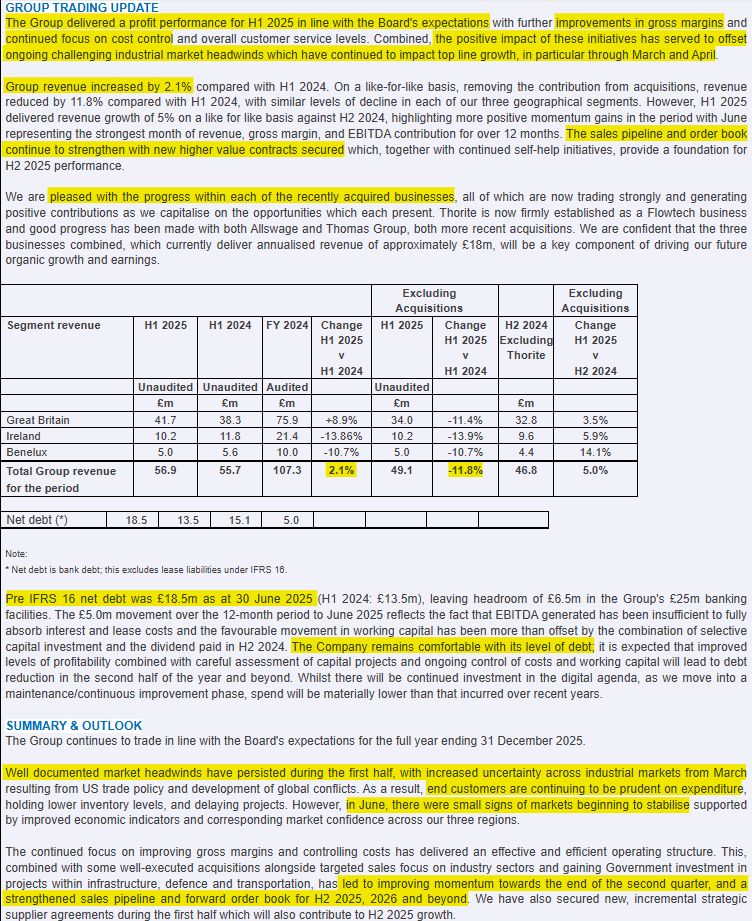

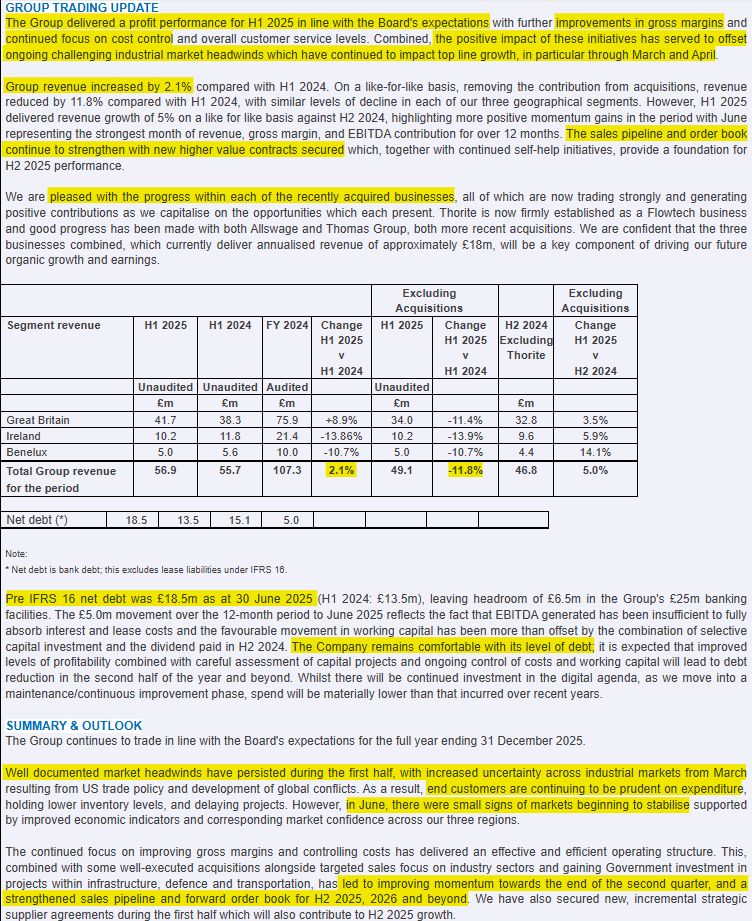

#FLO.L - TU

➡️Rev up 2.1% (lfl down 11.8%).

➡️Sales pipeline & order book said to be strengthening.

➡️Pleased with progress of acquired businesses.

➡️Weak March & April - June much stronger.

➡️Trading in line with FY expectations.

➡️Net debt up to £18.5m - not much headroom left...

29.07.2025 06:13 — 👍 2 🔁 0 💬 0 📌 0

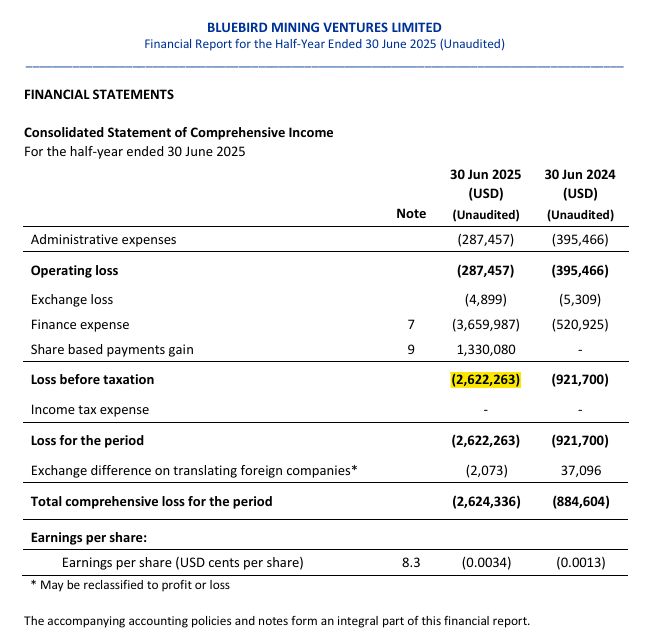

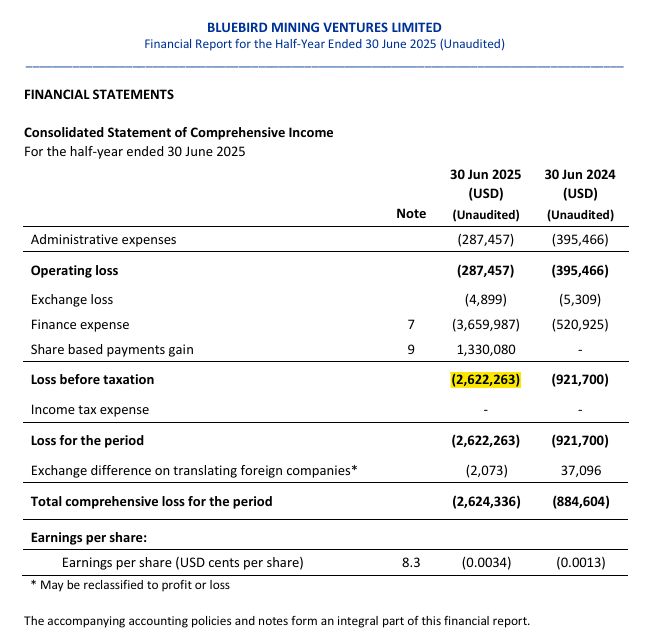

#BMV.L - Interims

Looks like the difinition of "bargepole" for me.

"We are evolving into a platform that blends real asset exposure with digital economics – leveraging gold, Bitcoin, and structured yield strategies."

Looking for the next capital raise as I write...

28.07.2025 06:42 — 👍 3 🔁 0 💬 0 📌 0

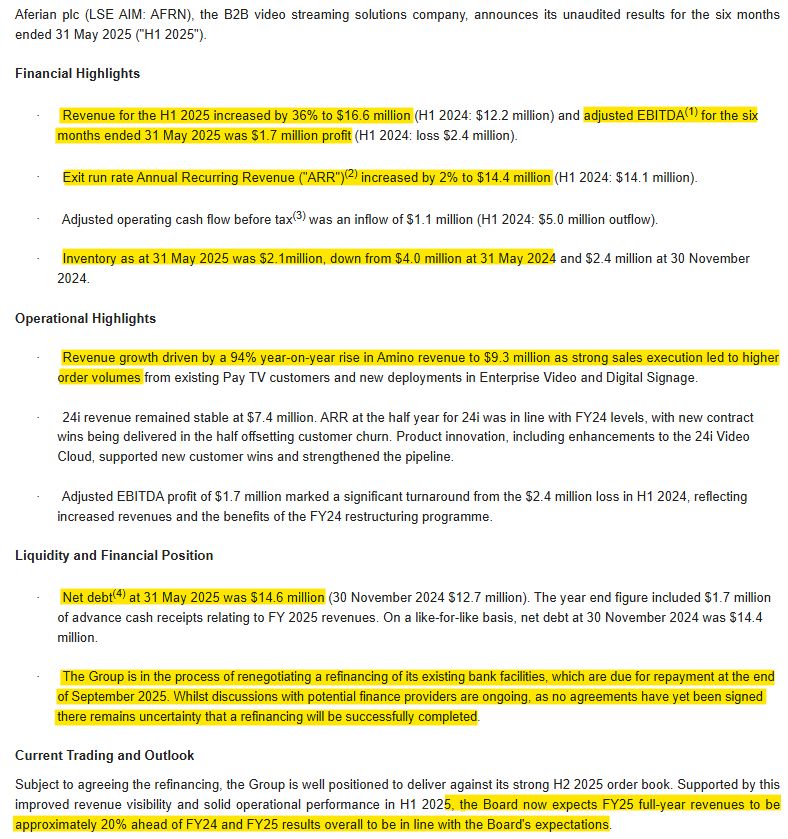

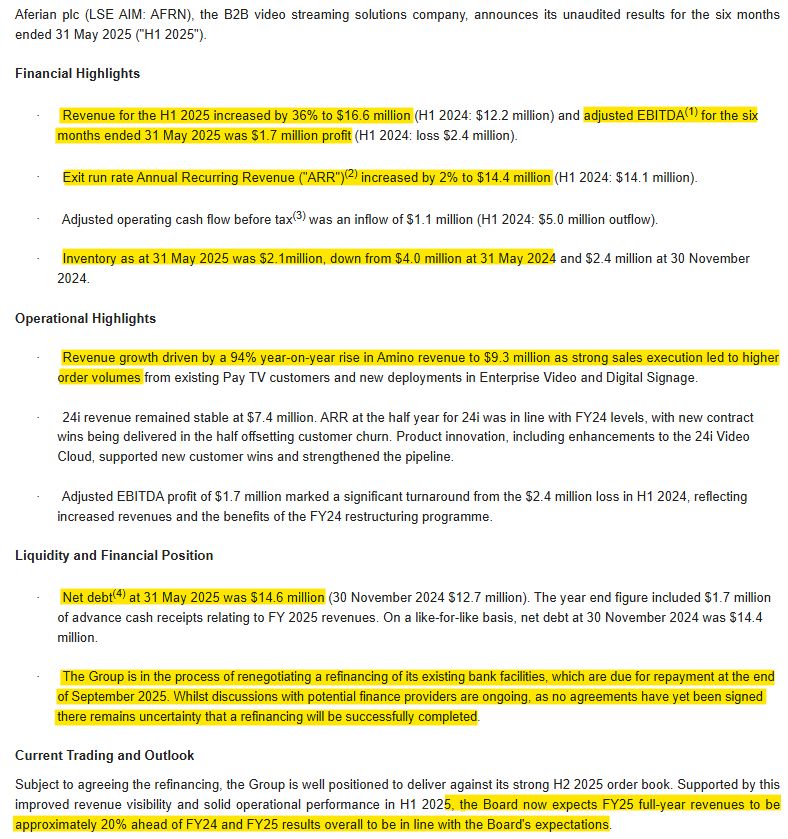

#AFRN.L - Interims

➡️Rev up 36%, LBT reduced from $10.9m to $1.4m.

➡️Inventory down significantly to $2.1m.

➡️Rev growth driven by higher order volumes from Pay TV customers.

➡️Net debt stable at $14.6m - bank refinancing due Sept 2025 😳

➡️On track for FY guidance. FY Rev to be up 20%.

28.07.2025 06:32 — 👍 1 🔁 0 💬 0 📌 0

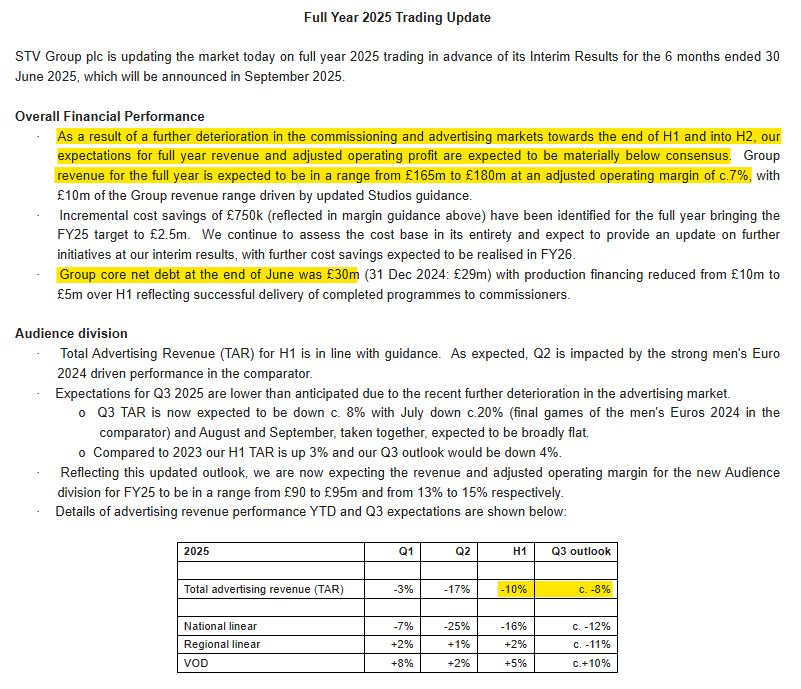

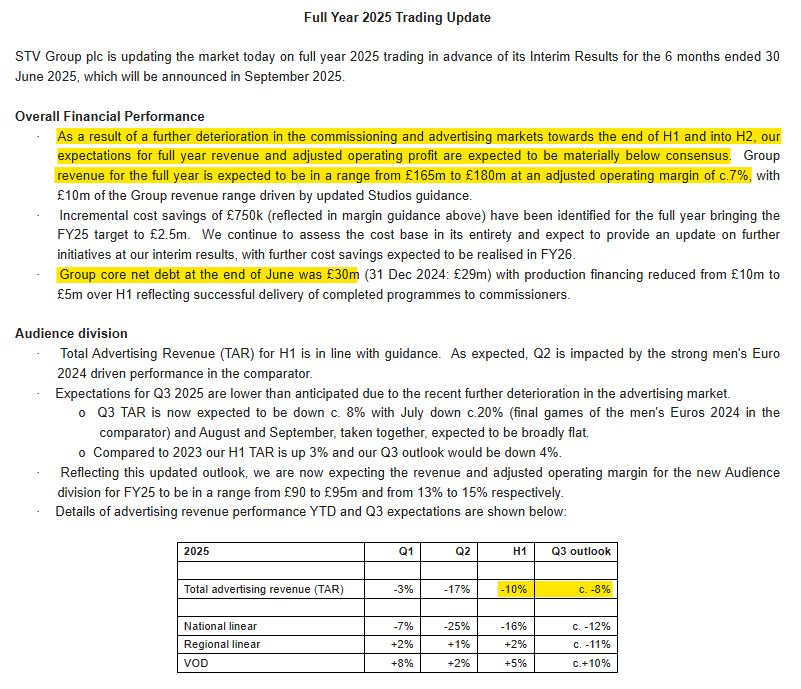

#STV.L -1H TU

This has never really come up on my radar, but today warns that "our expectations for full year revenue and adjusted operating profit are expected to be materially below consensus"

Looks like Rev is down & adj op profit margin significant down on PY. Blames commissioning & ad markets

28.07.2025 06:22 — 👍 3 🔁 0 💬 1 📌 0

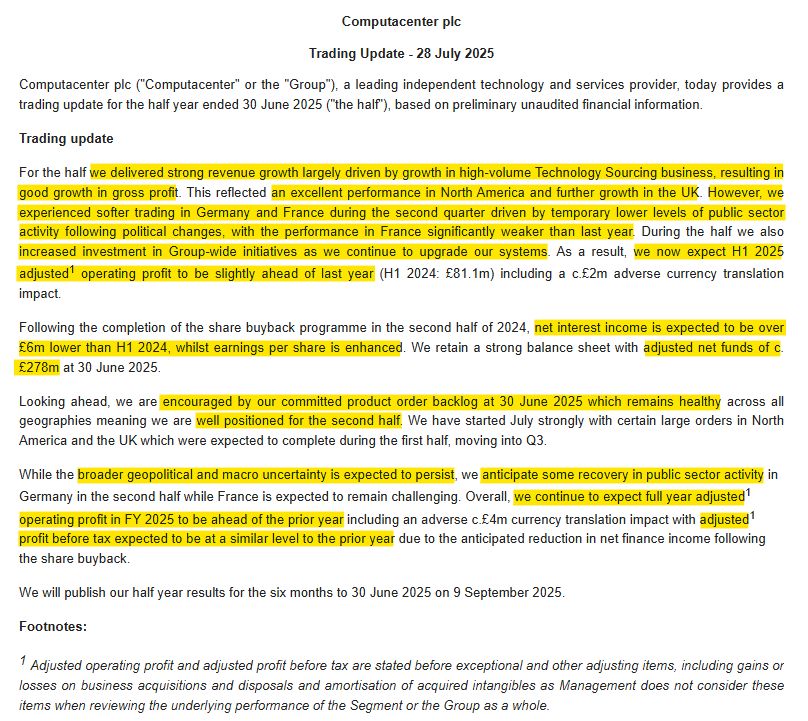

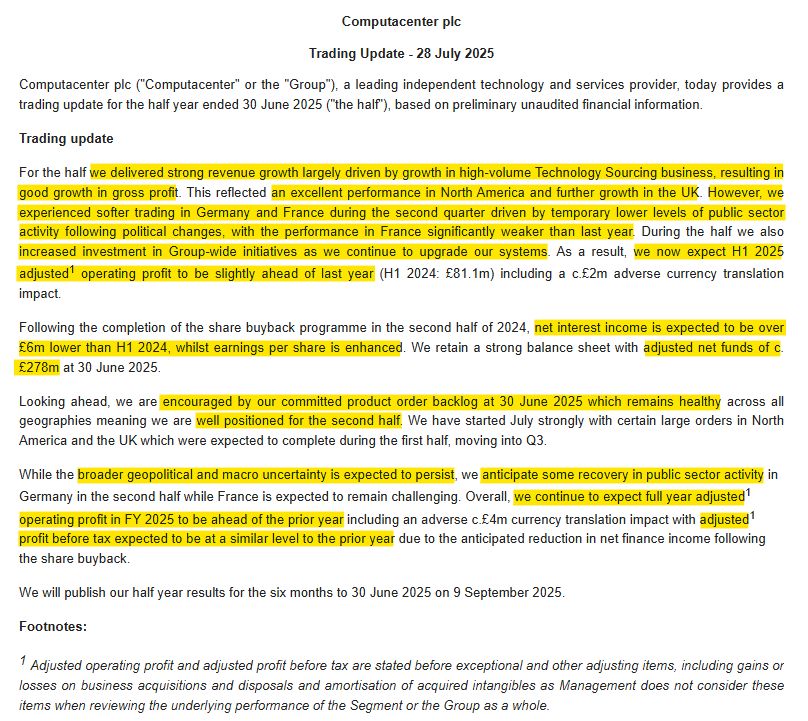

#CCC.L - 1H TU

➡️Overall, FY adj PBT to be similar to PY, which looks like a downward nudge in guidance.

➡️1H saw strong Rev & GM growth. US & UK growing while FR & DE softer.

➡️1H adj op profit slightly up on PY

➡️Cash of £278m & strong B/S.

➡️Solid order backlog - "well positioned for 2H.

28.07.2025 06:13 — 👍 5 🔁 0 💬 0 📌 0

This week, I expect quite a few updates on my holdings:

Tues: #GAW.L - Finals

Wed: #FDM.L - Interims

Thurs: #FSG.L - AGM TU

TU Potentially Due For: #COST.L, #CTA.L, #HERC.L & #CCC.L

Looks an interesting mix of updates that may come in!

26.07.2025 12:57 — 👍 2 🔁 0 💬 1 📌 0

I was just looking at P/Tang Book Value for #PMP.L and doing my own calculations for this earlier today! It does hopefully provide some underpinning to the SP so long as debt remains under control!

Hope you were still holding #PEB.L this week! 😉

26.07.2025 12:07 — 👍 1 🔁 0 💬 1 📌 0

Investor in UK and Australian stocks. See Substack for research, performance, trades and holdings.

mattbrazier.substack.com

La madre dei cretini è sempre incinta!

https://mrmisanthropeblog.wordpress.com/

Small/Mid Caps investor/commentator

CVO (Chief Visionary officer) behind mojostrat™ a new global incoherence recognition and interpretation advisory CFA. Mainly UK stocks and some global themes.

V occasional blogs here: https://medium.com/@mojomogoz

www.firevlondon.com . #Investing to be Financially Independent and able to Retire Early.

In £££London, and having fun, so FatFIRE really.

Investment Professional in UK Equities for 24 years, since retiring early have been working on living life, growing my net worth & income in real terms.

It’s pronounced Patchy!

** I'll be more inclined to follow you if you have a bio or some posts/replies **

UK investor with 20+ experience. PF is around 40% ITs, 40% large/mid cap & 15% small/AIM

Small business owner & stock trader, I share set ups & other trading info. Plan the trade, trade the plan. Info & Education, not financial advice DYOR

UK based Investor. Primarily invests in UK small/midcaps. Life long learning ! Don’t follow anyone into buying/selling a stock, Do your own research.

Investing for 14+ years. Mistakes teach you more than successes, have fun along the way.

Investing/stocks. Ex. HF seeking ideas, contacts & capital. I may be long/short names mentioned. @LibrarianCap on Twitter. Also Substack https://librariancapital.substack.com/

Private investor and a director of ShareSoc. My tweets and RTs are merely opinions, not investment advice. They are my personal opinions and NOT ShareSoc's.

Britain's best-selling news and current affairs magazine with a unique mix of jokes and investigative journalism.

Website: https://private-eye.co.uk

Subscribe: http://subsonline.co.uk

Private Investor - sometimes get it right!

My mum always insists she doesn't have a 'favourite' child.

Which is pretty upsetting because i haven't got any brothers or sisters.

Breakouts and Pullbacks. Happy member of Tradingbases.

#SPSY.L #TRT.L #GMR.L #JNEO.L #SRC.L #QLT.L #JUST.L #ANP.L #MPE.L #WPHO.L #RFX.L #BCG.L #BKS.L #SUP.L #PAF.L #SYS1.L

Changing over from Twitter