This is the first project in my PhD that’s ready to be shared with the world! It’s been great working together with Dominika and Dirk on the incentives that Country-by-Country Reporting creates for profit-shifting multinationals. Read Dominika’s thread below!

18.11.2024 16:30 — 👍 3 🔁 0 💬 0 📌 0

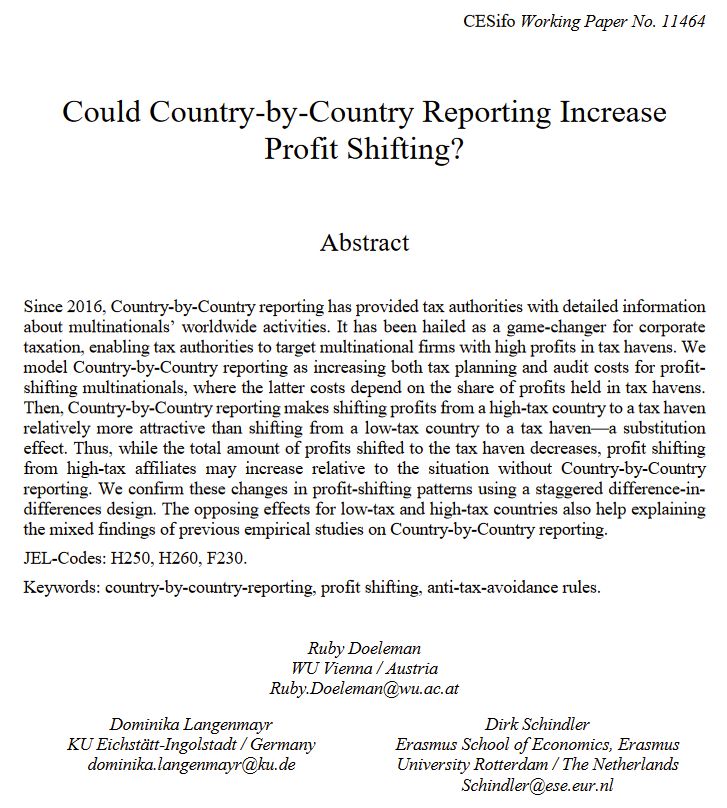

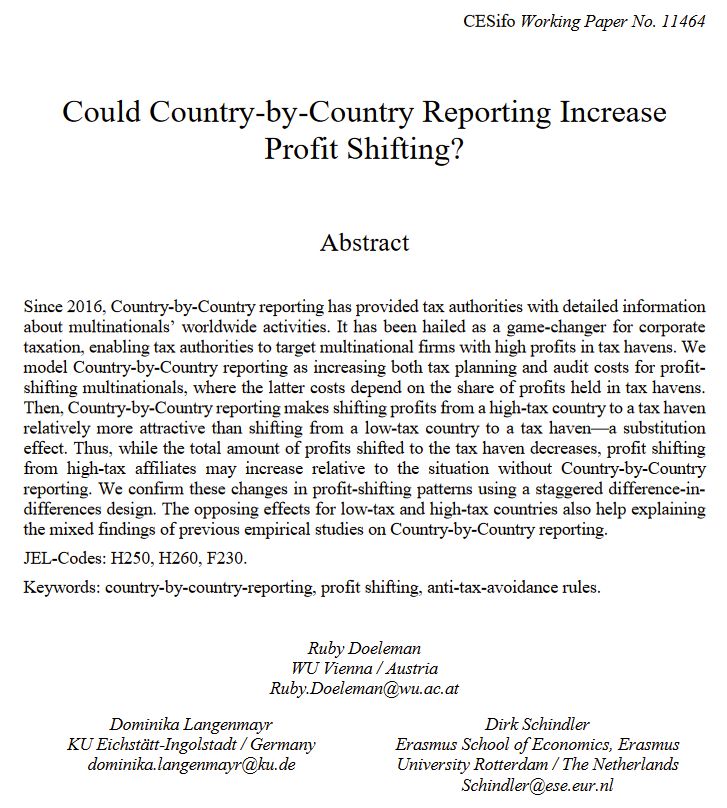

Since 2016, Country-by-Country reporting has provided tax authorities with detailed information about multinationals’ worldwide activities. It has been hailed as a game-changer for corporate taxation, enabling tax authorities to target multinational firms with high profits in tax havens. We model Country-by-Country reporting as increasing both tax planning and audit costs for profit-shifting multinationals, where the latter costs depend on the share of profits held in tax havens. Then, Country-by-Country reporting makes shifting profits from a high-tax country to a tax haven relatively more attractive than shifting from a low-tax country to a tax haven—a substitution effect. Thus, while the total amount of profits shifted to the tax haven decreases, profit shifting from high-tax affiliates may increase relative to the situation without Country-by-Country reporting. We confirm these changes in profit-shifting patterns using a staggered difference-in-differences design. The opposing effects for low-tax and high-tax countries also help explaining the mixed findings of previous empirical studies on Country-by-Country reporting.

How does transparency impact corporate tax avoidance? In a new working paper, @rubydoeleman.bsky.social, Dirk Schindler and I explore how Country-by-Country reporting (CbCR)—meant to curb tax avoidance—might unintentionally increase profit shifting. A 🧵 on our findings: 1/10

18.11.2024 16:14 — 👍 26 🔁 10 💬 2 📌 2

Can someone explain to me what is going on in Dutch politics?

Already texted my parents that I will stay in Austria. They texted back that they’re on their way to join me.

22.11.2023 20:52 — 👍 1 🔁 0 💬 0 📌 0

Thank you Simon!

25.10.2023 09:33 — 👍 0 🔁 0 💬 0 📌 0

I second your thoughts! Amazing group of people, I learned a lot!

25.10.2023 09:21 — 👍 1 🔁 0 💬 0 📌 0

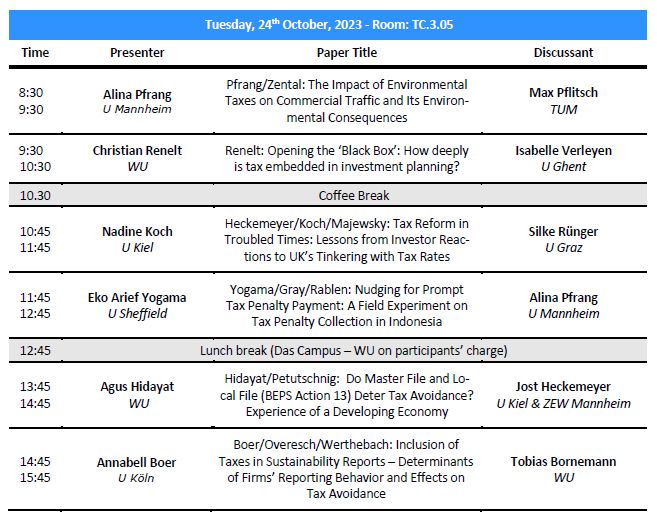

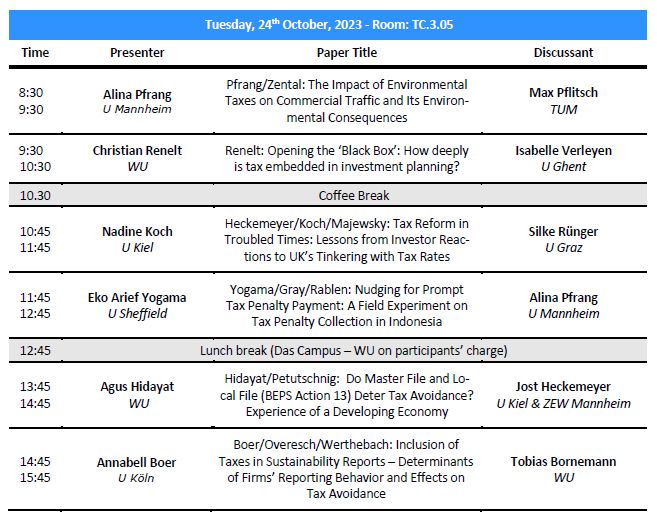

Methods include survey, experiment, field experiment, and many empirical-archival; topics include tax+cbcr, press coverage, auditor provided tax services, tax compliance costs, environmental taxes, tax function, UK tax reform, and tax administration research, see program below

25.10.2023 08:17 — 👍 0 🔁 1 💬 1 📌 0

Found my way to this site. Sky seems bluer here. Is the grass also greener? Will be reading along the econ (dis)course. ⛳️😜

25.10.2023 09:19 — 👍 3 🔁 1 💬 1 📌 0

Your #1 source for #econ, #finance & #datascience #jobs, #grad programs, #courses, summer schools, #conferences, #funding & career advice. Explore opportunities below! #EconSky #econ_ra #PhdOffers #EduSky #Econconf

----> https://inomics.com

Public economist @rsitunitue.bsky.social | Incoming AP @ub.edu & @fundacioieb.bsky.social | Previously @uio.no | @umich.edu Economics Ph.D.

@jackbrusco90 on the other place.

RT ≠ endorse

https://sites.google.com/site/giacomobrusco

PhD Student @UniMannheim, Researcher @ZEW

Interested in all things Tax

https://sites.google.com/view/lauraarnemann/

Operations Director. Previously TIME, VICE News and the Village Voice. Posting about media, technology and the future of work. Learn more: https://tylerborchers.com

Prof. in Corporate #Finance & #Banking at U. Strasbourg @unistra.fr + much more 👇🌐 #econsky

https://sites.google.com/view/profcjgodlewski/

Associate Professor in Economics @UniversityOfGroningen. Political Economy of Development (foreign aid, gender, conflict, culture, trust). 🌴🪷

PhD Candidate in Economics at VU Amsterdam and Tinbergen Institute, interested in macro/labor

Professor of Economics, University of Tübingen, CESifo, RSIT @rsitunitue.bsky.social, International Economics and Taxation. 🇦🇷 in 🇩🇪.

https://uni-tuebingen.de/de/147021

U Carlos III de Madrid prof, interested in life & work in frictional labor markets. http://ludovisschers.eu; team https://labourflows.co.uk/; Cesifo,IZA,EFI & Stone Centre; RT.ne.endorsed; Ordered my lattes in 🇳🇱 🇪🇺 🇪🇸 🏴 🇬🇧 🇨🇦 🇺🇸

Professor of Public Economics

Vrije Universiteit Amsterdam

Columnist EW Magazine

https://jacobs73.home.xs4all.nl/

Professor of Economic - VU Amsterdam

Director Tinbergen Institute

Econoom en journalist

www.mathijsbouman.nl

zzp'er sinds 2005.

Praat bij Nieuwsuur, schrijft in FD. Maakt podcast: “Wat nu…” bij Podimo.

Journalist NRC

Opgeleid als econoom

Schrijft column in zaterdagkrant

Maakt podcast met Maarten Schinkel

Beide getiteld 'Zo simpel is het niet'

Wonend in Voorhout, emeritus-econoom, gewerkt in Scheveningen, Parijs, 020, Den Haag. Roots Vlaardingen. Economie-, begroting - en netflixwatcher. Lid Genootschap ter verheffing van het onderbelichte cijfer.

Prof. Industrial Organization. University of Groningen.

Econoom stedelijk/woningmarkt/infra | ir. | piano | klassiek | 100% klimaatneutraal | beklom ooit de matterhorn | vader hoi persoonlijke titel etc

Directeur van het Instituut voor Publieke Economie (IPE)

Urban geographer (University of Amsterdam) | Housing | Author (Das Mag) | Co-director Amsterdam Centre for Inequality Studies (AMCIS) | Editor International Journal of Housing Policy, Beleid & Maatschappij | All links:

https://linktr.ee/codyhochstenbach